SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November, 2024

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

| 1. Operating Results |

7 |

| 1.1. Generation Segments |

7 |

| 1.2. Trading Segment |

10 |

| 1.3. Transmission Segment |

12 |

| 2. Consolidated result | IFRS and regulatory |

13 |

| 2.1. Operating Income |

15 |

| 2.2. Other Income |

22 |

| 2.3. Operating Costs and Expenses |

23 |

| 2.4. Equity Holdings |

27 |

| 2.5. EBITDA |

28 |

| 2.6. Financial Results |

30 |

| 2.7. Current and Deferred Taxes |

31 |

| 3. Debt and receivables |

32 |

| 3.1. Holding / Parent Company and Consolidated |

32 |

| 4. Loans and Financing (Receivables) |

34 |

| 4.1. Holding / Parent Company and Consolidated |

34 |

| 5. Investments |

34 |

| 6. ESG |

36 |

| 7. Cash Flow |

37 |

| 8. Annexes |

38 |

| 8.1. Annex 1 - Financial Statements |

38 |

| 8.2. Annex 2 – Annual RAP Adjustment – 2024/2025 cycle |

45 |

| 8.3. Annex 3 - Regulatory Remeasurement - Concession Contracts |

47 |

| 8.4. Annex 4 - Compulsory Loan |

48 |

| 8.5. Annex 5 - IFRS EBITDA |

49 |

| 8.6. Annex 6 - IFRS vs. Regulatory reconciliation |

50 |

ELETROBRAS

RELEASES RESULTS FOR

THE 3rd QUARTER OF 2024

Eletrobras' operating and financial results in

3Q24 reinforce its solid financial position, enabling the Company to accelerate investments in asset modernization, expansion through

transmission or generation auctions, operational streamlining and the effective reduction of legacy liabilities and contingencies.

Regulatory net operating revenue grew by 8.2%

to R$10.6 billion YoY, mainly reflecting the increase in generation revenue due to the renegotiation of the hydrological risk of the Tucuruí

Plant which had a R$1.3 billion impact. This increase was partially offset by the drop in transmission revenue, reflecting the effect

of the Annual Permitted Revenue (RAP) revision. It is also worth highlighting the net reversal of provision for the sale of energy to

Amazonas Energia, in the amount of R$347 million.

Adjusted regulatory EBITDA reached R$6.8 billion,

up R$544 million compared to 3Q23.

MAIN HIGHLIGHTS

OF 3Q24 RESULTS

| • | Regulatory Net Operating Revenue:

up 8.2% to R$10.6 billion YoY: |

+ R$1.3 billion impact from

renegotiation of Tucuruí plant's hydrological risk

| – | R$ 695 million YoY reduction in RAP due to the 2024 RTP,

of which R$ 328 million refers to PA Postponement |

| • | Adjusted regulatory PMSO: R$1,702

million (up 1% YoY), impacted by the following adjustments: (a) R$2 million VDP adjustment in Personnel, (b) R$221 million write-off of

court deposits in Others, and (c) R$89 million payment of court sentences for cases prior to 2022, in Others. |

| • | Provisions: net reversal of R$405

million, positively impacted by R$376 million related to Amazonas Energia from previous months and constitution of a R$29 million provision

related to the unpaid portion of the R$58 million of energy billed by Balbina plant in 3Q24. |

| • | Adjusted regulatory EBITDA: R$6,775

million (up 8.7% YoY) reflecting the effects above and including R$610 million from equity income. |

| • | Adjusted IFRS net income: R$7,563

million (up 588% YoY) due to higher EBITDA coupled with the recognition of remeasurement of transmission assets after the 2024 RTP for

a net amount of R$5,417 million (which had a positive impact on IFRS EBITDA but was neutral on regulatory EBITDA).

|

MAIN

OPERATING AND FINANCIAL INDICATORS

Table 1 - Operating Highlights

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

| Generation and Trading |

|

|

|

|

|

| Installed Generation Capacity (MW) |

44,191 |

44,654 |

-1.0 |

44,279 |

-0.2 |

| Assured Capacity (aMW)(1) |

21,912 |

22,294 |

-1.7 |

22,012 |

-0.5 |

| Net Generation (TWh) |

112.8 |

146.9 |

-23.2 |

86.6 |

30.3 |

| Energy Sold ACR (TWh)(2)(5) |

13.7 |

8.5 |

60.8 |

9.5 |

45.0 |

| Energy Sold ACL (TWh)(3) |

16.4 |

12.7 |

29.2 |

15.9 |

3.7 |

| Energy Sold Quotas (TWh)(3) |

8.7 |

11.6 |

-24.9 |

8.6 |

1.1 |

| Average ACR Price (R$/MWh)(4) |

255.88 |

227.21 |

12.6 |

212.56 |

20.4 |

| Average ACL Price (R$/MWh) |

154.15 |

199.81 |

-22.9 |

144.85 |

6.4 |

| Transmission |

|

|

|

|

|

| Transmission lines (km) |

67,149 |

66,909 |

0.4 |

66,993 |

0.2 |

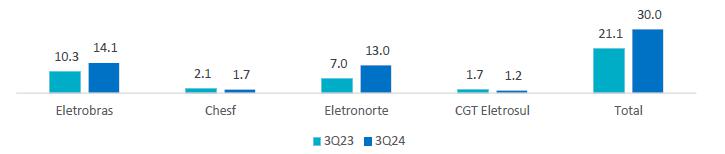

| RAP (R$ mm) |

17,015 |

17,714 |

-3.9 |

17,856 |

-4.7 |

(1) Assured Capacity (AC) reflects: (a) Ordinance GM/MME 544/21, which defined the

revision of AC values of the plants that had their concession renewed due to capitalization (plants under the Quotas regime, Tucuruí,

Itumbiara, Sobradinho, Mascarenhas de Moraes and Curuá-Una), with a significant reduction in AC as from 2023; (b) Ordinance GM/MME

709/22, with an Ordinary Review of the AC of hydroelectric plants as from 2023, affecting several Eletrobras plants; (c) increase in the

AC of Santa Cruz TPP due to the closure of the Combined Cycle, as of ANEEL Order 481, of Feb 23, 2023, authorizing the start of commercial

operation of a new generating unit at the plant; (d) exit of Candiota III TPP as of Jan/24; (e) inclusion of SPEs that started being consolidated:

HPPs Teles Pires (Sep/23), Baguari (Oct/23), Retiro Baixo (Nov/23) and Santo Antonio (Nov/23); and (f) f) inclusion of the expanding wind

farms Casa Nova B and Coxilha Negra with full AC in 2024.

(2) Does not include quotas;

(3) Includes contracts under Law 13,182/2015;

(4) The figures shown are the Assured Capacity of quotas in GWh.

(5) the significant increase in 3Q24 compared to 2Q24 was due to ACR contracts arising

from the Tucuruí Hydrological Risk Renegotiation, in high amounts only in July and August

(6) Approved RAP for the current regulatory cycle, associated with active modules at

the end of each period, including those that were active at the beginning of the cycle plus those that went into commercial operation.

Includes transmission contracts of the companies Eletrobras Holding, Chesf, CGT Eletrosul, Eletronorte, TMT and VSB.

Table 2 - Financial Highlights

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

9M24 |

9M23 |

Δ% |

| Financial Indicators |

|

|

|

|

|

|

|

|

| Gross Revenue |

12,960 |

10,599 |

22.3 |

10,280 |

26.1 |

33,811 |

32,617 |

- |

| Adjusted Gross Revenue |

12,960 |

10,549 |

22.9 |

10,280 |

26.1 |

33,811 |

32,636 |

3.6 |

| Net Operating Revenue |

11,043 |

8,781 |

25.8 |

8,395 |

31.5 |

28,156 |

27,237 |

3.4 |

| Adjusted Net Operating Revenue |

11,043 |

8,700 |

26.9 |

8,395 |

31.5 |

28,156 |

27,224 |

3.4 |

| Regulatory Net Operating Revenue |

10,596 |

9,877 |

7.3 |

9,735 |

8.8 |

30,031 |

27,701 |

8.4 |

| EBITDA |

12,159 |

4,815 |

152.5 |

4,430 |

174.5 |

21,209 |

16,297 |

30.1 |

| Adjusted EBITDA |

11,964 |

4,530 |

164.1 |

4,204 |

184.6 |

20,698 |

15,457 |

33.9 |

| Regulatory EBITDA |

6,970 |

6,516 |

7.0 |

6,235 |

11.8 |

18,791 |

17,601 |

6.8 |

| Adjusted Regulatory EBITDA |

6,775 |

6,231 |

8.7 |

6,010 |

12.7 |

18,280 |

16,761 |

9.1 |

| EBITDA Margin (%) |

110.1 |

54.8 |

55,3pp |

52.8 |

57,3pp |

75.3 |

59.8% |

15.5% |

| Adjusted EBITDA Margin (%) |

108.3 |

52.1 |

56,3pp |

50.1 |

58,3pp |

73.5% |

56.8% |

16.7% |

| Return on Equity (ROE %) |

8.4 |

2.7 |

5,7pp |

3.9 |

4,5pp |

8.4% |

2.7% |

5.7% |

| Adjusted Gross Debt |

70,732 |

70,990 |

-0.4 |

72,034 |

-1.8 |

70,732 |

70,990 |

-0.4 |

| Adjusted Net Debt (Adj Net Debt) |

40,855 |

39,107 |

4.5 |

44,620 |

-8.4 |

40,855 |

39,107 |

4.5 |

| Adj Net Debt/Adjusted LTM EBITDA |

1.7 |

2.0 |

-15.3 |

2.6 |

-36.2 |

1.7 |

2.0 |

-15.3 |

| Net Income |

7,195 |

1,477 |

387.3 |

1,743 |

312.9 |

9,268 |

3,501 |

164.7 |

| Adjusted Net Income |

7,563 |

1,099 |

588.3 |

615 |

1,129.1 |

8,626 |

3,574 |

141.4 |

| Investments |

1,713 |

1,871 |

-8.4 |

2,000 |

64 |

4,934 |

4,386 |

12.5 |

Generation Assets

In 3Q24, we operated 86 plants, of which 47 were hydroelectric,

7 thermal, 31 wind and 1 solar, taking into account corporate ventures, shared ownership and holdings via SPEs. Compared to 2Q24, there

was a reduction of 13 wind farms, due to the sale of the Chapada do Piauí I and II wind farms (in which the Holding had a stake)

and an increase of 1 wind farm due to the entry into commercial operation of CGT Eletrosul's Coxilha Negra 2 wind farm. As a result,

at quarter’s end wind farms totaled 31, down from 43.

