UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024

Commission File Number: 1-15224

Energy Company of Minas Gerais

(Translation of Registrant’s Name into English)

Avenida Barbacena, 1200

30190-131 Belo Horizonte, Minas Gerais, Brazil

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Forward-Looking Statements

This report contains statements about expected future events and financial results that are forward-looking and subject to risks and uncertainties. Actual results could differ materially from those predicted in such forward-looking statements. Factors which may cause actual results to differ materially from those discussed herein include those risk factors set forth in our most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. CEMIG undertakes no obligation to revise these forward-looking statements to reflect events or circumstances after the date hereof, and claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG |

|

|

|

|

By: |

/s/ Leonardo George de Magalhães |

|

Name: |

Leonardo George de Magalhães |

Date: July 18, 2024 |

Title: |

Chief Finance and Investor Relations Officer |

1- Notice to Shareholders dated April 29, 2024 – Resolutions of the AESM - Dividends and Bonus

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY-HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

NOTICE TO SHAREHOLDERS

Resolutions of the AESM - Dividends and Bonus

We hereby inform our shareholders that the Annual and Extraordinary Shareholders’ Meeting (AESM) held on this date, resolved, among other matters, the following:

1. DIVIDENDS:

a)As for the net income for 2023, in the amount of R$5,764,273 thousand, R$3,124,577 thousand shall be allocated as mandatory dividends for Company shareholders, to be paid in two equal installments, with the first installment paid by 06/30/2024, and the second by 12/30/2024, as follows:

✓ To ratify R$2,591,459 thousand as Interest on Equity (“IOE”), already declared according to the table below;

|

|

|

|

|

|

Approval Date |

Date “with rights” |

Date “ex-rights” |

Per common/preferred share (R$) |

Total

Amount

R$ thousand |

|

|

|

12/14/2023 |

12/21/2023 |

12/22/2023 |

0.601020796 |

1,322,561 |

|

09/20/2023 |

09/25/2023 |

09/26/2023 |

0.189942896 |

417,974 |

|

06/20/2023 |

06/23/2023 |

06/26/2023 |

0.193907405 |

426,698 |

|

03/22/2023 |

03/27/2023 |

03/28/2023 |

0.192784036 |

424,226 |

|

TOTAL |

1.177655133 |

2,591,459 |

|

✓ To declare R$533,118 thousand as dividends, corresponding to R$0.24226860196 per common/preferred share, payable to shareholders registered in the Book of Registry of Registered Shares on the date of the holding of the AESM, that is, 04/29/2024. The shares will be traded “ex-rights” from 04/30/2024.

2. SHARE CAPITAL INCREASE AND BONUS:

a)Increase in the Share Capital from R$11,006,853 thousand to R$14,308,909, with the issue of 660,411,207 new shares, being 220,754,287 registered common shares, at a nominal value of R$5.00 each and 439,656,920 registered preferred shares, at a nominal value of R$5.00 each, by capitalizing R$1,856,628 thousand, arising from the capital reserve, and R$1,445,428 from the retained earnings reserve, through share-based bonus, thereby distributing to shareholders a bonus

of 30.00000002726% consisted of new shares of the type of the previous ones, at a nominal value of R$5.00;

b)All shareholders of record on 04/29/2024, relating to shares traded on B3 S.A. – Brasil, Bolsa, Balcão (“B3”), will be entitled to the aforementioned benefit. The shares will be traded “ex-rights” as to the bonus as of 04/30/2024.

c)The shares arising from the bonus will be credited on 05/03/2024 and will not be entitled to receive the dividends resolved on for the 2023 fiscal year.

d)Pursuant to paragraph 1 of Article 58 of Normative Instruction 1585/2015 of the Brazilian Federal Revenue Service, the acquisition unit cost assigned to bonus shares is R$5.00.

e)As per Normative Instruction 168/91 of the Brazilian Securities and Exchange Commission - CVM, the value calculated from the sale, in reais, of the fractions resulting from the calculation of the bonus will be paid to the respective holders of said fractions, on the same payment date of the second installment of the mandatory dividends for 2023, that is, 12/30/2024.

Shareholders whose shares are not held in custody at CBLC (Companhia Brasileira de Liquidação e Custódia) and whose registration data is outdated are advised to go to a branch of Banco Itaú Unibanco S.A. (The institution administering CEMIG’s Registered Shares System) bearing their personal documents for the due update of their registration data.

Belo Horizonte, April 29, 2024.

Leonardo George de Magalhães

Vice President of Finance and Investor Relations

2 - Notice to the Market dated April 30, 2024 – Filing of Form 20-F

COMPANHIA ENERGÉTICA DE MINAS GERAIS - CEMIG

PUBLICLY HELD COMPANY

Corporate Taxpayer’s ID (CNPJ): 17.155.730/0001-64

Company Registry (NIRE): 31300040127

NOTICE TO THE MARKET

Form 20-F

A COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG (“CEMIG”), a publicly held company with shares traded on the stock exchanges of São Paulo, New York and Madrid, hereby informs the Brazilian Securities and Exchange Commission (CVM), B3 S.A. – Brasil, Bolsa, Balcão (“B3”) and the market in general that it has filed on April 30, 2024, Form 20-F for the 2023 fiscal year (“2023 Form 20-F”) with the U.S. Securities and Exchange Commission (“SEC”).

2023 Form 20-F can be accessed on SEC’s website, at www.sec.gov, or the Company’s

Investor Relations website, at http://ri.cemig.com.br.

Belo Horizonte, April 30, 2024.

