UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

Dated: October 7, 2024

Commission File Number: 333-12138

CANADIAN NATURAL RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

2100, 855 - 2ND Street S. W., Calgary, Alberta T2P 4J8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ____ Form 40-F X

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(1): ____

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101(b)(7): ____

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

| | | | | |

| Exhibit Number | Description |

| | |

| 99.1 | |

| | |

| Canadian Natural Resources Limited Announces the Acquisition of Chevron’s Alberta Assets and a 7% Dividend Increase |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | Canadian Natural Resources Limited (Registrant) | |

| | | | |

| | | | |

| Date: October 7, 2024 | By: | /s/ Stephanie A. Graham | |

| | | Stephanie A. Graham | |

| | | Corporate Secretary and Associate General Counsel, Canada | |

CANADIAN NATURAL RESOURCES LIMITED ANNOUNCES

THE ACQUISITION OF CHEVRON’S ALBERTA ASSETS

AND A 7% DIVIDEND INCREASE

CALGARY, ALBERTA – OCTOBER 7, 2024 – FOR IMMEDIATE RELEASE

Canadian Natural Resources Limited (“Canadian Natural” or the “Company”) announces that it entered into an agreement to acquire, subject to regulatory approvals, from Chevron Canada Limited (“Chevron”) its 20% interest in the Athabasca Oil Sands Project (“AOSP”), which includes 20% of the Muskeg River and Jackpine mines, the Scotford Upgrader and the Quest Carbon Capture and Storage facility. This acquisition brings Canadian Natural’s total current working interest in AOSP to 90%. The acquisition adds approximately 62,500 bbl/d(1) of long life no decline Synthetic Crude Oil (”SCO”) production, contributing to Canadian Natural’s significant sustainable free cash flow generation. The agreement also includes the acquisition of additional various working interests in a number of other non-producing oil sands leases with aggregate acreage of approximately 267,000 gross / 100,000 net acres.

In addition, Canadian Natural has also agreed to acquire, subject to regulatory approvals, Chevron’s 70% operated working interest of light crude oil and liquids rich assets in the Duvernay play in Alberta. Production from these assets is targeted to average in 2025 approximately 60,000 BOE/d, consisting of 179 MMcf/d of natural gas and 30,000 bbl/d of liquids. These Duvernay assets provide the opportunity for meaningful near term growth while contributing additional free cash flow.

The effective date for these acquisitions is September 1st, 2024 and are targeted to close in the fourth quarter of 2024. The aggregate consideration for these acquisitions will be a cash payment at close to Chevron of US$6.5 billion, before closing adjustments. These acquisitions add targeted 2025 production of approximately 122,500 BOE/d, and the addition of approximately 1,448 MMBOE of Total Proved plus Probable reserves(1).

Commenting on the acquisitions, Canadian Natural’s President Scott Stauth stated, “These assets are a great fit for Canadian Natural and will allow us to further implement our strong operating culture and drive significant value for shareholders. We have made significant progress in driving efficiencies at AOSP over the last 7 years since the original acquisition in May 2017. We expect further efficiencies and improved performance going forward as a result of our relentless focus on continuous improvement. The light crude oil and liquids rich Duvernay assets fit well with our current operations in the area and will drive significant value from our area knowledge and significant experience in this type of resource play. Both acquisitions provide Canadian Natural with immediate free cash flow generation and further opportunities to drive long term shareholder value.”

Mark Stainthorpe, Canadian Natural’s Chief Financial Officer added, “This is a great opportunity to add to our world class Oil Sands Mining and Upgrading asset at AOSP, as well as light crude oil and liquids rich assets in Alberta. Both of these acquisition properties are targeted to provide significant free cash flow generation on a go forward basis. Having operated the AOSP mines and knowing the assets well, eliminates the risks associated with a brownfield or greenfield project. These transactions are immediately cash flow and earnings accretive to Canadian Natural shareholders. Given our strong balance sheet and significant free cash flow generation we are in an excellent position to take advantage of these opportunities that don’t come along very often.

