UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2024

Commission File Number: 001-40754

Cazoo Group Ltd

(Exact Name of Registrant as Specified in Its Charter)

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman, KY1-1104

Cayman Islands

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

CAZOO GROUP LTD |

| |

|

| Date: June 21, 2024 |

By: |

/s/ Gareth Purnell |

| |

|

Name: |

Gareth Purnell |

| |

|

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Cazoo Group Ltd

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman, KY1-1104

Cayman Islands

June 21, 2024

Dear Shareholder:

You

are cordially invited to attend an Extraordinary General Meeting of Shareholders of Cazoo Group Ltd (“we,” “us,”

“our,” or the “Company”), which will be held at 2:00 p.m. GMT on Tuesday, July 2, 2024 at 100 Bishopsgate

London EC2P 2SR and via live webcast at www.virtualshareholdermeeting.com/CZOO2024SM (the “Extraordinary General Meeting”).

You will be able to vote during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/CZOO2024SM and inputting

your unique 16-digit control number. If you desire to attend the meeting, see page 10 below.

The purpose of the Extraordinary

General Meeting is to approve the voluntary winding up of the Company (the “Winding Up”) and, in connection with the Winding

Up, to approve the appointment of Neema Griffin and David Soden as joint voluntary liquidators (the “Voluntary Liquidators”)

and the remuneration of the Voluntary Liquidators. The formal notice of the Extraordinary General Meeting and the Proxy Statement has

been made a part of this invitation.

The board of directors (the

“Board”) of Cazoo Group Ltd has unanimously determined that the Winding Up, the appointment of the Voluntary Liquidators,

and the remuneration of the Voluntary Liquidators is advisable and in the best interests of the Company and its stakeholders and directed

that the Winding Up Proposal be submitted to the Company’s shareholders for approval. The Board unanimously recommends that you

vote “FOR” the proposal to approve the Winding Up, the appointment of the Voluntary Liquidators and the remuneration of the

Voluntary Liquidators.

More information about the

Winding Up, the Voluntary Liquidators and the Extraordinary General Meeting is contained in the accompanying Proxy Statement. In particular,

you should carefully read the section titled “Risk Factors” beginning on page 12 of the Proxy Statement for a discussion

of risks you should consider in evaluating the Winding Up.

It is important that your

shares be represented and voted at the Extraordinary General Meeting. After reading the Proxy Statement, please promptly vote. Your

shares cannot be voted unless you vote by Internet, telephone or email, vote as instructed by your broker, or vote your shares at the

Extraordinary General Meeting.

If you are a shareholder of

record, you may request copies of the Notice of Extraordinary General Meeting of Shareholders, Proxy Statement and your proxy card (including

your 16-digit control number) by writing to ShareholderMeeting@Cazoo.co.uk.

Sincerely,

| /s/ Gareth Purnell |

|

| Gareth Purnell |

|

Chief Financial Officer

Cazoo Group Ltd

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman, KY1-1104

Cayman Islands

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON JULY 2, 2024

To Our Shareholders:

You

are cordially invited to attend an Extraordinary General Meeting of Shareholders of Cazoo Group Ltd (“we,” “us,”

“our,” or the “Company”), which will be held at 2:00 p.m. GMT on Tuesday, July 2, 2024 at 100 Bishopsgate

London EC2P 2SR and via live webcast at www.virtualshareholdermeeting.com/CZOO2024SM (the “Extraordinary General Meeting”).

You will be able to vote during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/CZOO2024SM and inputting

your unique 16-digit control number. If you desire to attend the meeting, see page 10 below.

The matters to be considered

at the Extraordinary General Meeting are:

| 1. | Winding Up Proposal. As an ordinary resolution, as follows (the “Winding Up Proposal”): |

“RESOLVED AS AN ORDINARY RESOLUTION

THAT:

| a) | The Company be placed in voluntary winding up, on the basis that it is unable to pay its debts; |

| b) | Neema Griffin and David Soden be appointed joint voluntary liquidators (collectively the “Voluntary

Liquidators”) of the Company with the power to act individually or jointly and severally; and |

| c) | the remuneration of the Voluntary Liquidators, as set out in the Schedule of Hourly Rates, be ratified

and approved. |

| 2. | Adjournment Proposal. As an ordinary resolution, the adjournment of the meeting to a later date

or dates, if necessary, to permit further solicitation and vote of proxies if there are not sufficient votes at the time of the Extraordinary

General Meeting to approve the Winding Up Proposal (the “Adjournment Proposal”). |

The holders of our $200 million

aggregate principal amount of 4.00%/2.00% cash/payment-in-kind toggle senior secured notes due 2027 (the “Senior Secured Notes”)

own 92%, in the aggregate, of the Company’s outstanding Class A ordinary shares and two of the holders own, in the aggregate, in

excess of 58% of our outstanding Class A ordinary shares and therefore will have significant influence over all shareholder votes, including

the matters submitted to the Extraordinary General Meeting. The Senior Secured Notes are secured by a substantial portion of the assets

of the Company and its subsidiaries, and as such, the holders

of our Senior Secured Notes, as secured creditors, will have interests different from our shareholders who are not secured creditors.

These items of business are

described in the Proxy Statement that follows this notice. Shareholders of record at the close of business on May 31, 2024 (the “Record

Date”) are entitled to notice of and to vote at the Extraordinary General Meeting and any adjournments or postponements of the Extraordinary

General Meeting. The Extraordinary General Meeting may transact such other business as may properly come before the meeting and any and

all postponements or adjournments thereof.

Your vote is important. Voting

your shares will ensure the presence of a quorum at the Extraordinary General Meeting. Please promptly vote your Class A ordinary

shares by following the instructions for voting by completing, signing, dating and returning your proxy card via email to ShareholderMeeting@Cazoo.co.uk

or by voting as described above. A proxy card must be received no later than July 1, 2024. If you are a shareholder of record, you

may request copies of the Notice of Extraordinary General Meeting of Shareholders, Proxy Statement and your proxy card (including your

16-digit control number), by writing to ShareholderMeeting@Cazoo.co.uk.

By Order of Board of Directors,

| /s/ Gareth Purnell |

|

| Gareth Purnell |

|

Chief Financial Officer

This Notice of Extraordinary

General Meeting of Shareholders and Proxy Statement are first being made available to shareholders on or about June 21, 2024 and are available

on our website at https://www.cazoogroupltd-shareholders.co.uk/.

TABLE OF CONTENTS

| |

|

Page |

| INFORMATION CONCERNING VOTING AND SOLICITATION |

|

1 |

| ABOUT THIS PROXY STATEMENT |

|

2 |

| QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE EXTRAORDINARY GENERAL MEETING |

|

3 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

11 |

| RISK FACTORS |

|

12 |

| PROPOSAL 1: THE WINDING UP PROPOSAL |

|

14 |

| PROPOSAL 2: THE ADJOURNMENT PROPOSAL |

|

20 |

| PRINCIPAL SECURITYHOLDERS |

|

21 |

| OTHER MATTERS |

|

23 |

| WHERE YOU CAN FIND Additional Information |

|

23 |

Cazoo Group Ltd

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman, KY1-1104

Cayman Islands

PROXY STATEMENT

FOR THE EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

INFORMATION CONCERNING VOTING AND SOLICITATION

This Proxy Statement is being

furnished to you in connection with the solicitation by the board of directors (the “Board”) of Cazoo Group Ltd, an exempted

company incorporated under the laws of the Cayman Islands (“Cazoo,” “we,” “us,” “our”

or the “Company”), of proxies to be used at the Extraordinary General Meeting of Shareholders of the Company to be held at

2:00 p.m. GMT on Tuesday, July 2, 2024 at 100 Bishopsgate London EC2P 2SR and via live

webcast at www.virtualshareholdermeeting.com/CZOO2024SM (the “Extraordinary General Meeting”).

