Form 8-K - Current report

February 03 2025 - 4:26PM

Edgar (US Regulatory)

0000764065false00007640652025-02-032025-02-03

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 3, 2025

CLEVELAND-CLIFFS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | | 1-8944 | | 34-1464672 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 200 Public Square, | Suite 3300, | Cleveland, | Ohio | 44114-2315 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (216) 694-5700

| | |

Not Applicable |

(Former name or former address, if changed since last report) |

| | | | | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered: |

| Common Shares, par value $0.125 per share | | CLF | | New York Stock Exchange |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On February 3, 2025, Cleveland-Cliffs Inc. (the “Company”) issued a press release announcing preliminary fourth-quarter and full-year 2024 financial results for the period ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information contained in this Item 2.02 and Exhibit 99.1 attached hereto is being furnished and shall not be deemed to be filed for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, unless such subsequent filing specifically references this Current Report on Form 8-K.

On February 3, 2025, the Company announced that it launched and priced a private offering of $850 million aggregate principal amount of Senior Guaranteed Notes due 2031 (the “Notes”) in an offering exempt from the registration requirements of the Securities Act. The Notes will bear interest at an annual rate of 7.500% and will be issued at par.

The Notes offering is expected to close on February 6, 2025, subject to the satisfaction of customary closing conditions.

A copy of the launch and pricing press releases are attached as Exhibit 99.2 and Exhibit 99.3, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

This Current Report on Form 8-K does not constitute an offer to sell, nor a solicitation of an offer to buy, the Notes or any other securities. The Notes will not be and have not been registered under the Securities Act, and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

(d)Exhibits. |

Exhibit

Number | | Description |

| |

| | Cleveland-Cliffs Inc. published a news release on February 3, 2025 captioned “Cleveland-Cliffs Provides Preliminary Fourth-Quarter and Full-Year 2024 Results.” |

| | Cleveland-Cliffs Inc. published a news release on February 3, 2025 captioned “Cleveland-Cliffs Inc. Announces Proposed Offering of $750 Million of Senior Unsecured Guaranteed Notes.” |

| | Cleveland-Cliffs Inc. published a news release on February 3, 2025 captioned “Cleveland-Cliffs Inc. Announces Upsizing and Pricing of $850 Million of Senior Unsecured Guaranteed Notes due 2031.” |

| 101 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | CLEVELAND-CLIFFS INC. |

| | | |

| Date: | February 3, 2025 | By: | /s/ James D. Graham |

| | Name: | James D. Graham |

| | Title: | Executive Vice President, Chief Legal and Administrative Officer & Secretary |

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 NEWS RELEASE Cleveland-Cliffs Provides Preliminary Fourth-Quarter and Full-Year 2024 Results CLEVELAND – February 3, 2025 – Cleveland-Cliffs Inc. (NYSE: CLF) today announced its preliminary fourth-quarter and full-year 2024 financial results for the period ended December 31, 2024. The Company completed its acquisition of Stelco Holdings Inc. (“Stelco”) on November 1, 2024. Due to the accounting integration associated with the acquisition, only selected preliminary financial information is available at this time. The Company plans to announce its complete fourth-quarter and full-year 2024 earnings results after the U.S. market close on February 24, 2025. The below selected financial results expectations include the results of Stelco only from November 1, 2024 through December 31, 2024. Fourth-quarter 2024 results expectations: • Steel shipments of 3.8 million net tons • Revenues of approximately $4.3 billion • Adjusted EBITDA1 loss of approximately $85 million Full-year 2024 results expectations: • Steel shipments of 15.6 million net tons • Revenues of approximately $19.2 billion • Adjusted EBITDA1 of approximately $775 million • Including Stelco, 2024 Pro-Forma Adjusted EBITDA1 of approximately $1.2 billion Lourenco Goncalves, Cliffs’ Chairman, President, and CEO said: “Other than the COVID-impacted 2020, 2024 was the worst year for domestic steel demand since 2010. As the largest supplier to the automotive industry in North America, we were especially impacted by muted demand from this sector in the second half of the year. This was the primary driver of our weaker results, particularly in the fourth quarter, which we expect to be the trough as we look forward. So far into this new year, we have already seen improvements in our order book, both automotive and non-automotive, and are confident that the manufacturing-friendly items on President Trump’s agenda will have an outsized benefit on Cleveland- Cliffs. This includes the recently announced tariffs on Mexico, Canada, and China and the expectation that there is more to come on steel specifically. Stelco has been a major contributor since day 1 and a EXHIBIT 99.1

