- Surpassed more than 2 million enrollments in generative AI

catalog created by trusted brands

- Launched a record number of entry-level Professional

Certificates from leading industry partners

Coursera, Inc. (NYSE: COUR) today announced financial results

for its second quarter ended June 30, 2024.

“We are excited to surpass more than two million enrollments in

our generative AI catalog of courses, credentials, and hands-on

projects created by the world’s top technology companies and

research universities,” said Coursera CEO Jeff Maggioncalda.

“Individuals and institutions are looking to harness the potential

of emerging technologies. With our global scale, trusted brands,

and focus on high-quality credentials, we are creating a leading

destination for learners looking to discover, develop, and

demonstrate generative AI skills for career advancement.”

Financial Highlights for Second Quarter 2024

- Total revenue was $170.3 million, up 11% from $153.7 million a

year ago.

- Gross profit was $90.2 million or 53% of revenue, compared to

$79.7 million or 52% of revenue a year ago. Non-GAAP gross profit

was $92.3 million or 54% of revenue, compared to $81.9 million or

53% of revenue a year ago.

- Net loss was $(23.0) million or (13.5)% of revenue, compared to

$(31.7) million or (20.7)% of revenue a year ago. Non-GAAP net

income was $13.8 million or 8.1% of revenue, compared to a non-GAAP

net loss of $(0.3) million or (0.2)% of revenue a year ago.

- Net loss per share was $(0.15), compared to $(0.21) a year ago.

Non-GAAP net income per share was $0.09, compared to $0.00 a year

ago.

- Adjusted EBITDA was $10.4 million or 6.1% of revenue, compared

to $(2.9) million or (1.9)% of revenue a year ago.

- Net cash provided by operating activities was $23.9 million,

compared to a use of $(6.4) million a year ago. Free Cash Flow was

$17.0 million, compared to $(12.2) million a year ago.

“I am pleased with our second quarter results, delivering growth

across our segments with strong operating leverage and cash flow

performance,” said Ken Hahn, Coursera’s CFO. “As we enter the

second half, we are focused on execution of our key growth

initiatives, while delivering on our annual EBITDA margin

commitment of approximately four percent.”

For more information regarding the non-GAAP financial measures

discussed in this press release, please see “Non-GAAP Financial

Measures” and “Reconciliation of GAAP to Non-GAAP Financial

Measures” below.

Operating Segment Highlights for Second Quarter 2024

- Consumer revenue was $97.3 million, up 12% from a year

ago on growth in Coursera Plus amid demand for entry-level

Professional Certificates and generative AI credentials. Segment

gross margin was $52.4 million, or 54% of Consumer revenue,

compared to 52% a year ago. We added approximately 7 million new

registered learners during the quarter for a total of 155

million.

- Enterprise revenue was $58.7 million, up 8% from a year

ago on growth across our business, campus, and government

verticals. The total number of Paid Enterprise Customers increased

to 1,511, up 17% from a year ago. Segment gross margin was $39.9

million, or 68% of Enterprise revenue, compared to 71% a year ago.

Our Net Retention Rate for Paid Enterprise Customers was 93%.

- Degrees revenue was $14.3 million, up 14% from a year

ago on scaling of new programs. Segment gross margin was 100% of

Degrees revenue as there is no content cost attributable to the

Degrees segment. The total number of Degrees Students reached

22,600, up 19% from a year ago.

All key business metrics are as of June 30, 2024. For more

information regarding the metrics discussed in this press release,

please see “Key Business Metrics Definitions” below.

Content, Customer, and Platform Highlights

Content and Credentials:

- Launched a record number of entry-level Professional

Certificates from leading industry partners like Google Cloud,

IBM, Meta, and Microsoft that equip learners with the essential

skills needed to start a high-demand career in the technology

industry.

- Enhanced eight existing IBM, Meta, and Microsoft entry-level

Professional Certificates with job-relevant generative AI

content to ensure these credentials, which have collectively

reached more than 1.7 million learners, keep pace with the rapidly

changing labor market and emerging skill requirements.

- Announced a master's in computer science degree program from

new partner, Clemson University, that has performance-based

admissions, an AI-focused curriculum, and an affordable

tuition.

Enterprise Customers:

- Coursera for Business partnered with Dow to deploy,

among others, generative AI and leadership training designed to

empower employee's career advancement, fill critical knowledge

gaps, and use AI technology responsibly, with 80% of their IT

workforce engaged and plans to broaden access across the

organization in 2024.

