Cazoo Group Ltd (NYSE: CZOO) (“Cazoo” or “the Company”), the UK

online used car retailer, which makes buying and selling a car as

simple as ordering any other product online, announces today the

completion of its restructuring transactions (the “Transactions”)

on December 6, 2023. The Transactions significantly de-levered the

Company through the exchange of $630 million aggregate principal

amount of 2.00% Convertible Senior Notes due 2027 for a pro rata

portion of (1) $200 million aggregate principal amount of

4.00%/2.00% cash/payment-in-kind toggle senior secured notes due

2027 and (2) 4,499,721 Class A ordinary shares of Cazoo, which

represents approximately 92% of the 4,891,002 Class A ordinary

shares estimated to be outstanding as of December 6, 2023 (the

“Exchange Offer”), after giving effect to the Reverse Stock Split

(as defined below) and subject to change due to related rounding.

In connection with the Transactions, the new Board of Cazoo now

consists of five members, comprised of one existing legacy director

and four new directors.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231206913728/en/

(Photo: Business Wire)

Paul Whitehead, Chief Executive Officer of Cazoo, said,

“I am delighted that we have now completed these transactions.

Cazoo launched only four years ago this week and has already sold

almost 150,000 cars entirely online to consumers across the UK. On

behalf of the Company, I’d like to thank Alex Chesterman and the

other retiring Board members for their service and guidance since

our foundation.

“Completion of these transactions represents a significant

inflection point for Cazoo. With an improved capital structure and

encouraging operational momentum, as demonstrated by our successive

record retail GPU figures and much-improved unit economics, we can

look to 2024 with confidence. I and the management team welcome the

opportunity to work with the new Board to deliver continued

progress against our strategic goals of achieving profitable

growth, while capturing a higher share of the UK used car market

and exploring various strategic initiatives to complement our

business model and brand.”

Reverse Stock Split and Increase in Share Capital

After giving effect to a 1-for-100 reverse stock split (the

“Reverse Stock Split”) and the share increase, Cazoo’s authorized

share capital is US$22,105,000, divided into 100,000,000 Class A

ordinary shares with a par value of US$0.20 each, 25,000 Class B

ordinary shares with a par value of US$0.20 each, 500,000 Class C

ordinary shares with a par value of US$0.20 each and 10,000,000

preference shares with a par value of US$0.20 each. The Reverse

Stock Split and increase in share capital became effective at 4:05

p.m. (ET) on December 5, 2023, and the Class A ordinary shares

began trading on a split-adjusted basis when the New York Stock

Exchange (the “NYSE”) opened for trading on December 6, 2023.

New Warrants

The contemplated distribution of three tranches of warrants to

purchase Cazoo’s Class A ordinary shares (the “New Warrants”) will

be made to holders of record of Cazoo’s Class A ordinary shares

(the “Warrant Distribution”) as of the close of business on

December 7, 2023, after giving effect to the Reverse Stock Split

and other than to holders receiving Class A ordinary shares in the

Exchange Offer.

The last day a shareholder could purchase the Class A ordinary

shares, subject to the standard two-day settlement cycle, and be

entitled to the Warrant Distribution was December 5, 2023.

Shareholders that sell their Class A ordinary shares beginning

December 6, 2023 and prior to the close of business on December 7,

2023 subject to the standard two-day settlement cycle will be

eligible to participate in the Warrant Distribution. The Class A

ordinary shares began to trade on an ex-dividend basis at the open

of trading on December 6, 2023. Shareholders entitled to

participate in the Warrant Distribution will receive, in respect of

each Class A ordinary share held as of the record date,

approximately (i) 1.0870 Tranche 1 Warrants, (ii) 1.1905 Tranche 2

Warrants and (iii) 1.3158 Tranche 3 Warrants. The payment date for

the Warrant Distribution is expected to be on or around December

14, 2023. More information about the New Warrants is included in

Cazoo’s related registration statement on Form F-1, which was

declared effective by the U.S. Securities and Exchange Commission

(the “SEC”) on November 16, 2023.

New Board

The new Board is chaired by Tim Isaacs. Brief biographies of the

Board members are provided below.

Tim Isaacs joined the Board on December 6, 2023. A fellow

of the Institution of Chartered Accountants qualifying with Arthur

Andersen, Mr. Isaacs’ background combines professional services and

equity fund management investment experience, together with

operational experience gained in telco services growth companies.

Mr. Isaacs has supported and led numerous companies going through

periods of change across sectors including retail, healthcare,

business services and industrials in board, executive and

non-executive capacities.

Alan J. Carr joined the Board on December 6, 2023. Mr.

Carr currently serves as the Managing Member and Chief Executive

Officer of Drivetrain, LLC, an independent fiduciary services firm,

a position he has held since September 2013. Mr. Carr has served

and does currently serve on public and private company boards of

directors in various jurisdictions around the world and in various

industries.

Andrew Herd joined the Board on December 6, 2023. Mr.

Herd, who is a chartered accountant, is the principal of Lancashire

Court Capital Limited, a consulting and investment company. His

current roles include being Chair of VGC Developments Limited (a

leisure and gaming business) and a Non-executive Director of Nexus

Group Holdings Limited (a property, investment and publishing

group) and UTB Partners plc (a bank).