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 2 substantial portion of our expected synergies are already in motion. Based on their experience in 2018, we expect Stelco will benefit from steel tariffs as well. We look forward to the success in 2025 that all of these developments will ultimately bring.” Mr. Goncalves added: “We applaud President Trump for taking decisive action on tariffs. Cleveland-Cliffs is a firm believer in the long-term positive impact that tariffs can play to make America a manufacturing superpower once again. The President continues to prove that he is a man of his word. Promises made, promises kept. Country-specific tariffs on adversaries as well as allies are a great first step, and we look forward to continuing to work with the Trump administration on further tariff action to come on steel specifically, against our adversaries and allies who have taken advantage of our market. A level playing field in steel will set the foundation to usher in a new golden era and a manufacturing renaissance that will make America strong again.” 1Adjusted EBITDA is a non-GAAP financial measure that management uses in evaluating operating performance. The presentation of this measure is not intended to be considered in isolation from, as a substitute for, or as superior to, the financial information prepared and presented in accordance with U.S. GAAP. The presentation of this measure may be different from non-GAAP financial measures used by other companies. We are unable to reconcile, without unreasonable effort, our expected adjusted EBITDA to its most directly comparable GAAP financial measure, net income, due to the uncertainty and inherent difficulty of predicting the occurrence and the financial impact of items impacting comparability. This includes the finalization of the preliminary allocation of consideration related to the Stelco acquisition to the net tangible and intangible assets acquired and liabilities assumed and associated tax impacts. For the same reasons, we are unable to address the probable significance of the unavailable information. Note: Deloitte & Touche LLP has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, Deloitte & Touche LLP does not express an opinion or any other form of assurance with respect thereto. About Cleveland-Cliffs Inc. Cleveland-Cliffs is a leading North America-based steel producer with focus on value-added sheet products, particularly for the automotive industry. The Company is vertically integrated from the mining of iron ore, production of pellets and direct reduced iron, and processing of ferrous scrap through primary steelmaking and downstream finishing, stamping, tooling, and tubing. Headquartered in Cleveland, Ohio, Cleveland-Cliffs employs approximately 30,000 people across its operations in the United States and Canada. For more information, visit http://www.clevelandcliffs.com. Forward-Looking Statements This release contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry or our businesses, are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: the finalization of our financial statements for the year ended December 31, 2024, continued volatility of steel, iron ore and scrap metal market prices, which directly and indirectly impact the prices of the products that we sell to our customers; uncertainties associated with the highly competitive and cyclical steel industry and our reliance on the demand for steel from the automotive industry; potential weaknesses and

