FALSE000147511500014751152024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________

FORM 8-K

___________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 7, 2024

_________________________________________________________________________________

EVENTBRITE, INC.

(Exact Name of Registrant as Specified in Charter)

_________________________________________________________________________________ | | | | | | | | |

Delaware | 001-38658 | 14-1888467 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

95 Third Street, 2nd Floor,

San Francisco, California 94103

(Address of principal executive offices) (Zip Code)

(415) 692-7779

(Registrant’s telephone number, include area code)

Not applicable

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.00001 per share | EB | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 8, 2024, Eventbrite, Inc. (the "Company") issued a press release and Shareholder Letter (the "Letter") announcing its financial results for the quarter ended June 30, 2024. Copies of the issued press release and the Letter are attached hereto as Exhibits 99.1 and 99.2, respectively, and each of the press release and the Letter are incorporated herein by reference. Additional supplemental financial information (the "Supplemental Information") has been posted to the Investor Relations section of the Company's website at investor.eventbrite.com.

In the Letter, the Company also announced that it would be holding a live webcast on August 8, 2024, at 2:00 p.m. Pacific Time to discuss its financial results for the quarter ended June 30, 2024. A copy of the unofficial transcript of the webcast will be available after the webcast on the Investor Relations section of the Company's website at investor.eventbrite.com.

The Company is making reference to non-GAAP financial information in the Letter, the Supplemental Information and the webcast. Reconciliations of these non-GAAP financial measures to their nearest GAAP equivalents are provided in the Letter and the Supplemental Information, as applicable.

The information furnished pursuant to Item 2.02 of this Form 8-K, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 2.05 Costs Associated with Exit or Disposal Activities

On August 7, 2024, the Board of Directors of the Company (the “Board”) approved a reduction in force that is designed to reduce operating costs and results in the termination of approximately 11% of the Company’s workforce, or approximately 100 employees. The Company expects the reduction in force to be substantially complete by the third quarter of 2024.

The Company expects to incur total costs associated with the reduction in force of up to $7 million, pre-tax, primarily one-time employee termination and related costs in cash. The Company expects the majority of the employee termination costs to be incurred in the third quarter of 2024.

The estimates of the charges and expenditures that the Company expects to incur in connection with the reduction in force, and the timing thereof, are subject to a number of assumptions, including local law requirements in various jurisdictions, and actual amounts may differ materially from estimates.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b)(c)(e) On August 7, 2024, the Board appointed Lanny Baker, the Company’s Chief Financial Officer, to the expanded role of Chief Operating and Financial Officer, effective as of August 7, 2024. On August 16, 2024, Xiaojing Fan, the Company’s Chief Accounting Officer and principal accounting officer, will cease providing services to the Company. In addition, effective as of August 16, 2024, the Board appointed Mr. Baker as principal accounting officer of the Company.

In this expanded capacity, Mr. Baker will oversee business operations, cross-functional performance and resource optimization. He will lead Eventbrite’s global sales, customer success and sales operations teams. He will continue to lead the Company’s global finance function, including financial planning, accounting and reporting, tax, and treasury.

Mr. Baker, age 57, has served as the Company’s Chief Financial Officer since September 2019. Prior to joining the Company, Mr. Baker served as chief financial officer of Yelp Inc., a technology platform for local

business reviews, from May 2016 to August 2019. Prior to joining Yelp, Mr. Baker served as chief executive officer and president of ZipRealty, Inc., an online real estate brokerage and technology company, from September 2010 through March 2016. He also served as executive vice president and chief financial officer of ZipRealty from December 2008 to September 2010. ZipRealty was acquired by Realogy Holdings, Inc. in August 2014. From June 2007 to December 2008, Mr. Baker was an independent investor. From March 2005 to June 2007, he served as senior vice president and chief financial officer of Monster Worldwide, Inc., which operates the employment website monster.com. From 1993 to 2005, Mr. Baker held various positions at Salomon Brothers (subsequently Salomon Smith Barney, then Citigroup), including managing director in the Equity Research Department.

There are no arrangements or understandings between Mr. Baker and any other persons pursuant to which he was appointed as Chief Operating and Financial Officer or principal accounting officer of the Company. There are no family relationships between Mr. Baker and any director or executive officer of the Company and he has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Act other than as disclosed in the Company’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 25, 2024.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104.1 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

Date: August 8, 2024 | EVENTBRITE, INC. |

| | |

| By: | | /s/ Julia Hartz |

| | | Julia Hartz |

| | | Chief Executive Officer |

Eventbrite Reports Second Quarter 2024 Financial Results

Second quarter revenue grows 7% year-over-year to $84.6 million, within outlook range

Revises full year net revenue outlook reflecting pricing-related adjustments

Announces plan to reduce operating expenses and strengthen long-term results

8/8/2024

SAN FRANCISCO -- (BUSINESS WIRE) -- Eventbrite (NYSE: EB), a global marketplace for shared experiences, reported its financial results for the second quarter ended June 30, 2024. The Second Quarter 2024 Shareholder Letter can be found on Eventbrite’s Investor Relations website at https://investor.eventbrite.com.

“Our second-quarter performance, while within our guidance, was pressured by the pricing-related headwinds related to our transition to a two-sided marketplace,” said Julia Hartz, Co-Founder and Chief Executive Officer. “We are taking action to refine the go-to-market strategy and reduce our expense structure to work towards profitability even despite the revised revenue outlook for the year. That said, we are encouraged by the growth in the consumer side of the business, namely in mobile app adoption and tickets driven by Eventbrite’s discovery experiences. I’m confident that leaning into our marketplace strategy will enable long-term growth for creators and an increased engagement of consumers as the desire to gather at live events continues.”

Second Quarter 2024 Highlights

•Net Revenue of $84.6 million, up 7% year-over-year. Marketplace-related revenue from organizer fees and Eventbrite Ads grew to over 13% of total net revenue.

•Total free and paid ticket volume of 66.8 million tickets across 1.4 million events.

•Gross Margin of 70.9% vs 68.8% a year ago.

•Net income of $1.1 million and Net Income Margin of 1.3%, which includes a net benefit of $8.2 million from a legal settlement and minimal restructuring charges, compared to net loss of $2.9 million in the same period last year.

•Adjusted EBITDA of $12.8 million, and Adjusted EBITDA margin of 15.2%.1

1 For more information on these non-GAAP financial measures, please see "―About non-GAAP financial measures" and the tables under "―Reconciliation of GAAP to non-GAAP financial results" included at the end of this release.

