0001534254

false

0001534254

2023-10-10

2023-10-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): October 11, 2023 (October 10, 2023)

CĪON

Investment Corporation

(Exact Name of Registrant as Specified

in Charter)

| Maryland |

|

000-54755 |

|

45-3058280 |

| (State

or Other Jurisdiction of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer Identification No.) |

| |

100 Park Avenue, 25th Floor

New York, New York 10017 |

|

| |

(Address of Principal Executive Offices) |

|

| |

(212)

418-4700 |

|

| |

(Registrant’s

telephone number, including area code) |

|

| |

Not

applicable |

|

| |

(Former

name or former address, if changed since last report) |

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.001 per share |

|

CION |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry Into a Material Definitive

Agreement.

On October 10, 2023, CĪON

Investment Corporation (“CION”) issued approximately $33.7 million in aggregate principal amount of its additional Series

A Unsecured Notes due 2026 (the “Additional Notes”) to institutional investors in Israel. The Additional Notes were issued

pursuant to the Deed of Trust dated as of February 20, 2023 (the “Deed of Trust”) with Mishmeret Trust Company Ltd.,

as trustee, and were issued by way of expanding, and have the same terms and conditions as, the existing Series A Unsecured Notes

due 2026 that were issued by CION on February 28, 2023. After the deduction of fees and other offering

expenses, CION received net proceeds of approximately $32.3 million, which CION intends to use to make investments in portfolio companies

in accordance with its investment objectives and for working capital and general corporate purposes. The Additional Notes are rated A1.il

by Midroog Ltd., an affiliate of Moody’s, and commenced trading on the Tel Aviv Stock Exchange Ltd. on October 10, 2023.

The

Additional Notes will mature on August 31, 2026 and may be redeemed in whole or in part at

CION’s option at par plus a “make-whole” premium, if applicable, as set forth in the Deed

of Trust. The Additional Notes bear interest at a floating rate equal to the Secured

Overnight Financing Rate (“SOFR”) plus a credit spread of 3.82% per year, which will be paid quarterly on

February 28, May 31, August 31, and November 30 of each year, commencing on November 30, 2023. The Additional Notes are CION’s

general unsecured obligations that rank senior in right of payment to all of CION’s existing and future indebtedness that is

expressly subordinated in right of payment to the Additional Notes, rank pari passu with all existing and future

unsecured unsubordinated indebtedness issued by CION, rank effectively junior to any of CION’s secured indebtedness (including

unsecured indebtedness that CION later secures) to the extent of the value of the assets securing such indebtedness, and rank

structurally junior to all existing and future indebtedness (including trade payables) incurred by CION’s subsidiaries,

financing vehicles or similar facilities.

The Deed of Trust contains

other terms and conditions, including, without limitation, affirmative and negative covenants such as (i) information reporting,

(ii) maintenance of CION’s status as a business development company within

the meaning of the Investment Company Act of 1940, as amended, (iii) minimum shareholders’ equity of $525 million, (iv) a

minimum asset coverage ratio of not less than 150%, and (v) an unencumbered asset coverage ratio of 1.25 to 1.00. In addition, the

Deed of Trust contains customary events of default with customary cure and notice periods, including, without limitation, nonpayment,

incorrect representation in any material respect, breach of covenant, cross-default under other indebtedness of CION in

an outstanding aggregate principal amount of at least $50,000,000, certain judgments and orders, and certain events of bankruptcy.

The

Additional Notes were sold in an offshore transaction to certain non-U.S. persons outside the United States pursuant to Regulation S

under the Securities Act of 1933, as amended (the “Securities Act”). The Additional Notes have not been registered under

the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an

applicable exemption from such registration requirements.

The foregoing description

of the Deed of Trust as set forth in this Item 1.01 is a summary only and is qualified

in all respects by the provisions of such agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated by reference

herein. A copy of a press release announcing the foregoing is also attached hereto as Exhibit 99.1

and is incorporated by reference herein.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01

of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01.

Financial Statements and Exhibits.

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

CĪON Investment Corporation

|

| Date: |

October 11, 2023 |

By: /s/ Michael A. Reisner |

| |

|

Co-Chief Executive Officer |

EXHIBIT LIST

Exhibit

99.1

CION Investment Corporation

Announces Issuance of Approximately $34 Million of Additional Series A Unsecured Notes in Israel

Additional Series A

Unsecured Notes are rated A1.i1

NEW YORK, NY (October 11, 2023)--(BUSINESS

WIRE)--CION Investment Corporation (NYSE: CION) (“CION”) announced today that it closed an additional offering

in Israel of approximately $33.7 million in aggregate principal amount of its Series A Unsecured Notes due 2026 (the “Additional

Notes”). The Additional Notes were issued by way of expanding, and have the same terms and conditions as, the existing Series A

Unsecured Notes due 2026 that were issued by CION in February 2023.

