false

0000894627

0000894627

2024-08-07

2024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

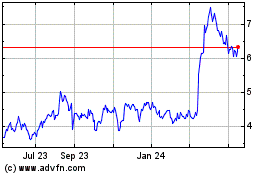

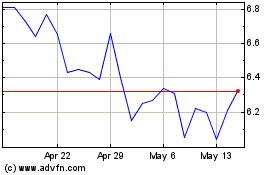

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-32167

|

|

76-0274813

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

9800 Richmond Avenue, Suite 700

Houston, Texas

|

|

77042

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 623-0801

Not Applicable

(Former Name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.10

|

EGY

|

New York Stock Exchange

|

|

Common Stock, par value $0.10

|

EGY

|

London Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2024, VAALCO Energy, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter of 2024 and guidance for the third quarter and the remainder of 2024. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Presentation slides accompanying this earnings release are available on the Company’s website at www.vaalco.com located on the “Webcasts/Presentations” page within the Investor Relations section of the site.

The information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and is not incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 7.01. Regulation FD Disclosure.

Earnings Release and Conference Call. As previously announced, the Company is hosting a conference call to discuss its financial and operational results on Wednesday morning, August 7, 2024 at 10:00 a.m. Central Time (11:00 a.m. Eastern Time and 4:00 p.m. London Time).

The information in this Item 7.01 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section. The information in this Item 7.01 shall not be incorporated by reference into any filing under the Exchange Act or the Securities Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

| |

VAALCO Energy, Inc.

|

|

| |

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

|

Date: August 7, 2024

|

|

|

|

| |

By:

|

/s/ Lynn Willis

|

|

| |

Name:

|

Lynn Willis

|

|

| |

Title:

|

Interim Chief Accounting Officer and Controller

|

|

Exhibit 99.1

VAALCO ENERGY, INC. ANNOUNCES

SECOND QUARTER 2024 RESULTS

HOUSTON – August 6, 2024 - VAALCO Energy, Inc. (NYSE: EGY, LSE: EGY) ("VAALCO" or the "Company") today reported operational and financial results for the second quarter of 2024.

Second Quarter 2024 Highlights and Recent Key Items:

| |

● |

Closed the accretive all cash acquisition of Svenska Petroleum Exploration AB (“Svenska”) for a net purchase price of $40.2 million; |

| |

|

● Updated third-party reserve engineer's calculation of proved reserves as of December 31, 2023 for Svenska that shows significant increase of SEC proved reserves to 16.9 million barrels of oil equivalent (“MMBOE”) (93% oil); |

| |

|

● Realized a $19.9 million bargain purchase gain on the transaction; |

| |

● |

Reported strong Q2 2024 net income of $28.2 million ($0.27 per diluted share) and, Adjusted Net Income(1) of $22.6 million ($0.22 per diluted share); |

| |

● |

Increased Adjusted EBITDAX(1) by 17% to $72.5 million compared to Q1 2024, driven by sales increase associated with Côte d’Ivoire lifting in May following the closing of the Svenska acquisition; |

| |

● |

Achieved production of 20,588 net revenue interest (“NRI”)(2) barrels of oil equivalent per day (“BOEPD”) and working interest (“WI”)(3) production of 25,411 BOEPD; second quarter 2024 included new production of 3,329 NRI BOEPD (3,329 WI BOEPD) from Côte d’Ivoire; |

| |

● |

Delivered better than expected results from the Canadian drilling program with three wells averaging 30 day initial production (“IP”)1 rates of 464 barrels of oil per day (“BOPD”), significantly increasing the liquid ratio in Canada; |

| |

● |

Reported NRI sales of 1,764,000 barrels of oil equivalent (“BOE”), or 19,386 BOEPD, above the midpoint of guidance; and 18% above the first quarter of 2024 due to the Côte d’Ivoire lifting; |

| |

● |

Posted unrestricted cash of $62.9 million which is after $40.2 million paid for the Svenska acquisition, $6.5 million paid for quarterly dividend and $32.5 million in cash capital spending for the quarter; |

| |

|

● Received $8 million payment post quarter-end of back dated accounts receivables (“AR”) in Egypt from EGPC. And, in July, written confirmation that the invoice was recognized in their June Accounts Payable as owed to us for our Merged Concession effective date adjustment; |

| |

● |

Settled $30.2 million in foreign income taxes for Gabon through the government taking its oil in-kind during a Q2 2024 lifting; and |

| |

● |

Announced quarterly cash dividend of $0.0625 per share of common stock to be paid on September 20, 2024. |

| |

(1)

|

Adjusted EBITDAX, Adjusted Net Income, Adjusted Working Capital and Free Cash Flow2 are Non-GAAP financial measures and are described and reconciled to the closest GAAP measure in the attached table under “Non-GAAP Financial Measures.” |

| |

(2)

|

All NRI production rates are VAALCO's working interest volumes less royalty volumes, where applicable. |

| |

(3) |

All WI production rates and volumes are VAALCO's working interest volumes, where applicable. |

George Maxwell, VAALCO’s Chief Executive Officer commented, “We had another strong quarter operationally and financially, closed on a highly accretive acquisition and continue to focus on profitably generating cash flow to fund future projects, while maintaining our commitment to meaningful shareholder returns through our quarterly dividend policy. We are very pleased with the solid results from our Canadian drilling program, which improved our liquid mix considerably in the second quarter as we had three of the four wells come in with higher-than-expected IP30 rates. We closed the Côte d‘Ivoire transaction on April 30, had a lifting there in May and collected payment in June.”

“Looking at our highly accretive Côte d’Ivoire acquisition, we recognized a $19.9 million non-cash bargain purchase gain, which benefited our second quarter earnings, but it’s the strategic opportunities that provide VAALCO another strong asset to support future growth that we are most excited about. We are very pleased with the results of our third-party reserve engineer’s calculation of proved reserves as of December 31, 2023 that shows even greater reserves than we initially disclosed, up approximately 30% from our initial disclosure. This strategic and highly cost-effective acquisition strategically expands our West African focus area with a sizeable producing asset that has significant upside potential and considerable future development opportunities in Côte d’Ivoire, a well-established and investment-friendly country.”

