- Net income attributable to all partners of $33.7

million

- Reported record Adjusted EBITDA of $106.8 million up 9% year

over year

- During the 3rd quarter Delek Logistics:

- Closed the acquisition of H2O Midstream

- Completed the acquisition of Delek US' interest in the Wink

to Webster ("W2W") pipeline

- Amended and extended agreements with Delek US for a period

of up to seven years

- Announced the final investment decision (FID) on a new gas

processing plant adjacent to the existing Delaware plant

- DKL raised $165.3 million from a primary offering in October

to fund its accretive growth projects in the Delaware

Basin

- Continued with its consistent distribution growth policy

with recent increase to $1.100/unit

Delek Logistics Partners, LP (NYSE: DKL) ("Delek Logistics")

today announced its financial results for the third quarter

2024.

“Delek Logistics continues to provide the best combination of

yield and growth in the midstream sector. We are proud of

the 47th consecutive increase in our distribution and we expect to

continue to increase our distribution in the future. The

completion of our previously announced strategic actions position

Delek Logistics as a premier, full-service, midstream provider in

the prolific Permian Basin,” said Avigal Soreq, President of Delek

Logistics' general partner.

"Our recent equity offering allows us to bring forward

additional growth opportunities and strengthen our position in the

Delaware basin. We will continue to strengthen and grow DKL through

a prudent management of liquidity and leverage," Mr. Soreq

continued.

DKL reported third quarter 2024 net income attributable to

limited partners of $33.7 million, or $0.71 per diluted common

limited partner unit. The third quarter 2024 net income

attributable to limited partners included $8.7 million of

transaction costs and impacts of sales-type lease accounting. This

compares to net income attributable to limited partners of $34.8

million, or $0.80 per diluted common limited partner unit, in the

third quarter 2023. Net cash provided in operating activities was

$24.9 million in the third quarter 2024 compared to $46.8 million

in the third quarter 2023. Distributable cash flow, as adjusted was

$62.0 million in the third quarter 2024, compared to $61.4 million

in the third quarter 2023.

For the third quarter 2024, earnings before interest, taxes,

depreciation and amortization ("EBITDA") was $69.2 million compared

to $98.2 million in the third quarter 2023. The third quarter 2024

EBITDA included $8.7 million of transaction costs and impacts of

sales-type lease accounting. For the third quarter 2024, Adjusted

EBITDA was $106.8 million compared to $98.2 million in the third

quarter 2023.

Distribution and

Liquidity

On October 29, 2024, Delek Logistics declared a quarterly cash

distribution of $1.100 per common limited partner unit for the

third quarter 2024. This distribution will be paid on November 14,

2024 to unitholders of record on November 8, 2024. This represents

a 0.9% increase from the second quarter 2024 distribution of $1.090

per common limited partner unit, and a 5.3% increase over Delek

Logistics’ third quarter 2023 distribution of $1.045 per common

limited partner unit. Distribution cash flow coverage ratio, as

adjusted for the quarter was 1.1x, lower than our target of 1.3x,

primarily because of transitory timing effects. H2O Midstream

closed late in the third quarter and W2W distributions came in post

the quarter close in October.

As of September 30, 2024, Delek Logistics had total debt of

approximately $1.89 billion and cash of $7.3 million and a leverage

ratio of approximately 4.15x. Additional borrowing capacity, under

the $1.15 billion third party revolving credit facility was $695.1

million.

Consolidated Operating

Results

Adjusted EBITDA in the third quarter 2024 was $106.8 million

compared to $98.2 million in the third quarter 2023. The $8.6

million increase in Adjusted EBITDA reflects higher contributions

from the Midland Gathering systems, terminalling and marketing rate

increases, as well as impacts from the W2W dropdown.

Gathering and Processing

Segment

Adjusted EBITDA in the third quarter 2024 was $55.0 million

compared with $52.9 million in the third quarter 2023. The increase

was primarily due to higher throughput from Permian Basin assets

and incremental EBITDA from the H2O Midstream acquisition.

Wholesale Marketing and Terminalling

Segment

Adjusted EBITDA in the third quarter 2024 was $24.7 million,

compared with third quarter 2023 Adjusted EBITDA of $28.1 million.

The decrease was primarily due to a decline in wholesale

margins.