Our total installed capacity was 44,191 MW in

3Q24, which represents 22% of the total installed in Brazil. Of this total, 97% is derived from clean sources, with low greenhouse gas

emissions.

Table 3 - Generation Assets

| Source |

Installed Capacity (MW) |

Assured Capacity

(aMW) |

Accumulated Generated Energy (GWh) |

| Hydro (47 plants) |

42,293.49 |

20,629.79 |

108,340.77 |

| Thermal (7 plants) |

1,270.23 |

1,058.60 |

3,244.46 |

| Wind power (31 plants) |

626.47 |

223.94 |

1,222.07 |

| Solar (1 plant) |

0.93 |

- |

0.68 |

| Total (86 plants) |

44,191.12 |

21,912.32 |

112,807.98 |

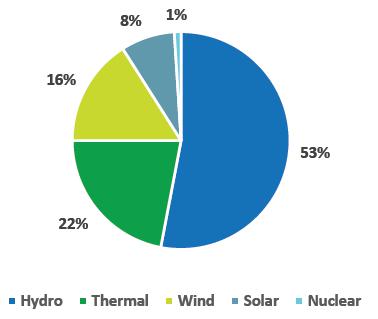

System Data - Installed Capacity and Generation

In 3Q24, Brazil's installed capacity was 205,521.59 MW.

Chart 1 – Brazil’s Installed capacity - by source

Source: ANEEL’s Generation Information System - SIGA

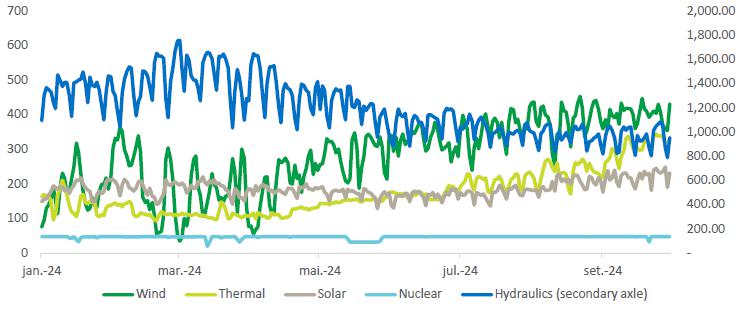

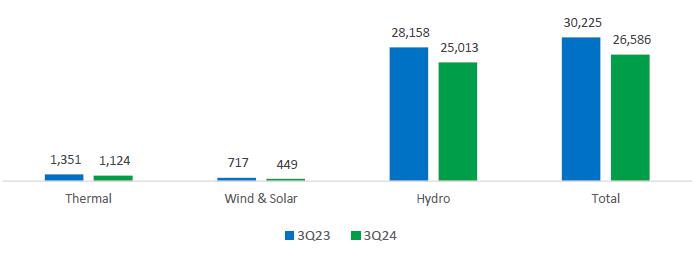

Chart 2 - Generated Energy SIN - National Interconnected System (GWh)

Source: Operating Results 01/01 to 9/30/2024 - ONS

Eletrobras Data - Generated Energy

The total amount of energy generated by Eletrobras declined

12% YoY in 3Q24.

Chart 3 - Eletrobras - Net Energy Generation (GWh)

System Data - Energy Market

Table 4 - PLD

| |

|

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

| Market |

GSF (%) |

79.09 |

80.55 |

-1.8 |

99.19 |

-20.3 |

| PLD SE (R$/MWh) |

169.67 |

72.73 |

133.3 |

62.83 |

170.0 |

| PLD S (R$/MWh) |

169.72 |

72.73 |

133.4 |

62.83 |

170.1 |

| NE PLD (R$/MWh) |

142.72 |

72.73 |

96.2 |

62.83 |

127.2 |

| PLD N (R$/MWh) |

172.55 |

72.73 |

137.2 |

62.83 |

174.6 |

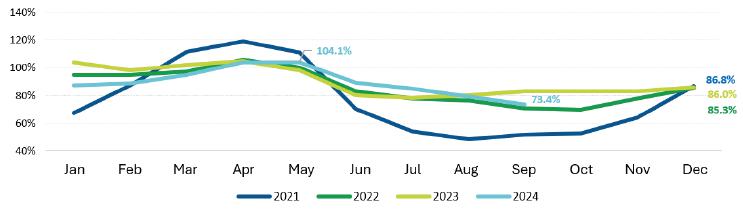

Chart 4 - GSF (%)

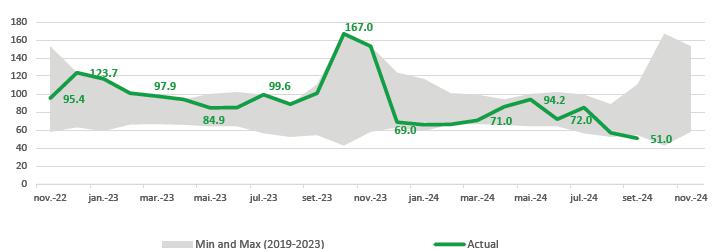

Chart 5 - Historical Average of Affluent Natural Energy (ENA) - SIN (%)

During 3Q24, the indicator fluctuated between its historical

high and low, closing the quarter at 51%, close to the bottom of the 93-year historical band.

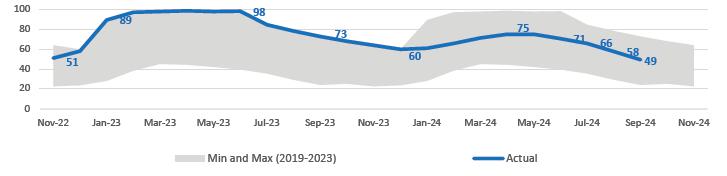

Chart 6 - Energy Stored in Reservoirs - SIN (%)

2024 has been low in terms of tributary flow, except for April

and May, mainly due to the rains in the southern region of the country.. Taking into account the entire 93-year history, notably September

2024 was the 2nd worst September performance during the period.

New Projects

Two projects are at the construction stage which,

when completed, will add approximately 330 MW to Eletrobras' installed capacity by year-end 2024. These are the Coxilha Negra Wind Farm,

with 302 MW and located in Rio Grande do Sul, and the Casa Nova B wind farm, with 27 MW, located in Bahia.

At Coxilha Negra, to date the assembly of 55 of the

72 wind turbines was completed by the end of 3Q24. The wind farm began its test operation in February 2024. Commercial operation began

in July 2024, in stages. At the end of 3Q24, 23 wind turbines at Coxilha Negra 2 were operating commercially and a further 13 were in

test phase. The construction progress of the project is at 94%.

The works at Casa Nova B also progressed in 3Q24, with construction continuing

on the Medium Voltage Network (MVN) and Line Entrance (EL). With regard to the RMT, the excavation, duct laying, cable laying and backfill

phases have been completed, and the interconnection boxes for the input and output of the wind turbines are currently under construction

with 15 of 35 completed by the end of September. The Casa Nova B Project has completed a wind farm which had been halted. At the end of

3Q24, the construction progress was at 72 %.

Energy Sold in 3Q24

Eletrobras companies sold 38.7 TWh of energy in 3Q24,

up 18% on the 32.8 TWh traded in 3Q23. The volumes sold include energy from plants under the quota regime, renewed by Law 12.783/2013,

as well as from plants under the operating regime (Free Market - ACL and Regulated Market - ACR) and from consolidated SPEs (HPPs Teles

Pires, as of Oct/23; Baguari, as of Oct/23; Retiro Baixo, as of Nov/23; and Santo Antonio, as of Nov/23).