“The focus for the second half of 2024 will be the preparation for major projects expected to deliver a step-change in organic growth across the portfolio in 2025. We expect to see an increase in capex investment through the second half of the year associated with these numerous projects including the drilling campaign in Gabon and the FPSO upgrade in Cote d’Ivoire. We are excited about the future and plan to continue to generate strong operational cash flow to fund our impressive organic opportunities moving forward, while continuing to return capital to our shareholders through the quarterly dividend.”

Operational Update

Egypt

VAALCO focused on enhancing production in the first half of 2024 through a series of planned workovers, as well as through interventions using the OGS-10 rig. VAALCO finalized the K-81 recompletion at the start of the first quarter which was a carry-over from its 2023 drilling activity. The EA-55 well, drilled in October 2023, was fracked and put online in January 2024. Three additional workover recompletions were completed in the second quarter with one more in progress. With the low cost of workovers, the well economics are strongly positive.

A summary of the Egyptian workover campaign's impact in the first half of 2024 is presented below:

|

VAALCO Egypt 2024 Workover Wells

|

|

|

Well

|

Workover date

|

Type

|

Completion Zone

|

|

Perforation Interval (ft)

|

|

|

IP-30 Rate (BOPD)

|

|

|

K-81

|

1-Jan-24

|

Recompletion

|

Asl-D

|

|

|

13.1 |

|

|

|

154 |

|

|

EA-55

|

10-Jan-24

|

Frac & Complete

|

Redbed

|

|

Hydraulic Frac

|

|

|

|

143 |

|

|

H-22

|

7-Feb-24

|

Recompletion

|

Yusr-A

|

|

|

9.8 |

|

|

|

82 |

|

|

K-65_ST1

|

14-Feb-24

|

Recompletion

|

Asl-D

|

|

|

13.1 |

|

|

|

43* |

|

|

K-85

|

16-Mar-24

|

Recompletion

|

Asl-D

|

|

|

13.1 |

|

|

|

420 |

|

|

K-84

|

27-Mar-24

|

Recompletion

|

Asl-G

|

|

|

16.4 |

|

|

|

58* |

|

|

K-74

|

3-Apr-24

|

Water Shut-off Recompletion

|

Asl-A

|

|

|

8.2 |

|

|

|

108 |

|

|

K-77

|

7-Apr-24

|

Recompletion

|

Asl-A

|

|

|

26.2 |

|

|

|

100 |

|

|

K-84

|

13-Jun-24

|

Recompletion

|

Asl-D

|

|

|

19.7 |

|

|

|

430 |

|

|

K-80

|

19-Jun-24

|

Recompletion

|

Asl-D

|

|

|

13.1 |

|

|

|

188 |

|

*Production as of June 30, 2024 – Sand production – Possible Sand Screen Required

Canada

The 2024 drilling campaign commenced in January 2024 with the drilling of 9-12-30-4W5, which was spud on January 17, 2024. The first well was drilled to a total depth of 22,732 feet. The second well of the program, 10-12-30-4W5, was spud on February 9, 2024, and drilled to a total depth of 21,736 feet. The third well on the program, 11-12-30-4W5 was spud on February 23, 2024, and drilled to a total depth of 21,624 feet. The fourth well on the program 1-18-30-3W5 was spud on March 9, 2024, and drilled to a total depth of 20,669 feet. The drilling rig was released on March 24, 2024.

Completion of the wells began in late March and was completed in April. By early May all wells were on production with strong initial rates as noted below:

|

VAALCO Canada 2024 Wells

|

|

Well

|

Spud date

|

Net Pay (ft)

|

Penetrated Pay Zones

|

Completion Zone

|

|

Perforation Interval (ft)

|

|

IP-30 Rate (BOEPD)

|

|

09-12-30-4W5

|

1/17/2024

|

2.75-Mile Hz (4,400m, 14,430ft)

|

Upper Bioturbated Cardium

|

Cardium

|

|

|

115 Stg x 15T Hydraulic Fracture Treatment |

|

479

|

|

10-12-30-4W5

|

2/22/2024

|

2.75-Mile Hz (4,400m, 14,430ft)

|

Upper Bioturbated Cardium

|

Cardium

|

|

|

100 Stg x 15T Hydraulic Fracture Treatment |

|

469

|

|

11-12-30-4W5

|

2/23/2024

|

2.75-Mile Hz (4,400m, 14,430ft)

|

Upper Bioturbated Cardium

|

Cardium

|

|

|

108 Stg x 15T Hydraulic Fracture Treatment |

|

444

|

|

1-18-30-3W5

|

9/3/2024

|

2.75-Mile Hz (4,400m, 14,430ft)

|

Upper Bioturbated Cardium

|

Cardium

|

|

|

106 Stg x 15T Hydraulic Fracture Treatment |

|

182

|

Gabon

VAALCO is currently finalizing locations and planning for the next drilling campaign at Etame that is expected to occur early in 2025. In October 2022, VAALCO successfully completed its transition to a Floating Storage and Offloading vessel (“FSO”) and related field reconfiguration processes. This project provides a low cost FSO solution that increases the storage capacity for the Etame block and improved operational performance. The Company continues to emphasize operational excellence, production uptime and enhancement in 2024 to minimize decline until the next drilling campaign.

The focus is on the continued production optimization of the new flow line configurations through the Etame Facility, for final processing before being pumped to the FSO. This continued optimization and understanding of the post-reconfiguration process dynamics of the Etame platform, have resulted in a very high uptime of the Etame Facility.

Côte d'Ivoire

Prior to closing of the acquisition, at the beginning of Q2 2024, production was shut in due to the planned field maintenance shutdown. The Baobab production shutdown took place successfully and as per plan between March 21, 2024 and April 13, 2024. All nine operational production wells were successfully restarted in mid-April with flush production rates of just over 21,000 BOEPD, which has since stabilized to around 18,000 BOEPD.

During the second quarter, one lifting took place in May of 655,715 gross barrels or 211,294 net barrels to VAALCO, achieving a price of $81.70 per barrel.

Work with Modec, the operator of the Baobab Floating Production and Offloading Vessel (“FPSO”), on the drydocking project for the FPSO, projected to be offline in 2025, continued in the second quarter of 2024. The operator is currently preparing detailed project timetable and costings for the partners and regulator; however preliminary work including the execution of a letter of intent with Modec on April 4, 2024 which covers the key contracts to be executed, including vessel purchase, EPC, and O&M amendments, as well as selection of the disconnect and reconnect contractor, and support for the revised yard bid from Dubai dry docks among other activities. Additionally, in the second quarter of 2024, the outstanding tank inspections continued in preparation for the dry dock.