This Proxy Statement is first

being made available to shareholders on June 21, 2024 and is available on our website at https://www.cazoogroupltd-shareholders.co.uk/.

IMPORTANT

Please promptly vote by

Internet, telephone or email, or by following the instructions provided by your broker, bank or nominee, so that your shares can be represented

at the Extraordinary General Meeting.

Shareholders of record will need their 16-digit

control number to vote. You may vote in one of the following ways:

|

Internet |

|

Telephone |

|

Email |

|

At the Extraordinary General Meeting |

| Shareholders can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card |

|

Shareholders can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card |

|

Shareholders can vote by email by signing, dating and returning their proxy card to ShareholderMeeting@Cazoo.co.uk |

|

Shareholders can vote their shares during the Extraordinary General Meeting either in person (if registered to attend by June 28, 2024) or via the Internet by following the instructions at www.virtualshareholdermeeting.com/CZOO2024SM |

If you are a shareholder

of record, you may request copies of the Notice of Extraordinary General Meeting of Shareholders, Proxy Statement and your proxy card

(including your 16-digit control number), by writing to ShareholderMeeting@Cazoo.co.uk. As stated above, the Proxy Statement is first

being made available to shareholders on June 21, 2024 and is available on our website at https://www.cazoogroupltd-shareholders.co.uk/.

If your shares are held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or

otherwise vote through the bank or broker.

ABOUT THIS PROXY STATEMENT

This document constitutes

a Notice of the Extraordinary General Meeting and a Proxy Statement with respect to the Extraordinary General Meeting of Cazoo Group Ltd

at which Cazoo shareholders are being asked to consider and vote upon a proposal to approve the Winding Up Proposal, among other matters.

References to “U.S.$,”

“U.S. Dollars,” “USD” and “$” in this Proxy Statement are to United States dollars, the legal currency

of the United States. References to “Pound(s) Sterling,” “GBP” and “£” in this Proxy Statement

are to the legal currency of the United Kingdom. Any discrepancies in any table between totals and sums of the amounts listed are due

to rounding. Certain amounts and percentages have been rounded; consequently, certain figures may add up to be more or less than the total

amount and certain percentages may add up to be more or less than 100% due to rounding. In particular and without limitation, amounts

expressed in millions contained in this Proxy Statement have been rounded to a single decimal place for the convenience of readers.

Any financial information

of the Company and its consolidated subsidiaries contained herein are unaudited and provided for informational purposes only, and final

calculations may differ from the information presented, which could be material.

QUESTIONS AND ANSWERS ABOUT

THE PROXY MATERIALS AND THE EXTRAORDINARY GENERAL MEETING

Why am I receiving this Proxy Statement?

The Company is soliciting

your proxy to vote at the Extraordinary General Meeting that Cazoo is holding to seek shareholder approval of the Winding Up Proposal

and the Adjournment Proposal, as described in further detail herein. This Proxy Statement summarizes the information you need to vote

at the Extraordinary General Meeting. You do not need to attend the Extraordinary General Meeting to vote your shares.

See the sections entitled

“Proposal 1: The Winding Up Proposal” and “Proposal 2: The Adjournment Proposal.”

What is the purpose of the Extraordinary General Meeting?

At the Extraordinary General

Meeting, shareholders will vote on the matters described in the accompanying Notice of Extraordinary General Meeting of Shareholders and

this Proxy Statement. The only matters expected to be voted upon at the Extraordinary General Meeting are the Winding Up Proposal and

the Adjournment Proposal.

The Company is proposing the

Winding Up and asking shareholders to approve the Winding Up Proposal because we believe that we are unable to continue our ongoing operations,

and are unable to pay our debts, with our current cash and anticipated future cash flow balanced against our liabilities. We have been

unable to secure additional equity, debt or other financing or sell the Company at a price which would repay our outstanding indebtedness.

The Board has a duty to take the actions that it believes will result in the best recovery for Cazoo’s creditors. The Board has

therefore deemed it advisable and in the best interests of Cazoo and its stakeholders to effectuate the Winding Up. The Company believes

that the Winding Up presents the best opportunity for the highest possible recovery under the circumstances for all creditors.

Holders of our Senior Secured

Notes also hold approximately 92% of our outstanding ordinary shares, and therefore will have significant influence over the proposals

presented at the meeting. If the Winding Up Proposal is approved by our shareholders, the Voluntary Liquidators will be appointed and

all of the powers of the directors shall cease. As required under Cayman Islands law, in order for the Voluntary Liquidators to bring

the liquidation under the supervision of the Grand Court of the Cayman Islands (the “Court”) (see below), the Voluntary Liquidators

must be independent professionals with certain qualifications as required under Cayman Islands law, who will act as agents for Cazoo in

the Winding Up.

Why is Cazoo seeking a shareholder vote on

the Winding Up Proposal?

Under Section 116 of the Companies

Act (As Revised) (the “Companies Act”) of the Cayman Islands, a company incorporated and registered under the Companies Act

may be wound up voluntarily if the company, in a general meeting, resolves by ordinary resolution that it will be wound up voluntarily

because it is unable to pay its debts. The Board considers that this shareholder vote is the most efficient way to commence the Winding

Up process, which is in turn appropriate for the reasons described above.

Why is Cazoo seeking a shareholder vote on

the Adjournment Proposal?

Adjourning the Extraordinary

General Meeting to a later date will give the Company additional time to solicit proxies and obtain sufficient votes in favor of approval

of the Winding Up Proposal if there are not sufficient votes to approve such proposal at the time of the Extraordinary General Meeting.

Consequently, Cazoo is seeking your approval of the Adjournment Proposal to ensure that, if necessary, Cazoo will have enough time to

solicit the required votes for approval of the Winding Up Proposal.

What will happen if the Winding Up is approved?

If the Winding Up is approved

by our shareholders, the Voluntary Liquidators will be appointed immediately and a number of steps must be undertaken within 28 days of

the commencement of the Winding Up: (a) notice of the appointment of the Voluntary Liquidators must be published in the Cayman Islands

Official Gazette, which will invite creditors of the Company to submit to the liquidator details of their claims against the Company;

(b) notice of the Winding Up must be filed with the Cayman Islands Registrar of Companies; and (c) the Voluntary Liquidators’ consents

to act must be filed with the Cayman Islands Registrar of Companies before their appointments can become effective. In addition, because

the directors will be unable to sign declarations as to the Company’s solvency, the Voluntary Liquidators will be required to apply

to the Court to continue the Winding Up under the supervision of the Court, at which point the liquidation will continue as an “official

liquidation.”

The Voluntary Liquidators

will owe personal duties to maximize the returns to those with an economic interest in the Company. The Voluntary Liquidators will act

as agents of the Company and their authority to bind the Company will displace the authority of the directors to do so. Cayman Islands

law gives the Voluntary Liquidators wide powers to deal with the affairs of the Company (in some cases, once the liquidation is brought

under the supervision of the Court, with the sanction of the Court). The Voluntary Liquidators will liquidate any remaining assets and

satisfy or make reasonable provisions for the Company’s remaining obligations. The Company does not presently expect that there

will be any remaining proceeds for our shareholders.

What are the recommendations of the Board for

how I should vote my shares?

The Board unanimously recommends

that you vote “FOR” the Winding Up Proposal and “FOR” the Adjournment Proposal.

Will shareholders receive payments of liquidating

distributions?

The Company does not expect

that there will be any distributions for our shareholders.