Leonardo George de Magalhães

Vice President of Finance and Investor Relations

3 - Earnings Release – 1Q2024

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

4 |

|

CONSOLIDATED RESULTS FOR THE QUARTER

Consolidated results – 1Q24

|

|

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

Ebitda by company, IFRS |

|

|

|

|

(R$ ’000) |

|

Cemig D |

(IFRS) |

746,490 |

775,088 |

–3.7% |

Cemig GT |

(IFRS) |

800,893 |

818,897 |

–2.2% |

Gasmig |

(IFRS) |

217,642 |

257,995 |

–15.6% |

Consolidated |

(IFRS) |

2,011,234 |

2,161,971 |

–7.0% |

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

Ebitda by company, Adjusted |

|

|

|

(R$ ’000) |

|

|

|

Cemig D |

746,490 |

741,098 |

0.7% |

Cemig GT |

780,862 |

788,809 |

–1.0% |

Consolidated |

1,990,700 |

2,072,566 |

–3.9% |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

5 |

|

Profit and loss accounts

|

|

|

|

|

|

|

1Q24 |

1Q23 |

Change, % |

PROFIT AND LOSS ACCOUNTS |

(R$ ’000) |

|

|

|

NET REVENUE |

|

9,057,867 |

8,646,937 |

4.8% |

|

|

|

|

|

COSTS |

|

5,785,012 |

5,462,332 |

5.9% |

Cost of electricity |

|

3,510,632 |

3,444,067 |

1.9% |

Gas purchased for resale |

|

510,177 |

614,803 |

–17.0% |

Charges for use of national grid |

|

843,222 |

700,181 |

20.4% |

Infrastructure construction costs |

|

920,981 |

703,281 |

31.0% |

|

|

|

|

|

OPERATING EXPENSES |

|

1,680,664 |

1,478,341 |

13.7% |

People |

|

324,058 |

335,197 |

–3.3% |

Employees’ and managers’ profit shares |

|

39,232 |

38,127 |

– |

Post-employment obligations |

|

142,285 |

103,038 |

38.1% |

Materials |

|

28,970 |

29,233 |

–0.9% |

Outsourced services |

|

518,907 |

467,446 |

11.0% |

Depreciation and amortization |

|

328,542 |

302,666 |

8.5% |

Operating provisions / adjustments |

|

139,585 |

113,536 |

22.9% |

Impairment |

|

22,958 |

46,126 |

–50.2% |

Provisions for client default |

|

75,853 |

7,926 |

857.0% |

Gain on disposal of plants |

|

–42,989 |

0 |

– |

Gain on disposal of investment |

|

0 |

–30,487 |

–100.0% |

Other operating costs and expenses, net |

|

103,263 |

65,533 |

57.6% |

|

|

|

|

|

Share of profit (loss) in non–consolidated investees |

|

90,501 |

153,041 |

–40.9% |

|

|

|

|

|

Net finance income (expenses) |

|

–180,986 |

–105,914 |

70.9% |

Profit before income and Social Contribution taxes |

|

1,501,706 |

1,753,391 |

–14.4% |

Deferred income tax and Social Contribution tax |

|

–348,815 |

–355,185 |

–1.8% |

|

|

|

|

|

NET PROFIT FOR THE PERIOD |

|

1,152,891 |

1,398,206 |

–17.5% |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

6 |

|

RESULTS BY BUSINESS SEGMENT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION BY SEGMENT, 1Q24 |

|

Electricity |

Gas |

Equity

interests |

Eliminations |

TOTAL |

Generation |

Transmission |

Trading |

Distribution |

NET REVENUE |

714,883 |

285,785 |

1,750,127 |

5,970,234 |

792,017 |

7,920 |

-463,099 |

9,057,867 |

|

|

|

|

|

|

|

|

|

COST OF ELECTRICITY AND GAS |

–78,944 |

–106 |

–1,454,588 |

–3,274,737 |

–510,177 |

–538 |

455,059 |

–4,864,031 |

|

|

|

|

|

|

|

|

|

OPERATIONAL COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

People |

–37,764 |

–36,716 |

–5,886 |

–210,155 |

–16,377 |

–17,160 |

0 |

–324,058 |

Employees’ and managers’ profit shares |

–3,968 |

–4,077 |

–650 |

–25,117 |

0 |

–5,420 |

0 |

–39,232 |

Post-employment obligations |

–15,126 |

–9,348 |

–2,142 |

–96,053 |

0 |

–19,616 |

0 |

–142,285 |

Materials, Outsourced services and Other expenses |

–18,667 |

–20,409 |

–4,710 |

–567,270 |

–12,760 |

–15,555 |

8,040 |

–631,331 |

Depreciation and amortization |

–83,583 |

59 |

–6 |

–216,199 |

–23,727 |

–5,086 |

0 |

–328,542 |

Operating provisions / adjustments |

–3,190 |

–3,165 |

–2,380 |

–191,435 |

–608 |

–14,438 |

0 |

–215,216 |

Infrastructure construction costs |

0 |

–27,554 |

0 |

–858,976 |

–34,451 |

0 |

0 |

–920,981 |

Total, operational |

–162,298 |

–101,210 |

–15,774 |

–2,165,205 |

–87,923 |

–77,275 |

8,040 |

–2,601,645 |

|

|

|

|

|

|

|

|

|

TOTAL COSTS AND EXPENSES |

–241,242 |

–101,316 |

–1,470,362 |

–5,439,942 |

–598,100 |

–77,813 |

463,099 |

–7,465,676 |

|

|

|

|

|

|

|

|

|

Share of profit (loss) in non-consolidated investees |

–1,012 |

0 |

0 |

0 |

0 |

91,513 |

0 |

90,501 |

Finance income (expenses) |

–27,802 |

–16,587 |

7,449 |

–108,781 |

–17,159 |

–18,106 |

0 |

–180,986 |

Profit (loss) before taxes on profit |

444,827 |

167,882 |

287,214 |

421,511 |

176,758 |

3,514 |

0 |

1,501,706 |

Income tax and Social Contribution tax |

–73,033 |

–35,576 |

–95,210 |

–99,173 |

–59,750 |

13,927 |

0 |

–348,815 |

|

|

|

|

|

|

|

|

|

NETPROFIT FORTHEPERIOD |

371,794 |

132,306 |

192,004 |

322,338 |

117,008 |

17,441 |

0 |

1,152,891 |

|

|

|

|

|

|

|

|

|

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

7 |

|

CONSOLIDATED ELECTRICITY MARKET

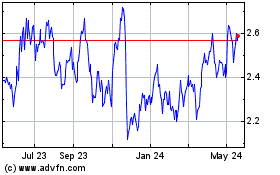

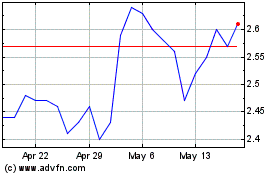

Cemig’s electricity market

In March 2024 the Cemig Group billed approximately 9.25 million clients – an addition of approximately 174,000 clients, or a 1.9% increase in its consumer base from March 2023.

•9,247,020 of these consumers are final consumers (including Cemig’s own consumption);

•537 are other agents in the Brazilian power sector.

The charts below itemize the Cemig Group’s sales to final consumers:

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

8 |

|

PERFORMANCE BY COMPANY

Cemig D

Billed electricity market

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

Captive clients + Transmission service (MWh) |

|

|

|

Residential |

3,250,170 |

2,984,825 |

8.9% |

Industrial |

5,574,606 |

5,457,071 |

2.2% |

Captive market |

275.264 |

334.141 |

–17.6% |

Transport of energy |

5,299,342 |

5,122,930 |

3.4% |

Commercial, Services and Others |

1,657,340 |

1,612,350 |

2.8% |

Captive market |

1,076,142 |

1,113,679 |

–3.4% |

Transport of energy |

581,198 |

498,671 |

16.5% |

Rural |

614,792 |

528,060 |

16.4% |

Captive market |

600,086 |

517,361 |

16.0% |

Transport of energy |

14,706 |

10,699 |

37.5% |

Public services |

845,626 |

870,898 |

–2.9% |

Captive market |

719,985 |

765,523 |

–5.9% |

Transport of energy |

125,641 |

105,375 |

19.2% |

Concession holders |

76,189 |

64,686 |

17.8% |

Transport of energy |

76,189 |

64,686 |

17.8% |

Own consumption |

8,188 |

7,545 |

8.5% |

Total |

12,026,911 |

11,525,435 |

4.4% |

Total, captive market |

5,929,835 |

5,723,074 |

3.6% |

Total, energy transported for Free Clients |

6,097,076 |

5,802,361 |

5.1% |

In 1Q24 energy supplied to captive clients plus energy transported for Free Clients and distributors totaled 12,030 GWh, or 4.4% more than in 1Q23, mainly reflecting increases in consumption by residential consumers (+265.3 GWh or +8.9%), commercial clients (+117.5 GWh or +2.2%), and rural clients (+86.7 GWh or +16.4%), reflecting higher temperatures, higher economic activity, and higher need for irrigation in the period.

The growth of 4.4% in total energy distributed comprises:

•An increase of 5.1% (+294.7 GWh) in use of the network by Free Clients, and

•an increase of 3.6% (+206.8 GWh) in consumption by the captive market.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

9 |

|

Sources and uses of electricity – MWh

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

Metered market – MWh |

|

|

|

Transported for distributors |

75,697 |

64,614 |

17.2% |

Transported for Free Clients |

6,033,163 |

5,768,677 |

4.6% |

Own load + Distributed generation |

8,743,130 |

8,277,750 |

5.6% |

Consumption by captive market |

5,693,805 |

5,682,138 |

0.2% |

Distributed Generation market |

1,438,331 |

1,020,445 |

41.0% |

Losses in distribution network |

1,610,994 |

1,575,168 |

2.3% |

Total volume carried |

14,851,991 |

14,111,042 |

5.3% |

Client base

9.24 million consumers were billed in March 2024 – 1.9% more than in March 2023. Of this total, 3,186 were Free Clients using the distribution network of Cemig D.

|

|

|

|

|

Mar. 2024 |

Mar. 2023 |

Change % |

Number of captive clients |

|

|

|

Residential |

7,780,429 |

7,543,247 |

3.1% |

Industrial |

27,869 |

28,908 |

–3.6% |

Commercial, services and Others |

925,561 |

946,504 |

–2.2% |

Rural |

416,378 |

458,641 |

–9.2% |

Public authorities |

69,960 |

69,453 |

0.7% |

Public lighting |

6,728 |

7,249 |

–7.2% |

Public services |

13,691 |

13,605 |

0.6% |

Own consumption |

762 |

764 |

–0.3% |

Total, captive clients |

9,241,378 |

9,068,371 |

1.9% |

|

|

|

|

Number of free clients |

|

|

|

Industrial |

1302 |

1097 |

18.7% |

Commercial |

1,819 |

1,524 |

19.4% |

Rural |

29 |

14 |

107.1% |

Concession holders |

8 |

8 |

0.0% |

Other |

28 |

20 |

40.0% |

Total, Free Clients |

3,186 |

2,663 |

19.6% |

|

|

|

|

Total, Captive market + Free Clients |

9,244,564 |

9,071,034 |

1.9% |

Performance by sector

Industrial: Energy distributed to Industrial clients was 2.2% higher in 1Q24 than 1Q23, on higher physical production by industry, and was 46.4% of Cemig D’s total distribution. The greater part was energy transported for industrial Free Clients (44.1%), which was 3.4% higher by volume than in 1Q23. Energy billed to captive clients was 2.3% by volume of the total distributed, and 17.6% less in total than in 1Q23 – mainly due to migration of clients to the Free Market. Highlights of electricity consumption, by industrial sector, were: higher consumption by Mining (up +12.3%), Steel (up 8.5%), Food and beverages (up 5.5%), and Cement (up 5.0%); while consumption was lower in Chemicals (down 6.2%), and Castings (down 11.4%).