Financial Update – Second Quarter of 2024

VAALCO reported net income of $28.2 million ($0.27 per diluted share) for the second quarter of 2024 which was up significantly compared with net income of $7.7 million ($0.07 per diluted share) in the first quarter of 2024 and up compared to $6.8 million ($0.06 per diluted share) in the second quarter of 2023. The increase in earnings is driven by the non-cash bargain purchase gain on the acquisition, increased sales associated with Côte d’Ivoire and was partially offset by increased production expense.

Adjusted EBITDAX totaled $72.5 million in the second quarter of 2024, an increase from $61.7 million in the first quarter of 2024 and from $65.3 million generated in the same period in 2023. The increase was primarily due to additional sales volumes from Côte d'Ivoire.

|

Quarterly Summary - Sales and Net Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

Three Months Ended June 30, 2024

|

|

|

Three Months Ended March 31, 2024

|

|

| |

|

Gabon

|

|

|

Egypt

|

|

|

Canada

|

|

|

Côte d'Ivoire

|

|

|

Total

|

|

|

Gabon

|

|

|

Egypt

|

|

|

Canada

|

|

|

Côte d'Ivoire

|

|

|

Total

|

|

|

Oil Sales

|

|

|

62,327 |

|

|

|

65,314 |

|

|

|

9,547 |

|

|

|

17,240 |

|

|

|

154,428 |

|

|

|

64,788 |

|

|

|

63,192 |

|

|

|

4,153 |

|

|

|

— |

|

|

|

132,133 |

|

|

NGL Sales

|

|

|

— |

|

|

|

— |

|

|

|

1,922 |

|

|

|

— |

|

|

|

1,922 |

|

|

|

— |

|

|

|

— |

|

|

|

1,977 |

|

|

|

— |

|

|

|

1,977 |

|

|

Gas Sales

|

|

|

— |

|

|

|

— |

|

|

|

384 |

|

|

|

- |

|

|

|

384 |

|

|

|

- |

|

|

|

- |

|

|

|

820 |

|

|

|

— |

|

|

|

820 |

|

|

Gross Sales

|

|

|

62,327 |

|

|

|

65,314 |

|

|

|

11,854 |

|

|

|

17,240 |

|

|

|

156,734 |

|

|

|

64,788 |

|

|

|

63,192 |

|

|

|

6,951 |

|

|

|

— |

|

|

|

134,931 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Costs & carried interest

|

|

|

- |

|

|

|

(117 |

) |

|

|

(318 |

) |

|

|

- |

|

|

|

(435 |

) |

|

|

1,174 |

|

|

|

(111 |

) |

|

|

(143 |

) |

|

|

— |

|

|

|

920 |

|

|

Royalties & taxes

|

|

|

(8,653 |

) |

|

|

(29,716 |

) |

|

|

(1,152 |

) |

|

|

- |

|

|

|

(39,521 |

) |

|

|

(8,458 |

) |

|

|

(26,120 |

) |

|

|

(1,118 |

) |

|

|

— |

|

|

|

(35,696 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue

|

|

|

53,674 |

|

|

|

35,481 |

|

|

|

10,384 |

|

|

|

17,240 |

|

|

|

116,778 |

|

|

|

57,504 |

|

|

|

36,961 |

|

|

|

5,690 |

|

|

|

— |

|

|

|

100,155 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Sales MMB (working interest)

|

|

|

759 |

|

|

|

953 |

|

|

|

130 |

|

|

|

211 |

|

|

|

2,053 |

|

|

|

770 |

|

|

|

950 |

|

|

|

61 |

|

|

|

— |

|

|

|

1,781 |

|

|

Average Oil Price Received

|

|

$ |

82.13 |

|

|

$ |

68.52 |

|

|

$ |

73.52 |

|

|

$ |

81.70 |

|

|

$ |

75.22 |

|

|

$ |

84.19 |

|

|

$ |

66.52 |

|

|

$ |

67.83 |

|

|

|

— |

|

|

$ |

74.21 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Brent Price

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

$ |

84.65 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

$ |

83.00 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas Sales MMCF (working interest)

|

|

|

— |

|

|

|

— |

|

|

|

423 |

|

|

|

|

|

|

|

423 |

|

|

|

— |

|

|

|

— |

|

|

|

469 |

|

|

|

|

|

|

|

469 |

|

|

Average Gas Price Received

|

|

|

— |

|

|

|

— |

|

|

$ |

0.91 |

|

|

|

|

|

|

$ |

0.91 |

|

|

|

— |

|

|

|

— |

|

|

$ |

1.75 |

|

|

|

|

|

|

$ |

1.75 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-48 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Aeco Price ($USD)

|

|

|

— |

|

|

|

— |

|

|

$ |

0.84 |

|

|

|

|

|

|

$ |

0.84 |

|

|

|

— |

|

|

|

— |

|

|

$ |

1.46 |

|

|

|

|

|

|

$ |

1.46 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-42 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NGL Sales MMB (working interest)

|

|

|

— |

|

|

|

— |

|

|

|

76 |

|

|

|

|

|

|

|

76 |

|

|

|

— |

|

|

|

— |

|

|

|

76 |

|

|

|

|

|

|

|

76 |

|

|

Average Liquids Price Received

|

|

|

— |

|

|

|

— |

|

|

$ |

25.16 |

|

|

|

|

|

|

$ |

25.16 |

|

|

|

— |

|

|

|

— |

|

|

$ |

25.98 |

|

|

|

|

|

|

$ |

25.98 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue and Sales

|

|

Q2 2024

|

|

|

Q2 2023

|

|

|

% Change Q2 2024 vs. Q2 2023

|

|

|

Q1 2024

|

|

|

% Change Q2 2024 vs. Q1 2024

|

|

|

Production (NRI BOEPD)

|

|

|

20,588 |

|

|

|

19,676 |

|

|

|

5 |

% |

|

|

16,848 |

|

|

|

22 |

% |

|

Sales (NRI BOE)

