CVR Energy - Value

December 02 2012 - 6:00PM

Zacks

A strong third-quarter performance for

CVR Energy Inc. (CVI)

sent all earnings estimates higher on the petroleum refiner in the

past 30 days. This Zacks #1 Rank (Strong Buy) also hit its 52-week

high on November 29. In addition, CVR Energy has a compelling

valuation and is a true value pick with a price-to-book (P/B) ratio

of 2.4, a price-to-sales (P/S) ratio of 0.5 and a price-to-earnings

(P/E) ratio of 6.4.

Stellar Q3 Results

On November 5, CVR Energy reported stellar third quarter

adjusted earnings of $2.95 per share that exceeded the Zacks

Consensus Estimate by 29.4%. The result also surged 90.3% from last

year. The outperformance was led by strong operating performances

across all refineries.

Total revenue surged 78.2% to $2,409.6 million in the quarter

from last year’s $1,352.0 million, which also surpassed the Zacks

Consensus Estimate of $2,161.0.

Earnings Momentum Trending Higher

All 4 earnings estimates for 2012 have moved north over the past

30 days, lifting the Zacks Consensus Estimate by 13.2% to $7.14 per

share. For 2013, the Zacks Consensus Estimate increased 15.2% to

$5.77 over the same period as all 4 earnings estimates moved

upward.

Impressive Valuation

The company has a price-to-book (P/B) ratio of 2.4 and a

price-to-sales (P/S) ratio of just 0.5. In addition, its forward

price-to-earnings (P/E) multiple of 6.4 is lower than the peer

group average of 8.0. A P/E below 15.0, a P/S ratio less than 1.0

and a P/B ratio under 3.0 generally indicate value.

CVR Energy has a trailing 12-month ROE of 41.4%, compared with

the peer group average of 20.9%. This suggests that the company

invests its earnings better than industry rivals. The stock also

looks attractive with respect to its trailing 12-month return on

assets (ROA) of 17.6% and return on investment (ROI) of 25.8%,

which are above the peer group averages of 7.3% and 15.1%,

respectively.

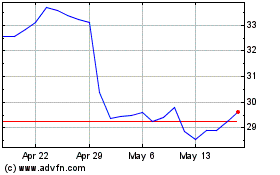

A Look at Chart

Shares of CVR Energy have been trading above the 50-day and

200-days moving averages. In particular, the continuous uptrend in

stock prices and the ever increasing gap between the share price

and the moving average since mid November indicate a bullish trend.

The year-to-date return for the stock is 144.1% compared with the

S&P 500 return of just 12.6%.

Headquartered in Sugar Land, Texas, CVR Energy, Inc. is an

independent refiner with more than 185,000 barrels per day of

processing capacity in the Mid-continent United States. With its

subsidiaries and affiliated businesses, the company operates

independent refining assets in Coffeyville, Kansas, and Wynnewood,

Oklahoma. CVR Energy also remains engaged in marketing high value

transportation fuels to customers through tanker trucks and

pipeline terminals, and a crude oil gathering system serving

Kansas, Missouri, Oklahoma, Nebraska and Texas. Through a limited

partnership - CVR Partners, L.P. (UAN), - it acts as a producer of

ammonia and urea ammonium nitrate, or UAN, fertilizers.

Want More of Our Best Recommendations?

Zacks' Executive VP, Steve Reitmeister, knows when key trades

are about to be triggered and which of our experts has the hottest

hand. Then each week he hand-selects the most compelling trades and

serves them up to you in a new program called Zacks

Confidential.

Learn More>>

CVR ENERGY INC (CVI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

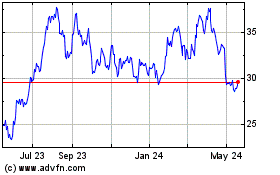

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jul 2023 to Jul 2024