The summary of GAAP and non-GAAP consolidated financial results are in the table below (in thousands, except percentages, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Gross ticket sales | $ | 840,247 | | | $ | 889,930 | | | (6) | % | | $ | 1,693,997 | | | $ | 1,796,363 | | | (6) | % |

| Net revenue | $ | 84,551 | | | $ | 78,912 | | | 7 | % | | $ | 170,803 | | | $ | 156,826 | | | 9 | % |

| Gross profit | $ | 59,940 | | | $ | 54,309 | | | 10 | % | | $ | 121,160 | | | $ | 105,828 | | | 14 | % |

| Gross profit margin | 71 | % | | 69 | % | | | | 71 | % | | 67 | % | | |

| Net income (loss) | $ | 1,063 | | | $ | (2,921) | | | 136 | % | | $ | (3,427) | | | $ | (15,607) | | | (78) | % |

| Net income (loss) margin | 1 | % | | (4) | % | | | | (2) | % | | (10) | % | | |

| Adjusted EBITDA (non-GAAP) | $ | 12,836 | | | $ | 11,313 | | | 13 | % | | $ | 23,249 | | | $ | 13,455 | | | 73 | % |

| Adjusted EBITDA margin (non-GAAP) | 15 | % | | 14 | % | | | | 14 | % | | 9 | % | | |

Operating Highlights

The key operating metrics of our business are summarized below (in thousands, except average ticket value, unaudited):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| Total tickets | 66,791 | | | 79,805 | | | (16) | % | | 132,611 | | | 154,036 | | | (14) | % |

| Paid tickets | 21,243 | | | 23,309 | | | (9) | % | | 42,459 | | | 46,487 | | | (9) | % |

| Total events | 1,415 | | | 1,607 | | | (12) | % | | 2,524 | | | 2,709 | | | (7) | % |

| Paid events | 529 | | | 563 | | | (6) | % | | 933 | | | 936 | | | — | % |

| Total creators | 358 | | | 422 | | | (15) | % | | 504 | | | 564 | | | (11) | % |

| Paid creators | 177 | | | 189 | | | (6) | % | | 248 | | | 253 | | | (2) | % |

| Average ticket value (ATV) | $ | 39.55 | | | $ | 38.15 | | | 4 | % | | $ | 39.73 | | | $ | 38.52 | | | 3 | % |

| Total ticket buyers | 27,356 | | | 32,638 | | | (16) | % | | 48,313 | | | 55,675 | | | (13) | % |

Business Outlook

The company has updated its outlook for fiscal year 2024, based on factors that include:

•Lower than anticipated paid ticket volume reflecting reduced creator acquisition and retention

•Planned changes to pricing and packaging plans offered to creators including the introduction of a free tier

As a result, the company now expects fiscal third quarter 2024 revenue to be in the range of $74 to $77 million and $318 million to $325 million for fiscal year 2024.

The company has reviewed its product roadmap, organizational structure, and staffing with a focus on continuing support for the strategic transformation, increasing operating efficiency, and lowering costs. Today, the company announced the elimination of roughly 100 positions and initiated plans to reduce other costs. The company expects to incur up to $7 million in expenses related to severance and cost-reduction actions during Q3, and that these actions will reduce the company’s total annualized operating costs by $30 million.

At the mid-point of its revenue outlook, the company now expects a 10% Adjusted EBITDA margin for the full year 2024, excluding the impact of restructuring costs and other items.

*We have not provided an outlook for GAAP net income (loss) or GAAP net income (loss) margin or reconciliations of expected Adjusted EBITDA to GAAP net income (loss) or expected Adjusted EBITDA margin to GAAP net income (loss) margin, because GAAP net income (loss) and GAAP net income (loss) margin on a forward-looking basis are not available without unreasonable efforts due to the potential variability and complexity of the items that are excluded from Adjusted EBITDA and Adjusted EBITDA margin, such as share-based compensation expense, foreign exchange gains and losses, and other non-recurring expenses.

Earnings Webcast Information

Event: Eventbrite Second Quarter 2024 Earnings Conference Call

Date: Thursday, August 8, 2024

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investor.eventbrite.com

An archived webcast of the conference call will be accessible on Eventbrite’s Investor Relations page, https://investor.eventbrite.com.

About Eventbrite

Eventbrite is a global events marketplace that serves event creators and event-goers in nearly 180 countries. Since its inception, Eventbrite has been at the center of the experience economy, transforming how people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz and Renaud Visage, with a vision to build a self-service platform that would make it possible for anyone to create and sell tickets to live experiences. With over 300 million tickets distributed for over 5 million events in 2023, Eventbrite is where people worldwide discover new things to do or new ways to do more of what they love. Eventbrite has also earned industry recognition as a top employer with special designations that include a coveted spot on Fast Company’s prestigious The World’s 50 Most Innovative Companies and Fast Company’s Brands That Matter lists, the Great Place to Work® Award in the U.S., and Inc.'s Best-Led Companies honor. Learn more at www.eventbrite.com.

Eventbrite Investor Relations

investors@eventbrite.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the Company’s expectations with respect to its operating model; and the Company’s expectations described under “Business Outlook” above. In some cases, forward-looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this press release, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied. All forward-looking statements are based on information and estimates available to the Company at the time of this release, and are not guarantees of future performance, and reported results should not be considered as an indication of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this press release.

Disclaimer Regarding Ticketing, Creator and Event Metrics

This press release includes certain measures related to our ticketing business, such as paid tickets, paid creators, ticket buyers, average ticket value, and paid events. We believe that the use of these metrics is helpful to our investors as these metrics are used by management in assessing the health of our business and our operating performance. These metrics are based on what we believe to be reasonable estimates for the applicable period of measurement. There are inherent challenges in measuring these metrics, and we regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy. You should not consider these metrics in isolation or as substitutes for analysis of our results of operations as reported under GAAP.

