--12-31

false

0001592000

0001592000

2024-10-15

2024-10-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

October 15, 2024

ENLINK

MIDSTREAM, LLC

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-36336 |

|

46-4108528 |

(State

or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer Identification No.) |

1722

ROUTH STREET, SUITE

1300

DALLAS,

Texas |

|

75201 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s telephone number, including

area code: (214) 953-9500

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13(c))

SECURITIES REGISTERED PURSUANT TO SECTION 12(b)

OF THE SECURITIES EXCHANGE ACT OF 1934:

| Title of Each Class |

|

Symbol |

|

Name of Exchange on which Registered |

Common

Units Representing Limited Liability Company Interests |

|

ENLC |

|

The

New York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 5.01. Changes in Control of Registrant.

On October 15, 2024, the transactions (collectively,

the “Transactions”) contemplated by that certain Purchase Agreement, dated August 28, 2024 (the “Purchase Agreement”),

by and among GIP III Stetson I, L.P. (“Seller I”) and GIP III Stetson

II, L.P. (“Seller II” and together with Seller I, collectively, the “Sellers”), each of which is an affiliate

of Global Infrastructure Management, LLC, EnLink Midstream Manager, LLC (the “Manager”), acting solely in its individual capacity

and not in its capacity as managing member of EnLink Midstream, LLC (“ENLC”), and ONEOK, Inc. (“ONEOK”)

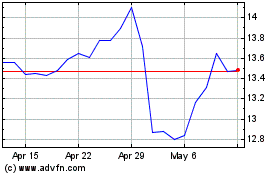

(NYSE: OKE), were consummated (the “Closing”). Pursuant to the Purchase Agreement, ONEOK acquired (i) approximately

43% of the outstanding common units representing limited liability company interests in ENLC (“Common Units”), consisting

of 97,207,538 Common Units from Seller I and 103,133,215 Common Units from Seller II, in exchange for consideration equal to $14.90 in

cash per Common Unit and (ii) all of the outstanding limited liability

company interests in the Manager from Seller I in exchange for $300.0 million in cash, for a total cash consideration of approximately

$3.285 billion. As a result of the Transactions, ONEOK acquired control of the operations of ENLC and its subsidiaries.

ONEOK used a portion of the net proceeds from its

underwritten public offering of senior notes, completed on September 24, 2024, to fund the purchase price for the Transactions.

The information set forth in Item 5.02 below under

the subheading “Director Resignations and Appointments” is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Director Resignations and Appointments

In connection with the Closing, on October 15,

2024, Benjamin M. Daniel, Matthew C. Harris, and Scott E. Telesz each tendered his resignation from the Board of Directors of the Manager

(the “Manager Board”). In addition, Mr. Harris resigned from his position as Chairman of the Manager Board, each of Mr. Daniel

and Mr. Harris resigned from the Governance and Compensation Committee of the Manager Board (the “Governance and Compensation

Committee”), and Mr. Telesz resigned from the Sustainability Committee of the Manager Board (the “Sustainability Committee”).

The foregoing resignations did not result from a disagreement with the Manager. Jesse Arenivas, Deborah G. Adams, Tiffany (TJ) Thom Cepak,

and Leldon E. Echols will continue to serve on the Manager Board.

Additionally, on October 15, 2024, each of

the following individuals was appointed to the Manager Board (the “New Directors”) and Pierce H. Norton II was appointed to

serve as Chairman of the Manager Board:

Pierce H. Norton II

Walter S. Hulse III

Lyndon C. Taylor

In addition, the Manager Board appointed (i) Mr. Norton

and Mr. Taylor to serve on the Governance and Compensation Committee in the vacancies left by the resignation of Mr. Harris

and Mr. Daniel and (ii) Mr. Hulse to serve on the Sustainability Committee in the vacancy left by the resignation of Mr. Telesz.

Biographical information for each of the New Directors

is set forth below:

Pierce H. Norton II, 64, is President and Chief Executive Officer of

ONEOK and is a member of the ONEOK Board of Directors. Previously, Mr. Norton was president and chief executive officer of ONE Gas, Inc.

for more than seven years and served as a member of the ONE Gas board. Mr. Norton worked for ONEOK for almost 10 years, having joined

the company in 2004. Prior to the separation of ONE Gas in January 2014, Mr. Norton served as executive vice president, commercial,

of ONEOK and ONEOK Partners. His other roles at ONEOK included executive vice president and chief operating officer of ONEOK and ONEOK

Partners, responsible for the company's natural gas gathering and processing, natural gas pipelines, natural gas liquids, natural gas

distribution and energy services business segments. Mr. Norton also held the position as president of ONEOK Distribution Companies

– Oklahoma Natural Gas, Kansas Gas Service and Texas Gas Service. Mr. Norton began his natural gas industry career in 1982

at Delhi Gas Pipeline, a subsidiary of Texas Oil and Gas Corporation. He later worked for American Oil and Gas with operational responsibilities

for natural gas gathering and processing, and for intrastate and interstate pipelines. He then worked for KN Energy as vice president

and general manager of the Heartland Region, before moving to Bear Paw Energy as vice president of business development. In 2002, he was

named president of Bear Paw Energy, now ONEOK Rockies Midstream. Mr. Norton is currently on the board of directors for the American

Petroleum Institute and is a 2024 tri-chair for the Tulsa Area United Way citywide campaign. He is a past board member of the Interstate

Natural Gas Association of America, the Texas Pipeline Association, the North Dakota Petroleum Council, the Western Alliance, American

Gas Association (AGA) and served as chairman of the AGA board in 2017. Locally he is a past board member of Tulsa Community College

Foundation, Tulsa Community Foundation and Oklahoma Center for Community and Justice. An Alabama native, Mr. Norton earned a Bachelor

of Science degree in mechanical engineering in 1982 from the University of Alabama in Tuscaloosa and was a University of Alabama College

of Engineering Distinguished Fellow. He also is a graduate of Harvard Business School's Advanced Management Program.

