Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or “the Company”), the

UK’s leading independent online car retailer, which makes buying

and selling a car as simple as ordering any other product online,

announced today that it is offering holders of its existing

convertible notes the opportunity to exchange their convertible

notes and receive new secured notes and Class A ordinary shares of

the Company. Holders of 85% of the Company’s convertible notes have

already committed to participate in this transaction.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231103770191/en/

(Photo: Business Wire)

The Company is making an offer to the holders of all $630

million aggregate principal amount of the Company’s 2% Convertible

Senior Notes due 2027 (the “Convertible Notes”) issued pursuant to

the indenture (the “2022 Indenture”) dated as of February 16, 2022,

between the Company, as issuer, and U.S. Bank Trust Company,

National Association, as trustee (the “Convertible Notes Trustee”).

The Company is offering to exchange, upon the terms and subject to

the conditions set forth in the exchange offer memorandum dated

November 3, 2023 (the “Offering Memorandum”), any and all

Convertible Notes (including any accrued and unpaid interest up to

but not including the Closing Date (as defined herein)) for (i) a

pro rata portion of US$200 million aggregate principal amount of

4.00%/2.00% Cash/Payment-in-Kind Toggle Senior Secured Notes due

2027 (the “New Notes”) and (ii) a pro rata portion of Cazoo’s Class

A ordinary shares (the “New Shares” and, together with the New

Notes, the “Offered Securities”) which will represent 92% of the

total Class A ordinary shares outstanding immediately after giving

effect to the exchange offer (the “Exchange Offer”).

The New Notes will be issued by Cazoo Group Ltd and will be

guaranteed by all of the Company’s existing subsidiaries organized

in the United Kingdom (the “New Notes Guarantors”). The New Notes

will be secured, subject to certain agreed security principles and

customary limitations and exceptions, by (a) a first priority fixed

charge over the Company’s bank accounts; (b) a first priority

assignment of all intragroup receivables owed to the Company; (c) a

first priority fixed charge over all of the shares in Cazoo

Holdings Limited granted by the Company; (d) a first priority fixed

charge over each New Notes Guarantors’ bank accounts kept in

England and Ireland, including at least one bank account of Cazoo

Holdings Limited that shall hold a minimum balance of £50,000,000

at all times; (e) a first priority fixed charge over the shares in

each New Notes Guarantor; (f) a first priority assignment of all

intragroup receivables owed to each New Notes Guarantor; and (g) a

first priority floating charge over the assets of each New Notes

Guarantor, including intellectual property but excluding (among

others) vehicles which secure or are subject to a negative pledge

under floor plan facilities and transporter vehicles that secure or

are subject to a negative pledge under arrangements used to finance

such transporter vehicles (the “New Notes Collateral”). The New

Notes will be issued pursuant to an indenture expected to be

entered into with U.S. Bank Trust Company, National Association, as

trustee, and GLAS Trust Corporation Limited, as security agent.

The New Notes will be the Company’s general senior obligations

and (1) will rank equally in right of payment with any existing and

future indebtedness of the Company that is not subordinated in

right of payment to the New Notes; (2) will rank senior in right of

payment to any existing and future indebtedness of the Company that

is expressly subordinated in right of payment to the New Notes; (3)

will rank senior to any existing and future unsecured indebtedness

of the Company to the extent of the value of the property and

assets which secure the New Notes; (4) will be effectively

subordinated to any existing and future secured indebtedness of the

Company and its subsidiaries that is secured by property or assets

that do not secure the New Notes, to the extent of the value of the

property and assets securing such indebtedness; and (5) will be

structurally subordinated to any existing and future indebtedness

of subsidiaries of the Company that do not guarantee the New

Notes.

Interest on the New Notes will accrue at a rate of 6.00% per

annum from the date of the issuance of the New Notes, with a

minimum of 4.00% payable in cash and, at the option of the Company,

up to 2.00% payable in kind.

The Company’s Class A ordinary shares are currently listed on

the New York Stock Exchange under the symbol “CZOO”. On November 2,

2023, the last reported sale price of the Company’s Class A

ordinary shares as reported on the New York Stock Exchange was

$0.41 per Class A ordinary share.

