0001306830false00013068302025-02-182025-02-180001306830us-gaap:CommonStockMember2025-02-182025-02-180001306830ce:EURSeniorUnsecuredNotesDue2026Member2025-02-182025-02-180001306830ce:EURSeniorUnsecuredNotesDue2027Member2025-02-182025-02-180001306830ce:EURSeniorUnsecuredNotesDue2028Member2025-02-182025-02-180001306830ce:EURSeniorUnsecuredNotesDue2029Member2025-02-182025-02-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 18, 2025

CELANESE CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-32410 | | 98-0420726 |

| | | | | |

(State or other jurisdiction

of incorporation) | | (Commission File

Number) | | (IRS Employer

Identification No.) |

222 West Las Colinas Blvd. Suite 900N, Irving, TX 75039

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (972) 443-4000

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.0001 per share | CE | The New York Stock Exchange |

| | |

| 4.777% Senior Notes due 2026 | CE /26A | The New York Stock Exchange |

| 2.125% Senior Notes due 2027 | CE /27 | The New York Stock Exchange |

| 0.625% Senior Notes due 2028 | CE /28 | The New York Stock Exchange |

| 5.337% Senior Notes due 2029 | CE /29A | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On February 19, 2025, Scott A. Richardson, President, Chief Executive Officer and Director of Celanese Corporation (the "Company"), will make a presentation to investors and analysts via a webcast hosted by the Company at 9:00 a.m. ET (8:00 a.m. CT) regarding the Company's financial results for its fourth quarter and full year 2024. The webcast, press release, prepared remarks from management and a slide presentation may be accessed on our website at investors.celanese.com under News & Events / Events Calendar. A copy of the prepared remarks and a copy of the slide presentation posted for the webcast are attached to this Current Report on Form 8-K ("Current Report") as Exhibit 99.1(a) and Exhibit 99.1(b), respectively, and are incorporated herein solely for purposes of this Item 7.01 disclosure. During the webcast, management may make, and management's prepared remarks and the attached slide presentation contain, references to certain Non-US GAAP financial measures. Non-US GAAP financial measures appearing in management's prepared remarks are defined and reconciled to the most comparable US GAAP financial measure in our Non-US GAAP Financial Measures and Supplemental Information document furnished with this Current Report as Exhibit 99.2 (and available on our website) and incorporated herein solely for purposes of this Item 7.01 disclosure.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibits are being furnished herewith:

| | | | | | | | |

Exhibit

Number | | |

| Description |

| | |

| 99.1(a) | | |

| | |

| 99.1(b) | | |

| | |

| 99.2 | | |

| | |

| 104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document contained in Exhibit 101) |

* In connection with the disclosure set forth in Item 7.01, the information in this Current Report, including the exhibits attached hereto, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of such section. The information in this Current Report, including the exhibits, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing. This Current Report will not be deemed an admission as to the materiality of any information in this Current Report that is required to be disclosed solely by Regulation FD.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | | |

| | CELANESE CORPORATION |

| | By: | /s/ ASHLEY B. DUFFIE |

| | Name: | Ashley B. Duffie |

| | Title: | Senior Vice President, General Counsel and Corporate Secretary |

| | | | |

| Date: | February 18, 2025 | |

Exhibit 99.1(a)

Fourth Quarter 2024 Earnings Prepared Comments

Bill Cunningham, Celanese Corporation, Vice President, Investor Relations

This is the Celanese Corporation fourth quarter 2024 earnings prepared comments. The Celanese Corporation fourth quarter 2024 earnings release was distributed via Business Wire this afternoon and posted on our investor relations website, investors.celanese.com. As a reminder, some of the matters discussed below may include forward-looking statements concerning, for example, our future objectives and plans. Please note the cautionary language contained at the end of these comments. Also, some of the matters discussed include references to non-GAAP financial measures. Explanations of these measures and reconciliations to the comparable GAAP measures are included on our investor relations website under Financial Information/Non-GAAP Financial Measures. The earnings release and non-GAAP information and the reconciliations are being furnished to the SEC in a Current Report on Form 8-K. These prepared comments are also being furnished to the SEC in a separate Current Report on Form 8-K.

On the earnings conference call tomorrow morning, management will be available to answer questions.

Scott Richardson, Celanese Corporation, President and Chief Executive Officer

I'd like to open by saying it is an honor to serve as the newest CEO of Celanese. Over its history, Celanese has developed a reputation of relentlessly executing against its earnings growth strategy and creating long-term value for shareholders. As Celanese navigates the challenges facing us, we are driving the changes needed to reestablish our company’s track record of success and industry leadership.

This past year was one of the most difficult in my nearly two decades with the company, and I want to thank our teams for their efforts and resilience while we continue to face unrelenting demand weakness and significant change. This tenacity, and determination, is core to our culture and will be critical as we reestablish consistent earnings growth, drive performance improvement and enhanced productivity, and return our company to the upper tier of shareholder value creation.

In order to do so, we are focused on three key priorities: intensifying cost reduction, driving top line growth through our pipeline model in the Engineered Materials (EM) business and downstream optionality in the Acetyl Chain (AC), and increasing cash flow to accelerate deleveraging. Our mission is

to reestablish Celanese as a top quartile company for total shareholder return by delivering earnings growth even if fundamental demand remains flat or declines further.

Now, let me turn to our results. For the full year 2024 we delivered adjusted earnings per share of $8.37 (inclusive of approximately $1.45 per share of total Celanese transaction amortization1). During the year, we completed both the Clear Lake expansion and the M&M integration, as well as the realization of the majority of cost synergies associated with the M&M acquisition. As of year-end 2024, we achieved over $250 million in cost synergies. Our focus as we move forward is to capitalize on our investments to drive growth with our customers.

In the fourth quarter we delivered adjusted earnings per share of $1.45 (inclusive of approximately $0.36 per share of total Celanese transaction amortization1), reflective of a soft demand environment that was offset by slightly favorable costs. The fourth quarter again reflected sluggishness in key end-markets like automotive, industrial, paints, coatings, and construction. While the continual unevenness in these sectors makes it difficult to determine a demand outlook across 2025, early signs point to weak demand continuing through the first half of this year. For example, the automotive market, our largest for the EM business, is forecasted by many third parties to have close to no global industry growth as auto builds are projected to be roughly flat for the second consecutive year. Likewise, critical end-markets for AC, like paints, coatings, and construction, show scant signs of any near-term improvement in any region.

The macroeconomic environment underscores the necessity of delivering cost reduction, earnings growth, and cash flow regardless of the conditions. As we move forward, we will build on the proactive steps we have taken to realign our organization and operating model to better reflect these strategic priorities:

•We have completed the actions necessary to exceed our target of $75 million in 2025 cost reductions, primarily in selling, general, and administrative (SG&A), announced in our third quarter earnings release. Scrutinizing levels of affordability and areas of optimization allowed us to better align our cost structure with current market realities. The SG&A effort was focused on streamlining our management structure, including an approximate 25% reduction in costs associated with the levels of vice president and above. These changes have begun to contribute to first quarter earnings, and we expect to exceed our target and fully realize over $80 million in cost reductions in 2025 from actions already taken.