Storage and Transportation

Segment

Adjusted EBITDA in the third quarter 2024 was $19.4 million,

compared with $17.9 million in the third quarter 2023. The increase

was primarily due to increased storage and transportation

rates.

Investments in Pipeline Joint

Ventures Segment

During the third quarter 2024, income from equity method

investments was $15.6 million compared to $9.3 million in the third

quarter 2023. The increase was primarily due to the impacts of the

W2W dropdown.

Corporate

Adjusted EBITDA in the third quarter 2024 was a loss of $7.9

million compared to a loss of $10.0 million in the third quarter

2023.

Third Quarter 2024 Results | Conference

Call Information

Delek Logistics will hold a conference call to discuss its third

quarter 2024 results on Wednesday, November 6, 2024 at 10:30 a.m.

Central Time. Investors will have the opportunity to listen to the

conference call live by going to www.DelekLogistics.com.

Participants are encouraged to register at least 15 minutes early

to download and install any necessary software. An archived version

of the replay will also be available at www.DelekLogistics.com for

90 days.

About Delek Logistics Partners,

LP

Delek Logistics is a midstream energy master limited partnership

headquartered in Brentwood, Tennessee. Through its owned assets and

joint ventures located primarily in and around the Permian Basin,

the Delaware Basin and other select areas in the Gulf Coast region,

Delek Logistics provides gathering, pipeline and other

transportation services primarily for crude oil and natural gas

customers, storage, wholesale marketing and terminalling services

primarily for intermediate and refined product customers, and water

disposal and recycling services. Delek US Holdings, Inc. ("Delek

US") owns the general partner interest as well as a majority

limited partner interest in Delek Logistics, and is also a

significant customer.

Safe Harbor Provisions Regarding

Forward-Looking Statements

This press release contains forward-looking statements that are

based upon current expectations and involve a number of risks and

uncertainties. Statements concerning current estimates,

expectations and projections about future results, performance,

prospects, opportunities, plans, actions and events and other

statements, concerns, or matters that are not historical facts are

“forward-looking statements,” as that term is defined under the

federal securities laws. These statements contain words such as

“possible,” “believe,” “should,” “could,” “would,” “predict,”

“plan,” “estimate,” “intend,” “may,” “anticipate,” “will,” “if,”

“expect” or similar expressions, as well as statements in the

future tense, and can be impacted by numerous factors, including

the fact that a significant portion of Delek Logistics' revenue is

derived from Delek US, thereby subjecting us to Delek US' business

risks; risks relating to the securities markets generally; risks

and costs relating to the age and operational hazards of our assets

including, without limitation, costs, penalties, regulatory or

legal actions and other effects related to releases, spills and

other hazards inherent in transporting and storing crude oil and

intermediate and finished petroleum products; the impact of adverse

market conditions affecting the utilization of Delek Logistics'

assets and business performance, including margins generated by its

wholesale fuel business; risks and uncertainties with respect to

the possible benefits of the H2O Midstream transaction, as well as

from integration post-closing; uncertainties regarding future

decisions by OPEC regarding production and pricing disputes between

OPEC members and Russia; an inability of Delek US to grow as

expected as it relates to our potential future growth

opportunities, including dropdowns, and other potential benefits;

projected capital expenditures, scheduled turnaround activity; the

results of our investments in joint ventures; adverse changes in

laws including with respect to tax and regulatory matters; and

other risks as disclosed in our Annual Report on Form 10-K,

Quarterly Reports on Form 10-Q and other reports and filings with

the United States Securities and Exchange Commission.

Forward-looking statements include, but are not limited to,

statements regarding future growth at Delek Logistics;

distributions and the amounts and timing thereof; potential

dropdown inventory; projected benefits of the Delaware Gathering

acquisition; expected earnings or returns from joint ventures or

other acquisitions; expansion projects; ability to create long-term

value for our unit holders; financial flexibility and borrowing

capacity; and distribution growth. Forward-looking statements

should not be read as a guarantee of future performance or results

and will not be accurate indications of the times at, or by, which

such performance or results will be achieved. Forward-looking

information is based on information available at the time and/or

management's good faith belief with respect to future events, and

is subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in

the statements. Delek Logistics undertakes no obligation to update

or revise any such forward-looking statements to reflect events or

circumstances that occur, or which Delek Logistics becomes aware

of, after the date hereof, except as required by applicable law or

regulation.

