Coterra Energy Inc. (NYSE: CTRA) (“Coterra” or the

“Company”) today reported second-quarter 2024 financial and

operating results and declared a quarterly dividend of $0.21 per

share. Additionally, the Company provided third-quarter production

and capital guidance and updated full-year 2024 guidance.

Key Takeaways & Updates

- For the second quarter of 2024, total barrels of oil equivalent

(BOE) production, natural gas production, and oil production all

beat the high-end of guidance, and incurred capital expenditures

(non-GAAP) came in near the low-end of guidance.

- Increasing full-year 2024 BOE production guidance by 1% and oil

production guidance by 2.4% from guidance provided in May, driven

by faster cycle times and strong well performance. Maintaining

full-year 2024 incurred capital expenditure (non-GAAP)

guidance.

- For the second quarter of 2024, shareholder returns totaled

120% of Free Cash Flow (non-GAAP), inclusive of our declared

quarterly base dividend and $140 million of share repurchases

during the quarter (cash basis, excluding 1% excise tax). The

Company remains committed to returning 50% or greater of its annual

Free Cash Flow (non-GAAP) to shareholders and has returned 103%

year to date.

- Simul-frac efficiencies are exceeding expectations on our

Windham Row Development. To date, 21 of the planned wells in the

row have come online an average of 4 days ahead of schedule. We now

plan to add an additional 3 Harkey wells to the project, bringing

total wells in the row to 57, and further improving the capital

efficiency of the project. Furthermore, due to early success, we

now plan to simul-frac 45 of the 57 wells in the row.

Tom Jorden, Chairman, CEO and President of Coterra, noted,

"Coterra's second quarter results continue the trend of delivering

outstanding performance. The ingenuity and hard work of our

operating team are driving results that exceed expectations across

our portfolio of high-quality assets. As we move into the second

half of 2024, we remain focused on executing our plan while

maintaining significant investment optionality between oil and gas

in 2025. Coterra's investment thesis remains strong. Operational

excellence, efficient development of our diversified, low-cost,

long-life assets, our fortress balance sheet, and an unwavering

commitment to shareholder returns underpin our value

proposition."

Second-Quarter 2024 Highlights

- Net Income (GAAP) totaled $220 million, or $0.30 per share.

Adjusted Net Income (non-GAAP) was $272 million, or $0.37 per

share.

- Cash Flow From Operating Activities (GAAP) totaled $558

million. Discretionary Cash Flow (non-GAAP) totaled $725

million.

- Cash paid for capital expenditures for drilling, completion and

other fixed asset additions (GAAP) totaled $479 million. Incurred

capital expenditures from drilling, completion and other fixed

asset additions (non-GAAP) totaled $477 million, near the low end

of our guidance range of $470 to $550 million.

- Free Cash Flow (non-GAAP) totaled $246 million.

- Unit operating cost (reflecting costs from direct operations,

transportation, production taxes and G&A) totaled $8.35 per

BOE, within our annual guidance range of $7.45 to $9.55 per

BOE.

- Total equivalent production of 669 MBoepd (thousand barrels of

oil equivalent per day), was above the high end of guidance (625 to

655 MBoepd), driven by improved cycle times and strong well

performance in all three of our regions.

- Oil production averaged 107.2 MBopd (thousand barrels of oil

per day), slightly exceeding the high end of guidance (103 to 107

MBopd).

- Natural gas production averaged 2,780 MMcfpd (million cubic

feet per day), exceeding the high end of guidance (2,600 to 2,700

MMcfpd) as Marcellus base production outperformed

expectations.

- NGLs production averaged 98.8 MBoepd.

- Realized average prices:

- Oil was $79.37 per Bbl (barrel), excluding the effect of

commodity derivatives, and $79.39 per Bbl, including the effect of

commodity derivatives.

- Natural Gas was $1.26 per Mcf (thousand cubic feet), excluding

the effect of commodity derivatives, and $1.40 per Mcf, including

the effect of commodity derivatives.

- NGLs were $19.53 per Bbl.

Shareholder Return Highlights

- Common Dividend: On August 1, 2024, Coterra's Board of

Directors (the "Board") approved a quarterly base dividend of $0.21

per share, equating to a 3.3% annualized yield, based on the

Company's $25.80 closing share price on July 31, 2024. The dividend

will be paid on August 29, 2024 to holders of record on August 15,

2024.

- Share Repurchases: During the quarter, the Company

repurchased 5.0 million shares for $140 million (cash basis,

excluding 1% excise tax) at a weighted-average price of

approximately $27.72 per share, leaving $1.3 billion remaining as

of June 30, 2024 on its $2.0 billion share repurchase

authorization.