Chart 7 - Energy Sold - ACL and ACR (TWh)

Chart 8 - Energy Sold - quotas (TWh)

ENERGY BALANCE

Table 5 - Energy Balance 3Q24 (aMW)

| |

2024 |

2025 |

2026 |

2027 |

| Resources with no impact on the balance sheet (1) |

1,192 |

0 |

0 |

0 |

| |

|

|

|

|

|

|

|

| Resources (A) |

14,518 |

15,391 |

16,581 |

17,678 |

| Own resources (2) (3) (4) (5) |

12,899 |

14,185 |

15,449 |

16,628 |

| Hydraulic |

12,708 |

13,935 |

15,199 |

16,378 |

| Wind |

191 |

250 |

250 |

250 |

| Energy Purchase |

1,620 |

1,206 |

1,132 |

1,050 |

| Limit => |

|

Lower |

Higher |

Lower |

Higher |

Lower |

Higher |

| Sales (B) (6) |

12,848 |

9,599 |

12,099 |

7,599 |

9,099 |

5,990 |

7,240 |

| ACR - Except quotas |

3,638 |

3,099 |

3,099 |

2,990 |

| ACL - Bilateral Contracts + STM implemented (range) (6) |

9,210 |

6,500 |

9,000 |

4,500 |

6,000 |

3,000 |

4,250 |

| Average prices Contracts signed |

|

|

|

|

| Limit => |

|

Lower |

Higher |

Lower |

Higher |

Lower |

Higher |

Average Price of Sales Contracts

(ACR and ACL - R$/MWh) |

179 |

170 |

180 |

180 |

200 |

185 |

215 |

| Balance (A - B) |

1,671 |

5,792 |

3,292 |

8,982 |

7,482 |

11,688 |

10,438 |

| Balance considering estimated hedge (9) |

146 |

3,256 |

756 |

6,216 |

4,716 |

8,707 |

7,457 |

| Decontracted energy considering estimated hedge (9) |

1% |

21% |

5% |

37% |

28% |

49% |

42% |

Contracts signed until 09/30/2024.

It should be noted that the balance sheet considers the SPEs

consolidated by Eletrobras: Santo Antônio HPP (as of 3Q22), Baguari HPP and Retiro Baixo HPP (as of 4Q23), whether in terms of resources,

sales or average prices. In the same way, it considers the SPE consolidated by Eletronorte: Teles Pires HPPs (as from 4Q23).

1. The Independent Energy Producers (IEP) contracts resulting

from the Amazonas Distribuidora de-verticalization process, the thermal plant availability contracts and the Assured Capacity Quotas are

not included in this energy balance, whether in resources, requirements (sales) or average prices. These resources are presented only

for 2024 and are not considered for the following years due to divestments.

2. Own Resources include the plants migrating from the

quota regime to the independent production regime (new IEPs) and the New Grants (Sobradinho, Itumbiara, Tucuruí, Curuá-Una

and Mascarenhas de Moraes). For the hydroelectric projects, an estimate of GFIS2 was considered, i.e. the Assured Capacity taking into

account the Adjustment Factors due to Internal Losses, Losses in the Basic Grid and Availability as well as adjustments due to the particularities

of the portfolio.

3. The revised Assured Capacity values, as defined in

Ministerial Order No. 709/GM/MME, of November 30, 2022, are taken into account.

4. The plants currently under the quota regime will be

granted a new concession under the Independent Energy Producer (IEP) regime, gradually over a 5-year period starting in 2023 (“Decotization”).

The Assured Capacity values were defined in Ministerial Order GM/MME No. 544/21.

5. Taking into account the new concession grants from 2023 onwards

for the Sobradinho, Itumbiara, Tucuruí, Curuá-Una and Mascarenhas de Moraes plants, whose Assured Capacity values were defined

in Ministerial Order GM/MME No. 544/21.

6. The balances from 2025 to 2027 consider around 200 aMW of intercompany transactions,

impacting the energy purchase and sales lines on the ACL.

Table 6 - Assured Capacity Quotas of Hydroelectric Power Plants (aMW)

| |

2024 |

2025 |

2026 |

2027 |

| Assured Capacity Quotas (7) (8) |

3,939 |

2,626 |

1,313 |

- |

7. This does not include the Assured Capacity of the Jaguari HPP, of 12.7

aMW, whose concession is under provisional administration by Furnas.

8. Decotization will take place gradually over a 5-year period

starting in 2023. The Assured Capacity values considered from 2023 onwards were those defined in Ministerial Order GM/MME No. 544/21.

9. The figures show an estimate of the decontracted

energy. The estimated amount for 2024 is 88.0%. For the other years, an average historical GSF value from 2018 to 2023 of 81.8% was used.

Source: CCEE, obtained from the CCEE website, at the following link: https://www.ccee.org.br/dados-e-analises/dados-geracao (in Portuguese),

under the MRE option in the panel. It should be noted that this is only an estimate, based on facts that occurred in the past.

Transmission Lines

The company ended 3Q24 with 74,0 thousand km of lines,

being 67,1 thousand km of own lines and 6.8 thousand km of lines with partners, as well as 404 substations, including 295 of its own substations

and 109 third-party substations.

Table 7 - Transmission Lines (Km)

| Company |

Own(1) |

In Partnership (2) |

Total |

| Chesf |

22,055 |

1,831 |

23,886 |

| Eletronorte |

10,978 |

1,073 |

12,051 |

| CGT Eletrosul |

12,021 |

5 |

12,026 |

| Furnas |

22,094 |

3,902 |

25,996 |

| Total |

67,149 |

6,810 |

73,958 |

(1) Includes TMT (100%) and VSB (90%).

(1) Partnerships consider extensions proportional to the capital

invested by Eletrobras Companies in the project.

New Projects

245 large-scale transmission projects are being implemented,

including reinforcements, improvements and auction projects. With respect to Nova Era Janapu, which was included in 2Q24. Nova Era Catarina,

Nova Era Ceará, Nova Era Integração and Nova Era Teresina were included in 3Q24.

The group of new projects takes into account those

registered with ANEEL's Transmission Management System (SIGET). Projects enter this group when they become part of SIGET, and leave it

when either they are canceled or enter commercial operation.

The estimated investment is of R$ 13.2 billion, with

an associated additional RAP of R$ 1.8 billion between 2024-2029. The projects will add approximately 2,359 km of TL and 9,695 MVA in

substations. More information is available in the "Operating Data" document for 3Q24 available on the IR website.

According to the Improvement and Reinforcement Plans

Management System (SGPMR), Eletrobras companies had a total of 11,130 small-scale events under implementation or to be implemented, of

which 10,491 referred to small-scale improvements and 639 to small-scale reinforcements.

| 2. | Consolidated result | IFRS and regulatory |

Table 8 - Income Statement IFRS (R$ mm)

| |

3Q24 |

3Q23 |

2Q24 |

9M24 |

9M23 |

| |

IFRS |

Adjustment |

Adjusted |

Adjusted |

%

Y/Y |

Adjusted |

%

Q/Q |

Adjusted |

Adjusted |

%

Y/Y |

| Generation |

8,348 |

0 |

8,348 |

6,368 |

31.1 |

5,828 |

43.2 |

20,109 |

19,415 |

3.6 |

| Transmission |

4,566 |

0 |

4,566 |

4,067 |

12.3 |

4,395 |

3.9 |

13,520 |

12,874 |

5.0 |

| Others |

46 |

0 |

46 |

114 |

-59.7 |

57 |

-18.6 |

182 |

348 |

-47.7 |

| Gross

Revenue |

12,960 |

0 |

12,960 |

10,549 |

22.9 |

10,280 |

26.1 |

33,811 |

32,636 |

3.6 |

| (-)

Deductions from Revenue |

-1,918 |

0 |

-1,918 |

-1,850 |

3.7 |

-1,884 |

1.8 |

-5,655 |

-5,412 |

4.5 |

| Net

Revenue |

11,043 |

0 |

11,043 |

8,700 |

26.9 |

8,395 |

31.5 |

28,156 |

27,224 |

3.4 |

| Energy

resale, grid, fuel and construction |

-4,014 |

0 |

-4,014 |

-3,020 |

32.9 |

-3,046 |

31.8 |

-9,917 |

-7,911 |

25.4 |

| Personnel,

Material, Services and Others |

-2,005 |

313 |

-1,692 |

-1,682 |

0.6 |

-1,576 |

7.4 |

-4,862 |

-5,444 |

-10.7 |

| Operating

provisions |

229 |

-480 |

-251 |

-115 |

118.1 |

-269 |

-6.7 |

-834 |

-200 |

318.0 |

| Regulatory

remeasurements - Transmission contracts |

6,130 |

0 |

6,130 |

-12 |

- |

0 |

- |

6,130 |

-12 |

- |

| Other

income and expenses |

28 |

-28 |

0 |

0 |

- |

0 |

- |

0 |

0 |

- |

| EBITDA,

before Equity holdings |

11,411 |

-195 |

11,216 |

3,871 |

189.7 |

3,504 |

220.1 |

18,674 |

13,658 |

36.7 |

| Equity

holdings |

749 |

0 |

749 |

659 |

13.6 |

700 |

6.9 |

2,025 |

1,798 |

12.6 |

| EBITDA |

12,159 |

-195 |

11,964 |

4,530 |

164.1 |

4,204 |

184.6 |

20,698 |

15,457 |

33.9 |

| D&A |

-990 |

0 |

-990 |

-925 |

7.1 |

-968 |

2.3 |

-2,955 |

-2,722 |

8.5 |

| EBIT |

11,169 |

-195 |

10,974 |

3,605 |

204.4 |

3,236 |

239.1 |

17,743 |

12,734 |

39.3 |

| Financial

Result |

-2,788 |

563 |

-2,225 |

-2,022 |

10.1 |

-2,750 |

-19.1 |

-7,755 |

-7,705 |

0.7 |

| EBT |

8,381 |

368 |

8,749 |

1,584 |

452.5 |

487 |

1,698 |

9,988 |

5,030 |

98.6 |

| Income

Tax and Social Contribution |

-1,186 |

0 |

-1,186 |

-485 |

144.7 |

129 |

-1,020.9 |

-1,362 |

-1,456 |

-6.5 |

| Net

Income |

7,195 |

368 |

7,563 |

1,099 |

588.3 |

615 |

1,129.1 |

8,626 |

3,574 |

141.4 |

Table 9 - Regulatory DRE (R$ mm)

| |

3Q24 |

3Q23 |

2Q24 |

9M24 |

9M23 |

| |

Regulatory |

Adjustment |

Adjusted |

Adjusted |

%

Y/Y |

Adjusted |

%

Q/Q |

Adjusted |

Adjusted |

%

Y/Y |

| Generation |

8,001 |

0 |

8,001 |

6,368 |

25.6 |

6,310 |

26.8 |

20,676 |

19,415 |

6.5 |

| Transmission |

4,467 |

0 |

4,467 |

5,163 |

-13.5 |

5,254 |

-15.0 |

14,831 |

13,339 |

11.2 |

| Others |

45 |

0 |

45 |

114 |

-60.5 |

56 |

-18.9 |

179 |

348 |

-48.4 |

| Gross

Revenue |

12,513 |

0 |

12,513 |

11,645 |

7.5 |

11,620 |

7.7 |

35,686 |

33,101 |

7.8 |

| (-)