Sales-Type Leases

During the third quarter of 2024, Delek Logistics and Delek US

renewed and amended certain commercial agreements. These amendments

required the embedded leases within these agreements to be

reassessed under Accounting Standards Codification 842, Leases. As

a result of these amendments, certain of these agreements met the

criteria to be accounted for as sales-type leases. Therefore,

portions of our payments received for minimum volume commitments

under agreements subject to sales-type lease accounting are

recorded as interest income with the remaining amounts recorded as

a reduction in net investment in leases. Prior to the amendments,

these agreements were accounted for as operating leases and these

minimum volume commitments were recorded as revenues.

Non-GAAP Disclosures:

Our management uses certain "non-GAAP" operational measures to

evaluate our operating segment performance and non-GAAP financial

measures to evaluate past performance and prospects for the future

to supplement our financial information presented in accordance

with United States ("U.S.") Generally Accepted Accounting

Principles ("GAAP"). These financial and operational non-GAAP

measures are important factors in assessing our operating results

and profitability and include:

- Earnings before interest, taxes, depreciation and amortization

("EBITDA") - calculated as net income before net interest expense,

income tax expense, depreciation and amortization expense,

including amortization of customer contract intangible assets,

which is included as a component of net revenues.

- Adjusted EBITDA - EBITDA adjusted for (i) significant,

infrequently occurring transaction costs and (ii) throughput and

storage fees associated with the lease component of commercial

agreements subject to sales-type lease accounting.

- Distributable cash flow - calculated as net cash flow from

operating activities adjusted for changes in assets and

liabilities, maintenance capital expenditures net of

reimbursements, sales-type lease receipts, net of income recognized

and other adjustments not expected to settle in cash.

- Distributable cash flow, as adjusted -calculated as

distributable cash flow adjusted to exclude significant,

infrequently occurring transaction costs.

Our EBITDA, Adjusted EBITDA, distributable cash flow and

distributable cash flow, as adjusted measures are non-GAAP

supplemental financial measures that management and external users

of our consolidated financial statements, such as industry

analysts, investors, lenders and rating agencies, may use to

assess:

- Delek Logistics' operating performance as compared to other

publicly traded partnerships in the midstream energy industry,

without regard to historical cost basis or, in the case of EBITDA

and Adjusted EBITDA, financing methods;

- the ability of our assets to generate sufficient cash flow to

make distributions to our unitholders on a current and on-going

basis;

- Delek Logistics' ability to incur and service debt and fund

capital expenditures; and

- the viability of acquisitions and other capital expenditure

projects and the returns on investment of various investment

opportunities.

We believe that the presentation of these non-GAAP measures

provide information useful to investors in assessing our financial

condition and results of operations and assists in evaluating our

ongoing operating performance and liquidity for current and

comparative periods. Non-GAAP measures should not be considered

alternatives to net income, operating income, cash flow from

operating activities or any other measure of financial performance

or liquidity presented in accordance with U.S. GAAP. Non-GAAP

measures have important limitations as analytical tools, because

they exclude some, but not all, items that affect net earnings, net

cash provided by operating activities and operating income. These

measures should not be considered substitutes for their most

directly comparable U.S. GAAP financial measures. Additionally,

because EBITDA, Adjusted EBITDA, distributable cash flow and

distributable cash flow, as adjusted may be defined differently by

other partnerships in our industry, our definitions may not be

comparable to similarly titled measures of other partnerships,

thereby diminishing their utility. See the accompanying tables in

this earnings release for a reconciliation of these non-GAAP

measures to the most directly comparable GAAP measures.

