Cenovus Energy Inc. (TSX: CVE) (NYSE: CVE) delivered solid results

across its portfolio in the first quarter of 2024. Production from

its upstream assets remained strong through the quarter, and

reflects scheduled maintenance in the Atlantic region. The

downstream assets continued to run with high operational

availability, allowing them to benefit from improved benchmark

pricing in the U.S. Beginning in the second quarter of 2024, the

Board of Directors approved a 29% increase in the base dividend to

$0.72 per share annually, and declared a variable dividend of

$0.135 per share to fulfill the company’s first quarter shareholder

return allocation. Consistent with Cenovus’s financial framework,

the base dividend is fully supported over the long term by funds

flow generation at the bottom of the commodity price cycle.

“We continue to focus on safe and reliable operations across our

integrated business as we progress our priorities of deleveraging

our balance sheet, increasing our shareholder returns, advancing

work to decarbonize our production and furthering our growth

projects,” said Jon McKenzie, Cenovus President & Chief

Executive Officer. “As we outlined at our Investor Day, our

high-quality assets with long reserve life, together with our

integrated strategy and strong operating performance, position

Cenovus for success not only today but well into the future.”

First-quarter highlights

- Upstream production of almost 801,000 barrels of oil equivalent

per day (BOE/d)1, including 114,100 barrels per day (bbls/d) at the

Lloydminster thermals.

- Downstream throughput of more than 655,000 bbls/d, representing

94% utilization in Canadian Refining and 87% in U.S. Refining.

- Attained targeted mid-BBB credit ratings from all rating

agencies, with S&P Global Ratings upgrading Cenovus to BBB with

a stable outlook.

- Pathways Alliance began filing regulatory applications to the

Alberta Energy Regulator for the proposed carbon capture and

storage project.

- Progressed our growth projects at West White Rose, Foster

Creek, Christina Lake and Sunrise.

|

Financial, production & throughput

summary |

|

For the period ended March 31 |

2024 Q1 |

2023 Q4 |

2023 Q1 |

|

Financial ($ millions, except per share

amounts) |

|

Cash from (used in) operating activities |

1,925 |

2,946 |

(286) |

|

Adjusted funds flow2 |

2,242 |

2,062 |

1,395 |

|

Per share (diluted)2 |

1.19 |

1.09 |

0.71 |

|

Capital investment |

1,036 |

1,170 |

1,101 |

|

Free funds flow2 |

1,206 |

892 |

294 |

|

Excess free funds flow2 |

832 |

471 |

(499) |

|

Net earnings (loss) |

1,176 |

743 |

636 |

|

Per share (diluted) |

0.62 |

0.39 |

0.32 |

|

Long-term debt, including current portion |

7,227 |

7,108 |

8,681 |

|

Net debt |

4,827 |

5,060 |

6,632 |

|

Production and throughput (before royalties, net to

Cenovus) |

|

Oil and NGLs (bbls/d)1 |

658,200 |

662,600 |

636,200 |

|

Conventional natural gas (MMcf/d) |

855.8 |

876.3 |

857.0 |

|

Total upstream production (BOE/d)1 |

800,900 |

808,600 |

779,000 |

|

Total downstream throughput (bbls/d) |

655,200 |

579,100 |

457,900 |

1 See Advisory for production by product type.2 Non-GAAP

financial measure or contains a non-GAAP financial measure. See

Advisory.

First-quarter resultsOperating

results1

Cenovus’s total revenues were approximately $13.4 billion in the

first quarter of 2024, up slightly from $13.1 billion in the fourth

quarter, driven primarily by strong operating results. Upstream

revenues were about $7.1 billion, an increase from $6.9 billion in

the prior quarter, while downstream revenues were approximately

$8.6 billion, an increase from the fourth quarter of 2023. Total

operating margin3 was about $3.2 billion, compared with $2.2

billion in the previous quarter. Upstream operating margin4 was

approximately $2.6 billion, in line with the fourth quarter.

Downstream operating margin4 was $560 million in the first quarter,

compared with an operating margin shortfall of $304 million in the

previous quarter. In the first quarter, operating margin in U.S.

Refining benefited from approximately $195 million of first-in,

first-out (FIFO) gains.