Deductions from Revenue |

-1,918 |

0 |

-1,918 |

-1,850 |

3.7 |

-1,884 |

1.8 |

-5,655 |

-5,412 |

4.5 |

| Net

Revenue |

10,596 |

0 |

10,596 |

9,795 |

8.2 |

9,735 |

8.8 |

30,031 |

27,689 |

8.5 |

| Energy

resale, grid, fuel and construction |

-3,135 |

0 |

-3,135 |

-2,334 |

34.3 |

-2,435 |

28.7 |

-7,960 |

-6,529 |

21.9 |

| Personnel,

Material, Services and Others |

-2,014 |

313 |

-1,702 |

-1,685 |

1.0 |

-1,500 |

13.4 |

-4,901 |

-5,433 |

-9.8 |

| Operating

provisions |

885 |

-480 |

405 |

-144 |

-382.4 |

-419 |

-196.7 |

-575 |

-283 |

103.1 |

| Regulatory

remeasurements - Transmission contracts |

0 |

0 |

0 |

0 |

- |

0 |

- |

- |

0 |

- |

| Other

income and expenses |

28 |

-28 |

0 |

0 |

- |

0 |

- |

- |

0 |

- |

| EBITDA,

before Equity holdings |

6,360 |

-195 |

6,165 |

5,633 |

9.4 |

5,380 |

14.6 |

16,594 |

15,444 |

7.4 |

| Equity

holdings |

610 |

0 |

610 |

598 |

2.0 |

629 |

-3.0 |

1,686 |

1,316 |

28.1 |

| EBITDA |

6,970 |

-195 |

6,775 |

6,231 |

8.7 |

6,010 |

12.7 |

18,280 |

16,761 |

9.1 |

| D&A |

-1,490 |

0 |

-1,490 |

-1,325 |

12.4 |

-1,450 |

2.7 |

-4,419 |

-3,988 |

10.8 |

| EBIT |

5,480 |

-195 |

5,285 |

4,905 |

7.7 |

4,559 |

15.9 |

13,862 |

12,773 |

8.5 |

| Financial

Result |

-2,915 |

563 |

-2,351 |

-1,883 |

24.9 |

-3,055 |

-23.0 |

-8,166 |

-7,286 |

12.1 |

| EBT |

2,566 |

368 |

2,934 |

3,023 |

-2.9 |

1,504 |

95.0 |

5,696 |

5,486 |

3.8 |

| Income

Tax and Social Contribution |

-410 |

0 |

-410 |

-610 |

-32.8 |

-208 |

96.9 |

-988 |

-1,477 |

-33.1 |

| Net

Income |

2,156 |

368 |

2,524 |

2,413 |

4,6 |

1,296 |

94.7 |

4,707 |

4,009 |

17.4 |

(1) In 3Q24, the difference in regulatory generation revenue

versus IFRS consists of the different treatment of Amazonas Energia's client billing in the amount of R$347 million, without impacting

IFRS and Regulatory EBITDA.

IFRS Generation Revenue

In 3Q24, recurring IFRS generation revenue was

R$8.348 billion, an increase of R$1,930 million over 3Q23. The main reasons for the increase were: (a) the renegotiation of Tucuruí's

hydrological risk, with an impact of R$1,327 million; and ( b) the incorporation of Teles Pires, contributing R$251 million. These increases

were partially offset by the reduction of R$ 158 million due to the sale of TPP Candiota in January 2024.

Sequentially, the increase was of R$

2,520 million. In addition to the contribution from Tucuruí, there was also the recognition in September of R$606 million in revenue

related to energy sold to Amazonas Energia from April to August, including R$376 million related to billing from April to June, unrecognized

in 2Q24.

Note on the sale of

thermal power plants

On June 10, 2024, a contract was signed

with Âmbar for the sale of Eletrobras' thermoelectric portfolio for R$4.7 billion, of which R$1.2 billion consists of earn-out.

In addition, Âmbar immediately assumed the credit risk of the energy contracts in this portfolio.

On June 12, 2024, Provisional Measure

1,232 was published, amending the legislation on isolated systems. The text established that, if ANEEL recognizes the loss of service

conditions, a corporate transfer plan can be approved as an alternative to terminating the concession. The Provisional Measure also changes

the rules on energy purchase and sale contracts, which are currently reimbursable by the Fuel Consumption Account (CCC). As a result,

Eletronorte signed Reserve Energy Contracts (CERs) with the Brazilian Electric Energy Trading Chamber (CCEE), backed by the Aparecida,

Jaraqui, Tambaqui, Cristiano Rocha, Manauara and Ponta Negra TPPs.

In addition, the following were signed with Amazonas

Distribuidora de Energia S/A: (i) Terms of Termination of the Power Purchase Agreements (CCVEEs) backed by the aforementioned plants;

and (ii) Term of Waiver and Renunciation of pre-existing rights against the Federal Government relating to the purchase and sale of electricity

arising from events prior to the "exchange of contracts for CERs".

The drafts of the CERs, the Terms of

Termination and the Term of Waiver and Resignation were approved on a sub judice basis, under the terms of ANEEL Order No. 3.025,

of July 10, 2024.

The Company has been in negotiations

with the CCEE to start receiving the payments for the CERs since June 13, 2024, the date on which the energy provided for in the CERs

began to be supplied.

Regulatory Generation Revenue

Recurring regulatory revenue was R$8,001

million in 3Q24, R$347 million lower than recurring IFRS generation revenue, reflecting the different treatment of Balbina and thermal

power plant billing.

In the regulatory result, the methodology

of previous quarters is maintained. All billing is recognized in revenue, whether or not it has been paid, followed by any provisions

or reversals.

In the IFRS result, bad debts with

no prospect of being collected are not recognized either in revenue or in provisions. If the prospect of collection returns, billing that

was previously in default is recognized. The situation of default, and the respective accounting treatment, depends on each plant.

With respect to Balbina, the billing

recognized in regulatory revenue was R$58 million in 3Q24, of which R$29 million was defaulted on, and consequently provisioned. In IFRS

results, only the R$29 million effectively paid was recognized.

Regulatory revenue therefore differs

from IFRS revenue in two ways: the recognition of Balbina's defaulted billing of R$29 million and the billing for the months prior to

3Q24 of R$376 million. This difference between the two views, IFRS and regulatory, also occurs in the same amount in the provision line.

In in regulatory revenue, both Balbina's

unpaid billing for 3Q24 (R$ 29 million) and the thermal power plants' billing for months prior to 3Q24 (R$ 376 million) were recognized.

This difference also occurs, in the same amount, in the provision line.

Below we present the difference between

regulatory and IFRS operating result (EBITDA):

Consistent throughout the first half

of 2024, there was no difference between IFRS and regulatory EBITDA.

In 3Q24, revenue of R$376 million was

recognized in IFRS results for the months prior to 3Q24, with no corresponding provision. On the regulatory results, all of the 3Q24 revenue

from the sale to Amazonas Energia was recognized in revenue, including the R$29 million default on Balbina. As for the regulatory provisions,

there was an expense of the same R$29 million and also a reversal of R$376 million that had been provisioned in previous months.

Generation Revenue - by type of Contracting Environment

If we exclude from the recurring regulatory revenue

the construction portion, and, especially, the effect of eliminations, we arrive at revenues from the sale of energy in all contracting

environments of R$ 8,078 million in 3Q24, 25% and 28% higher than in 3Q23 and 2Q24, respectively.

The

increase in revenue is mainly explained by volume of 1,872 aMW in 3Q24, being 3,445 aMW during the 50-day period from July 12 to August

30, when the contract extensions were valid and settled in the ACR, relating to the additional sale in the ACR from Tucuruí[1]

totaling R$1,327 million in the quarter. In addition, revenue was impacted by

the effects of the sale or purchase of equity holdings (M&A), full or partial, in generating plants, primarily from: (a) the sale

of TPP Candiota, which contributed R$158 million in 3Q24; (b) an increase in the stake in Baguari and Retiro Baixo, which contributed

R$87 million in 3Q24, up from R$22 million in 3Q23; and (c) an increase in the stake in Teles Pires, which contributed R$251 million in

3Q24.

Excluding the effects mentioned above,

regulatory revenue totaled R$6,422 million, up 1.9% YoY, as a result of an average sales price 2.2% higher than the previous year coupled

with a 0.4% decline in volume.