Condensed Consolidated Balance Sheets

(in thousands; unaudited) | | | | | | | | | | | |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 575,499 | | | $ | 489,200 | |

| Funds receivable | 28,869 | | | 48,773 | |

| Short-term investments, at amortized cost | 56,698 | | | 153,746 | |

| Accounts receivable, net | 4,856 | | | 2,814 | |

| Creator signing fees, net | 3,601 | | | 634 | |

| Creator advances, net | 6,852 | | | 2,804 | |

| Prepaid expenses and other current assets | 12,147 | | | 13,880 | |

| Total current assets | 688,522 | | | 711,851 | |

| | | |

| Creator signing fees, net noncurrent | 1,553 | | | 1,303 | |

| Property and equipment, net | 12,643 | | | 9,384 | |

| Operating lease right-of-use assets | 1,000 | | | 177 | |

| Goodwill | 174,388 | | | 174,388 | |

| Acquired intangible assets, net | 9,132 | | | 13,314 | |

| Other assets | 7,282 | | | 2,913 | |

| Total assets | $ | 894,520 | | | $ | 913,330 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable, creators | $ | 314,718 | | | $ | 303,436 | |

| Accounts payable, trade | 1,467 | | | 1,821 | |

| Chargebacks and refunds reserve | 8,213 | | | 8,088 | |

| Accrued compensation and benefits | 8,534 | | | 17,522 | |

| Accrued taxes | 5,712 | | | 8,796 | |

| Operating lease liabilities | 1,973 | | | 1,523 | |

| Other accrued liabilities | 13,062 | | | 16,425 | |

| Total current liabilities | 353,679 | | | 357,611 | |

| Accrued taxes, noncurrent | 4,532 | | | 4,526 | |

| Operating lease liabilities, noncurrent | 1,423 | | | 1,768 | |

| Long-term debt | 358,725 | | | 357,668 | |

| | | |

| Total liabilities | 718,359 | | | 721,573 | |

| Stockholders’ equity | | | |

| Common stock | 1 | | | 1 | |

| Additional paid-in capital | 1,032,205 | | | 1,007,190 | |

| Treasury stock at cost | (37,184) | | | — | |

| Accumulated deficit | (818,861) | | | (815,434) | |

| Total stockholders’ equity | 176,161 | | | 191,757 | |

| Total liabilities and stockholders’ equity | $ | 894,520 | | | $ | 913,330 | |

Condensed Consolidated Statement of Operations

(in thousands, except share and per share amounts; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenue | $ | 84,551 | | | $ | 78,912 | | | $ | 170,803 | | | $ | 156,826 | |

| Cost of net revenue | 24,611 | | | 24,603 | | | 49,643 | | | 50,998 | |

| Gross profit | 59,940 | | | 54,309 | | | 121,160 | | | 105,828 | |

| Operating expenses | | | | | | | |

| Product development | 26,057 | | | 23,486 | | | 52,741 | | | 50,050 | |

| Sales, marketing and support | 24,521 | | | 15,679 | | | 45,390 | | | 32,739 | |

| General and administrative | 15,816 | | | 21,826 | | | 37,053 | | | 43,544 | |

| Total operating expenses | 66,394 | | | 60,991 | | | 135,184 | | | 126,333 | |

| Loss from operations | (6,454) | | | (6,682) | | | (14,024) | | | (20,505) | |

| Interest income | 7,382 | | | 6,926 | | | 14,789 | | | 12,379 | |

| Interest expense | (2,806) | | | (2,786) | | | (5,606) | | | (5,538) | |

| | | | | | | |

| Other income (expense), net | 3,725 | | | 80 | | | 2,472 | | | (873) | |

| Income (loss) before income taxes | 1,847 | | | (2,462) | | | (2,369) | | | (14,537) | |

| Income tax provision | 784 | | | 459 | | | 1,058 | | | 1,070 | |

| Net income (loss) | $ | 1,063 | | | $ | (2,921) | | | $ | (3,427) | | | $ | (15,607) | |

| Net income (loss) per share | | | | | | | |

| Basic | $ | 0.01 | | | $ | (0.03) | | | $ | (0.04) | | | $ | (0.16) | |

| Diluted | $ | 0.01 | | | $ | (0.03) | | | $ | (0.04) | | | $ | (0.16) | |

| Weighted-average number of shares outstanding used to compute net income (loss) per share | | | | | | | |

| Basic | 96,142 | | | 99,995 | | | 95,557 | | | 99,748 | |

| Diluted | 96,290 | | | 99,995 | | | 95,557 | | | 99,748 | |

Condensed Consolidated Statements of Cash Flows

(in thousands; unaudited)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (3,427) | | | $ | (15,607) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 7,242 | | | 6,709 | |

| Stock-based compensation expense | 29,239 | | | 26,693 | |

| Amortization of debt discount and issuance costs | 1,057 | | | 1,010 | |

| Unrealized gain on foreign currency exchange | (1,326) | | | (1,674) | |

| Accretion on short-term investments | (2,769) | | | (3,585) | |

| Non-cash operating lease expenses | 273 | | | 5,002 | |

| Amortization of creator signing fees | 401 | | | 468 | |

| Changes related to creator advances, creator signing fees, and allowance for credit losses | (2,920) | | | (1,496) | |

| Provision for chargebacks and refunds | 14,559 | | | 5,755 | |

| Gain on litigation settlement | (3,927) | | | — | |

| Other | 623 | | | 908 | |

| Changes in operating assets and liabilities | | | |

| Accounts receivable | (2,866) | | | (763) | |

| Funds receivable | 20,155 | | | 24,136 | |

| Creator signing fees and creator advances | (3,922) | | | 655 | |

| Prepaid expenses and other assets | 1,291 | | | 1,061 | |

| Accounts payable, creators | 9,712 | | | 15,789 | |

| Accounts payable | (366) | | | (487) | |

| Chargebacks and refunds reserve | (14,415) | | | (8,350) | |

| Accrued compensation and benefits | (8,988) | | | 985 | |

| Accrued taxes | (3,840) | | | (8,596) | |

| Operating lease liabilities | (991) | | | (1,933) | |

| Other accrued liabilities | (4,003) | | | 1,480 | |

| Net cash provided by operating activities | 30,792 | | | 48,160 | |

| Cash flows from investing activities | | | |

| Purchases of short-term investments | (112,185) | | | (150,565) | |

| Maturities of short-term investments | 212,002 | | | 85,500 | |

| Purchases of property and equipment | (403) | | | (521) | |

| Capitalized internal-use software development costs | (4,818) | | | (3,161) | |

| Net cash provided by (used in) investing activities | 94,596 | | | (68,747) | |

| Cash flows from financing activities | | | |

| Repurchase of common stock | (36,508) | | | — | |

| Proceeds from exercise of stock options | — | | | 748 | |

| Taxes paid related to net share settlement of equity awards | (5,776) | | | (3,201) | |

| Proceeds from issuance of common stock under ESPP | 454 | | | 567 | |

| Principal payments on finance lease obligations | — | | | (1) | |

| Net cash used in financing activities | (41,830) | | | (1,887) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 2,741 | | | 2,787 | |

| Net increase in cash, cash equivalents and restricted cash | 86,299 | | | (19,687) | |

| Cash, cash equivalents and restricted cash | | | |

| Beginning of period | 489,200 | | | 540,174 | |

| End of period | $ | 575,499 | | | $ | 520,487 | |

Reconciliation of Net Income (Loss) to Adjusted EBITDA and the Calculation of Adjusted EBITDA Margin

