Christina Lake Cannabis Corp. (the “Company” or “CLC” or

“Christina Lake Cannabis”) (CSE: CLC) (OTCQB: CLCFF)

(FRANKFURT: CLB) is pleased to report its financial

results for the third quarter ended August 31, 2023 (“Q3’23”). All

amounts are expressed in Canadian dollars unless otherwise noted.

Q3’23 Highlights

- Revenue up 30% to $8.9M over

nine-month period end Q3’22;

- Distillate volumes sold increased

by 85% compared to the nine-month period ending Q3’22;

- Gross profit of $4.0M or 45.2%

before fair value adjustments for the nine-month period;

- Decreased G&A expenses by $137k

or 4% from prior year period

“Through a steadfast commitment to meeting our

customers’ ever-expanding demands and consistently delivering high

quality products, CLC has continued to maintain impressive sales

growth in Q3,” said Mark Aiken, Chief Executive Officer of

Christina Lake Cannabis. “Our agility in responding to

dynamic market conditions is evident through the successful

introduction of our expanded product lines, garnering positive

customer feedback and substantial reorders. Our continued success

is a testament to our relentless pursuit of excellence, our

continuous drive for operating efficiency, and our focus on

innovation.”

OPERATIONAL AND FINANCIAL

HIGHLIGHTS

|

|

August 31,2023 |

August 31,2022 |

$ Change |

% Change |

|

Revenue from the sale of goods |

$ |

8,939,679 |

|

$ |

6,885,968 |

|

$ |

2,053,711 |

|

30 |

% |

|

Costs of sales |

|

(4,895,324 |

) |

|

(3,284,724 |

) |

|

1,610,600 |

|

49 |

% |

|

Gross profit before fair value adjustment |

|

4,044,355 |

|

|

3,601,244 |

|

|

443,111 |

|

12 |

% |

|

Changes in fair value of inventory sold |

|

(2,305,915 |

) |

|

(1,173,677 |

) |

|

1,132,238 |

|

96 |

% |

|

Gross profit from sale of goods |

|

1,738,440 |

|

|

2,427,567 |

|

|

(689,127 |

) |

(28 |

%) |

|

Fair value change growth biological asset |

|

2,614,303 |

|

|

3,002,383 |

|

|

(388,080 |

) |

(13 |

%) |

|

General and administrative expenses |

|

(3,134,742 |

) |

|

(3,271,790 |

) |

|

(137,048 |

) |

(4 |

%) |

|

Other items |

|

(722,949 |

) |

|

1,556 |

|

|

(724,505 |

) |

(46562 |

%) |

|

Income (loss) |

|

495,052 |

|

|

2,159,716 |

|

|

(1,664,664 |

) |

(77 |

%) |

|

|

|

|

|

|

|

Income (loss) per share |

|

0.00 |

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

Gross margin % |

|

45.2 |

% |

|

52.3 |

% |

|

|

|

|

|

|

|

|

|

Financial Position |

|

|

|

|

|

Working capital |

|

4,139,795 |

|

|

3,683,558 |

|

|

|

|

Inventory |

|

1,954,344 |

|

|

4,621,213 |

|

|

|

|

Biological assets |

|

4,035,020 |

|

|

4,380,074 |

|

|

|

|

Total assets |

|

18,836,093 |

|

|

21,483,084 |

|

|

|

|

Total liabilities |

|

7,121,404 |

|

|

6,725,056 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Distillate volumes sold increased by 85% from

the comparative period ending Q3’22 resulting in revenue growth of

30% to $8.9M from $6.9M despite market price compression in the

price of distillate. Revenue growth was primarily driven by

increased demand in distillate.

Gross Margin Before Fair Value Adjustments was

45.2% compared to 52.3% in the prior year period. The decline in

gross margin is primarily attributed to a significant drop in the

price of wholesale distillate. Cost of goods sold increased by 49%

from the comparative period due to the significant increase in

distillate volume produced and sold as noted above. The Company

continues to work towards production efficiencies to combat price

compression in the wholesale distillate market as production and

sales continued to ramp up.

Total general & administrative (“G&A”)

expenses declined by $137k or 4% from prior comparative period,

driven by year-over-year reductions in consulting fees, management

fees, insurance, marketing, share based compensation and repairs

and maintenance expenses, which were partially offset by increases

in depreciation, professional fees, research and development,

salaries and regulatory fees. G&A decreased to 35% of revenue

during the period, compared with 48% in the prior year.

Income (Loss) and comprehensive income (loss) in

Q3’23 was $495k which is a $1.7M decrease from the prior year

period income of $2.2M. The year-over-year decrease in income is

primarily driven by an increase in changes in fair value of

inventory sold of $1.1M, a reduction in income from other items

relating to a one-time settlement of $258k and debt modification of

$386k in the comparative period, and a decrease in the fair value

change in biological asset adjustment of $388k.

Cash and Working Capital

As at August 31, 2023, the Company had working

capital of $4,139,795 (November 30, 2022 – $3,683,558) which

consisted of cash of $1,728,432 (November 30, 2022 - $1,810,639),

receivables of $2,312,232 (November 30, 2022 - $1,906,820), prepaid

expenses of $51,757 (November 30, 2022 - $3,885), inventory of

$1,954,344 (November 30, 2022 - $5,766,418), Biological assets of

$4,035,020 (November 30, 2022 - $Nil). Current liabilities, being

accounts payable and accrued liabilities, current portion of loan

and current portion of convertible debentures, $5,941,991 (November

30, 2022 – $5,832,954).

About Christina Lake Cannabis

Corp.

Christina Lake Cannabis is a licensed producer

of cannabis under the Cannabis Act. It has secured a standard

cultivation license and corresponding processing amendment from

Health Canada (March 2020 and August 2020, respectively) as well as

a research and development license (early 2020). Christina Lake

Cannabis’ facility consists of a 32-acre property, which includes

over 950,000 square feet of outdoor grow space, offices,

propagation and drying rooms, research facilities, and a facility

dedicated to processing and extraction. Christina Lake Cannabis

also owns a 99-acre plot of land adjoining its principal

site. CLC focuses its production on creating high quality

extracts and distillate for its B2B client base with proprietary

strains specifically developed for outdoor cultivation to enhance

extraction quality.

On behalf of Christina Lake

Cannabis:

“Mark Aiken”Mark Aiken, CEO

For more information about CLC, please

visit: www.christinalakecannabis.com

Jennifer SmithInvestor Relations and Media

Inquiriesinvestors@clcannabis.com902-229-7265

THE CANADIAN SECURITIES EXCHANGE (“CSE”) HAS NOT

REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR

ADEQUACY OF THIS RELEASE, NOR HAS OR DOES THE CSE’S REGULATION

SERVICES PROVIDER.

Non-IFRS Financial Measures

In this news release, the Company reports "Gross

Margin Before Fair Value Adjustments", a financial measure that is

not determined or defined in accordance with the International

Financial Reporting Standards, as issued by the International

Accounting Standards Board ("IFRS"). Gross Margin

Before Fair Value Adjustments does not have a standardized meaning

prescribed by IFRS and the Company's methods of calculating this

financial measure may differ from methods used by other companies.

Accordingly, such non-IFRS financial measure may not be comparable

to similarly titled measures presented by other companies. This

measure is provided as additional information to complement IFRS by

providing a further understanding of operations from management's

perspective and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. Gross margin before fair value adjustments are non-GAAP

financial measures that is calculated as revenue less cost of goods

sold, excluding changes in fair value of biological assets and

change in fair value of biological assets through inventory

sold.

This data is furnished to provide additional

information and are non-IFRS measures and do not have any

standardized meaning prescribed by IFRS. The Company uses these

non-IFRS measures to provide shareholders and others with

supplemental measures of its operating performance. The Company

also believes that securities analysts, investors and other

interested parties, frequently use these non-IFRS measures in the

evaluation of companies, many of which present similar metrics when

reporting their results. As other companies may calculate these

non-IFRS measures differently than the Company, these metrics may

not be comparable to similarly titled measures reported by other

companies.

Forward Looking Statements

This news release contains statements that

constitute "forward-looking statements." Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results, performance or achievements,

or developments in the industry to differ materially from the

anticipated results, performance or achievements expressed or

implied by such forward-looking statements. Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by the words "expects",

"plans", "anticipates", "believes", "intends", "estimates",

"projects", "potential" and similar expressions, or that events or

conditions "will", "would", "may", "could" or "should" occur.

Although the Company believes that the expectations and assumptions

on which the forward-looking statements are based are reasonable,

undue reliance should not be placed on the forward-looking

statements because the Company can give no assurance that they will

prove to be correct. Since forward-looking statements address

future events and conditions, by their very nature they involve

inherent risks and uncertainties. These statements speak only as of

the date of this News Release. Actual results could differ

materially from those currently anticipated due to a number of

factors and risks including various risk factors discussed in the

Company’s disclosure documents which can be found under the

Company’s profile on http://www.sedarplus.com. Should one or

more of these risks or uncertainties materialize, or should

assumptions underlying the forward-looking statements prove

incorrect, actual results may vary materially from those described

herein as intended, planned, anticipated, believed, estimated or

expected. The Company does not intend, and does not assume any

obligation, to update these forward-looking statements except as

otherwise required by applicable law.

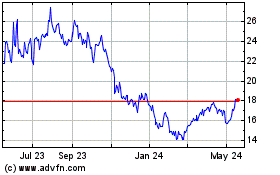

Core Laboratories (NYSE:CLB)

Historical Stock Chart

From Dec 2024 to Jan 2025

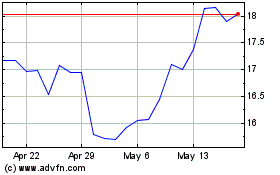

Core Laboratories (NYSE:CLB)

Historical Stock Chart

From Jan 2024 to Jan 2025