Walter S. Hulse III, 60, is Executive Vice President, Chief

Financial Officer, Treasurer, Investor Relations and Corporate Development of ONEOK. Mr. Hulse joined ONEOK in 2015 from

Spinnaker Strategic Advisory Services, LLC, which provided consulting services to mid-cap and large-cap publicly traded companies,

including the review of merger and/or acquisition opportunities, debt and equity markets, corporate restructuring and potential

divestitures. Mr. Hulse served as a consultant to ONEOK for many years, including during the separation of the company's

natural gas distribution business into the stand-alone publicly traded company, ONE Gas. Previously, Mr. Hulse was vice

chairman of the Investment Banking Department, managing director and head of the business development group at UBS Investment Bank.

Prior to that, he was head of the Global Utility Group at UBS Investment Bank. Before joining UBS through its merger with

PaineWebber Incorporated, Mr. Hulse held various roles at Paine Webber and J.P. Morgan. Mr. Hulse graduated from the

Wharton School at the University of Pennsylvania with a Bachelor of Science in economics.

Lyndon Taylor, 66, is Executive Vice President,

Chief Legal Officer, and Assistant Secretary of ONEOK. Mr. Taylor joined ONEOK in 2023. Before joining ONEOK, he was Executive Vice

President, Chief Legal and Administrative Officer of Devon Energy Corporation from 2005 to 2021, responsible for overseeing the legal,

corporate governance, compliance and government relations functions. Prior to Devon, Mr. Taylor founded and led the Houston office

of Skadden Arps, serving the legal needs of numerous energy clients for 12 years. He has in-depth experience in many aspects of the energy

business, including capital markets and Securities and Exchange Commission activities, merger and acquisition deals, commercial transactions,

regulatory compliance, labor and employment matters, intellectual property and litigation. With nearly 40 years of legal expertise, primarily

in the energy space, Mr. Taylor has extensive experience guiding organizations on legal and business strategies that balance risk

and company objectives, helping them to be successful in a changing market. Mr. Taylor earned a Juris Doctor with honors from the

University of Oklahoma College of Law and a Bachelor of Science in industrial engineering and management from Oklahoma State University.

The New Directors, as officers of ONEOK, will not

receive any separate compensation for their respective service as directors.

Indemnification Agreements

ENLC has a practice of entering into indemnification

agreements (the “Indemnification Agreements”) with each of the Manager’s directors and executive officers (collectively,

the “Indemnitees”). In connection with the appointment of the New Directors to the Manager Board, ENLC entered into an Indemnification

Agreement with each of the New Directors. Under the terms of the Indemnification Agreements, ENLC has agreed to indemnify and hold the

Indemnitees harmless, subject to certain conditions, from and against any and all losses, claims, damages, liabilities, judgments, fines,

taxes (including ERISA excise taxes), penalties (whether civil, criminal, or other), interest, assessments, amounts paid or payable in

settlements, or other amounts and any and all “expenses” (as defined in the Indemnification Agreements) arising from any and

all threatened, pending, or completed claims, demands, actions, suits, proceedings, or alternative dispute mechanisms, whether civil,

criminal, administrative, arbitrative, investigative, or otherwise, whether made pursuant to federal, state, or local law, whether formal

or informal, and including appeals (each, a “proceeding”), in each case, in which the Indemnitee may be involved, or is threatened

to be involved, as a party, a witness, or otherwise, including any inquiries, hearings, or investigations that the Indemnitee determines

might lead to the institution of any proceeding, related to the fact that the Indemnitee is or was a director, manager, or officer of

ENLC or the Manager, or is or was serving at the request of ENLC or the Manager, each as applicable, as a manager, managing member, general

partner, director, officer, fiduciary, trustee, or agent of any other entity, organization, or person of any nature. ENLC has also agreed

to advance the expenses of an Indemnitee relating to the foregoing. To the extent that a change in the laws of the State of Delaware permits

greater indemnification under any statute, agreement, organizational document, or governing document than would be afforded under the

Indemnification Agreements as of the date of the Indemnification Agreements, the Indemnitee shall enjoy the greater benefits so afforded

by such change.

The foregoing description of the Indemnification

Agreements does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Form of Indemnification

Agreement, the form of which was filed as Exhibit 10.1 to ENLC’s Current Report on Form 8-K dated July 17, 2018, filed with the Securities and Exchange Commission on July 23, 2018, and which is incorporated herein by reference.

Item 5.03. Amendments to Articles of

Incorporation or Bylaws; Change in Fiscal Year.

On October 15, 2024, in connection with the

Closing, ONEOK entered into the Third Amended and Restated Limited Liability Company Agreement of the Manager (the “Amended and

Restated Manager Agreement”) to, among other things, replace references to Seller I with references to ONEOK.

The foregoing description of the Amended and Restated

Manager Agreement does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amended and

Restated Manager Agreement, a copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENLINK MIDSTREAM,