Total upstream production was 800,900 BOE/d in the first

quarter, a slight decrease from the fourth quarter as the SeaRose

floating production, storage and offloading (FPSO) vessel suspended

production in late December in preparation for its planned

off-station. Foster Creek volumes were 196,000 bbls/d compared with

198,800 bbls/d in the fourth quarter and Christina Lake production

was 236,500 bbls/d, in line with the previous quarter. Sunrise

production of 48,800 bbls/d was also in line with the fourth

quarter. At the Lloydminster thermal projects, production increased

to 114,100 bbls/d from 106,600 bbls/d in the prior quarter, which

reflects higher reliability from the optimization of the asset and

the implementation of Cenovus operating practices.

Production in the Conventional segment was 120,700 BOE/d in the

first quarter, in line with the fourth quarter.

In the Offshore segment, production was 64,900 BOE/d compared

with approximately 70,200 BOE/d in the fourth quarter. Asia Pacific

sales volumes in the first quarter were in line with the prior

quarter. In the Atlantic region, production was 7,200 bbls/d

compared with 9,700 bbls/d in the prior quarter due to the SeaRose

FPSO vessel beginning its planned drydock. Maintenance work is

underway and the company anticipates the return of White Rose field

production late in the third quarter of this year. The

quarter-over-quarter offshore production decrease was partially

offset by the non-operated Terra Nova FPSO vessel resuming

operations offshore Newfoundland and Labrador. Light crude oil

production from the White Rose and Terra Nova fields is stored at

an onshore terminal before shipment to buyers, which can result in

a timing difference between production and sales. Sales volumes in

the Atlantic region in the first quarter were 3,900 bbls/d,

compared with 15,000 bbls/d in the fourth quarter of 2023.

Refining throughput in the quarter of 655,200 bbls/d was a

record volume as Cenovus continues to improve its downstream

reliability. Crude throughput in the Canadian Refining segment was

104,100 bbls/d in the first quarter, compared with 100,300 bbls/d

in the fourth quarter, with the increase primarily due to higher

reliability in the first quarter. In the coming weeks, the Upgrader

will commence a planned seven-week turnaround, which will impact

throughput and utilization in the second quarter.

In U.S. Refining, crude throughput was 551,100 bbls/d in the

first quarter, compared with 478,800 bbls/d in the fourth quarter.

Throughput in the quarter increased primarily due to improved

operating performance and availability across the company's

operated and non-operated refining assets, in addition to lower

levels of planned maintenance when compared with the prior

quarter.

3 Non-GAAP financial measure. Total operating margin is the

total of Upstream operating margin plus Downstream operating

margin. See Advisory.4 Specified financial measure. See

Advisory.

Financial results

First-quarter cash from operating activities, which includes

changes in non-cash working capital, was about $1.9 billion,

compared with $2.9 billion in the fourth quarter of 2023. Adjusted

funds flow was approximately $2.2 billion, compared with $2.1

billion in the prior period and free funds flow was $1.2 billion,

an increase from $892 million in the fourth quarter. First-quarter

financial results were positively impacted by higher refining

benchmark prices and a FIFO gain in the U.S. Refining segment,

partially offset by approximately $250 million related to

stock-based compensation paid in the first quarter of 2024.

Net earnings in the first quarter were $1.2 billion, compared

with $743 million in the previous quarter, with the increase

primarily due to higher operating margin and a gain on asset

divestitures in the first quarter of 2024. This was partially

offset by higher income taxes, general and administrative expenses

and a foreign exchange loss in the first quarter compared with a

gain in the fourth quarter of 2023.

Long-term debt, including the current portion, was $7.2 billion

at March 31, 2024, in line with year-end 2023. Net debt was

approximately $4.8 billion at March 31, 2024, a decrease from $5.1

billion at December 31, 2023, primarily due to free funds flow of

$1.2 billion, partially offset by shareholder returns of $436

million and a build in non-cash working capital. In the first

quarter, the company achieved its targeted mid-BBB credit ratings

from all rating agencies. S&P Global Ratings upgraded Cenovus

to BBB with a stable outlook, citing the company's debt

reduction.

Capital investment of $1.0 billion in the first quarter was

primarily directed towards sustaining production in the Oil Sands

segment, drilling, completions and infrastructure projects in the

Conventional business, and sustaining activities in the Downstream

segments. Additionally, the company continues to progress growth

and optimization projects in its upstream business. Work on the

West White Rose project is progressing and the company anticipates

first production from the field in 2026. Construction of the

tie-back of Narrows Lake to Christina Lake remains on track to

start up in the first half of 2025. At Sunrise, the company will

bring two additional well pads on line later this year, which will

support sustaining current production levels. In addition, the

Foster Creek optimization project is well underway, and expected to

add 30,000 bbls/d once fully ramped up by the end of 2027.