(in thousands; unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net income (loss)(1) | $ | 1,063 | | | $ | (2,921) | | | $ | (3,427) | | | $ | (15,607) | |

| Add: | | | | | | | |

| Depreciation and amortization | 3,649 | | | 3,193 | | | 7,243 | | | 6,708 | |

| Stock-based compensation | 15,276 | | | 14,599 | | | 29,238 | | | 26,693 | |

| Interest income | (7,382) | | | (6,926) | | | (14,789) | | | (12,379) | |

| Interest expense | 2,806 | | | 2,786 | | | 5,606 | | | 5,538 | |

| Employer taxes related to employee equity transactions | 365 | | | 203 | | | 792 | | | 559 | |

| Other (income) expense, net | (3,725) | | | (80) | | | (2,472) | | | 873 | |

| Income tax provision | 784 | | | 459 | | | 1,058 | | | 1,070 | |

| Adjusted EBITDA | $ | 12,836 | | | $ | 11,313 | | | $ | 23,249 | | | $ | 13,455 | |

| | | | | | | |

| Net revenue | $ | 84,551 | | | $ | 78,912 | | | $ | 170,803 | | | $ | 156,826 | |

| Adjusted EBITDA margin | 15 | % | | 14 | % | | 14 | % | | 9 | % |

(1) Net income (loss) and Adjusted EBITDA includes loss recovery from a legal settlement and minimal restructuring costs totaling $4.3 million and $4.2 million in the three and six months ended June 30, 2024, and restructuring costs totaling $5.6 million and $14.4 million in the three and six months ended June 30, 2023.

About Non-GAAP Financial Measures

We believe that the use of Adjusted EBITDA and Adjusted EBITDA margin is helpful to our investors in understanding and evaluating our results of operations and useful measures for period-to-period comparisons of our business performance as they are metrics used by management in assessing the health of our business and our operating performance, making operating decisions, and performing strategic planning and annual budgeting. These measures are not prepared in accordance with GAAP and have limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate non-GAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Some amounts in this press release may not add due to rounding.

Adjusted EBITDA

We calculate Adjusted EBITDA as net income (loss) adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, interest income, employer taxes related to employee transactions, other (income) expense net, which consists of foreign exchange rate gains and losses, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP.

Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar to the adjustments in this release. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-routine items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net income (loss) and other GAAP results.

Adjusted EBITDA Margin

Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net revenue. Because of the limitations described above, you should consider Adjusted EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including net income (loss), net income (loss) margin and our other GAAP results.

Shareholder Letter Th e Lo nd on Fi lm M us ic O rc he st ra Q2 2024 Aug 8, 2024

. Net Revenue Paid Tickets Gross Ticket Sales Net Revenue Per Ticket (1) Includes the net benefit of a loss recovery from a legal settlement and minimal restructuring expenses totaling $4.3 million in the second quarter. (2) Adjusted EBITDA is a financial measure that is not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). See the section in this letter titled “About Non-GAAP Financial Measures” for information regarding Adjusted EBITDA, including the limitations of non-GAAP measures, and see the end of this letter for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure. Quarterly Highlights Net revenue of $84.6 million grew 7% year-over-year. Higher marketplace revenue lifted revenue per ticket to $3.98, an 18% increase year-over-year. Consumer average monthly active users were 93 million, and mobile app users were up 22% year-over-year. Paid Creators Net Income (1) Paid Buyers Adjusted EBITDA(1)(2) (7%) Y/Y +136% Y/Y (7%) Y/Y +13% Y/Y 176.9K $1.1M 10.3M $12.8M Q2 2024 Q2 2023 $79M $85M +7% Y/Y Q2 2024 Q2 2023 $890M $840M (6%) Y/Y Q2 2024 Q2 2023 23M 21M (9%) Y/Y Q2 2024 Q2 2023 $3.39 $3.98 +18% Y/Y Marketplace revenue, including organizer fees and Eventbrite Ads, exceeded 13% of second quarter net revenue. Page 2Eventbrite Q2 2024 Shareholder Letter

Dear Eventbrite Shareholder, During the second quarter and first half of 2024, our Eventbrite team has remained focused on the ongoing transformation of our business into a vibrant two-sided marketplace for live events. We believe this transformation will meaningfully expand our addressable opportunity over time and enable us to better capture it. We made significant strategic progress during the quarter, particularly on our consumer experience, mobile app users, and Eventbrite ads, bolstering confidence in our plan’s powerful potential. Eventbrite continues to be both a partner of choice for mid-market creators and a trusted resource for consumers seeking high-quality live experiences. In the second quarter of the year, we connected 27.4 million free and paid ticket buyers with 358,000 creators across a wide variety of categories and locations. In total, we issued 67 million tickets to more than 1.4 million free and paid events, and $840 million in total ticket value was transacted in our marketplace. Second quarter paid ticketing volume, however, was down 9% compared to the prior year, and continuing to trend lower at the start of the second half. The pricing model changes we began implementing last year, including the introduction of organizer fees, are impacting creator acquisition and retention and reducing event inventory and ticket volume. To address this, we plan to make meaningful adjustments to our pricing plans in the near term. The expected impact of changes to our pricing plans and lower paid ticket volume has been reflected in our updated business outlook below. The Rock Orchestra MEGA Events Museums, caves, airfields, and cathedrals might not strike you as typical party hotspots. But the novelty of dancing the night away in unusual places is what makes Silent Discos in Incredible Places so memorable—and unmissable. It’s just one of many innovative event concepts from MEGA Events, a pioneering experiential events company that spans pop culture, music, and entertainment. UK-based founder Nathan Reed and team are experts at tapping into the cultural zeitgeist of what people want to do and making it happen on a huge scale. MEGA Events is Eventbrite’s top EMEA creator and hosts events worldwide. Page 3Eventbrite Q2 2024 Shareholder Letter

We’ve been listening and responding to our creator’s needs, and we’re hard at work to eliminate the factors that are holding back growth in paid ticket volume. Next month, we will reintroduce a free tier with no creator fees to allow more creators to discover the value of our offerings and the power of our large and growing consumer audience. We believe this new tier will help position us to boost creator acquisition and retention, win back creators who have recently left the platform, and stabilize paid ticket volume over time. Looking ahead, we plan to introduce a premium marketplace tier that delivers enhanced event visibility, as well as incentives and support aligned to driving growth. While the addition of a new free tier and packaging our marketplace offerings in a premium subscription will likely impact near-term monetization, we believe these actions can help drive improvement in creator acquisition that will translate into growth in ticket volume. In light of the reduced revenue outlook and in keeping with our commitment to financial discipline, we have taken decisive action to significantly reduce operating expenses. We believe these steps will allow us to support margins and drive operating leverage as we plan for creator and ticket volume trends to return to more historical levels over time. Despite the near-term challenges we are addressing, we remain committed to our transformation plan and delivering stronger results in the future. Unicorn World Rainbows, hula-hoops, sparkles, and ball pits — these are a few of the things the family-friendly event Unicorn World charms attendees with. Created by parents Patrick and Lauren Mines, Unicorn World offers an immersive adventure complete with life-size animatronic unicorns, an enchanted forest to explore, and take-home arts and crafts. Galloping across the U.S. while hosting events in three to four cities per month on Eventbrite, Unicorn World is continually expanding tour dates to bring the dazzling experience to more communities. Page 4Eventbrite Q2 2024 Shareholder Letter