•We recently announced our intention to cease production and execute the closure of our Luxembourg manufacturing operations of Mylar Specialty Films, a 50/50 joint venture owned by

1 Calculated as intangible amortization from transactions divided by diluted weighted average shares outstanding.

Celanese and Teijin. Similar to other footprint optimization initiatives we have implemented, the closure follows our core principle of exiting our higher cost facilities while driving productivity through debottlenecking in our lower cost facilities.

•We continue to sharpen the focus of our growth model to respond to business conditions. We are redeploying resources more efficiently to higher growth pockets like servers, medical applications, and athletic wear. We are also leveraging our core competencies in application development to capitalize on the large automotive electric vehicle growth opportunities, especially in China. Additionally, we are realigning processes to enable quick progression of smaller projects. Our ability to successfully manage the inherent complexity of these high margin, smaller-sized projects was a significant advantage for us and a hallmark in the growth of our pipeline model.

Collectively, these steps deliver a simplified organizational structure that reflects our priorities around lowering costs and driving growth across the company. For the EM business, the new streamlined structure positions us to drive productivity through greater speed and agility and complements the significant fixed cost reductions we have made in the business. As previously announced, Todd Elliott rejoined Celanese as Senior Vice President of EM. In one of his previous roles as head of global sales for EM, Todd was instrumental in launching the customer project pipeline model. Going forward, the EM team is focusing on driving productivity in the business and leveraging the lowered cost base to amplify the margin of every incremental ton sold.

These actions are pivotal steps to improve earnings, drive our deleveraging efforts, and increase total shareholder return. And there is more to do. We are conducting rapid deep dive assessments of all aspects of our business to drive additional actions. These include further manufacturing optimization, a reduction in our distribution and warehouse costs, continued cost efficiency, and increasing our use of low-cost locations for shared service centers. Within EM, we are targeting $50-100 million in annual earnings improvement by streamlining complexity, and I will provide further details around that later. We are committed to continuing to scrutinize our overall cost structure to realize our objectives based on evolving business conditions. With that, let me turn to the performance of our two businesses.

Engineered Materials (EM) delivered fourth quarter adjusted EBIT of $156 million and operating EBITDA of $270 million at margins of 12 and 21 percent, respectively. Sequential net sales declined by 14 percent, which constituted decreases of 10 percent in volume and 3 percent in price as well as a small currency impact. Our key end-markets developed through the quarter in line with our expectations, with sharp sequential downturns in our automotive and industrial businesses in the Western Hemisphere due to severe destocking in response to the rapid consumer pullback experienced by the original equipment

manufacturers (OEMs) and the supplier tiers in the third quarter. Our teams responded to these challenges with focused execution driving operating costs down for the fourth quarter beyond our original expectations. These lower costs partially offset the depressed demand and drove earnings that exceeded our anticipated range. Additionally, the steps we took to curtail production to better match available demand enabled us to reduce inventory by over $200 million, exceeding our target for the quarter.

For the full year 2024, EM delivered adjusted EBIT of $859 million and operating EBITDA of $1.3 billion at margins of 15 percent and 23 percent, respectively. Compared to 2023, net sales declined by 9 percent consisting of declines of 5 percent in volume, 3 percent in price and 1 percent currency. The intensifying competitive dynamics for standard grade applications in our largest product lines like nylon offset the significant year-over-year improvements made to the EM cost position that were driven by lower raw materials and extensive manufacturing footprint fixed cost reduction. For example, China prices for undifferentiated nylon polymer remained challenged in the quarter and continue to reflect supply that is outpacing soft demand. Our more contemporary nylon business model has improved our make versus buy optionality and enabled us to somewhat temper these dynamics by sourcing more polymer in Asia to take advantage of current economics while continuing to import our differentiated products.

As I discussed earlier, the second half downturn in Western Hemisphere automotive had the largest impact on EM in 2024. For context, the Western Hemisphere has historically accounted for approximately 60 percent of EM automotive sales, while contributing approximately 45 percent of global auto industry builds. Automotive builds produced by China-based OEMs continued to increase in 2024, and they now produce 25 percent of the global electric vehicles, which has accelerated the market share loss of Japanese and European-based suppliers in Asia. While our content per vehicle today is greater in Western Hemisphere OEMs, our growth rate is higher in China-based electric vehicle projects. Given that automotive margins in China tend to be lower than in the West, it is critical that we focus our automotive project pipeline model on winning in China while continuing to upgrade mix by leveraging our capabilities as applications become more sophisticated. The closed-won metric in our pipeline model, which is a measure of projects that have been won and have initiated sales, was approximately 20 percent higher in 2024 for automotive in China compared to automotive in Europe.

As I mentioned earlier, our immediate priority in EM is a comprehensive deep-dive review of all drivers of business value with a focus on three areas:

•Reduce complexity: With the integration largely behind us, we will now focus on simplifying and streamlining the business to eliminate post-integration costs and complexity. Through an assessment of our distribution network, we expect to reduce our warehouse sites and optimize our

transportation network. We are also assessing further SG&A efficiencies. Overall, we are targeting an annual reduction of $50 to $100 million through these initiatives..

•Increase cash flow: It is paramount that we unlock cash from the working capital profile within the business today. Our priorities are to clear out residual inventories and adjust our lead times and service levels to better leverage our more efficient global network. Through these steps, we are targeting a reduction of over $100 million in inventory value in 2025.

•Evolve the growth model: EM is fine tuning the revenue enhancement model to improve connectivity to global growth sectors like electric vehicles, servers, medical applications, and athletic wear. We are redeploying resources more efficiently and effectively to those pockets of higher growth.

Turning to 2025, the demand environment for the first quarter continues to be tepid. Auto builds are expected to fall sequentially by approximately 10 percent, with demand softness across all regions and most pronounced in Asia. While first quarter global builds are typically seasonally impacted by Chinese New Year, the rate of sequential decline in the first quarter of 2025 is projected to be even more extreme than last year. Similarly, we expect little meaningful sequential volume improvement in our other end-markets.

There are other factors impacting our first quarter outlook beyond the demand environment. We anticipate a seasonal sequential decline in our medical implants business that will represent an approximate $20 million headwind. The impact from the planned turnaround at our Bishop, Texas POM facility will be approximately $25 million in the first quarter. Additionally, we expect affiliate earnings to decline by approximately $20 million in the quarter, largely driven by a turnaround at Ibn Sina. As we consider these dynamics, we anticipate EM first quarter adjusted EBIT of $90 to $110 million and EM first quarter operating EBITDA of $190 to $210 million.

We expect sequential seasonal volume recovery in the second quarter, as well as additional tailwinds to favorable turnaround costs as the POM turnaround will be completed in the first quarter, favorable sequential medical implant seasonality with a return to normal ordering patterns, and some sequential improvement in affiliate earnings.