LLC |

| |

|

| |

By: |

EnLink Midstream

Manager, LLC, |

| |

|

its Managing Member |

| |

|

| Date: October 15, 2024 |

By: |

/s/

Benjamin D. Lamb |

| |

|

Benjamin D. Lamb |

| |

|

Executive Vice President and

Chief Financial Officer |

Exhibit 3.1

Execution Version

THIRD AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

ENLINK MIDSTREAM MANAGER, LLC

TABLE OF CONTENTS

Page

| Article I DEFINITIONS |

1 |

| Section 1.1 |

Definitions |

1 |

| Section 1.2 |

Construction |

4 |

| |

|

|

| Article II ORGANIZATION |

4 |

| Section 2.1 |

Formation |

4 |

| Section 2.2 |

Name |

4 |

| Section 2.3 |

Registered Office; Registered Agent; Principal Office; Other Offices |

4 |

| Section 2.4 |

Purpose and Business |

4 |

| Section 2.5 |

Powers |

5 |

| Section 2.6 |

Term |

5 |

| Section 2.7 |

Title to Company Assets |

5 |

| |

|

|

| Article III RIGHTS OF SOLE MEMBER |

5 |

| Section 3.1 |

Voting |

5 |

| Section 3.2 |

Distributions |

5 |

| |

|

|

| Article IV CAPITAL CONTRIBUTIONS; PREEMPTIVE RIGHTS; NATURE OF MEMBERSHIP INTEREST |

5 |

| Section 4.1 |

Capital Contributions |

5 |

| Section 4.2 |

No Preemptive Rights |

5 |

| Section 4.3 |

Fully Paid and Non-Assessable Nature of Membership Interests |

6 |

| Section 4.4 |

No Liability of the Sole Member |

6 |

| |

|

|

| Article V MANAGEMENT AND OPERATION OF BUSINESS |

6 |

| Section 5.1 |

Establishment of the Board |

6 |

| Section 5.2 |

The Board; Delegation of Authority and Duties |

6 |

| Section 5.3 |

Term of Office |

7 |

| Section 5.4 |

Meetings of the Board and Committees |

7 |

| Section 5.5 |

Voting |

8 |

| Section 5.6 |

Responsibility and Authority of the Board |

9 |

| Section 5.7 |

Devotion of Time |

10 |

| Section 5.8 |

Certificate of Formation |

10 |

| Section 5.9 |

Benefit Plans |

10 |

| Section 5.10 |

Indemnification |

10 |

| Section 5.11 |

Liability of Indemnitees |

12 |

| Section 5.12 |

Reliance by Third Parties |

13 |

| Section 5.13 |

Other Business of Members |

13 |

| |

|

|

| Article VI OFFICERS |

14 |

| Section 6.1 |

Officers |

14 |

| Section 6.2 |

Compensation |

15 |

| |

|

|

| Article VII BOOKS, RECORDS, ACCOUNTING AND REPORTS |

15 |

| Section 7.1 |

Records and Accounting |

15 |

| Section 7.2 |

Reports |

16 |

| Section 7.3 |

Bank Accounts |

16 |

| |

|

|

| Article VIII DISSOLUTION AND LIQUIDATION |

16 |

| Section 8.1 |

Dissolution |

16 |

| Section 8.2 |

Effect of Dissolution |

17 |

| Section 8.3 |

Application of Proceeds |

17 |

| |

|

|

| Article IX GENERAL PROVISIONS |

17 |

| Section 9.1 |

Addresses and Notices |

17 |

| Section 9.2 |

Creditors |

17 |

| Section 9.3 |

Applicable Law |

18 |

| Section 9.4 |

Invalidity of Provisions |

18 |

| Section 9.5 |

Third Party Beneficiaries |

18 |

| Section 9.6 |

Amendments |

18 |

THIRD AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

ENLINK MIDSTREAM MANAGER, LLC

THIS THIRD AMENDED AND

RESTATED LIMITED LIABILITY COMPANY AGREEMENT (this “Agreement”) of EnLink Midstream Manager, LLC (the “Company”),

dated as of October 15, 2024, is entered into by ONEOK, Inc., an Oklahoma corporation (“ONEOK”), as the sole member

of the Company as of the date hereof.

RECITALS:

WHEREAS, the Company

was previously governed by that certain Second Amended and Restated Limited Liability Company Agreement of the Company, dated as of July

18, 2018 (the “Second A&R LLC Agreement”), entered into by GIP III Stetson I, L.P., a Delaware limited partnership

(“GIP III Stetson I”), as the former sole member of the Company;

WHEREAS, on the date

hereof, in accordance with that certain Purchase Agreement, dated as of August 28, 2024, by and among ONEOK, the Company, acting solely

in its individual capacity and not in its capacity as managing member of EnLink Midstream (as defined below), GIP III Stetson I and GIP

III Stetson II, L.P., a Delaware limited partnership, ONEOK acquired from GIP III Stetson I 100% of the limited liability company interests

in the Company; and

WHEREAS, ONEOK now

desires to amend and restate the Second A&R LLC Agreement in its entirety by executing this Third Amended and Restated Limited Liability

Company Agreement.

NOW, THEREFORE, in

consideration of the covenants, conditions and agreements contained herein, the Sole Member hereby enters into this Agreement:

Article

I

DEFINITIONS

Section 1.1

Definitions.

The following definitions

shall be for all purposes, unless otherwise clearly indicated to the contrary, applied to the terms used in this Agreement.

“Act”

means the Delaware Limited Liability Company Act, 6 Del. C. § 18-101, et seq., as amended, supplemented or restated from time to

time, and any successor to such statute.

“Affiliate”

means, with respect to any Person, any other Person that directly or indirectly through one or more intermediaries controls, is controlled

by or is under common control with, the Person in question. As used herein, the term “control” means the possession, direct

or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through ownership of voting

securities, by contract or otherwise.

“Agreement”

means this Third Amended and Restated Limited Liability Company Agreement of EnLink Midstream Manager, LLC, as it may be amended, supplemented

or restated from time to time. The Agreement constitutes a “limited liability company agreement” as such term is defined

in the Act.

“Board”

has the meaning assigned to such term in Section 5.1.

“Capital Contribution”

means any cash, cash equivalents or the value of Contributed Property contributed to the Company.

“Certificate of

Formation” has the meaning assigned to such term in Section 2.1.

“Chairman”

has the meaning assigned to such term in Section 5.2(d).

“Company”

means EnLink Midstream Manager, LLC, a Delaware limited liability company, and any successors thereto.