Table 10 - Generation Revenue by Contracting Environment (R$ mm)

| Revenue Generation |

Volume (aMW) (a) |

Price (R$/MWh) (b) |

Regulatory Revenue (c) = (a) x (b) |

| 3Q24 |

% Y/Y |

% Q/Q |

3Q24 |

% Y/Y |

% Q/Q |

3Q24 |

% Y/Y |

% Q/Q |

| (+) Regulated Market |

6,022 |

70.5% |

50.9% |

308 |

-7.7% |

0.0% |

4,097 |

57.3% |

52.6% |

| Existing |

2,641 |

1.6% |

0.3% |

225 |

4.6% |

0.4% |

1,313 |

6.3% |

1.9% |

| M&As (4) |

685 |

149.4% |

-4.1% |

158 |

-46.6% |

-2.6% |

239 |

33.2% |

-5.6% |

| Tucuruí Extension |

1,872 |

- |

- |

321 |

- |

- |

1,327 |

- |

- |

| Thermal |

824 |

25.2% |

27.9% |

669 |

-18.3% |

-17.6% |

1,217 |

2.3% |

6.5% |

| (+) Free Market |

7,399 |

29.4% |

2.2% |

157 |

-23.2% |

7.1% |

2,560 |

-0.6% |

10.6% |

| Existing |

7,092 |

24% |

2.3% |

157 |

-22.9% |

7.5% |

2,462 |

-4.4% |

11.2% |

| M&As (4) |

307 |

- |

0.0% |

145 |

- |

-2.4% |

98 |

- |

-1.4% |

| (+) O&M (Quotas) |

3,941 |

-25% |

0.0% |

84 |

1.8% |

-9.0% |

734 |

-23.7% |

-8.0% |

| (+) ST Market (CCEE)(1) |

1,766 |

-15.6% |

-52.4% |

178 |

140.4% |

180.8% |

696 |

103.0% |

35.2% |

| (=) Ex others |

19,128 |

15.2% |

1.3% |

191 |

8.2% |

25.1% |

8,087 |

24.7% |

28.1% |

| (+) Other (2) |

- |

- |

- |

- |

- |

- |

-86 |

28.3% |

4325.0% |

| (=) Total |

- |

- |

- |

- |

- |

- |

8,001 |

24.7% |

26.8% |

| Recurring |

- |

- |

- |

- |

- |

- |

8,001 |

25.6% |

26.8% |

| Non-recurring |

- |

- |

- |

- |

- |

- |

- |

- |

- |

1 Referring

to the 12th and 13th Existing Energy Auctions by the Tucuruí Plant, as a result of the extension of the grant

period by signing an energy contract in the ACR due to the renegotiation of the hydrological risk of power generation, according to ANEEL

Order No. 1,395, of May 20, 2019. Revenue for the period between July 12, 2024 and August 30, 2024.

| Revenue Generation |

Regulatory Revenue (c) |

Accounting Adjustment (d) (3) |

Accounting Revenue (e) = (c) + (d) |

| 3Q24 |

3Q23 |

2Q24 |

3Q24 |

3Q23 |

2Q24 |

3Q24 |

3Q23 |

3Q24 x 3Q23 |

2Q24 |

3Q24 x 2Q24 |

| Regulated Market |

4,097 |

2,605 |

2,685 |

347 |

0 |

-482 |

4,444 |

2,605 |

70.6 |

2,203 |

101.7 |

| Free Market |

2,560 |

2,575 |

2,314 |

0 |

0 |

0 |

2,560 |

2,575 |

-0.6 |

2,314 |

10.6 |

| O&M (Quotas) |

734 |

961 |

798 |

0 |

0 |

0 |

734 |

961 |

-23.7 |

798 |

-8.0 |

| Short-term market (1) |

696 |

343 |

514 |

0 |

0 |

0 |

696 |

343 |

103.0 |

514 |

35.2 |

| Energy sales |

8,087 |

6,485 |

6,312 |

347 |

0 |

-482 |

8,434 |

6,485 |

30.1 |

5,830 |

44.7 |

| Others (2) |

-86 |

-67 |

-2 |

0 |

0 |

0 |

-86 |

-67 |

28.3 |

-2 |

4325.0 |

| Total |

8,001 |

6,417 |

6,310 |

347 |

0 |

-482 |

8,348 |

6,417 |

30.1 |

5,828 |

43.2 |

| Recurring |

8,001 |

6,368 |

6,310 |

347 |

0 |

-482 |

8,348 |

6,368 |

31.1 |

5,828 |

43.2 |

| Non-recurring |

0 |

50 |

0 |

0 |

0 |

0 |

0 |

50 |

-100.0 |

0 |

- |

(1) Short-term market: Electricity Trading Chamber (CCEE)

(2) Construction Revenues, Financial Effect of Itaipu and Elimination

(accounting adjustments - internal sales). The sale of energy from Candiota took place on the ACR market, and 48% of the volume sold (227

aMW) was obtained via the purchase of energy from Eletronorte on the free market. In 3Q23, Eletronorte's revenue from the sale of energy

to Candiota was R$ 67 million, in the form of eliminations. Between 3Q23 and 3Q24, the volume sold by Eletronorte, excluding the effect

of consolidating Teles Pires, rose by 1 .274 aMW.

(3) Amazonas' revenue of R$482 million in 2Q24 was not recognized

as accounting revenue. In 3Q24, the difference of R$347 million between regulatory and IFRS revenue represents: (a) recognition on regulatory

revenue of R$ 58 million related to the defaulted billing from Balbina for 3Q24, while on the IFRS revenue only the defaulted R$29 million

was recognized, and (b) R$ 376 million recognized in IFRS revenue, referring to previously unrecognized billing prior to 3Q24.

(4) M&A: involves revenue from assets in which Eletrobras'

stake has changed over the last 12 months.

Regulated Market (ACR)

Regulatory revenue from generation in the Regulated

Contracting Environment (ACR) totaled R$2,784 million in 3Q24, up R$1,709 million YoY, primarily due to R$1,327 million from Eletronorte,

arising from the renegotiation of Tucuruí’s hydrological risk, and the effect of R$162 million due to the incorporation of

Teles Pires.

Free Market (ACL)

Regulatory revenue from generation in the Free

Contracting Environment (ACL) totaled R$2,593 million in 3Q24, down R$87 million YoY, primarily due to the R$144 million reduction in

Eletronorte's revenue, reflecting the 29% decline in average sales prices and the R$114 million reduction at Chesf due to the lower volume

of energy contracted in the period. This was partially offset by the increase in the volume contracted at Eletrobras, with a positive

impact of R$136 million.

CCEE Revenue

CCEE (short-term market) revenue was R$695 million

in 3Q24, up R$353 million YoY.

Operation and Maintenance

(O&M) Revenue - Plants Renewed by Law 12,783/2013

O&M Revenues were R$734 million, down R$228 million

YoY, mainly reflecting the decotization process, mitigated by the effects of the yearly adjustment of the Annual Generation Revenue (RAG),

according to Homologatory Resolutions No. 3,068/2022 (2022-2023 cycle) and No. 3,225/2023 (2023-2024 cycle), impacting Eletronorte, Chesf

and Furnas.

Table 11 shows the breakdown of IFRS Generation revenue

in line with the financial statements.

Power supply for distribution companies is obtained from clients

who are not end consumers, such as distributors, traders and generators - contracts in the ACR and ACL. Power supply for end consumers,

in turn, is obtained directly from end consumers, such as industry and commerce, with only ACL contracts.

Table 11 - Gross Revenue 3Q24 (R$ mm)

| |

3Q24 |

| Eletrobras + Furnas and Others |

Chesf |

Eletronorte |

CGT

Eletrosul |

Total |

Disposal |

Consolidated IFRS |

| Power supply for distribution companies |

2,313 |

120 |

3,642 |

204 |

6,278 |

-54 |

6,224 |

| Power supply for end consumers |

215 |

97 |

370 |

13 |

695 |

0 |

695 |

| CCEE |

150 |

265 |

268 |

12 |

695 |

0 |

695 |

| O&M revenue |

250 |

477 |

6 |

0 |

734 |

0 |

734 |

| Generation Revenues |

2,929 |

959 |

4,285 |

229 |

8,402 |

-54 |

8,348 |

| Non-recurring items - Adjustments |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Adjusted Generation Revenue |

2,929 |

959 |

4,285 |

229 |

8,402 |

-54 |

8,348 |

Table 12 - Gross Revenue 3Q23 (R$ mm)

| Gross Revenue |

3Q23 |

| Eletrobras + Furnas and Others |

Chesf |

Eletronorte |

CGT Eletrosul |

Total |

Disposal |

Consolidated IFRS |

| Power supply for distribution companies |

1,920 |

154 |

1,816 |

391 |

4,281 |

-67 |

4,214 |

| Power supply for end consumers |

313 |

222 |

365 |

0 |

900 |

0 |

900 |

| CCEE |

100 |

56 |

181 |

6 |

343 |

0 |

343 |

| O&M revenue |

325 |

670 |

9 |

0 |

1,004 |

-43 |

961 |

| Generation Revenues |

2,658 |

1,102 |

2,370 |

397 |

6,527 |

-110 |

6,417 |

| Non-recurring items - Adjustments |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Adjusted Generation Revenue |

2,658 |

1,102 |

2,370 |

397 |

6,527 |

-110 |

6,417 |

IFRS Transmission Revenue

IFRS transmission revenue was R$4,566 million in

3Q24, up 12% over 3Q23, primarily due to increases of R$336 million and R$239 million in Contractual and Construction revenue, respectively,

partially offset by the reduction of R$76 million in O&M revenue.