- Coursera for Government partnered with a Qatari-based

foundation, Education Above All Foundation, for women and girls in

Afghanistan. The initiative aims to provide learning programs for

thousands of Afghan women and girls over the next three years.

- Coursera for Campus enabled higher education

institutions across the Asia Pacific region to offer online

learning and industry content and credentials for academic credit,

including King Mongkut's University of Technology Thonburi

(Thailand), Universitas Indonesia (Indonesia), Universitas Katolik

Indonesia Atma Jaya (Indonesia), and Van Lang University

(Vietnam).

Learning Platform:

- Launched a new suite of generative AI-powered academic

integrity features to help universities scale their ability to

create and grade assessments, enhance learning and evaluations,

deter AI-assisted cheating, and meet the rigorous standards

required for academic credit.

- Announced general availability of Coursera Coach, our

interactive, AI-powered guide, for paid Consumer and Enterprise

learners, with an updated visual identify and optimized experience

that seamlessly integrates Coursera Coach throughout the learner

journey.

- Expanded our GenAI Academy with GenAI for Teams, a new

catalog of skills training and credentials from leading industry

brands and university partners that offers curated, role-specific

programs by business function, such as data science, product, and

marketing.

Highlights reflect developments since March 31, 2024 through

today’s announcement. For additional information on these

developments, see the Coursera Blog at blog.coursera.org.

Share Repurchase Program

We are pleased to have completed our previously announced $95

million share repurchase authorization, executing the program in a

manner consistent with the Company’s capital allocation strategy,

which prioritizes long-term growth opportunities and strategic

optionality. During the second quarter of 2024, we repurchased 2.7

million shares at an average price of $11.47 per share for a total

amount of $30.6 million, excluding commissions.

Financial Outlook

- Third quarter 2024:

- Revenue in the range of $171 to $175 million

- Adjusted EBITDA in the range of $0 to $4 million

- Full year 2024:

- Revenue in the range of $695 to $705 million

- Adjusted EBITDA in the range of $24 to $28 million, reaffirming

our Adjusted EBITDA margin outlook of approximately 4%

Actual results may differ materially from Coursera’s Financial

Outlook as a result of, among other things, the factors described

under “Special Note on Forward-Looking Statements” below.

A reconciliation of our non-GAAP guidance measure (Adjusted

EBITDA) to the corresponding GAAP guidance measure is not available

on a forward-looking basis without unreasonable effort due to the

uncertainty regarding, and the potential variability of, expenses

that may be incurred in the future. Stock-based compensation

expense-related charges, including employer payroll tax-related

items on employee stock transactions, are impacted by the timing of

employee stock transactions, the future fair market value of our

common stock, and our future hiring and retention needs, all of

which are difficult to predict and subject to constant change. We

have provided a reconciliation of GAAP to non-GAAP financial

measures in the financial statement tables for our historical

non-GAAP financial results included in this press release.

Conference Call Details

As previously announced, Coursera will hold a conference call to

discuss its second quarter 2024 performance today, July 25, 2024,

at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

A live, audio-only webcast of the conference call and earnings

release materials will be available to the public on our investor

relations page at investor.coursera.com. For those unable to listen

to the broadcast live, an archived replay will be accessible in the

same location for one year.

Disclosure Information

In compliance with disclosure obligations under Regulation FD,

Coursera announces material information to the public through a

variety of means, including filings with the Securities and

Exchange Commission (“SEC”), press releases, company blog posts,

public conference calls, and webcasts, as well as via Coursera’s

investor relations website.

About Coursera

Coursera was launched in 2012 by two Stanford Computer Science

professors, Andrew Ng and Daphne Koller, with a mission to provide

universal access to world-class learning. It is now one of the

largest online learning platforms in the world, with 155 million

registered learners as of June 30, 2024. Coursera partners with

over 325 leading university and industry partners to offer a broad

catalog of content and credentials, including courses,

Specializations, Professional Certificates, Guided Projects, and

bachelor’s and master’s degrees. Institutions around the world use

Coursera to upskill and reskill their employees, citizens, and

students in fields such as data science, technology, and business.

Coursera became a Delaware public benefit corporation and a B Corp

in February 2021.

Key Business Metrics Definitions

Registered Learners

We count the total number of registered learners at the end of

each period. For purposes of determining our registered learner

count, we treat each customer account that registers with a unique

email as a registered learner and adjust for any spam, test

accounts, and cancellations. Our registered learner count is not

intended as a measure of active engagement. New registered learners

are individuals that register in a particular period.