Will warrant holders receive payments of liquidating

distributions?

The Company does not expect

that there will be any distributions for our warrant holders.

Will option holders receive payments of liquidating

distributions?

The Company does not expect

that there will be any distributions for our option holders.

What is the listing status of the Company?

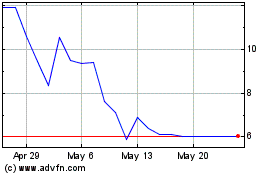

The Company’s Class

A ordinary shares were delisted by the NYSE effective on June 3, 2024. The Company’s Class A ordinary shares are currently trading

on the OTC Pink Marketplace.

If the Winding Up is approved

by our shareholders, we will immediately close our share transfer books (the “Effective Time”). After the Effective Time,

we will not record any further transfers of our ordinary shares, unless approved by the Court, and we will not issue any new stock certificates,

other than replacement certificates. In addition, after the Effective Time, we will not issue any ordinary shares upon exercise of outstanding

options or warrants.

Do I have appraisal rights in connection with

the Winding Up?

No. Neither Cayman Islands

law nor our Amended and Restated Articles of Association (the “Articles”) provide for appraisal or other similar rights for

dissenting shareholders in connection with the Winding Up, and we do not intend to independently provide shareholders with any such right.

Who are the proposed Voluntary Liquidators?

The proposed Voluntary Liquidators

are Ms. Neema Griffin of Teneo in the Cayman Islands and Mr. David Soden of Teneo in London. Ms. Griffin and Mr. Soden are both experienced

insolvency practitioners, whom the Company considers to be qualified appropriate appointees for this role. The Company also believes that

Ms. Griffin and Mr. Soden meet the independence, professional qualification, residency and insurance requirements prescribed by Cayman

Islands law for Court-supervised liquidations.

The Company also believes

that there are highly likely to be efficiencies in engaging Voluntary Liquidators associated with Teneo because individuals from Teneo

have been appointed as administrators of certain of the Company’s subsidiaries in the UK.

What is the proposed remuneration of the Voluntary

Liquidators?

The Schedule of Hourly Rates

of Ms. Neema Griffin of Teneo (Cayman) Limited and Mr. David Soden of Teneo Financial Advisory Limited acting as Joint Voluntary Liquidators

of Cazoo Group Ltd, and the members of their staff (exclusive of any applicable taxes) are shown in the table below:

| Level | |

Hourly Rate (USD) | |

| Senior Managing Director / Appointee | |

| 1,025 | |

| Managing Director | |

| 985 | |

| Director | |

| 810 | |

| Associate Director | |

| 680 | |

| Manager | |

| 570 | |

| Senior Consultant | |

| 525 | |

| Consultant | |

| 400 | |

| Administrator | |

| 230 | |

| Associate Consultant | |

| 205 | |

Are there any risks related to the Winding

Up?

Yes. You should carefully

review the section titled “Risk Factors” beginning on page 12 of this Proxy Statement for a description of risks

related to the Winding Up.

What will happen to our ordinary shares if

the Winding Up is approved?

From and after the Effective

Time, and subject to applicable law, each holder of ordinary shares shall cease to have any rights in respect of those shares, except

the right to receive distributions. However, the Company does not expect that there will be any remaining proceeds for our shareholders.

At the Effective Time, our

share transfer records shall be closed, and we will not record or recognize any transfer of our ordinary shares occurring after the Effective

Time, unless the Court otherwise orders. Under Cayman Islands law, no shareholder shall have any appraisal rights in connection with the

Winding Up.

We expect the Voluntary Liquidators

to file notice of their appointment and “consent to act” with the Cayman Islands Registrar of Companies, as well as their

application to bring the liquidation under the supervision of the Court, as soon as reasonably practicable after the Winding Up is approved

by our shareholders.

Will there be any other items of business on

the agenda?

As of the date of this Proxy

Statement, we do not know of any matters to be properly presented at the Extraordinary General Meeting other than those referred to in

this Proxy Statement. If other matters are properly presented at the meeting or any adjournment or postponement thereof for consideration,

and you are a shareholder of record and have submitted a proxy card, the persons named in your proxy card will have the discretion to

vote on those matters for you.

When does the Company expect the Winding Up

to be completed?

It is currently expected that

the Winding Up will be completed in the second half of 2024. However, this will largely depend upon the progress and timing of the administration

processes in the United Kingdom.

When and where will the Extraordinary General

Meeting be held?

The Extraordinary General

Meeting will be held at 2:00 p.m. GMT on Tuesday, July 2, 2024 at 100 Bishopsgate London EC2P

2SR and via live webcast at www.virtualshareholdermeeting.com/CZOO2024SM. You will be able to vote during the meeting

via live webcast by visiting www.virtualshareholdermeeting.com/CZOO2024SM.

Who is entitled to vote at the Extraordinary

General Meeting?

Shareholders of record holding

Class A ordinary shares as of the close of business on May 31, 2024 (the “Record Date”) are entitled to receive notice of,

attend, and vote at the Extraordinary General Meeting and any postponement or adjournment thereof.

At the close of business on

the Record Date, 4,898,984 of our Class A ordinary shares were issued and outstanding and entitled to vote. On the basis that voting

at the Extraordinary General Meeting will be conducted by way of a poll, each Class A ordinary share issued and outstanding as of

the close of business on the Record Date is entitled to one (1) vote on each resolution at the Extraordinary General Meeting. You

will need to obtain your own Internet access if you choose to attend the Extraordinary General Meeting online and/or vote over the Internet.

Copies of the proxy materials will be posted to the Company’s website.

Are holders of warrants able to vote?

No. Only holders of Cazoo’s

Class A ordinary shares are able to vote on the proposals.

Are holders of stock options able to vote?

No. Only holders of Cazoo’s

Class A ordinary shares are able to vote on the proposals.

What is the difference between being a “record

holder” and holding shares in “street name”?

A record holder (also called

a “registered holder”) holds their Class A ordinary shares in his or her name. Class A ordinary shares held in “street

name” means that such Class A ordinary shares are held in the name of a bank, broker or other nominee on the holder’s behalf.

How do I vote my shares and what are the

voting deadlines?

Shareholders of record will need their 16-digit control number to vote. If you are a shareholder of

record, there are four ways to vote:

| |

1. |

By Internet — You can vote over the Internet at www.proxyvote.com by following the instructions on the proxy card; |

| |

2. |

By Telephone — You can vote by telephone by calling 1-800-690-6903 and following the instructions on the proxy card; |

| |

3. |

By Email — You can vote by email by signing, dating and returning the proxy card to ShareholderMeeting@Cazoo.co.uk; or |

| |

4. |

At the Extraordinary General Meeting — Shareholders

can vote their shares during the Extraordinary General Meeting either in person (if registered to attend by June 28, 2024) or

via the Internet by following the instructions at www.virtualshareholdermeeting.com/CZOO2024SM |

If you are a shareholder of

record, you may request copies of the Notice of Extraordinary General Meeting of Shareholders, Proxy Statement and your proxy card (including

your 16-digit control number), by writing to ShareholderMeeting@Cazoo.co.uk. As stated above, the Proxy Statement is first being made

available to shareholders on June 21, 2024 and is available on our website at https://www.cazoogroupltd-shareholders.co.uk/.

Telephone and Internet voting

facilities for shareholders of record will be available 24 hours a day and will close at 11:59 p.m. ET on July 1, 2024.

A proxy card must be received no later than July 1, 2024. Even if you plan to attend the Extraordinary General Meeting, we encourage

you to vote your shares by proxy. You may still vote your shares at the meeting (if registered to attend by June 28, 2024) even if you

have previously voted by proxy. If you do not register to attend the Extraordinary General Meeting by June 28, 2024, you will not be permitted

to attend the Extraordinary General Meeting.