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 3 uncertainties in global economic conditions, excess global steelmaking capacity, oversupply of iron ore, prevalence of steel imports and reduced market demand; severe financial hardship, bankruptcy, temporary or permanent shutdowns or operational challenges of one or more of our major customers, key suppliers or contractors, which, among other adverse effects, could disrupt our operations or lead to reduced demand for our products, increased difficulty collecting receivables, and customers and/or suppliers asserting force majeure or other reasons for not performing their contractual obligations to us; risks related to U.S. government actions and other countries’ reactions with respect to Section 232 of the Trade Expansion Act of 1962 (as amended by the Trade Act of 1974), the United States-Mexico-Canada Agreement and/or other trade agreements, tariffs, treaties or policies, as well as the uncertainty of obtaining and maintaining effective antidumping and countervailing duty orders to counteract the harmful effects of unfairly traded imports; impacts of existing and increasing governmental regulation, including actual and potential environmental regulations relating to climate change and carbon emissions, and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorizations of, or from, any governmental or regulatory authority and costs related to implementing improvements to ensure compliance with regulatory changes, including potential financial assurance requirements, and reclamation and remediation obligations; potential impacts to the environment or exposure to hazardous substances resulting from our operations; our ability to maintain adequate liquidity, our level of indebtedness and the availability of capital could limit our financial flexibility and cash flow necessary to fund working capital, planned capital expenditures, acquisitions, and other general corporate purposes or ongoing needs of our business, or to repurchase our common shares; our ability to reduce our indebtedness or return capital to shareholders within the currently expected timeframes or at all; adverse changes in credit ratings, interest rates, foreign currency rates and tax laws; challenges to successfully implementing our business strategy to achieve operating results in line with our guidance; the outcome of, and costs incurred in connection with, lawsuits, claims, arbitrations or governmental proceedings relating to commercial and business disputes, antitrust claims, environmental matters, government investigations, occupational or personal injury claims, property-related matters, labor and employment matters, or suits involving legacy operations and other matters; supply chain disruptions or changes in the cost, quality or availability of energy sources, including electricity, natural gas and diesel fuel, critical raw materials and supplies, including iron ore, industrial gases, graphite electrodes, scrap metal, chrome, zinc, other alloys, coke and metallurgical coal, and critical manufacturing equipment and spare parts; problems or disruptions associated with transporting products to our customers, moving manufacturing inputs or products internally among our facilities, or suppliers transporting raw materials to us; the risk that the cost or time to implement a strategic or sustaining capital project may prove to be greater than originally anticipated; our ability to consummate any public or private acquisition transactions and to realize any or all of the anticipated benefits or estimated future synergies, as well as to successfully integrate any acquired businesses into our existing businesses; uncertainties associated with natural or human-caused disasters, adverse weather conditions, unanticipated geological conditions, critical equipment failures, infectious disease outbreaks, tailings dam failures and other unexpected events; cybersecurity incidents relating to, disruptions in, or failures of, information technology systems that are managed by us or third parties that host or have access to our data or systems, including the loss, theft or corruption of our or third parties’ sensitive or essential business or personal information and the inability to access or control systems; liabilities and costs arising in connection with any business decisions to temporarily or indefinitely idle or permanently close an operating facility or mine, which could adversely impact the carrying value of associated assets and give rise to impairment charges or closure and reclamation obligations, as well as uncertainties associated with restarting any previously idled operating facility or mine; our ability to realize the anticipated synergies or other expected benefits of the Stelco acquisition, as well as the impact of additional liabilities and obligations incurred in connection with the Stelco acquisition; our level of self-insurance and our ability to obtain sufficient third-party insurance to adequately cover potential adverse events and business risks; uncertainties associated with our ability to meet customers' and suppliers' decarbonization goals and reduce our greenhouse gas emissions in alignment with our own announced targets; challenges to maintaining our social license to operate with our stakeholders, including the impacts of our operations on local communities, reputational impacts of operating in a carbon-intensive industry that produces greenhouse gas emissions, and our ability to foster a consistent operational and safety track record; our actual economic mineral reserves or reductions in current mineral reserve estimates, and any title defect or loss of any lease, license, option, easement or other possessory interest for any mining property; our ability to maintain satisfactory labor relations with unions and employees; unanticipated or higher costs associated with pension and other post-employment benefit obligations resulting from changes in the value of plan assets or contribution increases required for unfunded obligations; uncertain availability or cost of skilled workers to fill critical operational positions and potential labor shortages caused by experienced employee attrition or otherwise, as well as our ability to attract, hire, develop and retain key personnel; the amount and timing of any repurchases of our common shares; and potential significant deficiencies or material weaknesses in our internal control over financial reporting .