|

|

|

1,764,000 |

|

|

|

1,803,000 |

|

|

|

(2 |

)% |

|

|

1,490,000 |

|

|

|

18 |

% |

|

Realized commodity price ($/BOE)

|

|

$ |

66.05 |

|

|

$ |

59.37 |

|

|

|

11 |

% |

|

$ |

66.43 |

|

|

|

(1 |

)% |

|

Commodity (Per BOE including realized commodity derivatives)

|

|

$ |

66.03 |

|

|

$ |

59.34 |

|

|

|

11 |

% |

|

$ |

66.41 |

|

|

|

(1 |

)% |

|

Total commodity sales ($MM)

|

|

$ |

116.5 |

|

|

$ |

109.2 |

|

|

|

7 |

% |

|

$ |

100.2 |

|

|

|

16 |

% |

VAALCO had net revenues increase by $16.0 million or 16% as total NRI sales volumes of 1,764,000 BOE was higher than Q1 2024 and decreased 2% compared to 1,803,000 BOE for Q2 2023. Q2 2024 NRI sales were toward the upper end of VAALCO's guidance. The Company expects third quarter 2024 NRI sales to be between 21,700 and 24,000 BOEPD, reflecting the addition of the Côte d'Ivoire volume for an entire quarter.

Q2 2024 realized pricing (net of royalties) was virtually flat compared to Q1 2024 and 11% higher compared to Q2 2023.

|

Costs and Expenses

|

|

Q2 2024

|

|

|

Q2 2023

|

|

|

% Change Q2 2024 vs. Q2 2023

|

|

|

Q1 2024

|

|

|

% Change Q2 2024 vs. Q1 2024

|

|

|

Production expense, excluding offshore workovers and stock comp ($MM)

|

|

$ |

52.4 |

|

|

$ |

38.8 |

|

|

|

35 |

% |

|

$ |

32.1 |

|

|

|

63 |

% |

|

Production expense, excluding offshore workovers ($/BOE)

|

|

$ |

29.70 |

|

|

$ |

21.51 |

|

|

|

38 |

% |

|

$ |

21.58 |

|

|

|

38 |

% |

|

Offshore workover expense ($MM)

|

|

$ |

0.1 |

|

|

$ |

(0.2 |

) |

|

|

134 |

% |

|

$ |

(0.1 |

) |

|

|

— |

% |

|

Depreciation, depletion and amortization ($MM)

|

|

$ |

33.1 |

|

|

$ |

38.0 |

|

|

|

(13 |

)% |

|

$ |

25.8 |

|

|

|

28 |

% |

|

Depreciation, depletion and amortization ($/BOE)

|

|

$ |

18.78 |

|

|

$ |

21.10 |

|

|

|

(11 |

)% |

|

$ |

17.33 |

|

|

|

8 |

% |

|

General and administrative expense, excluding stock-based compensation ($MM)

|

|

$ |

6.6 |

|

|

$ |

4.8 |

|

|

|

38 |

% |

|

$ |

5.9 |

|

|

|

14 |

% |

|

General and administrative expense, excluding stock-based compensation ($/BOE)

|

|

$ |

3.8 |

|

|

$ |

2.70 |

|

|

|

40 |

% |

|

$ |

3.9 |

|

|

|

(4 |

)% |

|

Stock-based compensation expense ($MM)

|

|

$ |

0.9 |

|

|

$ |

0.6 |

|

|

|

50 |

% |

|

$ |

0.9 |

|

|

|

- |

% |

|

Current income tax expense (benefit) ($MM)

|

|

$ |

13.3 |

|

|

$ |

12.4 |

|

|

|

7 |

% |

|

$ |

25.7 |

|

|

|

(48 |

)% |

|

Deferred income tax expense (benefit) ($MM)

|

|

$ |

(4.0 |

) |

|

$ |

(0.8 |

) |

|

|

405 |

% |

|

$ |

(3.4 |

) |

|

|

17 |

% |

Total production expense (excluding offshore workovers and stock compensation) of $52.4 million in Q2 2024 was an increase compared to Q1 2024 and an increase compared to the same period in 2023. The increase in Q2 2024 was primarily driven by a non-cash purchase price adjustment for the Svenska acquisition flowing through production expense and increased operating expenditure associated with the addition of Côte d'Ivoire in the quarter. VAALCO has seen withholding tax, inflationary and industry supply chain pressure on personnel and contractor costs.

Q2 2024 had minimal offshore workover expense and was equal to workover expense in Q1 2024.

Q2 2024 production expense per BOE, excluding offshore workover expense, increased to $29.70 per BOE which was higher than Q2 2023 and Q1 2024 primarily due to the increased costs associated with the non-cash purchase price adjustment for the Svenska acquisition.

DD&A expense for Q2 2024 was $33.1 million which was higher than $25.8 million in Q1 2024 and lower than $38.0 million in Q2 2023. The increase in Q2 2024 DD&A expense compared to Q1 2024 is due primarily to increased depletion associated with the addition of Côte d'Ivoire. The decrease in Q2 2024 DD&A expense compared to Q2 2023 is due to lower depletable costs in Gabon, Egypt, and Canada partially offset by higher depletable costs in Côte d'Ivoire.

General and administrative (“G&A”) expense, excluding stock-based compensation, increased to $6.6 million in Q2 2024 from $5.9 million in Q1 2024 and $4.8 million in Q2 2023. The increase in general and administrative expenses compared to Q2 2023 and Q1 2024 is primarily due to higher professional service fees, salaries and wages, and accounting and legal fees due to growth due to the acquisition. Q2 2024 cash G&A was within the Company’s guidance and nearly flat compared to Q1 2024 on a per barrel basis.

Non-cash stock-based compensation expense was $0.9 million for Q2 2024 compared to $0.6 million for Q2 2023. Non-cash stock-based compensation expense for Q1 2024 was $0.9 million.

Other income (expense), net, was an expense of $2.0 million for Q2 2024, compared to an expense of $0.5 million during Q2 2023 and an expense of $1.8 million for Q1 2024. Other income (expense), net, normally consists of foreign currency losses. Also included in Q2 2024 amount are $1.8 million in transaction costs related to the Svenska acquisition.