- Total Shareholder Return: During the quarter, total

shareholder returns amounted to $295 million, comprised of $155

million of declared dividends and $140 million of share repurchases

(cash basis, excluding 1% excise tax).

- Reiterate Shareholder Return Strategy: Coterra is

committed to returning 50% or greater of annual Free Cash Flow

(non-GAAP) to shareholders through its $0.84 per share annual

dividend and share repurchases. Year to date, Coterra has returned

103% of Free Cash Flow (non-GAAP) to shareholders.

Guidance Updates:

- Reiterated 2024 incurred capital expenditures (non-GAAP) of

$1.75 to $1.95 billion.

- Increased 2024 oil production guidance to 105.5 to 108.5 MBopd,

up 2.4% at the mid-point versus prior guidance.

- Maintained 2024 natural gas production guidance at the

mid-point, tightened range to 2,675 to 2,775 MMcfpd.

- Increased 2024 BOE production guidance to 645 to 675, up 1% at

the mid-point versus prior guidance.

- Announced third-quarter 2024 total equivalent production of 620

to 650 MBoepd, oil production of 107.0 to 111.0 MBopd, natural gas

production of 2,500 to 2,630 MMcfpd, and incurred capital

expenditures (non-GAAP) of $450 to $530 million.

- Estimate 2024 Discretionary Cash Flow (non-GAAP) of

approximately $3.2 billion and 2024 Free Cash Flow (non-GAAP) of

approximately $1.3 billion, at $80/bbl WTI and $2.37/mmbtu annual

average NYMEX assumptions.

- For more details on annual and third quarter 2024 guidance, see

2024 Guidance Section in the tables below.

Strong Financial Position

As of June 30, 2024, Coterra had total debt outstanding of

$2.646 billion, of which $575 million is due in September 2024.

Coterra expects to retire its September 2024 maturity with cash on

hand. The Company exited the quarter with cash and cash equivalents

of $1.07 billion, $250 million in short-term investments, and no

debt outstanding under its $1.5 billion revolving credit facility,

resulting in total liquidity of approximately $2.82 billion.

Coterra's net debt to trailing twelve-month EBITDAX ratio

(non-GAAP) at June 30, 2024 was 0.4x.

See “Supplemental non-GAAP Financial Measures” below for

descriptions of the above non-GAAP measures as well as

reconciliations of these measures to the associated GAAP

measures.

Committed to Sustainability and ESG Leadership

Coterra is committed to environmental stewardship, sustainable

practices, and strong corporate governance. The Company's

sustainability report can be found under "ESG" on www.coterra.com.

Coterra published its 2024 Sustainability report on August 1,

2024.

Second-Quarter 2024 Conference Call

Coterra will host a conference call tomorrow, Friday, August 2,

2024, at 8:00 AM CT (9:00 AM ET), to discuss second-quarter 2024

financial and operating results.

Conference Call Information

Date: August 2, 2024

Time: 8:00 AM CT / 9:00 AM ET

Dial-in (for callers in the U.S. and Canada): (800) 715-9871

International dial-in: +1 (646) 307-1963

Conference ID: 8017228

The live audio webcast and related earnings presentation can be

accessed on the "Events & Presentations" page under the

"Investors" section of the Company's website at www.coterra.com.

The webcast will be archived and available at the same location

after the conclusion of the live event.

About Coterra Energy

Coterra is a premier exploration and production company based in

Houston, Texas with operations focused in the Permian Basin,

Marcellus Shale, and Anadarko Basin. We strive to be a leading

energy producer, delivering sustainable returns through the

efficient and responsible development of our diversified asset

base. Learn more about us at www.coterra.com.

Cautionary Statement Regarding Forward-Looking

Information

This press release contains certain forward-looking statements

within the meaning of federal securities laws. Forward-looking

statements are not statements of historical fact and reflect

Coterra's current views about future events. Such forward-looking

statements include, but are not limited to, statements about

returns to shareholders, enhanced shareholder value, reserves

estimates, future financial and operating performance, and goals

and commitment to sustainability and ESG leadership, strategic

pursuits and goals, including with respect to the publication of

Coterra’s Sustainability Report, and other statements that are not

historical facts contained in this press release. The words

"expect," "project," "estimate," "believe," "anticipate," "intend,"

"budget," "plan," "predict," "potential," "possible," "may,"