Table 13 - Transmission Operating Revenue (R$ mm)

| |

3Q24 |

3Q23 |

% |

2Q24 |

% |

9M24 |

9M23 |

% |

| Transmission Revenues |

4,566 |

4,067 |

12.3 |

4,395 |

3.9 |

13,520 |

12,874 |

5.0 |

| Revenue from Operation & Maintenance |

1,906 |

1,982 |

-3.8 |

2,058 |

-7.4 |

5,863 |

5,612 |

4.5 |

| Construction Revenue |

1,044 |

805 |

29.7 |

721 |

44.9 |

2,351 |

1,688 |

39.2 |

| Contractual Revenue - Transmission |

1,616 |

1,280 |

26.2 |

1,616 |

0.0 |

5,306 |

5,574 |

-4.8 |

| Non-recurring items - Adjustments |

0 |

0 |

- |

0 |

- |

0 |

0 |

- |

| Adjusted Transmission Operating Revenue |

4,566 |

4,067 |

12.3 |

4,395 |

3.9 |

13,520 |

12,874 |

5.0 |

O&M revenue

O&M revenue was R$1.906 billion in 3Q24,

down R$76 million YoY, mainly reflecting the R$57 million reduction in invoiced RAP, already deducted from the variation in amortizations

of contractual assets.

Construction Revenue

Construction

revenue for the periods is directly related to the investments made (appropriated and allocated) in transmission projects in progress.

Construction revenue totaled R$1,044 million, up R$239 million over 3Q23, mainly reflecting an increase of R$92 million related to construction

revenue from the SPEs Nova Era Teresina (R$58 million), Nova Era Integração (R$27 million) and Nova Era Ceará (R$6

million). In addition, the increase of R$82 million associated with greater investments in reinforcements and improvements added to the

respective construction margins at Chesf, associated with contract 061/2001.

Contractual Revenue

Contractual (financial) revenue is

associated with the application of inflationary indices to the balances of the contract assets of each concession. The accumulated IPCA

index for July-Sept/2024 was 0.57%, while for July-Sept/2023 it was 0.27%. The IGP-M index varied by 1.72% and -2.77%, respectively, in

the same periods. These effects are due to the application of IFRS rules and differ from the regulatory revenue, which applied the readjustment

in July 2024, according to Homologatory Resolution No. 3,348/24, repositioning the RAPs for the 2024/2025 cycle.

Thus, contractual revenue in 3Q24 was

R$1,616 million, R$336 million higher than in 3Q23. The impact on Eletrobras companies was:

(a) Chesf: up R$107 million,

mainly due to the R$76 million increase in monetary restatement and of R$28 million in financial revenue from the renewed contract, due

to the variation in the asset base;

(b) Eletrobras: R$105 million,

mainly due to the increase of R$76 million in monetary restatement;

(c) CGT Eletrosul: R$50 million,

mainly due to the increase of R$42 million in monetary restatement;

(d) Eletronorte: R$45 million, mainly due to the R$36 million increase

in monetary restatement and R$14 million in RBNI financial revenue, and a decrease of R$5 million in RBSE financial revenue.

Regulatory Transmission

Revenue

Regulatory transmission

revenue was R$4.467 billion, down 13.5% and 15% compared to 3Q23 and 2Q24, respectively, reflecting the approval of the 2023 and 2024

periodic tariff review (RTP) processes, with emphasis on the review of revenue from concession contracts 057/2001, 058/2001, 061/2001

and 062/2001, extended by Law 12.783/2013.

Table 14 - IFRS vs. Regulatory Revenue (R$ mm)

| |

2Q24 |

2Q23 |

Regulatory

Δ% |

| IFRS |

Adjustments |

Regulatory |

IFRS |

Adjustments |

Regulatory |

| Furnas |

1,780 |

20 |

1,800 |

1,601 |

556 |

2,157 |

-16.5 |

| Chesf |

1,342 |

100 |

1,442 |

1,198 |

388 |

1,587 |

-9.1 |

| CGT Eletrosul |

519 |

-36 |

482 |

502 |

28 |

530 |

-9.0 |

| Eletronorte |

1,027 |

-182 |

845 |

813 |

123 |

937 |

-9.8 |

| Eliminations |

-102 |

0 |

-102 |

-48 |

0 |

-48 |

114.1 |

| TOTAL |

4,566 |

-99 |

4,467 |

4,067 |

1,095 |

5,163 |

-13.5 |

It is important to note that, in transmission, the drop in gross revenue mainly reflects

two negative effects: a R$385 million drop in the Annual Permitted Revenue (RAP) and R$328 million in the form of the Adjustment Portion

(PA) due to the postponement to 2024 of the Periodic Tariff Review (RTP) process for renewed contracts, originally scheduled to take place

in 2023.

Regulatory Transmission

Revenue: Approved RAP x Gross Revenue 3Q24

Chart 9 below shows the reconciliation between approved RAP and

regulatory revenue in 3Q24, highlights of which will follow.

Graph 9 - Reconciliation of RAP and Transmission Revenue 3Q24 (R$ mm)

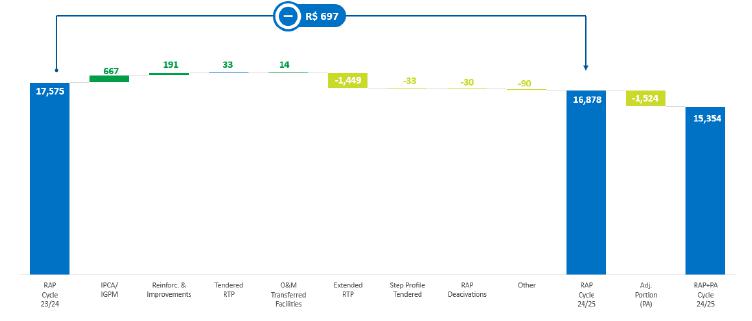

| n | Approved RAP and PA 3Q24: Corresponds to ¼

of the RAP and PA, respectively, of R$16.983 million and R$1.529 million, approved for the 2024/2025 cycle by Homologatory Resolution no. 3.348/2024 of the transmission concession

contracts of the Eletrobras companies (after Furnas incorporation), Chesf, CGT Eletrosul, Eletronorte, TMT and VSB; |

| n | Discount from Variable Portion: associated with the unavailability of transmission

facilities, as regulated by Module 4 of the Rules for Transmission Services (available at ANEEL's website in Portuguese: https://www.gov.br/aneel/pt-br/centrais-de-conteudos/

procedimentos-regulatorios/regras-de-transmissao) |

| n | Prepayment Apportionment: relates to the difference

arising from the collection deficit or surplus that occurs in the calculation carried out by the ONS, considered in the Credit Notice

(AVC) issued by the ONS, then offset through the Adjustment Portion (PA); |

| n | CDE/Proinfa: correspond to the collection of sector

charges (pass through) from consumers connected directly to Eletrobras' transmission facilities, referring to the energy development

account and the program to encourage alternative sources of electricity, considered in the AVCs issued by the ONS; |

| n | CDE Fund: corresponds to the receipt via the CCEE

of the amounts not collected as a result of discounts on tariffs, which are compensated annually by means of the Adjustment Portion. These

amounts already include the PIS/COFINS portion; |

| n | New Investments: additional RAP for new installations

(reinforcements and large-scale improvements) in the basic network, authorized with previously defined revenues, which started commercial

operations during the quarter; |

| n | PIS/COFINS taxes: related to the billing of revenue

from the Basic Grid, Border Basic Grid and Shared DIT, according to AVCs issued by the ONS. |

Table 15 - Other Operating Revenues (R$ mm)

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

9M24 |

9M23 |

Δ% |

| Other income |

46 |

114 |

-59.7 |

57 |

-18.6 |

182 |

348 |

-47.7 |

Other Operating Income totaled R$46 million in 3Q24, down

59.7% from 3Q23. The variation is mainly due to events that occurred in 3Q23, but had no counterpart in 3Q24, including R$4 million received

in August 2023 relating to a Leniency Agreement, and R$18 million relating to the recalculation of court deposit balances from 2023. In

addition, there was a revenue reduction in O&M contracts for telecommunications in the subsidiaries, in the amount of R$9 million.

| 2.3. | Operating Costs and Expenses |

Table 16 - Operating Costs and Expenses (R$ mm)

| |

2Q24 |

2Q23 |

Δ% |

1Q24 |

Δ% |

6M24 |

6M23 |

Δ% |

| Energy purchased for resale |

1,452 |

807 |

79.9 |

797 |

82.2 |

2,986 |

2,087 |

43.1 |

| Charges on use of the electricity grid |

1,016 |

876 |

15.9 |

999 |

1.7 |

2,986 |

2,498 |

19.5 |

| Fuel for electricity production |

491 |

510 |

-3.8 |

464 |

5.8 |

1,461 |

1,441 |

1.4 |

| Construction |

1,055 |

866 |

21.8 |

787 |

34.1 |

2,483 |

1,920 |

29.3 |

| Personnel, Material, Services and Others |

2,005 |

2,525 |

-20.6 |

1,629 |

23.1 |

5,261 |

6,757 |

-22.1 |

| Depreciation and Amortization |

990 |

925 |

7.1 |

968 |

2.3 |

2,955 |

2,722 |

8.5 |

| Operating provisions |

-229 |

-173 |

32.2 |

-1 |

- |

-34 |

-1,116 |

-97.0 |

| Regulatory remeasurements |

-6,130 |

12 |

-50,575.7 |

0 |

- |

-6,130 |

12 |

-50,575.7 |

| Costs and expenses |

650 |

6,348 |

-89.8 |

5,642 |

-88.5 |

11,968 |

16,320 |

-26.7 |

| Non-recurring events |

|

|

|

|

|

|

|

|

| (-) Non-recurring PMSO events |

-313 |

-843 |

-62.9 |

-53 |

488.9 |

-399 |

-1,314 |

-69.6 |

| (-) Non-recurring provisions |

480 |

288 |

66.5 |

270 |

77.8 |

868 |

1,316 |

-34.0 |

| (-) Retroactive Calculation ICMS increase |

0 |

-40 |

-100.0 |

0 |

- |

0 |

-34 |

-100.0 |

| (-) Regulatory remeasurements |

817 |

5,753 |

-85.8 |

5,859 |

-86.1 |

12,438 |

16,288 |

-23.6 |

| Recurring Costs and Expenses |

1,452 |

807 |

79.9 |

797 |

82.2 |

2,986 |

2,087 |

43.1 |

Energy purchased for resale

Energy purchased for resale totaled R$1,452 million

in 3Q24, representing an increase of R$ 645 million compared to 3Q23, of which R$363 million at Eletrobras Holding, if which

R$138 million from SAESA, due to the increase in CCEE costs, due to the low GSF in the period related to a scenario of low hydrology.