Given our strong financial position and significant and sustainable free cash flow generation the Board of Directors have agreed to increase the quarterly dividend by 7% to $0.5625 per share payable at the next regular quarterly dividend payment in January 2025. This will make 2025 the 25th consecutive year of dividend increases by Canadian Natural, with a compound annual growth rate (“CAGR”) of 21% over that time. Concurrently with the acquisitions closing, the Board of Directors have agreed to amend our free cash flow allocation policy so that it will continue to provide significant distributions to shareholders while maintaining our strong balance sheet. Post closing of the acquisitions, free cash flow will be allocated 60% to shareholders and 40% to the balance sheet until net debt reaches $15 billion. When net debt is between $12 billion and $15 billion, free cash flow will be allocated 75% to shareholders and 25% to the balance sheet and when net debt is at or below $12 billion, 100% of free cash flow will be allocated to shareholders.

(1) All Production and Reserves are presented on a “before royalties” basis and reflect Canadian Natural estimates.

In a US$70/bbl WTI environment this change in free cash flow distribution to 60% allocation to shareholders targets to be approximately the equivalent absolute return to shareholders, including dividends, of what was targeted under the 100% of free cash flow allocation to shareholders existing prior to the acquisitions. Due to the additional free cash flow generation from the acquired assets our balance sheet strengthens quickly. Over time, the acquisitions and the new free cash flow allocation policy will provide additional free cash flow returns to shareholders exceeding what would have been returned under the current 100% distribution of free cash flow to shareholders.”

Other various working interests in the additional undeveloped oil sands leases to be acquired contain significant Bitumen resource in place including:

i.20% working interest in Pierre River increasing Canadian Natural’s total working interest to 90%;

ii.60% working interest in Ells River increasing Canadian Natural’s total working interest to 90%;

iii.33% working interest in Saleski increasing Canadian Natural’s total working interest to 83% and;

iv.6% working interest in Namur increasing Canadian Natural’s total working interest to 65%.

On the Duvernay assets there are significant liquids rich drill to fill opportunities in this proven, low risk resource play where the Company’s expertise in the area and in similar plays, such as the Montney, will drive efficiencies and long term value. There are greater than 340 net light crude oil and liquids rich locations already identified with extensive infrastructure and available processing capacity, which depending on capital allocation, has a defined plan with potential to grow to 70,000 BOE/d by 2027.

In conjunction with the acquisitions, Canadian Natural welcomes the Chevron employees that will be joining as part of the acquisitions.

FINANCING PLAN

Canadian Natural has obtained a fully committed $4 billion term loan facility which will be used, along with existing cash and committed bank facilities, to fund the acquisition cost. At September 30, 2024, Canadian Natural had approximately $6.2 billion in available liquidity, including cash.

Upon completion of the acquisitions, Canadian Natural will maintain its strong financial position. Balance sheet metrics, based upon US$70/bbl WTI, are targeted to exit 2024 with debt to book capitalization at approximately 30% and debt to 12 month forward EBITDA at approximately 1.1x.

The fully committed term loan facility was provided by The Bank of Nova Scotia and the Royal Bank of Canada as underwriters and bookrunners.

DIVIDEND INCREASE

As a result of Canadian Natural’s significant free cash flow, including targeted additional free cash flow generation from the acquired assets and the Company’s strong financial position, the Board of Directors has agreed to increase the Company’s quarterly dividend by 7% to $0.5625 per share payable at the next regular quarterly dividend payment in January 2025. This will make 2025 the 25th consecutive year of dividend increases by Canadian Natural, with a CAGR of 21% over that time.

UPDATE TO FREE CASH FLOW POLICY

Free cash flow is defined as adjusted funds flow, less capital and dividends. The Company will manage the allocation of free cash flow on a forward looking annual basis, while managing working capital and cash management as required. As a result of the acquisitions, the Board of Directors has adjusted the free cash flow allocation policy which will now be allocated as follows:

▪60% of free cash flow to shareholder returns and 40% to the balance sheet until net debt reaches $15 billion.

▪When net debt is between $12 billion and $15 billion, free cash flow allocation will be 75% to shareholder returns and 25% to the balance sheet.

▪When net debt is at or below $12 billion, up from the current target of $10 billion, free cash flow allocation will be 100% to shareholder returns.