The following table describes certain terms of the Exchange

Offer:

Title of Existing Notes

CUSIP Number(1)

Principal Amount

Outstanding

Consideration per $1,000 of

Convertible Notes(2)

Total Consideration

2% Convertible Senior Notes due 2027

14986T AA3

$

630,000,000

(1) $317.46 4.00%/2.00%

Cash/Payment-in-Kind Toggle Senior Secured Notes due 2027 and (2)

7.08 Class A ordinary shares(3)

(1) $ 200,000,000 4.00%/2.00%

Cash/Payment-in-Kind Toggle Senior Secured Notes due 2027 and (2)

4,465,799 Class A ordinary shares(3)

____________________

(1)

No representation is made as to the

correctness or accuracy of the CUSIP numbers listed in this

communication or printed on the Convertible Notes. CUSIPs are

provided solely for convenience.

(2)

Consideration in the form of Offered

Securities per $1,000 principal amount of Convertible Notes that

are validly tendered and accepted for exchange (including any

accrued and unpaid interest up to but not including the Closing

Date (as defined herein) and Additional Amounts (as defined in the

2022 Indenture), subject to any rounding as described herein.

(3)

Illustrative calculation using the number

of Class A ordinary shares issued and outstanding as of September

22, 2023 of 38,833,034 Class A ordinary shares to represent the 8%

of the total Class A ordinary shares outstanding immediately after

giving effect to the Exchange Offer held by existing shareholders,

resulting in 446,579,891 Class A ordinary shares to be issued to

holders of the Convertible Notes as Offered Securities,

representing 92% of the total Class A ordinary shares outstanding

immediately after giving effect to the Exchange Offer. After

applying the 1-to-100 ratio to be used in the reverse stock split

that is a part of the Transactions (as defined below), the total

number of Class A ordinary shares to be issued to holders of the

Convertible Notes as Offered Securities amounts to 4,465,799 Class

A ordinary shares. The actual number of Class A ordinary shares to

be issued in connection with the Exchange Offer will depend on the

number of Class A ordinary shares issued and outstanding following

the Reverse Stock Split immediately prior to the Closing Date.

The Exchange Offer will expire at 11:59 p.m., New York City

time, on December 4, 2023, unless extended or earlier terminated by

the Company (such date and time, as they may be extended, the

“Expiration Deadline”). To be eligible to receive the Offered

Securities, holders of Convertible Notes must validly tender their

Convertible Notes at or prior to 11:59 p.m., New York City time, on

December 4, 2023, unless extended by the Company. Tenders of

Convertible Notes may be validly withdrawn at any time at or prior

to the Expiration Deadline, except as such Expiration Deadline may

be extended by the Company (such date and time, as they may be

extended, the “Withdrawal Deadline”).

The obligation of the Company to complete the Exchange Offer is

subject to certain conditions, including the receipt of Convertible

Notes validly tendered (and not validly withdrawn) prior to the

Expiration Deadline representing not less than 100% of the

aggregate principal amount of Convertible Notes outstanding (the

“Minimum Exchange Condition”). The Exchange Offer may be amended or

extended at any time prior to the Expiration Deadline and for any

reason, including if any of the conditions of the Exchange Offer

are not satisfied or waived by the Expiration Deadline, subject to

applicable law and the Transaction Support Agreement (as defined

below).

The Convertible Notes may be tendered and will be accepted for

payment only in principal amounts equal to the minimum denomination

of US$1,000 and integral multiples of US$1,000 in excess thereof.

No alternative, conditional or contingent tenders will be accepted.

The New Notes will be issued in a minimum denomination of US$1,000

and integral multiples of US$1 in excess thereof. In addition, no

fractional Class A ordinary shares will be issued in connection

with the Exchange Offer. If, under the terms of the Exchange Offer,

(1) any tendering holder of Convertible Notes is entitled to

receive New Notes in a principal amount that is not a permitted

denomination, the principal amount of the New Notes will be rounded

down to the nearest permitted denomination and no cash will be paid

for fractional New Notes not received as a result of such rounding

down and (2) any tendering holder of Convertible Notes is entitled

to receive fractional amounts of New Shares, the amount of the New

Shares will be rounded down to the nearest Class A ordinary share

and no cash will be paid for fractional New Shares not received as

a result of such rounding down.