Residential: Residential consumption was 27.0% of total energy distributed by Cemig D, and 8.9% higher than in 1Q23. Average monthly consumption per consumer in the quarter, at 139.2 kWh/month, was 5.6% higher than in 1Q23, reflecting higher than historic average temperatures, increased family income – and our actions to recover energy losses. Also contributing to higher consumption was the growth in the number of clients in this category – an increase of 3.1% (237,100 clients).

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

10 |

|

Commercial and services: Energy distributed to these consumers was 13.8% of the total distributed by Cemig D in 1Q24, and by volume 2.8% more than in 1Q23. This increase is the result of a 3.4% reduction in energy billed to captive clients, and an increase of 16.5% in the volume of energy transported for Free Clients. The increase in consumption is related to expansion of the services sector, growth of retail sales, temperatures above historical averages in the period. It is worth noting that the increase in this user category happened in spite of the migration of consumers to distributed generation, which, along with migration to the Free Market, was reducing captive consumption.

Rural: Consumption by rural clients was 5.1% of the total energy distributed, and 16.4% higher by volume than in 1Q23, mainly due to higher consumption for irrigation, due to lower volume of rainfall.

Public services: consumed 7.0% of the energy distributed in 1Q24, in total 2.9% lower by volume than in 1Q23. Total captive consumption in 1Q24 fell by 45.5 GWh year-on-year, while the Free Market expanded by 20.3 GWh. This figure was mainly due to consumers migrating to the Free Market.

The Tariff Adjustment and the Tariff Review

The tariffs of Cemig D are adjusted in May of each year; and every five years there is the Periodic Tariff Review, also in May. The aim of the Tariff Adjustment is to pass on changes in non-manageable costs in full to the client; while the Tariff Review aims to provide inflation adjustment for the costs specified as manageable. Manageable costs are adjusted by the IPCA inflation index, less a factor known as the ‘X Factor’, to capture productivity, under a system using the price-cap regulatory model.

On May 22, 2023 Aneel ratified the result of Cemig D’s 2023 Annual Tariff Adjustment, effective from May 28, 2023 to May 27, 2024, the result of which was an average increase for consumers of 13.27%. The average effect for low-voltage clients was an increase of 15.55%, and for residential consumers 14.91%. The percentage component corresponding to the Company’s management costs (referred to as ‘Portion B’) was 0.66%. The increase relating to non-manageable costs (‘Portion A’ – comprising purchase of energy, transmission, sector charges and non-recoverable revenues) was 5.09%; and the increase in the financial components of the tariff was 7.52%. The effect in the financial components comes mainly from absence of the R$ 2.81 billion component included in the 2022 adjustment for repayment to consumers of credits of PIS, Pasep and Cofins taxes – while repayment of R$ 1.27 billion was incorporated into the Tariff Review of 2023.

|

|

Average effects of the May 2023 Tariff Adjustment |

High voltage – average |

8.94% |

Low voltage – average |

15.55% |

Average effect |

13.27% |

Comparison of the Tariff Reviews of 2023 and the previous cycle:

|

|

|

Five-year Tariff Reviews compared – 2018 and 2023 |

2018 |

2023 |

Gross Remuneration Base R$ mn |

20,490 |

25,587 |

Net Remuneration Base R$ mn |

8,906 |

15,200 |

Average depreciation rate: % |

3.84% |

3.95% |

WACC (after taxes) % |

8.09% |

7.43% |

Remuneration of ‘Special Obligations’ R$ mn |

149 |

272 |

CAIMI* R$ mn |

333 |

484 |

QRR* – Depreciation (Gross base x depreciation rate) R$ mn |

787 |

1,007 |

* CAIMI: (Cobertura Anual de Instalações Móveis e Imóveis) – Annual support for facilities.

** QRR: ‘Regulatory Reintegration Quota’: Gross base x annual depreciation rate.

See more details at this link:

https://www2.aneel.gov.br/aplicacoes/tarifa/arquivo/NT%2012%202023%20RTP%20Cemig.pdf

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

11 |

|

Quality indicators – DEC and FEC

In 2023 the State of Minas Gerais was impacted by an increase in extreme atmospheric events, which caused a slight increase in electricity outages. Given this challenging scenario, Cemig has implemented several initiatives to reduce the number and duration of outages, and has made major investments in the distribution business to provide a quality service to clients.

These actions are already generating positive results: the DEC indicator (Average Outage Duration per Consumer) returned to a level within the regulatory limit: this limit was 9.64 hours, and Cemig's DEC in the 12-month window to end-March was 9.38 hours.

Combating default

Maintaining a high level of collection actions, the Company kept its Receivables Recovery Index above 99% in March 2024.

New payment channels, and online negotiation, made available in recent quarters (PIX instant payments, automatic bank debits, payments by card and app, etc.) have continued to increase the proportion of collection via digital channels – in 1Q24 it reached 66.39% of the total collected, compared to 59.63% in 1Q23.

A highlight is the use of the PIX instant payment system, which was launched 2 years ago, and in March 2024 already was used for 24.0% of all collection payments.

The change in the collection mix reduced costs by 19% – a saving of R$ 3.4 million compared to 1Q23.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

12 |

|

Energy losses

Energy losses were compliant with the regulatory level in the 12 months to end March 2024, at 10.59% (the regulatory level is 10.69%).

Highlights of our combat of energy losses in 1Q24 include: approximately 75,000 inspections; replacement of more than 149,000 obsolete meters; exchange of 30,200 conventional meters for smart meters (bringing the total of smart meters installed since the project began in September 2021 to 343,000); and regularization of 1,300 clandestine connections for families living in ‘invaded’ or low-income areas, through our Energia Legal program, which includes ‘bulletproofed’ networks – with a total of 13,937 regularizations since the project began in February 2023.

Planned for full-year 2024 are: 350,000 inspections; installation of a further 200 thousand smart meters; and regularization of 30,000 families in low-income communities.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

13 |

|

Cemig GT and the Cemig Holding Company

Electricity market

The total volume of electricity sold by Cemig GT and by the Cemig holding company (‘Cemig H’), excluding sales on the wholesale power exchange (CCEE) was 4.0% higher than in 1Q23. Cemig GT billed 5,182 GWh (including quota sales) in 1Q24, 18.1% less than in 1Q23. This reduction reflects the transfer to Cemig H of contracts for sales of electricity totaling 1,522 GWh more than in 1Q23.

As a result the holding company reported sales of 4,520 GWh in 1Q24, 50.7% more than in 1Q23. Migration of purchase contracts from Cemig GT to the holding company began in 3Q21, and has been gradually increasing since then. The percentage of GT contracts transferred to Cemig H is now at around 60%.

|

|

|

|

|

|

|

|

1Q24 |

1Q23 |

|

Change % |

Cemig GT – MWh |

Free Clients |

|

2,953,278 |

3,843,590 |

|

–23.2% |

Industrial |

|

1,916,629 |

2,883,714 |

|

–33.5% |

Commercial |

|

1,007,960 |

956,466 |

|

5.4% |

Rural |

|

5,033 |

3,410 |

|

47.6% |

Public authorities |

|

717 |

– |

|

– |

Free Clients – ‘Retailers’ |

|

22,939 |

|

|

|

Free Market – Traders and cooperatives |

|

1,065,136 |

1,305,488 |

|

–18.4% |

Quota supply |

|

571,019 |

584,390 |

|

–2.3% |

Regulated Market |

|

561,529 |

565,779 |

|

–0.8% |

Regulated Market – Cemig D |

|

317,92 |

32,607 |

|

–2.5% |

Total, Cemig GT |

|

5,182,754 |

6,331,854 |

|

–18.1% |

|

|

|

|

|

|

Cemig H – MWh |

|

|

|

|

|

Free Clients |

|

2,397,577 |

1,368,672 |

|

75.2% |

Industrial |

|

1,926,233 |

1,089,819 |

|

76.7% |

Commercial |

|

455,186 |

273,315 |

|

66.5% |

Rural |

|

16,158 |

5,538 |

|

191.8% |

Free Market – Traders and cooperatives |

|

2,122,441 |

1,629,701 |

|

30.2% |

Total Cemig H |

|

4,520,018 |

2,998,373 |

|

50.7% |

|

|

|

|

|

|

Cemig GT + H |

|

9,702,772 |

9330,227 |

|

4.0% |

Sources and uses of electricity

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

14 |

|

Gasmig

Gasmig is the exclusive distributor of piped natural gas for the whole of the state of Minas Gerais. It supplies industrial, commercial and residential users, compressed natural gas and vehicle natural gas, and gas as fuel for thermoelectric generation plants. Its concession expires in January 2053. Cemig owns 99.57% of Gasmig.