The Acetyl Chain (AC) delivered fourth quarter adjusted EBIT of $253 million and operating EBITDA of $316 million, at margins of 23 and 28 percent, respectively. Net sales in the quarter decreased sequentially by 7 percent, comprised of a 4 percent decline in volume and a 2 percent decline in price, as well as unfavorable currency. As anticipated, the already weak demand environment in the Western Hemisphere

was further impacted by year-end seasonality that was softer than normal in all regions. Currency variations late in the quarter caused a headwind exceeding $5 million. By temporarily idling production to align our supply with customer demand, we were able to deliver results within our expectations. For example, production at our Singapore site was idled for 30 days and resumed operation in the second half of the quarter. Additionally, we idled our Frankfurt VAM plant for over half of the fourth quarter, and recently restarted it to support planned turnarounds in the first half of 2025.

Our 2024 AC adjusted EBIT of $1.1 billion and operating EBITDA of $1.3 billion demonstrated the benefits of our agile operating model and the resilience of the business in an environment of persistent low global demand within critical AC end-markets like construction, paints, and coatings. Net sales were down slightly for the year, with volume gains of 4 percent that were offset by pricing declines of 6 percent. I am grateful to our teams for their efforts to deliver these results in the face of continued Western Hemisphere weakness, particularly in Europe, as well as continued demand sluggishness in Asia compounded by supply increases in China. The challenges presented over the course of the year once again demonstrated why we have strategically enhanced our optionality across our integrated product chain allowing our commercial teams to find additional downstream outlets to place incremental volumes. Utilizing this approach, we delivered new record sales volumes of redispersible powders (RDP), while also expanding the product line's variable margin by 13 percent compared to 2023. We also achieved significant milestones in our production capabilities at Clear Lake through the successful startup of our new 1.3 million ton Clear Lake acetic acid unit and our ISCC-certified carbon capture and utilization (CCU) expansion of our Fairway Methanol joint venture with Mitsui. Despite significant production losses in the second quarter attributable to the largest unplanned supply disruption in over 15 years, we are proud that our Clear Lake team was able to set a new record of annual production at the site.

For the first quarter, we expect continued soft demand in the Western Hemisphere in core end-markets of paints, coatings, and construction. We also anticipate weaker than normal volumes in China due in part to an earlier Chinese New Year and continued weakness in construction. There are indications that additional acetic acid capacities have been scheduled to start up in 2025, though actual commissioning and utilization of those new facilities will depend on many factors as the business environment evolves. The region has largely been operating at or near the cost curve for an extended period of time, and we do not anticipate significant incremental impact as a result of additional near-term capacity. Demand in Asia has steadily grown but at rates inadequate to absorb the new capacity, which we expect to continue into 2025.

Beyond the demand environment, we expect additional situational headwinds to drive first quarter earnings below the fourth quarter, including:

•Change in schedule of acetate tow dividend income: Recent changes in Chinese law create a reset in the cadence that dividends are received from the joint ventures there. Instead of quarterly dividends, the payments will now be made three times a year, beginning in the second quarter, with the impact contained to the first quarter. Additionally, joint ventures in China need to contribute to a capital reserve threshold, which will be funded over several years. As a result, we anticipate the dividend payout to be approximately $40 million in the second quarter and slightly lower for the full year versus 2024.

•Western Hemisphere contract resets: Some of the pricing declines we have seen in the spot markets throughout 2024 will now roll through to certain large customer contract resets for 2025. We expect this to be an approximately $10 million headwind sequentially.

We expect further sequential volume impacts of approximately $15 million, primarily due to timing in acetate tow, as some customers postpone their ordering patterns to the second quarter to rebalance inventories. Given these dynamics, we expect our AC first quarter adjusted EBIT to be $175 to $190 million, and our operating EBITDA to be $235 to $250 million. Over the last half decade, the AC team has built a track record of agility and will continue to leverage the chain's optionality to take full advantage of opportunities to capture incremental value.

Chuck Kyrish, Celanese Corporation, Senior Vice President and Chief Financial Officer

Before discussing free cash flow performance and our actions to drive deleveraging, I would like to provide an update on our earnings for the quarter.

In Other Activities for the fourth quarter, we reported a net expense of $76 million in adjusted EBIT and $69 million in operating EBITDA, in line with our expectations. Net expenses for 2024 were reduced by more than 10 percent compared to 2023, thanks to numerous cost reduction initiatives implemented by the team throughout the year.

For the first quarter we anticipate net expense of approximately $70 million in adjusted EBIT and $60 million in operating EBITDA. This reflects the full year of benefits from 2024 actions and incremental savings from the $75 million cost reduction initiative that Scott described.

As discussed earlier, our SG&A initiative primarily focuses on aligning our cost structure with market conditions. The majority of the cash cost to achieve these reductions will appear as a headwind to first quarter free cash flow. The initial benefits will be realized in first quarter earnings, and we expect to

approach the full run rate in the second quarter, with approximately 85 percent of the benefits split between EM and Other Activities, with the remainder in AC.

Lastly, related to earnings, the tax rate for U.S. GAAP purposes was negative 51 percent for the full year 2024. This was due to a book goodwill impairment charge of $1.5 billion for the EM reporting unit that did not provide a tax benefit as well as an increase to valuation allowances on local country non-U.S. tax credits due to a decline in projected future earnings as considered in the goodwill impairment analysis. The effective tax rate for adjusted earnings was 9 percent for 2024. At this point, we anticipate an effective tax rate for adjusted earnings in 2025 that is similar to 2024 absent any material changes in jurisdictional earnings mix.

For cash taxes, the elevated use of 2024 cash was largely driven by a transfer tax payment related to restructuring. This was a one-time tax, and we anticipate recouping it in the coming years through corresponding foreign tax credits. Additionally, 2024 cash taxes were affected by other non-recurring items and timing.

Now let me provide context to the impairment charge that we recognized for the fourth quarter. In the third quarter, we completed our annual goodwill and indefinite-lived intangible assets impairment test. The test concluded that the fair value of the EM reporting unit exceeded its book value, but with a delta of less than 10 percent. The sustained significant decrease in Celanese’s share price after the third quarter earnings release and additional deterioration in the projected financial results for 2025 compared to the analyses prepared in the third quarter triggered an updated impairment test in the fourth quarter. As a result of changes in key assumptions, primarily to near-term earnings projections, as well as discount rate, we recorded impairment losses related to goodwill and indefinite-lived intangible assets of $1.5 billion and $83 million, respectively. These losses are non-cash, do not impact future depreciation and amortization, and drove a $14.64 per share impact to our GAAP earnings for the fourth quarter.

Turning to cash generation, we reported free cash flow of $381 million for the fourth quarter. This performance was in line with expectations, driven by sequentially lower net cash interest and a $188 million release of working capital. These sequential benefits in free cash flow were partially offset by approximately $40 million in cash costs, primarily related to the previously announced footprint rationalization.

Historically, our business experiences seasonally lower cash generation in the first quarter, mainly driven by working capital, and we expect this trend to continue in 2025. In addition to the seasonal working capital headwind, we anticipate that the first quarter will:

•Represent our highest net cash interest cost due to the timing of coupon payments.

•Bear roughly $90 million of cash cost to generate savings. Included in this amount are cash costs related to the previously mentioned footprint rationalization and realization of the $75 million cost reduction primarily related to SG&A. This roughly $90 million represents approximately 60 percent of our projected burden during 2025.

•Incur the highest capital expenditure amount for the year.

•Deliver the lowest quarterly earnings of the year, due to factors such as a first-half weighted turnaround schedule and timing changes of our China acetate joint venture dividend payment schedule.