Paid Enterprise Customers

We count the total number of Paid Enterprise Customers at the

end of each period. For purposes of determining our customer count,

we treat each customer account that has a corresponding contract as

a unique customer, and a single organization with multiple

divisions, segments, or subsidiaries may be counted as multiple

customers. We define a “Paid Enterprise Customer” as a customer who

purchases Coursera via our direct sales force. For purposes of

determining our Paid Enterprise Customer count, we exclude our

Enterprise customers who do not purchase Coursera via our direct

sales force, which include organizations engaging on our platform

through our Coursera for Teams offering or through our channel

partners.

Net Retention Rate (“NRR”) for Paid Enterprise

Customers

We calculate annual recurring revenue (“ARR”) by annualizing

each customer’s monthly recurring revenue (“MRR”) for the most

recent month at period end. We calculate “Net Retention Rate” for a

period by starting with the ARR from all Paid Enterprise Customers

as of the 12 months prior to such period end, or Prior Period ARR.

We then calculate the ARR from these same Paid Enterprise Customers

as of the current period end (“Current Period ARR”). Current Period

ARR includes expansion within Paid Enterprise Customers and is net

of contraction or attrition over the trailing 12 months, but

excludes revenue from new Paid Customers in the current period. We

then divide the total Current Period ARR by the total Prior Period

ARR to arrive at our Net Retention Rate.

Number of Degrees Students

We count the total number of Degrees students for each period

that are matriculated in a degree program and enrolled in one or

more related courses, including students enrolled within any

wind-down or teach-out periods of existing programs. When a degree

term spans more than one fiscal quarter, we count the student for

each of those quarters within the degree term. For purposes of

determining our Degrees student count, we do not include students

who are matriculated in a degree program but are not enrolled in a

related course in that period.

Non-GAAP Financial Measures

In addition to financial information presented in accordance

with GAAP, this press release includes non-GAAP gross profit,

non-GAAP net income (loss), non-GAAP net income (loss) per share,

Adjusted EBITDA, Adjusted EBITDA Margin, and Free Cash Flow, each

of which is a non-GAAP financial measure. These are key measures

used by our management to help us analyze our financial results,

establish budgets and operational goals for managing our business,

evaluate our performance, and make strategic decisions.

Accordingly, we believe that these non-GAAP financial measures

provide useful information to investors and others in understanding

and evaluating our operating results in the same manner as our

management and board of directors. In addition, we believe these

measures are useful for period-to-period comparisons of our

business. We also believe that the presentation of these non-GAAP

financial measures provides an additional tool for investors to use

in comparing our core business and results of operations over

multiple periods with other companies in our industry, many of

which present similar non-GAAP financial measures to investors, and

to analyze our cash performance. However, the non-GAAP financial

measures presented may not be comparable to similarly titled

measures reported by other companies due to differences in the way

that these measures are calculated. These non-GAAP financial

measures are presented for supplemental informational purposes only

and should not be considered as a substitute for or in isolation

from financial information presented in accordance with GAAP. These

non-GAAP financial measures have limitations as analytical

tools.

Non-GAAP Gross Profit, Non-GAAP Net Income (Loss), and

Non-GAAP Net Income (Loss) Per Share

We define non-GAAP gross profit and non-GAAP net income (loss)

as GAAP gross profit and GAAP net loss excluding: (1) stock-based

compensation expense; (2) amortization of stock-based compensation

expense capitalized as internal-use software costs; (3) payroll tax

expense related to stock-based compensation; (4) merger and

acquisition (“M&A”) related transaction costs; (5) costs and

settlement (gains) losses related to significant and non-recurring

legal matters, net of insurance recoveries; and (6) restructuring

related charges. Non-GAAP net income (loss) per share is calculated

by dividing non-GAAP net income (loss) by the diluted weighted

average shares of common stock outstanding. We believe the

presentation of these adjusted operating results provides useful

supplemental information to investors and facilitates the analysis

and comparison of our operating results across reporting

periods.

Adjusted EBITDA and Adjusted EBITDA Margin

We define Adjusted EBITDA as our GAAP net loss excluding: (1)

depreciation and amortization; (2) interest income, net; (3) income

tax expense; (4) other expense (income), net; (5) stock-based

compensation expense; (6) payroll tax expense related to

stock-based compensation; (7) M&A related transaction costs;

(8) costs and settlement (gains) losses related to significant and

non-recurring legal matters, net of insurance recoveries; and (9)

restructuring related charges. We define Adjusted EBITDA Margin as

Adjusted EBITDA divided by revenue.