In addition, there was a R$93 million increase due to the entry of incentivized energy PPA contracts, also at Eletrobras.

Charges on use of the electricity grid

Charges on the use of the network totaled R$1,016

million in 3Q24, up R$139 million YoY, explained mainly by the incorporation of Teles Pires into Eletronorte, adding R$111 million in

charges for the use of the network, and by the TUST readjustment by the IPCA inflation index, which resulted in an increase of R$7 million

in SAESA.

Fuel for electricity production

The costs associated with the use of fuel to

produce electricity amounted to R$491 million in 3Q24, down R$19 million YoY, mainly reflecting the R$94 million drop at CGT Eletrosul

due to the TPP Candiota sale. This effect was partially offset by a R$47 million increase at Eletronorte, due to the annual adjustment

of the natural gas price and the dispatches Outside the Order of Merit and Price (FOMP), which are not eligible for reimbursement from

the Fuel Consumption Account (CCC). In addition, there was a R$27 million increase at Eletrobras, also due to the natural gas price adjustment.

Construction

Construction-related

costs totaled R$1,055 million in 3Q24, up R$189 million YoY, mainly due to the increase in costs related to new concessions, with R$96

million at Nova Era Janapu.

PMSO - Personnel, Material, Services and Other

Personnel

Recurring personnel costs and expenses totaled

R$902 million in 3Q24, down 3.4% from R$934 million in 3Q23. There was a reduction of 192 employees from the sale of Candiota, totaling

savings of R$11 million in 2024.

It is important to highlight that Personnel costs

and expenses include R$10 million related to indemnity allowances for the readjustment of managers' salaries, bringing Eletrobras' practices

in line with those of the market.

Additionally, the following were noted in the

quarter: (a) pro rata recognition of R$75 million as Profit Sharing (PLR) and Short-Term Incentive (ICP), which in 2023 were fully

booked in 4Q23; (b) greater recognition of hours worked as investments, with an increase of R$37 million in personnel costs in 3Q24.

Non-recurring effects: VDP totaling R$2 million

in the period.

Material

Recurring material costs and expenses totaled

R$64 million in 3Q24, up 27% compared to R$51 million in 3Q23. The rise in material costs was mainly explained by the R$10 million increase

at Eletrobras as a result of higher direct purchases of materials for maintenance, health and safety.

There were no non-recurring effects in the

quarter.

Services

Recurring costs and expenses with services totaled

R$569 million in 3Q24, in line with R$574 million in 3Q23. The main highlights of the quarter were: (a) a reduction in personnel services

of approximately R$37 million, reflecting, among other things, the reclassification of benefits to the Personnel account; and (b) an increase

in the cost of operational maintenance services of approximately R$12 million.

There were no non-recurring effects in the

quarter.

Others

Other recurring costs and expenses totaled R$157

million in 3Q24, up by R$97 million YoY, due to, among other effects, the R$65 million increase in consulting, legal and financial services.

It is worth noting that the expense with the

premium paid for GSF insurance rose from R$15 million in 3Q23 to R$91 million in 3Q24, of which R$74 million from the extension of Tucuruí

plant's ACR contracts recognized in July and August, with no counterpart in 3Q23. In return for this contracted protection, which is a

product of the SP100 type, a revenue of R$126 million was recognized.

Non-recurring effects 3Q24: R$221 million, related to the write-off

of court deposits and R$89 million, related to litigation prior to 2022.

Table 17 - PMSO 3Q24 (R$ mm)

PMSO

(R$ million) |

3Q24 |

| Eletrobras + Furnas and others |

Chesf |

Eletronorte |

CGT Eletrosul |

Eletropar |

Total |

Elimination |

Consolidated

IFRS |

| Personnel |

387 |

226 |

208 |

81 |

0 |

902 |

0 |

902 |

| Voluntary Dismissal Plan (VDP) - Provision |

0 |

3 |

-2 |

0 |

0 |

2 |

0 |

2 |

| Material |

19 |

13 |

27 |

5 |

0 |

64 |

0 |

64 |

| Services |

295 |

112 |

121 |

39 |

1 |

569 |

0 |

569 |

| Other |

360 |

51 |

96 |

3 |

1 |

511 |

-43 |

468 |

| PMSO |

1,061 |

405 |

451 |

129 |

2 |

2,048 |

-43 |

2,005 |

| Non-recurring events |

|

|

|

|

|

|

|

|

| Personnel: Incentive Plans (PAE, VDP) |

0 |

-3 |

2 |

0 |

0 |

-2 |

0 |

-2 |

| Services: Commissions relating to the compulsory loan |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

| Other: Judicial convictions |

-89 |

0 |

0 |

0 |

0 |

-89 |

0 |

-89 |

| Other: Write-off of court deposits |

-216 |

0 |

0 |

-5 |

0 |

-221 |

0 |

-221 |

| Recurring PMSO |

755 |

401 |

453 |

124 |

2 |

1,735 |

-43 |

1,692 |

| GSF Hedge Premium, Tucuruí, 12th and 13th auctions |

0 |

0 |

74 |

0 |

0 |

74 |

0 |

74 |

Table 18 - PMSO 2Q23 (R$ mm)

PMSO

(R$ million) |

3Q24 |

| Eletrobras + Furnas and others |

Chesf |

Eletronorte |

CGT Eletrosul |

Eletropar |

Total |

Elimination |

Consolidated

IFRS |

| Personnel |

360 |

218 |

233 |

123 |

1 |

934 |

0 |

934 |

| Voluntary Dismissal Plan (VDP) - Provision |

0 |

22 |

0 |

0 |

0 |

22 |

0 |

22 |

| Material |

20 |

10 |

17 |

4 |

0 |

51 |

0 |

51 |

| Services |

325 |

86 |

133 |

55 |

1 |

601 |

0 |

601 |

| Other |

771 |

106 |

25 |

-7 |

7 |

901 |

16 |

917 |

| PMSO |

1,477 |

441 |

407 |

176 |

8 |

2,508 |

16 |

2,525 |

| Non-recurring events |

|

|

|

|

|

|

|

|

| Personnel: Incentive Plans (PAE, PDV) |

0 |

-22 |

0 |

0 |

0 |

-22 |

0 |

-22 |

| Personnel: Other (allocation to investment activities, from January to September/2023, and PLR provision) |

62 |

0 |

0 |

0 |

0 |

62 |

0 |

62 |

| Services: Consultancy costs associated with the Transformation Plan ("TMO") |

-27 |

0 |

0 |

0 |

0 |

-27 |

0 |

-27 |

| Other: adjustment of judicial deposits written off |

-846 |

0 |

0 |

0 |

0 |

-846 |

0 |

-846 |

| Other: recovery of retroactive expenses Cal - CGT Eletrosul, transfer of CEPEL balance, refund to Eletrobras of funds from the ECFS-261 Financing and Grant Agreement |

3 |

0 |

0 |

-14 |

0 |

-11 |

0 |

-11 |

| Recurring PMSO |

669 |

420 |

407 |

162 |

8 |

1,665 |

16 |

1,682 |

Table 19 - PMSO IFRS (R$ mm)

| |

3Q24 |

3Q23 |

2Q24 |

9M24 |

9M23 |

| |

Total (a) |

Non-recurring (b) |

Recurring (c) = (a) - (b) |

Recurring |

Δ% |

Recurring |

Δ% |

Total (a) |

Non-recurring (b) |

Recurring (c) = (a) - (b) |

Recurring |

Δ% |

| Personnel |

902 |

0 |

902 |

997 |

-9.5 |

923 |

-2.3 |

2,771 |

0 |

2,771 |

3,188 |

-13.1 |

| VDP |

2 |

-2 |

0 |

0 |

- |

0 |

- |

45 |

-45 |

0 |

0 |

- |

| Material |

64 |

0 |

64 |

51 |

27.0 |

37 |

73.5 |

147 |

0 |

147 |

152 |

-2.8 |

| Services |

569 |

0 |

569 |

574 |

-0.9 |

415 |

36.9 |

1,464 |

-42 |

1,422 |

1,597 |

-10.9 |

| Other |

468 |

-311 |

157 |

60 |

159.3 |

200 |

-21.8 |

833 |

-311 |

522 |

507 |

2.9 |

| Total |

2,005 |

-313 |

1,692 |

1,682 |

0.6 |

1,576 |

7.4 |

5,261 |

-399 |

4,862 |

5,444 |

-10.7 |

Table 20 - Other Costs and Expenses (R$ mm)