The closing date for the Exchange Offer will occur promptly

after the Expiration Deadline (the “Closing Date”). The Convertible

Notes that are validly tendered (and not validly withdrawn) prior

to the Expiration Deadline in exchange for the Offered Securities,

will be retired and cancelled on or around the Closing Date and

cannot be reissued. Upon such retirement and cancellation, the 2022

Indenture will be discharged and any claims under the Convertible

Notes will be released in consideration for the Offered Securities.

On the Closing Date, the New Notes and New Shares will be issued by

the Company in exchange for the Convertible Notes which are

tendered for exchange and accepted by the Company on the Closing

Date in the amount and manner described in the Offering Memorandum.

On the Closing Date, (1) the New Notes due to such holders pursuant

to the terms hereof will be delivered to accounts specified by such

holders through DTC and (2) the New Shares due to such holder will

be delivered to accounts of such holders established by the

Company’s transfer agent, Equiniti Trust Company.

This Exchange Offer is being made in accordance with the terms

of a Transaction Support Agreement dated September 20, 2023, as

amended on November 3, 2023 (the “Transaction Support Agreement”)

among the Company, certain of its subsidiaries, certain holders of

Convertible Notes, who, together with the holders of Convertible

Notes who signed joinder agreements to the Transaction Support

Agreement as of the date of the Offering Memorandum, hold 85% of

the aggregate outstanding principal amount of the Convertible Notes

(the “Consenting Noteholders”) and certain holders of our Class A

ordinary shares (together with the shareholders who signed joinder

agreements to the Transaction Support Agreement as of the date of

the Offering Memorandum, the “Consenting Equityholders” and,

together with the Consenting Noteholders, the “Consenting

Stakeholders”). Subject to the terms and conditions set forth in

the Transaction Support Agreement, the Consenting Noteholders have

agreed to tender their Convertible Notes in the Exchange Offer

prior to the Expiration Deadline.

The Exchange Offer is one of a series of transactions being

implemented by the Company pursuant to the Transaction Support

Agreement, which include (i) the Exchange Offer, (ii) the issuance

of three tranches of new warrants to our existing shareholders,

(iii) the replacement of the existing board of directors with a new

seven-person board of directors on or after the closing date of the

Transactions (as defined below), with six members chosen by the

holders of our Convertible Notes, (iv) a reverse stock split, (v)

an increase in our authorized share capital, (vi) amendments to our

amended and restated articles of association and (vii) the

solicitation of shareholder approval of the Exchange Offer, the

issuance of the new warrants, the change in the board, the reverse

stock split, the increase in our authorized share capital,

amendments to our amended and restated articles of association and

the Transaction Support Agreement and the transactions contemplated

thereby (collectively, the ”Transactions”).

If the Exchange Offer is not completed due to failure to satisfy

the Minimum Exchange Condition, the Company will implement the

Exchange Offer through an English restructuring plan or scheme of

arrangement rather than through this Exchange Offer (a “Scheme

Transaction”). Pursuant to a Scheme Transaction, if approved by the

requisite majorities (which are more than 75% by value of the

Convertible Notes who vote in the case of a restructuring plan and

more than 75% by value of the Convertible Notes and more than 50%

by number of the holders of the Convertible Notes who vote in the

case of a scheme of arrangement) and then sanctioned by an English

court, the Company would be authorized by the court to exchange the

Convertible Notes for the New Notes and the New Shares. The

Consenting Noteholders own 85% of the aggregate principal amount of

the Convertible Notes outstanding as of the date of the Offering

Memorandum and have agreed to vote in favor of a Scheme

Transaction, subject to the terms of the Transaction Support

Agreement. Accordingly, the approval of the Consenting Noteholders

suffices to implement a Scheme Transaction. As a result, if holders

of the Convertible Notes do not tender their Convertible Notes in

the Exchange Offer or if the Exchange Offer is not completed due to

the failure to satisfy the Minimum Exchange Condition, holders of

Convertible Notes, subject to the sanction of the English court,

will likely still be exchanged into the Offered Securities pursuant

to a Scheme Transaction.