Financial framework

Maintaining a strong balance sheet with the resilience to

withstand price volatility and capitalize on opportunities

throughout the commodity price cycle is a key element of Cenovus’s

capital allocation framework. In 2022 Cenovus established a net

debt target of ~1.0x adjusted funds flow at the bottom of the

commodity price cycle, or US$45 West Texas Intermediate (WTI),

which translates into approximately $4.0 billion in net debt.

Currently, Cenovus’s shareholder returns framework has a target of

returning 50% of Excess Free Funds Flow (EFFF) to shareholders for

quarters where the ending net debt is between $9.0 billion and $4.0

billion, and 100% of EFFF to shareholders where the ending net debt

is below $4.0 billion.

The company has made a modification to the shareholder returns

framework, specifically to address a scenario following the

achievement of the target where net debt rises above $4.0 billion

in any given quarter. Under the adjusted framework, should net debt

rise above the $4.0 billion target in a given quarter, instead of

reverting to a 50% payout ratio, the company will deduct the amount

by which the previous quarter’s net debt exceeded $4.0 billion from

the 100% EFFF payout. If the previous quarter net debt is below

$4.0 billion, Cenovus will target to return 100% of EFFF to

shareholders with no adjustment.

In order to efficiently manage working capital

and cash, the allocation of EFFF to shareholder returns in any of

the scenarios described above may be accelerated, deferred or

reallocated between quarters, while maintaining our target to, over

time, allocate 100% of EFFF to shareholder returns and sustain net

debt at $4.0 billion.

Dividend declarations and share purchases

The Board of Directors has declared a quarterly base dividend of

$0.180 per common share, payable on June 28, 2024 to shareholders

of record as of June 14, 2024.

The Board also declared a variable dividend of $0.135 per common

share to shareholders of record on May 17, 2024, payable on May 31,

2024.

In addition, the Board has declared a quarterly dividend on each

of the Cumulative Redeemable First Preferred Shares – Series 1,

Series 2, Series 3, Series 5 and Series 7 – payable on July 2, 2024

to shareholders of record as of June 14, 2024 as follows:

|

Preferred shares dividend summary |

|

Share series |

Rate (%) |

Amount ($/share) |

| Series 1 |

2.577 |

0.16106 |

| Series 2 |

6.711 |

0.41715 |

| Series 3 |

4.689 |

0.29306 |

| Series 5 |

4.591 |

0.28694 |

| Series 7 |

3.935 |

0.24594 |

| |

|

|

All dividends paid on Cenovus’s common and preferred shares will

be designated as “eligible dividends” for Canadian federal income

tax purposes. Declaration of dividends is at the sole discretion of

the Board and will continue to be evaluated on a quarterly

basis.

In the first quarter, the company returned $436 million to

shareholders, composed of $165 million through its normal

course issuer bid and $271 million through common and

preferred share dividends. In addition, the variable dividend will

deliver $251 million to shareholders in the second quarter.

2024 planned maintenance

The following table provides details on planned maintenance

activities at Cenovus assets through 2024 and anticipated

production or throughput impacts.

|

2024 planned maintenance |

|

Potential quarterly production/throughput impact

(Mbbls/d) |

|

|

Q2 |

Q3 |

Q4 |

Annualized impact |

| Upstream |

|

|

|

|

| Oil Sands |

11 - 14 |

42 - 47 |

6 - 10 |

13 - 16 |

| Atlantic |

8 - 10 |

8 - 10 |

— |

5 - 7 |

| Conventional |

3 - 5 |

4 - 6 |

— |

2 - 4 |

|

Downstream |

|

|

|

|

| Canadian Refining |

42 - 46 |

— |

— |

10 - 12 |

| U.S. Refining |

12 - 16 |

30 - 34 |

56 - 60 |

30 - 35 |

| |

|

|

|

|

Organizational updates

Geoff Murray, currently Senior Vice-President, Commercial, has

been promoted to Executive Vice-President, Commercial, and will

continue to report to the Chief Commercial Officer.

Jeff Hart, Executive Vice-President, Corporate & Operations

Services, has chosen to leave the organization to pursue

personal and other professional opportunities. Logan Popko,

currently Vice-President, Well Delivery, is being promoted to

Senior Vice-President, Corporate & Operations Services,

reporting to the Chief Operating Officer.

Sustainability

During the first quarter, Pathways Alliance began filing

regulatory applications to the Alberta Energy Regulator for the

proposed carbon capture and storage (CCS) project. The proposed CCS

project would be one of the world’s largest carbon sequestration

networks. Discussions with the federal and Alberta governments on

the co-investment mechanisms to support advancement of the CCS

project are ongoing.