Gasmig’s Tariff Review was completed in April 2022. Highlights:

▪The WACC used as basis for the calculation (real, after taxes) was reduced from 10.02% p.a. to 8.71% p.a.

▪The Net Remuneration Base was increased significantly, to R$ 3.48 billion.

▪The regulator recognized the cost of PMSO (Personnel, Materials, Services outsourced and Other expenses) in full.

|

|

|

|

|

|

Market (Volume in ’000 m3) |

2022 |

2023 |

1Q23 |

1Q24 |

1Q23–1Q24 |

Automotive |

40,950 |

31,907 |

7,494 |

5,371 |

–28.3% |

Compressed vehicle natural gas |

364 |

541 |

178 |

124 |

–30.3% |

Industrial |

870,667 |

830,943 |

211,978 |

191,349 |

–9.7% |

Industrial compressed natural gas |

13,616 |

12,473 |

2,835 |

2,099 |

–26.0% |

Residential |

11,392 |

11,912 |

2,728 |

2,602 |

-4.6% |

Co–generation |

13,137 |

12,075 |

2,626 |

3,549 |

35.1% |

Commercial |

23,114 |

21,964 |

4,830 |

4,973 |

3.0% |

Subtotal - conventional gas |

973,240 |

921,815 |

232,669 |

210,067 |

–9.7% |

Thermal plants |

37,991 |

– |

– |

– |

– |

Subtotal – gas sold |

1,011,231 |

921,815 |

232,669 |

210,067 |

–9.7% |

Industrial – Free Market |

87,133 |

92,362 |

22,356 |

22,767 |

1.8% |

Industrial compressed natural gas – Free Market |

– |

– |

– |

2,359 |

0.0% |

Thermal – Free Market |

7,119 |

19,050 |

280 |

116 |

-58.6% |

Total (sales + Free Clients) |

1,105,483 |

1,033,227 |

255,305 |

235,309 |

–7.8% |

|

|

|

Ebitda (R$ ’000) |

1Q24 |

1Q23 |

Profit (loss) for the period |

117,007 |

155,361 |

Income tax and Social Contribution tax |

61,452 |

65,943 |

Finance income (expenses) |

17,159 |

15,269 |

Depreciation and amortization |

22,024 |

21,422 |

Ebitda per CVM Resolution 156 |

217,642 |

257,995 |

The volume of gas sold in 1Q24 was 9.7% lower than in 1Q23, and volume distributed to industrial Free Clients was 1.8% higher.

Gasmig’s Ebitda was 15.6% lower in 1Q24 than 1Q23, reflecting (i) lower volume, and (ii) the lower compensatory component in the tariff (for differences between actual costs and cost included in the tariff award calculation).

The number of Gasmig’s clients increased by 15.7% from 1Q23, to a total of 98,021 consumers in 1Q24. This growth reflects expansion of both the commercial and the residential client bases (addition of 13,200 clients)

Financial results

Consolidated operational revenue

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

R$ ’000 |

|

|

|

Revenue from supply of electricity |

8,019,144 |

7,095,344 |

13.0% |

Revenue from use of distribution systems (TUSD charge) |

1,169,299 |

980,398 |

19.3% |

CVA and Other financial components in tariff adjustments |

75,675 |

20,840 |

263.1% |

Reimbursement (to consumers) of credits of PIS, Pasep and Cofins taxes – Amounts realized |

322,666 |

695,989 |

–53.6% |

Transmission – operation and maintenance revenue |

66,562 |

87,740 |

–24.1% |

Transmission – construction revenue |

63,394 |

39,403 |

60.9% |

Financial remuneration of transmission contractual assets |

151,392 |

177,254 |

–14.6% |

Generation indemnity revenue |

21,434 |

22,476 |

–4.6% |

Distribution construction revenue |

893,427 |

676,448 |

32.1% |

Adjustment to expected cash flow from indemnifiable financial assets of the distribution concession |

30,951 |

30,844 |

0.3% |

Gain on financial updating of Concession Grant Fee |

128,625 |

134,766 |

–4.6% |

Settlements on CCEE |

40,757 |

29,363 |

38.8% |

Transactions in the Surpluses Sales Mechanism (MVE) |

0 |

–3766 |

–100.0% |

Retail supply of gas |

919,648 |

1,123,570 |

–18.1% |

Penalty for continuity indicator shortfall |

–45,927 |

–38,469 |

19.4% |

Other operational revenues |

636,954 |

492,015 |

29.5% |

Taxes and charges reported as deductions from revenue |

-3,436,134 |

-2,917,278 |

17.8% |

Net operational revenue |

9,057,867 |

8,646,937 |

4.8% |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

16 |

|

Revenue from supply of electricity

|

|

|

|

|

|

|

|

|

|

1Q24 |

1Q23 |

Change, % |

|

MWh |

R$ ’000 |

Average

price billed

– R$/MWh

(1) |

MWh |

R$ ’000 |

Average

price billed –

R$/MWh (1) |

MWh |

R$ ’000 |

Residential |

3,250,170 |

3,126,496 |

961.95 |

2,984,825 |

2,394,792 |

802.32 |

8.9% |

30.6% |

Industrial |

4,130,114 |

1,298,596 |

314.42 |

4,307,674 |

1,439,741 |

334.23 |

–4.1% |

–9.8% |

Commercial, Services and Others |

2,547,884 |

1,674,462 |

657.2 |

2,343,460 |

1,503,080 |

641.39 |

8.7% |

11.4% |

Rural |

623,633 |

533,356 |

855.24 |

526,308 |

392,758 |

746.25 |

18.5% |

35.8% |

Public authorities |

253,258 |

223,285 |

881.65 |

223,654 |

164,544 |

735.71 |

13.2% |

35.7% |

Public lighting |

248,003 |

130,982 |

528.15 |

269,516 |

116,991 |

434.08 |

–8.0% |

12.0% |

Public services |

219,441 |

185,343 |

844.61 |

272,353 |

164,251 |

603.08 |

–19.4% |

12.8% |

Subtotal |

11,272,503 |

7,172,520 |

636.28 |

10,927,790 |

6,176,157 |

565.18 |

3.2% |

16.1% |

Own consumption |

8,188 |

0 |

– |

7545 |

0 |

– |

8.5% |

– |

Retail supply not yet invoiced, net |

0 |

-155,322 |

– |

0 |

13,439 |

– |

– |

– |

|

11,280,691 |

7,017,198 |

636.28 |

10,935,335 |

6,189,596 |

565.18 |

3.2% |

13.4% |

Wholesale supply to other concession holders (2) |

4,275,663 |

1,051,019 |

245.81 |

4,038,776 |

964,188 |

238.73 |

5.9% |

9.0% |

Wholesale supply not yet invoiced, net |

0 |

-49,073 |

– |

0 |

-58,440 |

– |

– |

–16.0% |

Total |

15,556,354 |

8,019,144 |

528.91 |

14,974,111 |

7,095,344 |

477.09 |

3.9% |

13.0% |

(1)The calculation of average price does not include revenue from supply not yet billed.

(2)Includes Regulated Market Electricity Sale Contracts (CCEARs) and ‘bilateral contracts’ with other agents.

Energy sold to final consumers

Gross revenue from energy sold to final consumers in 1Q24 was R$ 7,017.20 million, compared to R$ 6,189.60 million in 1Q24, an increase of 13.4% YoY, in spite of volume being only 3.2% higher. The increase mainly reflects the re-inclusion, in the basis for calculation of ICMS tax, of the Transmission and Distribution charges, as from Decree 45572/2023, of February 2023.

Wholesale supply

Revenue from wholesale supply in 1Q24 was R$ 1,001.9 million, compared to R$ 905.7 million in 1Q23. The increase reflects (i) updating of the amounts of contracts, and (ii) volume sold 5.9% higher.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

17 |

|

Transmission

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

TRANSMISSION REVENUE (R$ ’000) |

|

|

|

Operation and maintenance |

66,562 |

87,740 |

–24.1% |

Infrastructure construction, strengthening and enhancement |

63,394 |

39,403 |

60.9% |

Financial remuneration of transmission contractual assets |

151,392 |

177,254 |

–14.6% |

Total |

281,348 |

304,397 |

–7.6% |

Transmission revenue was 7.6% lower, due to revenue from operation and maintenance being 24.1% lower, and revenue from financial remuneration of transmission contractual assets being 14.6% (R$ 25.9 million) lower, due to the different IPCA inflation rate – the basis for the remuneration of the contract – which was 1.42% positive in 1Q24, compared to 2.09% (positive) in 1Q23. Construction revenue increased by 60.9% (R$ 24.0 million), mainly due to additions made to projects with higher construction margins in the period.