As a result, we anticipate first quarter free cash flow to be an approximate $300 million use of cash.

Looking forward, there are a number of drivers for 2025 that I want to compare versus 2024.

•Working capital is anticipated to be a $100 to $150 million source of cash in 2025, versus a $131 million use of cash in 2024 which was caused by the timing of footprint rationalization and unanticipated demand deterioration, primarily in the auto sector.

•Cash taxes are forecasted to be lower in 2025 by approximately $175 million to $200 million compared to the previous year, primarily due to the absence of the 2024 items discussed earlier.

•Capital expenditures are budgeted between $300 to $350 million in 2025, landing approximately $85 million to $135 million lower than 2024.

•Cash costs related to our cost reduction initiatives are expected to tick a bit higher with 2025 cost increasing by approximately $25 million compared to 2024. The cadence during the year is anticipated to be different, with 2024 costs concentrated in the fourth quarter, and 2025 costs heaviest in the first quarter.

•Net cash interest in 2025 is anticipated to be largely consistent with 2024 due to offsetting drivers. We plan to continue to pay down debt and to have less gross debt in 2025. Offsetting this benefit, there will be coupon step-ups on certain bonds, potential changes in borrowing rates through usage of our delayed draw term loan, and reduced proceeds earned from interest income due to a lower average cash balance.

In summary, despite an uncertain demand environment, we anticipate higher 2025 free cash flow when compared to 2024.

Lastly, before turning it back over to Scott, I wanted to provide additional color on our deleveraging efforts. Over the past seven consecutive quarters we have successfully reduced our gross debt, retiring more than $2 billion in the last two years. At the end of 2024, we had our $1.75 billion revolving credit facility undrawn and nearly $1 billion in cash on the balance sheet. Additionally, due to the previously disclosed dividend reduction that is effective in the first quarter of 2025, we will have an incremental $300 million available from our annual free cash flow generation to deploy toward debt reduction.

Although our deleveraging progress has been slower than anticipated, we remain steadfast in our laser focus on debt reduction. In the first quarter, we are set to retire $1.3 billion in maturing bonds using the $1 billion delayed draw term loan from the fourth quarter of 2024, cash on hand, and the revolver. Similar to previous quarters, drawing on the revolver is primarily related to managing cash flow timing, such as the anticipated use of cash to start the year. After the first quarter, our next bond maturity is in the third quarter of 2026.

Looking ahead, we are proactively taking the necessary steps for refinancing and will be opportunistic in extending and optimizing the maturity profile of our debt, potentially as early as the first quarter of 2025. We continue actively pursuing multiple divestiture opportunities of various sizes. Although the timing remains uncertain, we expect to sign one of these deals in 2025 based on our current progress.

Scott Richardson, Celanese Corporation, President and Chief Executive Officer

With little indication of meaningful macroeconomic recovery in the near-term, we expect the first quarter demand environment to be largely unchanged from the fourth quarter. In addition, we expect an approximately $100 million impact from a few specific first quarter timing items like the Acetyls dividend, acetate tow ordering pattern timing, EM medical implant seasonality, and the POM turnaround, that will not repeat in the second quarter. Given these dynamics, we anticipate first quarter adjusted earnings per share of $0.25 to $0.50.

We expect significant sequential improvement in the second quarter due to several factors. We anticipate improvement of approximately $100 million due to the non-repeating first quarter items highlighted above. Additionally, we expect second quarter sequential seasonal volume improvements, particularly in Asia across both businesses, and we anticipate approaching the full quarterly run rate realization of our SG&A cost reductions. Given these factors, we anticipate second quarter earnings per share to be

approximately $1 per share higher than the first quarter without taking into account benefits from any other business improvement actions taken.

Our focus for 2025 is driving controllable business improvements in an uncertain landscape, and as we get greater clarity on the impacts of our actions we will provide a more complete outlook for the year. That said, when considering factors such as the concentration of turnarounds in the first half, the timing of affiliate dividend payments, and the results of actions described previously, we believe our results in the second half of 2025 will be an improvement over the first half.

Going forward, we are executing against the priorities that I described earlier to drive the changes needed and the performance for which we are known. We are taking actions to improve our earnings, accelerate deleveraging, and increase shareholder returns in any environment. In my time at Celanese we have been through periods similar to what we are experiencing now, when our leverage was elevated, demand was poor, and there was overcapacity of supply. Similar to then, our response today is to deliver productivity every day, prudently allocate capital, and drive top-line growth. We emerged from that earlier period as a stronger company, and we have the capability to do that again.

Forward-Looking Statements

These prepared comments may contain "forward-looking statements," which include information concerning the Company's plans, objectives, goals, strategies, future revenues, cash flow, financial performance, synergies, capital expenditures, deleveraging efforts, dividend policy, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in these comments. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; volatility or changes in the price and availability of raw materials and energy, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, carbon monoxide, wood pulp, hexamethylene diamine, Polyamide 66 ("PA66"), polybutylene terephthalate, ethanol, natural gas and fuel oil, and the prices for electricity and other energy sources; the ability to pass increases in raw materials prices, logistics costs and other costs on to customers or otherwise improve margins through price increases; the possibility that we will not be able to realize the anticipated benefits of the Mobility & Materials business (the "M&M Business") we acquired from DuPont de Nemours, Inc. (the "M&M Acquisition"), including synergies and growth opportunities, whether as a result of difficulties arising from the operation of the M&M Business or other unanticipated delays, costs, inefficiencies or liabilities; additional impairments of goodwill or intangible assets; increased commercial, legal or regulatory complexity of entering into, or expanding our exposure to, certain end markets and geographies; risks in the global economy and equity and credit markets and their potential impact on our ability to pay down debt in the future and/or refinance at suitable rates, in a timely manner, or at all; risks and costs associated with increased leverage from the M&M Acquisition, including increased interest expense and potential reduction of business and strategic flexibility; the ability to maintain plant utilization rates and to implement planned capacity additions, expansions and maintenance; the ability to reduce or maintain current levels of production costs and to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; the ability to identify desirable potential acquisition or divestiture opportunities and to complete such transactions, including obtaining regulatory approvals, consistent with the Company's strategy; market acceptance of our products and technology; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, transportation, logistics or supply chain disruptions, cybersecurity incidents, terrorism or political unrest, public health crises, or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the direct or indirect consequences of acts of war or conflict (such as the Russia-Ukraine conflict or conflicts in the Middle East) or terrorist incidents or as a result of weather, natural disasters, or other crises; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the Company; changes in applicable tariffs, duties and trade agreements, tax rates or legislation throughout the world including, but not limited to, anti-dumping and countervailing duties, adjustments, changes in estimates or interpretations or the resolution of tax examinations or audits that may impact recorded or future tax impacts and potential regulatory and legislative tax developments in the United States and other jurisdictions; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; potential liability for remedial actions and increased costs under existing or future environmental, health and safety regulations, including those relating to climate change or other sustainability matters; potential liability resulting from pending or future claims or litigation, including investigations or enforcement actions, or from changes in the laws, regulations or policies of governments or other governmental activities, in the countries in which we operate; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry, and the success of our deleveraging efforts, as well as any changes to our credit ratings; changes in currency exchange rates and interest rates; tax rates and changes thereto; and various other factors discussed from time to time in the Company's filings with the Securities and Exchange Commission.

Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Non-GAAP Financial Measures

These prepared comments, and statements made in connection with these prepared comments, refer to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measure used, including definitions and reconciliations of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Financial Document Library.

2025 Key Actions February 2025 Exhibit 99.1(b)

Celanese Corporation Disclosures Forward-Looking Statements This presentation may contain "forward-looking statements," which include information concerning Celanese Corporation’s (the “Company”) plans objectives, goals, strategies, future revenues, cash flow, financial performance, synergies, capital expenditures, deleveraging efforts, dividend policy, financing needs and other information that is not historical information. All forward-looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations or that these beliefs will prove correct. There are a number of risks and uncertainties that could cause actual results to differ materially from the results expressed or implied in the forward-looking statements contained in this release. These risks and uncertainties include, among other things: changes in general economic, business, political and regulatory conditions in the countries or regions in which we operate; the length and depth of product and industry business cycles, particularly in the automotive, electrical, textiles, electronics and construction industries; volatility or changes in the price and availability of raw materials and energy, particularly changes in the demand for, supply of, and market prices of ethylene, methanol, natural gas, carbon monoxide, wood pulp, hexamethylene diamine, Polyamide 66 ("PA66"), polybutylene terephthalate, ethanol, natural gas and fuel oil, and the prices for electricity and other energy sources; the ability to pass increases in raw materials prices, logistics costs and other costs on to customers or otherwise improve margins through price increases; the possibility that we will not be able to realize the anticipated benefits of the Mobility & Materials business (the "M&M Business") we acquired from DuPont de Nemours, Inc. (the "M&M Acquisition"), including synergies and growth opportunities, whether as a result of difficulties arising from the operation of the M&M Business or other unanticipated delays, costs, inefficiencies or liabilities; additional impairments of goodwill or intangible assets; increased commercial, legal or regulatory complexity of entering into, or expanding our exposure to, certain end markets and geographies; risks in the global economy and equity and credit markets and their potential impact on our ability to pay down debt in the future and/or refinance at suitable rates, in a timely manner, or at all; risks and costs associated with increased leverage from the M&M Acquisition, including increased interest expense and potential reduction of business and strategic flexibility; the ability to maintain plant utilization rates and to implement planned capacity additions, expansions and maintenance; the ability to reduce or maintain current levels of production costs and to improve productivity by implementing technological improvements to existing plants; increased price competition and the introduction of competing products by other companies; the ability to identify desirable potential acquisition or divestiture opportunities and to complete such transactions, including obtaining regulatory approvals, consistent with the Company's strategy; market acceptance of our products and technology; compliance and other costs and potential disruption or interruption of production or operations due to accidents, interruptions in sources of raw materials, transportation, logistics or supply chain disruptions, cybersecurity incidents, terrorism or political unrest, public health crises, or other unforeseen events or delays in construction or operation of facilities, including as a result of geopolitical conditions, the direct or indirect consequences of acts of war or conflict (such as the Russia-Ukraine conflict or conflicts in the Middle East) or terrorist incidents or as a result of weather, natural disasters, or other crises; the ability to obtain governmental approvals and to construct facilities on terms and schedules acceptable to the Company; changes in applicable tariffs, duties and trade agreements, tax rates or legislation throughout the world including, but not limited to, anti-dumping and countervailing duties, adjustments, changes in estimates or interpretations or the resolution of tax examinations or audits that may impact recorded or future tax impacts and potential regulatory and legislative tax developments in the United States and other jurisdictions; changes in the degree of intellectual property and other legal protection afforded to our products or technologies, or the theft of such intellectual property; potential liability for remedial actions and increased costs under existing or future environmental, health and safety regulations, including those relating to climate change or other sustainability matters; potential liability resulting from pending or future claims or litigation, including investigations or enforcement actions, or from changes in the laws, regulations or policies of governments or other governmental activities, in the countries in which we operate; our level of indebtedness, which could diminish our ability to raise additional capital to fund operations or limit our ability to react to changes in the economy or the chemicals industry, and the success of our deleveraging efforts, as well as any changes to our credit ratings; changes in currency exchange rates and interest rates; tax rates and changes thereto; and various other factors discussed from time to time in the Company's filings with the Securities and Exchange Commission. Any forward-looking statement speaks only as of the date on which it is made, and the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. Results Unaudited The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Historical results should not be taken as an indication of the results of operations to be reported for any future period. Pro forma financial information herein is preliminary and subject to change. Presentation This document presents the Company’s two business segments, Engineered Materials and Acetyl Chain. Non-GAAP Financial Measures This presentation, and statements made in connection with this presentation, may refer to non-GAAP financial measures. For more information on the non-GAAP financial measures used by the Company, including the most directly comparable GAAP financial measure for each non-GAAP financial measures used, including definitions and reconciliations of the differences between such non-GAAP financial measures and the comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Non-GAAP Financial Measures. 2

Discussion Topics 3 Company Overview Historical Financials Strategic Priorities

. . . A global chemical and specialty materials company that engineers and manufactures a variety of products essential to everyday living Company Snapshot 4 20+ COUNTRIES 56 MANUFACTURING SITES Dallas HEADQUARTERS ~$2.4B 2024 Operating EBITDA ~$10.3B 2024 NET SALES 12,163 GLOBAL EMPLOYEES * * Represents a non-GAAP measure. For information on historical non-GAAP financial measures used by the Company, including definitions and reconciliations to comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Non-GAAP Financial Measures.

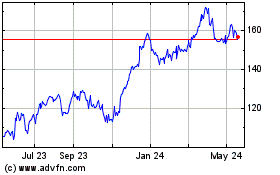

$4.07 $4.50 $5.67 $6.02 $6.61 $7.51 $11.00 $9.53 $7.64 $18.12 $15.88 $8.92 $8.37 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 1.3 1.4 1.6 1.5 1.6 1.7 2.2 1.8 1.5 2.8 2.6 2.4 2.4 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Committed to Taking Bold Action to Reestablish Industry Leadership and Lift Earnings We are committed to: • Reestablishing consistent earnings growth • Driving performance improvement and enhanced productivity • Returning Celanese to the upper tier of shareholder value creation Operating EBITDA ($B) Adjusted EPS 5* Represents a non-GAAP measure. For information on historical non-GAAP financial measures used by the Company, including definitions and reconciliations to comparable GAAP financial measures, please refer to the Non-US GAAP Financial Measures and Supplemental Information document available on our website, investors.celanese.com, under Financial Information/Non-GAAP Financial Measures. * * + 7% CAGR + 13% CAGR

Advancing Strategic Priorities to Realize Celanese’s Potential 6 INCREASE CASH FLOW to Deleverage the balance sheet DRIVE TOP-LINE GROWTH through Supercharging the pipeline & industry opportunities INTENSIFY COST REDUCTION by Driving productivity everyday