Foreign income taxes for Gabon are settled by the government taking oil in-kind. Q2 2024 income tax expense was an expense of $9.3 million and is comprised of current tax expense of $13.3 million and deferred tax benefit of $4.0 million. Current quarter tax was impacted by non-deductible items (such as the Svenska transaction costs) and the change in market value of tax barrels due to Gabon State mark-to-market at quarter end. Q1 2024 income tax expense was an expense of $22.2 million. This was comprised of $25.7 million of current tax expense and a deferred tax benefit of $3.4 million. Q2 2023 income tax expense was an expense of $11.6 million. This was comprised of $12.4 million of current tax expense and a deferred tax benefit of $0.8 million. For all periods, VAALCO’s overall effective tax rate was impacted by non-deductible items associated with tax rates in foreign jurisdictions higher than the US statutory rate and by non-deductible items associated with operations.

Financial Update – First Six Months of 2024

WI Sales for the first six months of 2024 increased to 4,134 MBOE compared to 3,438 MBOE in the first six months of 2023. The increase was driven primarily by the Côte d'Ivoire acquisition. Crude oil sales are a function of the number and size of crude oil liftings in each quarter and do not always coincide with volumes produced in any given period.

The average realized crude oil price for the first six months of 2024 was $74.75 per barrel, representing an increase of 8.0% from $69.28 realized in the first six months of 2023. This increase in crude oil price reflects the increase in commodity pricing over the past year.

The Company reported net income for the six months ended June 30, 2024 of $35.8 million, which compares to $10.2 million for the same period of 2023. The increase in net income for the six months ended June 30, 2024 compared to the same period in 2023 was primarily due to the bargain purchase gain related to the Svenska acquisition in April, as well as higher sales and realized pricing.

|

Year to Date Summary - Sales and Net Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

Six Months Ended June 30, 2024

|

|

|

Six Months Ended June 30, 2023

|

|

| |

|

Gabon

|

|

|

Egypt

|

|

|

Canada

|

|

|

Côte d'Ivoire

|

|

|

Total

|

|

|

Gabon

|

|

|

Egypt

|

|

|

Canada

|

|

|

Côte d'Ivoire

|

|

|

Total

|

|

|

Oil Sales

|

|

|

127,115 |

|

|

|

128,506 |

|

|

|

13,700 |

|

|

|

17,240 |

|

|

|

286,561 |

|

|

|

130,079 |

|

|

|

104,822 |

|

|

|

14,979 |

|

|

|

— |

|

|

|

249,880 |

|

|

NGL Sales

|

|

|

— |

|

|

|

— |

|

|

|

3,898 |

|

|

|

|

|

|

|

3,898 |

|

|

|

— |

|

|

|

— |

|

|

|

4,348 |

|

|

|

|

|

|

|

4,348 |

|

|

Gas Sales

|

|

|

— |

|

|

|

— |

|

|

|

1,205 |

|

|

|

|

|

|

|

1,205 |

|

|

|

— |

|

|

|

— |

|

|

|

1,661 |

|

|

|

|

|

|

|

1,661 |

|

|

Gross Sales

|

|

|

127,115 |

|

|

|

128,506 |

|

|

|

18,802 |

|

|

|

17,240 |

|

|

|

291,663 |

|

|

|

130,079 |

|

|

|

104,822 |

|

|

|

20,988 |

|

|

|

— |

|

|

|

255,889 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling Costs & carried interest

|

|

|

1,174 |

|

|

|

(228 |

) |

|

|

(461 |

) |

|

|

|

|

|

|

485 |

|

|

|

2,212 |

|

|

|

(498 |

) |

|

|

— |

|

|

|

|

|

|

|

1,714 |

|

|

Royalties & taxes

|

|

|

(17,111 |

) |

|

|

(55,836 |

) |

|

|

(2,269 |

) |

|

|

|

|

|

|

(75,216 |

) |

|

|

(17,630 |

) |

|

|

(48,232 |

) |

|

|

(2,098 |

) |

|

|

— |

|

|

|

(67,960 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Revenue

|

|

|

111,178 |

|

|

|

72,442 |

|

|

|

16,073 |

|

|

|

17,240 |

|

|

|

216,933 |

|

|

|

114,661 |

|

|

|

56,092 |

|

|

|

18,890 |

|

|

|

— |

|

|

|

189,643 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Sales MMB (working interest)

|

|

|

1,528 |

|

|

|

1,903 |

|

|

|

191 |

|

|

|

211 |

|

|

|

3,834 |

|

|

|

1,641 |

|

|

|

1,750 |

|

|

|

216 |

|

|

|

— |

|

|

|

3,607 |

|

|

Average Oil Price Received

|

|

$ |

83.17 |

|

|

$ |

67.52 |

|

|

$ |

71.70 |

|

|

$ |

81.70 |

|

|

$ |

74.75 |

|

|

$ |

79.29 |

|

|

$ |

59.89 |

|

|

$ |

69.27 |

|

|

$ |

- |

|

|

$ |

69.28 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Brent Price

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

83.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

79.47 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gas Sales MMCF (working interest)

|

|

|

— |

|

|

|

— |

|

|

|

892 |

|

|

|

|

|

|

|

892 |

|

|

|

— |

|

|

|

— |

|

|

|

857 |

|

|

|

|

|

|

|

857 |

|

|

Average Gas Price Received

|

|

|

— |

|

|

|

— |

|

|

$ |

1.35 |

|

|

|

|

|

|

$ |

1.35 |

|

|

|

— |

|

|

|

— |

|

|

$ |

1.94 |

|

|

|

|

|

|

$ |

1.94 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-30 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Aeco Price ($USD)

|

|

|

|

|

|

|

|

|

|

$ |

1.15 |

|

|

|

|

|

|

$ |

1.15 |

|

|

|

|

|

|

|

|

|

|

$ |

1.96 |

|

|

|

|

|

|

$ |

1.96 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-41 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NGL Sales MMB (working interest)

|

|

|

— |

|

|

|

— |

|

|

|

152 |

|

|

|

|

|

|

|

152 |

|

|

|

— |

|

|

|

— |

|

|

|

155 |

|

|

|

|

|

|

|

155 |

|

|

Average Liquids Price Received

|

|

|

— |

|

|

|

— |

|

|

$ |

25.63 |

|

|

|

|

|

|

$ |

25.63 |

|

|

|

— |

|

|

|

— |

|

|

$ |

28.08 |

|

|

|

|

|

|

$ |

28.08 |

|

|

Change

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Investments/Balance Sheet

For the second quarter of 2024, net capital expenditures totaled $32.5 million on a cash basis and $22.4 million on an accrual basis. These expenditures were primarily related to costs associated with the development drilling programs in Egypt and Canada.