Business Update In the second quarter of 2024, we delivered revenue results consistent with our outlook for the period, although toward the lower end of the range we provided. Net revenue of $84.6 million was up 7% over last year’s second quarter. Ticketing revenue was 4% lower than a year earlier, reflecting declines in creator count and paid tickets related to the implementation of organizer fees. Revenue per ticket increased to $3.98 compared with $3.39 in the comparable quarter last year, propelled by strong growth in non-ticketing marketplace revenue (consisting of organizer fees and advertising revenue). Net income for the second quarter was $1.1 million, which includes the net benefit of an $8.2 million legal settlement award and minimal restructuring- related expenses. Second quarter Adjusted EBITDA was reported at $12.8 million. Excluding a net benefit of $4.3 million from the legal settlement and minimal restructuring-related expenses, Adjusted EBITDA was $8.5 million for the second quarter, representing a 10% margin. Our financial position remains strong. Total cash and cash equivalents were $575.5 million, and available liquidity (defined at the bottom of this Shareholder Letter) was $353.2 million as of June 30, 2024. Year to date, we have completed $37.0 million in share repurchases under the $100 million plan authorized in March, reducing shares outstanding by approximately 7% thus far. Marketplace Highlights We continue to upgrade the functionality and performance of our technology, always with an eye on serving the most innovative and successful creators of live events. During the third quarter, we plan to release a new timed entry ticketing capability, enabling Eventbrite to support events that offer tickets in multiple time slots during the day. This new functionality is intended to serve several new verticals, such as tours and museums, expand the breadth of inventory available in our marketplace, and increase paid ticket volume. We’ve made great strides in helping creators unlock greater scale, which is a top need for our customers both large and small. We recently announced a partnership with TikTok, which offers Eventbrite creators and consumers a powerful new way to share and promote events via the TikTok platform. 2,000000 2,214286 2,428571 2,642857 2,857143 3,071429 3,285714 3,500000 Q2 2024 Q2 2023 Q2 2022 Q2 2019 $3.04 $3.02 $3.39 7.1% 7.8% 8.9% 10.1% $3.98 // Net Revenue per Ticket and Take Rate Page 5Eventbrite Q2 2024 Shareholder Letter

Eventbrite creators and TikTok users can now link videos directly to an event page on the Eventbrite app, where consumers can discover full event details and directly purchase event tickets. This partnership adds significant consumer reach and engagement for creators, extending well beyond Eventbrite’s own marketplace. We are strengthening our outbound sales function to attract more high-value events with the greatest consumer appeal. These creators bring a large and diverse array of new consumers into our marketplace, feeding our flywheel when their event-going fans discover other events curated for them within the Eventbrite marketplace. We’ve expanded our sales team under new leadership and are using Eventbrite data to target creators in the categories and metros that exhibit the strongest consumer demand. Bookings of new, large creators continued to pace well ahead of 2023, increasing 60% year to year in the second quarter. We are both diversifying our revenue and enabling creators to effectively market their events through Eventbrite Ads. Our investments to improve relevance and targeting continued to drive down costs to Eventbrite Ads users and increase the return on their investment. Creators who participate in Eventbrite Ads tend to generate more revenue and display higher retention rates on our platform than those who have not yet adopted this service. We grew the number of creators using Eventbrite Ads by 20% between the first and second quarter, and more than doubled ad revenue year over year. We continue to expand Eventbrite Ads’ geographic coverage to both large and smaller metros, while fine-tuning our localized targeting capabilities at the same time. Leveraging the power of Eventbrite’s consumer reach and brand for the benefit of creators is a key element of our marketplace transition. Average monthly active users (MAUs) rose to 93 million in the quarter, with mobile app users increasing 22% from a year ago. We offer creators on our platform strong web search visibility as well as direct exposure to active ticket buyers on Eventbrite. In a recent study of consumer behavior, we observe consumer loyalty to our platform, as more than 60% of repeat buyers come back to purchase tickets to a different creator’s event the next time they return, making our marketplace a natural demand generating engine for creators. Buck’s Backyard Nestled just outside Austin, Texas, Buck’s Backyard is a vibrant venue that has captured hearts since opening its doors in 2017. Renowned for its cold beer, delicious food, and stellar live music scene, and owned and operated by industry veterans, this 15-acre oasis on Onion Creek offers a laid-back, family- and dog-friendly atmosphere. With live music rocking the stage every Friday and Saturday night, plus epic seasonal concerts, Buck’s Backyard embodies everything we love about live events — fun, community, and unforgettable moments. Page 6Eventbrite Q2 2024 Shareholder Letter

We plan to continue leveraging AI to fine-tune our consumer app and enhance personalization and relevance, and later this year, we plan to relaunch our app, leaning into social connections and hyper-local discovery of events through friends. Summary The work we are doing today to transition Eventbrite beyond a ticketing platform is designed to realize the tremendous potential we see in our market, our business, and our brand. We are positioning Eventbrite to capture that potential by focusing on creator success, consumer engagement, and continuous innovation. In doing so, we believe we are also building a stronger, more resilient company for the long term. We are energized by the opportunities ahead of us and confident in our ability to deliver on their promise. Sincerely, DC9 Nightclub This year marks twenty years since Washington DC’s hugely popular DC9 music venue and dance space first opened its doors. At DC9 it’s all about variety. Yes, there are intimate gigs, but with 26 events a month, there’s plenty more for music fans to get their kicks at. Think nostalgia- fueled 90s-themed-music events, trivia nights, weekday happy hours, karaoke (with a twist), and oh-so-hot-right-now dance parties (their ‘honest, blunt, and a little bit volatile’ dance night celebrates all things Charli XCX, complete with lime green Brat-style branding). Julia Hartz CEO Lanny Baker COO & CFO Page 7Eventbrite Q2 2024 Shareholder Letter