“Company Group”

means the Company and any Subsidiary of the Company, treated as a single consolidated entity.

“Contributed Property”

means each property or other asset, in such form as may be permitted by the Act, but excluding cash, contributed to the Company.

“Directors”

has the meaning assigned to such term in Section 5.1.

“EnLink Midstream”

means EnLink Midstream, LLC, a Delaware limited liability company.

“EnLink Midstream

Agreement” means the Second Amended and Restated Operating Agreement of EnLink Midstream, LLC, as it may be amended, supplemented

or restated from time to time.

“EnLink Midstream

Interest” means an interest in EnLink Midstream, which shall include any managing member interest and other membership interests

but shall exclude any options, rights, warrants and appreciation rights relating to an equity interest in EnLink Midstream.

“GIP III Stetson

I” has the meaning assigned to such term in the recitals of this Agreement.

“Group Member”

means a member of the Company Group.

“Indemnitee”

means (a) the Sole Member; (b) any Person who is or was an Affiliate of the Company; (c) any Person who is or was a manager, managing

member, member, partner, director, officer, employee, agent, fiduciary or trustee of the Company, any Group Member or EnLink Midstream;

(d) any Person who is or was serving at the request of the Sole Member or any of its Affiliates as a manager, managing member, member,

partner, director, officer, employee, agent, fiduciary or trustee of another Person owing a fiduciary or similar duty to any Group Member,

in each case, acting in such capacity, provided, that a Person shall not be an Indemnitee by reason of providing, on a fee-for-services

basis, trustee, fiduciary or custodial services; and (e) any Person the Company designates as an “Indemnitee” for purposes

of this Agreement.

“Independent Director”

has the meaning assigned to such term in Section 5.2(c)(ii).

“Majority of Voting

Power” means the eligibility of one or more Directors to cast a number of votes equal to, or in excess of, a majority of the

total number of votes eligible to be cast by all of the Directors then in office.

“Membership Interest”

means all of the Sole Member’s rights and interest in the Company in the Sole Member’s capacity as the Sole Member, all as

provided in the Certificate of Formation, this Agreement and the Act.

“Officers”

has the meaning assigned to such term in Section 6.1(a).

“ONEOK”

has the meaning assigned to such term in the introductory paragraph of this Agreement.

“Person”

means an individual or a corporation, limited liability company, partnership, joint venture, trust, unincorporated organization, association,

government agency or political subdivision thereof or other entity.

“Second A&R

LLC Agreement” has the meaning assigned to such term in the recitals of this Agreement.

“Sole Member”

means any Person executing this Agreement as of the date of this Agreement as the sole member of the Company or hereafter admitted to

the Company as the sole member as provided in this Agreement, but such term does not include any Person who has ceased to be a member

in the Company.

“Subsidiary”

means, with respect to any Person, (a) a corporation of which more than 50% of the voting power of shares entitled (without regard to

the occurrence of any contingency) to vote in the election of directors or other governing body of such corporation is owned, directly

or indirectly, at the date of determination, by such Person, by one or more Subsidiaries of such Person or a combination thereof, (b)

a partnership (whether general or limited) in which such Person or a Subsidiary of such Person is, at the date of determination, a general

partner of such partnership, but only if such Person, directly or by one or more Subsidiaries of such Person, or a combination thereof,

controls such partnership, directly or indirectly, at the date of determination or (c) any other Person in which such Person, one or

more Subsidiaries of such Person, or a combination thereof, directly or indirectly, at the date of determination, has (i) at least a

majority ownership interest or (ii) the power to elect or direct the election of a majority of the directors or other governing body

of such Person.

Section 1.2

Construction.

(a)

Unless the context requires otherwise: (i) capitalized terms used herein but not otherwise defined shall have the meanings assigned

to such terms in the EnLink Midstream Agreement; (ii) any pronoun used in this Agreement shall include the corresponding masculine, feminine

or neuter forms; (iii) references to Articles and Sections refer to Articles and Sections of this Agreement; and (iv) the term “include”

or “includes” means includes, without limitation, and “including” means including, without limitation.

(b)

A reference to any Person includes such Person’s successors and permitted assigns.

Article

II

ORGANIZATION

Section 2.1

Formation. The Company was originally formed on October 16, 2013 as a limited liability company pursuant to the provisions

of the Act by virtue of the filing of a Certificate of Formation (as amended, supplemented or restated from time to time, the “Certificate

of Formation”) with the Secretary of State of the State of Delaware.

Section 2.2

Name. The name of the Company shall be “EnLink Midstream Manager, LLC”. The Company’s business may

be conducted under any other name or names deemed necessary or appropriate by the Board in its discretion, including, if consented to

by the Board, the name of EnLink Midstream. The words “Limited Liability Company,” “L.L.C.” or “LLC”

or similar words or letters shall be included in the Company’s name where necessary for the purpose of complying with the laws

of any jurisdiction that so requires. The Board in its discretion may change the name of the Company at any time and from time to time

and shall promptly notify the Sole Member of such change.

Section 2.3

Registered Office; Registered Agent; Principal Office; Other Offices. Unless and until changed by the Board, the registered

office of the Company in the State of Delaware shall be located at Corporation Trust Center, 1209 Orange Street, Wilmington, Delaware

19801, and the registered agent for service of process on the Company in the State of Delaware at such registered office shall be The

Corporation Trust Company. The principal office of the Company shall be located at 100 West Fifth Street, Tulsa, Oklahoma 74103, or such

other place as the Board may from time to time designate. The Company may maintain offices at such other place or places within or outside

the State of Delaware as the Board deems necessary or appropriate.