At the end of the second quarter of 2024, VAALCO had an unrestricted cash balance of $62.9 million. Working capital at June 30, 2024 was $31.2 million compared with $45.7 million at December 31, 2023, while Adjusted Working Capital at June 30, 2024 totaled $43.5 million.

In Egypt, the Company received written confirmation from EGPC that $51.7 million was recognized in their June Accounts Payable as owed to Company for our Merged Concession effective date adjustment, from which they will offset $11.2 million to satisfy any obligation of VAALCO or its subsidiaries in connection with the TransGlobe combination. This allowance of $11.2 million is fully covered in the 30th June 2024 Balance Sheet. Having this confirmation from EGPC is an important step in the process of getting this paid.

Quarterly Cash Dividend

VAALCO paid a quarterly cash dividend of $0.0625 per share of common stock for the second quarter of 2024 on June 21, 2024. The Company also announced its next quarterly cash dividend of $0.0625 per share of common stock for the third quarter of 2024 ($0.25 annualized), to be paid on September 20, 2024 to stockholders of record at the close of business on August 23, 2024. Future declarations of quarterly dividends and the establishment of future record and payment dates are subject to approval by the VAALCO Board of Directors (the "Board").

Svenska Acquisition

VAALCO closed its acquisition of Svenska for the net purchase price of $40.2 million, on April 30, 2024 after certain regulatory and government approvals were received.

Svenska’s primary license interest is a 27.39% non-operated working interest (30.43% paying interest) in the CI-40 license, which includes the producing Baobab field, located in deepwater offshore Côte d’Ivoire. The field is operated by CNR International, which holds a 57.61% working interest in the project, with the national oil company, Petroci Holding, owning the remaining 15% working interest (10% of which is carried by the other license partners). The CI-40 license has an initial term through mid-2028 with the contractual option to extend the license term by 10 years to 2038, subject to certain conditions. Production in the Baobab field was approximately 5,000 WI BOEPD, with cumulative gross production from the field has been approximately 150 MMBOE, a portion of the estimated over one billion barrels of oil equivalent volumes initially in place.

At the time of the initial announcement of the acquisition, VAALCO disclosed that the transaction included estimated 1P WI CPR reserves, as of October 1, 2023, of 13.0 MMBOE (99% oil) and total 2P WI CPR reserves at October 1, 2023, of 21.7 million MMBOE (97% oil). VAALCO at that time did not have a calculation of SEC proved reserves as of December 31, 2023 but has since worked with its third-party reserves auditors to calculate its SEC proved reserves. VAALCO reported on July 16, 2024 that SEC net proved reserves as of December 31, 2023 totaled 16.9 MMBOE and that 2P WI CPR reserves for Svenska as of December 31, 2023 are estimated at 22.5 MMBOE. On a pro-forma basis, this results in VAALCO’s year-end 2023 pro-forma SEC net proved reserves totaling 45.6 MMBOE, a 59% increase from its reported yearend 2023 SEC net proved reserves of 28.6 MMBOE. Utilizing the net cash purchase price of $40.2 million, VAALCO paid approximately $2.37 per net proved barrel of reserves.

CI-40 has a long history of production and significantly de-risked reservoirs. With almost 20 years of production to date, the FPSO is planned to come off station at the start of 2025 for planned maintenance and upgrade work to allow the FPSO to continue to produce through the end of the expected extended field license in 2038. The scope of work for the FPSO upgrade is currently being finalized. Production on Baobab is expected to re-start in 2026 following the FPSO work program. In addition, a fully appraised development drilling program is expected to start in 2026, targeting the significant incremental probable reserve base on the field. VAALCO sees reduced geological risk relating to this drilling program and the joint venture partners have already commenced the ordering of certain long-lead drilling items. Further future drilling phases have not yet been sanctioned, but there is significant incremental potential in both the Baobab field itself, as well as the nearby Kossipo development, which has also been appraised by two wells drilled in 2002 and 2019.

In addition to the CI-40 license in Côte d’Ivoire, VAALCO currently owns a 21.05% working interest in the early stage Uge discovery in the OML 145 concession in Nigeria alongside partners ExxonMobil (21.05%), Chevron (21.05%), Oando (21.05%) and NPDC (15.80%). There are minimal commitments on this license interest and no drilling or development is currently planned.

Hedging

The Company continued to opportunistically hedge a portion of its expected future production to lock in strong cash flow generation to assist in funding its capital and shareholder returns programs.

The following includes hedges remaining in place as of the end of the second quarter of 2024:

|

Settlement Period

|

Type of Contract

|

Index

|

|

Average Monthly Volumes

|

|

|

Weighted Average Put Price

|

|

|

Weighted Average Call Price

|

|

| |

|

|

|

(Bbls)

|

|

|

(per Bbl)

|

|

|

(per Bbl)

|

|

|

July 2024 - September 2024

|

Collars

|

Dated Brent

|

|

|

80,000 |

|

|

$ |

65.00 |

|

|

$ |

92.00 |

|

a) The premium for these options was $4.01 per barrel and was paid in October 2023.

|

Settlement Period

|

Type of Contract

|

Index

|

|

Average Monthly Volumes

|

|

|

Weighted Average Put Price

|

|

| |

|

|

|

(Bbls)a

|

|

|

(per Bbl)

|

|

|

July 2024 - December 2024

|

Put Options

|

Dated Brent

|

|

|

125,000 |

|

|

$ |

65.00 |

|

|

Settlement Period

|

Type of Contract

|

Index

|

|

Average Monthly Volumes

|

|

|

Weighted Average SWAP Price in CAD

|

|

| |

|

|

|

(GJ)b

|

|

|

(per GJ)

|

|

|

November 2024 - March 2025

|

Swap

|

AECO (7A)

|

|

|

67,000 |

|

|

$ |

2.80 |

|

| |

|

|

|

|

|

|

|

|

|

|

b) One gigajoule (GJ) equals one billion joules (J). A gigajoule of natural gas is about 25.5 cubic metres at standard conditions.