Gas

Gross revenue from supply of gas in 1Q24 was R$ 919.6 million, compared to R$ 1,123.6 million in 1Q23. The lower figure is due to: (i) passthrough to tariffs of downward adjustments made in the price of gas acquired in the prior 12 months (lower average prices); and (ii) the lower volume of sales in the industrial and automotive markets.

Revenue from Use of Distribution Systems – The TUSD charge

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

TUSD (R$ ’000) |

Use of the Electricity Distribution System |

1,169,299 |

980,398 |

19.3% |

In 1T24 revenue from the TUSD – charged to Free Consumers on their distribution of energy – was R$ 188.9 million higher than in 1Q24. This reflects (i) volume of energy transported for Free Clients 5.1% higher; and (ii) re-inclusion in the basis for calculation of ICMS tax of transmission and distribution charges, as from February 2023.

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

ENERGY TRANSPORTED – MWh |

Industrial |

5,299,342 |

5,122,930 |

3.4% |

Commercial |

581,198 |

498,671 |

16.5% |

Rural |

14,706 |

10,699 |

37.5% |

Public services |

125,641 |

105,375 |

19.2% |

Concession holders |

76,189 |

64,686 |

17.8% |

Total energy transported |

6,097,076 |

5,802,361 |

5.1% |

Operational costs and expenses

Operational costs and expenses in 1Q24 totaled R$ 7.47 billion, which compares with R$ 6.94 billion in 1Q23. This mainly reflects higher posting of construction cost (+R$ 217.7 million), higher cost of use of the national grid (+R$ 143.0 million), higher amounts posted for losses on expected receivables (+R$ 67.9 million), and, in counterpart, lower expense on purchase of gas (–R$ 104.6 million). See more details on costs and expenses in the pages below.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

18 |

|

Operational costs and expenses

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

R$ ’000 |

|

|

|

Electricity bought for resale |

3,510,632 |

3,444,067 |

1.9% |

Charges for use of national grid |

843,222 |

700,181 |

20.4% |

Gas purchased for resale |

510,177 |

614,803 |

–17.0% |

Construction cost |

920,981 |

703,281 |

31.0% |

People |

324,058 |

335,197 |

–3.3% |

Employees’ and managers’ profit shares |

39,232 |

38,127 |

2.9% |

Post-employment obligations |

142,285 |

103,038 |

38.1% |

Materials |

28,970 |

29,233 |

–0.9% |

Outsourced services |

518,907 |

467,446 |

11.0% |

Depreciation and amortization |

328,542 |

302,666 |

8.5% |

Provisions / adjustments for losses |

139,585 |

113,536 |

22.9% |

Impairments (reversal) |

22,958 |

46,126 |

–50.2% |

Provisions (reversals) for client default |

75,853 |

7,926 |

857.0% |

Gain on sale of plants |

–42,989 |

0 |

- |

Gain on disposal of investment |

0 |

–30,487 |

–100.0% |

Other operating costs and expenses, net |

103,263 |

65,533 |

57.6% |

Total |

7,465,676 |

6,940,673 |

7.6% |

Electricity purchased for resale

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

CONSOLIDATED (R$ ’000) |

|

|

|

Electricity acquired in Free Market |

1,239,531 |

1,225,659 |

1.1% |

Electricity acquired in Regulated Market auctions |

1,001,518 |

937,269 |

6.9% |

Distributed generation |

663,764 |

618,732 |

7.3% |

Supply from Itaipu Binacional |

268,696 |

262,175 |

2.5% |

Physical guarantee quota contracts |

220,391 |

226,248 |

–2.6% |

Individual (‘bilateral’) contracts |

127,290 |

125,429 |

1.5% |

Proinfa |

113,113 |

127,894 |

–11.6% |

Spot market |

63,761 |

110,319 |

–42.2% |

Quotas for Angra I and II nuclear plants |

94,399 |

89,917 |

5.0% |

Credits of PIS, Pasep and Cofins taxes |

–281,831 |

–279,575 |

0.8% |

|

3,510,632 |

3,444,067 |

1.9% |

The expense on electricity bought for resale in 1Q24 was R$ 3.51 billion, R$ 66.6 million (1.9%) higher than in 1Q23. This reflects, mainly:

▪Expenses on energy acquired in the Regulated Market R$ 64.2 million (6.9%) higher than in 1Q23. reflecting (i) the annual adjustments to contracts, by the IPCA inflation index, and (ii) entry of new contracts.

▪Expense on distributed generation R$ 45.0 million (+7.3%) higher, reflecting the higher number of generation facilities installed (261,000 in March 2024, compared to 215,000 in March 2023), and a 44.2% increase, year-on-year, in the volume of energy injected, that was 1.438 GWh in 1Q24.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

19 |

|

▪The costs of energy acquired in the Free Market (the Company’s highest cost of purchased energy), were R$ 1,239.5 million, R$ 13.9 million (1.1%) higher than in 1Q23.

▪The cost of Proinfa supply was 11.6% (R$ 14.8 million) lower, mainly due to winds throughout Brazil’s Northeast being far lower than in previous periods, with an impact on wind generation by several enterprises.

Note that for Cemig D, purchased energy is a non-manageable cost: the difference between the amounts used as a reference for calculation of tariffs and the costs actually incurred is compensated for in the next tariff adjustment.

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

Cemig D (R$ ’000) |

|

|

|

Supply acquired in auctions on the Regulated Market |

1,026,912 |

951,606 |

7.9% |

Distributed generation |

663,764 |

618,732 |

7.3% |

Supply from Itaipu Binacional |

268,696 |

262,175 |

2.5% |

Physical guarantee quota contracts |

224,569 |

239,079 |

–6.1% |

Individual (‘bilateral’) contracts |

127,290 |

125,429 |

1.5% |

Proinfa |

113,113 |

127,894 |

–11.6% |

Quotas for Angra I and II nuclear plants |

94,399 |

89,917 |

5.0% |

Spot market – CCEE |

47,226 |

72,151 |

–34.5% |

Credits of PIS, Pasep and Cofins taxes |

–166,596 |

–163,169 |

2.1% |

|

2,399,373 |

2,323,814 |

3.3% |

Charges for use of the transmission network and other system charges

Charges for use of the transmission network in 1Q24 totaled R$ 843.2 million, 20.4% higher year-on-year. The difference primarily reflects: (i) a higher need for dispatching of thermoelectric generation plants in 2023, on days and intra-day periods of higher demand, due to higher temperatures; and (ii) entry into operation of the Reserve Energy contracts arising from the Simplified Competitive Procedure (Procedimento Competitivo Simplificado – PCS) of 2021, with a consequent increase in the Reserve Energy charges in the period. This is a non-manageable cost in the distribution business: the difference between the amounts used as a reference for calculation of tariffs and the costs actually incurred is compensated for in the next tariff adjustment.

Gas purchased for resale

The expense on acquisition of gas in 1Q24 was R$ 510.2 million, or 17.0% less than in 1Q23. This is due to a lower price of gas acquired for resale, and also lower quantity – 9.7% less by volume.

Outsourced services

Expenditure on outsourced services was 11.0% (R$ 51.5 million) higher than in 1Q23, the main factors being higher expenses on: maintenance of electrical installations and equipment (R$ 34.1 million, or 19.4%, higher); cleaning of power line pathways (+R$ 8.0 million, or 33.5%, higher); and information technology (R$ 7.2 million, or 13.9%, higher).

Provisions for client default

The expense on provisions for losses due to client default in 1Q24 was R$ 75.8 million, compared to R$ 7.9 million in1Q23, mainly due to the revision, in 3Q22, of the criteria for accounting for overdue client receivables (increase of the threshold for posting 100% loss, from 12 to 24 months, to reflect the actual performance of Cemig clients more faithfully) – which also had a positive effect in 1Q23).

Provisions for contingencies

Contingency provisions totaled R$ 139.6 million in 1Q24, 22.9% more than in 1Q23. This reflected a higher volume of provisions in Cemig Distribution, mainly in provisions for employment-law and third-party liability contingencies, reassessment of chances of loss in lawsuits in progress, and decisions against the Company in cases completed or with final settlement in 1Q24.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

20 |

|

Impairments

Provisions for impairment in 1Q24 totaled R$ 23.0 million: R$ 17.7 million for plants classified as held for sale, and R$ 5.3 million for a receivable from a client disputing amounts owed. In 1Q23 an impairment of R$ 46.1 million had been posted for the plants of Cemig GT which were in the process of sale (this was reversed with the success of the sale auction).