Section 2.4

Purpose and Business. The purpose and nature of the business to be conducted by the Company shall be to (a) serve as

the managing member of EnLink Midstream and, in connection therewith, to exercise all rights conferred upon the Company as the managing

member of EnLink Midstream in accordance with the EnLink Midstream Agreement; (b) engage directly in, or enter into or form any corporation,

partnership, joint venture, limited liability company or other arrangement to engage indirectly in, any business activity that the Company

is permitted to engage in and, in connection therewith, to exercise all of the rights and powers conferred upon the Company pursuant

to the agreements relating to such business activity; (c) engage directly in, or enter into or form any corporation, partnership, joint

venture, limited liability company or other arrangement to engage indirectly in, any business activity that is approved by the Sole Member

and that lawfully may be conducted by a limited liability company organized pursuant to the Act and, in connection therewith, to exercise

all of the rights and powers conferred upon the Company pursuant to the agreements relating to such business activity; or (d) do anything

necessary or appropriate to the foregoing, including the making of capital contributions or loans to a Group Member, EnLink Midstream

or any Subsidiary of EnLink Midstream.

Section 2.5 Powers.

The Company shall be empowered to do any and all acts and things necessary, appropriate, proper, advisable, incidental to or convenient

for the furtherance and accomplishment of the purposes and business described in Section 2.4 and for the protection and benefit

of the Company.

Section 2.6 Term.

The term of the Company commenced upon the filing of the Certificate of Formation in accordance with the Act and shall continue in existence

in perpetuity or until the dissolution of the Company in accordance with the provisions of Article VIII. The existence of the Company

as a separate legal entity shall continue until the cancellation of the Certificate of Formation as provided in the Act.

Section 2.7 Title

to Company Assets. Title to Company assets, whether real, personal or mixed and whether tangible or intangible, shall be deemed

to be owned by the Company as an entity, and the Sole Member shall not have any ownership interest in such Company assets or any portion

thereof.

Article III

RIGHTS OF SOLE MEMBER

Section 3.1 Voting.

Unless otherwise granted to the Board by this Agreement, the Sole Member shall possess the entire voting interest in all matters relating

to the Company, including the matters set forth in Section 5.6(b) and Section 5.6(c).

Section 3.2 Distributions.

Distributions by the Company of cash or other property shall be made to the Sole Member at such time as the Sole Member deems appropriate.

Article IV

CAPITAL CONTRIBUTIONS; PREEMPTIVE RIGHTS; NATURE OF MEMBERSHIP INTEREST

Section 4.1 Capital

Contributions. The Sole Member may make Capital Contributions to the Company from time to time but shall not be obligated to

make any Capital Contributions to the Company.

Section 4.2 No

Preemptive Rights. No Person shall have preemptive, preferential or other similar rights with respect to: (a) additional

Capital Contributions; (b) issuance or sale of any class or series of Membership Interests, whether unissued, held in the treasury

or hereafter created; (c) issuance of any obligations, evidences of indebtedness or other securities of the Company convertible

into or exchangeable for, or carrying or accompanied by any rights to receive, purchase or subscribe to, any such Membership Interests;

(d) issuance of any right of subscription to or right to receive, or any warrant or option for the purchase of, any such Membership

Interests; or (e) issuance or sale of any other securities that may be issued or sold by the Company.

Section 4.3 Fully

Paid and Non-Assessable Nature of Membership Interests. All Membership Interests issued pursuant to, and in accordance with,

the requirements of this Article IV shall be fully paid and non-assessable Membership Interests, except as such non-assessability

may be affected by Section 18-607 of the Act.

Section 4.4 No

Liability of the Sole Member. Except as otherwise required by applicable law, the Sole Member shall not have any personal liability

whatsoever hereunder in its capacity as the Sole Member, whether to the Company, to the creditors of the Company or to any other third

party, for the debts, liabilities, commitments or any other obligations of the Company or for any losses of the Company.

Article V

MANAGEMENT AND OPERATION OF BUSINESS

Section 5.1 Establishment

of the Board.

(a) The

number of directors (each a “Director” and collectively the “Directors”) constituting the board

of directors of the Company (the “Board”) shall be at least three and not more than twelve, unless otherwise fixed

from time to time pursuant to action by the Sole Member.

(b) The

Directors shall be elected or appointed by the Sole Member. The Directors shall serve as Directors of the Company for their term of office

established pursuant to Section 5.3. The Sole Member may from time to time appoint one or more observers to the Board.

(c) As

of the date of this Agreement, the Directors of the Company are Deborah G. Adams, Jesse Arenivas, Tiffany Thom Cepak, Leldon E. Echols,

Pierce H. Norton II, Walter S. Hulse III and Lyndon C. Taylor.

Section 5.2 The

Board; Delegation of Authority and Duties.

(a) Sole

Members and Board. Except as otherwise provided in this Agreement, the business and affairs of the Company shall be managed under

the direction of the Board, which shall possess all rights and powers which are possessed by “managers” under the Act and

otherwise by applicable law, pursuant to Section 18-402 of the Act, subject to the provisions of this Agreement. Except as otherwise

provided for herein, the Sole Member hereby consents to the exercise by the Board of all such powers and rights conferred on it by the

Act or otherwise by applicable law with respect to the management and control of the Company.

(b) Delegation

by the Board. The Board shall have the power and authority to delegate to one or more other Persons the Board’s rights and

powers to manage and control the business and affairs of the Company, including delegating such rights and powers of the Board to agents

and employees of the Company (including Officers). The Board may authorize any Person (including the Sole Member, or any Director or

Officer) to enter into any document on behalf of the Company and perform the obligations of the Company thereunder.

(c) Committees.

(i) The

Board may establish committees of the Board and may delegate any of its responsibilities to such committees.