"should," "could," "would," "will," "strategy," "outlook", "guide"

and similar expressions are also intended to identify

forward-looking statements. We can provide no assurance that the

forward-looking statements contained in this press release will

occur as projected and actual results may differ materially from

those projected. Forward-looking statements are based on current

expectations, estimates and assumptions that involve a number of

risks and uncertainties that could cause actual results to differ

materially from those projected. These risks and uncertainties

include, without limitation, the volatility in commodity prices for

crude oil and natural gas; cost increases; the effect of future

regulatory or legislative actions; the impact of public health

crises, including pandemics and epidemics and any related company

or governmental policies or actions, financial condition and

results of operations; actions by, or disputes among or between,

the Organization of Petroleum Exporting Countries and other

producer countries; market factors; market prices (including

geographic basis differentials) of oil and natural gas; impacts of

inflation; labor shortages and economic disruption, (geopolitical

disruptions such as the war in Ukraine or conflict in the Middle

East or further escalation thereof); determination of reserves

estimates, adjustments or revisions, including factors impacting

such determination such as commodity prices, well performance,

operating expenses and completion of Coterra’s annual PUD reserves

process, as well as the impact on our financial statements

resulting therefrom; the presence or recoverability of estimated

reserves; the ability to replace reserves; environmental risks;

drilling and operating risks; exploration and development risks;

competition; the ability of management to execute its plans to meet

its goals; and other risks inherent in Coterra's businesses. In

addition, the declaration and payment of any future dividends,

whether regular base quarterly dividends, variable dividends or

special dividends, will depend on Coterra's financial results, cash

requirements, future prospects and other factors deemed relevant by

Coterra's Board. While the list of factors presented here is

considered representative, no such list should be considered to be

a complete statement of all potential risks and uncertainties.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual outcomes may

vary materially from those indicated. For additional information

about other factors that could cause actual results to differ

materially from those described in the forward-looking statements,

please refer to Coterra's annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K and other filings

with the SEC, which are available on Coterra's website at

www.coterra.com.

Forward-looking statements are based on the estimates and

opinions of management at the time the statements are made. Except

to the extent required by applicable law, Coterra does not

undertake any obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise. Readers are cautioned not to place

undue reliance on these forward-looking statements that speak only

as of the date hereof.

Operational Data

The tables below provide a summary of production volumes, price

realizations and operational activity by region and units costs for

the Company for the periods indicated:

Quarter Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

PRODUCTION VOLUMES

Marcellus Shale

Natural gas (Mmcf/day)

2,114.4

2,322.8

2,212.6

2,229.1

Daily equivalent production (MBoepd)

352.4

387.1

368.8

371.5

Permian Basin

Natural gas (Mmcf/day)

484.5

406.7

485.6

416.9

Oil (MBbl/day)

99.6

89.7

98.3

87.0

NGL (MBbl/day)

78.1

65.4

74.1

64.7

Daily equivalent production (MBoepd)

258.4

222.9

253.3

221.2

Anadarko Basin

Natural gas (Mmcf/day)

179.4

173.9

170.3

184.1

Oil (MBbl/day)

7.5

6.1

6.5

7.0

NGL (MBbl/day)

20.6

19.6

20.3

19.4

Daily equivalent production (MBoepd)

58.0

54.7

55.2

57.1

Total Company

Natural gas (Mmcf/day)

2,779.8

2,904.4

2,869.9

2,830.9

Oil (MBbl/day)

107.2

95.8

104.9

94.0

NGL (MBbl/day)

98.8

85.0

94.5

84.2

Daily equivalent production (MBoepd)

669.2

664.9

677.7

650.1

AVERAGE SALES PRICE (excluding

hedges)

Marcellus Shale

Natural gas ($/Mcf)

$

1.66

$

1.78

$

1.94

$

2.70

Permian Basin

Natural gas ($/Mcf)

$

(0.53

)

$

0.92

$

0.25

$

1.16

Oil ($/Bbl)

$

79.37

$

71.71

$

77.30

$

72.80

NGL ($/Bbl)

$

18.95

$

15.36

$

19.70

$

18.85

Anadarko Basin

Natural gas ($/Mcf)

$

1.35

$

1.57

$

1.70

$

2.40

Oil ($/Bbl)

$

79.40

$

74.32

$

77.45

$

74.56

NGL ($/Bbl)

$

21.75

$

21.02

$

22.39

$

24.27

Total Company

Natural gas ($/Mcf)

$

1.26

$

1.65

$

1.64

$

2.46

Oil ($/Bbl)

$

79.37

$

71.88

$

77.31

$

72.93

NGL ($/Bbl)