If your Class A ordinary shares

are held in the name of a bank, broker or other holder of record, you will receive instructions on how to vote from the bank, broker or

holder of record. You must follow the instructions of such bank, broker or holder of record in order for your shares to be voted.

Can I revoke or change my vote after I

submit my proxy?

Yes. Whether you have voted

by Internet, telephone or email, if you are a shareholder of record, you may change your vote and revoke your proxy by:

| |

1. |

sending a written statement to that effect to the attention of our Company Secretary at our corporate offices, provided such statement is received no later than July 1, 2024; |

| |

2. |

voting again by Internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m. ET on July 1, 2024; |

| |

3. |

submitting a properly signed proxy card with a later date that is received no later than July 1, 2024; or |

| |

4. |

attending the Extraordinary General Meeting, revoking your proxy and voting again. |

If you hold shares in

street name (through a broker), you may submit new voting instructions by contacting your bank, broker or other nominee. You may also change your vote

or revoke your proxy in person at the Extraordinary General Meeting if you obtain a signed proxy from the record holder (broker,

bank or other nominee) giving you the right to vote the shares.

Your most recent proxy card

or telephone or Internet proxy is the one that is counted. Your attendance at the Extraordinary General Meeting by itself will not revoke

your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote in person at the Extraordinary

General Meeting.

How are votes counted?

Under the laws of the Cayman

Islands and our Articles, the affirmative vote of a simple majority of the holders of Class A ordinary shares in respect of which

votes are cast is necessary for approval of the Winding Up Proposal and the Adjournment Proposal. If you provide specific instructions,

your shares will be voted as you instruct. If you sign your proxy card or voting instruction form with no further instructions, your shares

will be voted in accordance with the recommendations of our current Board (i.e., “FOR” the Proposals).

What is the effect of a broker non-vote?

If you hold shares

beneficially in street name (through a broker) and do not provide your broker or nominee with voting instructions, your shares may

constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker or nominee does not have

discretionary voting authority to vote on that matter without instructions from the beneficial owner and instructions are not given.

Discretionary items are proposals considered “routine”. For such proposals considered

“routine,” the broker or nominee may exercise discretion and vote your shares, despite your lack of instruction. In

tabulating the voting result, shares that constitute broker non-votes are not considered votes cast.

The Winding Up Proposal

and Adjournment Proposal are both considered “non-routine” items for which brokers and nominees do not have

discretionary voting power and, therefore, broker non-votes may exist with respect to these proposals. However, assuming a quorum is

present, broker non-votes will not affect the outcome of the Winding Up Proposal or the Adjournment Proposal.

What is the effect of an abstention?

Assuming a quorum is present

(as discussed below), abstentions will have no effect on the outcome of the vote for any of the proposals under Cayman Islands law.

What vote is required to approve each of the

proposals? How does the Board recommend that I vote and what is the voting requirement for each proposal?

The affirmative “FOR”

vote from the holders of more than 50% of the Class A ordinary shares in respect of which votes are cast at the Extraordinary General

Meeting will be required to approve the Winding Up Proposal and the Adjournment Proposal. The table below describes the vote required

to approve each Proposal to be considered at the Extraordinary General Meeting:

| Proposal |

|

Board

Recommendation |

|

Vote Required |

|

Effect of

Abstentions |

|

Broker

Discretionary

Voting Allowed? |

| |

|

|

|

|

|

|

|

|

| Winding Up Proposal |

|

FOR |

|

The affirmative “FOR” vote from the holders of more than 50% of the Class A ordinary shares present at the meeting, in person or by proxy, assuming a quorum is present, in respect of which votes are cast. |

|

No effect.

Not considered votes cast on this proposal. Counts as present for purposes of quorum. |

|

No.

Brokers without voting instructions will not be able to vote on this proposal. |

| Adjournment Proposal |

|

FOR |

|

The affirmative “FOR” vote from the holders of more than 50% of the Class A ordinary shares present at the meeting, in person or by proxy, assuming a quorum is present, in respect of which votes are cast. |

|

No effect.

Not considered votes cast on this proposal. Counts as present for purposes of quorum. |

|

No.

Brokers without voting instructions will not be able to vote on this proposal. |

How many shareholders must be present to hold the Extraordinary

General Meeting?

A quorum must be present at

the Extraordinary General Meeting in order for any business to be transacted. One or more shareholders, present in person or by proxy

or if a corporation or other non-natural person by its duly authorized representative or proxy, and entitled to vote, holding in aggregate

not less than one-third (1/3) of the voting power of Class A ordinary shares in issue carrying a right to vote at such general meeting

of the Company constitutes a quorum. If you sign and return your proxy card or authorize a proxy to vote, your shares will be counted

to determine whether we have a quorum even if you abstain or fail to vote as indicated in the proxy materials.

What happens if a quorum is not present at the Extraordinary General

Meeting?

If a quorum is not present

or represented by proxy within half an hour of the scheduled time of the Extraordinary General Meeting, the Extraordinary General Meeting

shall stand adjourned to the same day in the next week at the same time and/or place or to such other day, time and/or place as the Board

may determine, and if at the adjourned meeting a quorum is not present within half an hour from the time appointed for the meeting to

commence, the shareholders present shall be a quorum.

Who will count the votes?

Representatives of Broadridge

Investor Communications Services (“Broadridge”) will tabulate the votes, and representatives of Broadridge will act as inspectors

of election.

Where can I find the voting results of the Extraordinary General

Meeting?

The voting results will be

published following the Extraordinary General Meeting in a Report of Foreign Private Issuer on Form 6-K that will be furnished to

the Securities and Exchange Commission (the “SEC”).

What happens if I sell my Class A ordinary shares before the meeting?

If you transfer your Class

A ordinary shares after the record date, but before the meeting, unless the transferee obtains from you a proxy to vote those shares,

you will retain your right to vote at the meeting.

How are proxies solicited?

Our employees, officers and

directors may solicit proxies. We have engaged Morrow Sodali to assist in the solicitation of proxies and provide related advice and informational

support.

How can I attend the Extraordinary General Meeting?

Shareholders

of record of our Class A ordinary shares as of the close of business on the Record Date are entitled to participate in the Extraordinary

General Meeting by attending in person or via live webcast at www.virtualshareholdermeeting.com/CZOO2024SM. You will be able

to vote during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/CZOO2024SM and inputting your unique

16-digit control number.

Instructions

on how to attend and participate via the Internet, including how to demonstrate proof of share ownership, will be posted at www.virtualshareholdermeeting.com/CZOO2024SM. Assistance

with questions regarding how to attend and participate via the Internet will be provided at www.virtualshareholdermeeting.com/CZOO2024SM

on the day of the Extraordinary General Meeting.

To

attend and participate in the Extraordinary General Meeting virtually, you will need their 16-digit control number. If your shares are

held in “street name,” you should contact your bank or broker to obtain your 16-digit control number or otherwise vote through

the bank or broker. Without your 16-digit control number, you may join the Extraordinary General Meeting as a “Guest,”

but you will not be able to vote. The meeting webcast will begin promptly at 2:00 p.m. GMT. We encourage you to access the meeting

prior to the start time. Online check-in will begin at 1:45 p.m. GMT, and you should allow ample time for the check-in procedures.

If you are a shareholder

of record, you may request copies of the Notice of Extraordinary General Meeting of Shareholders, Proxy Statement and your proxy

card (including your 16-digit control number), by writing to ShareholderMeeting@Cazoo.co.uk. As stated above, the Proxy Statement is

first being made available to shareholders on June 21, 2024 and is available on our website at https://www.cazoogroupltd-shareholders.co.uk/.

