Current Report Filing (8-k)

January 10 2022 - 5:17AM

Edgar (US Regulatory)

0001739104

false

0001739104

2022-01-10

2022-01-10

0001739104

us-gaap:CommonStockMember

2022-01-10

2022-01-10

0001739104

elan:TangiblePercentEquityUnitsMember

2022-01-10

2022-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): January 10, 2022

Elanco Animal Health Incorporated

(Exact name of registrant as specified

in its charter)

|

Indiana

|

|

001-38661

|

|

82-5497352

|

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

2500 Innovation Way

Greenfield,

Indiana

|

|

46140

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (877) 352-6261

Not Applicable

(Former Name or Address, if Changed

Since Last Report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which

registered

|

|

Common stock, no par value

|

|

ELAN

|

|

New York Stock Exchange

|

|

5.00% Tangible Equity Units

|

|

ELAT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

In connection with its participation at the 40th Annual

J.P. Morgan Health Care Conference (the “JPM Conference”) to be held from January 10-13, 2022, Elanco Animal Health Incorporated

(the “Company”) will report that it continues to expect to deliver results within its financial guidance ranges for the full

year and fourth quarter of 2021, which were previously provided by the Company on November 5, 2021 and November 30, 2021.

This is based on management’s initial analysis of operations

for the full year and fourth quarter of 2021. However, the Company is still in the process of completing the closing procedures for its

financial results for such periods and the related financial audit. The Company expects to issue full financial results for the full year

and fourth quarter of 2021 in February 2022.

Item 7.01 Regulation

FD Disclosure.

On January 11, 2022, the Company will present at the JPM Conference.

A copy of the Company’s presentation is furnished as Exhibit 99.1.

In addition to the information about the Company’s 2021 financial

guidance set forth in Item 2.02 above, key points from the presentation include:

|

|

·

|

In 2022, the Company expects to deliver continued revenue growth and double-digit

percent adjusted EBITDA and adjusted EPS growth. The Company plans to provide 2022 financial guidance in connection with its fourth quarter

and full year 2021 earnings release in February 2022.

|

|

|

·

|

In November 2021, the Company announced a restructuring that, once fully

realized, should deliver approximately $70 million in annualized savings. Approximately $45 million of those savings are expected to be

incremental to the $300 million value capture commitment the Company made in connection with its acquisition of Bayer Animal Health in

2020.

|

|

|

·

|

In 2022, the Company expects to obtain approval, and intends to launch, at

least seven new products in major markets. These portfolio-enhancing products are expected to be concentrated in pet health and are expected

to include products in the following areas: pain, parvovirus, vaccines, and over-the-counter (OTC) parasiticides.

|

|

|

·

|

The Company is making progress against the development milestones related

to the potential pet health blockbuster products in its portfolio.

|

|

|

·

|

The Company continues to believe it will deliver annualized innovation-related

sales of $600 million to $700 million by 2025, as well as achieve its previously communicated long-term adjusted gross margin, adjusted

EBITDA margin and net leverage targets.

|

|

|

·

|

Finally, as part of its short-term compensation program, the Company is introducing

an EVA-like metric that focuses on improving returns on after-tax cash in excess of cost of capital, which has been shown to correlate

with total shareholder return.

|

The information contained in the accompanying Exhibit 99.1 is being

furnished pursuant to Item 7.01 of Form 8-K. Neither the information set forth in Item 2.02 above, or the information furnished pursuant

to this Item 7.01, shall be deemed to be “filed” for purposes of Section 18 of the Exchange Act, nor otherwise subject to

the liabilities of that Section, and shall not be incorporated by reference into any registration statement or other document pursuant

to the Securities Act or the Exchange Act, whether made before or after the date hereof, except as otherwise expressly stated in such

filing.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), including but not limited to statements about the Company’s

financial results and future performance, expected cost savings from the Company’s restructuring program, and future product launches

and associated revenue. These forward-looking statements are based on the Company’s current expectations and assumptions regarding,

among other things, the Company’s operations, performance, and financial condition, and are subject to change. The Company’s

current expectations are also subject to the completion of the Company’s financial close process and financial audit for the full

year 2021 and are also subject to change. You are cautioned not to place undue reliance on these forward-looking statements, which reflect

management’s analysis only as of the date of this Current Report on Form 8-K. The Company undertakes no duty to update forward-looking

statements.

Item 9.01 Financial

Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Elanco Animal Health Incorporated

|

|

|

|

|

Date: January 10, 2022

|

By:

|

/s/ Todd Young

|

|

|

|

Name: Todd Young

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

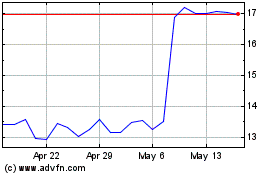

Elanco Animal Health (NYSE:ELAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Elanco Animal Health (NYSE:ELAN)

Historical Stock Chart

From Jul 2023 to Jul 2024