Post closing of the acquisitions, the Company will target to allocate 60% of free cash flow to shareholders. In a US$70/bbl WTI environment this change in free cash flow distribution to 60% allocation to shareholders targets to be approximately the equivalent absolute return to shareholders, including dividends, of what was targeted under the 100% of free cash flow allocation to shareholders existing prior to the acquisitions. Due to the additional free cash flow generation from the acquired assets, the Company’s balance sheet strengthens quickly. Over time, the acquisitions and the new free cash flow allocation policy will provide additional free cash flow returns to shareholders exceeding what would have been returned under the current 100% distribution of free cash flow to shareholders.

| | | | | | | | |

| Canadian Natural Resources Limited | 2 | Press Release |

CONFERENCE CALL

Canadian Natural Resources Limited (TSX-CNQ / NYSE-CNQ) announces the acquisition of Chevron’s Alberta assets and a 7% dividend increase on Monday, October 7, 2024 before market open.

A conference call and webcast will be held at 7:00 a.m. MDT / 9:00 a.m. EDT on Monday on October 7, 2024.

Dial-in to the live event:

North America 1-800-717-1738 / International 001-289 514-5100.

Listen to the audio webcast:

Access the audio webcast on the home page of our website, www.cnrl.com.

Conference call playback:

North America 1-888-660-6264 / International 001-289-819-1325 (Passcode 58023#).

Webcast

The conference call will also be webcast with presentation slides and can be accessed on the home page our website at www.cnrl.com. Presentation slides in PDF format will be available for download on our website home page approximately 30 minutes prior to the call.

Canadian Natural is a senior crude oil and natural gas production company, with continuing operations in its core areas located in Western Canada, the U.K. portion of the North Sea and Offshore Africa.

| | |

CANADIAN NATURAL RESOURCES LIMITED T (403) 517-6700 F (403) 517-7350 E ir@cnrl.com 2100, 855 - 2 Street S.W. Calgary, Alberta, T2P 4J8 www.cnrl.com |

|

|

SCOTT G. STAUTH President MARK A. STAINTHORPE Chief Financial Officer LANCE J. CASSON Manager, Investor Relations Trading Symbol - CNQ Toronto Stock Exchange New York Stock Exchange |

| | | | | | | | |

| Canadian Natural Resources Limited | 3 | Press Release |

ADVISORY

Special Note Regarding Forward-Looking Statements

Certain statements relating to Canadian Natural Resources Limited (the "Company") in this document or documents incorporated herein by reference constitute forward-looking statements or information (collectively referred to herein as "forward-looking statements") within the meaning of applicable securities legislation. Forward-looking statements can be identified by the words "believe", "anticipate", "expect", "plan", "estimate", "target", "focus", "continue", "could", "intend", "may", "potential", "predict", "should", "will", "objective", "project", "forecast", "goal", "guidance", "outlook", "effort", "seeks", "schedule", "proposed", "aspiration" or expressions of a similar nature suggesting future outcome or statements regarding an outlook. Disclosure related to the Company's strategy or strategic focus, capital budget, expected future commodity pricing, forecast or anticipated production volumes, earnings and free cash flow generation, impacts to and the strength of the Company’s balance sheet, forecast changes to the Company’s free cash flow allocation policy, reserves additions, capital expenditures, financing plans, and other plans and targets provided herein, including the strength of the Company's balance sheet, the sources and adequacy of the Company's liquidity, and the flexibility of the Company's capital structure, constitute forward-looking statements. Disclosure of plans relating to and expected results of existing and future developments, including, without limitation, those in relation to: the Company's assets at the Athabasca Oil Sands Project ("AOSP"), Pierre River, Ells River, Saleski, or Namur; the financial capacity of the Company to complete its growth projects and responsibly and sustainably grow in the long-term also constitute forward-looking statements. These forward-looking statements are based on annual budgets and multi-year forecasts, and are reviewed and revised throughout the year as necessary in the context of targeted financial ratios, project returns, product pricing expectations and balance in project risk and time horizons. These statements are not guarantees of future performance and are subject to certain risks. The reader should not place undue reliance on these forward-looking statements as there can be no assurances that the plans, initiatives or expectations upon which they are based will occur. In addition, statements relating to "reserves" are deemed to be forward-looking statements as they involve the implied assessment based on certain estimates and assumptions that the reserves described can be profitably produced in the future. There are numerous uncertainties inherent in estimating quantities of proved and proved plus probable crude oil, natural gas and NGLs reserves and in projecting future rates of production and the timing of development expenditures. The total amount or timing of actual future production may vary significantly from reserves and production estimates. The forward-looking statements are based on current expectations, estimates and projections about the Company and the industry in which the Company operates, which speak only as of the earlier of the date such statements were made or as of the date of the report or document in which they are contained, and are subject to known and unknown risks and uncertainties that could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