If

you plan to attend the Extraordinary General Meeting in person, you should RSVP by emailing ShareholderMeeting@Cazoo.co.uk,

no later than 11:59 p.m. GMT, on June 28, 2024 to have your name placed on the attendance list. In order to be admitted into the

Extraordinary General Meeting you must present government-issued photo identification (such as a driver’s license) so that it

can be determined by reference to the register of members of the Company that you are entitled to attend and vote at the

Extraordinary General Meeting. If you do not register to attend the Extraordinary General Meeting by June 28, 2024, you will not be

permitted to attend the Extraordinary General Meeting.

What if I have technical difficulties accessing or participating

in the Extraordinary General Meeting website?

We will have technicians ready

to assist you with technical difficulties you may have accessing the meeting website. Please refer to the technical support telephone

number provided on the meeting website login page.

Who can I reach out to if I have questions?

If you have questions about the proposals, you

may contact the Company’s proxy solicitor at:

Morrow Sodali LLC

333 Ludlow Street, 5th Floor, South Tower

Stamford, CT 06902

Tel: (800) 662 -5200 (toll-free) or (203) 658-9400 (banks and brokers can call collect)

Email: CZOO@info.morrowsodali.com

If you are a shareholder of

record, you may request copies of the Notice of Extraordinary General Meeting of Shareholders, Proxy Statement and your proxy card (including

your 16-digit control number), by writing to ShareholderMeeting@Cazoo.co.uk. You may also obtain additional information about Cazoo from

documents filed with the SEC by following the instructions in the section entitled “Where You Can Find Additional Information.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in

this Proxy Statement constitute forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Exchange Act, that do not directly or exclusively relate to historical facts. You should not place

undue reliance on such statements because they are subject to numerous uncertainties and factors relating to our operations and business

environment, all of which are difficult to predict and many of which are beyond our control. Forward-looking statements include information

concerning our possible or assumed future results of operations, including descriptions of our business strategy. These statements are

often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,”

“may,” “would,” “should,” “intend,” “plan,” “potential,” “predict,”

“forecast,” “will,” “expect,” “budget,” “contemplate,” “believe,”

“estimate,” “continue,” “project,” “positioned,” “strategy,” “outlook”

and similar expressions. You should read statements that contain these words carefully because they: (i) discuss future expectations;

(ii) contain projections of future results of operations or financial condition; or (iii) state other “forward-looking” information.

All such forward-looking statements

involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ

materially from the results expressed in the statements. We believe it is important to communicate our expectations to our security holders.

However, there may be events in the future that we are not able to predict accurately or over which we have no control. The risk factors

and cautionary language discussed in this Proxy Statement provide examples of risks, uncertainties and events that may cause actual results

to differ materially from the expectations described by us in such forward-looking statements, including among other things:

| ● | our

ability to complete the Winding Up in a timely manner; |

| | | |

| ● | that

our shareholders will not realize any value from the Company’s shares that they own; |

| | | |

| ● | the

holders of our Senior Secured Notes will have significant influence over all shareholder

votes, and they, as secured creditors, will have interests different from our shareholders

who are not secured creditors; |

| | | |

| ● | the

risk that shareholders may not approve the Winding Up; |

| | | |

| ● | the

risk that our warrantholders will receive nothing for their warrants; |

| | | |

| ● | the

possibility that our creditors will not receive a full recovery in connection with our Winding

Up; |

| | | |

| ● | the

risk that our shareholders will not be able to buy or sell shares after we close our share

transfer books in connection with the Winding Up; |

| | | |

| ● | the

impact of business uncertainties in connection with the Winding Up; |

| | | |

| ● | the

risk that we may have liabilities or obligations about which we are not currently aware;

and |

| | | |

| ● | the

risk that the cost of settling our liabilities and contingent obligations could be higher

than anticipated. |

These

and other factors are more fully discussed in the “Risk Factors” section and elsewhere in this Proxy Statement.

These risks could cause actual results to differ materially from those implied by the forward-looking statements contained in this Proxy

Statement.

All forward-looking statements

included herein attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements

contained or referred to in this section. Except to the extent required by applicable laws and regulations, we undertake no obligation

to update these forward-looking statements to reflect events or circumstances after the date of this Proxy Statement or to reflect the

occurrence of unanticipated events.

RISK FACTORS

The following risk

factors, together with the other information in this Proxy Statement and in the “Risk Factors” sections included in the

documents incorporated by reference into this Proxy Statement (see the section titled “Where You Can Find Additional

Information” beginning on page 23 of this Proxy Statement), should be carefully considered before deciding whether to vote to

approve the Winding Up Proposal as described in this Proxy Statement. In addition, shareholders should keep in mind that the risks

described below are not the only risks that are relevant to your voting decision. The risks described below are the risks that we

currently believe are the material risks of which our shareholders should be aware. Nonetheless, additional risks that are not

presently known to us, or that we currently believe are not material, may also prove to be important. Notably, the Company cautions

that trading in the Company’s securities is highly speculative and poses substantial risks.

Trading prices for the

Company’s securities may bear little or no relationship to the actual value realized, if any, by holders of the Company’s

securities. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

If the Winding Up Proposal is approved and

the Company is wound up, equityholders will not receive any distributions for the Company’s shares or warrants

If the Winding Up Proposal

is approved and the Company is wound up, we expect that our equityholders will not receive any distributions for the Company’s shares

or warrants. Under Cayman Islands law, before a company may make any distribution to its equityholders, it must pay or make reasonable

provision to pay all of its claims and obligations, including all contingent, conditional or unmatured contractual claims known to the

company. For example, we will need to pay the holders of our Senior Secured Notes in full prior to us making any payments to lower-ranking

classes of creditors, like our shareholders and warrant holders.

In addition, funds will be

retained to pay ongoing operational and liquidation costs; payments to service providers and any continuing employees or consultants;

taxes; and legal, accounting and consulting fees. We also expect to incur corporate and administrative costs and expenses associated with

winding up the Company and its subsidiaries. In addition to the liabilities of which we are aware, we may also be subject to potential

liabilities relating to indemnification obligations, if any, to third parties or to our current and former officers and directors. Given

the known amounts owed to the holders of our Senior Secured Notes, the amounts associated with continuing our operations and eventual

winding down the Company, and that we may incur additional unexpected expenses, we do not expect that our equityholders will receive any

distributions for their shares or warrants.

Further shareholder approval will not be

required in connection with the implementation of the Winding Up, including the sale or disposition of any of our assets following the

Effective Time of the Winding Up

The approval of the

Winding Up Proposal by the requisite vote of our shareholders will grant full and complete authority to the Voluntary Liquidators to

proceed with the Winding Up in accordance with any applicable provision of Cayman Islands law. Following the Effective Time, the

Voluntary Liquidators may sell, distribute or otherwise dispose of any remaining non-cash assets, if any, without further

shareholder approval. As a result, our shareholders will no longer have the opportunity to approve or reject any sale after the Voluntary Liquidators have been appointed. Also, after the Effective Time, the Voluntary

Liquidators may, in order to maximize value for our stakeholders, authorize actions in implementing the Winding Up, including the

specific terms and prices for the sales and dispositions of its remaining assets, with which shareholders may not agree.

Our shareholders of record will not be able

to buy or sell our ordinary shares after we close our share transfer books

We will close our share transfer

books and discontinue recording transfers of our ordinary shares at the Effective Time. After we close our share transfer books, we will

not record any further transfers of our ordinary shares on our books unless the Court otherwise orders. Therefore, ordinary shares will

not be freely transferable after the Effective Time.