Delek Logistics Partners, LP

Consolidated Balance Sheets

(Unaudited)

(In thousands, except unit

data)

September 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

7,317

$

3,755

Accounts receivable

48,173

41,131

Accounts receivable from related

parties

—

28,443

Lease receivable - affiliate

23,852

—

Inventory

4,632

2,264

Other current assets

1,967

676

Total current assets

85,941

76,269

Property, plant and equipment:

Property, plant and equipment

1,480,553

1,320,510

Less: accumulated depreciation

(440,557

)

(384,359

)

Property, plant and equipment, net

1,039,996

936,151

Equity method investments

322,745

241,337

Customer relationship intangible, net

191,655

181,336

Marketing contract intangible, net

—

102,155

Other intangibles, net

95,538

59,536

Goodwill

12,203

12,203

Operating lease right-of-use assets

15,222

19,043

Net lease investment - affiliate

186,361

—

Other non-current assets

11,062

14,216

Total assets

$

1,960,723

$

1,642,246

LIABILITIES AND DEFICIT

Current liabilities:

Accounts payable

$

35,683

$

26,290

Accounts payable to related parties

442

—

Current portion of long-term debt

—

30,000

Interest payable

15,559

5,805

Excise and other taxes payable

7,641

10,321

Current portion of operating lease

liabilities

5,371

6,697

Accrued expenses and other current

liabilities

4,886

11,477

Total current liabilities

69,582

90,590

Non-current liabilities:

Long-term debt, net of current portion

1,894,257

1,673,789

Operating lease liabilities, net of

current portion

5,820

8,335

Asset retirement obligations

15,453

10,038

Other non-current liabilities

20,719

21,363

Total non-current liabilities

1,936,249

1,713,525

Total liabilities

2,005,831

1,804,115

Preferred units - 70,000 units issued and

outstanding at September 30, 2024

70,000

—

Equity (Deficit):

Common unitholders - public; 12,932,311

units issued and outstanding at September 30, 2024 (9,299,763 at

December 31, 2023)

282,458

160,402

Common unitholders - Delek Holdings;

34,111,278 units issued and outstanding at September 30, 2024

(34,311,278 at December 31, 2023)

(397,566

)

(322,271

)

Total deficit

(115,108

)

(161,869

)

Total liabilities, preferred units and

deficit

$

1,960,723

$

1,642,246

Delek Logistics Partners, LP

Consolidated Statement of Income and

Comprehensive Income (Unaudited)

(In thousands, except unit and per unit

data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net revenues:

Affiliate

$

114,899

$

156,411

$

411,352

$

414,403

Third party

99,171

119,413

319,421

351,857

Net revenues

214,070

275,824

730,773

766,260

Cost of sales:

Cost of materials and other -

affiliate

84,015

115,149

279,962

298,262

Cost of materials and other - third

party

33,495

35,479

99,300

106,587

Operating expenses (excluding depreciation

and amortization presented below)

27,746

32,611

88,895

85,302

Depreciation and amortization

19,969

23,261

67,882

65,494

Total cost of sales

165,225

206,500

536,039

555,645

Operating expenses related to wholesale

business (excluding depreciation and amortization presented

below)

174

392

569

1,397

General and administrative expenses

15,745

5,545

26,624

19,666

Depreciation and amortization

1,235

1,324

4,024

3,923

Other operating income, net

(117

)

(491

)

(1,294

)

(804

)

Total operating costs and expenses

182,262

213,270

565,962

579,827

Operating income

31,808

62,554

164,811

186,433

Interest income

(23,470

)

—

(23,498

)

—

Interest expense

37,022

36,901

112,547

104,581

Income from equity method investments

(15,602

)

(9,296

)

(31,974

)

(22,897

)

Other expense (income), net

34

(3

)

(177

)

(24

)

Total non-operating expenses, net

(2,016

)

27,602

56,898

81,660

Income before income tax expense

33,824

34,952

107,913

104,773

Income tax expense

150

127

533

685

Net income attributable to partners

$

33,674

$

34,825

$

107,380

$

104,088

Comprehensive income attributable to

partners

$

33,674

$

34,825

$

107,380

$

104,088

Net income per limited partner

unit:

Basic

$

0.71

$

0.80

$

2.32

$

2.39

Diluted

$

0.71

$

0.80

$

2.32

$

2.39

Weighted average limited partner units

outstanding:

Basic

47,109,008

43,588,316

46,248,003

43,578,636

Diluted

47,135,101

43,604,792

46,269,423

43,598,547

Cash distribution per common limited

partner unit

$

1.095

$

1.045

$

3.255

$

3.105

Delek Logistics Partners, LP

Condensed Consolidated Statements of

Cash Flows (In thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

(Unaudited)