In connection with any Scheme Transaction, holders of the

Convertible Notes will receive their pro rata portion of up to $180

million of the New Notes. In addition, in connection with any

Scheme Transaction, only holders of the Convertible Notes who are a

party to the Transaction Support Agreement, who execute a joinder

and become a party to the Transaction Support Agreement or who

become a party to an alternative agreement (an “Alternative Tender

Agreement”) with the Company to tender (or cause to be tendered)

and not withdraw such holder’s Convertible Notes in the Exchange

Offer in accordance with the Offering Memorandum on or prior to

November 17, 2023 (the “Scheme Incentive Deadline”) (together, the

“Scheme Incentive Noteholders”) will receive a pro rata portion of

the remaining $20 million of the New Notes (the “Scheme Transaction

Incentive”) while holders of the Convertible Notes who are not

Scheme Incentive Noteholders will not receive any portion of the

remaining $20 million of the New Notes.

As a result, in connection with any Scheme Transaction, if the

Scheme Incentive Noteholders comprise less than all of the holders

of the Convertible Notes, the aggregate principal amount of the New

Notes would be less than $200 million. For the avoidance of doubt,

the Scheme Transaction Incentive will not apply if the Exchange

Offer is completed in accordance with its terms, including if 100%

of the holders of the Convertible Notes become a party to the

Transaction Support Agreement or an Alternative Tender Agreement

prior to the Scheme Incentive Deadline.

To become a party to the Transaction Support Agreement, holders

of the Convertible Notes are requested to submit a validly

completed executed joinder to the Transaction Support Agreement in

the form attached as Appendix V to the Offering Memorandum to the

Company at legal@cazoo.co.uk.

The Company has not registered the Offered Securities under the

United States Securities Act of 1933, as amended (the “Securities

Act”), or under the securities laws of any state of the United

States. The Offered Securities may not be offered or sold absent

registration except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The Offered Securities are being offered only (1)

inside the United States in accordance with Section 4(a)(2) of the

Securities Act to (i) “qualified institutional buyers” as defined

in Rule 144A under the Securities Act (“QIBs”) and (ii)

institutional “accredited investors” (within the meaning of Rule

501(a)(1), (2), (3), (7), (8), (9), (12) or (13) under the

Securities Act) (“IAIs”), and (2) outside the United States, to

persons other than “U.S. persons” as defined in Rule 902 under the

Securities Act in compliance with Regulation S under the Securities

Act (collectively, “Regulation S Holders”).

Requests for the Offering Memorandum and other documents

relating to the Exchange Offer may be directed to U.S. Bank Trust

Company, National Association, the exchange agent and information

agent for the Exchange Offer, toll free at (800) 934-6802.

None of the Company, any of its subsidiaries or affiliates, or

any of their respective officers, boards of directors, members or

managers, the exchange agent, the information agent, Convertible

Notes Trustee or the trustee of the New Notes is making any

recommendation as to whether holders of Convertible Notes should

tender any Convertible Notes in response to the Exchange Offer, and

no one has been authorized by any of them to make such a

recommendation.

About Cazoo — www.cazoo.co.uk

Our mission is to transform the car buying and selling

experience across the UK by providing better selection, value,

transparency, convenience and peace of mind. Our aim is to make

buying or selling a car no different to ordering any other product

online, where consumers can simply and seamlessly buy, sell or

finance a car entirely online for delivery or collection in as

little as 72 hours.