Free Cash Flow

We define Free Cash Flow as net cash provided by (used in)

operating activities, less purchases of property, equipment, and

software, capitalized internal-use software costs, and purchases of

content assets as we consider these capital expenditures necessary

to support our ongoing operations. Current and prior period Free

Cash Flow amounts reported herein reflect the previously disclosed

change to our definition of Free Cash Flow to include purchases of

content assets.

Reconciliations of these non-GAAP financial measures to the most

directly comparable GAAP financial measures are included in the

Appendix.

Special Note on Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. Any statements

contained in this press release that are not statements of

historical facts may be deemed to be forward-looking statements. In

some cases, you can identify forward-looking statements by terms

such as: “accelerate,” “anticipate, “believe,” “can,” “continue,”

“could,” “demand,” “design”, “estimate,” “expand,” “expect,”

“intend,” “may,” “might,” “mission,” “need”, “objective,”

“ongoing,” “outlook”, “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would,” or the negative of these

terms, or other comparable terminology intended to identify

statements about the future. These forward-looking statements

include, but are not limited to, statements regarding our ability

to enable a new era of education to better meet the needs of a

changing global workforce; our belief regarding the accessibility

of high quality education to learners anywhere in the world,

including through the acceleration of our machine-learning

translation initiative to meet the needs of learners coming to

Coursera; the expected benefits of our differentiated catalog of

high-quality, branded industry micro-credentials and its

anticipated impact on our financial performance; our ability to

invest in our platform’s multiple growth opportunities while

demonstrating leverage and scale in our operating model; the

anticipated features and benefits of our AI initiatives, expanded

talent and skills development partnerships, new certificate and

degree programs and partnerships, and our learning platform and

offerings (including our machine-learning translation initiative,

credit recommendations, new degree pathways, Coursera Coach, and

Course Builder); our mission to provide universal access to

world-class learning; the demand for online learning; anticipated

features and benefits of our customer and educator partner

relationships and our content and platform offerings; the

anticipated utility of our non-GAAP financial measures; anticipated

growth rates; and our financial outlook, future financial and

operational performance, and expectations, among others. These

forward-looking statements involve known and unknown risks,

uncertainties, and other factors that may cause our actual results,

levels of activity, performance, or achievements to be materially

different from the information expressed or implied by these

forward-looking statements. These risks and uncertainties include,

but are not limited to, the following: our ability to attract,

engage, and retain learners; our ability to increase sales of our

offerings; our limited operating history; the relative nascency of

online learning solutions and generative AI; risks related to

market acceptance and demand for our offerings; our ability to

maintain and expand our existing educator partner relationships and

to develop new partnerships; our dependence on our educator

partners’ content; risks related to our AI innovations and AI

generally; our ability to compete effectively; adverse impacts on

our business and financial condition due to macroeconomic or market

conditions; our ability to manage our growth; regulatory matters

impacting us or our educator partners; risks related to

intellectual property; cybersecurity and privacy risks and

regulations; potential disruptions to our platform; risks related

to operations, regulatory, economic, and geopolitical conditions,

current and future legal proceedings, the impact of actions to

improve operational efficiencies and operating costs, our history

of net losses and ability to achieve or sustain profitability,

pandemics or similar widespread health crises, and our status as a

certified B Corp, as well as the risks and uncertainties discussed

in our most recently filed periodic reports on Forms 10-K and 10-Q

and subsequent filings and as detailed from time to time in our SEC

filings. You should not rely upon forward-looking statements as

predictions of future events. Although we believe that the

expectations reflected in the forward-looking statements are

reasonable, we cannot guarantee that the future results, levels of

activity, performance, or events and circumstances reflected in the

forward-looking statements will be achieved or occur. Moreover,

neither we nor any other person assumes responsibility for the

accuracy and completeness of the forward-looking statements. Such

forward-looking statements relate only to events as of the date of

this press release. We undertake no obligation to update any

forward-looking statements except to the extent required by

law.