(ii) The

Board shall have an audit committee comprised of at least three Directors, all of whom shall be Independent Directors. Such audit committee

shall establish a written audit committee charter in accordance with the rules of the principal national securities exchange on

which a class of EnLink Midstream Interests of EnLink Midstream are listed or admitted to trading, as amended from time to time. “Independent

Director” shall mean Directors meeting independence standards required of directors who serve on an audit committee of a board

of directors established by the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Securities and

Exchange Commission thereunder and by the national securities exchange on which any class of EnLink Midstream Interests of EnLink Midstream

are listed or admitted to trading.

(d) Chairman

of the Board. The Sole Member may appoint a chairman (the “Chairman”) of the Board. The Chairman of the Board,

if appointed, shall be a member of the Board and shall preside at all meetings of the Board and of the non-managing members of EnLink

Midstream. The Chairman of the Board shall not be an Officer by virtue of being the Chairman of the Board but may otherwise be an Officer.

The Chairman of the Board may be removed either with or without cause at any time by the Sole Member. No removal or resignation as Chairman

of the Board shall affect such Chairman’s status as a Director unless such person is also removed or resigns as a Director.

Section 5.3 Term

of Office. Once designated pursuant to Section 5.1, a Director shall continue in office until the removal of such

Director in accordance with the provisions of this Agreement or until the earlier death or resignation of such Director. Any Director

may resign at any time by giving written notice of such Director’s resignation to the Board. Any such resignation shall take effect

at the time the Board receives such notice or at any later effective time specified in such notice. Unless otherwise specified in such

notice, the acceptance by the Board of such Director’s resignation shall not be necessary to make such resignation effective. Notwithstanding

anything herein or under applicable law to the contrary, any Director may be removed at any time with or without cause by the Sole Member.

Section 5.4 Meetings

of the Board and Committees.

(a) Meetings.

The Board (or any committee of the Board) shall meet at such time and at such place as the Chairman of the Board (or the chairman of

such committee) may designate. Written notice of all regular meetings of the Board (or any committee of the Board) must be given to all

Directors (or all members of such committee) at least two days prior to the regular meeting of the Board (or such committee). Special

meetings of the Board (or any committee of the Board) shall be held at the request of the Sole Member, the Chairman, the Directors having

a Majority of Voting Power or, in the case of a committee of the Board, a majority of the members of such committee, in each case, upon

at least two days (if the meeting is to be held in person) or twenty-four hours (if the meeting is to be held telephonically) oral or

written notice to the Directors (or the members of such committee) or upon such shorter notice as may be approved by the Directors (or

the members of such committee), which approval may be given before or after the relevant meeting to which the notice relates. All notices

and other communications to be given to Directors (or members of a committee) shall be sufficiently given for all purposes hereunder

if in writing and delivered by hand, courier or overnight delivery service or three days after being mailed by certified or registered

mail, return receipt requested, with appropriate postage prepaid, or when received as an attachment to an electronic mail message or

facsimile, and shall be directed to the address, electronic mail address or facsimile number as such Director (or member) shall designate

by notice to the Company. Neither the business to be transacted at, nor the purpose of, any regular or special meeting of the Board (or

committee) need be specified in the notice of such meeting. Any Director (or member of such committee) may waive the requirement of such

notice as to such Director (or such member).

(b) Conduct

of Meetings. Any meeting of the Board (or any committee of the Board) may be held in person or by telephone conference or similar

communications equipment by means of which all persons participating in the meeting can hear each other.

(c) Quorum.

Directors having a Majority of Voting Power (or, in the case of a committee of the Board, a majority of the members of such committee),

present in person or participating in accordance with Section 5.4(b), shall constitute a quorum for the transaction of business,

but if at any meeting of the Board (or committee) there shall be less than a quorum present, the Directors present and having a number

of votes equal to, or in excess of, a majority of the total number of votes eligible to be cast by the then-present Directors (or, in

the case of a committee, a majority of the present members of such committee) may adjourn the meeting without further notice. The Directors

(or members of a committee) present at a duly organized meeting may continue to transact business until adjournment, notwithstanding

the withdrawal of enough Directors (or members of a committee) to leave less than a quorum; provided, however, that only

the acts of the Directors (or members of a committee) meeting the requirements of Section 5.5 shall be deemed to be acts

of the Board (or such committee).

Section 5.5 Voting.

Except as otherwise provided in this Agreement, each Director shall have one vote on each matter brought before the Board for consideration;

provided, however, that the Sole Member shall have the right from time to time to modify the number of votes allocated to any

Director (other than any Independent Director), which allocation may be disproportionate among the Directors so long as each Director

has at least one vote. If, at any time, any Director has more than one vote, then any vote, consent, abstention, or other action by such

Director with respect to any matter brought before the Board for consideration shall apply to each of the votes eligible to be cast by

such Director. Except as otherwise provided in this Agreement, the effectiveness of any vote, consent or other action of the Board (or

any committee of the Board) in respect of any matter shall require either (i) the presence of a quorum and the affirmative vote

of the Directors having a Majority of Voting Power (or, in the case of a committee of the Board, a majority of the members of such committee)

or (ii) the written consent (in lieu of meeting) of the Directors (or members of such committee) having not less than the minimum

number of votes that would be necessary to authorize or take such action at a meeting of the Board (or any committee) at which all Directors

(or members of such committee) entitled to vote thereon were present and voted. Any Director may vote in person or by proxy (pursuant

to a power of attorney) on any matter that is to be voted on by the Board at a meeting thereof.

Section 5.6 Responsibility

and Authority of the Board.

(a) General.

Except as otherwise provided in this Agreement, the relative authority and functions of the Board, on the one hand, and the Officers,

on the other hand, shall be identical to the relative authority and functions of the board of directors and officers, respectively, of

a corporation organized under the General Corporation Law of the State of Delaware. The Officers shall be vested with such powers and

duties as are set forth in Section 6.1 hereof and as are specified by the Board from time to time. Accordingly, except as

otherwise specifically provided in this Agreement, the day-to-day activities of the Company shall be conducted on the Company’s

behalf by the Officers who shall be agents of the Company. In addition to the powers and authorities expressly conferred on the Board

by this Agreement, the Board may exercise all such powers of the Company and do all such acts and things as are not restricted by this

Agreement, the EnLink Midstream Agreement, the Act or applicable law.