$

19.53

$

16.67

$

20.28

$

20.11

Quarter Ended June 30,

Six Months Ended June

30,

2024

2023

2024

2023

AVERAGE SALES PRICE (including

hedges)

Total Company

Natural gas ($/Mcf)

$

1.40

$1.95

$

1.76

$

2.81

Oil ($/Bbl)

$

79.39

$72.17

$

77.25

$

73.11

NGL ($/Bbl)

$

19.53

$16.67

$

20.28

$

20.11

Quarter Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

WELLS DRILLED(1)

Gross wells

Marcellus Shale

8

16

22

36

Permian Basin

63

33

111

72

Anadarko Basin

11

11

19

17

82

60

152

125

Net wells

Marcellus Shale

8.0

16.0

21.0

36.0

Permian Basin

26.8

21.3

50.0

37.9

Anadarko Basin

7.0

5.1

13.7

8.4

41.8

42.4

84.7

82.3

TURN IN LINES

Gross wells (2)

Marcellus Shale

12

20

23

45

Permian Basin

56

34

98

79

Anadarko Basin

26

3

31

7

94

57

152

131

Net wells (2)

Marcellus Shale

12.0

20.0

23.0

45.0

Permian Basin

22.6

19.1

44.5

42.2

Anadarko Basin

15.2

—

15.3

0.1

49.8

39.1

82.8

87.3

AVERAGE RIG COUNTS

Marcellus Shale

1.2

3.0

1.6

3.0

Permian Basin

8.0

6.0

8.0

6.0

Anadarko Basin

1.3

2.0

1.7

1.5

(1)

Wells drilled represents wells drilled to

total depth during the period.

(2)

The 12 turn-in lines in the Marcellus

Shale were brought online for less than 10 days on average in order

to de-water the developments. These wells were subsequently shut-in

or heavily curtailed and contributed negligible volumes during the

quarter (a total of 18 MMcf/d, or less than 0.1% of total company

gas volumes during the quarter). The wells were returned online in

early July.

Quarter Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

AVERAGE UNIT COSTS ($/Boe) (1)

Direct operations

$

2.62

$

2.16

$

2.56

$

2.24

Gathering, processing and

transportation

3.99

4.27

3.99

4.20

Taxes other than income

0.89

1.05

1.04

1.27

General and administrative (excluding

stock-based compensation and severance expense)

0.85

0.79

0.92

0.85

Unit Operating Cost

$

8.35

$

8.27

$

8.52

$

8.56

Depreciation, depletion and

amortization

7.34

6.54

7.12

6.50

Exploration

0.09

0.09

0.08

0.08

Stock-based compensation

0.26

0.11

0.24

0.19

Severance expense

—

0.05

—

0.09

Interest expense, net

0.23

0.09

0.15

0.09

$

16.26

$

15.15

$

16.10

$

15.51

(1)

Total unit costs may differ from the sum

of the individual costs due to rounding.

Derivatives

Information

As of June 30, 2024, the Company had the

following outstanding financial commodity derivatives:

2024

Natural Gas

Third Quarter

Fourth Quarter

NYMEX collars

Volume (MMBtu)

45,080,000

28,890,000

Weighted average floor ($/MMBtu)

$

2.75

$

2.75

Weighted average ceiling ($/MMBtu)

$

3.94

$

4.68

2025

Natural Gas

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

NYMEX collars

Volume (MMBtu)

27,000,000

27,300,000

27,600,000

27,600,000

Weighted average floor ($/MMBtu)

$

2.92

$

2.92

$

2.92

$

2.92

Weighted average ceiling ($/MMBtu)

$

5.12

$

4.37

$

4.37

$

6.20

2026

Natural Gas

First Quarter

NYMEX collars

Volume (MMBtu)

18,000,000

Weighted average floor ($/MMBtu)

$

2.75

Weighted average ceiling ($/MMBtu)

$

8.30

2024

2025

Oil

Third Quarter

Fourth Quarter

First Quarter

Second Quarter

WTI oil collars

Volume (MBbl)

3,220

3,220

1,800

1,820

Weighted average floor ($/Bbl)

$

65.00

$

65.00

$

62.50

$

62.50

Weighted average ceiling ($/Bbl)

$

87.01

$

87.01

$

81.67

$

81.67

WTI Midland oil basis swaps

Volume (MBbl)

4,600

4,600

1,800

1,820

Weighted average differential ($/Bbl)

$

1.13

$

1.13

$

1.24

$

1.24

In July 2024, the Company entered into the

following financial commodity derivatives:

2025

Oil

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

WTI oil collars

Volume (MBbl)