Refinance certain debt maturities and de-risk capital structure Actively pursue divestiture opportunities to advance deleveraging Reduce inventory in Engineered Materials (EM) by over $100M Post-integration inventory optimization Update lead times and service levels to better leverage our global footprint Reduce inventory further through a more contemporary, lower cost-to- serve distribution network Increase Cash Flow to Deleverage the Balance Sheet >$2B $ Reduced CapEx Spend Total Debt Retired $14.7B $13.7B 12.6B 2022 2023 2024 2025 PrioritiesActions Taken 7 $568M $435M $300-$350M 2023 2024 2025

Actions Taken Intensify Cost Reduction 13,263 12,410 12,163 ~11,850 Jan 2023 Jan 2024 Jan 2025 Jan 2025 11% 42 plants 34 plants Nov 2022 Feb-25 19% Implemented Workforce Reductions Engineered Materials Manufacturing Footprint $75 million in SG&A cost reductions underway with a goal of achieving top tier SG&A / sales Streamline Engineered Materials post-integration complexities to deliver $50 - $100M in annual savings Reduction of warehouses, distribution networks, and logistics Further manufacturing optimization Further deep dive assessments of all business aspects, including Review global deployment of resources to drive efficiency and better match to high growth opportunities Optimize use of low-cost locations for shared service centers 2025 Priorities Feb 2025 02/2025 8 12/31/2022 12/31/2023 12/31/2024

Actions Taken Drive Top-Line Growth Engineered Materials - Projects Won in High Growth Segments Percent increase 2024 vs 2023 Acetyl Chain – Unparalleled Optionality Drives Growth Align revenue enhancement model to global growth sectors Refocus on smaller volume, high-margin projects Deliver ~$200M of pipeline expansion and 10% improvement in win rate by 2026 in EM Fully exercise Acetyl Chain’s optionality to drive growth 2025 Priorities 9 31% 50% 21% Electric Vehicles Future Connectivity Medical 75

Why Own Celanese Today Our mission is to position Celanese as a top quartile company for total shareholder return by delivering earnings growth in any environment 10 Strong earnings leverage as demand recovers Actions underway to deliver near-term earnings improvement New leadership driving change Attractive valuation with upside potential for stock History of innovationDisciplined stewards of capital focused on deleveraging

Non-US GAAP Financial Measures and Supplemental Information

February 18, 2025

In this document, the terms the "Company," "we" and "our" refer to Celanese Corporation and its subsidiaries on a consolidated basis.

Purpose

The purpose of this document is to provide information of interest to investors, analysts and other parties including supplemental financial information and reconciliations and other information concerning our use of non-US GAAP financial measures. This document is updated quarterly.

Presentation

This document presents the Company's two business segments, Engineered Materials and the Acetyl Chain.

Use of Non-US GAAP Financial Measures

From time to time, management may publicly disclose certain numerical "non-GAAP financial measures" in the course of our earnings releases, financial presentations, earnings conference calls, investor and analyst meetings and otherwise. For these purposes, the Securities and Exchange Commission ("SEC") defines a "non-GAAP financial measure" as a numerical measure of historical or future financial performance, financial position or cash flows that excludes amounts, or is subject to adjustments that effectively exclude amounts, included in the most directly comparable measure calculated and presented in accordance with US GAAP, and vice versa for measures that include amounts, or are subject to adjustments that effectively include amounts, that are excluded from the most directly comparable US GAAP measure so calculated and presented. For these purposes, "GAAP" refers to generally accepted accounting principles in the United States.

Non-GAAP financial measures disclosed by management are provided as additional information to investors, analysts and other parties because the Company believes them to be important supplemental measures for assessing our financial and operating results and as a means to evaluate our financial condition and period-to-period comparisons. These non-GAAP financial measures should be viewed as supplemental to, and should not be considered in isolation or as alternatives to, net earnings (loss), operating profit (loss), operating margin, cash flow from operating activities (together with cash flow from investing and financing activities), earnings per share or any other US GAAP financial measure. These non-GAAP financial measures should be considered within the context of our complete audited and unaudited financial results for the given period, which are available on the Financial Information/Financial Document Library page of our website, investors.celanese.com. The definition and method of calculation of the non-GAAP financial measures used herein may be different from other companies' methods for calculating measures with the same or similar titles. Investors, analysts and other parties should understand how another company calculates such non-GAAP financial measures before comparing the other company's non-GAAP financial measures to any of our own. These non-GAAP financial measures may not be indicative of the historical operating results of the Company nor are they intended to be predictive or projections of future results.

Pursuant to the requirements of SEC Regulation G, whenever we refer to a non-GAAP financial measure, we will also present in this document, in the presentation itself or on a Form 8-K in connection with the presentation on the Financial Information/Financial Document Library page of our website, investors.celanese.com, to the extent practicable, the most directly comparable financial measure calculated and presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference and such comparable GAAP financial measure.

This document includes definitions and reconciliations of non-GAAP financial measures used from time to time by the Company.

Specific Measures Used

This document provides information about the following non-GAAP measures: adjusted EBIT, adjusted EBIT margin, operating EBITDA, operating EBITDA margin, operating profit (loss) attributable to Celanese Corporation, adjusted earnings per share, net debt, free cash flow and return on invested capital (adjusted). The most directly comparable financial measure presented in accordance with US GAAP in our consolidated financial statements for adjusted EBIT and operating EBITDA is net earnings (loss) attributable to Celanese Corporation; for adjusted EBIT margin and operating EBITDA margin is operating margin; for operating profit (loss) attributable to Celanese Corporation is operating profit (loss); for adjusted earnings per share is earnings (loss) from continuing operations attributable to Celanese Corporation per common share-diluted; for net debt

is total debt; for free cash flow is net cash provided by (used in) operations; and for return on invested capital (adjusted) is net earnings (loss) attributable to Celanese Corporation divided by the sum of the average of beginning and end of the year short- and long-term debt and Celanese Corporation shareholders' equity.

Definitions

•Adjusted EBIT is a performance measure used by the Company and is defined by the Company as net earnings (loss) attributable to Celanese Corporation, plus (earnings) loss from discontinued operations, less interest income, plus interest expense, plus refinancing expense and taxes, and further adjusted for Certain Items (refer to Table 8). We believe that adjusted EBIT provides transparent and useful information to management, investors, analysts and other parties in evaluating and assessing our primary operating results from period-to-period after removing the impact of unusual, non-operational or restructuring-related activities that affect comparability. Our management recognizes that adjusted EBIT has inherent limitations because of the excluded items. Adjusted EBIT is one of the measures management uses for planning and budgeting, monitoring and evaluating financial and operating results and as a performance metric in the Company's incentive compensation plan. We do not provide reconciliations for adjusted EBIT on a forward-looking basis (including those contained in this document) when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of Certain Items, such as mark-to-market pension gains and losses, that have not yet occurred, are out of our control and/or cannot be reasonably predicted. For the same reasons, we are unable to address the probable significance of the unavailable information. Adjusted EBIT margin is defined by the Company as adjusted EBIT divided by net sales. Adjusted EBIT margin has the same uses and limitations as adjusted EBIT. •Operating EBITDA is a performance measure used by the Company and is defined by the Company as net earnings (loss) attributable to Celanese Corporation, plus (earnings) loss from discontinued operations, less interest income, plus interest expense, plus refinancing expense, taxes and depreciation and amortization, and further adjusted for Certain Items, which Certain Items include accelerated depreciation and amortization expense. Operating EBITDA is equal to adjusted EBIT plus depreciation and amortization. We believe that operating EBITDA provides transparent and useful information to investors, analysts and other parties in evaluating our operating performance relative to our peer companies. We do not provide reconciliations for operating EBITDA on a forward-looking basis (including those contained in this document) when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of Certain Items, such as mark-to-market pension gains and losses, that have not yet occurred, are out of our control and/or cannot be reasonably predicted. For the same reasons, we are unable to address the probable significance of the unavailable information. Operating EBITDA margin is defined by the Company as operating EBITDA divided by net sales. Operating EBITDA margin has the same uses and limitations as operating EBITDA.