Important Additional Information

This communication is not an offer to purchase nor a

solicitation of an offer to sell any securities. In connection with

the commencement of the Exchange Offer, the Company will file with

the SEC a tender offer statement on Schedule TO. The Exchange Offer

will be made only pursuant to the Offering Memorandum and related

tender offer documents filed as part of the Schedule TO with the

SEC upon commencement of the Exchange Offer. You are strongly

advised to read the tender offer statement (including the Offering

Memorandum and related tender offer documents) that will be filed

by the Company with the SEC in its entirety when it becomes

available, because it will contain important information, including

the terms and conditions of the Exchange Offer. These documents

will be made available at no charge on the SEC’s website at

www.sec.gov. These documents may also be obtained free of charge

from Cazoo by requesting them by mail at 41 Chalton Street, London

NW1 1JD, United Kingdom.

No Offer

This communication does not constitute an offer to sell or

exchange, or the solicitation of an offer to buy or exchange any

securities, or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such

offer, solicitation, sale or exchange would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

Forward-Looking Statements

This communication contains forward-looking statements that are

based on Cazoo’s current expectations, estimates and projections.

The safe harbor provisions for forward-looking statements contained

in the Securities Act and Securities Exchange Act of 1934, as

amended (the “Exchange Act”) do not apply to any forward-looking

statements that we make in connection with the Exchange Offer,

including forward-looking statements in this communication. The

expectations, estimates, and projections of the business of Cazoo

may differ from its actual results and, consequently, you should

not rely on forward-looking statements as predictions of future

events. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,” “will

likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future

events that are based on current expectations and assumptions and,

as a result, are subject to risks and uncertainties. Many factors

could cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: (1) the implementation of and expected benefits from

our business realignment plan, the wind-down of operations in

mainland Europe, the five-year plan (which extends the revised 2023

plan to 2027), and other cost-saving initiatives; (2) reaching and

maintaining profitability in the future; (3) global inflation and

cost increases for labor, fuel, materials and services; (4)

geopolitical and macroeconomic conditions and their impact on

prices for goods and services and on consumer discretionary

spending; (5) having access to suitable and sufficient vehicle

inventory for resale to customers and reconditioning and selling

inventory expeditiously and efficiently; (6) availability of credit

for vehicle and other financing and the affordability of interest

rates; (7) increasing Cazoo’s service offerings and price

optimization; (8) effectively promoting Cazoo’s brand and

increasing brand awareness; (9) expanding Cazoo’s product offerings

and introducing additional products and services; (10) enhancing

future operating and financial results; (11) achieving our

long-term growth goals; (12) acquiring and integrating other

companies; (13) acquiring and protecting intellectual property;

(14) attracting, training and retaining key personnel; (15)

complying with laws and regulations applicable to Cazoo’s business;

(16) our inability to consummate the Transactions contemplated by

the Transaction Support Agreement as scheduled or at all; (17) the

volatility of the trading price of our Class A ordinary shares,

which may increase as a result of the issuance of the New Equity

and New Warrants pursuant to the Transaction Support Agreement;

(18) the Company’s ability to regain compliance with the continued

listing standards of the NYSE within the applicable cure period;

(19) the Company’s ability to continue to comply with applicable

listing standards of the NYSE; and (20) other risks and

uncertainties set forth in the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” in the

Annual Report on Form 20-F filed with the SEC by Cazoo Group Ltd on

March 30, 2023 and in subsequent filings with the SEC. The

foregoing list of factors is not exhaustive. You should carefully

consider the foregoing factors and the disclosure included in other

documents filed by Cazoo from time to time with the SEC. These

filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements. Cazoo gives no assurance that it will achieve its

expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231103770191/en/

Investor Relations: Cazoo: Anna Gavrilova, Head of

Investor Relations, investors@cazoo.co.uk ICR: cazoo@icrinc.com

Media: Cazoo: Peter Bancroft, Interim Communications

Director, press@cazoo.co.uk Brunswick: Simone Selzer +44 20 7404

5959 / cazoo@brunswickgroup.com

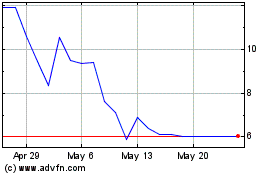

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Jan 2024 to Jan 2025