Financial Discussion Second Quarter 2024 Results All financial comparisons are on a year-over-year basis unless otherwise noted. Financial statement tables, including the reconciliation of non-GAAP financial measures, can be found at the end of this letter. Net Revenue Net revenue of $84.6 million in the second quarter of 2024 was up 7% compared to a year ago, benefiting from higher organizer fees and advertising services. Net revenue per paid ticket was $3.98 for the second quarter of 2024 compared to $3.39 a year ago, and a revenue take rate of 10.1% was 120 basis points higher. Net revenue per paid ticket included a $0.53 contribution from organizer fees and Eventbrite Ads revenue, which combined for $11.2 million or 13% of total revenue in the quarter. Q2 2024Q1 2024Q4 2023Q3 2023Q2 2023 $79M $82M $88M $86M $85M Paid Ticket Volume Paid ticket volume of 21.2 million in the second quarter of 2024 was down 9% compared to a year ago. Paid creators were 177,000, down 7% compared to 189,000 in the second quarter a year ago. Paid ticket volume for events outside of the U.S. represented 40% of total paid tickets in the second quarter, flat to a year ago. Q2 2024Q1 2024Q4 2023Q3 2023Q2 2023 23M 23M 24M 21M 21M Page 8Eventbrite Q2 2024 Shareholder Letter

Gross Profit Gross profit was $59.9 million in the second quarter of 2024, up 10% year-over-year for a gross margin of 70.9% compared to 68.8% a year ago. The improvement in gross margins reflects the increased contribution of marketplace revenue year-over-year as well as steps taken to reduce the cost of revenue. Gross profit in the second quarter of 2024 included minimal restructuring costs, whereas the second quarter of 2023 included a $0.8 million processing fee credit partially offset by $0.7 million in restructuring costs. Q2 2024Q1 2024Q4 2023Q3 2023Q2 2023 $54M $56M $61M $61M $60M Operating Expenses Operating expenses were $66.4 million in the second quarter of 2024, compared to $61.0 million in the second quarter of 2023. Operating expenses included a benefit of $4.4 million loss recovery from a legal settlement in the second quarter of 2024, and the second quarter of 2023 included $4.9 million in restructuring costs partially offset by a $4.0 million benefit from other costs. Product development expenses were $26.1 million for the second quarter, compared to $23.5 million a year ago. In the second quarter of 2023, product development expenses included $2.0 million related to restructuring costs. Product development expenses grew 11% year-over-year, reflecting investment in our consumer marketplace strategy. Sales, marketing, and support expenses were $24.5 million for the second quarter, compared to $15.7 million a year ago. Sales, marketing, and support expenses in the second quarter of 2024 saw an increase in chargeback volume of $5.7 million compared to $1.1 million a year ago in the same period. The second quarter of 2023 included $1.0 million in expenses related to restructuring costs and a $3.0 million benefit in other costs. Including the aforementioned items, sales, marketing, and support costs grew 56% year-over-year. Product Development Sales, Marketing & Support General & Administrative Q2 2023 Q2 2024 $22M $16M $23M $61M $24M $26M $66M $16M As reported GAAP Total Operating Expense Page 9Eventbrite Q2 2024 Shareholder Letter

General and administrative expenses were $15.8 million in the second quarter, compared to $21.8 million in the second quarter of 2023. General and administrative expenses in the second quarter of 2024 included a benefit of $4.4 million related to a loss recovery from a legal settlement. General and administrative expenses in the second quarter of 2023 included $1.8 million related to restructuring costs and a $1.0 million benefit in other costs. Including those items, General and administrative expenses were down 28% year-over-year. Net Income (Loss) Net income was $1.1 million for the second quarter of 2024, compared with a net loss of ($2.9) million in the same period in 2023. Net income in the second quarter of 2024 included a net benefit of $8.2 million from a legal settlement, comprising a $4.4 million loss recovery recorded as a credit to general and administrative expenses, $3.9 million in other income, and minimal restructuring costs. The net loss in the second quarter of 2023 included a net impact of $0.8 million from a processing fee credit, restructuring costs, and other items. OpEx Investment Profile Q2 2024 24% General & Administrative 39% 37% Product Development Sales & Marketing As reported As reported ($4M) ($1M) ($10M) Q2 2024Q1 2024Q4 2023Q3 2023Q2 2023 ($3M) ($1M) $1M Page 10Eventbrite Q2 2024 Shareholder Letter

$11M $13M $10M $9M $6M Q2 2024Q1 2024Q4 2023Q3 2023Q2 2023 Adjusted EBITDA Adjusted EBITDA of $12.8 million reported in the second quarter of 2024 included the benefit of $4.3 million due to a loss recovery from a legal settlement and minimal restructuring costs. Adjusted EBITDA in the second quarter of 2023 was $11.3 million and included a $0.8 million processing fee credit, $5.6 million in restructuring costs, and a $4.0 million benefit in other costs. Adj. EBITDA impact from non-routine items in Q2 2024 Impact to Net revenue Impact to Cost of net revenue Impact to Operating expense Total Adjusted EBITDA impact Recorded Amount ($M) - (0.1) 4.4 4.3 Balance Sheet and Cash Flow Cash and cash equivalents totaled $575.5 million at the end of the second quarter of 2024, down from $579.9 million as of March 31, 2024. To evaluate Eventbrite’s liquidity, the company adds funds receivable from ticket sales within the last five business days of the period to creator advances, short-term investments, and cash and cash equivalents, and then reduces the balance by creator payables. On that basis, the company’s available liquidity as of June 30, 2024 was $353.2 million compared to $377.7 million as of March 31, 2024. Long-term debt as of June 30, 2024 was $358.7 million compared to $358.2 million as of March 31, 2024. Available Liquidity in Q2 2024 Cash and cash equivalents Funds receivable Short term investments Creator advances, net Accounts payable, creators Available liquidity Recorded Amount ($M) $575.5 28.9 56.7 6.9 (314.7) $353.2 Page 11Eventbrite Q2 2024 Shareholder Letter

*We have not provided an outlook for GAAP net income (loss) or GAAP net income (loss) margin or reconciliations of expected Adjusted EBITDA to GAAP net income (loss) or expected Adjusted EBITDA margin to GAAP net income (loss) margin, because GAAP net income (loss) and GAAP net income (loss) margin on a forward-looking basis are not available without unreasonable efforts due to the potential variability and complexity of the items that are excluded from Adjusted EBITDA and Adjusted EBITDA margin, such as share-based compensation expense, foreign exchange rate gains and losses, and other non-recurring expenses. Business Outlook Based on current information, we anticipate third-quarter revenue will be within a range of $74 to $77 million, and full-year 2024 revenue will be within a range of $318 million to $325 million. At the midpoint of our revenue outlook range, we expect Adjusted EBITDA margins, excluding the impact of severance costs and other non-routine items, to be approximately 10% for the year. Page 12Eventbrite Q2 2024 Shareholder Letter