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 4 For additional factors affecting the business of Cliffs, refer to Part I, Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, and other filings with the U.S. Securities and Exchange Commission. Source: Cleveland-Cliffs Inc. MEDIA CONTACT: Patricia Persico Senior Director, Corporate Communications (216) 694-5316 INVESTOR CONTACT: James Kerr Director, Investor Relations (216) 694-7719 ###

NEWS RELEASE Cleveland-Cliffs Inc. Announces Proposed Offering of $750 Million of Senior Unsecured Guaranteed Notes CLEVELAND – February 3, 2025 – Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs”) announced today that it intends to offer to sell, subject to market and other conditions, $750 million aggregate principal amount of Senior Guaranteed Notes due 2031 (the “Notes”) in an offering that is exempt from the registration requirements of the Securities Act of 1933 (the “Securities Act”). The Notes will be guaranteed on a senior unsecured basis by Cliffs’ material direct and indirect wholly-owned domestic subsidiaries, other than certain excluded subsidiaries. Cliffs intends to use the net proceeds from the Notes for general corporate purposes, including the repayment of borrowings under its asset-based credit facility. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities. The Notes and related guarantees are being offered only to qualified institutional buyers in reliance on the exemption from registration set forth in Rule 144A under the Securities Act, and outside the United States to non-U.S. persons in reliance on the exemption from registration set forth in Regulation S under the Securities Act. The Notes and the related guarantees have not been registered under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from the Securities Act and applicable state securities or blue sky laws and foreign securities laws. About Cleveland-Cliffs Inc. Cleveland-Cliffs is a leading North America-based steel producer with focus on value-added sheet products, particularly for the automotive industry. The Company is vertically integrated from the mining of iron ore, production of pellets and direct reduced iron, and processing of ferrous scrap through primary steelmaking and downstream finishing, stamping, tooling, and tubing. Headquartered in Cleveland, Ohio, Cleveland-Cliffs employs approximately 30,000 people across its operations in the United States and Canada. Forward-Looking Statements This release contains statements that constitute “forward-looking statements” within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry or our businesses, are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: continued volatility of steel, iron ore and scrap metal market prices, which directly and indirectly impact the prices of the products that we sell to our customers; uncertainties associated with the highly competitive and cyclical steel industry and our reliance on the demand for steel from the automotive industry; potential weaknesses and uncertainties in global economic conditions, excess global steelmaking capacity, oversupply of iron ore, prevalence CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 EXHIBIT 99.2