(b) Member

Consent Required for Extraordinary Matters. Notwithstanding anything herein to the contrary, the Board will not take any action without

approval of the Sole Member with respect to an extraordinary matter that would have, or would reasonably be expected to have, a material

effect, directly or indirectly, on the Sole Member’s interests in the Company. The type of extraordinary matter referred to in

the prior sentence which requires approval of the Sole Member shall include, but not be limited to, the following: (i) commencement

of any action relating to bankruptcy, insolvency, reorganization or relief of debtors by the Company, EnLink Midstream or a material

Subsidiary thereof; (ii) a merger, consolidation, recapitalization or similar transaction involving the Company, EnLink Midstream

or a material Subsidiary thereof; (iii) a sale, exchange or other transfer not in the ordinary course of business of a substantial

portion of the assets of EnLink Midstream or a material Subsidiary of EnLink Midstream, viewed on a consolidated basis, in one or a series

of related transactions; (iv) dissolution or liquidation of the Company or EnLink Midstream; and (v) a material amendment of

the EnLink Midstream Agreement. An extraordinary matter will be deemed approved by the Sole Member if (A) the Board receives a written,

facsimile or electronic instruction evidencing such approval from the Sole Member or (B) the Directors that do not qualify as Independent

Directors because of their affiliation with the Sole Member approve such matter by the vote of such Directors having a number of votes

equal to, or in excess of, a majority of the total number of votes eligible to be cast by such non-Independent Directors. To the fullest

extent permitted by law, a Director, acting as such, shall have no duty, responsibility or liability to the Sole Member with respect

to any action by the Board approved by the Sole Member.

(c) Member-Managed

Decisions. Notwithstanding anything herein to the contrary, the Sole Member shall have exclusive authority over the internal business

and affairs of the Company that do not relate to management and control of EnLink Midstream and its subsidiaries. For illustrative purposes,

the internal business and affairs of the Company where the Sole Member shall have exclusive authority include (i) the amount and

timing of distributions paid by the Company, (ii) the issuance or repurchase of any equity interests in the Company, (iii) the

prosecution, settlement or management of any claim made directly against the Company, (iv) the decision to sell, convey, transfer

or pledge any asset of the Company, (v) the decision to amend, modify or waive any rights relating to the assets of the Company

and (vi) the decision to enter into any agreement to incur an obligation of the Company other than an agreement entered into for

and on behalf of EnLink Midstream for which the Company is liable exclusively by virtue of the Company’s capacity as managing member

of EnLink Midstream or of any of its Affiliates.

In addition, notwithstanding

anything herein to the contrary, the Sole Member shall have exclusive authority to cause the Company to exercise the rights of the Company

as managing member of EnLink Midstream (or those exercisable after the Company ceases to be the managing member of EnLink Midstream)

where (a) the Company makes a determination or takes or declines to take any other action in its individual capacity under the EnLink

Midstream Agreement or (b) where the EnLink Midstream Agreement permits the Company to make a determination or take or decline to

take any other action in its sole discretion. For illustrative purposes, a list of provisions where the Company would be acting in its

individual capacity or is permitted to act in its sole discretion is contained in Appendix A hereto.

Section 5.7 Devotion

of Time. The Directors shall not be obligated and shall not be expected to devote all of their time or business efforts to the

affairs of the Company (except, to the extent appropriate, in their capacity as officers or as employees of the Company or any Affiliate

of the Company).

Section 5.8 Certificate

of Formation. The Certificate of Formation has been filed with the Secretary of State of the State of Delaware as required by

the Act and certain other certificates or documents necessary or appropriate for the qualification and operation of the Company have

been filed with the appropriate offices in certain other states. The Board shall use all reasonable efforts to cause to be filed such

additional certificates or documents as may be determined by the Board to be necessary or appropriate for the formation, continuation,

qualification and operation of a limited liability company in the State of Delaware or any other state in which the Company may elect

to do business or own property. To the extent that such action is determined by the Board to be necessary or appropriate, the Board shall

cause the Officers to file amendments to and restatements of the Certificate of Formation and do all things to maintain the Company as

a limited liability company under the laws of the State of Delaware or of any other state in which the Company may elect to do business

or own property.

Section 5.9 Benefit

Plans. The Board may propose and adopt on behalf of the Company employee benefit plans, employee programs and employee practices,

or cause the Company to issue interests of the Company (or to exercise its authority to cause EnLink Midstream to issue EnLink Midstream

Interests), in connection with or pursuant to any employee benefit plan, employee program or employee practice maintained or sponsored

by any Group Member or any Affiliate thereof, in each case for the benefit of employees of the Company, any Group Member or any Affiliate

thereof, or any of them, in respect of services performed, directly or indirectly, for the benefit of any Group Member.

Section 5.10 Indemnification.

(a) To

the fullest extent permitted by law but subject to the limitations expressly provided in this Agreement, all Indemnitees shall be indemnified

and held harmless by the Company from and against any and all losses, claims, damages, liabilities, joint or several, expenses (including

legal fees and expenses), judgments, fines, penalties, interest, settlements or other amounts arising from any and all threatened, pending

or completed claims, demands, actions, suits or proceedings, whether civil, criminal, administrative or investigative, and whether formal

or informal and including appeals, in which any Indemnitee may be involved, or is threatened to be involved, as a party or otherwise,

by reason of its status as an Indemnitee and acting (or refraining to act) in such capacity on behalf of or for the benefit of the Company;

provided, that the Indemnitee shall not be indemnified and held harmless if there has been a final and non-appealable judgment

entered by a court of competent jurisdiction determining that, in respect of the matter for which the Indemnitee is seeking indemnification

pursuant to this Section 5.10, the Indemnitee acted in bad faith or, in the case of a criminal matter, acted with knowledge

that the Indemnitee’s conduct was unlawful. Any indemnification pursuant to this Section 5.10 shall be made only out

of the assets of the Company, it being agreed that the Sole Member shall not be personally liable for such indemnification and shall

have no obligation to contribute or loan any monies or property to the Company to enable it to effectuate such indemnification.