The Additional Notes will bear interest

at a floating rate equal to the Secured Overnight Financing Rate plus a credit spread of 3.82% per year, which will be paid quarterly

commencing on November 30, 2023. The Additional Notes will mature on August 31, 2026 and may be redeemed in whole or in part at CION’s

option at par plus a “make-whole” premium, if applicable. The Additional Notes will be general, unsecured obligations and

rank equal in right of payment with all of CION’s existing and future unsecured indebtedness. The Additional Notes are rated A1.il

by Midroog Ltd., an affiliate of Moody’s.

The Additional Notes listed and commenced

trading on the Tel Aviv Stock Exchange Ltd. (the “TASE”) on October 10, 2023. CION expects to use the net proceeds of this

offering to make investments in portfolio companies in accordance with its investment objectives and for working capital and general corporate

purposes.

Leader Underwriters (1993) Ltd. is acting

as sole distributor and advisor for this offering.

The Additional Notes were sold in an offshore

transaction to certain non-U.S. persons outside the United States pursuant to Regulation S under the Securities Act of 1933, as amended

(the “Securities Act”). This announcement does not constitute an offer to sell or a solicitation of an offer to buy any of

the Additional Notes, nor shall there be any offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful. The Additional Notes have not been registered under the Securities Act or any state securities laws and may

not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements.

Michael A. Reisner, co-CEO of CION stated,

“We are grateful for the continued enthusiastic backing and keen interest shown by institutional investors from Israel for this

offering. This offering allows us to remain naturally hedged with our predominantly floating rate investment portfolio and allows us to

attractively invest in all interest rate environments without having to speculate on the timing, sizing, and direction of future actions

of the Federal Reserve. We continue to see robust deal flow as we aim to deliver steady returns to our shareholders over the long haul.”

ABOUT CION INVESTMENT CORPORATION

CION Investment Corporation is a leading publicly

listed business development company that had approximately $1.8 billion in total assets as of June 30, 2023. CION seeks to generate current

income and, to a lesser extent, capital appreciation for investors by focusing primarily on senior secured loans to U.S. middle-market

companies. CION is advised by CION Investment Management, LLC, a registered investment adviser and an affiliate of CION. For more information,

please visit www.cionbdc.com.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward-looking terminology

such as "may," "will," "should," "expect," "anticipate," "project," "target,"

"estimate," "intend," "continue," or "believe" or the negatives thereof or other variations thereon

or comparable terminology. You should read statements that contain these words carefully because they discuss CION’s plans, strategies,

prospects and expectations concerning its business, operating results, financial condition and other similar matters. These statements

represent CION’s belief regarding future events that, by their nature, are uncertain and outside of CION’s control. There

are likely to be events in the future, however, that CION is not able to predict accurately or control. Any forward-looking statement

made by CION in this press release speaks only as of the date on which it is made. Factors or events that could cause CION’s actual

results to differ, possibly materially from its expectations, include, but are not limited to, the risks, uncertainties and other factors

CION identifies in the sections entitled "Risk Factors" and "Forward-Looking Statements" in filings CION makes with

the SEC, and it is not possible for CION to predict or identify all of them. CION undertakes no obligation to update or revise publicly

any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

OTHER INFORMATION

The information in this press release is summary

information only and should be read in conjunction with CION’s Current Reports on Form 8-K, which CION filed with the SEC on February

28, 2023 and October 11, 2023, as well as CION’s other reports filed with the SEC. A copy of CION’s Current Reports on Form

8-K and CION’s other reports filed with the SEC can be found on CION’s website at www.cionbdc.com and the SEC’s

website at www.sec.gov.

CONTACTS

Media

Susan Armstrong

sarmstrong@cioninvestments.com

Investor Relations

1-800-343-3736

Analysts and Institutional Investors

James Carbonara

Hayden IR

(646)-755-7412

James@haydenir.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

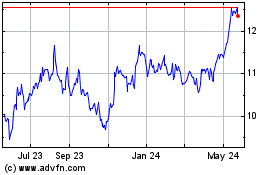

CION Investment (NYSE:CION)

Historical Stock Chart

From May 2024 to Jun 2024

CION Investment (NYSE:CION)

Historical Stock Chart

From Jun 2023 to Jun 2024