•Operating profit (loss) attributable to Celanese Corporation is defined by the Company as operating profit (loss), less earnings (loss) attributable to noncontrolling interests ("NCI"). We believe that operating profit (loss) attributable to Celanese Corporation provides transparent and useful information to management, investors, analysts and other parties in evaluating our core operational performance. Operating margin attributable to Celanese Corporation is defined by the Company as operating profit (loss) attributable to Celanese Corporation divided by net sales. Operating margin attributable to Celanese Corporation has the same uses and limitations as operating profit (loss) attributable to Celanese Corporation.

•Adjusted earnings per share is a performance measure used by the Company and is defined by the Company as earnings (loss) from continuing operations attributable to Celanese Corporation, adjusted for income tax (provision) benefit, Certain Items, and refinancing and related expenses, divided by the number of basic common shares and dilutive restricted stock units and stock options calculated using the treasury method. We believe that adjusted earnings per share provides transparent and useful information to management, investors, analysts and other parties in evaluating and assessing our primary operating results from period-to-period after removing the impact of the above stated items that affect comparability and as a performance metric in the Company's incentive compensation plan. We do not provide reconciliations for adjusted earnings per share on a forward-looking basis (including those contained in this document) when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of Certain Items, such as mark-to-market pension gains and losses, that have not yet occurred, are out of our control and/or cannot be reasonably predicted. For the same reasons, we are unable to address the probable significance of the unavailable information.

Note: The income tax expense (benefit) on Certain Items ("Non-GAAP adjustments") is determined using the applicable rates in the taxing jurisdictions in which the Non-GAAP adjustments occurred and includes both current and deferred income tax expense (benefit). The income tax rate used for adjusted earnings per share approximates the midpoint in a range of forecasted tax rates for the year. This range may include certain partial or full-year forecasted tax opportunities and related costs, where applicable, and specifically excludes changes in uncertain tax positions, discrete recognition of GAAP items on a quarterly basis, other pre-tax items adjusted out of our GAAP earnings for adjusted earnings per share purposes and changes in management's assessments regarding the ability to realize deferred tax assets for GAAP. In determining the adjusted earnings per share tax rate, we reflect the impact of foreign tax credits when utilized, or expected to be utilized, absent discrete events impacting the timing of foreign tax credit utilization. We analyze this rate quarterly and adjust it if there is a material change in the range of forecasted tax rates; an updated forecast would not necessarily result in a change to our tax rate used for adjusted earnings per share. The adjusted tax rate is an estimate and may differ from the actual tax rate used for GAAP reporting in any given reporting period. Table 3a summarizes the reconciliation of our estimated GAAP effective tax rate to the adjusted tax

rate. The estimated GAAP rate excludes discrete recognition of GAAP items due to our inability to forecast such items. As part of the year-end reconciliation, we will update the reconciliation of the GAAP effective tax rate to the adjusted tax rate for actual results.

•Free cash flow is a liquidity measure used by the Company and is defined by the Company as net cash provided by (used in) operations, less capital expenditures on property, plant and equipment, and adjusted for contributions from or distributions to our NCI joint ventures. We believe that free cash flow provides useful information to management, investors, analysts and other parties in evaluating the Company's liquidity and credit quality assessment because it provides an indication of the long-term cash generating ability of our business. Although we use free cash flow as a measure to assess the liquidity generated by our business, the use of free cash flow has important limitations, including that free cash flow does not reflect the cash requirements necessary to service our indebtedness, lease obligations, unconditional purchase obligations or pension and postretirement funding obligations. Free cash flow is not a measure of cash available for discretionary expenditures since the Company has certain debt service and finance lease payments that are not deducted from that measure. We do not provide reconciliations for free cash flow on a forward-looking basis when we are unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the timing and amount of items such as working capital changes, fluctuations in foreign currency exchange rates, the impact and timing of potential acquisitions and divestitures, and other structural changes, that have not yet occurred, are out of our control and/or cannot be reasonably predicted. For the same reasons, we are unable to address the probable significance of the unavailable information.

•Net debt is defined by the Company as total debt less cash and cash equivalents. We believe that net debt provides useful information to management, investors, analysts and other parties in evaluating changes to the Company's capital structure and credit quality assessment.

•Return on invested capital (adjusted) is defined by the Company as adjusted EBIT, tax effected using the adjusted tax rate, divided by the sum of the average of beginning and end of the year short- and long-term debt and Celanese Corporation shareholders' equity. We believe that return on invested capital (adjusted) provides useful information to management, investors, analysts and other parties in order to assess our income generation from the point of view of our shareholders and creditors who provide us with capital in the form of equity and debt and whether capital invested in the Company yields competitive returns.

Supplemental Information

Supplemental Information we believe to be of interest to investors, analysts and other parties includes the following:

•Net sales for each of our business segments and the percentage increase or decrease in net sales attributable to price, volume, currency and other factors for each of our business segments.

•Cash dividends received from our equity investments.

•For those consolidated ventures in which the Company owns or is exposed to less than 100% of the economics, the outside shareholders' interests are shown as NCI. Amounts referred to as "attributable to Celanese Corporation" are net of any applicable NCI.

Results Unaudited

The results in this document, together with the adjustments made to present the results on a comparable basis, have not been audited and are based on internal financial data furnished to management. Quarterly results should not be taken as an indication of the results of operations to be reported for any subsequent period or for the full fiscal year.