2 of steel imports and reduced market demand; severe financial hardship, bankruptcy, temporary or permanent shutdowns or operational challenges of one or more of our major customers, key suppliers or contractors, which, among other adverse effects, could disrupt our operations or lead to reduced demand for our products, increased difficulty collecting receivables, and customers and/or suppliers asserting force majeure or other reasons for not performing their contractual obligations to us; risks related to U.S. government actions and other countries’ reactions with respect to Section 232 of the Trade Expansion Act of 1962 (as amended by the Trade Act of 1974), the United States-Mexico-Canada Agreement and/or other trade agreements, tariffs, treaties or policies, as well as the uncertainty of obtaining and maintaining effective antidumping and countervailing duty orders to counteract the harmful effects of unfairly traded imports; impacts of existing and increasing governmental regulation, including actual and potential environmental regulations relating to climate change and carbon emissions, and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorizations of, or from, any governmental or regulatory authority and costs related to implementing improvements to ensure compliance with regulatory changes, including potential financial assurance requirements, and reclamation and remediation obligations; potential impacts to the environment or exposure to hazardous substances resulting from our operations; our ability to maintain adequate liquidity, our level of indebtedness and the availability of capital could limit our financial flexibility and cash flow necessary to fund working capital, planned capital expenditures, acquisitions, and other general corporate purposes or ongoing needs of our business, or to repurchase our common shares; our ability to reduce our indebtedness or return capital to shareholders within the currently expected timeframes or at all; adverse changes in credit ratings, interest rates, foreign currency rates and tax laws; challenges to successfully implementing our business strategy to achieve operating results in line with our guidance; the outcome of, and costs incurred in connection with, lawsuits, claims, arbitrations or governmental proceedings relating to commercial and business disputes, antitrust claims, environmental matters, government investigations, occupational or personal injury claims, property-related matters, labor and employment matters, or suits involving legacy operations and other matters; supply chain disruptions or changes in the cost, quality or availability of energy sources, including electricity, natural gas and diesel fuel, critical raw materials and supplies, including iron ore, industrial gases, graphite electrodes, scrap metal, chrome, zinc, other alloys, coke and metallurgical coal, and critical manufacturing equipment and spare parts; problems or disruptions associated with transporting products to our customers, moving manufacturing inputs or products internally among our facilities, or suppliers transporting raw materials to us; the risk that the cost or time to implement a strategic or sustaining capital project may prove to be greater than originally anticipated; our ability to consummate any public or private acquisition transactions and to realize any or all of the anticipated benefits or estimated future synergies, as well as to successfully integrate any acquired businesses into our existing businesses; uncertainties associated with natural or human-caused disasters, adverse weather conditions, unanticipated geological conditions, critical equipment failures, infectious disease outbreaks, tailings dam failures and other unexpected events; cybersecurity incidents relating to, disruptions in, or failures of, information technology systems that are managed by us or third parties that host or have access to our data or systems, including the loss, theft or corruption of our or third parties’ sensitive or essential business or personal information and the inability to access or control systems; liabilities and costs arising in connection with any business decisions to temporarily or indefinitely idle or permanently close an operating facility or mine, which could adversely impact the carrying value of associated assets and give rise to impairment charges or closure and reclamation obligations, as well as uncertainties associated with restarting any previously idled operating facility or mine; our ability to realize the anticipated synergies or other expected benefits of the Stelco acquisition, as well as the impact of additional liabilities and obligations incurred in connection with the Stelco acquisition; our level of self-insurance and our ability to obtain sufficient third-party insurance to adequately cover potential adverse events and business risks; uncertainties associated with our ability to meet customers' and suppliers' decarbonization goals and reduce our greenhouse gas emissions in alignment with our own announced targets; challenges to maintaining our social license to operate with our stakeholders, including the impacts of our operations on local communities, reputational impacts of operating in a carbon-intensive industry that produces greenhouse gas emissions, and our ability to foster a consistent operational and safety track record; our actual economic mineral reserves or reductions in current mineral reserve estimates, and any title defect or loss of any lease, license, option, easement or other possessory interest for any mining property; our ability to maintain satisfactory labor relations with unions and employees; unanticipated or higher costs associated with pension and other post-employment benefit obligations resulting from changes in the value of plan assets or contribution increases required for unfunded obligations; uncertain availability or cost of skilled workers to fill critical operational positions and potential labor shortages caused by experienced employee attrition or otherwise, as well as our ability to attract, CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 3 hire, develop and retain key personnel; the amount and timing of any repurchases of our common shares; and potential significant deficiencies or material weaknesses in our internal control over financial reporting. For additional factors affecting the business of Cliffs, refer to Part I, Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, and other filings with the U.S. Securities and Exchange Commission. Source: Cleveland-Cliffs Inc. MEDIA CONTACT: Patricia Persico Senior Director, Corporate Communications (216) 694-5316 INVESTOR CONTACT: James Kerr Director, Investor Relations (216) 694-7719