For a more detailed discussion of risks and uncertainties associated with the Company’s business, refer to the Company’s annual MD&A for the year ended December 31, 2023 dated February 28, 2024 that is available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should any of the Company's assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements. The impact of any one factor on a particular forward-looking statement is not determinable with certainty as such factors are dependent upon other factors, and the Company's course of action would depend upon its assessment of the future considering all information then available. Readers are cautioned that the foregoing list of factors is not exhaustive. Unpredictable or unknown factors not discussed in this document or the Company's MD&A could also have adverse effects on forward-looking statements. Although the Company believes that the expectations conveyed by the forward-looking statements are reasonable based on information available to it on the date such forward-looking statements are made, no assurances can be given as to future results, levels of activity and achievements. All subsequent forward-looking statements, whether written or oral, attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Except as required by applicable law, the Company assumes no obligation to update forward-looking statements in this document or the Company's MD&A, whether as a result of new information, future events or other factors, or the foregoing factors affecting this information, should circumstances or the Company’s estimates or opinions change.

Special Note Regarding Currency, Financial Information and Production

All dollar amounts are referenced in millions of Canadian dollars, except where noted otherwise. Production volumes and per unit statistics are presented throughout this document on a "before royalties" or "company gross" basis. In addition, reference is made to crude oil and natural gas in common units called barrel of oil equivalent ("BOE"). A BOE is derived by converting six thousand cubic feet ("Mcf") of natural gas to one barrel ("bbl") of crude oil (6 Mcf:1 bbl). This conversion may be misleading, particularly if used in isolation, since the 6 Mcf:1 bbl ratio is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. In comparing the value ratio using current crude oil prices relative to natural gas prices, the 6 Mcf:1 bbl conversion ratio may be misleading as an indication of value.

Special Note Regarding Non-GAAP and Other Financial Measures

This document includes references to non-GAAP measures, which include non-GAAP and other financial measures as defined in National Instrument 52-112 – Non-GAAP and Other Financial Measures Disclosure. "Free cash flow" is a non-GAAP financial measure. The Company considers free cash flow a key measure in demonstrating the Company’s ability to generate cash flow to fund future growth through capital investment, to repay debt and to pay returns to shareholders through dividends and share repurchases pursuant to its free cash flow allocation policy. Free cash flow is defined as adjusted funds flow, less capital and dividends.

Non-GAAP and other financial measures are not defined by IFRS and therefore are referred to as non-GAAP and other financial measures. The non-GAAP and other financial measures used by the Company may not be comparable to similar measures presented by other companies, and should not be considered an alternative to or more meaningful than the most directly comparable financial measure presented in the Company's financial statements, as applicable, as an indication of the Company's performance.

| | | | | | | | |

| Canadian Natural Resources Limited | 4 | Press Release |

Special Note Regarding Reserves Estimates

The total proved and total proved plus probable reserves estimates were determined as of September 1, 2024 and assume US$75/bbl WTI for 2025 and subsequent years and C$2.00/GJ AECO for 2025 until September 2025 and C$3.25/GJ AECO in October 2025 and subsequent years. The reserves estimates have been prepared in accordance with the Canadian Oil and Gas Evaluation Handbook by professional engineers employed by the Company.

| | | | | | | | |

| Canadian Natural Resources Limited | 5 | Press Release |

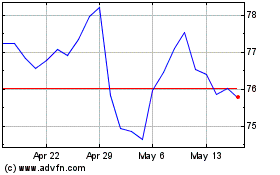

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Canadian Natural Resources (NYSE:CNQ)

Historical Stock Chart

From Dec 2023 to Dec 2024