ClearBridge Energy Midstream Opportunity Fund Inc. Announces Completion of Mergers and Share Conversion Prices

September 09 2024 - 7:30AM

Business Wire

ClearBridge Energy Midstream Opportunity Fund Inc. (NYSE: EMO)

today announced the completion of the mergers of ClearBridge MLP

and Midstream Fund Inc. (NYSE: CEM) and ClearBridge MLP and

Midstream Total Return Fund Inc. (NYSE: CTR) and together with EMO,

the “Funds” or each, a “Fund”) with and into EMO (the “Mergers”).

Effective before markets open on Monday, September 9, 2024, CEM and

CTR stockholders became EMO stockholders.

Each share of common stock of CEM and CTR, par value $0.001

per share, converted into an equivalent dollar amount (to the

nearest $0.001) of full shares of common stock of EMO, based on the

net asset value of each Fund on the business day preceding the

Mergers. EMO will not issue fractional shares to CEM and CTR

stockholders. In lieu of issuing fractional shares, EMO will pay

cash to each former holder of CEM and CTR common stock in an amount

equal to the net asset value of the fractional shares of EMO common

stock that the investor would otherwise have received in the

Mergers. The conversion price was based on each Fund’s net asset

value (NAV) per share calculated at the close of business on

Friday, September 6, 2024.

NAV, as of 9/6/24 market close

EMO

$46.6960

CEM

$51.9511

CTR

$47.0194

The conversion ratio was calculated at 1.112539 common shares of

EMO for each CEM common share. EMO did not issue any fractional

common shares to CEM stockholders. In lieu thereof, EMO purchased

all fractional shares at the then current NAV and remitted the cash

proceeds to former CEM stockholders in proportion to their

fractional shares.

The conversion ratio was calculated at 1.006926 common shares of

EMO for each CTR common share. EMO did not issue any fractional

common shares to CTR stockholders. In lieu thereof, EMO purchased

all fractional shares at the then current NAV and remitted the cash

proceeds to former CTR stockholders in proportion to their

fractional shares.

EMO’s post-Merger net assets totaled $849,413,976, and its NAV

per common share was $46.6960 based on approximately 18,190,295

shares outstanding, as of the close of business on September 6,

2024.

EMO issued and delivered to each of the CEM and CTR’s Mandatory

Redeemable Preferred Stock (“MRPS”) holders newly issued shares of

EMO’s MRPS with the same aggregate liquidation preference (of $35

per share) and terms as their MRPS that were issued and outstanding

immediately before the date of the Mergers. EMO also amended its

MRPS that are outstanding to align the voting rights of all of

EMO’s outstanding preferred stock so that each preferred

stockholder will have one vote for every $35 of liquidation

preference following the Mergers. No fractional MRPS will be issued

to CEM and CTR holders as a result of the Mergers. EMO will round

up to the next whole share instead of issuing fractional shares of

MRPS.

EMO is a non-diversified, closed-end management investment

company managed by Franklin Templeton Fund Adviser, LLC (formerly

known as Legg Mason Partners Fund Advisor, LLC) (“FTFA”), and

subadvised by ClearBridge Investments, LLC (“ClearBridge”). FTFA

and ClearBridge are both indirect wholly-owned subsidiaries of

Franklin Resources, Inc., a global investment management

organization operating as Franklin Templeton.

For more information, please call Investor Relations on

1-888-777-0102, or consult the Fund’s website at

www.franklintempleton.com/investments/options/closed-end-funds.

Hard copies of the Fund’s complete audited financial statements are

available free of charge upon request.

THIS PRESS RELEASE IS NOT AN OFFER TO PURCHASE NOR A

SOLICITATION OF AN OFFER TO SELL SHARES OF THE FUND. THIS PRESS

RELEASE MAY CONTAIN STATEMENTS REGARDING PLANS AND EXPECTATIONS FOR

THE FUTURE THAT CONSTITUTE FORWARD-LOOKING STATEMENTS WITHIN THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. ALL STATEMENTS

OTHER THAN STATEMENTS OF HISTORICAL FACT ARE FORWARD-LOOKING AND

CAN BE IDENTIFIED BY THE USE OF WORDS SUCH AS “MAY,” “WILL,”

“EXPECT,” “ANTICIPATE,” “ESTIMATE,” “BELIEVE,” “CONTINUE” OR OTHER

SIMILAR WORDS. SUCH FORWARD-LOOKING STATEMENTS ARE BASED ON THE

FUND’S CURRENT PLANS AND EXPECTATIONS, AND ARE SUBJECT TO RISKS AND

UNCERTAINTIES THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY

FROM THOSE DESCRIBED IN THE FORWARD-LOOKING STATEMENTS.

ADDITIONAL INFORMATION CONCERNING SUCH RISKS AND UNCERTAINTIES

IS CONTAINED IN THE FUND’S FILINGS WITH THE SECURITIES AND EXCHANGE

COMMISSION.

About Franklin Templeton

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 150 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With more than 1,500 investment professionals, and offices in major

financial markets around the world, the California-based company

has over 75 years of investment experience and over $1.6 trillion

in assets under management as of July 31, 2024. For more

information, please visit franklintempleton.com and follow us on

LinkedIn, Twitter and Facebook.

Category: Fund Announcement

Investor Contact: Fund Investor Services 1-888-777-0102

Source: Franklin Resources, Inc.

Source: Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240909554666/en/

Media Contact: Lisa Tibbitts +1 (904) 942-4451

Lisa.Tibbitts@franklintempleton.com

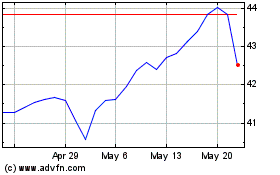

ClearBridge MLP and Mids... (NYSE:CTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

ClearBridge MLP and Mids... (NYSE:CTR)

Historical Stock Chart

From Jan 2024 to Jan 2025