NEWS RELEASE Cleveland-Cliffs Inc. Announces Upsizing and Pricing of $850 Million of Senior Unsecured Guaranteed Notes due 2031 CLEVELAND – February 3, 2025 – Cleveland-Cliffs Inc. (NYSE: CLF) (“Cliffs”) announced today that it has upsized and priced $850 million aggregate principal amount of Senior Guaranteed Notes due 2031 (the “Notes”) in an offering that is exempt from the registration requirements of the Securities Act of 1933 (the “Securities Act”). The Notes will bear interest at an annual rate of 7.500% and will be issued at par. The Notes will be guaranteed on a senior unsecured basis by Cliffs’ material direct and indirect wholly- owned domestic subsidiaries, other than certain excluded subsidiaries. The Notes offering is expected to close on February 6, 2025, subject to the satisfaction of customary closing conditions. Cliffs intends to use the net proceeds from the Notes for general corporate purposes, including the repayment of borrowings under its asset-based credit facility. This transaction is leverage neutral, improves liquidity, and replaces secured debt with unsecured debt. This news release does not constitute an offer to sell or the solicitation of an offer to buy any securities. The Notes and related guarantees are being offered only to qualified institutional buyers in reliance on the exemption from registration set forth in Rule 144A under the Securities Act, and outside the United States to non-U.S. persons in reliance on the exemption from registration set forth in Regulation S under the Securities Act. The Notes and the related guarantees have not been registered under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from the Securities Act and applicable state securities or blue sky laws and foreign securities laws. About Cleveland-Cliffs Inc. Cleveland-Cliffs is a leading North America-based steel producer with focus on value-added sheet products, particularly for the automotive industry. The Company is vertically integrated from the mining of iron ore, production of pellets and direct reduced iron, and processing of ferrous scrap through primary steelmaking and downstream finishing, stamping, tooling, and tubing. Headquartered in Cleveland, Ohio, Cleveland-Cliffs employs approximately 30,000 people across its operations in the United States and Canada. Forward-Looking Statements This release contains statements that constitute “forward-looking statements” within the meaning of the federal securities laws. All statements other than historical facts, including, without limitation, statements regarding our current expectations, estimates and projections about our industry or our businesses, are forward-looking statements. We caution investors that any forward-looking statements are subject to risks and uncertainties that may cause actual results and future trends to differ materially from those matters expressed in or implied by such forward-looking statements. Investors are cautioned not to place undue reliance on forward-looking statements. Among the risks and uncertainties that could cause actual results to differ from those described in forward-looking statements are the following: the products that we sell to our customers; uncertainties associated with the highly competitive and cyclical steel industry and our reliance on the demand for steel from the automotive industry; potential weaknesses and CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 EXHIBIT 99.3