Gain on disposal of investment

With the completion of the sale of Small Hydro Plants in 1Q24, a gain of R$ 42.9 million was posted in Other costs and expenses. In 1Q23 a gain of R$ 30.5 million been posted in this line, for part of the sale of the stake in Santo Antônio.

Post-employment liabilities

The impact of the Company’s post-retirement obligations on operational profit in 1Q24 was an expense of R$ 142.3 million, compared to an expense of R$ 103.0 million in 1Q23. The lower figure represents remeasurement, in 1Q23, of the post-employment liability, with a positive impact of R$ 56.9 million, reflecting acceptance of the new health plan by some of the active employees.

People

Expense on personnel in 1Q24 was R$ 324.1 million, 3.3% less than in 1Q23, even after the 4.14% increase in salaries under the Collective Work Agreement of November 2023. The reduction is explained by (i) the lower cost of newly-hired employees than of those that left the Company, and (ii) the average number of employees being 1.2% lower than in 1Q23.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

21 |

|

CONSOLIDATED EBITDA (IFRS and Adjusted)

Ebitda is a non-accounting measure prepared by the Company, reconciled with its consolidated financial statements in accordance with the specifications in CVM Circular SNC/SEP 01/2007 and CVM Resolution 156 of June 23, 2022. It comprises: Net profit adjusted for the effects of: (i) Net financial revenue (expenses), (ii) depreciation and amortization, and (iii) income tax and the Social Contribution tax. Ebitda is not a measure recognized by Brazilian GAAP nor by IFRS; it does not have a standard meaning; and it may be non-comparable with measures with similar titles provided by other companies. Cemig publishes Ebitda because it uses it to measure its own performance. Ebitda should not be considered in isolation or as a substitute for net profit or operational profit, nor as an indicator of operational performance or cash flow, nor to measure liquidity nor the capacity for payment of debt. In accordance with CVM Instruction 156/2022, the Company adjusts Ebitda to exclude extraordinary items which, by their nature, do not contribute to information on the potential for gross cash flow generation.

|

|

|

|

|

|

|

|

|

1Q24 consolidated Ebitda |

R$ ’000 |

Generation |

Transmission |

Trading |

Distribution |

Gas |

Holding

co. and

equity

interests |

Total |

Profit (loss) for the period |

371,794 |

132,306 |

192,004 |

322,338 |

117,008 |

17,441 |

1152,891 |

Income tax and Social Contribution tax |

73,033 |

35,576 |

95,210 |

99,173 |

59,750 |

–13,927 |

348,815 |

Finance income (expenses) |

27,802 |

16,587 |

-7,449 |

108,781 |

17,159 |

18,106 |

180,986 |

Depreciation and amortization |

83,583 |

–59 |

6 |

216,199 |

23,727 |

5,086 |

328,542 |

Ebitda per CVM Resolution 156 |

556,212 |

184,410 |

279,771 |

746,491 |

217,644 |

26,706 |

2,011,234 |

Net profit attributed to non–controlling stockholders |

– |

– |

– |

– |

–503 |

– |

–503 |

Gain on sale of generation plants |

–42,989 |

– |

– |

– |

– |

– |

–42,989 |

Impairment |

22,958 |

– |

– |

– |

– |

– |

22,958 |

Adjusted Ebitda |

536,181 |

184,410 |

279,771 |

746,491 |

217,141 |

26,706 |

1,990,700 |

|

|

|

|

|

|

|

|

1Q23 consolidated Ebitda |

R$ ’000 |

Generation |

Transmission |

Trading |

Distribution |

Gas |

Holding

co. and

equity

interests |

Total |

Profit (loss) for the period |

348,395 |

154,910 |

232,593 |

369,533 |

155,359 |

137,416 |

1,398,206 |

Income tax and Social Contribution tax |

100,990 |

35,885 |

108,152 |

118,970 |

64,240 |

-73,052 |

355,185 |

Finance income (expenses) |

-12,517 |

649 |

-15,528 |

92,347 |

15,270 |

25,693 |

105,914 |

Depreciation and amortization |

81,140 |

1 |

4 |

194,240 |

23,125 |

4,156 |

302,666 |

Ebitda per CVM Resolution 156 |

518,008 |

191,445 |

325,221 |

775,090 |

257,994 |

94,213 |

2,161,971 |

Non-recurring and non-cash effects |

|

|

|

|

|

|

Net profit attributed to non-controlling stockholders |

- |

- |

- |

- |

-668 |

- |

-668 |

Gain on disposal of investment |

- |

- |

- |

- |

- |

-55,391 |

-55,391 |

Remeasurement of post-employment liabilities |

-10,679 |

-6,599 |

-1,512 |

-33,990 |

- |

-4,181 |

-56,961 |

Impairment |

46,126 |

- |

- |

- |

- |

- |

46,126 |

Other |

- |

- |

-22,511 |

- |

- |

- |

-22,511 |

Adjusted Ebitda |

553,455 |

184,846 |

301,198 |

741,100 |

257,326 |

34,641 |

2,072,566 |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

22 |

|

|

|

|

|

Ebitda of Cemig D |

1Q24 |

1Q23 |

Change % |

Cemig D Ebitda – R$ ’000 |

|

|

|

Net profit for the period |

322,338 |

369,530 |

–12.8% |

Income tax and Social Contribution tax |

99,173 |

118,970 |

–16.6% |

Net finance revenue (expenses) |

108,780 |

92,348 |

17.8% |

Amortization |

216,199 |

194,240 |

11.3% |

EBITDA |

746,490 |

775,088 |

–3.7% |

Post-employment – Cemig Saúde |

0 |

–33,990 |

–100.0% |

Adjusted Ebitda |

746,490 |

741,098 |

0.7% |

Cemig D posted Ebitda of R$ 746.5 million, 0.7% more than the adjusted Ebitda of 1Q23. Main effects in Ebitda in the quarter:

▪4.4% more energy distributed than in 1Q23 (+3.6% in the captive market and +5.1% in the Free Market), reflecting (i) high temperatures, (ii) improved economic activity, and (iii) greater need for irrigation in the period – rural consumption was up 16.4%, residential consumption was up 8.9%, and industrial consumption up 2.2%.

▪Full effect of the May 2023 Tariff Review in the period.

▪Personnel expenditure R$ 14.5 million (6.5%) lower in 1Q24.

▪Energy losses: Cemig D outperformed the regulatory limit – reporting 10.59%, vs. the regulatory limit of 10.69%.

▪New Replacement Value (VNR) of R$ 30.9 million in 1Q24, and R$ 30.8 million in 1Q23.

▪Higher volume of client default provisions: R$ 73.0 million in 1Q24,vs. R$ 8.1 million in 1Q23 – partly due to revision, in 3Q22, of the rules for measurement of provisions for default, which had a positive effect in the subsequent 12 months.

▪Higher volume of provisions for contingencies, especially employment-law and third-party liability litigation: R$ 106.0 million in 1Q24, compared to R$ 55.9 million in 1Q23.

▪Net expense on deactivation of assets R$ 15.6 million (57.6%) higher than in 1Q23.

▪Positive effect of R$ 34.0 million in 1Q23, resulting from remeasurement of post-employment liabilities as a result of the new health plan being accepted by part of the employees.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

23 |

|

Cemig GT – Ebitda

|

|

|

|

|

|

Cemig GT 1Q24 Ebitda |

|

|

|

|

|

R$ ’000 |

Generation |

Transmission |

Trading |

Equity

interests |

Total |

Profit (loss) for the period |

372,261 |

129,598 |

50145 |

-58,198 |

493,806 |

Income tax and Social Contribution tax |

73,033 |

34,221 |

22,130 |

25,359 |

154,743 |

Finance income (expenses) |

27,802 |

16,693 |

–7,449 |

31,706 |

68,752 |

Depreciation and amortization |

83,584 |

2 |

6 |

– |

83,592 |

Ebitda per CVM Resolution 156 |

556,680 |

180,514 |

64,832 |

-1,133 |

800,893 |

Gain on sale of assets |

–42,989 |

– |

– |

– |

–42,989 |

Impairment |

22,958 |

– |

– |

– |

22,958 |

Adjusted Ebitda |

536,649 |

180,514 |

64,832 |

-1,133 |

780,862 |

|

|

|

|

|

|

Cemig GT 1Q23 Ebitda |

|

|

|

|

|

R$ ’000 |

Generation |

Transmission |

Trading |

Equity

interests |

Total |

Profit (loss) for the period |

348,917 |

153,445 |

55,592 |

51,549 |

609,503 |

Income tax and Social Contribution tax |

100,990 |

35,140 |

16,970 |

–19,039 |

134,061 |

Finance income (expenses) |

–12,517 |

877 |

–15,528 |

21,356 |

–5,812 |

Depreciation and amortization |

81,140 |

1 |

4 |

– |

81,145 |

Ebitda per CVM Resolution 156 |

518,530 |

189,463 |

57,038 |

53,866 |

818,897 |

– Gain on sale of investments |

– |

– |

– |

–55,391 |

–55,391 |

– Remeasurement of post-employment liabilities |

–10,679 |

–6,600 |

–1,512 |

–2,032 |

–20,823 |

+ Impairment |

46,126 |

– |

– |

– |

46,126 |

Adjusted Ebitda |

553,977 |

182,863 |

55,526 |

–3,557 |

788,809 |

The Ebitda of Cemig GT in 1Q24 was R$ 800.9 million, 2.2% lower than in 1Q23.