900

910

1,380

1,380

Weighted average floor ($/Bbl)

$

65.00

$

65.00

$

65.00

$

65.00

Weighted average ceiling ($/Bbl)

$

84.07

$

84.07

$

83.18

$

83.18

WTI Midland oil basis swaps

Volume (MBbl)

900

910

1,380

1,380

Weighted average differential ($/Bbl)

$

1.13

$

1.13

$

1.14

$

1.14

CONDENSED CONSOLIDATED

STATEMENT OF OPERATIONS (Unaudited)

Quarter Ended

Six Months Ended

June 30,

June 30,

(In millions,

except per share amounts)

2024

2023

2024

2023

OPERATING REVENUES

Oil

$

774

$

626

$

1,475

$

1,241

Natural gas

319

436

857

1,258

NGL

176

129

349

306

Gain (loss) on derivative instruments

(16

)

(12

)

(16

)

126

Other

18

6

39

31

1,271

1,185

2,704

2,962

OPERATING EXPENSES

Direct operations

160

130

316

264

Gathering, processing and

transportation

242

258

492

494

Taxes other than income

54

63

128

149

Exploration

5

5

10

9

Depreciation, depletion and

amortization

447

395

879

764

General and administrative (excluding

stock-based compensation and severance expense)

52

48

114

100

Stock-based compensation

16

7

29

23

Severance expense

—

3

—

11

976

909

1,968

1,814

Gain on sale of assets

1

—

—

5

INCOME FROM OPERATIONS

296

276

736

1,153

Interest expense

34

16

53

33

Interest income

(19

)

(10

)

(35

)

(22

)

Income before income taxes

281

270

718

1,142

Income tax expense

61

61

146

256

NET INCOME

$

220

$

209

$

572

$

886

Earnings per share - Basic

$

0.30

$

0.28

$

0.77

$

1.16

Weighted-average common shares

outstanding

742

755

746

760

CONDENSED CONSOLIDATED BALANCE SHEET

(Unaudited)

(In

millions)

June 30, 2024

December 31,

2023

ASSETS

Cash and cash equivalents

$

1,070

$

956

Short-term investments

250

—

Other current assets

1,017

1,059

Properties and equipment, net (successful

efforts method)

17,996

17,933

Other assets

431

467

$

20,764

$

20,415

LIABILITIES, REDEEMABLE PREFERRED STOCK

AND STOCKHOLDERS' EQUITY

Current liabilities

$

1,090

$

1,085

Current portion of long-term debt

575

575

Long-term debt, net (excluding current

maturities)

2,071

1,586

Deferred income taxes

3,390

3,413

Other long term liabilities

601

709

Cimarex redeemable preferred stock

8

8

Stockholders’ equity

13,029

13,039

$

20,764

$

20,415

CONDENSED CONSOLIDATED

STATEMENT OF CASH FLOWS (Unaudited)

Quarter Ended June 30,

Six Months Ended June

30,

(In

millions)

2024

2023

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income

$

220

$

209

$

572

$

886

Depreciation, depletion and

amortization

447

395

879

764

Deferred income tax (benefit) expense

(1

)

4

(23

)

27

Gain on sale of assets

(1

)

—

—

(5

)

(Gain) loss on derivative instruments

16

12

16

(126

)

Net cash received in settlement of

derivative instruments

36

84

62

184

Stock-based compensation and other

13

7

25

24

Income charges not requiring cash

(5

)

(6

)

(9

)

(10

)

Changes in assets and liabilities

(167

)

(59

)

(108

)

396

Net cash provided by operating

activities

558

646

1,414

2,140

CASH FLOWS FROM INVESTING

ACTIVITIES

Capital expenditures for drilling,

completion and other fixed asset additions

(479

)

(592

)

(936

)

(1,075

)

Capital expenditures for leasehold and

property acquisitions

(2

)

(5

)

(3

)

(6

)

Purchases of short-term investments

—

—

(250

)

—

Proceeds from sale of assets

1

28

1

33

Net cash used in investing activities

(480

)

(569

)

(1,188

)

(1,048

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net proceeds from debt

—

—

499

—

Repayment of finance leases

(2

)

(1

)

(3

)

(3

)

Common stock repurchases

(140

)

(57

)

(290

)

(325

)

Dividends paid

(156

)

(152

)

(314

)

(588

)

Tax withholding on vesting of stock

awards

—

—

—

(1

)

Capitalized debt issuance costs

—

—

(5

)

(7

)

Cash paid for conversion of redeemable

preferred stock

—

—

—

(1

)

Cash received for stock option

exercises

1

—

1

—

Net cash used in financing activities

(297

)

(210

)

(112

)

(925

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

$

(219

)

$

(133

)

$

114

$

167

Reconciliation of Incurred Capital

Expenditures

Incurred capital expenditures is defined as capital expenditures

for drilling, completion and other fixed asset additions less

changes in accrued capital costs.