Cenovus is a founding member of Pathways, a collaboration of

companies representing approximately 95% of Canadian oil sands

production. Members Cenovus, Canadian Natural, ConocoPhillips

Canada, Imperial, MEG Energy and Suncor share the goal of reducing

emissions from oil sands production in phases, on the path to

reaching net zero emissions from production by 2050.

| Conference call

today9 a.m. Mountain Time (11 a.m. Eastern Time)Cenovus

will host a conference call today, May 1, 2024, starting at 9 a.m.

MT (11 a.m. ET).To join the conference call without operator

assistance, please register here approximately 5 minutes in

advance to receive an automated call-back when the session

begins.Alternatively, you can dial 888-664-6383 (toll-free in North

America) or 416-764-8650 to reach a live operator who will join you

into the call. A live audio webcast will also be available and

archived for approximately 90 days.Cenovus will host its Annual

Meeting of Shareholders today, May 1, 2024, in a virtual format

beginning at 11 a.m. MT (1 p.m. ET). The webcast link to the

Shareholders Meeting is available under Presentations and Events in

the Investors section of cenovus.com. |

| |

Advisory

Basis of Presentation

Cenovus reports financial results in Canadian dollars and

presents production volumes on a net to Cenovus before royalties

basis, unless otherwise stated. Cenovus prepares its financial

statements in accordance with International Financial Reporting

Standards (IFRS) Accounting Standards.

Barrels of Oil Equivalent

Natural gas volumes have been converted to barrels of oil

equivalent (BOE) on the basis of six thousand cubic feet (Mcf) to

one barrel (bbl). BOE may be misleading, particularly if used in

isolation. A conversion ratio of one bbl to six Mcf is based on an

energy equivalency conversion method primarily applicable at the

burner tip and does not represent value equivalency at the

wellhead. Given that the value ratio based on the current price of

crude oil compared with natural gas is significantly different from

the energy equivalency conversion ratio of 6:1, utilizing a

conversion on a 6:1 basis is not an accurate reflection of

value.

Product types

|

Product type by operating segment |

|

|

Three months endedMarch 31,

2024 |

|

Oil Sands |

|

Bitumen (Mbbls/d) |

595.4 |

|

Heavy crude oil (Mbbls/d) |

17.9 |

|

Conventional natural gas (MMcf/d) |

11.9 |

|

Total Oil Sands segment production (MBOE/d) |

615.3 |

|

Conventional |

|

|

Light crude oil (Mbbls/d) |

5.3 |

|

Natural gas liquids (Mbbls/d) |

22.0 |

|

Conventional natural gas (MMcf/d) |

560.5 |

|

Total Conventional segment production

(MBOE/d) |

120.7 |

|

Offshore |

|

|

Light crude oil (Mbbls/d) |

7.2 |

|

Natural gas liquids (Mbbls/d) |

10.4 |

|

Conventional natural gas (MMcf/d) |

283.4 |

|

Total Offshore segment production (MBOE/d) |

64.9 |

|

Total upstream production (MBOE/d) |

800.9 |

Forward‐looking Information

This news release contains certain forward‐looking statements

and forward‐looking information (collectively referred to as

“forward‐looking information”) within the meaning of applicable

securities legislation about Cenovus’s current expectations,

estimates and projections about the future of the company, based on

certain assumptions made in light of the company’s experiences and

perceptions of historical trends. Although Cenovus believes that

the expectations represented by such forward‐looking information

are reasonable, there can be no assurance that such expectations

will prove to be correct.

Forward‐looking information in this document is identified by

words such as “anticipate”, “continue”, “deliver”, “expect”,

“focus”, “progress”, “target” and “will” or similar expressions and

includes suggestions of future outcomes, including, but not limited

to, statements about: deleveraging; decarbonizing; shareholder

returns; funds flow generation; downstream reliability; return of

production at the White Rose field; turnaround activity at the

Lloydminster Upgrader; growth and optimization projects; topside

completion and first production at the West White Rose project;

start-up of the Narrows Lake tie-back project; drilling well pads

at the Sunrise facility to increase production; increased

production at Foster Creek due to optimization; maintaining a

strong balance sheet; net debt; net debt to adjusted funds flow;

Cenovus’s shareholder returns framework; excess free funds flow;

planned maintenance; dividend payments; the proposed Pathways

Alliance carbon capture and storage pipeline; reducing emissions

from oil sands operations; and Cenovus’s 2024 corporate guidance

available on cenovus.com.