Nicholas Pike joined the Board on December 6, 2023. Mr.

Pike is a solicitor by profession and was a partner in DLA Piper,

Gowling WLG and Pinsent Masons LLP’s London offices where he led a

section of the Finance team. He retired from legal practice in 2020

and founded a management consultancy, specializing in board

appointments to assist with governance and strategy.

Mary Reilly has served as a Cazoo Director since February

2023. Ms. Reilly is also a board member and Audit Committee Chair

of MITIE plc, Essentra plc and Mar Holdco Sarl. She is also a

non-executive director at Gemfields plc.

About Cazoo - www.cazoo.co.uk

Our mission is to transform the car buying and selling

experience across the UK by providing better selection, value,

transparency, convenience and peace of mind. Our aim is to make

buying or selling a car no different to ordering any other product

online, where consumers can simply and seamlessly buy, sell or

finance a car entirely online for delivery or collection in as

little as 72 hours.

No Offer

This communication does not constitute an offer to sell or

exchange, or the solicitation of an offer to buy or exchange any

securities, or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such

offer, solicitation, sale or exchange would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except by

means of a prospectus meeting the requirements of section 10 of the

Securities Act of 1933, as amended, or an exemption therefrom.

Forward-Looking Statements

This communication contains “forward-looking statements”. The

expectations, estimates, and projections of the business of Cazoo

may differ from its actual results and, consequently, you should

not rely on forward-looking statements as predictions of future

events. These forward-looking statements generally are identified

by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,”

“may,” “should,” “will,” “would,” “will be,” “will continue,” “will

likely result,” and similar expressions. Forward-looking statements

are predictions, projections and other statements about future

events that are based on current expectations and assumptions and,

as a result, are subject to risks and uncertainties. Many factors

could cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: (1) the Company’s ability to raise additional capital

before the beginning of the second half of 2024 in order to satisfy

its liquidity needs on terms acceptable to it or at all; (2) the

Company’s ability to achieve the expected benefits from the

Transactions contemplated by the Transaction Support Agreement; (3)

the Company’s ability to successfully engage in strategic

transactions including mergers, acquisitions, joint ventures,

partnerships and other equity and debt investments; (4) the

Company’s ability to implement and obtain the expected benefits

from our business plans, and other cost-saving initiatives; (5) the

risk that the Company’s board of directors may take actions with

which shareholders disagree; (6) reaching and maintaining

profitability in the future; (7) global inflation and cost

increases for labor, fuel, materials and services; (8) geopolitical

and macroeconomic conditions and their impact on prices for goods

and services and on consumer discretionary spending; (9) having

access to suitable and sufficient vehicle inventory for resale to

customers and reconditioning and selling inventory expeditiously

and efficiently; (10) availability of credit for vehicle and other

financing and the affordability of interest rates; (11) increasing

Cazoo’s service offerings and price optimization; (12) effectively

promoting Cazoo’s brand and increasing brand awareness; (13)

expanding Cazoo’s product offerings and introducing additional

products and services; (14) enhancing future operating and

financial results; (15) achieving our long-term growth goals; (16)

acquiring and protecting intellectual property; (17) attracting,

training and retaining key personnel; (18) complying with laws and

regulations applicable to Cazoo’s business; (19) the volatility of

the trading price of our Class A Shares, which may increase as a

result of the issuance of Class A ordinary shares and warrants

pursuant to the Transaction Support Agreement; (20) the Company’s

ability to comply with the restrictive debt covenants, including

the liquidity covenant, contained in the new notes indenture (21)

the Company’s ability to regain compliance with the continued

listing standards of the NYSE as set forth in Sections 802.01B and

802.01C of the NYSE Listed Company Manual within the applicable

cure period; (22) the Company’s ability to continue to comply with

applicable listing standards of the NYSE; (23) the risk that Cazoo

may cease to be a listed company or an SEC-reporting company in the

future; and (24) other risks and uncertainties set forth in the

sections entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the Annual Report on Form 20-F filed

with the SEC by Cazoo Group Ltd on March 30, 2023 and in subsequent

filings with the SEC. The foregoing list of factors is not

exhaustive. You should carefully consider the foregoing factors and

the disclosure included in other documents filed by Cazoo from time

to time with the SEC. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Cazoo assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. Cazoo gives no assurance that it will

achieve its expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231206913728/en/

Investor Relations at investors.cazoo.co.uk: Cazoo: Anna

Gavrilova, investors@cazoo.co.uk ICR: cazoo@icrinc.com Media

at cazoo.co.uk/press: Cazoo: Peter Bancroft, press@cazoo.co.uk

Brunswick: Simone Selzer +44 20 7404 5959 /

cazoo@brunswickgroup.com

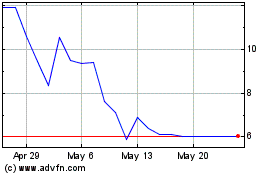

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cazoo (NYSE:CZOO)

Historical Stock Chart

From Jan 2024 to Jan 2025