The holders of our Senior Secured Notes

own 92%, in the aggregate, of the Company’s outstanding Class A ordinary shares and two of our holders own, in the aggregate, in

excess of 58% of our outstanding Class A ordinary shares and therefore will have significant influence over all shareholder votes, including

the matters submitted to the Extraordinary General Meeting, and they, as secured creditors, will have interests different from our shareholders

who are not secured creditors

The holders of our Senior

Secured Notes own 92%, in the aggregate, of the Company’s outstanding Class A ordinary shares and two of the holders own, in the

aggregate, in excess of 58% of our outstanding Class A ordinary shares and therefore will have significant influence over all shareholder

votes, including the matters submitted to the Extraordinary General Meeting. The Senior Secured Notes are secured by a substantial portion

of the assets of the Company and its subsidiaries, and as such,

the holders of our Senior Secured Notes, as secured creditors, will have interests different from our shareholders who are not secured

creditors.

PROPOSAL 1: THE WINDING UP PROPOSAL

We are asking you to authorize

and approve the Winding Up. The Board has determined that the Winding Up is advisable and in the best interests of the Company and our

stakeholders and has approved the Winding Up. A description of the history of the Company leading up to the Winding Up is described under

“— Background of the Proposed Winding Up” and a description of the reasons for the Winding Up is described

under “— Reasons for the Proposed Winding Up.” The Winding Up requires approval by the holders of a majority

of the outstanding Class A ordinary shares entitled to vote at the Extraordinary General Meeting. The Board unanimously recommends that

our shareholders authorize the Winding Up.

In general terms, when

we commence the Winding Up, we will cease conducting our business, wind up our affairs, dispose of our non-cash assets, if any, pay

or otherwise provide for our obligations, and distribute our remaining assets, if any, as required by Cayman Islands law.

The holders of our Senior

Secured Notes own 92%, in the aggregate, of the Company’s outstanding Class A ordinary shares and two of the holders own, in the

aggregate, in excess of 58% of our outstanding Class A ordinary shares and therefore will have significant influence over all shareholder

votes, including the matters submitted to the Extraordinary General Meeting. The Senior Secured Notes are secured by a substantial portion

of the assets of the Company and its subsidiaries, and as such,

the holders of our Senior Secured Notes, as secured creditors, will have interests different from our shareholders who are not secured

creditors.

With respect to the Winding

Up, we will follow the dissolution and winding-up procedures prescribed by Cayman Islands law, as described in further detail under “— Cayman

Islands law Applicable to Our Winding Up.” You should carefully consider the risk factors relating to our winding up and dissolution

and described under “Risk Factors” beginning on page 12 of this Proxy Statement.

Subject to the requirements

of Cayman Islands law, as further described below, we will use our existing cash to pay for our winding-up procedures, including:

| ● | the

costs associated with our Winding Up, which may include, among others, expenses necessary to the implementation and administration of

the Winding Up and fees and other amounts payable to professional advisors (including legal counsel, financial advisors and others) and

to consultants and others assisting us with our Winding Up; |

| ● | any

claims by others against us that the Official Liquidators (as defined below) do not reject as part of the dissolution process; |

| ● | any

amounts owed by us under contracts with third parties; and |

| ● | the

funding of any reserves or other security we are required to establish, or deem appropriate to establish, to pay for asserted claims

(including lawsuits) and possible future claims, as further described below. |

The

above payments will be made in accordance with the priority rules established by Cayman Islands law, including in light of any security

granted by the Company (including pursuant to the Senior Secured Notes), and as a result, not all of these amounts may in fact

be paid as part of the winding up process.

On June 20, 2024, the

Company received the consent of the holders of more than a majority in principal amount of the Senior Secured Notes to permit the

use of £470,000 of cash from a bank account securing the Senior Secured Notes for costs related to the Winding Up, which may

be increased by up to an additional £200,000 so long as the Voluntary Liquidators reasonably believe that such additional

amount is both necessary and sufficient to complete the Winding Up of the Company.

Background of the Proposed Winding Up

On December 6, 2023, the Company

concluded a debt for new debt and equity restructuring which significantly deleveraged its balance sheet. The restructuring consisted

of an exchange of the Company’s $630 million aggregate principal amount of its 2.00% Convertible Senior Notes due 2027 for a pro

rata portion of (1) the Senior Secured Notes and (2) 4,499,721 Class A ordinary shares of the Company. In connection with the restructuring,

the Senior Secured Notes were guaranteed by all of the Company’s existing subsidiaries organized in the United Kingdom (subject

to customary exceptions and limitations). The Senior Secured Notes are secured by a substantial portion of the assets of the Company and

its subsidiaries, subject to certain agreed security principles and customary limitations and exceptions, including over, among other

things, a first priority fixed charge over the bank accounts of the Company and its subsidiaries, including a separate blocked bank account

of Cazoo Holdings Limited (in administration) that holds a minimum balance of £50 million at all times.

Shortly after completion of

the restructuring, the Company engaged financial advisors to conduct an M&A process with the intention of finding a buyer of the Company

and its business (the “Initial M&A Process”). The Initial M&A Process attracted limited interest and there was no

adequate offer received.

As the Initial M&A Process

was being conducted, the Company also considered other measures that the Company could take to continue to operate the business in the

event that the Initial M&A Process did not lead to a successful transaction and it was considered inappropriate to continue to operate

in its current form. The Company instructed a consulting firm to assist it in that consideration. The options presented to the Company

included a realignment of the business to a marketplace model on which individuals could list and sell their vehicles.

On March 6, 2024, the Company

announced that it was pivoting to a marketplace model. Since the announcement, the Company’s operating subsidiaries have sold substantially

all inventory and paid off stocking loans owed by Cazoo Ltd (in administration) (our operating subsidiary through which our operations

were primarily operated); leases held by Cazoo Properties Limited (in administration) (our subsidiary that has historically held the majority

of our leaseholds) were either terminated or assigned; obsolete and other non-strategic assets were sold; and the business was transitioned

to a marketplace model operated by Cazoo Ltd (in administration).

The Company and its subsidiaries

also undertook measures in parallel to the M&A processes to conserve cash and generally preserve value in the business. For example,

Cazoo Ltd (in administration) (the entity at which substantially all our UK employees were historically employed) initiated redundancy

processes for employees involved with parts of the previous business which were discontinued following the announcement of the transition

to a marketplace model.

The Company continued to pursue

strategic alternatives for the remaining business or parts thereof, but did not receive any offers that would be significant enough, in

the aggregate or pursuant to those offers by themselves, for a business to continue as a going concern in the medium- to long-term.

On May 16, 2024, pursuant

to the Indenture governing the Senior Secured Notes, dated as of December 6, 2023, by and between the Company, the Guarantors named therein,

U.S. Bank Trust Company, National Association, as trustee (the “Trustee”), and GLAS Trust Corporation Limited, as security

agent (the “Security Agent”), the Company notified the Trustee that (1) the Company did not make the required interest payments

of approximately $5.3 million that were due on May 15, 2024 (the “Interest Payment”) and (2) the Company did not deliver its

audited financial statements to the Trustee as required under the Indenture. Under the Indenture, non-payment of the interest due resulted

in a Default (as such term is defined in the Indenture) and the Company has a 30-day grace period (through June 14, 2024) to make the

Interest Payment before such non-payment constituted an Event of Default (as such term is defined in the Indenture). In addition, failure

to deliver the Company’s audited financial statements constituted a Default under the Indenture and the Company has a 60-day grace

period after it receives written notice from the Trustee or by holders of at least 25% of the Senior Secured Notes then outstanding regarding

failure to deliver the audited financial statements before such non-delivery constitutes an Event of Default. Upon an Event of Default

in relation to the two Defaults described above, the Trustee or the holders of at least 25% of the Notes then outstanding may declare

the Senior Secured Notes to be due and payable immediately.

