Cazoo Receives Non-compliance Notice from NYSE Regarding 20-F Filing Delinquency

May 21 2024 - 8:09AM

Business Wire

Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or “the Company”), the UK

online used car platform, announces receipt of a written notice

(the “Notice”) from the New York Stock Exchange (the “NYSE”) on May

16, 2024 stating that the Company is not in compliance with the

NYSE continued listing standards set forth in Section 802.01E of

the NYSE Listed Company Manual, which requires timely filing of all

required periodic reports with the Securities and Exchange

Commission (the “SEC”), because of the Company’s failure to timely

file its Form 20-F for the fiscal year ended December 31, 2023 (the

“2023 Form 20-F”).

As previously disclosed on May 1, 2024, Cazoo was unable to file

its 2023 Form 20-F on or before the prescribed filing date without

unreasonable effort or expense. As a result of the significant

amount of time devoted by management to pursue strategic

initiatives, and the Company’s pivot to the marketplace model,

which has also required a dedication of the Company’s limited

personnel and resources, and because of our liquidity concerns

whereby we would not be able to demonstrate our ability to continue

as a going concern in the medium- to long-term, the Company was

unable to complete the preparation and review of its financial

statements and disclosures for the 2023 Form 20-F. Moreover, as a

result of the foregoing, the Company does not currently intend to

file the 2023 Form 20-F.

In accordance with Section 802.01E of the NYSE Listed Company

Manual, the NYSE will closely monitor the status of the Company’s

late filing and related public disclosures for up to six months

from the date of the filing delinquency (the “Initial Cure

Period”). The Company’s Class A ordinary shares will continue to

trade on the NYSE during the Initial Cure Period, subject to the

Company’s compliance with other continued listing requirements.

Notwithstanding the foregoing, if circumstances warrant, the NYSE

may commence delisting proceedings at any time.

Forward-Looking Statements

This communication contains “forward-looking statements”. The

expectations, estimates, and projections of the business of Cazoo

may differ from its actual results and, consequently, you should

not rely on forward-looking statements as predictions of future

events. These forward-looking statements generally are identified

by the words “plan,” “seek,” “intend,” “will,” “could,” and similar

expressions. Forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks and uncertainties. Many factors could cause actual

future events to differ materially from the forward-looking

statements in this press release, including but not limited to: (1)

our ability to complete the winding up in a timely manner; (2) that

our shareholders will not realize any value in the Company’s

shares; (3) the holders of our Senior Secured Notes will have

significant influence over all shareholder votes, and they, as

secured creditors, will have interests different from our

shareholders; (4) that our warrantholders will receive nothing for

their warrants; (5) the likelihood that our creditors will not

receive a full recovery in connection with our winding up; (6) the

risk that our shareholders will not be able to buy or sell shares

after we close our share transfer books in connection with the

Cayman Island winding-up process; (7) our directors and officers

will continue to receive benefits from the Company during the

winding up; (8) the impact of business uncertainties in connection

with the winding up; (9) the risk that we may have liabilities or

obligations about which we are not currently aware; (10) the risk

that the cost of settling our liabilities and contingent

obligations could be higher than anticipated; and (11) other risks

and uncertainties set forth in the sections entitled “Risk Factors”

and “Cautionary Note Regarding Forward-Looking Statements” in the

Form 6-K filed on March 6, 2024 and in subsequent filings with the

SEC. The foregoing list of factors is not exhaustive. You should

carefully consider the foregoing factors and the disclosure

included in other documents filed by Cazoo from time to time with

the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to

differ materially from those contained in the forward-looking

statements. Forward-looking statements speak only as of the date

they are made. Readers are cautioned not to put undue reliance on

forward-looking statements, and Cazoo assumes no obligation and

does not intend to update or revise these forward-looking

statements, whether as a result of new information, future events,

or otherwise. Cazoo gives no assurance that it will achieve its

expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521368249/en/

Investor Relations: Cazoo:

investors@cazoo.co.uk Media: Cazoo:

press@cazoo.co.uk Jess Reid – Teneo +44 (0) 7919 685287 Anthony Di

Natale – Teneo +44 (0) 7880 715975

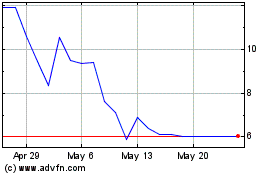

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Jan 2024 to Jan 2025