2024 Guidance:

The Company has provided third quarter 2024 guidance and updated its full year 2024 guidance. All of the quarterly and annual guidance is detailed in the tables below.

| |

|

|

FY 2024

|

|

|

Gabon

|

|

|

Egypt

|

|

|

Canada

|

|

|

Côte d'Ivoire

|

|

|

Production (BOEPD)

|

WI

|

|

|

23600 - 26500 |

|

|

|

8300 - 9600 |

|

|

|

9800 - 10600 |

|

|

|

2700 - 3200 |

|

|

|

2800 - 3100 |

|

|

Production (BOEPD)

|

NRI

|

|

|

18900 - 21400 |

|

|

|

7200 - 8300 |

|

|

|

6700 - 7400 |

|

|

|

2200 - 2600 |

|

|

|

2800 - 3100 |

|

|

Sales Volume (BOEPD)

|

WI

|

|

|

24300 - 27200 |

|

|

|

8300 - 9500 |

|

|

|

9800 - 10600 |

|

|

|

2700 - 3200 |

|

|

|

3500 - 3900 |

|

|

Sales Volume (BOEPD)

|

NRI

|

|

|

19600 - 22200 |

|

|

|

7200 - 8300 |

|

|

|

6700 - 7400 |

|

|

|

2200 - 2600 |

|

|

|

3500 - 3900 |

|

|

Production Expense (millions)

|

WI & NRI

|

|

$174.0 - $189.0 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production Expense per BOE

|

WI

|

|

$18.00 - $20.50

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production Expense per BOE

|

NRI

|

|

$22.00 - $26.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offshore Workovers (millions)

|

WI & NRI

|

|

$1 - $10 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash G&A (millions)

|

WI & NRI

|

|

$20.0 - $28.0 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPEX excluding acquisitions (millions)

|

WI & NRI

|

|

$115 - $140 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DD&A ($/BOE)

|

NRI

|

|

$16.00 - $20.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Q3 2024

|

|

|

Gabon

|

|

|

Egypt

|

|

|

Canada

|

|

|

Côte d'Ivoire

|

|

|

Production (BOEPD)

|

WI

|

|

|

24900 - 27600 |

|

|

|

8300 - 9300 |

|

|

|

9700 - 10700 |

|

|

|

2700 - 3000 |

|

|

|

4200 - 4600 |

|

|

Production (BOEPD)

|

NRI

|

|

|

20300 - 22800 |

|

|

|

7200 - 8200 |

|

|

|

6600 - 7500 |

|

|

|

2300 - 2500 |

|

|

|

4200 - 4600 |

|

|

Sales Volume (BOEPD)

|

WI

|

|

|

26100 - 28700 |

|

|

|

7300 - 8000 |

|

|

|

9700 - 10700 |

|

|

|

2700 - 3000 |

|

|

|

6400 - 7000 |

|

|

Sales Volume (BOEPD)

|

NRI

|

|

|

21700 - 24000 |

|

|

|

6400 - 7000 |

|

|

|

6600 - 7500 |

|

|

|

2300 - 2500 |

|

|

|

6400 - 7000 |

|

|

Production Expense (millions)

|

WI & NRI

|

|

$38.5 - $49.0 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production Expense per BOE

|

WI

|

|

$14.50 - $21.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production Expense per BOE

|

NRI

|

|

$17.50 - $25.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Offshore Workovers (millions)

|

WI & NRI

|

|

$0 - $0 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash G&A (millions)

|

WI & NRI

|

|

$4.5 - $6.5 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPEX excluding acquisitions (millions)

|

WI & NRI

|

|

$32 - $54 MM

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DD&A ($/BOE)

|

NRI

|

|

$16.00 - $20.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Conference Call

As previously announced, the Company will hold a conference call to discuss its second quarter 2024 financial and operating results tomorrow, Wednesday, August 7, 2024, at 10:00 a.m. Central Time (11:00 a.m. Eastern Time and 4:00 p.m. London Time). Interested parties may participate by dialing (833) 685-0907. Parties in the United Kingdom may participate toll-free by dialing 08082389064 and other international parties may dial (412) 317-5741. Participants should request to be joined to the “VAALCO Energy Second Quarter 2024 Conference Call.” This call will also be webcast on VAALCO’s website at www.vaalco.com. An archived audio replay will be available on VAALCO’s website.

A “Q2 2024 Supplemental Information” investor deck will be posted to VAALCO’s web site prior to its conference call on August 7, 2024 that includes additional financial and operational information.

About VAALCO

VAALCO, founded in 1985 and incorporated under the laws of Delaware, is a Houston, Texas, USA based, independent energy company with a diverse portfolio of production, development and exploration assets across Gabon, Egypt, Côte d'Ivoire, Equatorial Guinea and Canada.

For Further Information

| |

|

| |

|

|

VAALCO Energy, Inc. (General and Investor Enquiries)

|

+00 1 713 623 0801

|

|

Website:

|

www.vaalco.com

|

| |

|

| |

|

|

Al Petrie Advisors (US Investor Relations)

|

+00 1 713 543 3422

|

|

Al Petrie / Chris Delange

|

|

| |

|

|

Buchanan (UK Financial PR)

|

+44 (0) 207 466 5000

|

|

Ben Romney / Barry Archer

|

VAALCO@buchanan.uk.com

|

Forward Looking Statements

This press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created by those laws and other applicable laws and “forward-looking information” within the meaning of applicable Canadian securities laws. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. All statements other than statements of historical fact may be forward-looking statements. The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “forecast,” “outlook,” “aim,” “target,” “will,” “could,” “should,” “may,” “likely,” “plan” and “probably” or similar words may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements in this press release include, but are not limited to, statements relating to (i) estimates of future drilling, production, sales and costs of acquiring crude oil, natural gas and natural gas liquids; (ii) expectations regarding VAALCO's ability to effectively integrate assets and properties it has acquired as a result of the Svenska acquisition into its operations; (iii) expectations regarding future exploration and the development, growth and potential of VAALCO’s operations, project pipeline and investments, and schedule and anticipated benefits to be derived therefrom; (iv) expectations regarding future acquisitions, investments or divestitures; (v) expectations of future dividends; (vi) expectations of future balance sheet strength; and (vii) expectations of future equity and enterprise value.

