Strong end to FY22 with revised FY23 plan

aimed at rapidly improving unit economics and extending cash

runway

- Strong UK Retail unit sales of ~17,750 in Q4, up 100%+ YoY

as consumers continue to shift online

- Q4 UK Revenues of ~£315m and ~£1,245m for FY22 despite

significant macroeconomic headwinds

- Continued UK Retail GPU improvement in Q4 to ~£600, as

efficiencies gained across the business

- Balance sheet remains strong with over £250m of cash &

cash equivalents on hand at end FY 2022

- New FY23 plan focused on improved unit economics and lower

retail volume of 40,000-50,000 units

- Plan anticipates advancement towards profitability goal

without need to raise capital in next 18-24m

Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or the “Company”), the

UK’s leading online car retailer, which makes buying and selling a

car as simple as ordering any other product online, has announced

its preliminary financial results for the three months ended

December 31, 2022.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230118005164/en/

Cazoo Single Car Transporter Line Up

(Photo: Business Wire)

Alex Chesterman OBE, Founder & CEO of Cazoo,

commented, “I am pleased with our progress in Q4 despite the

challenging economic backdrop. We had another strong quarter of UK

retail unit sales, up over 100% YoY, and we have now sold well over

100,000 cars entirely online in the UK in just 3 years since our

launch.

“We remain, however, extremely mindful of the current economic

environment and believe the right course of action for 2023 is to

focus on further improving our unit economics, reducing our fixed

cost base and maximising our cash runway. During 2022 we have

proven our ability to buy and sell cars at scale. Our new 2023

plan, which includes more modest top line ambitions, ensures that

we continue to improve our unit economics, reduces our fixed costs

and conserves cash as we make continued progress towards our goal

of reaching profitability, without the need to raise further

funding over the next 18-24 months.

“Whilst 2022 was a challenging year in many respects, our

continued strong growth, notable improvement in unit economics

during each quarter and market-leading consumer feedback gives us

strong confidence in the long-term opportunity for Cazoo. We also

remain on track and on budget with our withdrawal plan from the EU,

having disposed of our Italian and Spanish businesses and largely

wound down our French and German operations in Q4 2022.

Fourth Quarter 2022 Preliminary Financial and Strategic

highlights1

- Strong growth in UK Revenue to approximately £315 million in Q4

and £1,245m in FY 2022

- UK Retail revenue up strongly year on year as consumers

continue to embrace our proposition

- UK Wholesale revenue down year on year as we sell more

inventory through our retail channel

- UK Retail units sold of around ~17,750 in Q4 and ~65,000 in FY

2022

- Strong sales despite challenging economic backdrop demonstrates

strength of offering

- Now sold well over 100,000 cars entirely online in the UK in

just 3 years since launch

- Continued optimisation of business and operations as part of

progress towards goal of reaching profitability

- Strong UK Retail GPU of ~£600 in Q4 with continuous improvement

every quarter during 2022

- Over 50% of retail units sold in the period sourced directly

from consumers

- Withdrawal from EU markets on track and in line with budget

- Disposed of our Italian and Spanish businesses, resulting in

exits ahead of budget

- French and German operations largely wound down with exception

of subscription operations

- Cash, cash equivalents and self-funded vehicles of over £325m

at the end of 2022

- Balance sheet remains strong with £250m+ of cash and cash

equivalents on hand at end FY 2022

- Self-funded vehicles of £75m+, including ~£50m of subscription

inventory to be realised during 2023

Revised 2023 Plan

Over the past 12 months we have demonstrated our ability to buy

and sell cars at significant scale and consolidated our resources

on the UK market. Our positive momentum has continued into 2023,

and so far in January we have seen solid unit sales and record

finance and ancillary attachment rates. However, in the current

economic environment we believe the right course of action for 2023

is to focus on further improving our unit economics, reducing our

fixed cost base and maximising our cash runway.

Our revised FY 2023 plan, approved by the Board of Directors,

aims to rapidly improve the unit economics of the business. To

enable these improvements, we are resetting our 2023 top line

ambitions to 40,000-50,000 UK retail units, allowing us to focus on

higher margin and faster moving inventory and to rationalise our

operational footprint. Following this reset, we expect Retail unit

sales to return to growth in FY 2024 and beyond. In line with the

lower unit expectations for 2023 and the current economic climate,

we will be making our operational and logistics networks more

efficient through the closure of certain of our vehicle preparation

centre and customer centre facilities and making further headcount

reductions. This plan is in the process of being finalised and we

will provide more detailed information at the time of our FY 2022

results.

Importantly, this plan is expected to deliver a significant

reduction in our cash consumption and continued progress towards

our goal of reaching profitability, without the need to raise

further external funding over the next 18-24 months. We expect to

end 2023 with over £100m of cash and cash equivalents on our

balance sheet.

The UK used car market is the largest in Europe, worth over

£100bn annually. Digital penetration remains materially below

almost all other retail sectors and we believe that our market

leading platform, brand, team and infrastructure position us well

to realise our ambition of achieving a 5% or greater share of the

UK used car market over time.

Changes to Management and Board of Directors

Effective from the start of April, the roles of Executive

Chairman and Chief Executive Officer will be split with Alex

Chesterman continuing in the role of full time Executive Chairman

and Paul Whitehead, currently Chief Operating Officer, taking on

the role of Chief Executive Officer. The splitting of these roles,

which is customary, will allow Alex to focus on the strategic

direction of the Company and Paul to focus on the day-to-day

operations of the business and unit economics improvements.

Effective from close of business on January 31, 2023, David

Hobbs will step down from the Board of Directors. Mary Reilly will

join the Board as a Class I director effective February 1, 2023, to

serve for the remainder of the full term of a Class I director.