Coursera Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (Unaudited)

(In thousands, except shares and

per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue

$

170,337

$

153,702

$

339,405

$

301,344

Cost of revenue(1)

80,162

74,001

159,733

144,175

Gross profit

90,175

79,701

179,672

157,169

Operating expenses:

Research and development(1)

33,701

41,286

68,311

85,095

Sales and marketing(1)

58,069

52,001

115,654

104,873

General and administrative(1)

29,570

24,937

54,513

50,460

Restructuring related charges(1)

44

(147

)

2,145

(5,806

)

Total operating expenses

121,384

118,077

240,623

234,622

Loss from operations

(31,209

)

(38,376

)

(60,951

)

(77,453

)

Other income, net:

Interest income, net

9,286

8,240

18,869

16,277

Other (expense) income, net

(21

)

(8

)

(306

)

94

Loss before income taxes

(21,944

)

(30,144

)

(42,388

)

(61,082

)

Income tax expense

1,030

1,599

1,842

3,025

Net loss

$

(22,974

)

$

(31,743

)

$

(44,230

)

$

(64,107

)

Net loss per share—basic and diluted

$

(0.15

)

$

(0.21

)

$

(0.28

)

$

(0.43

)

Weighted average shares used in computing

net loss per share—basic and diluted

156,292,508

150,262,064

156,335,959

149,621,816

(1)

Includes stock-based compensation expense

as follows:

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Cost of revenue

$

710

$

914

$

1,369

$

1,791

Research and development

10,873

13,303

21,874

26,768

Sales and marketing

8,520

7,499

16,442

15,856

General and administrative

9,913

7,609

18,188

15,240

Restructuring related charges

—

(17

)

—

(5,605

)

Total stock-based compensation expense

$

30,016

$

29,308

$

57,873

$

54,050

Coursera Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited)

(In thousands)

June 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

708,761

$

656,321

Marketable securities

—

65,746

Accounts receivable, net

57,734

67,418

Deferred costs, net

25,679

26,387

Prepaid expenses and other current

assets

28,515

16,614

Total current assets

820,689

832,486

Property, equipment, and software, net

33,068

30,408

Operating lease right-of-use assets

1,992

4,739

Intangible assets, net

14,953

11,720

Other assets

33,662

41,180

Total assets

$

904,364

$

920,533

Liabilities and Stockholders’

Equity

Current liabilities:

Educator partners payable

$

100,919

$

101,041

Other accounts payable and accrued

expenses

20,992

23,456

Accrued compensation and benefits

22,638

22,281

Operating lease liabilities, current

2,426

6,557

Deferred revenue, current

156,692

137,229

Other current liabilities

12,237

7,696

Total current liabilities

315,904

298,260

Operating lease liabilities,

non-current

—

39

Deferred revenue, non-current

1,759

2,861

Other liabilities

1,527

3,179

Total liabilities

319,190

304,339

Stockholders’ equity:

Common stock

2

2

Additional paid-in capital

1,489,751

1,459,964

Treasury stock, at cost

(79,672

)

(63,154

)

Accumulated other comprehensive income

—

59

Accumulated deficit

(824,907

)

(780,677

)

Total stockholders’ equity

585,174

616,194

Total liabilities and stockholders’

equity

$

904,364

$

920,533

Coursera Inc.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (Unaudited)

(In thousands)

Six Months Ended June

30,

2024

2023

Cash flows from operating

activities:

Net loss

$

(44,230

)

$

(64,107

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

12,625

10,842

Stock-based compensation expense

57,873

54,050

Accretion of marketable securities

(235

)

(9,413

)

Impairment of long-lived assets

—

1,275

Other

876

202

Changes in operating assets and

liabilities:

Accounts receivable, net

8,730

(19,686

)

Prepaid expenses and other assets

(3,678

)

(14,269

)

Operating lease right-of-use assets

2,747

2,407

Accounts payable and accrued expenses

(3,848

)

15,863

Accrued compensation and other

liabilities

3,250

2,259

Operating lease liabilities

(4,170

)

(4,139

)

Deferred revenue

18,361

23,037

Net cash provided by (used in) operating

activities

48,301

(1,679

)

Cash flows from investing

activities:

Purchases of marketable securities

—

(121,756

)

Proceeds from maturities of marketable

securities

66,000

235,000

Purchases of property, equipment, and

software

(310

)

(721

)

Capitalized internal-use software

costs

(8,668

)

(7,604

)

Purchases of content assets

(4,187

)

(1,300

)

Net cash provided by investing

activities

52,835

103,619

Cash flows from financing

activities:

Proceeds from exercise of stock

options

5,508

14,114

Proceeds from employee stock purchase

plan

3,816

3,530

Payments for repurchases of common

stock

(36,705

)

(53,066

)