Quarter Ended June 30,

Six Months Ended June

30,

(In

millions)

2024

2023

2024

2023

Cash paid for capital expenditures for

drilling, completion and other fixed asset additions (GAAP)

$

479

$

592

$

936

$

1,075

Change in accrued capital costs

(2

)

(55

)

(9

)

30

Incurred capital expenditures for

drilling, completion and other fixed asset additions (non-GAAP)

$

477

537

$

927

$

1,105

Supplemental Non-GAAP Financial Measures

(Unaudited)

We report our financial results in accordance with accounting

principles generally accepted in the United States (GAAP). However,

we believe certain non-GAAP performance measures may provide

financial statement users with additional meaningful comparisons

between current results and results of prior periods. In addition,

we believe these measures are used by analysts and others in the

valuation, rating and investment recommendations of companies

within the oil and natural gas exploration and production industry.

See the reconciliations below that compare GAAP financial measures

to non-GAAP financial measures for the periods indicated.

We have also included herein certain forward-looking non-GAAP

financial measures. Due to the forward-looking nature of these

non-GAAP financial measures, we cannot reliably predict certain of

the necessary components of the most directly comparable

forward-looking GAAP measures, such as changes in assets and

liabilities (including future impairments) and cash paid for

certain capital expenditures. Accordingly, we are unable to present

a quantitative reconciliation of such forward-looking non-GAAP

financial measures to their most directly comparable

forward-looking GAAP financial measures. Reconciling items in

future periods could be significant.

Reconciliation of Net Income to Adjusted Net

Income and Adjusted Earnings Per Share

Adjusted Net Income and Adjusted Earnings per Share are

presented based on our management's belief that these non-GAAP

measures enable a user of financial information to understand the

impact of identified adjustments on reported results. Adjusted Net

Income is defined as net income plus gain and loss on sale of

assets, non-cash gain and loss on derivative instruments,

stock-based compensation expense, severance expense, and tax effect

on selected items. Adjusted Earnings per Share is defined as

Adjusted Net Income divided by weighted-average common shares

outstanding. Additionally, we believe these measures provide

beneficial comparisons to similarly adjusted measurements of prior

periods and use these measures for that purpose. Adjusted Net

Income and Adjusted Earnings per Share are not measures of

financial performance under GAAP and should not be considered as

alternatives to net income and earnings per share, as defined by

GAAP.

Quarter Ended June 30,

Six Months Ended June

30,

(In millions,

except per share amounts)

2024

2023

2024

2023

As reported - net income

$

220

$

209

$

572

$

886

Reversal of selected items:

Gain on sale of assets

(1

)

—

—

(5

)

(Gain) loss on derivative

instruments(1)

52

96

78

58

Stock-based compensation expense

16

7

29

23

Severance expense

—

3

—

11

Tax effect on selected items

(15

)

(24

)

(24

)

(20

)

Adjusted net income

$

272

$

291

$

655

$

953

As reported - earnings per share

$

0.30

$

0.28

$

0.77

$

1.16

Per share impact of selected items

0.07

0.11

0.11

0.09

Adjusted earnings per share

$

0.37

$

0.39

$

0.88

$

1.25

Weighted-average common shares

outstanding

742

755

746

760

(1)

This amount represents the non-cash

mark-to-market changes of our commodity derivative instruments

recorded in Gain (loss) on derivative instruments in the Condensed

Consolidated Statement of Operations.

Reconciliation of Discretionary Cash Flow

and Free Cash Flow

Discretionary Cash Flow is defined as cash flow from operating

activities excluding changes in assets and liabilities.

Discretionary Cash Flow is widely accepted as a financial indicator

of an oil and gas company’s ability to generate available cash to

internally fund exploration and development activities, return

capital to shareholders through dividends and share repurchases,

and service debt and is used by our management for that purpose.

Discretionary Cash Flow is presented based on our management’s

belief that this non-GAAP measure is useful information to

investors when comparing our cash flows with the cash flows of

other companies that use the full cost method of accounting for oil

and gas producing activities or have different financing and

capital structures or tax rates. Discretionary Cash Flow is not a

measure of financial performance under GAAP and should not be

considered as an alternative to cash flows from operating

activities or net income, as defined by GAAP, or as a measure of

liquidity.