2024

2023

2024

2023

Cash flows from operating

activities

Net cash provided by operating

activities

$

24,944

$

46,828

$

156,441

$

110,630

Cash flows from investing

activities

Net cash used in investing activities

(299,107

)

(741

)

(314,528

)

(55,634

)

Cash flows from financing

activities

Net cash provided by (used in) financing

activities

276,369

(49,620

)

161,649

(58,784

)

Net increase (decrease) in cash and

cash equivalents

2,206

(3,533

)

3,562

(3,788

)

Cash and cash equivalents at the beginning

of the period

5,111

7,715

3,755

7,970

Cash and cash equivalents at the end of

the period

$

7,317

$

4,182

$

7,317

$

4,182

Delek Logistics Partners, LP

Reconciliation of Amounts Reported

Under U.S. GAAP (Unaudited)

(In thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Reconciliation of Net Income to

EBITDA:

Net income

$

33,674

$

34,825

$

107,380

$

104,088

Add:

Income tax expense

150

127

533

685

Depreciation and amortization

21,204

24,585

71,906

69,417

Amortization of marketing contract

intangible

601

1,803

4,206

5,408

Interest expense, net

13,552

36,901

89,049

104,581

EBITDA

69,181

98,241

273,074

284,179

Throughput and storage fees for sales-type

leases

28,972

—

28,972

—

Transaction costs

8,676

—

8,676

—

Adjusted EBITDA

$

106,829

$

98,241

$

310,722

$

284,179

Reconciliation of net cash from

operating activities to distributable cash flow:

Net cash provided by operating

activities

$

24,944

$

46,828

$

156,441

$

110,630

Changes in assets and liabilities

29,049

16,439

30,531

81,368

Non-cash lease expense

(3,788

)

(2,960

)

(5,689

)

(7,407

)

Distributions from equity method

investments in investing activities

704

3,037

3,377

4,477

Regulatory and sustaining capital

expenditures not distributable

(3,396

)

(2,069

)

(7,682

)

(5,924

)

Reimbursement from (refund to) Delek

Holdings for capital expenditures

—

(69

)

282

942

Sales-type lease receipts, net of income

recognized

5,474

—

5,474

—

Accretion

446

(177

)

73

(529

)

Deferred income taxes

(247

)

(124

)

(451

)

(753

)

Gain on disposal of assets

97

491

6,727

804

Distributable Cash Flow

53,283

61,396

189,083

183,608

Transaction costs

8,676

—

8,676

—

Distributable Cash Flow, as adjusted

(1)

$

61,959

$

61,396

$

197,759

$

183,608

(1)

Distributable cash flow adjusted to

exclude transaction costs associated with the H2O Midstream

Acquisition.

Delek Logistics Partners, LP

Distributable Coverage Ratio

Calculation (Unaudited)

(In thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Distributions to partners of Delek

Logistics, LP

$

56,613

$

45,558

$

158,397

$

135,334

Distributable cash flow

$

53,283

$

61,396

$

189,083

$

183,608

Distributable cash flow coverage ratio

(1)

0.94x

1.35x

1.19x

1.36x

Distributable cash flow, as adjusted

61,959

61,396

197,759

183,608

Distributable cash flow coverage ratio, as

adjusted (2)

1.09x

1.35x

1.25x

1.36x

(1)

Distributable cash flow coverage ratio is

calculated by dividing distributable cash flow by distributions to

be paid in each respective period.

(2)

Distributable cash flow coverage ratio, as

adjusted is calculated by dividing distributable cash flow, as

adjusted for transaction costs by distributions to be paid in each

respective period.

Delek Logistics Partners, LP

Segment Data (Unaudited)

(In thousands)

Three Months Ended September

30, 2024

Gathering and

Processing

Wholesale Marketing and

Terminalling

Storage and

Transportation

Investments in Pipeline Joint

Ventures

Corporate and Other

Consolidated

Net revenues:

Affiliate

$

39,910

$

51,682

$

23,307

$

—

$

—

$

114,899

Third party

41,617

55,256

2,298

—

—

99,171

Total revenue

$

81,527

$

106,938

$

25,605

$

—

$

—

$

214,070

Adjusted EBITDA

$

55,024

$

24,695

$

19,404

$

15,602

$

(7,896

)

