CBRE Announces Expanded $5 Billion Stock Repurchase Authorization

November 21 2024 - 3:15PM

Business Wire

CBRE Group, Inc. (NYSE: CBRE) today announced that its Board of

Directors has approved an expanded authorization for the repurchase

of up to an additional $5 billion of shares.

The expanded authorization is in addition to the existing $4

billion stock repurchase authorization, which had approximately

$1.4 billion remaining as of September 30, 2024.

“Share repurchases are a key part of our capital allocation

strategy. The expanded authorization is particularly timely given

that we believe our shares’ current valuation understates our

long-term growth prospects,” said Emma Giamartino, chief financial

officer of CBRE.

“We ended the third quarter in exceptionally strong financial

position with more than $4 billion of liquidity, low leverage and

free cash flow that is on track to exceed $1 billion this year.

Supported by our highly resilient and diversified business model,

CBRE is very well placed to sustain strong earnings and free cash

flow growth well into the future.”

Since 2021, CBRE has repurchased 36 million shares for

approximately $3 billion at a weighted average price of

approximately $83.50 per share.

About CBRE Group,

Inc.

CBRE Group, Inc. (NYSE: CBRE), a Fortune 500 and S&P 500

company headquartered in Dallas, is the world’s largest commercial

real estate services and investment firm (based on 2023 revenue).

The company has more than 130,000 employees (including Turner &

Townsend employees) serving clients in more than 100 countries.

CBRE serves a diverse range of clients with an integrated suite of

services, including facilities, transaction and project management;

property management; investment management; appraisal and

valuation; property leasing; strategic consulting; property sales;

mortgage services and development services. Please visit our

website at www.cbre.com. We routinely post important

information on our website, including corporate and investor

presentations and financial information. We intend to use our

website as a means of disclosing material, non-public information

and for complying with our disclosure obligations under Regulation

FD. Such disclosures will be included in the Investor Relations

section of our website at https://ir.cbre.com. Accordingly,

investors should monitor such portion of our website, in addition

to following our press releases, Securities and Exchange Commission

filings and public conference calls and webcasts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241121479854/en/

For further information: Chandni Luthra – Investors

212.984.8113 Chandni.Luthra@cbre.com

Steve Iaco – Media 212.984.6535 Steven.Iaco@cbre.com

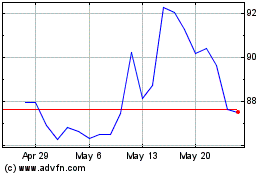

CBRE (NYSE:CBRE)

Historical Stock Chart

From Nov 2024 to Dec 2024

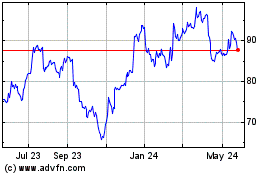

CBRE (NYSE:CBRE)

Historical Stock Chart

From Dec 2023 to Dec 2024