Table 1

Celanese Adjusted EBIT and Operating EBITDA - Reconciliation of Non-GAAP Measures - Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | Q4 '24 | | Q3 '24 | | Q2 '24 | | Q1 '24 | | 2023 | | Q4 '23 | | Q3 '23 | | Q2 '23 | | Q1 '23 |

| (In $ millions) |

| Net earnings (loss) attributable to Celanese Corporation | (1,522) | | | (1,914) | | | 116 | | | 155 | | | 121 | | | 1,960 | | | 698 | | | 951 | | | 220 | | | 91 | |

| (Earnings) loss from discontinued operations | 8 | | | 5 | | | 2 | | | 1 | | | — | | | 9 | | | 6 | | | 1 | | | (1) | | | 3 | |

| Interest income | (33) | | | (5) | | | (5) | | | (10) | | | (13) | | | (39) | | | (12) | | | (12) | | | (7) | | | (8) | |

| Interest expense | 676 | | | 164 | | | 169 | | | 174 | | | 169 | | | 720 | | | 178 | | | 178 | | | 182 | | | 182 | |

| Refinancing expense | — | | | — | | | — | | | — | | | — | | | 7 | | | — | | | 7 | | | — | | | — | |

| Income tax provision (benefit) | 510 | | | 387 | | | 61 | | | 29 | | | 33 | | | (790) | | | (575) | | | (236) | | | (4) | | | 25 | |

Certain Items attributable to Celanese Corporation (Table 8) | 2,009 | | | 1,696 | | | 114 | | | 102 | | | 97 | | | (114) | | | 139 | | | (438) | | | 54 | | | 131 | |

| Adjusted EBIT | 1,648 | | | 333 | | | 457 | | | 451 | | | 407 | | | 1,753 | | | 434 | | | 451 | | | 444 | | | 424 | |

Depreciation and amortization expense(1) | 728 | | | 184 | | | 187 | | | 181 | | | 176 | | | 691 | | | 174 | | | 173 | | | 172 | | | 172 | |

| Operating EBITDA | 2,376 | | | 517 | | | 644 | | | 632 | | | 583 | | | 2,444 | | | 608 | | | 624 | | | 616 | | | 596 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | Q4 '24 | | Q3 '24 | | Q2 '24 | | Q1 '24 | | 2023 | | Q4 '23 | | Q3 '23 | | Q2 '23 | | Q1 '23 |

| (In $ millions) |

| Engineered Materials | 73 | | | 1 | | | 16 | | | 11 | | | 45 | | | 15 | | | 15 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

| Acetyl Chain | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Other Activities(2) | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Accelerated depreciation and amortization expense | 73 | | | 1 | | | 16 | | | 11 | | | 45 | | | 15 | | | 15 | | | — | | | — | | | — | |

Depreciation and amortization expense(1) | 728 | | | 184 | | | 187 | | | 181 | | | 176 | | | 691 | | | 174 | | | 173 | | | 172 | | | 172 | |

| Total depreciation and amortization expense | 801 | | | 185 | | | 203 | | | 192 | | | 221 | | | 706 | | | 189 | | | 173 | | | 172 | | | 172 | |

______________________________

(1)Excludes accelerated depreciation and amortization expense as detailed in the table above, which amounts are included in Certain Items above.

(2)Other Activities includes corporate Selling, general and administrative ("SG&A") expenses, results of captive insurance companies and certain components of net periodic benefit cost (interest cost, expected return on plan assets and net actuarial gains and losses).

| | | | | | | | |

| Table 2 - Supplemental Segment Data and Reconciliation of Segment Adjusted EBIT and Operating EBITDA - Non-GAAP Measures - Unaudited | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | Q4 '24 | | Q3 '24 | | Q2 '24 | | Q1 '24 | | 2023 | | Q4 '23 | | Q3 '23 | | Q2 '23 | | Q1 '23 |

| (In $ millions, except percentages) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) / Operating Margin | | | | | | | | | | | | | | | | | | | | |

| Engineered Materials | (1,179) | | | (21.0) | % | | (1,508) | | | (117.7) | % | | 102 | | | 6.9 | % | | 138 | | | 9.4 | % | | 89 | | | 6.5 | % | | 1,083 | | | 17.6 | % | | 122 | | | 8.7 | % | | 691 | | | 45.2 | % | | 158 | | | 10.0 | % | | 112 | | | 6.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acetyl Chain | 951 | | | 20.0 | % | | 216 | | | 19.5 | % | | 239 | | | 20.1 | % | | 242 | | | 20.1 | % | | 254 | | | 20.1 | % | | 1,109 | | | 22.7 | % | | 264 | | | 22.4 | % | | 272 | | | 22.3 | % | | 295 | | | 23.9 | % | | 278 | | | 22.2 | % |

Other Activities(1) | (469) | | | | | (113) | | | | | (93) | | | | | (130) | | | | | (133) | | | | | (505) | | | | | (127) | | | | | (121) | | | | | (118) | | | | | (139) | | | |

| Total | (697) | | | (6.8) | % | | (1,405) | | | (59.3) | % | | 248 | | | 9.4 | % | | 250 | | | 9.4 | % | | 210 | | | 8.0 | % | | 1,687 | | | 15.4 | % | | 259 | | | 10.1 | % | | 842 | | | 30.9 | % | | 335 | | | 12.0 | % | | 251 | | | 8.8 | % |

| Less: Net Earnings (Loss) Attributable to NCI for Engineered Materials | (1) | | | | | 2 | | | | | 2 | | | | | (4) | | | | | (1) | | | | | (3) | | | | | 1 | | | | | (2) | | | | | (2) | | | | | — | | | |

| Less: Net Earnings (Loss) Attributable to NCI for Acetyl Chain | 9 | | | | | 1 | | | | | 2 | | | | | 2 | | | | | 4 | | | | | 7 | | | | | 2 | | | | | — | | | | | 3 | | | | | 2 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Profit (Loss) Attributable to Celanese Corporation | (705) | | | (6.9) | % | | (1,408) | | | (59.4) | % | | 244 | | | 9.2 | % | | 252 | | | 9.5 | % | | 207 | | | 7.9 | % | | 1,683 | | | 15.4 | % | | 256 | | | 10.0 | % | | 844 | | | 31.0 | % | | 334 | | | 11.9 | % | | 249 | | | 8.7 | % |

| Operating Profit (Loss) / Operating Margin Attributable to Celanese Corporation | | | | | | | | | | | | | | | | | | | | |

| Engineered Materials | (1,178) | | | (21.0) | % | | (1,510) | | | (117.9) | % | | 100 | | | 6.8 | % | | 142 | | | 9.7 | % | | 90 | | | 6.5 | % | | 1,086 | | | 17.7 | % | | 121 | | | 8.6 | % | | 693 | | | 45.4 | % | | 160 | | | 10.1 | % | | 112 | | | 6.9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Acetyl Chain | 942 | | | 19.8 | % | | 215 | | | 19.4 | % | | 237 | | | 19.9 | % | | 240 | | | 20.0 | % | | 250 | | | 19.8 | % | | 1,102 | | | 22.6 | % | | 262 | | | 22.2 | % | | 272 | | | 22.3 | % | | 292 | | | 23.7 | % | | 276 | | | 22.1 | % |

Other Activities(1) | (469) | | | | | (113) | | | | | (93) | | | | | (130) | | | | | (133) | | | | | (505) | | | | | (127) | | | | | (121) | | | | | (118) | | | | | (139) | | | |

| Total | (705) | | | (6.9) | % | | (1,408) | | | (59.4) | % | | 244 | | | 9.2 | % | | 252 | | | 9.5 | % | | 207 | | | 7.9 | % | | 1,683 | | | 15.4 | % | | 256 | | | 10.0 | % | | 844 | | | 31.0 | % | | 334 | | | 11.9 | % | | 249 | | | 8.7 | % |

| Equity Earnings and Dividend Income, Other Income (Expense) Attributable to Celanese Corporation | | | | | | | | | | | | | | | | | | | | |

| Engineered Materials | 178 | | | | | 33 | | | | | 46 | | | | | 49 | | | | | 50 | | | | | 87 | | | | | 45 | | | | | 12 | | | | | 20 | | | | | 10 | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |