This release includes business updates and unaudited interim

financial results for the three ("Q2", "Q2 2024" or the "Quarter")

and six months (“1H 2024") ended June 30, 2024 of Cool Company Ltd.

("CoolCo" or the "Company") (NYSE:CLCO / CLCO.OL).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240828946588/en/

Q2 Highlights and Subsequent Events

- Generated total operating revenues of $83.4 million in Q2,

compared to $88.1 million for the first quarter of 2024 ("Q1" or

"Q1 2024") primarily related to a drawn-out drydock, lower rates on

our single variable charter and lower vessel management fees as

contracts came to an end, partly offset by two vessels rolling over

to higher rates;

- Net income of $26.51 million in Q2, compared to $36.81 million

for Q1 with the decrease primarily related to a reduced unrealized

gain on our mark-to-market interest rate swaps;

- Achieved average Time Charter Equivalent Earnings ("TCE")2 of

$78,400 per day for Q2, compared to $77,200 per day for Q1,

supported by full quarter contributions from two vessels that

recently started higher rate charters;

- Adjusted EBITDA2 of $55.7 million for Q2, compared to $58.5

million for Q1;

- Secured a 14-year charter with GAIL (India) Limited during Q2

for one of the two state-of-the-art MEGA LNG carriers currently

under construction at Hyundai-Samho (the "Newbuilds");

- Completed our first drydock in Q2 in 43 days and subsequently

finished two more drydocks in a timely manner in Q3 2024, taking 21

and 20 days respectively. A fourth drydock, which includes LNGe

upgrade, is scheduled for completion in Q4 2024 and is expected to

take 45 days;

- Secured a one-year time charter agreement for a TFDE vessel

starting in Q3 2024 with an energy major and participating in two

formal processes for Kool Tiger, our other MEGA LNG carrier

currently under construction; and

- Declared a quarterly dividend of $0.41 per share, payable to

shareholders of record on September 9, 2024.

Richard Tyrrell, CEO, commented:

“During Q2 and the early part of Q3, CoolCo has taken advantage

of the seasonally quieter months to complete drydocks and secure

additional forward charter cover for both the relative short term

and the long term. Our TCE performance for the second quarter

increased to $78,400 per day, as the seasonal impact on our one

market-linked charter was more than offset by the full-quarter

contributions from two vessels that recently began improved time

charters.

CoolCo navigated the flat chartering market since our last

reporting through a back-to-back 12-month charter that increased

its backlog to $1.8 billion. Despite the continuing market

volatility, geopolitical uncertainty and focus on energy security

that continues to figure prominently in the LNG market, several

charterers are adopting short shipping strategies that have the

potential to spur sudden demand. Meanwhile, high gas inventories in

Europe are increasingly driving LNG shipments longer haul to a

diverse set of Asian markets, supporting ton-mile demand and

causing the global LNG carrier fleet to be underrepresented in the

Atlantic Basin ahead of the winter market.

We look forward to taking delivery of our two state-of-the-art

newbuilds later this year, one of which has already secured a

14-year time charter to service the fast-growing Indian LNG market.

Following our recent chartering activity, our fleet is now largely

fixed through the medium term. We are focused on securing

additional coverage for our limited charter market exposure in

2024-25, while maintaining the flexibility to benefit from the

substantial market tightening we anticipate as vast new LNG volumes

come online in 2025-26. Due to full charter coverage and improved

drydock performance, we expect a moderate increase in TCE rate and

time and charter voyage revenues for the third quarter compared to

the second quarter.”

Financial Highlights

The table below sets forth certain key financial information for

Q2 2024, Q1 2024, Q2 2023, 1H 2024 and for the six months ended

June 30, 2023 (“1H 2023”).

(in thousands of $, except average daily

TCE)

Q2 2024

Q1 2024

Q2 2023

1H 2024

1H 2023

Time and voyage charter revenues

76,401

78,710

82,071

155,111

173,239

Total operating revenues

83,372

88,125

90,316

171,497

188,965

Operating income

41,361

44,097

45,484

85,458

97,506

Net income 1

26,478

36,812

44,646

63,290

114,778

Adjusted EBITDA2

55,679

58,541

59,894

114,220

127,708

Average daily TCE2 (to the closest

$100)

78,400

77,200

81,100

77,800

82,500

LNG Market Review

The average Japan/Korea Marker gas price ("JKM") for the Quarter

was $11.05/MMBtu compared to $9.43/MMBtu for Q1 2024; with average

JKM for Q3 2024 at $10.88/MMBtu as of August 22, 2024. The Quarter

commenced with Dutch Title Transfer Facility gas price ("TTF") at

$8.76/MMBtu and quoted TFDE headline spot rates of $39,500 per day.

The Quarter concluded with TTF at $10.70/MMBtu and quoted TFDE

headline spot rates of $60,250 per day. The TFDE headline spot rate

has subsequently stabilized at around this level and was quoted at

$65,000 per day as of August 16, 2024.

The combination of very high European gas inventories and strong

commodity pricing has resulted in a sharp reduction in shipping

from the US Gulf into Europe and a correspondingly sharp increase

in long-haul, inter-basin voyages. These increased Pacific volumes

have been absorbed in part by India and China, but also by a

diverse set of importing markets including Thailand, Singapore,

Vietnam, and the Philippines.

The combination of geopolitical uncertainty and an oscillation

of charter market strength between East and West continues to

stretch the LNG carrier fleet even during the seasonally quieter

months. With the winter season ahead, the disposition of the global

fleet is increasingly skewed towards the Pacific Basin, setting the

stage for increased volatility if typical seasonal conditions

prevail following two consecutive mild winters.

Operational Review

CoolCo's fleet continued to perform well with a Q2 fleet

utilization of 99% compared to 95% for Q1 2024. The offhire was

technical in nature and related to the drawn out drydock of the

Kool Crystal, which went into drydock in early May and was

completed during the Quarter. The Kool Frost entered the yard for

its drydock towards the end of the Quarter, with a further two

vessels scheduled to start their drydocks during the third quarter

of 2024. The average cost of these drydocks is estimated to be

approximately $5.5 million per vessel. The last drydock scheduled

for this year will also include the upgrade of a vessel to LNGe

specification through the retrofit of a sub-cooler with high

liquefaction capacity and other performance enhancements at an

estimated cost of an additional $15.0 million and an additional 20

days off-hire.

Business Development

The chartering of one of CoolCo’s two Newbuilds sets a strong

foundation for the second Newbuild and CoolCo continues to be in

discussions with potential charterers regarding its employment of

its other newbuild vessel, which is part of two formal bidding

processes. CoolCo is also developing leads for its other vessel

redelivering late in the second half of 2024.

Financing and Liquidity

At the end of Q1 2024, the Company closed the upsize of the

existing $520 million term loan facility maturing in May 2029 in

anticipation of the maturity of the two existing sale &

leaseback facilities (Kool Ice and Kool Kelvin) during the first

quarter of 2025. As previously disclosed, the maximum $200 million

upsize is available on a delayed drawdown basis, at our option.

As of June 30, 2024, CoolCo had cash and cash equivalents of

$84.4 million and total short and long-term debt, net of deferred

finance charges, amounting to $1,002.4 million. In addition, CoolCo

has approximately $77 million remaining undrawn capacity under its

Newbuild Vessel pre-delivery facility. Total Contractual Debt2

stood at $1,108.3 million, which is comprised of $466.2 million in

respect of the $570 million bank facility maturing in March 2027,

$442.5 million in respect of the $520 million term loan facility

maturing in May 2029, $159.6 million of sale and leaseback

financing in respect of the two vessels maturing in the first

quarter of 2025 (Kool Ice and Kool Kelvin) and $40.0 million in

respect of the Newbuilds' financing.

Overall, the Company’s interest rate on its debt is currently

fixed or hedged for approximately 76% of the notional amount of net

debt, adjusting for existing cash on hand.

Corporate and Other Matters

As of June 30, 2024, CoolCo had 53,702,846 shares issued and

outstanding. Of these, 31,254,390 shares (58.2%) were owned by EPS

Ventures Ltd ("EPS") and 22,448,456 (41.8%) were owned by other

investors in the public markets.

In line with the Company’s variable dividend policy, the Board

has declared a Q2 dividend of $0.41 per common share. The record

date is September 9, 2024 and the dividend will be distributed to

DTC-registered shareholders on or around September 16, 2024, while

due to the implementation of the Central Securities Depositories

Regulation in Norway, the dividend will be distributed to Euronext

VPS-registered shareholders on or around September 20, 2024

Outlook

The LNG carrier charter market remains divided between the

highly variable spot market and the more stable time charter

market. With the spot market dominated by sub-lets and steam

turbine carriers, while more modern tonnage owned by independent

owners, such as CoolCo, prioritize term charters, where prevailing

rates remain within a narrower and materially higher range.

Long-term initial charters on legacy steam turbine vessels

continue to end, returning these vessels to a charter market that

increasingly favors more modern, fuel-efficient tonnage with

superior boil-off and environmental profiles. Representing

approximately 30% of the global LNG carrier fleet, these legacy

vessels face reduced utilization and future prospects, presenting

substantial potential for a combination of scrapping, conversion

into floating infrastructure, or redeployment into niche regional

trades.

In contrast to the volatility and uncertainties of the near-term

market, we believe longer-term sector prospects remain strongly

supported by the pipeline of new liquefaction projects that have

already reached Final Investment Decision (FID) and are set to

increase the total volume of LNG on the water by more than 50% in

the coming years. The sizable current newbuild orderbook consists

mainly of vessels secured on a long-term basis to transport these

new volumes, with a significant portion of that orderbook destined

for charterers who have traditionally been disinclined to maximize

vessel utilization through the out-charter/sub-let market. Coupled

with the departure of steam turbine ships from mainstream trades,

net fleet growth in the years ahead is expected to be well matched

and potentially outpaced by expected increased demand for modern

LNG carrier tonnage. With both an energy security focus and winter

market factors capable of absorbing even more tonnage beyond

underlying transportation demand, we anticipate that the multi-year

outlook remains highly favorable for independent owners of

high-quality modern vessels.

1 Net income for Q2 2024 includes a

mark-to market gain on interest rate swaps amounting to $4.1

million (Q1 2024: $11.3 million), of which $1.0 million was

unrealized gain (Q1 2024: $8.1 million).

2 Refer to 'Appendix A' - Non-GAAP

financial measures and definitions, for definitions of these

measures and a reconciliation to the nearest GAAP measure.

Forward Looking Statements

This press release and any other written or oral statements made

by us in connection with this press release include forward-looking

statements within the meaning of and made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. All statements, other than statements of historical facts,

that address activities and events that will, should, could, are

expected to or may occur in the future are forward-looking

statements. You can identify these forward-looking statements by

words or phrases such as “believe,” “anticipate,” “intend,”

“estimate,” “forecast,” “project,” “plan,” “potential,” “will,”

“may,” “should,” “expect,” “could,” “would,” “predict,” “propose,”

“continue,” or the negative of these terms and similar expressions.

These forward-looking statements include statements relating to our

outlook, industry trends, expected results, including our expected

TCE and revenue in the third quarter of 2024, expectations on

chartering and charter rates, chartering plan, expected drydockings

including the cost, timing and duration thereof, and impact of

performance enhancements on our vessels, timeline for delivery of

newbuilds, dividends and dividend policy, expected growth in LNG

supply and the impact of new liquefaction projects on LNG volume

expected industry and business trends and prospects including

expected trends in LNG demand and market trends and potential

future drivers of demand expected trends in LNG shipping capacity

including net fleet growth, LNG vessel supply and demand factors

impacting supply and demand of vessels, rates and expected trends

in charter rates, backlog, contracting, utilization and LNG vessel

newbuild order-book, expected multi-year outlook for independent

operators, statements made under “LNG Market Review” and “Outlook”

and other non-historical matters.

The forward-looking statements in this document are based upon

management’s current expectations, estimates and projections. These

statements involve significant risks, uncertainties, contingencies

and factors that are difficult or impossible to predict and are

beyond our control, and that may cause our actual results,

performance or achievements to be materially different from those

expressed or implied by the forward-looking statements. Numerous

factors could cause our actual results, level of activity,

performance or achievements to differ materially from the results,

level of activity, performance or achievements expressed or implied

by these forward-looking statements including:

- general economic, political and business conditions, including

sanctions and other measures;

- general LNG market conditions, including fluctuations in

charter hire rates and vessel values;

- changes in demand in the LNG shipping industry, including the

market for our vessels;

- changes in the supply of LNG vessels;

- our ability to successfully employ our vessels;

- changes in our operating expenses, including fuel or cooling

down prices and lay-up costs when vessels are not on charter,

drydocking and insurance costs;

- compliance with, and our liabilities under, governmental, tax,

environmental and safety laws and regulations;

- risk related to climate change, including climate-change or

greenhouse gas related legislation or regulations and the impact on

our business from physical climate-change related to changes in

weather patterns, and the potential impact of new regulations

relating to climate change and the potential impact on the demand

for the LNG shipping industry;

- changes in governmental regulation, tax and trade matters and

actions taken by regulatory authorities;

- potential disruption of shipping routes and demand due to

accidents, piracy or political events and/or instability, including

the ongoing conflicts in the Middle East;

- vessel breakdowns and instances of loss of hire;

- vessel underperformance and related warranty claims;

- our expectations regarding the availability of vessel

acquisitions;

- our ability to procure or have access to financing and

refinancing;

- continued borrowing availability under our credit facilities

and compliance with the financial covenants therein;

- fluctuations in foreign currency exchange and interest

rates;

- potential conflicts of interest involving our significant

shareholders;

- our ability to pay dividends;

- information system failures, cyber incidents or breaches in

security;

- adjustments in our ship management business and related costs;

and

- other risks indicated in the risk factors included in our

Annual Report on Form 20-F for the year ended December 31, 2023 and

other filings with and submission to the U.S. Securities and

Exchange Commission.

The foregoing factors that could cause our actual results to

differ materially from those contemplated in any forward-looking

statement included in this report should not be construed as

exhaustive. Moreover, we operate in a very competitive and rapidly

changing environment. New risks and uncertainties emerge from time

to time, and it is not possible for us to predict all risks and

uncertainties that could have an impact on the forward-looking

statements contained in this press release. The results, events and

circumstances reflected in the forward-looking statements may not

be achieved or occur, and actual results, events or circumstances

could differ materially from those described in the forward-looking

statements.

As a result, you are cautioned not to place undue reliance on

any forward-looking statements which speak only as of the date of

this press release. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise unless

required by law.

Responsibility Statement

We confirm that, to the best of our knowledge, the interim

unaudited condensed consolidated financial statements for the six

months ended June 30, 2024, which have been prepared in accordance

with accounting principles generally accepted in the United States

(US GAAP) give a true and fair view of the Company’s consolidated

assets, liabilities, financial position and results of operations.

To the best of our knowledge, the financial report for the six

months ended June 30, 2024 includes a fair review of important

events that have occurred during the period and their impact on the

interim unaudited condensed consolidated financial statements, the

principal risks and uncertainties, and major related party

transactions.

August 29, 2024 Cool Company Ltd. London, UK

Questions should be directed to: c/o Cool Company Ltd - +1(441)

295 2244

Richard Tyrrell (Chief Executive Officer

& Director)

Cyril Ducau (Chairman of the Board)

John Boots (Chief Financial Officer)

Antoine Bonnier (Director)

Joanna Huipei Zhou (Director)

Sami Iskander (Director)

Neil Glass (Director)

Peter Anker (Director)

Cool Company Ltd.

Unaudited Condensed Consolidated

Statements of Operations

For the three months

ended

For the six months

ended

(in thousands of $)

Apr-Jun 2024

Jan-Mar 2024

Apr-Jun 2023

Jan-Jun 2024

Jan-Jun 2023

Time and voyage charter revenues

76,401

78,710

82,071

155,111

173,239

Vessel and other management fee

revenues

2,479

4,923

3,757

7,402

7,133

Amortization of intangible assets and

liabilities - charter agreements, net

4,492

4,492

4,488

8,984

8,593

Total operating revenues

83,372

88,125

90,316

171,497

188,965

Vessel operating expenses

(17,037

)

(17,594

)

(18,835

)

(34,631

)

(37,423

)

Voyage, charter hire and commission

expenses, net

(900

)

(1,439

)

(877

)

(2,339

)

(2,376

)

Administrative expenses

(5,264

)

(6,059

)

(6,222

)

(11,323

)

(12,865

)

Depreciation and amortization

(18,810

)

(18,936

)

(18,898

)

(37,746

)

(38,795

)

Total operating expenses

(42,011

)

(44,028

)

(44,832

)

(86,039

)

(91,459

)

Operating income

41,361

44,097

45,484

85,458

97,506

Other non-operating income

—

—

21

—

42,549

Financial income/(expense):

Interest income

1,357

1,705

2,791

3,062

4,308

Interest expense

(19,180

)

(19,678

)

(19,863

)

(38,858

)

(39,348

)

Gains on derivative instruments

4,065

11,301

16,705

15,366

10,704

Other financial items, net

(972

)

(480

)

(414

)

(1,452

)

(807

)

Financial expenses, net

(14,730

)

(7,152

)

(781

)

(21,882

)

(25,143

)

Income before income taxes and

non-controlling interests

26,631

36,945

44,724

63,576

114,912

Income taxes, net

(153

)

(133

)

(78

)

(286

)

(134

)

Net income

26,478

36,812

44,646

63,290

114,778

Net income attributable to non-controlling

interests

(411

)

(238

)

344

(649

)

(943

)

Net income attributable to the Owners

of Cool Company Ltd.

26,067

36,574

44,990

62,641

113,835

Net income attributable to:

Owners of Cool Company Ltd.

26,067

36,574

44,990

62,641

113,835

Non-controlling interests

411

238

(344

)

649

943

Net income

26,478

36,812

44,646

63,290

114,778

Cool Company Ltd.

Unaudited Condensed Consolidated

Balance Sheets

At June 30,

At December 31,

(in thousands of $, except number of

shares)

2024

2023

(Audited)

ASSETS

Current assets

Cash and cash equivalents

84,362

133,496

Restricted cash and short-term

deposits

1,676

3,350

Intangible assets, net

—

825

Trade receivable and other current

assets

10,146

12,923

Inventories

879

3,659

Total current assets

97,063

154,253

Non-current assets

Restricted cash

463

492

Intangible assets, net

8,534

9,438

Newbuildings

206,549

181,904

Vessels and equipment, net

1,685,936

1,700,063

Other non-current assets

19,150

10,793

Total assets

2,017,695

2,056,943

LIABILITIES AND EQUITY

Current liabilities

Current portion of long-term debt and

short-term debt

175,156

194,413

Trade payable and other current

liabilities

106,415

98,917

Total current liabilities

281,571

293,330

Non-current liabilities

Long-term debt

827,241

866,671

Other non-current liabilities

81,938

90,362

Total liabilities

1,190,750

1,250,363

Equity

Owners' equity includes 53,702,846 (2023:

53,702,846) common shares of $1.00 each, issued and outstanding

755,706

735,990

Non-controlling interests

71,239

70,590

Total equity

826,945

806,580

Total liabilities and equity

2,017,695

2,056,943

Cool Company Ltd.

Unaudited Condensed Consolidated

Statements of Cash Flows

(in thousands of $)

Jan-Jun 2024

Jan-Jun 2023

Operating activities

Net income

63,290

114,778

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expenses

37,746

38,795

Amortization of intangible assets and

liabilities arising from charter agreements, net

(8,984

)

(8,593

)

Amortization of deferred charges and fair

value adjustments

1,876

2,319

Gain on sale of vessel

—

(42,549

)

Drydocking expenditure

(8,132

)

(4,284

)

Compensation cost related to share-based

payment

1,111

1,197

Change in fair value of derivative

instruments

(9,119

)

(6,446

)

Changes in assets and liabilities:

Trade accounts receivable

7,578

(3,885

)

Inventories

2,780

387

Other current and other non-current

assets

(2,743

)

(4,892

)

Amounts due to related parties

(542

)

(1,270

)

Trade accounts payable

(524

)

26,966

Accrued expenses

(6,674

)

(7,178

)

Other current and non-current

liabilities

3,706

12,236

Net cash provided by operating

activities

81,369

117,581

Investing activities

Additions to vessels and equipment

(2,744

)

(872

)

Additions to newbuildings

(22,501

)

—

Additions to intangible assets

(132

)

(432

)

Proceeds from sale of vessels &

equipment

—

184,300

Net cash (used in) / provided by

investing activities

(25,377

)

182,996

Financing activities

Proceeds from short-term and long-term

debt

—

70,000

Repayments of short-term and long-term

debt

(57,963

)

(144,828

)

Financing arrangement fees and other

costs

(4,830

)

(1,892

)

Cash dividends paid

(44,036

)

(43,487

)

Net cash used in financing

activities

(106,829

)

(120,207

)

Net (decrease)/ increase in cash, cash

equivalents and restricted cash

(50,837

)

180,370

Cash, cash equivalents and restricted

cash at beginning of period

137,338

133,077

Cash, cash equivalents and restricted

cash at end of period

86,501

313,447

Cool Company Ltd.

Unaudited Condensed Consolidated

Statements of Changes in Equity

For the six months ended June

30, 2024

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated balance at December 31,

2023

53,702,846

53,703

509,327

172,960

735,990

70,590

806,580

Net income for the period

—

—

—

62,641

62,641

649

63,290

Share based payments contribution

—

—

1,189

—

1,189

—

1,189

Forfeitures of share based

compensation

—

—

(78

)

—

(78

)

—

(78

)

Dividends

—

—

—

(44,036

)

(44,036

)

—

(44,036

)

Consolidated balance at

June 30, 2024

53,702,846

53,703

510,438

191,565

755,706

71,239

826,945

(1) Additional paid-in capital refers to

the amount of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

For the six months ended June

30, 2023

(in thousands of $, except number of

shares)

Number of common

shares

Owners’ Share Capital

Additional Paid-in

Capital(1)

Retained Earnings

Owners' Equity

Non- controlling

Interests

Total Equity

Consolidated balance at December 31,

2022

53,688,462

53,688

507,127

85,742

646,557

68,956

715,513

Net income for the period

—

—

—

113,835

113,835

943

114,778

Share based payments contribution

—

—

1,197

—

1,197

—

1,197

Dividends

—

—

—

(43,487

)

(43,487

)

—

(43,487

)

Consolidated balance at

June 30, 2023

53,688,462

53,688

508,324

156,090

718,102

69,899

788,001

(1) Additional paid-in capital refers to

the amount of capital contributed or paid-in over and above the par

value of the Company's issued share capital.

Appendix A - Non-GAAP Financial Measures and Definitions

Non-GAAP Financial Metrics Arising from How Management Monitors

the Business

In addition to disclosing financial results in accordance with

U.S. generally accepted accounting principles (US GAAP), this

earnings release and the associated investor presentation and

discussion contain references to the non-GAAP financial measures

which are included in the table below. We believe these non-GAAP

financial measures provide investors with useful supplemental

information about the financial performance of our business, enable

comparison of financial results between periods where certain items

may vary independent of business performance, and allow for greater

transparency with respect to key metrics used by management in

operating our business and measuring our performance. These

non-GAAP financial measures should not be considered a substitute

for, or superior to, financial measures calculated in accordance

with US GAAP, and the financial results calculated in accordance

with US GAAP. Non-GAAP measures are not uniformly defined by all

companies, and may not be comparable with similar titles, measures

and disclosures used by other companies. The reconciliations from

these results should be carefully evaluated.

Non-GAAP measure

Closest equivalent US GAAP

measure

Adjustments to reconcile to

primary financial statements prepared under US GAAP

Rationale for presentation of

the non-GAAP measure

Performance

Measures

Adjusted EBITDA

Net income

+/- Other non-operating income

+/- Net financial expense, representing:

Interest income, Interest expense, Gains/(Losses) on derivative

instruments and Other financial items, net

+/- Income taxes, net

+ Depreciation and amortization

- Amortization of intangible assets and

liabilities - charter agreements, net

Increases the comparability of total

business performance from period to period and against the

performance of other companies by removing the impact of other

non-operating income, depreciation, amortization of intangible

assets and liabilities - charter agreements, net, financing and tax

items.

Average daily TCE

Time and voyage charter revenues

- Voyage, charter hire and commission

expenses, net

The above total is then divided by

calendar days less scheduled off-hire days.

Measure of the average daily net revenue

performance of a vessel.

Standard shipping industry performance

measure used primarily to compare period-to-period changes in the

vessel’s net revenue performance despite changes in the mix of

charter types (i.e. spot charters, time charters and bareboat

charters) under which the vessel may be employed between the

periods.

Assists management in making decisions

regarding the deployment and utilization of its fleet and in

evaluating financial performance.

Liquidity

measures

Total Contractual Debt

Total debt (current and non-current), net

of deferred finance charges

+ VIE Consolidation and fair value

adjustments upon acquisition

+ Deferred Finance Charges

We consolidate two lessor VIEs for our

sale and leaseback facilities (for the vessels Ice and Kelvin).

This means that on consolidation, our contractual debt is

eliminated and replaced with the Lessor VIEs’ debt.

Contractual debt represents our actual

debt obligations under our various financing arrangements before

consolidating the Lessor VIEs.

The measure enables investors and users of

our financial statements to assess our liquidity and the split of

our debt (current and non-current) based on our underlying

contractual obligations.

Total Company Cash

CoolCo cash based on GAAP measures:

+ Cash and cash equivalents

+ Restricted cash and short-term deposits

(current and non-current)

- VIE restricted cash and short-term

deposits (current and non-current)

We consolidate two lessor VIEs for our

sale and leaseback facilities. This means that on consolidation, we

include restricted cash held by the lessor VIEs.

Total Company Cash represents our cash and

cash equivalents and restricted cash and short-term deposits

(current and non-current) before consolidating the lessor VIEs.

Management believes that this measure

enables investors and users of our financial statements to assess

our liquidity and aids comparability with our competitors.

Reconciliations - Performance

Measures

Adjusted EBITDA

For the three months

ended

(in thousands of $)

Apr-Jun 2024

Jan-Mar 2024

Apr-Jun 2023

Net income

26,478

36,812

44,646

Other non-operating income

—

—

(21

)

Interest income

(1,357

)

(1,705

)

(2,791

)

Interest expense

19,180

19,678

19,863

Gains on derivative instruments

(4,065

)

(11,301

)

(16,705

)

Other financial items, net

972

480

414

Income taxes, net

153

133

78

Depreciation and amortization

18,810

18,936

18,898

Amortization of intangible assets and

liabilities - charter agreements, net

(4,492

)

(4,492

)

(4,488

)

Adjusted EBITDA

55,679

58,541

59,894

For the six months

ended

(in thousands of $)

Jan-Jun 2024

Jan-Jun 2023

Net income

63,290

114,778

Other non-operating income

—

(42,549

)

Interest income

(3,062

)

(4,308

)

Interest expense

38,858

39,348

Gains on derivative instruments

(15,366

)

(10,704

)

Other financial items, net

1,452

807

Income taxes, net

286

134

Depreciation and amortization

37,746

38,795

Amortization of intangible assets and

liabilities - charter agreements, net

(8,984

)

(8,593

)

Adjusted EBITDA

114,220

127,708

Average daily TCE

For the three months

ended

(in thousands of $, except number of days

and average daily TCE)

Apr-Jun 2024

Jan-March 2024

Apr-Jun 2023

Time and voyage charter revenues

76,401

78,710

82,071

Voyage, charter hire and commission

expenses, net

(900

)

(1,439

)

(877

)

75,501

77,271

81,194

Calendar days less scheduled off-hire

days

963

1,001

1,001

Average daily TCE (to the closest

$100)

$

78,400

$

77,200

$

81,100

For the six months

ended

(in thousands of $, except number of days

and average daily TCE)

Jan-Jun 2024

Jan-Jun 2023

Time and voyage charter revenues

155,111

173,239

Voyage, charter hire and commission

expenses, net

(2,339

)

(2,376

)

152,772

170,863

Calendar days less scheduled off-hire

days

1,964

2,072

Average daily TCE (to the closest

$100)

$

77,800

$

82,500

Reconciliations - Liquidity

measures

Total Contractual Debt

(in thousands of $)

At June 30,

2024

At December 31,

2023

Total debt (current and non-current) net

of deferred finance charges

1,002,397

1,061,084

Add: VIE consolidation and fair value

adjustments

98,847

97,245

Add: Deferred finance charges

7,090

5,563

Total Contractual Debt

1,108,334

1,163,892

Total Company Cash

(in thousands of $)

At June 30,

2024

At December 31,

2023

Cash and cash equivalents

84,362

133,496

Restricted cash and short-term

deposits

2,139

3,842

Less: VIE restricted cash

(1,676

)

(3,350

)

Total Company Cash

84,825

133,988

Other definitions

Contracted Revenue Backlog

Contracted revenue backlog is defined as the contracted daily

charter rate for each vessel multiplied by the number of scheduled

hire days for the remaining contract term. Contracted revenue

backlog is not intended to represent Adjusted EBITDA or future

cashflows that will be generated from these contracts. This measure

should be seen as a supplement to and not a substitute for our US

GAAP measures of performance.

This information is subject to the disclosure requirements in

Regulation EU 596/2014 (MAR) article 19 number 3 and section 5-12

of the Norwegian Securities Trading Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828946588/en/

c/o Cool Company Ltd - +1(441) 295 2244

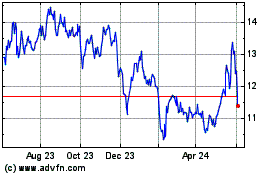

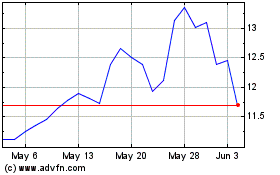

Cool (NYSE:CLCO)

Historical Stock Chart

From Sep 2024 to Oct 2024

Cool (NYSE:CLCO)

Historical Stock Chart

From Oct 2023 to Oct 2024