Adjusted Ebitda was 1.0% lower. Effects on Ebitda in the YoY comparison:

▪Completion of the sale of 15 Small Hydro Plants (PCHs) and Hydro Plants (CGHs) in 1Q24, with a gain of R$ 43.0 million.

▪Less advantageous GSF in 1Q24: in 1Q23 it was higher than 1, and approximately 10% lower in 1Q24.

▪Volume of energy sold, excluding settlements on the CCEE, 18% lower, due to transfer of contracts to the holding company.

▪Impairments of R$ 23.0 million were posted in 1Q24: R$ 17 million for plants held for sale, and R$ 5.3 million for a client questioning the amount of a receivable. In 1Q23 an impairment of R$ 46.1 million had been made for plants included in the process of sale.

▪Lower equity income (share of gain/loss in non-consolidated investees): R$ 7.6 million in 1Q24, compared to R$ 69.5 million in 1Q23. The main factors were (i) positive, in 1Q23, on the sale of Santo Antônio; and (ii) equity income from Belo Monte R$ 14.4 million lower.

▪Gain of R$ 55.4 million, in 1Q23, on disposal of the equity interest in Mesa (Santo Antônio plant), comprising R$ 30.5 for the directly held interest, and R$ 24.9 million via equity income.

▪Positive effect of R$ 20.8 million, in 1Q23, from remeasurement of post-employment liabilities, as a result of the new health plan being accepted by some of the employees.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

24 |

|

Finance income and expenses

|

|

|

|

|

1Q24 |

1Q23 |

Change % |

(R$ ’000) |

|

|

|

Finance income |

218,245 |

329,784 |

–33.8% |

Finance expenses |

–399,231 |

–435,698 |

–8.4% |

Finance income (expenses) |

–180,986 |

–105,914 |

70.9% |

For 1Q24 Cemig reports Net financial expenses of R$ 181.0 million, compared to Net financial expenses of R$ 105.9 million in 1Q23. Main factors:

▪Lower income from cash investments: R$ 64.8 million in 1Q24, R$ 33.2 million less than in 1Q23. The main factor was the lower CDI rate: 2.63% in 1Q24, vs. 3.25% in 1Q23.

▪Monetary updating on the balances of CVA and Other financial components in tariff increases: a gain (financial revenue item) of R$ 1.8 million in 1Q24, compared to a gain of R$ 26.6 million in 1Q23. This basically reflects a lower balance of items updated by the Selic rate in 1Q24.

▪In 1Q24 the US dollar appreciated by 3.2% (R$0.155) against the Real, but in 1Q23 it depreciated by 2.63% (R$ 0.137) – generating an expense related to dollar debt of R$ 59.0 million in 1Q24, and a gain of R$ 103.8 million in 1Q23.

▪The fair value of the financial instrument contracted to hedge the risks connected with the Eurobonds gained R$ 42.0 million in value in 1Q24; and lost value of R$ 12.7 million in 1Q23.

Eurobonds – Effect in the quarter (R$ ’000)

|

|

|

|

1Q24 |

1Q23 |

Effect of FX variation on the debt |

–59,034 |

103,814 |

Effect on the hedge |

42,032 |

–12,725 |

Net effect in Financial income (expenses) |

–17,002 |

91,089 |

Equity income (gain/loss in non–consolidated investees)

|

|

|

|

|

1Q24 |

1Q23 |

Change

R$ ’000 |

EQUITY INCOME* (R$ ’000) |

|

|

|

Taesa |

80,112 |

80,785 |

–673 |

Aliança Geração |

30,861 |

35,165 |

–4,304 |

Paracambi |

3,169 |

–345 |

3,514 |

Hidrelétrica Pipoca |

3,769 |

7,488 |

–3,719 |

Hidrelétrica Cachoeirão |

1,114 |

3,304 |

–2,190 |

Guanhães Energia |

2,318 |

16,695 |

–14,377 |

Cemig Sim (Equity holdings) |

3,373 |

3,377 |

–4 |

Mesa and FIP Melbourne (Santo Antônio Plant) |

0 |

12,826 |

–12,826 |

Baguari Energia |

0 |

9,426 |

-9,426 |

Retiro Baixo |

0 |

4,103 |

-4,103 |

Belo Monte (Aliança Norte and Amazônia Energia) |

–34,215 |

–19,783 |

–14,432 |

Total |

90,501 |

153,041 |

–4,103 |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

25 |

|

Net profit

For 1Q24, Cemig once again reports quarter Net profit of more than R$ 1 billion: R$ 1.153 billion in 1Q24, compared to R$ 1.398 billion in 1Q23. Adjusted net profit in 1Q24 is R$ 1,154 million, compared to R$ 1,270 billion in 1Q23. Main factors in this result were:

▪(i) Strong results from energy trading: Profit of R$ 192 million, due to a differentiated strategy, including anticipation of market movements, by Cemig GT and the Holding company, plus (ii) lower average cost of energy purchased in 1Q24, due to wind power generation from suppliers being lower than contracted levels resulting in the purchase of the difference at spot price

▪Cemig D distributed 4.4% more energy in 1Q24 than in 1Q23.

▪Conclusion of the sales of 15 Small Hydro Plants (PCHs) and Hydro Plants (CGHs), with positive effect of R$ 25.0 million in 1Q24 net profit.

▪Cemig D reports profit of R$ 322.3 million, 7.2% lower than the adjusted result for 1Q23, impacted by higher expenditure on provisions, and de-activation of assets.

▪Gasmig posted profit 24.7% lower than in 1Q23, due to (i) a lower volume of gas sold and (b) a lower compensatory component allowed in its tariffs (for differences between actual costs and the costs estimated in calculating the tariff).

▪Equity income (gain/loss in non-consolidated investees) was R$ 65.2 million lower. The main factors were (i) a positive item of R$ 25 million, in 1Q23, on the sale of Santo Antônio; and (ii) equity income from Belo Monte R$ 14.4 million lower in 1Q24.

▪Impairments posted, with effects of R$ 11.7 million on net profit in 1Q24, and R$ 30 million in 1Q23, for plants transferred to the process of sale. In 1Q24 an impairment of R$ 3.5 million was also posted for dispute of a receivable by a client.

▪Net financial expenses of R$ 181.0 million in 1Q24, and R$ 105.9 million in 1Q23 – the 1Q23 result reflected appreciation of the Real against the dollar.

Other effects in 1Q23:

▪Positive effect of R$ 38 million in 1Q23, resulting from remeasurement of post-employment liabilities, as a result of the new health plan being accepted by some of the employees.

▪Gain of R$ 45 million on disposal of the interest in Mesa (Santo Antônio plant).

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

26 |

|

Investments

The total invested in 2023 was R$ 1.02 billion, 36.0% more than in 1Q23.

The highlight was Cemig D with R$ 881 million invested in 1Q24.

Underlining our mission to grow in renewable generation, works are 92% complete on the Boa Esperança and Jusante photovoltaic solar generation plants, which will add generation capacity of 188 MWp, with start of operation planned for the end of first half 2024. Gasmig has begun works on the Center-West Project, with allocated capex of R$ 780 million, for construction of 300 kilometers of pipeline network.

Execution of the largest investment program in Cemig’s history will modernize and improve the reliability of Cemig’s electricity system, in line with its strategic plan of focusing on Minas Gerais and its core businesses, providing ever-improving service to the client. Investment totaling R$ 35.6 billion is planned over 2024-2028, of which R$ 6.2 billion to be invested in 2024.