Developing forward‐looking information involves reliance on a

number of assumptions and consideration of certain risks and

uncertainties, some of which are specific to Cenovus and others

that apply to the industry generally. The factors or assumptions on

which the forward‐looking information in this news release are

based include, but are not limited to: the allocation of free funds

flow to reducing net debt; commodity prices, inflation and supply

chain constraints; Cenovus’s ability to produce on an unconstrained

basis; Cenovus’s ability to access sufficient insurance coverage to

pursue development plans; Cenovus’s ability to deliver safe and

reliable operations and demonstrate strong governance; and the

assumptions inherent in Cenovus’s 2024 corporate guidance available

on cenovus.com.

The risk factors and uncertainties that could cause actual

results to differ materially from the forward‐looking information

in this news release include, but are not limited to: the accuracy

of estimates regarding commodity production and operating expenses,

inflation, taxes, royalties, capital costs and currency and

interest rates; risks inherent in the operation of Cenovus’s

business; and risks associated with climate change and Cenovus’s

assumptions relating thereto and other risks identified under “Risk

Management and Risk Factors” and “Advisory” in Cenovus’s

Management’s Discussion and Analysis (MD&A) for the year ended

December 31, 2023.

Except as required by applicable securities laws, Cenovus

disclaims any intention or obligation to publicly update or revise

any forward‐looking statements, whether as a result of new

information, future events or otherwise. Readers are cautioned that

the foregoing lists are not exhaustive and are made as at the date

hereof. Events or circumstances could cause actual results to

differ materially from those estimated or projected and expressed

in, or implied by, the forward‐looking information. For additional

information regarding Cenovus’s material risk factors, the

assumptions made, and risks and uncertainties which could cause

actual results to differ from the anticipated results, refer to

“Risk Management and Risk Factors” and “Advisory” in Cenovus’s

MD&A for the periods ended December 31, 2023 and March 31,

2024, and to the risk factors, assumptions and uncertainties

described in other documents Cenovus files from time to time with

securities regulatory authorities in Canada (available on SEDAR+ at

sedarplus.ca, on EDGAR at sec.gov and Cenovus’s website at

cenovus.com).

Specified Financial Measures

This news release contains references to certain specified

financial measures that do not have standardized meanings

prescribed by IFRS Accounting Standards. Readers should not

consider these measures in isolation or as a substitute for

analysis of the company’s results as reported under IFRS Accounting

Standards. These measures are defined differently by different

companies and, therefore, might not be comparable to similar

measures presented by other issuers. For information on the

composition of these measures, as well as an explanation of how the

company uses these measures, refer to the Specified Financial

Measures Advisory located in Cenovus’s MD&A for the period

ended March 31, 2024 (available on SEDAR+ at sedarplus.ca, on EDGAR

at sec.gov and on Cenovus's website at cenovus.com) which is

incorporated by reference into this news release.

Upstream Operating Margin and Downstream Operating

Margin

Upstream Operating Margin and Downstream Operating Margin, and

the individual components thereof, are included in Note 1 to the

interim Consolidated Financial Statements.

Total Operating Margin

Total Operating Margin is the total of Upstream Operating Margin

plus Downstream Operating Margin.

