Customers Bank Appoints Allen Love as Chief Compliance & AML Officer

August 09 2024 - 1:14PM

Business Wire

Financial industry veteran and former IRS

Special Agent will strengthen BSA/AML processes, further Bank’s

commitment to risk management

Customers Bank, the $22 billion asset subsidiary of Customers

Bancorp (NYSE:CUBI), has appointed Allen Love as Chief Compliance

and AML Officer. In this role, Love will be responsible for leading

the Bank’s enterprise-wide compliance program, ensuring it

continues to evolve as regulatory expectations increase.

Love will immediately begin work on strengthening Bank Secrecy

Act and Anti-Money Laundering (BSA/AML) protocols for the company’s

digital asset business in support of the Bank’s recent agreement

with the Federal Reserve Bank of Philadelphia and the Commonwealth

of Pennsylvania.

“Customers Bank has always been dedicated to the principles of

strong risk management, and we have already taken several important

steps towards meeting the expectations of our regulators, including

the appointment of Allen Love as Chief Compliance and AML Officer,”

said Joan Cheney, Executive Vice President and Chief Risk Officer

of Customers Bank. “Allen joins us from one of the top 10 banks in

the country with a long career in compliance and risk management. I

am incredibly confident in his ability to strengthen our programs

to further protect the Bank and provide enhanced services to our

customers, building off of the work we have already completed.”

Love brings a wealth of experience in financial crimes risk

management, having served as a senior compliance officer at some of

the largest banks in North America. He is a former Special Agent

with the IRS Criminal Investigation Division (IRS-CID) and has an

extensive background in Financial Crimes Risk Management. As a

financial industry veteran in top compliance roles, Love has also

performed reviews that resulted in the implementation of procedures

that enhanced BSA/AML and fraud control environments at

institutions across the U.S.

“I am excited to join Customers Bank and help guide the ongoing

maturation of its compliance program,” said Love. “In partnership

with the entire compliance team, I look forward to contributing to

the Bank’s continued success by strengthening initiatives that

safeguard and support our customers.”

Institutional Background

Customers Bancorp, Inc. (NYSE:CUBI) is one of the nation’s

top-performing banking companies with nearly $21 billion in assets,

making it one of the 80 largest bank holding companies in the U.S.

Customers Bank’s commercial and consumer clients benefit from a

full suite of technology-enabled tailored product experiences

delivered by best-in-class customer service distinguished by a

Single Point of Contact approach. In addition to traditional lines

such as C&I lending, commercial real estate lending and

multifamily lending, Customers Bank also provides a number of

national corporate banking services to specialized lending clients.

Major accolades include:

- No. 1 on American Banker 2024 list of top-performing banks with

$10B to $50B in assets

- No. 29 out of the 100 largest publicly traded banks in 2024

Forbes Best Banks list

- No. 52 on Investor’s Business Daily 100 Best Stocks for

2023

A member of the Federal Reserve System with deposits insured by

the Federal Deposit Insurance Corporation, Customers Bank is an

equal opportunity lender. Learn more:

www.customersbank.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240809868715/en/

Eric Lucero, Chief Marketing Officer (212) 843-4543

elucero@customersbank.com

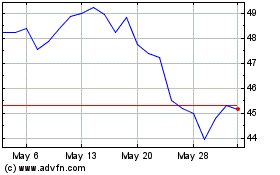

Customers Bancorp (NYSE:CUBI)

Historical Stock Chart

From Feb 2025 to Mar 2025

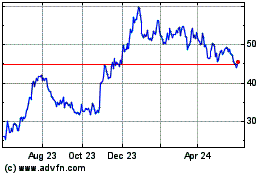

Customers Bancorp (NYSE:CUBI)

Historical Stock Chart

From Mar 2024 to Mar 2025