Debt

|

|

|

|

CONSOLIDATED – R$ ’000 |

Mar. 2024 |

2023 |

Change, % |

Gross debt |

11,625,874 |

9,831,139 |

18.3% |

Cash and equivalents + Securities |

45,53,488 |

2,311,464 |

97.0% |

Net debt |

7,072,386 |

7,519,675 |

-5.9% |

Debt in foreign currency |

1,968,173 |

1,854,093 |

6.2% |

|

|

|

|

CEMIG GT – R$ ’000 |

Mar. 2024 |

2023 |

Change, % |

Gross debt |

3,014,062 |

2,868,093 |

5.1% |

Cash and equivalents + Securities |

1,252,777 |

937,518 |

33.6% |

Net debt |

1,761,285 |

1,930,575 |

–8.8% |

Debt in foreign currency |

1,968,173 |

1,854,093 |

6.2% |

|

|

|

|

CEMIG D – R$ ’000 |

Mar. 2024 |

2023 |

Change, % |

Gross debt |

7,531,748 |

5,887,622 |

27.9% |

Cash and equivalents + Securities |

1,669,280 |

450,748 |

270.3% |

Net debt |

5,862,468 |

5,436,874 |

7.8% |

Debt in foreign currency |

0 |

0 |

– |

In 1Q24 Cemig D amortized debt of R$ 440.9 million, and in March 2024 concluded a further issue of R$ 2 billion in debentures, characterized as “ESG resource use securities – sustainable, for which demand was 2.73 times the offering, in two series: The first for R$ 400 million, remunerated at the CDI rate plus 0.80% p.a., with maturity at five years and partial amortization in the fourth year; the second, for R$ 1.6 billion, remunerated by the IPCA inflation index plus 6.1469%, p.a., with maturity at 10 years, and amortizations in the 8th and 9th years. After this issue the average tenor of the debt increased by approximately one year, to 3.6 years. Leverage (Net debt/adjusted Ebitda) remained at below 1x.

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

28 |

|

|

|

|

1Q24 |

DEBT AMORTIZED – R$ ’000 |

|

Cemig GT |

0 |

Cemig D |

440,916 |

Others |

0 |

Total |

440,916 |

* Debt in USD is protected by a hedge instrument, within an FX variation band – with payment of interest converted to % of the Brazilian CDI rate.

Covenants – Eurobonds

|

|

|

|

|

|

Last 12 months |

Mar. 2024 |

|

2023 |

R$ mn |

GT |

H |

|

GT |

H |

Net profit (loss) |

2,287 |

5,522 |

|

2,403 |

5,767 |

Net financial revenue (expenses) |

|

|

|

96 |

379 |

Income tax and Social Contribution tax |

|

|

170 |

454 |

1,084 |

Depreciation and amortization |

331 |

1,300 |

605 |

1,078 |

1,274 |

Profit (loss) in minority holdings |

–79 |

–319 |

|

–141 |

–432 |

Provisions for change in value of obligations under put option |

25 |

25 |

|

58 |

58 |

Non-operational profit (loss) – includes any gains on sales of assets and any write-offs of value in, or impairment of, assets |

–324 |

–324 |

|

–289 |

–289 |

Non–recurring non-monetary expenses and/or charges. |

– |

– |

|

–21 |

–57 |

Any non-recurring non-monetary credits or gains that increase net profit |

– |

– |

|

– |

23 |

Non-monetary gains related to transmission and/or generation reimbursements |

–511 |

–519 |

|

–515 |

–524 |

Dividends received in cash from minority investments (as measured in the Cash flow statement) |

366 |

549 |

|

363 |

592 |

Inflation correction on concession charges |

–406 |

–406 |

|

–412 |

–412 |

Cash inflows related to concession charges |

334 |

334 |

|

331 |

331 |

Cash inflows related to transmission revenue for coverage of cost of capital |

800 |

808 |

|

738 |

747 |

Adjusted Ebitda |

3,598 |

8,502 |

|

3,524 |

8,541 |

|

|

|

|

|

|

12 months |

Mar. 2024 |

|

2023 |

R$ mn |

GT |

H |

|

GT |

H |

Consolidated debt |

3,014 |

11,626 |

|

2,868 |

9,831 |

Derivative hedge instrument |

–410 |

–410 |

|

–368 |

–368 |

Debt contracts with Forluz |

126 |

559 |

|

138 |

611 |

Consolidated cash and cash equivalents and consolidated securities posted as current assets |

–1,253 |

–4,553 |

|

–938 |

–2,311 |

Adjusted net debt |

1,477 |

7,222 |

|

1,700 |

7,763 |

|

|

|

|

|

|

|

Mar. 2024 |

|

2023 |

Net debt covenant / Ebitda covenant |

0.41 |

0.85 |

|

0.48 |

0.91 |

Limit for: Net debt covenant / Ebitda covenant |

2.5 |

3.00 |

|

2.50 |

3.00 |

Consolidated debt with asset guarantees |

– |

2,279 |

|

– |

– |

(Consolidated debt with guarantees) / (Ebitda covenant) |

– |

0.27 |

|

– |

– |

Limit for: (Consolidated debt with guarantees) / (Ebitda covenant) |

– |

1.75 |

|

– |

1.75 |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

30 |

|

Cemig’s long-term ratings

Cemig’s ratings have improved significantly in recent years, and are currently at their highest-ever level. In 2021 the three principal rating agencies upgraded their ratings for Cemig. In April 2022, Moody’s again upgraded its rating for Cemig, this time by one notch. In 2023, S&P, Fitch Ratings and Moody’s maintained their ratings for Cemig. In May 2024 Moody’s increased its ratings on the Brazilian scale for Cemig, Cemig D and Cemig GT from “AA.br“ to “AA+.br reflecting our success in implementing measures that increased the Company’s credit quality.

More details in this table:

ESG – Report on performance

Cemig – Highlights

▪The Aneel IASC (Consumer Satisfaction) index reported an increase of 4.60% in consumer satisfaction with Cemig’s service quality, value and perceived reliability in 2023, compared to 2022 – attributing a score of 60.45 points, – while the result of the 'IASC Brazil Concessionaires' (average result of all distributors) was 59.91, which represented an increase of 1.91%.

▪Cemig D launched its Structuring Projects, which aim to improve distribution processes, stimulate increased investment, and consolidate the Company’s position as a benchmark in the electricity sector. These are a total of 14 projects aligned with the Company’s 2024–2028 strategic planning, primarily in the areas of procurement, information technology, real estate management, legal and other areas supporting execution of projects.

▪The sale of 15 small hydroelectric generation plants, to Mang Participações e Agropecuária, was completed: 12 owned by Cemig GT and 3 by Horizontes.

▪The consumer opinion platform consumidor.gov reported Cemig in second place in customer satisfaction in its sector, 9th in providing solutions, and 7th in response time. This is the best result since 2020, when the Company’ data began to be available on this platform, which allows direct dialog between consumers and companies in solving consumer problems.

▪Works were started on modernization of the Salto Grande Hydroelectric Plant, in Braúnas, Minas Gerais. This plant, with installed capacity of 102 MW, has been operating for 74 years. The estimated budget is approximately R$ 160 million.

Social

▪Cemig has joined the Desenrola Brasil (‘Simplify, Brazil’) Program, a federal government initiative for low-income earners who had been put on credit reporting lists between January 2019 and May 2023, to regularize and renegotiate personal debts of up to R$ 20,000 on advantageous terms.

▪We launched our Program to Combat Moral or Sexual Harassment, Discrimination and Other Forms of Violence in the Workplace, reaffirming our commitment to a safe, respectful and inclusive work environment for all employees.

Governance

▪Cemig has updated its policy on treatment of personal data and business information. One of the changes allows monitoring of use of the Company’s internal platforms, to protect personal data and corporate information, ensuring that all employees comply with laws, procedures, policies and internal rules.

▪An update of the Compliance Policy was approved, to include the subject of combating bribery, with reference also to prevention of fraud. This reinforces the Company’s commitment in managing conflicts of interest, and combating any act that could represent deviation from ethical conduct or compliance with legislation, or any internal or external rules.

Cemig in the main sustainability indices

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S. |

32 |

|

Indicators

|

|

|

Climate change and renewable energy |

1Q24 |

|

Indicators |

|

|

% of generation from renewable sources |

100% |

Consumption of electricity per employee (MWh) |

2.26 |

Consumption of renewable fuels (GJ) |

35,620.00 |

Consumption of non-renewable fuels (GJ) |

851,121.00 |

Index of energy losses in the national grid (Cemig GT)(%) |

2.51 |

I–REC (renewable-source) certificates sold |

1,627,823 |

Cemig RECs sold [2] |

1,667,149 |

Number of smart meters installed |

30,179 |

|

|

|

Impact and environmental protection |

|

|

|