On May 21, 2024, each of Cazoo

Holdings Limited (in administration), Cazoo Ltd (in administration), and Cazoo Properties Limited (in administration) filed for administration

in the United Kingdom. On May 21, 2024, Matthew Mawhinney and David Soden (the “Joint Administrators”) of Teneo Financial

Advisory Limited were appointed as joint administrators to each of Cazoo Holdings Limited (in administration), Cazoo Ltd (in administration),

and Cazoo Properties Limited (in administration) (the “Administration Companies”). Following their appointment, the Joint

Administrators have been managing the affairs, business and property of the Administration Companies. As part of the administration process,

the Joint Administrators continue to (i) pursue sale transactions in respect of the remaining assets of the Administration Companies,

including assets related to the marketplace model and (ii) mitigate certain liabilities. The filing for Administration by the Administration

Companies (who are Guarantors under the Senior Secured Notes) constituted an Event of Default under the Indenture.

As of May 21, 2024, the Company’s

asset position following the appointment of the Joint Administrators, excluding a cash balance of £2.8 million and the value of

its investment in its subsidiaries, reflects less than £2 million of current assets. Of that £2 million, approximately £1.5

million relates to a prepayment of insurance covering the Company and its consolidated subsidiaries, which was paid before the Administration

Companies entered administration. Also at May 21, 2024 the fair value of the Company’s liabilities was approximately £127

million, which reflects $200 million of Notes. Upon the Winding Up, the value of the subsidiary investments held by the Company will be

substantially written down. As at May 21, 2024, the consolidated subsidiaries of the Company, in the aggregate, had assets of approximately

£124 million (a large portion of which (other than cash) may not be realized), consisting of approximately: £96 million in

cash (£50 million of which is held in a separate blocked bank account); intangible assets with a balance sheet value of £11

million, which we do not expect to fully realize; and certain other assets with a balance sheet value of approximately £17 million,

which also may not be fully realized. Also at May 21, 2024 the consolidated subsidiaries of the Company, in the aggregate, had liabilities

of approximately £31 million (not including any liabilities arising under the Indenture). In light of the foregoing and as previously

disclosed, the Company will be holding the EGM in order to seek shareholder approval to place the Company into a Cayman Islands winding

up process.

The joint administrators of

Cazoo Ltd (in administration) continue to progress a sales process in respect of the marketplace model and/or related assets of Cazoo

Ltd (in administration) with a view to realizing value for the company’s creditors as a whole.

Reasons for the Proposed Winding Up

Given the factors described

above, the Board believes that the Winding Up is in the best interest of our stakeholders and recommends that our shareholders approve

the Winding Up Proposal.

Cayman Islands Law Applicable to Our Winding

Up

Under Section 116 of the Companies

Act of the Cayman Islands, a company incorporated and registered under the Companies Act may be wound up voluntarily if the company in

a general meeting resolves by ordinary resolution that it will be wound up voluntarily because it is unable to pay its debts. The Board

considers that this shareholder vote is the most efficient way to commence the Winding Up, which is in turn appropriate for the

reasons described above.

If the Winding Up Proposal

is approved by our shareholders, the Voluntary Liquidators will be appointed immediately and a number of steps must be undertaken within

28 days of the commencement of the Winding Up: (a) notice of the appointment of the Voluntary Liquidators must be published in the Cayman

Islands Official Gazette, which will invite creditors of the Company to submit to the liquidator details of their claims against the Company;

(b) notice of the Winding Up must be filed with the Cayman Islands Registrar of Companies; and (c) the Liquidators’ consents to

act must be filed with the Cayman Islands Registrar of Companies before their appointments can become effective. In addition, the Voluntary

Liquidators will apply to the Court to continue the winding up under the supervision of the Court.

The Voluntary Liquidators

will owe personal duties to maximize the returns to those with an economic interest in the Company. The Voluntary Liquidators will act

as agents of the Company and their authority to bind the Company will displace the authority of the directors to do so. Cayman Islands

law gives the Voluntary Liquidators wide powers to deal with the affairs of the Company (in some cases, once the liquidation is brought

under the supervision of the Court, with the sanction of the Court). The Voluntary Liquidators will liquidate any remaining assets and

satisfy or make reasonable provisions for the Company’s remaining obligations. The Company does not expect that there will be any

remaining proceeds for our shareholders.

Once the liquidation is brought

under the supervision of the Court, the liquidation will continue as an official liquidation and the Voluntary Liquidators will become

the official liquidators (the “Official Liquidators”). Further, Cayman Islands law imposes a moratorium on all claims against

the Company. Creditors will have a right to submit proofs of debt in the liquidation of the Company, should the Voluntary or Official

Liquidators call for claims (which they likely will in the event there is expected to be a surplus available for ordinary unsecured creditors

of the Company). The moratorium imposed by Cayman Islands law does not extend to secured creditors.

Once the Winding Up is brought

under the supervision of the Court, the Official Liquidators will be required to make a summary determination as to whether the Company

is solvent, insolvent, or of doubtful solvency. We anticipate that the Official Liquidators will determine that the Company is insolvent.

Assuming that is correct, (a) while the Official Liquidators will provide certain reports during the liquidation process, these reports

will most likely only be provided to the Company’s creditors; (b) any further stakeholder meetings which are convened will most

likely be meetings of the Company’s creditors only; and (c) while the Official Liquidators will look to form a liquidation committee,

only creditors of the Company will be eligible to serve on that liquidation committee.

The Winding Up will continue as long as it takes

the Official Liquidators to wind up the affairs of the Company. Once the affairs of the Company have been finally wound up, the Official

Liquidators will seek an order from the Court that the Company be dissolved.

Estimated Distributions to Shareholders

The Company does not expect

that there will be any distributions for our shareholders.

Estimated Distributions to Warrant Holders

The Company does not expect

that there will be any distributions for our warrant holders.

Estimated Distributions to Option Holders

The Company does not expect

that there will be any distributions for our option holders.

Interests of Certain Persons in the Winding

Up

The holders of our Senior

Secured Notes hold 92% of the Company’s outstanding Class A ordinary shares. As a result, they have the ability to significantly

influence all matters submitted to the shareholders, including the Winding Up Proposal and the Adjournment Proposal. In addition, two

of the holders of our New Notes own approximately 58% of our outstanding Class A ordinary shares. Because the holders of our Senior Secured

Notes are secured creditors, they have interests different from other shareholders who are not secured creditors, and may vote their shares

in their own interests, without regard to the interests of other shareholders. For more information, see “Risk Factors –

The holders of our Senior Secured Notes own 92%, in the aggregate, of the Company’s outstanding Class A ordinary shares and two

of our holders have, in the aggregate, in excess of 58% of our outstanding Class A ordinary shares and therefore will have significant

influence over all shareholder votes, including the matters submitted to the Extraordinary General Meeting, and they, as secured creditors,

will have interests different from our shareholders who are not secured creditors.”

The Proposed Voluntary Liquidators

The proposed Voluntary Liquidators

are Ms. Neema Griffin of Teneo in the Cayman Islands and Mr. David Soden of Teneo in London. Ms. Griffin and Mr. Soden are both experienced

insolvency practitioners, whom the Board considers to be qualified appropriate appointees for this role. The Board also believes that

Ms. Griffin and Mr. Soden meet the independence, professional qualification, residency and insurance requirements prescribed by Cayman

Islands law for Court-supervised liquidations.