Payments for tax withholding on vesting of

restricted stock units

(21,313

)

(24,855

)

Net cash used in financing activities

(48,694

)

(60,277

)

Net increase in cash, cash equivalents,

and restricted cash

52,442

41,663

Cash, cash equivalents, and restricted

cash—Beginning of period

658,086

322,878

Cash, cash equivalents, and restricted

cash—End of period

$

710,528

$

364,541

Coursera Inc.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES (Unaudited)

(In thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Gross profit

$

90,175

$

79,701

$

179,672

$

157,169

Stock-based compensation expense

710

914

1,369

1,791

Amortization of stock-based compensation

capitalized as internal-use software costs

1,424

1,217

2,901

2,386

Payroll tax expense related to stock-based

compensation

22

26

68

76

Non-GAAP gross profit

$

92,331

$

81,858

$

184,010

$

161,422

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(22,974

)

$

(31,743

)

$

(44,230

)

$

(64,107

)

Stock-based compensation expense

30,016

29,325

57,873

59,655

Amortization of stock-based compensation

capitalized as internal-use software costs

1,424

1,217

2,901

2,386

Payroll tax expense related to stock-based

compensation

640

1,014

2,381

2,377

M&A related transaction costs

3,369

—

3,369

—

Significant and non-recurring legal

matters

1,259

—

1,259

—

Restructuring related charges

44

(147

)

2,145

(5,806

)

Non-GAAP net income (loss)

$

13,778

$

(334

)

$

25,698

$

(5,495

)

Weighted-average shares used in computing

net loss per share—basic

156,292,508

150,262,064

156,335,959

149,621,816

Effect of dilutive securities(2)

4,674,908

—

9,044,276

—

Weighted-average shares used in computing

non-GAAP net income (loss) per share—diluted

160,967,416

150,262,064

165,380,235

149,621,816

Net loss per share—basic and diluted

$

(0.15

)

$

(0.21

)

$

(0.28

)

$

(0.43

)

Non-GAAP net income (loss) per

share—diluted

$

0.09

$

—

$

0.16

$

(0.04

)

(2)

For periods presented with a non-GAAP net

loss, we have excluded the effect of potentially dilutive

securities as their inclusion would be anti-dilutive.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(22,974

)

$

(31,743

)

$

(44,230

)

$

(64,107

)

Depreciation and amortization

6,269

5,331

12,625

10,842

Interest income, net

(9,286

)

(8,240

)

(18,869

)

(16,277

)

Income tax expense

1,030

1,599

1,842

3,025

Other expense (income), net

21

8

306

(94

)

Stock-based compensation expense

30,016

29,325

57,873

59,655

Payroll tax expense related to stock-based

compensation

640

1,014

2,381

2,377

M&A related transaction costs

3,369

—

3,369

—

Significant and non-recurring legal

matters

1,259

—

1,259

—

Restructuring related charges

44

(147

)

2,145

(5,806

)

Adjusted EBITDA

$

10,388

$

(2,853

)

$

18,701

$

(10,385

)

Net loss margin

(13

)%

(21

)%

(13

)%

(21

)%

Adjusted EBITDA Margin

6

%

(2

)%

6

%

(3

)%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net cash provided by (used in) operating

activities(3)

$

23,851

$

(6,371

)

$

48,301

$

(1,679

)

Less: purchases of property, equipment,

and software

(176

)

(423

)

(310

)

(721

)

Less: capitalized internal-use software

costs

(4,598

)

(4,742

)

(8,668

)

(7,604

)

Previously reported Free Cash Flow

(11,536

)

(10,004

)

Less: purchases of content assets

(2,034

)

(676

)

(4,187

)

(1,300

)

Free Cash Flow

$

17,043

$

(12,212

)

$

35,136

$

(11,304

)

(3)

The six months ended June 30, 2024 and

2023 include $2.1 million and $5.1 million in cash payments for

restructuring related charges. Related cash payments made during

the three months ended June 30, 2024 and 2023 were

immaterial.

Source Code: COUR-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725452896/en/

For investors: Cam Carey, ir@coursera.org

For media: Arunav Sinha, press@coursera.org

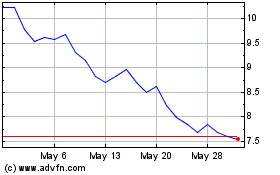

Coursera (NYSE:COUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Coursera (NYSE:COUR)

Historical Stock Chart

From Dec 2023 to Dec 2024