$

106,829

Transaction costs

—

—

—

—

8,676

8,676

Throughput and storage fees for sales-type

leases

12,644

4,450

11,878

—

—

28,972

Segment EBITDA

$

42,380

$

20,245

$

7,526

$

15,602

$

(16,572

)

$

69,181

Depreciation and amortization

16,424

2,796

1,218

—

766

21,204

Amortization of customer contract

intangible

—

601

—

—

—

601

Interest income

(11,531

)

(3,707

)

(8,232

)

—

—

(23,470

)

Interest expense

—

—

—

—

37,022

37,022

Income tax expense

150

Net income

$

33,674

Capital spending

$

62,086

$

1,202

$

1,910

$

—

$

—

$

65,198

Three Months Ended September

30, 2023

Gathering and

Processing

Wholesale Marketing and

Terminalling

Storage and

Transportation

Investments in Pipeline Joint

Ventures

Corporate and Other

Consolidated

Net revenues:

Affiliate

$

55,419

$

70,610

$

30,382

$

—

$

—

$

156,411

Third party

39,406

76,500

3,507

—

—

119,413

Total revenue

$

94,825

$

147,110

$

33,889

$

—

$

—

$

275,824

Adjusted EBITDA

$

52,906

$

28,135

$

17,914

$

9,288

$

(10,002

)

$

98,241

Segment EBITDA

$

52,906

$

28,135

$

17,914

$

9,288

$

(10,002

)

98,241

Depreciation and amortization

19,263

1,769

2,704

—

849

24,585

Amortization of customer contract

intangible

—

1,803

—

—

—

1,803

Interest expense

—

—

—

—

36,901

36,901

Income tax expense

127

Net income

$

34,825

Capital spending

$

12,002

$

2,123

$

522

$

—

$

—

$

14,647

Nine Months Ended September

30, 2024

Gathering and

Processing

Wholesale Marketing and

Terminalling

Storage and

Transportation

Investments in Pipeline Joint

Ventures

Corporate and Other

Consolidated

Net revenues:

Affiliate

$

143,992

$

175,463

$

91,897

$

—

$

—

$

411,352

Third party

126,061

186,345

7,015

—

—

319,421

Total revenue

$

270,053

$

361,808

$

98,912

$

—

$

—

$

730,773

Adjusted EBITDA

$

167,463

$

80,174

$

54,283

$

31,974

$

(23,172

)

$

310,722

Transaction costs

—

—

—

—

8,676

8,676

Throughput and storage fees for sales-type

leases

12,644

4,450

11,878

—

—

28,972

Segment EBITDA

$

154,819

$

75,724

$

42,405

$

31,974

$

(31,848

)

273,074

Depreciation and amortization

56,640

6,143

6,515

—

2,608

71,906

Amortization of customer contract

intangible

—

4,206

—

—

—

4,206

Interest income

(11,559

)

(3,707

)

(8,232

)

—

—

(23,498

)

Interest expense

—

—

—

—

112,547

112,547

Income tax expense

533

Net income

$

107,380

Capital spending

$

84,160

$

1,223

$

5,167

$

—

$

—

$

90,550

Nine Months Ended September

30, 2023

Gathering and

Processing

Wholesale Marketing and

Terminalling

Storage and

Transportation

Investments in Pipeline Joint

Ventures

Corporate and Other

Consolidated

Net revenues:

Affiliate

$

157,362

$

156,437

$

100,604

$

—

$

—

$

414,403

Third party

123,132

221,809

6,916

—

—

351,857

Total revenue

$

280,494

$

378,246

$

107,520

$

—

$

—

$

766,260

Adjusted EBITDA

$

161,014

$

78,071

$

46,316

$

22,889

$

(24,111

)

$

284,179

Segment EBITDA

$

161,014

$

78,071

$

46,316

$

22,889

$

(24,111

)

284,179

Depreciation and amortization

54,511

5,338

7,109

—

2,459

69,417

Amortization of customer contract

intangible

—

5,408

—

—

—

5,408

Interest income

—

—

—

—

—

—

Interest expense

—

—

—

—

104,581

104,581

Income tax expense

685

Net income

$

104,088

Capital spending

$

62,168

$

2,527

$

3,933

$

—

$

—

$

68,628

Delek Logistics Partners, LP

Segment Capital Spending

(In thousands)