Such forward-looking statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to: risks relating to any unforeseen liabilities of VAALCO; the ability to generate cash flows that, along with cash on hand, will be sufficient to support operations and cash requirements; risks relating to the timing and costs of completion for scheduled maintenance of the FPSO servicing the Baobab field; and the risks described under the caption “Risk Factors” in VAALCO’s 2023 Annual Report on Form 10-K filed with the SEC on March 15, 2024 and subsequent Quarterly Reports on Form 10-Q filed with the SEC.

Dividends beyond the third quarter of 2024 have not yet been approved or declared by the Board of Directors for VAALCO. The declaration and payment of future dividends remains at the discretion of the Board and will be determined based on VAALCO’s financial results, balance sheet strength, cash and liquidity requirements, future prospects, crude oil and natural gas prices, and other factors deemed relevant by the Board. The Board reserves all powers related to the declaration and payment of dividends. Consequently, in determining the dividend to be declared and paid on VAALCO common stock, the Board may revise or terminate the payment level at any time without prior notice.

WI CPR Reserves

WI CPR reserves represent proved (1P) and proved plus probable (2P) estimates as reported by Petroleum Development Consultants Limited and prepared in accordance with the definitions and guidelines set forth in the 2018 Petroleum Resources Management Systems approved by the Society of Petroleum Engineers. The SEC definitions of proved and probable reserves are different from the definitions contained in the 2018 Petroleum Resources Management Systems approved by the Society of Petroleum Engineers. As a result, 1P and 2P WI CPR reserves may not be comparable to United States standards. The SEC requires United States oil and gas reporting companies, in their filings with the SEC, to disclose only proved reserves after the deduction of royalties and production due to others but permits the optional disclosure of probable and possible reserves in accordance with SEC definitions.

1P and 2P WI CPR reserves, as disclosed herein, may differ from the SEC definitions of proved and probable reserves because:

| |

●

|

Pricing for SEC is the average closing price on the first trading day of each month for the prior year which is then held flat in the future, while the 1P and 2P WI CPR pricing assumption was $79.79 per barrel of oil beginning in 2024, $69.79 in 2025, and inflating 2% thereafter;

|

| |

●

|

Lease operating expenses are typically not escalated under the SEC’s rules, while for the WI CPR reserves estimates, they are escalated at 2% annually beginning in 2024.

|

Management uses 1P and 2P WI CPR reserves as a measurement of operating performance because it assists management in strategic planning, budgeting and economic evaluations and in comparing the operating performance of Svenska to other companies. Management believes that the presentation of 1P and 2P WI CPR reserves is useful to its international investors, particularly those that invest in companies trading on the London Stock Exchange, in order to better compare reserve information to other London Stock Exchange-traded companies that report similar measures. However, 1P and 2P WI CPR reserves should not be used as a substitute for proved reserves calculated in accordance with the definitions prescribed by the SEC. In evaluating VAALCO’s business, investors should rely on VAALCO’s SEC proved reserves and consider 1P and 2P WI CPR reserves only supplementally.

Other Oil and Gas Advisories

Investors are cautioned when viewing BOEs in isolation. The Svenska reserves estimates as of October 1, 2023 were calculated using a BOE conversion ratio of six thousand cubic feet of natural gas to one barrel of oil equivalent (6 MCF: 1 Bbl). The Svenska reserves estimates as of December 31, 2023 were calculated using a BOE conversion ratio of five thousand eight hundred cubic feet of natural gas to one barrel of oil equivalent (5.8 MCF: 1 Bbl). BOE conversion ratio is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of crude oil as compared to natural gas is significantly different from the energy equivalencies described above, utilizing such equivalencies may be incomplete as an indication of value.

Inside Information

This announcement contains inside information as defined in Regulation (EU) No. 596/2014 on market abuse which is part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 (“MAR”) and is made in accordance with the Company’s obligations under article 17 of MAR. The person responsible for arranging the release of this announcement on behalf of VAALCO is Matthew Powers, Corporate Secretary of VAALCO.

VAALCO ENERGY, INC AND SUBSIDIARIES

Consolidated Balance Sheets (Unaudited)

| |

|

As of June 30, 2024

|

|

|

As of December 31, 2023

|

|

|

ASSETS

|

|

(in thousands)

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

62,890 |

|

|

$ |

121,001 |

|

|

Restricted cash

|

|

|

139 |

|

|

|

114 |

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

Trade, net of allowances for credit loss and other of $0.2 and $0.5 million, respectively

|

|

|

64,934 |

|

|

|

44,888 |

|

|

Accounts with joint venture owners, net of allowance for credit losses of $0.8 and $0.8 million, respectively

|

|

|

721 |

|

|

|

1,814 |

|

|

Egypt receivables and other, net of allowances for credit loss and other of $11.2 and $4.6 million, respectively

|

|

|

41,903 |

|

|

|

45,942 |

|

|

Crude oil inventory

|

|

|

7,311 |

|

|

|

1,948 |

|

|

Prepayments and other

|

|

|

17,509 |

|

|

|

12,434 |

|

|

Total current assets

|

|

|

195,407 |

|

|

|

228,141 |

|

| |

|

|

|

|

|

|

|

|

|

Crude oil, natural gas and NGLs properties and equipment, net

|

|

|

548,415 |

|

|

|

459,786 |

|

|

Other noncurrent assets:

|

|

|

|

|

|

|

|

|

|

Restricted cash

|

|

|

8,788 |

|

|

|

1,795 |

|

|

Value added tax and other receivables, net of allowances for credit loss and other of $0.0 and $0.0 million, respectively

|

|

|

6,109 |

|

|

|

4,214 |

|

|

Right of use operating lease assets

|

|

|

580 |

|

|

|

2,378 |

|

|

Right of use finance lease assets

|

|

|

86,342 |

|

|

|

89,962 |

|

|

Deferred tax assets

|

|

|

64,859 |

|

|

|

29,242 |

|

|

Abandonment funding

|

|

|

6,268 |

|

|

|

6,268 |

|

|

Other long-term assets

|

|

|

1,216 |

|

|

|

1,430 |

|

|