Free Cash Flow is defined as Discretionary Cash Flow less cash

paid for capital expenditures. Free Cash Flow is an indicator of a

company’s ability to generate cash flow after spending the money

required to maintain or expand its asset base, and is used by our

management for that purpose. Free Cash Flow is presented based on

our management’s belief that this non-GAAP measure is useful

information to investors when comparing our cash flows with the

cash flows of other companies. Free Cash Flow is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating activities or net income,

as defined by GAAP, or as a measure of liquidity.

Quarter Ended June 30,

Six Months Ended June

30,

(In

millions)

2024

2023

2024

2023

Cash flow from operating activities

$

558

$

646

$

1,414

$

2,140

Changes in assets and liabilities

167

59

108

(396

)

Discretionary cash flow

725

705

1,522

1,744

Cash paid for capital expenditures for

drilling, completion and other fixed asset additions

(479

)

(592

)

(936

)

(1,075

)

Free cash flow

$

246

$

113

$

586

$

669

Reconciliation of Adjusted EBITDAX

Adjusted EBITDAX is defined as net income plus interest expense,

interest income, income tax expense, depreciation, depletion, and

amortization (including impairments), exploration expense, gain and

loss on sale of assets, non-cash gain and loss on derivative

instruments, stock-based compensation expense, and severance

expense. Adjusted EBITDAX is presented on our management’s belief

that this non-GAAP measure is useful information to investors when

evaluating our ability to internally fund exploration and

development activities and to service or incur debt without regard

to financial or capital structure. Our management uses Adjusted

EBITDAX for that purpose. Adjusted EBITDAX is not a measure of

financial performance under GAAP and should not be considered as an

alternative to cash flows from operating activities or net income,

as defined by GAAP, or as a measure of liquidity.

Quarter Ended June 30,

Six Months Ended June

30,

(In

millions)

2024

2023

2024

2023

Net income

$

220

$

209

$

572

$

886

Plus (less):

Interest expense

34

16

53

33

Interest income

(19

)

(10

)

(35

)

(22

)

Income tax expense

61

61

146

256

Depreciation, depletion and

amortization

447

395

879

764

Exploration

5

5

10

9

Gain on sale of assets

(1

)

—

—

(5

)

Non-cash loss on derivative

instruments

52

96

78

58

Severance expense

—

3

—

11

Stock-based compensation

16

7

29

23

Adjusted EBITDAX

$

815

$

782

$

1,732

$

2,013

Trailing Twelve Months

Ended

(In

millions)

June 30, 2024

December 31,

2023

Net income

$

1,311

$

1,625

Plus (less):

Interest expense

93

73

Interest income

(60

)

(47

)

Income tax expense

393

503

Depreciation, depletion and

amortization

1,756

1,641

Exploration

21

20

Gain on sale of assets

(7

)

(12

)

Non-cash loss on derivative

instruments

75

54

Severance expense

1

12

Stock-based compensation

65

59

Adjusted EBITDAX (trailing twelve

months)

$

3,648

$

3,928

Reconciliation of Net Debt

The total debt to total capitalization ratio is calculated by

dividing total debt by the sum of total debt and total

stockholders’ equity. This ratio is a measurement which is

presented in our annual and interim filings and our management

believes this ratio is useful to investors in assessing our

leverage. Net Debt is calculated by subtracting cash and cash

equivalents and short-term investments from total debt. The Net

Debt to Adjusted Capitalization ratio is calculated by dividing Net

Debt by the sum of Net Debt and total stockholders’ equity. Net

Debt and the Net Debt to Adjusted Capitalization ratio are non-GAAP

measures which our management believes are also useful to investors

when assessing our leverage since we have the ability to and may

decide to use a portion of our cash and cash equivalents and

short-term investments to retire debt. Our management uses these

measures for that purpose. Additionally, as our planned

expenditures are not expected to result in additional debt, our

management believes it is appropriate to apply cash and cash

equivalents and short-term investments to reduce debt in

calculating the Net Debt to Adjusted Capitalization ratio.