Effective February 1, 2023, Mary will be appointed as a member of

the Nominating and Corporate Governance Committee and the Audit

Committee and will be appointed as Chair of the Audit Committee

following completion of the 2022 audit. Mary is currently a Board

member and Audit Chair of companies including MITIE Plc, Essentra

Plc and Mar Holdco Sarl. She is also a non-executive director at

Gemfields plc. Previously Mary was a non-executive Director and

Audit Chair at several companies including Travelzoo Inc, Ferrexpo

Plc, Cape Plc and a main Board Director of the Department of

Transport.

Share Consolidation Plan

The Board has approved plans to undertake a share consolidation

exercise in order to reduce the number of shares outstanding and

bring the Company’s share price back into compliance with the

continued listing standards set forth in Rule 802.01C of the NYSE

Listed Company Manual that require listed companies to maintain an

average closing share price of at least $1.00 over a consecutive 30

trading-day period. The Company will be providing more information

to shareholders in the near future.

Conference Call

Cazoo will host a conference call today, January 18, 2023, at 8

a.m. ET. Investors and analysts interested in participating in the

call are invited to dial 1-877-704-6255, or for international

callers, 1-215-268-9947. A webcast of the call will also be

available on the investor relations page of the Company’s website

at https://investors.cazoo.co.uk.

About Cazoo - www.cazoo.co.uk

Our mission is to transform the car buying and selling

experience across the UK by providing better selection, value,

transparency, convenience and peace of mind. Our aim is to make

buying or selling a car no different to ordering any other product

online, where consumers can simply and seamlessly buy, sell or

finance a car entirely online for delivery or collection in as

little as 72 hours. Cazoo was founded in 2018 by serial

entrepreneur Alex Chesterman OBE and is a publicly traded company

(NYSE: CZOO).

Forward-Looking Statements

This communication contains “forward-looking statements” within

the meaning of the “safe harbour” provisions of the Private

Securities Litigation Reform Act of 1995. The expectations,

estimates, and projections of the business of Cazoo may differ from

its actual results and, consequently, you should not rely on

forward-looking statements as predictions of future events. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: (1) the implementation of and expected benefits from

our business realignment plan, the winddown of operations in

mainland Europe, the revised 2023 plan, and other cost-saving

initiatives; (2) realizing the benefits expected from the business

combination (the “Business Combination”) with Ajax I; (3) reaching

and maintaining profitability in the future; (4) global inflation

and cost increases for labor, fuel, materials and services; (5)

geopolitical and macroeconomic conditions and their impact on

prices for goods and services and on consumer discretionary

spending; (6) having access to suitable and sufficient vehicle

inventory for resale to customers and reconditioning and selling

inventory expeditiously and efficiently; (7) availability of credit

for vehicle and other financing and the affordability of interest

rates; (8) increasing Cazoo’s service offerings and price

optimization; (9) effectively promoting Cazoo’s brand and

increasing brand awareness; (10) expanding Cazoo’s product

offerings and introducing additional products and services; (11)

enhancing future operating and financial results; (12) achieving

our long-term growth goals; (13) acquiring and integrating other

companies; (14) acquiring and protecting intellectual property;

(15) attracting, training and retaining key personnel; (16)

complying with laws and regulations applicable to Cazoo’s business;

(17) successfully deploying the proceeds from the Business

Combination and the issuance of $630 million of convertible notes

to an investor group led by Viking Global Investors; and (18) other

risks and uncertainties set forth in the sections entitled “Risk

Factors” and “Forward-Looking Statements” in the Reports on Form

6-K filed with the U.S. Securities and Exchange Commission (the

“SEC”) by Cazoo Group Ltd on June 9, 2022 and September 8, 2022 and

in subsequent filings with the SEC. The foregoing list of factors

is not exhaustive. You should carefully consider the foregoing

factors and the disclosure included in other documents filed by

Cazoo from time to time with the SEC. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak

only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Cazoo assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. Cazoo gives no assurance that it will

achieve its expectations.

Cautionary Statement

The financial results for three months and full year ended

December 31, 2022, presented in this announcement are preliminary

and unaudited. Our actual results may differ from these preliminary

and unaudited results due to the completion of our financial

closing procedures, final adjustments, external auditor review of

the financial data and other developments that may arise between

the date of this press release and the time that financial results

for the three months and full year ended December 31, 2022, are

finalized. Our actual results for the three months and full year

ended December 31, 2022, may differ materially from the preliminary

and unaudited results disclosed herein (including as a result of

year-end closing and audit procedures and review adjustments) and

are not necessarily indicative of the results to be expected for

any future period. Accordingly, you should not place undue reliance

upon this information. Preliminary financial results are subject to

risks and uncertainties, many of which are not within our control.

The preliminary and unaudited results included herein have been

prepared by, and are the responsibility of, our management. Our

independent registered public accounting firm has not audited,

reviewed, compiled, or performed any procedures with respect to

this information. Accordingly, our independent registered public

accounting firm does not express an opinion or any other form of

assurance with respect thereto.

1 As a result of the decision made during Q3 2022 to withdraw

from its EU operations the Company will report its European segment

as discontinued operations in the FY 2022 results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230118005164/en/

Investor Relations: Cazoo: Robert Berg, Director of

Investor Relations and Corporate Finance, investors@cazoo.co.uk

ICR: cazoo@icrinc.com

Media: Cazoo: Lawrence Hall, Group Communications

Director, lawrence.hall@cazoo.co.uk Brunswick: Chris

Blundell/Simone Selzer +44 20 7404 5959 /

cazoo@brunswickgroup.com

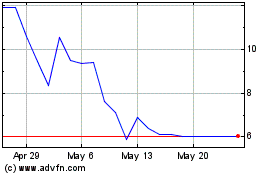

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Feb 2024 to Feb 2025