About Eventbrite Eventbrite is a global events marketplace that serves event creators and event-goers in nearly 180 countries. Since its inception, Eventbrite has been at the center of the experience economy, transforming how people organize and attend events. The company was founded by Julia Hartz, Kevin Hartz and Renaud Visage, with a vision to build a self-service platform that would make it possible for anyone to create and sell tickets to live experiences. With over 300 million tickets distributed for over 5 million events in 2023, Eventbrite is where people worldwide discover new things to do or new ways to do more of what they love. Eventbrite has also earned industry recognition as a top employer with special designations that include coveted spots on Fast Company’s prestigious The World’s 50 Most Innovative Companies and Fast Company’s Brands That Matter lists, the Great Place to Work® Award in the U.S., and Inc.'s Best-Led Companies honor. Learn more at www.eventbrite.com. Page 13Eventbrite Q2 2024 Shareholder Letter

Forward-Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, statements regarding the future performance of Eventbrite, Inc. and its consolidated subsidiaries (the “Company”); the Company’s business model and investments to support growth, including the Company’s marketplace strategy and impact on results; the Company’s expectations regarding the development of its marketplace and products; the Company’s long-term growth strategy, growth areas, pursuit of profitability, operating expenses, and investment initiatives and focus areas; the Company’s expectations with respect to its operating model, financial results and trends; and the Company’s expectations described under “Business Outlook” above. In some cases, forward- looking statements can be identified by terms such as “may,” “will,” “appears,” “shall,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern the Company’s expectations, strategy, plans, or intentions. Such statements are subject to a number of known and unknown risks, uncertainties, assumptions, and other factors that may cause the Company’s actual results, performance, or achievements to differ materially from results expressed or implied in this letter, including those more fully described in the Company’s filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Further information on potential risks that could affect actual results will be included in the subsequent periodic and current reports and other filings that the Company makes with the Securities and Exchange Commission from time to time. Investors are cautioned not to place undue reliance on these statements. Actual results could differ materially from those expressed or implied. All forward-looking statements are based on information and estimates available to the Company at the time of this letter, and are not guarantees of future performance, and reported results should not be considered as an indication of future performance. Except as required by law, the Company assumes no obligation to update any of the statements in this letter. Disclaimer Regarding Ticketing and Creator Metrics This letter includes certain measures related to our ticketing business, such as free and paid tickets, paid creators, paid buyers, monthly active users (MAUs), and Eventbrite Ads. We believe that the use of these metrics is helpful to our investors as these metrics are used by management in assessing the health of our business and our operating performance. These metrics are based on what we believe to be reasonable estimates for the applicable period of measurement. There are inherent challenges in measuring these metrics, and we regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy. You should not consider these metrics in isolation or as substitutes for analysis of our results of operations as reported under GAAP. About Non-GAAP Financial Measures We believe that the use of Adjusted EBITDA, Adjusted EBITDA margin and Available Liquidity is helpful to our investors in understanding and evaluating our results of operations and useful measures for period-to-period comparisons of our business performance as they are metrics used by management in assessing the health of our business and our operating performance, making operating decisions, and performing strategic planning and annual budgeting. These measures are not prepared in accordance with GAAP and have limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of our results of operations as reported under GAAP. In addition, other companies may not calculate non-GAAP financial measures in the same manner as we calculate them, limiting their usefulness as comparative measures. You are encouraged to evaluate the adjustments and the reasons we consider them appropriate. Some amounts in this shareholder letter may not sum due to rounding. Adjusted EBITDA We calculate Adjusted EBITDA as net income (loss) adjusted to exclude depreciation and amortization, stock-based compensation expense, interest expense, interest income, employer taxes related to employee transactions, other (income) expense net, which consists of foreign exchange rate gains and losses, and income tax provision (benefit). Adjusted EBITDA should not be considered as an alternative to net income (loss) or any other measure of financial performance calculated and presented in accordance with GAAP. Page 14Eventbrite Q2 2024 Shareholder Letter

Some of the limitations of Adjusted EBITDA include (i) Adjusted EBITDA does not properly reflect capital spending that occurs off of the income statement or account for future contractual commitments, (ii) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures and (iii) Adjusted EBITDA does not reflect the interest and principal required to service our indebtedness. In evaluating Adjusted EBITDA, you should be aware that in the future we expect to incur expenses similar to the adjustments in this release. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-routine items. When evaluating our performance, you should consider Adjusted EBITDA alongside other financial performance measures, including our net income (loss) and other GAAP results. Adjusted EBITDA Margin Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by net revenue. Because of the limitations described above, you should consider Adjusted EBITDA and Adjusted EBITDA Margin alongside other financial performance measures, including net income (loss), net income (loss) margin and our other GAAP results. Available Liquidity To evaluate Eventbrite’s liquidity, the Company adds funds receivable from ticket sales within the last five business days of the period to creator advances, short-term investments, and cash and cash equivalents, and then reduces the balance by funds payable and creator payables. Page 15Eventbrite Q2 2024 Shareholder Letter

Net revenue Cost of net revenue(1) Gross profit Operating expenses (1): Product development Sales, marketing and support General and administrative Total operating expenses Loss from operations Interest income Interest expense Other income (expense), net Loss before income taxes Income tax provision Net income (loss) Net income (loss) per share Basic Diluted Weighted-average number of shares outstanding used to compute net income (loss) per share Basic Diluted 84,551 24,611 59,940 26,057 24,521 15,816 66,394 (6,454) 7,382 (2,806) 3,725 1,847 784 1,063 0.01 0.01 96,142 96,290 170,803 49,643 121,160 52,741 45,390 37,053 135,184 (14,024) 14,789 (5,606) 2,472 (2,369) 1,058 (3,427) (0.04) (0.04) 95,557 95,557 78,912 24,603 54,309 23,486 15,679 21,826 60,991 (6,682) 6,926 (2,786) 80 (2,462) 459 (2,921) (0.03) (0.03) 99,995 99,995 156,826 50,998 105,828 50,050 32,739 43,544 126,333 (20,505) 12,379 (5,538) (873) (14,537) 1,070 (15,607) (0.16) (0.16) 99,748 99,748 Cost of net revenue Product development Sales, marketing and support General and administrative Total 128 7,060 1,850 6,238 15,276 279 13,034 4,284 11,641 29,238 226 5,184 2,792 6,397 14,599 423 9,508 5,020 11,742 26,693 Condensed Consolidated Statements of Operations ($ in thousands, except per share data)(unaudited) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Six Months Ended June 30, Three Months Ended June 30, 20242024 20232023 (1) Includes stock-based compensation as follows: Page 16Eventbrite Q2 2024 Shareholder Letter