(In

millions)

June 30, 2024

December 31,

2023

Current portion of long-term debt

$

575

$

575

Long-term debt, net

2,071

1,586

Total debt

2,646

2,161

Stockholders’ equity

13,029

13,039

Total capitalization

$

15,675

$

15,200

Total debt

$

2,646

$

2,161

Less: Cash and cash equivalents

(1,070

)

(956

)

Less: Short-term investments

(250

)

—

Net debt

$

1,326

$

1,205

Net debt

$

1,326

$

1,205

Stockholders’ equity

13,029

13,039

Total adjusted capitalization

$

14,355

$

14,244

Total debt to total capitalization

ratio

16.9

%

14.2

%

Less: Impact of cash and cash

equivalents

7.7

%

5.7

%

Net debt to adjusted capitalization

ratio

9.2

%

8.5

%

Reconciliation of Net Debt to Adjusted

EBITDAX

Total debt to net income is defined as total debt divided by net

income. Net debt to Adjusted EBITDAX is defined as net debt divided

by trailing twelve month Adjusted EBITDAX. Net debt to Adjusted

EBITDAX is a non-GAAP measure which our management believes is

useful to investors when assessing our credit position and

leverage.

(In

millions)

June 30, 2024

December 31,

2023

Total debt

$

2,646

$

2,161

Net income

1,311

1,625

Total debt to net income ratio

2.0 x

1.3 x

Net debt (as defined above)

$

1,326

$

1,205

Adjusted EBITDAX (Trailing twelve

months)

3,648

3,928

Net debt to Adjusted EBITDAX

0.4 x

0.3 x

2024 Guidance

The tables below present full-year and second quarter 2024

guidance.

Full Year Guidance

2024 Guidance (May)

Updated 2024 Guidance

Low Mid High

Low Mid High

Total Equivalent Production (MBoed)

635 - 655 - 675

645 - 660 - 675

Gas (Mmcf/day)

2,650 - 2,725 - 2,800

2,675 - 2,725 - 2,775

Oil (MBbl/day)

102.0 - 104.5 - 107.0

105.5 - 107.0 - 108.5

Net wells turned in line

Marcellus Shale

37 - 40 - 43

No change

Permian Basin

75 - 83 - 90

80 - 85 - 90

Anadarko Basin

20 - 23 - 25

21 - 24 - 27

Incurred capital expenditures ($ in

millions)

Total Company

$1,750 - $1,850 - $1,950

No change

Drilling and completion

Marcellus Shale

$350- $375 -$400

$375 midpoint

Permian Basin

$945 - $1,000 - $1,055

$1,000 midpoint

Anadarko Basin

$270 - $290 - $320

$290 midpoint

Midstream, saltwater disposal and

infrastructure

$185 - $185 - $185

$185 midpoint

Commodity price assumptions:

WTI ($ per bbl)

$79

$80

Henry Hub ($ per mmbtu)

$2.35

$2.37

Cash Flow & Investment ($ in

billions)

Discretionary Cash Flow

$3.1

$3.2

Incurred Capital Expenditures

$1.75 - $1.85 - $1.95

No change

Free Cash Flow (DCF - cash capex)

$1.3

$1.3

$ per boe, unless noted:

Lease operating expense + workovers +

region office

$2.15 - $2.50 - $2.85

No change

Gathering, processing, &

transportation

$3.50 - $4.00 - $4.50

No change

Taxes other than income

$1.00 - $1.10 - $1.20

No change

General & administrative (1)

$0.80 - $0.90 - $1.00

No change

Unit Operating Cost

$7.45 - $8.50 - $9.55

No change

(1)

Excludes stock-based compensation and

severance expense

Quarterly Guidance

Second Quarter 2024

Guidance

Second Quarter 2024

Actual

Third Quarter 2024

Guidance

Low Mid High

Low Mid High

Total Equivalent Production (MBoed)

625 - 640 - 655

669

620 - 635 - 650

Gas (Mmcf/day)

2,600 - 2,650 - 2,700

2,780

2,500 - 2,565 - 2,630

Oil (MBbl/day)

103.0 - 105.0 - 107.0

107.2

107.0 - 109.0 - 111.0

Net wells turned in line

Marcellus Shale

0 - 0 - 0

12

0 – 4 - 7

Permian Basin

15 - 23 - 30

23

15 - 20 - 25

Anadarko Basin

7-10-13

15

5

Incurred capital expenditures ($ in

millions)

Total Company

$470 - $510 - $550

$477

$450 - $480 - $530

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801776861/en/

Investor Contact Daniel Guffey - Vice President of

Finance, IR & Treasury 281.589.4875

Hannah Stuckey - Investor Relations Manager

281.589.4983

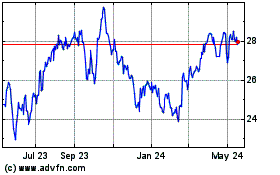

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

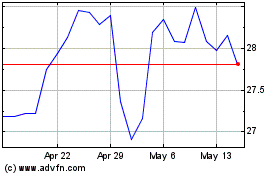

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Nov 2023 to Nov 2024