| |

Upstream (1) |

|

Downstream (1) |

|

Total |

| ($

millions) |

Q1 2024 |

|

Q4 2023 |

|

Q1 2023 |

|

Q1 2024 |

|

Q4 2023 |

|

Q1 2023 |

|

Q1 2024 |

|

Q4 2023 |

|

Q1 2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Sales |

7,864 |

|

|

7,797 |

|

|

7,217 |

|

|

8,567 |

|

8,404 |

|

|

7,137 |

|

16,431 |

|

|

16,201 |

|

|

14,354 |

|

| Less: Royalties |

(747 |

) |

|

(902 |

) |

|

(596 |

) |

|

— |

|

— |

|

|

— |

|

(747 |

) |

|

(902 |

) |

|

(596 |

) |

| |

7,117 |

|

|

6,895 |

|

|

6,621 |

|

|

8,567 |

|

8,404 |

|

|

7,137 |

|

15,684 |

|

|

15,299 |

|

|

13,758 |

|

| Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Purchased Product |

771 |

|

|

663 |

|

|

838 |

|

|

7,219 |

|

7,888 |

|

|

5,991 |

|

7,990 |

|

|

8,551 |

|

|

6,829 |

|

| Transportation and Blending |

2,811 |

|

|

2,894 |

|

|

3,027 |

|

|

— |

|

— |

|

|

— |

|

2,811 |

|

|

2,894 |

|

|

3,027 |

|

| Operating |

898 |

|

|

864 |

|

|

1,029 |

|

|

787 |

|

826 |

|

|

754 |

|

1,685 |

|

|

1,690 |

|

|

1,783 |

|

| Realized (Gain) Loss on Risk

Management |

6 |

|

|

19 |

|

|

16 |

|

|

1 |

|

(6 |

) |

|

1 |

|

7 |

|

|

13 |

|

|

17 |

|

| Operating

Margin |

2,631 |

|

|

2,455 |

|

|

1,711 |

|

|

560 |

|

(304 |

) |

|

391 |

|

3,191 |

|

|

2,151 |

|

|

2,102 |

|

(1) Found in the March 31, 2024, or the December

31, 2023, interim Consolidated Financial Statements.

Adjusted Funds Flow, Free Funds Flow and

Excess Free Funds Flow

The following table provides a reconciliation of cash from (used

in) operating activities found in Cenovus’s Consolidated Financial

Statements to Adjusted Funds Flow, Free Funds Flow and Excess Free

Funds Flow. Adjusted Funds Flow per Share – Basic and Adjusted

Funds Flow per Share – Diluted are calculated by dividing Adjusted

Funds Flow by the respective basic or diluted weighted average

number of common shares outstanding during the period and may be

useful to evaluate a company’s ability to generate cash.

| |

Three Months Ended |

|

($ millions) |

Mar. 31, 2024 |

|

Dec. 31, 2023 |

|

Mar. 31, 2023 |

|

|

Cash From (Used in) Operating Activities (1) |

1,925 |

|

2,946 |

|

(286 |

) |

| (Add) Deduct: |

|

|

|

| Settlement of Decommissioning

Liabilities |

(48 |

) |

(65 |

) |

(48 |

) |

| Net Change in Non-Cash Working

Capital |

(269 |

) |

949 |

|

(1,633 |

) |

| Adjusted Funds

Flow |

2,242 |

|

2,062 |

|

1,395 |

|

| Capital Investment |

1,036 |

|

1,170 |

|

1,101 |

|

| Free Funds

Flow |

1,206 |

|

892 |

|

294 |

|

| Add (Deduct): |

|

|

|

| Base Dividends Paid on Common

Shares |

(262 |

) |

(261 |

) |

(200 |

) |

| Dividends Paid on Preferred

Shares |

(9 |

) |

(9 |

) |

(18 |

) |

| Settlement of Decommissioning

Liabilities |

(48 |

) |

(65 |

) |

(48 |

) |

| Principal Repayment of

Leases |

(70 |

) |

(72 |

) |

(70 |

) |

| Acquisitions, Net of Cash

Acquired |

(10 |

) |

(14 |

) |

(465 |

) |

| Proceeds From

Divestitures |

25 |

|

— |

|

8 |

|

| Excess Free Funds

Flow |

832 |

|

471 |

|

(499 |

) |

(1) Found in the March 31, 2024, or the December 31, 2023,

interim Consolidated Financial Statements.

Cenovus Energy Inc.

Cenovus Energy Inc. is an integrated energy company with oil and

natural gas production operations in Canada and the Asia Pacific

region, and upgrading, refining and marketing operations in Canada

and the United States. The company is focused on managing its

assets in a safe, innovative and cost-efficient manner, integrating

environmental, social and governance considerations into its

business plans. Cenovus common shares and warrants are listed on

the Toronto and New York stock exchanges, and the company’s

preferred shares are listed on the Toronto Stock Exchange. For more

information, visit cenovus.com.

Find Cenovus on Facebook, X, LinkedIn, YouTube and

Instagram.

Cenovus contacts

|

Investors |

Media |

|

Investor Relations general line403-766-7711 |

Media Relations general line403-766-7751 |

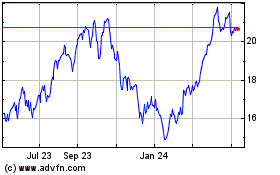

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Jan 2025 to Feb 2025

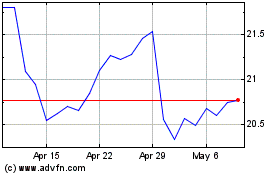

Cenovus Energy (NYSE:CVE)

Historical Stock Chart

From Feb 2024 to Feb 2025