Assets Current assets Cash and cash equivalents Funds receivable Short-term investments, at amortized cost Accounts receivable, net Creator signing fees, net Creator advances, net Prepaid expenses and other current assets Total current assets Creator signing fees, net noncurrent Property and equipment, net Operating lease right-of-use assets Goodwill Acquired intangible assets, net Other assets Total assets Liabilities and Stockholders’ Equity Current liabilities Accounts payable, creators Accounts payable, trade Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Total current liabilities Accrued taxes, noncurrent Operating lease liabilities, noncurrent Long-term debt Total liabilities Stockholders’ equity Common stock, at par Additional paid-in capital Treasury stock, at cost Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity 575,499 28,869 56,698 4,856 3,601 6,852 12,147 688,522 1,553 12,643 1,000 174,388 9,132 7,282 894,520 314,718 1,467 8,213 8,534 5,712 1,973 13,062 353,679 4,532 1,423 358,725 718,359 1 1,032,205 (37,184) (818,861) 176,161 894,520 $ $ $ $ $ $ $ $ 489,200 48,773 153,746 2,814 634 2,804 13,880 711,851 1,303 9,384 177 174,388 13,314 2,913 913,330 303,436 1,821 8,088 17,522 8,796 1,523 16,425 357,611 4,526 1,768 357,668 721,573 1 1,007,190 — (815,434) 191,757 913,330 Condensed Consolidated Balance Sheets ($ in thousands)(unaudited) June 30, December 31, 2024 2023 Page 17Eventbrite Q2 2024 Shareholder Letter

Cash flows from operating activities Net loss Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization Stock-based compensation expense Amortization of debt discount and issuance costs Unrealized gain on foreign currency exhange Accretion on short-term investments Non-cash operating lease expenses Amortization of creator signing fees Changes related to creator advances, creator signing fees, and allowance for credit losses Provision for chargebacks and refunds Gain on litigation settlement Other Changes in operating assets and liabilities: Accounts receivable Funds receivable Creator signing fees and creator advances Prepaid expenses and other assets Accounts payable, creators Accounts payable Chargebacks and refunds reserve Accrued compensation and benefits Accrued taxes Operating lease liabilities Other accrued liabilities Net cash provided by operating activities Cash flows from investing activities Purchase of short-term investments Maturities of short-term investments Purchases of property and equipment Capitalized internal-use software development costs Net cash provided by (used in) investing activities Cash flows from financing activities Repurchase of common stock Proceeds from exercise of stock options Taxes paid related to net share settlement of equity awards Proceeds from issuance of common stock under ESPP Principal payments on finance lease obligations Net cash used in financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Net increase (decrease) in cash, cash equivalents and restricted cash (3,427) 7,242 29,239 1,057 (1,326) (2,769) 273 401 (2,920) 14,559 (3,927) 623 (2,866) 20,155 (3,922) 1,291 9,712 (366) (14,415) (8,988) (3,840) (991) (4,003) 30,792 (112,185) 212,002 (403) (4,818) 94,596 (36,508) — (5,776) 454 — (41,830) 2,741 86,299 $ $ $ $ (15,607) 6,709 26,693 1,010 (1,674) (3,585) 5,002 468 (1,496) 5,755 — 908 (763) 24,136 655 1,061 15,789 (487) (8,350) 985 (8,596) (1,933) 1,480 48,160 (150,565) 85,500 (521) (3,161) (68,747) — 748 (3,201) 567 (1) (1,887) 2,787 (19,687) Consolidated Statements of Cash Flows ($ in thousands)(unaudited) Six Months Ended June 30, 2024 2023 Page 18Eventbrite Q2 2024 Shareholder Letter

Cash, cash equivalents and restricted cash Beginning of period End of period Supplemental cash flow data Interest paid Income taxes paid, net of refunds Non-cash investing and financing activities Operating lease right-of-use assets obtained in exchange for operating lease liabilities Reduction of right-of-use assets due to modification or exit Other accrued liability recorded for treasury stock purchases 489,200 575,499 4,548 994 1,011 — 536 540,174 520,487 4,549 323 — 3,917 — Consolidated Statements of Cash Flows (cont.) ($ in thousands)(unaudited) Six Months Ended June 30, 2024 2023 $ $ $ $ $ $ $ $ $ $ Page 19Eventbrite Q2 2024 Shareholder Letter

Net revenue Paid ticket volume Net revenue per paid ticket Net income (loss) Add: Depreciation and amortization Stock-based compensation Interest income Interest expense Employer taxes related to employee equity transactions Other (income) expense, net Income tax provision Adjusted EBITDA Adjusted EBITDA Margin (3,427) 7,243 29,238 (14,789) 5,606 792 (2,472) 1,058 23,249 14 1,063 3,649 15,276 (7,382) 2,806 365 (3,725) 784 12,836 15 (15,607) 6,708 26,693 (12,379) 5,538 559 873 1,070 13,455 9 (2,921) 3,193 14,599 (6,926) 2,786 203 (80) 459 11,313 14 $ $ $ $ $ $ $ $ Key Operating Metrics and Non-GAAP Financial Measures (In thousands, except per ticket data)(Unaudited) 170,803 42,459 4.02 84,551 21,243 3.98 156,826 46,487 3.37 78,912 23,309 3.39 $ $ $ $ $ $ $ $ Six Months Ended June 30, Three Months Ended June 30, 20242024 20232023 Adjusted EBITDA Reconciliation %% %% Page 20Eventbrite Q2 2024 Shareholder Letter

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

EVENTBRITE, INC.

|

| Entity Central Index Key |

0001475115

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38658

|

| Entity Tax Identification Number |

14-1888467

|

| Entity Address, Address Line One |

95 Third Street, 2nd Floor,

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94103

|

| City Area Code |

415

|

| Local Phone Number |

692-7779

|

| Title of 12(b) Security |

Class A common stock, par value $0.00001 per share

|

| Trading Symbol |

EB

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

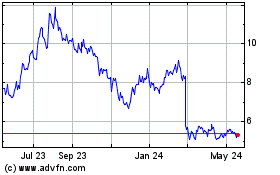

Eventbrite (NYSE:EB)

Historical Stock Chart

From Nov 2024 to Dec 2024

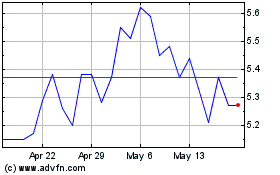

Eventbrite (NYSE:EB)

Historical Stock Chart

From Dec 2023 to Dec 2024