Coeur Reports Record 2023 Fourth Quarter Production at its Newly Expanded Rochester Operation and Provides Update on First Half 2024 Crusher Commissioning and Ramp-Up Progress

January 29 2024 - 3:30PM

Business Wire

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today

provided an update on expansion-related activities taking place at

its Rochester silver and gold operation in Nevada.

Fourth quarter production reached record levels of approximately

1.3 million ounces of silver and 19,847 ounces of gold, which

represented quarter-over-quarter increases of 120% and 345% and

year-over-year increases of 38% and 71%, respectively. These

materially higher production levels were driven by the initial

surge of ounces produced from the new Stage 6 leach pad and new

Merrill-Crowe process plant, which began delivering silver and gold

ounces late in the third quarter of 2023.

Commissioning of the new three-stage crushing circuit is

progressing after the successful feed of initial material through

the primary crusher during the fourth quarter of last year and

through the secondary crushers and truck loadout facility during

January 2024. Commissioning of the pre-screen and tertiary crushers

is expected to be completed in the current quarter. Ramp-up

activities at Rochester are anticipated to be completed during the

first half of 2024. Once operating at full capacity, throughput

levels are expected to average 32 million tons per year, which is

approximately 2.5 times higher than historical levels, making

Rochester one of the world’s largest open pit heap leach

operations.

In addition, work on dismantling the legacy X-Pit crushing

system commenced in the fourth quarter of 2023 with the primary and

secondary crushers now fully disassembled and the remainder of the

system to be completed throughout the first half of 2024 to allow

for access to higher-grade ore that is now being mined.

“Rochester’s fourth quarter production represents the first

glimpse of its full potential as an engine of significantly higher

cash flow generation and as a linchpin of Coeur’s near-term growth

profile,” said Mitchell J. Krebs, President and Chief Executive

Officer. “Just as importantly, Rochester now assumes a key position

as America’s largest source of domestically produced and refined

silver just as global demand is set to increase with the rapid

proliferation of electrification technologies that require

silver.”

The Company expects lower production levels at Rochester during

the first quarter of 2024 as commissioning and ramp-up of the new

crushing circuit takes place. Materially higher production levels

at Rochester are anticipated to build throughout 2024 commensurate

with the completion of the ramp-up and accessing the higher grades

that were underneath the dismantled X-Pit crusher.

On February 21, 2024, Coeur will report full fourth quarter 2023

consolidated operating and financial results as well as the

Company’s 2024 operating guidance.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing

precious metals producer with four wholly-owned operations: the

Palmarejo gold-silver complex in Mexico, the Rochester silver-gold

mine in Nevada, the Kensington gold mine in Alaska and the Wharf

gold mine in South Dakota. In addition, the Company wholly-owns the

Silvertip silver-zinc-lead exploration project in British

Columbia.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding the Company’s anticipated

production, operations, expectations and initiatives at Rochester,

including the Rochester expansion project, and expected increases

in the demand for silver. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors which may

cause Coeur’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such factors include, among others, the risk that

anticipated production, cost and expense levels are not attained,

the risks and hazards inherent in the mining business (including

risks inherent in developing large-scale mining projects,

environmental hazards, industrial accidents, weather or

geologically-related conditions), changes in the market prices of

or demand for gold and silver and a sustained lower price or higher

treatment and refining charge environment, the uncertainties

inherent in Coeur’s production, exploratory and developmental

activities, including risks relating to permitting and regulatory

delays, changes in mining laws, ground conditions and, grade and

recovery variability, any future labor disputes or work stoppages

(involving the Company and its subsidiaries or third parties), the

uncertainties inherent in the estimation of mineral reserves,

changes that could result from Coeur’s future acquisition of new

mining properties or businesses, the loss of access or insolvency

of any third-party refiner or smelter to which Coeur markets its

production, the potential effects of the COVID-19 pandemic,

including impacts to the availability of our workforce, continued

access to financing sources, government orders that may require

temporary suspension of operations at one or more of our sites and

effects on our suppliers or the refiners and smelters to whom the

Company markets its production and on the communities where we

operate, the effects of environmental and other governmental

regulations and government shut-downs, the risks inherent in the

ownership or operation of or investment in mining properties or

businesses in foreign countries, Coeur’s ability to raise

additional financing necessary to conduct its business, make

payments or refinance its debt, as well as other uncertainties and

risk factors set out in filings made from time to time with the

United States Securities and Exchange Commission, and the Canadian

securities regulators, including, without limitation, Coeur’s most

recent report on Form 10-K and 10-Q. Actual results, developments

and timetables could vary significantly from the estimates

presented. Readers are cautioned not to put undue reliance on

forward-looking statements. Coeur disclaims any intent or

obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities. This does not constitute an offer of any securities for

sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240129110827/en/

Coeur Mining, Inc. Jeff Wilhoit, Director, Investor Relations

Phone: (312) 489-5800 www.coeur.com

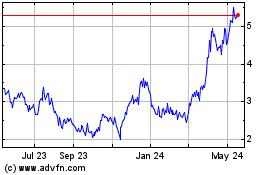

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2024 to May 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From May 2023 to May 2024