2 uncertainties in global economic conditions, excess global steelmaking capacity, oversupply of iron ore, prevalence of steel imports and reduced market demand; severe financial hardship, bankruptcy, temporary or permanent shutdowns or operational challenges of one or more of our major customers, key suppliers or contractors, which, among other adverse effects, could disrupt our operations or lead to reduced demand for our products, increased difficulty collecting receivables, and customers and/or suppliers asserting force majeure or other reasons for not performing their contractual obligations to us; risks related to U.S. government actions and other countries’ reactions with respect to Section 232 of the Trade Expansion Act of 1962 (as amended by the Trade Act of 1974), the United States-Mexico-Canada Agreement and/or other trade agreements, tariffs, treaties or policies, as well as the uncertainty of obtaining and maintaining effective antidumping and countervailing duty orders to counteract the harmful effects of unfairly traded imports; impacts of existing and increasing governmental regulation, including actual and potential environmental regulations relating to climate change and carbon emissions, and related costs and liabilities, including failure to receive or maintain required operating and environmental permits, approvals, modifications or other authorizations of, or from, any governmental or regulatory authority and costs related to implementing improvements to ensure compliance with regulatory changes, including potential financial assurance requirements, and reclamation and remediation obligations; potential impacts to the environment or exposure to hazardous substances resulting from our operations; our ability to maintain adequate liquidity, our level of indebtedness and the availability of capital could limit our financial flexibility and cash flow necessary to fund working capital, planned capital expenditures, acquisitions, and other general corporate purposes or ongoing needs of our business, or to repurchase our common shares; our ability to reduce our indebtedness or return capital to shareholders within the currently expected timeframes or at all; adverse changes in credit ratings, interest rates, foreign currency rates and tax laws; challenges to successfully implementing our business strategy to achieve operating results in line with our guidance; the outcome of, and costs incurred in connection with, lawsuits, claims, arbitrations or governmental proceedings relating to commercial and business disputes, antitrust claims, environmental matters, government investigations, occupational or personal injury claims, property-related matters, labor and employment matters, or suits involving legacy operations and other matters; supply chain disruptions or changes in the cost, quality or availability of energy sources, including electricity, natural gas and diesel fuel, critical raw materials and supplies, including iron ore, industrial gases, graphite electrodes, scrap metal, chrome, zinc, other alloys, coke and metallurgical coal, and critical manufacturing equipment and spare parts; problems or disruptions associated with transporting products to our customers, moving manufacturing inputs or products internally among our facilities, or suppliers transporting raw materials to us; the risk that the cost or time to implement a strategic or sustaining capital project may prove to be greater than originally anticipated; our ability to consummate any public or private acquisition transactions and to realize any or all of the anticipated benefits or estimated future synergies, as well as to successfully integrate any acquired businesses into our existing businesses; uncertainties associated with natural or human-caused disasters, adverse weather conditions, unanticipated geological conditions, critical equipment failures, infectious disease outbreaks, tailings dam failures and other unexpected events; cybersecurity incidents relating to, disruptions in, or failures of, information technology systems that are managed by us or third parties that host or have access to our data or systems, including the loss, theft or corruption of our or third parties’ sensitive or essential business or personal information and the inability to access or control systems; liabil ities and costs arising in connection with any business decisions to temporarily or indefinitely idle or permanently close an operating facility or mine, which could adversely impact the carrying value of associated assets and give rise to impairment charges or closure and reclamation obligations, as well as uncertainties associated with restarting any previously idled operating facility or mine; our ability to realize the anticipated synergies or other expected benefits of the Stelco acquisition, as well as the impact of additional liabilities and obligations incurred in connection with the Stelco acquisition; our level of self-insurance and our ability to obtain sufficient third-party insurance to adequately cover potential adverse events and business risks; uncertainties associated with our ability to meet customers' and suppliers' decarbonization goals and reduce our greenhouse gas emissions in alignment with our own announced targets; challenges to maintaining our social license to operate with our stakeholders, including the impacts of our operations on local communities, reputational impacts of operating in a carbon-intensive industry that produces greenhouse gas emissions, and our ability to foster a consistent operational and safety track record; our actual economic mineral reserves or reductions in current mineral reserve estimates, and any title defect or loss of any lease, license, option, easement or other possessory interest for any mining property; our ability to maintain satisfactory labor relations with unions and employees; unanticipated or higher costs associated with pension and other post-employment benefit obligations resulting from changes in the value of plan assets or contribution increases required for unfunded obligations; uncertain availability or cost of skilled workers to fill critical operational positions CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544

CLEVELAND-CLIFFS INC. • 200 PUBLIC SQUARE • SUITE 3300 • CLEVELAND, OH 44114-2544 3 and potential labor shortages caused by experienced employee attrition or otherwise, as well as our ability to attract, hire, develop and retain key personnel; the amount and timing of any repurchases of our common shares; and potential significant deficiencies or material weaknesses in our internal control over financial reporting. For additional factors affecting the business of Cliffs, refer to Part I, Item 1A. Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2023, our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, and other filings with the U.S. Securities and Exchange Commission. Source: Cleveland-Cliffs Inc. MEDIA CONTACT: Patricia Persico Senior Director, Corporate Communications (216) 694-5316 INVESTOR CONTACT: James Kerr Director, Investor Relations (216) 694-7719

v3.25.0.1

Cover Document

|

Feb. 03, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 03, 2025

|

| Entity Registrant Name |

CLEVELAND-CLIFFS INC.

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

1-8944

|

| Entity Tax Identification Number |

34-1464672

|

| Entity Address, Address Line One |

200 Public Square,

|

| Entity Address, Address Line Two |

Suite 3300,

|

| Entity Address, City or Town |

Cleveland,

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44114-2315

|

| City Area Code |

216

|

| Local Phone Number |

694-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, par value $0.125 per share

|

| Trading Symbol |

CLF

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000764065

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

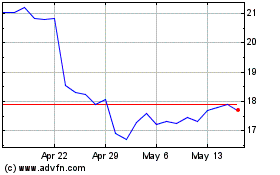

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cleveland Cliffs (NYSE:CLF)

Historical Stock Chart

From Feb 2024 to Feb 2025