D.R. Horton, Inc. Announces Pricing of $700 Million of 5.500% Senior Notes Due 2035

February 19 2025 - 6:17PM

Business Wire

D.R. Horton, Inc. (“D.R. Horton” or the “Company”) (NYSE:DHI),

America’s Builder, announced that it has priced a registered

underwritten public offering of $700 million aggregate principal

amount of 5.500% senior notes due 2035. The senior notes will pay

interest semi-annually at a rate of 5.500% per year and will mature

on October 15, 2035. The closing of the offering is expected to

occur on February 26, 2025, subject to the satisfaction of

customary closing conditions. D.R. Horton intends to use the net

proceeds of the offering for general corporate purposes.

Mizuho Securities USA LLC, J.P. Morgan Securities LLC, TD

Securities (USA) LLC, BofA Securities, Inc., U.S. Bancorp

Investments, Inc., Wells Fargo Securities, LLC, PNC Capital Markets

LLC and Truist Securities, Inc. are acting as Joint Book-Running

Managers in the transaction.

The Company has filed a registration statement (including a

prospectus and a related prospectus supplement) with the United

States Securities and Exchange Commission (the “SEC”) for the

offering to which this communication relates. Before you invest,

you should read the prospectus in that registration statement, the

prospectus supplement and other documents D.R. Horton has filed

with the SEC for more complete information about the Company and

this offering. You may get these documents free of charge by

visiting EDGAR on the SEC website at www.sec.gov. Alternatively,

copies of the prospectus supplement and accompanying prospectus may

be obtained by contacting Mizuho Securities USA LLC at 866-271-7403

or at the following address: 1271 Avenue of the Americas, New York,

New York 10020, Attention: Debt Capital Markets; J.P. Morgan

Securities LLC at the following address: 383 Madison Avenue, New

York, New York 10179, Attention: Investment Grade Syndicate Desk;

or TD Securities (USA) LLC at the following address: 1 Vanderbilt

Ave, 11th Floor, New York, New York 10017, Attention:

DCM-Transaction Advisory.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these senior notes, nor shall there

be any offer, solicitation or sale of these senior notes in any

state or jurisdiction in which such an offer, solicitation or sale

would be unlawful. The senior notes offering is being made only by

means of the prospectus supplement and accompanying prospectus.

Forward-Looking Statements

Portions of this document may constitute “forward-looking

statements” as defined by the Private Securities Litigation Reform

Act of 1995. Although D.R. Horton believes any such statements are

based on reasonable assumptions, there is no assurance that actual

outcomes will not be materially different. All forward-looking

statements are based upon information available to D.R. Horton on

the date this release was issued. D.R. Horton does not undertake

any obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Forward-looking statements in this release include

that the closing of the offering is expected to occur on February

26, 2025, subject to the satisfaction of customary closing

conditions, and that D.R. Horton intends to use the net proceeds

for general corporate purposes.

Factors that may cause the actual results to be materially

different from the future results expressed by the forward-looking

statements include, but are not limited to: the cyclical nature of

the homebuilding, rental and lot development industries and changes

in economic, real estate or other conditions; adverse developments

affecting the capital markets and financial institutions, which

could limit our ability to access capital, increase our cost of

capital and impact our liquidity and capital resources; reductions

in the availability of mortgage financing provided by government

agencies, changes in government financing programs, a decrease in

our ability to sell mortgage loans on attractive terms or an

increase in mortgage interest rates; the risks associated with our

land, lot and rental inventory; our ability to effect our growth

strategies, acquisitions, investments or other strategic

initiatives successfully; the impact of an inflationary,

deflationary or higher interest rate environment; risks of

acquiring land, building materials and skilled labor and challenges

obtaining regulatory approvals; the effects of public health issues

such as a major epidemic or pandemic on the economy and our

businesses; the effects of weather conditions and natural disasters

on our business and financial results; home warranty and

construction defect claims; the effects of health and safety

incidents; reductions in the availability of performance bonds;

increases in the costs of owning a home; the effects of information

technology failures, data security breaches, and the failure to

satisfy privacy and data protection laws and regulations; the

effects of governmental regulations and environmental matters on

our land development and housing operations; the effects of

governmental regulations on our financial services operations; the

effects of competitive conditions within the industries in which we

operate; our ability to manage and service our debt and comply with

related debt covenants, restrictions and limitations; the effects

of negative publicity; the effects of the loss of key personnel;

and the effects of actions by activist stockholders. Additional

information about issues that could lead to material changes in

performance is contained in D.R. Horton’s annual report on Form

10-K and our subsequent quarterly report on Form 10-Q, both of

which are filed with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219276990/en/

D.R. Horton, Inc. Jessica Hansen, 817-390-8200 Senior Vice

President - Communications InvestorRelations@drhorton.com

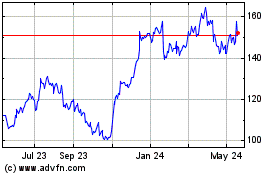

D R Horton (NYSE:DHI)

Historical Stock Chart

From Jan 2025 to Feb 2025

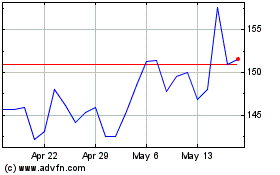

D R Horton (NYSE:DHI)

Historical Stock Chart

From Feb 2024 to Feb 2025