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

9M24 |

9M23 |

Δ% |

| Write-off of court deposits |

221 |

866 |

-74 |

0 |

- |

231 |

866 |

-73 |

| Indemnization, losses and fines |

57 |

4 |

1,202 |

128 |

-55 |

144 |

185 |

-22 |

| Insurance |

92 |

15 |

496 |

5 |

1787 |

130 |

46 |

183 |

| Equity holdings |

76 |

30 |

149 |

27 |

177 |

141 |

76 |

85 |

| Taxes |

10 |

10 |

0 |

16 |

-36 |

43 |

13 |

220 |

| Donations and contributions |

17 |

-17 |

-198 |

10 |

62 |

81 |

84 |

-3 |

| Rent |

17 |

15 |

12 |

8 |

117 |

38 |

58 |

-34 |

| Recovery of expenses |

-24 |

-59 |

-59 |

-6 |

282 |

-70 |

-121 |

-42 |

| GSF |

-1 |

34 |

-103 |

11 |

-109 |

44 |

96 |

-54 |

| Others |

3 |

18 |

-83 |

2 |

71 |

51 |

76 |

-32 |

| Total |

468 |

917 |

-49 |

200 |

134 |

833 |

1,379 |

-40 |

Operating

Provisions

Table 21 - Operating Provisions (R$ mm)

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

9M24 |

9M23 |

Δ% |

| Operating Provisions / Reversals |

|

|

|

|

|

|

|

|

| Provision/Reversal for Litigation |

418 |

515 |

-18 |

89 |

370 |

646 |

1,626 |

-60 |

| Estimated losses on investments |

11 |

167 |

-93 |

-14 |

-180 |

-18 |

138 |

-113 |

| Measurement at fair value of assets available for sale |

-30 |

92 |

-133 |

41 |

-174 |

11 |

92 |

-88 |

| Provision for the Implementation of Lawsuits - Compulsory Loan |

3 |

57 |

-93 |

-17 |

-120 |

-47 |

17 |

-381 |

| ECL - Loans and financing |

-6 |

0 |

- |

0 |

- |

-10 |

-13 |

-20 |

| ECL - Consumers and resellers |

-59 |

-94 |

-36 |

-43 |

38 |

-235 |

-83 |

181 |

| ECL - Other credits |

-10 |

9 |

-203 |

-25 |

-60 |

-125 |

18 |

-782 |

| Onerous contracts |

52 |

0 |

- |

45 |

17 |

136 |

0 |

- |

| Results of actuarial reports |

-128 |

-97 |

31 |

-128 |

0 |

-384 |

-292 |

31 |

| Other |

-23 |

-477 |

-95 |

52 |

-144 |

60 |

-386 |

-115 |

| Operating Provisions / Reversals |

229 |

173 |

32 |

1 |

- |

34 |

1,116 |

-97 |

| Non-recurring items / Adjustments |

-480 |

-288 |

66 |

-270 |

77 |

-868 |

-1,316 |

-34 |

| Provision for Litigation |

-418 |

-515 |

-18 |

-89 |

370 |

-646 |

-1,626 |

-60 |

| Measurement at fair value of assets available for sale |

0 |

-37 |

-100 |

-167 |

-100 |

-167 |

-37 |

346 |

| Estimated losses on investments |

-11 |

-167 |

-93 |

14 |

-180 |

18 |

-138 |

-113 |

| Provision for the Implementation of Lawsuits - Compulsory Loan |

-3 |

-57 |

-93 |

17 |

-120 |

47 |

-17 |

-382 |

| ECL - Loans and financing |

6 |

0 |

- |

0 |

- |

10 |

13 |

-21 |

| Onerous contracts |

-52 |

0 |

- |

-45 |

17 |

-136 |

0 |

- |

| Impairment |

0 |

0 |

- |

0 |

-51 |

6 |

0 |

- |

| Restitution RGR |

0 |

489 |

-100 |

0 |

- |

0 |

489 |

-100 |

| Adjusted Provisions/Reversals |

-251 |

-115 |

118 |

-269 |

-7 |

-834 |

-200 |

318 |

Positive values in this table mean a reversal of provision.

| n | Onerous contracts: main highlights

were R$24 million reversals at CGT Eletrosul, R$15 million at Eletrobras and R$13 million at Chesf, following a reassessment of the onerous

contracts values. |

| n | Provision for litigation: reversal

of R$418 million in 3Q23 from R$515 million in 3Q23 with emphasis on: (a) constitutions of R$233 million and reversals of R$211 million,

in addition to discounts of R$300 million for agreements signed regarding compulsory loans; (b) reversal of R$100 million related to the

change in the likely outcome of a lawsuit; and (c) reversal of R$96 million at Eletrosul after rectification of the calculation by the

expert in the labor lawsuit. |

| n | Measurement at fair value of assets

held for sale: primarily reflects the process of divesting the stake in non-operating

wind farms of the former direct investee Livramento Holding S.A., resulting in full control of the only operating company, Eólica

Ibirapuitã S.A., with a R$92 million effect on Eletrosul in 3Q23. In 3Q24, the effects were R$18 million from the provision for

devaluation of the equity stake in Lagoa Azul Transmissora and R$12 million from the adjustment of the asset held for sale of Santa Cruz,

considering the updating of fixed assets through the new capital contributions. |

| n | Estimated losses on investments: primarily

due to the R$80 million increase at Eletrobras, mainly due to the recovery of the investment in SPE MESA in 3Q23, with no counterpart

in 3Q24. |

| n | Estimated losses on doubtful accounts

(ECL) - consumers and resellers: in 3Q24, a provision of R$59 million was recorded, mainly due to the constitution of provision related

to energy transmission defaults in the amount of R$56 million. |

| n | Result of actuarial reports: provision

of R$133 million relating to the interest cost and current service cost defined in the 2024actuarial reports. |

Income from equity holdings include contributions of R$230 million

from CTEEP and of R$148 million from Eletronuclear.

Table 22 – Equity Holdings (R$ mm)

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

9M24 |

9M23 |

Δ% |

| Highlights Affiliates |

|

|

|

|

|

|

|

|

| Eletronuclear |

148 |

212 |

-30.2 |

103 |

43.5 |

451 |

413 |

9.2 |

| CEB Lajeado |

9 |

12 |

-25.4 |

- |

- |

43 |

35 |

21.7 |

| Cemar |

71 |

67 |

5.5 |

52 |

36.8 |

178 |

54 |

229.8 |

| CTEEP |

230 |

247 |

-6.9 |

230 |

0.0 |

660 |

510 |

29.5 |

| Emae |

15 |

25 |

-39.8 |

8 |

90.7 |

40 |

25 |

58.2 |

| Lajeado |

31 |

33 |

-6.5 |

- |

- |

89 |

30 |

196.2 |

| SPE highlights |

504 |

597 |

-15.5 |

393 |

28.3 |

1,461 |

1.067 |

36.9 |

| IE Madeira |

11 |

37 |

-69.1 |

65 |

-82.6 |

92 |

160 |

-42.5 |

| BMTE |

-28 |

57 |

-149.0 |

55 |

-150.8 |

48 |

158 |

-69.7 |

| Chapecoense |

-35 |

52 |

-166.4 |

50 |

-169.1 |

-6 |

144 |

-104.4 |

| ESBR Jirau |

2 |

-9 |

-119.0 |

36 |

-95.5 |

35 |

5 |

645.1 |

| IE Garanhuns |

5 |

9 |

-47.0 |

20 |

-75.8 |

46 |

44 |

3.9 |

| Norte Energia |

-49 |

-143 |

-65.4 |

-174 |

-71.6 |

-125 |

-151 |

-17.4 |

| Other Equivalents |

360 |

58 |

515.1 |

132 |

172.4 |

496 |

371 |

33.6 |

| TOTAL Equity Holdings |

770 |

659 |

16.9 |

577 |

33.4 |

2,046 |

1.798 |

13.8 |

Adjusted Regulatory EBITDA

Table 23 –

Adjusted Regulatory EBITDA

(R$ mm)

| |

3Q24 |

3Q23 |

Δ% |

2Q24 |

Δ% |

9M24 |

9M23 |

Δ% |

| Net Revenue (1) |

10,596 |

9,795 |

8.2 |

9,735 |

8.8 |

30,031 |

27,689 |

8.5 |

| - Energy resale, grid charges, fuel |

-3,135 |

-2,334 |

34.3 |

-2,435 |

28.7 |

-7,960 |

-6,529 |

21.9 |

| - Personnel, Material, Services and Others |

-1,702 |

-1,685 |

1.0 |

-1,500 |

13.4 |

-4,901 |

-5,433 |

-9.8 |

| - Operating provisions (1) |

405 |

-144 |

-382.4 |

-419 |

-196.7 |

-575 |

-283 |

103.1 |

| - Other income and expenses |

0 |

0 |

- |

0 |

- |

0 |

0 |

- |

| + Equity Holdings |

610 |

598 |

2.0 |

629 |

-3.0 |

1,686 |

1,316 |

28.1 |

| Adjusted IFRS EBITDA |

6,775 |

6,231 |

8.7 |

6,010 |

12.7 |

18,280 |

16,761 |

9.1 |

| (1) | Recognizes the amounts of R$482 million

in 2Q24 and R$432 million in 1Q24 relating to revenue from Amazonas Energia. Due to default, these balances are also fully recognized

in operating provisions. As far as 3Q24 is concerned, billing from Amazonas continued to be recognized in revenue. As part of Balbina's

billing is still in default, a provision of R$29 million was constituted in 3Q24. Thermal power plant billings for 3Q24 were not provisioned,

while part of the defaulted amount prior to 3Q24, of R$376 million, was reversed from the provision. |

In 3Q24, Adjusted IFRS EBITDA was R$6,775 million, up R$544

million YoY.

Regulatory net revenue added R$801 million to the result,

especially revenue from the Tucuruí contract extensions of R$1,327 million in July and August, which was partially offset by a R$695