Capital One Earnings Up Sharply -- WSJ

July 20 2018 - 2:02AM

Dow Jones News

By AnnaMaria Andriotis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 20, 2018).

Capital One Financial Corp.'s second-quarter profit rose sharply

as consumer card spending surged and credit losses fell.

Net income for the quarter surged 84% to $1.91 billion, or $3.71

a share, from $1.04 billion, or $1.94 a share, in the year-ago

period. Revenue rose 7% to $7.2 billion from $6.7 billion.

Results beat analyst estimates, and shares were up 2% in

after-hours trading Thursday.

The loan performance of the company, which has a large subprime

card business, often serves as a gauge for consumers' willingness

to spend and their ability to pay back their debts. After rising

for many quarters on a year-over-year basis, the company's net

charge-off rate for its domestic card business fell to 4.72% in the

second quarter compared with 5.11% a year prior. That was the first

year-over-year decline in this metric since the second quarter of

2015.

Richard Fairbank, Capital One's chief executive, said

performance in the domestic card business has turned a corner

"We are now on the good side of growth math," he said on an

earnings call Thursday. "Credit performance on the loans booked

during our growth surge [between 2014 and 2016] has now turned and

is improving year over year."

Also helping Capital One's loan performance is its recent

acquisition of the credit-card portfolio of outdoor-gear retailer

Cabela's, whose cardholders tend to have high credit scores.

Provisions for future credit losses in Capital One's domestic

card business fell 18% from a year ago. Purchase card volume

increased 17% from a year prior, while card balances rose 8%.

Non-interest expenses totaled $3.4 billion, mostly unchanged

from a year prior as the company continues to invest in becoming

more of a digital bank.

Capital One also is looking to become a bigger force in merchant

card partnerships. The bank is in talks to become the issuer of

Walmart Inc. credit cards, according to people familiar with the

matter, a change that would be a major shakeup in the card

industry. Synchrony Financial has been Walmart's exclusive card

issuer since 1999.

Mr. Fairbank said Capital One is looking for a merchant partner

with a strong brand and commitment to the card program as an avenue

of growth.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

July 20, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

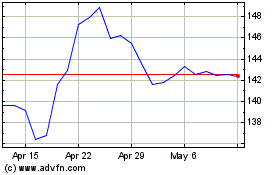

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jun 2024 to Jul 2024

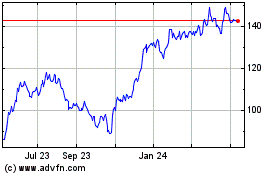

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Jul 2023 to Jul 2024