Three Months Ended September

30,

Nine Months Ended September

30,

Gathering and Processing

2024

2023

2024

2023

Regulatory capital spending

$

—

$

31

$

—

$

31

Sustaining capital spending

284

980

1,292

980

Growth capital spending (1)

61,802

10,991

82,868

61,157

Segment capital spending

$

62,086

$

12,002

$

84,160

$

62,168

Wholesale Marketing and

Terminalling

Regulatory capital spending

$

379

$

292

406

371

Sustaining capital spending

823

1,679

817

754

Growth capital spending

—

152

—

1,402

Segment capital spending

$

1,202

$

2,123

$

1,223

$

2,527

Storage and Transportation

Regulatory capital spending

$

366

$

522

$

688

$

1,670

Sustaining capital spending

1,544

—

4,479

2,263

Growth capital spending

—

—

$

—

$

—

Segment capital spending

$

1,910

$

522

$

5,167

$

3,933

Consolidated

Regulatory capital spending

$

745

$

845

$

1,094

$

2,072

Sustaining capital spending

2,651

2,659

6,588

3,997

Growth capital spending (1)

61,802

11,143

82,868

62,559

Total capital spending

$

65,198

$

14,647

$

90,550

$

68,628

(1)

2024 includes $53.4 million of capital

spending related to the new gas processing plant.

Delek Logistics Partners, LP

Segment Operating Data

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Gathering and Processing

Segment:

Throughputs (average bpd)

El Dorado Assets:

Crude pipelines (non-gathered)

68,430

70,153

71,576

64,835

Refined products pipelines to Enterprise

Systems

55,283

63,991

59,681

54,686

El Dorado Gathering System

13,886

14,774

12,113

13,935

East Texas Crude Logistics System

35,891

36,298

26,319

29,928

Midland Gathering System

185,179

248,443

201,796

230,907

Plains Connection System

188,421

250,550

218,323

248,763

Delaware Gathering Assets:

Natural Gas Gathering and Processing

(Mcfd(1))

75,719

69,737

76,092

72,569

Crude Oil Gathering (average bpd)

125,123

111,973

124,190

110,935

Water Disposal and Recycling (average

bpd)

123,856

99,158

120,360

104,920

Midland Water Gathering System:

Water Disposal and Recycling (average bpd)

(2)

100,335

—

100,335

—

Wholesale Marketing and Terminalling

Segment:

East Texas - Tyler Refinery sales volumes

(average bpd) (3)

70,172

69,178

69,246

57,894

Big Spring marketing throughputs (average

bpd)

22,700

81,617

60,109

78,399

West Texas marketing throughputs (average

bpd)

6,552

10,692

5,276

9,871

West Texas gross margin per barrel

$

3.38

$

9.64

$

2.85

$

8.76

Terminalling throughputs (average bpd)

(4)

160,849

121,430

152,272

116,455

(1)

Mcfd - average thousand cubic feet per

day.

(2)

2024 volumes include volumes from

September 11, 2024 through September 30, 2024.

(3)

Excludes jet fuel and petroleum coke.

(4)

Consists of terminalling throughputs at

our Tyler, Big Spring, Big Sandy and Mount Pleasant, Texas, El

Dorado and North Little Rock, Arkansas and Memphis and Nashville,

Tennessee terminals.

Information about Delek Logistics Partners, LP can be found on

its website (www.deleklogistics.com), investor relations webpage

(https://www.deleklogistics.com/investor-relations), news webpage

(https://www.deleklogistics.com/news-releases) and its X account

(@DelekLogistics).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106740630/en/

Investor Relations and Media/Public

Affairs Contact: investor.relations@delekus.com

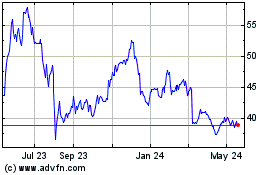

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Nov 2024 to Dec 2024

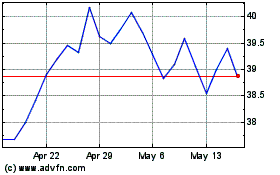

Delek Logistics Partners (NYSE:DKL)

Historical Stock Chart

From Dec 2023 to Dec 2024