The Board also believes that

there are highly likely to be efficiencies in engaging liquidators associated with Teneo because individuals from Teneo have been appointed

as administrators of certain of the Company’s subsidiaries in the UK.

The Proposed Remuneration of the Voluntary

Liquidators

The Schedule of Hourly Rates

of Ms. Neema Griffin of Teneo (Cayman) Limited and Mr. David Soden of Teneo Financial Advisory Limited acting as Joint Voluntary Liquidators

of Cazoo Group Ltd, and the members of their staff (exclusive of any applicable taxes) are shown in the table below:

| Level | |

Hourly Rate (USD) | |

| Senior Managing Director / Appointee | |

| 1,025 | |

| Managing Director | |

| 985 | |

| Director | |

| 810 | |

| Associate Director | |

| 680 | |

| Manager | |

| 570 | |

| Senior Consultant | |

| 525 | |

| Consultant | |

| 400 | |

| Administrator | |

| 230 | |

| Associate Consultant | |

| 205 | |

Our Articles and the Cayman Islands Law

During the Winding Up, subject

to Cayman Islands law, we will continue to be governed by our Articles insofar as their terms apply and insofar as necessary or appropriate

to implement the Winding Up.

Authority of the Board

The Board, without further

action by our shareholders, is authorized to take all actions as it deems necessary or advisable to implement the Winding Up. All determinations

and decisions to be made by the Board will be at the absolute and sole discretion of the Board. However, upon the Winding Up Proposal

taking effect and the Voluntary Liquidators being duly appointed, the Board’s powers will then be suspended.

Consequences if the Winding Up Proposal is

Not Approved

If the Winding Up Proposal

is not approved there is no guarantee that Cazoo Group Ltd would be subject to an orderly winding up and dissolution process. This is

because it is not certain that another party with standing to make an application to wind up Cazoo Group Ltd (for example a creditor)

would make such an application to the Court. Even if another party was prepared to make such an application this is likely to lead to

a more expensive, slower and less coordinated process (including because there is no guarantee that the applicant would nominate the same

liquidators who are managing the affairs, business and property of the Administration Companies (as defined below) which the Company has

done).

Vote Required for Approval

The affirmative

“FOR” vote from the holders of more than 50% of the Class A ordinary shares in respect of which votes are cast at the

Extraordinary General Meeting will be required to approve the Winding Up Proposal. A quorum must be present at the Extraordinary

General Meeting in order for any business to be transacted. One or more shareholders, present in person or by proxy or if a

corporation or other non-natural person by its duly authorized representative or proxy, and entitled to vote, holding in aggregate

not less than one-third (1/3) of the voting power of Class A ordinary shares in issue carrying a right to vote at such general

meeting of the Company constitutes a quorum. Abstentions, broker non-votes and failures to vote will have no effect on the outcome

of the vote with respect to the Winding Up Proposal.

The Board Recommends a Vote “FOR”

the Winding Up Proposal.

PROPOSAL 2: THE ADJOURNMENT PROPOSAL

The Adjournment Proposal allows

the Board to submit a proposal to adjourn the meeting to a later date or dates, if necessary, to permit further solicitation of proxies

because there are not sufficient votes to approve and adopt the Winding Up Proposal. The purpose of the Adjournment Proposal is

to provide more time for Cazoo and/or its affiliates to solicit proxies or other arrangements that would increase the likelihood of obtaining

a favorable vote on the Winding Up Proposal.

In addition to an adjournment

of the meeting upon approval of the Adjournment Proposal, the Board is empowered under Cayman Islands law to postpone the meeting

at any time prior to the meeting being called to order. In such event, Cazoo will issue a press release and take such other steps as it

believes are necessary and practical in the circumstances to inform its shareholders of the postponement.

Consequences if the Adjournment Proposal is

not Approved

If the Adjournment Proposal is

presented at the meeting and is not approved by the shareholders, the Board may not be able to adjourn the meeting to a later date if

Cazoo is unable to solicit sufficient votes to approve and adopt the Winding Up Proposal. In such event, the Winding Up cannot be completed

and it is possible that we would seek voluntary winding up at a later time and potentially with diminished assets.

Vote Required for Approval

The affirmative “FOR”

vote from the holders of more than 50% of the Class A ordinary shares in respect of which votes are cast at the Extraordinary General

Meeting will be required to approve the Adjournment Proposal. A quorum must be present at the Extraordinary General Meeting in order for

any business to be transacted. One or more shareholders, present in person or by proxy or if a corporation or other non-natural person

by its duly authorized representative or proxy, and entitled to vote, holding in aggregate not less than one-third (1/3) of the voting

power of Class A ordinary shares in issue carrying a right to vote at such general meeting of the Company constitutes a quorum. Abstentions,

broker non-votes and failures to vote will have no effect on the outcome of the vote with respect to the Adjournment Proposal.

The Board Recommends a Vote “FOR”

the Adjournment Proposal.

PRINCIPAL SECURITYHOLDERS

The following table sets forth

information regarding the beneficial ownership of our Class A ordinary shares as of May 31, 2024, based on 4,898,984 Class A ordinary

shares outstanding, by:

| ● | each

person known by the Company to be the beneficial owner of more than 5% of the Class A ordinary shares; |

| ● | each

of the Company’s executive officers and directors; and |

| ● | all of the Company’s executive officers and directors

as a group. |

In accordance with SEC rules,

the individuals and entities below are shown as having beneficial ownership over Class A ordinary shares they own or have the right to

acquire within 60 days, as well as Class A ordinary shares for which they have the right to vote or dispose of. Also in accordance

with SEC rules, for purposes of calculating percentages of beneficial ownership, Class A ordinary shares which a person has the right

to acquire within 60 days are included both in that person’s beneficial ownership as well as in the total number of Class A

ordinary shares issued and outstanding used to calculate that person’s percentage ownership but not for purposes of calculating

the percentage for other persons.

Except as indicated by the

footnotes below, the Company believes that the persons named below have sole voting and dispositive power with respect to all Class A

ordinary shares that they beneficially own. The Class A ordinary shares owned by the persons named below have the same voting rights as

the Class A ordinary shares owned by other holders. The percentage of outstanding Class A ordinary shares indicated in the table below

is based on 4,898,984 Class A ordinary shares outstanding at May 31, 2024.

| Name and Address of Beneficial Owner | |

Number of

Class A

ordinary

shares | | |

Percentage of

outstanding

Class A

ordinary shares | |

| Directors and Executive Officers of the Company | |

| | |

| |

| Tim Isaacs | |

| * | | |

| * | |

| Alan J. Carr | |

| * | | |

| * | |

| Andrew Herd | |

| * | | |

| * | |

| Nicholas Pike | |

| * | | |

| * | |

| Mary Reilly | |

| * | | |

| * | |

| Gareth Purnell | |

| * | | |

| * | |

| All Directors and Executive Officers of the Company as a Group (6 Individuals) | |

| * | | |

| * | |

| Holders of 5% or Greater: | |

| | | |

| | |

| Viking Global Entities(1) | |

| 2,142,728 | | |

| 43.7 | % |

| Farallon Funds(2) | |

| 714,240 | | |

| 14.6 | % |

| Mubadala(3) | |

| 357,121 | | |

| 7.3 | % |

| Inherent Funds(4) | |

| 357,120 | | |

| 7.3 | % |

| * |

None of the Directors and Executive Officers own any Class A ordinary shares, other

than Mary Reilly and Gareth Purnell, each of whom holds vested options to purchase less than 1% of our Class A ordinary shares. |

| (1) |