(b) To

the fullest extent permitted by law, expenses (including legal fees and expenses) incurred by an Indemnitee who is indemnified pursuant

to Section 5.10(a) in appearing at, participating in or defending any claim, demand, action, suit or proceeding shall,

from time to time, be advanced by the Company prior to a final and non-appealable judgment entered by a court of competent jurisdiction

determining that, in respect of the matter for which the Indemnitee is seeking indemnification pursuant to this Section 5.10,

that the Indemnitee is not entitled to be indemnified upon receipt by the Company of any undertaking by or on behalf of the Indemnitee

to repay such amount if it shall be ultimately determined that the Indemnitee is not entitled to be indemnified as authorized by this

Section 5.10.

(c) The

indemnification provided by this Section 5.10 shall be in addition to any other rights to which an Indemnitee may be entitled

under any agreement, as a matter of law, in equity or otherwise, both as to actions in the Indemnitee’s capacity as an Indemnitee

and as to actions in any other capacity, and shall continue as to an Indemnitee who has ceased to serve in such capacity and shall inure

to the benefit of the heirs, successors, assigns and administrators of the Indemnitee; provided, that any right of indemnification

(including the right to advancement of expenses) of an Indemnitee provided under this Agreement shall be the primary source of indemnification,

and any other indemnification or similar rights of an Indemnitee shall be secondary to rights under this Agreement.

(d) The

Company may, and at the reasonable request of the Sole Member shall, purchase and maintain (or reimburse the Sole Member or its Affiliates

for the cost of) insurance, on behalf of the Directors, the Officers, the Sole Member, its Affiliates, the Indemnitees and such other

Persons as the Sole Member shall determine, against any liability that may be asserted against, or expense that may be incurred by, such

Person in connection with the Company’s activities or such Person’s activities on behalf of the Company, regardless of whether

the Company would have the power to indemnify such Person against such liability under the provisions of this Agreement.

(e) For

purposes of this Section 5.10, the Company shall be deemed to have requested an Indemnitee to serve as fiduciary of an employee

benefit plan whenever the performance by it of its duties to the Company also imposes duties on, or otherwise involves services by, it

to the plan or participants or beneficiaries of the plan; excise taxes assessed on an Indemnitee with respect to an employee benefit

plan pursuant to applicable law shall constitute “fines” within the meaning of Section 5.10(a); and action taken

or omitted by an Indemnitee with respect to any employee benefit plan in the performance of its duties for a purpose reasonably believed

by it to be in the best interest of the participants and beneficiaries of the plan shall be deemed to be for a purpose that is in the

best interests of the Company.

(f) An

Indemnitee shall be fully protected in relying in good faith upon the records of the Company and upon such information, opinions, reports

or statements presented to the Company by any person or entity (including any other Indemnitee and any expert or advisor retained by

or on behalf of the Company or the Board) as to matters the Indemnitee reasonably believes to be within such other person’s or

entity’s professional or expert competence.

(g) In

no event may an Indemnitee subject the Sole Member to personal liability by reason of the indemnification provisions set forth in this

Agreement.

(h) An

Indemnitee shall not be denied indemnification in whole or in part under this Section 5.10 because the Indemnitee had an

interest in the transaction with respect to which the indemnification applies if the transaction was otherwise permitted by the terms

of this Agreement.

(i) The

provisions of this Section 5.10 are for the benefit of the Indemnitees and their heirs, successors, assigns, executors and

administrators and shall not be deemed to create any rights for the benefit of any other Persons.

(j) No

amendment, modification or repeal of this Section 5.10 shall in any manner terminate, reduce or impair the right of any past,

present or future Indemnitee to be indemnified by the Company, nor the obligations of the Company to indemnify any such Indemnitee under

and in accordance with the provisions of this Section 5.10 as in effect immediately prior to such amendment, modification

or repeal with respect to claims arising from or relating to matters occurring, in whole or in part, prior to such amendment, modification

or repeal, regardless of when such claims may arise or be asserted.

Section 5.11 Liability

of Indemnitees.

(a) Notwithstanding

anything to the contrary set forth in this Agreement or the EnLink Midstream Agreement, no Indemnitee shall be liable for monetary damages

to the Company, the Sole Member or any other Persons who have acquired interests in the Company, for losses sustained or liabilities

incurred as a result of any act or omission of an Indemnitee unless there has been a final and non-appealable judgment entered by a court

of competent jurisdiction determining that, in respect of the matter in question, the Indemnitee acted in bad faith or, in the case of

a criminal matter, acted with knowledge that the Indemnitee’s conduct was criminal.

(b) To

the extent that, at law or in equity, an Indemnitee has duties (including fiduciary duties) and liabilities relating thereto to the Company

or to the Sole Member and any other Indemnitee acting in connection with the Company’s business or affairs shall not be liable

to the Company, the Sole Member or any other Indemnitee for its good faith reliance on the provisions of this Agreement.

(c) Any

amendment, modification or repeal of this Section 5.11 shall be prospective only and shall not in any way affect the limitations

on the liability of the Indemnitees under this Section 5.11 as in effect immediately prior to such amendment, modification

or repeal with respect to claims arising from or relating to matters occurring, in whole or in part, prior to such amendment, modification

or repeal, regardless of when such claims may arise or be asserted.

Section 5.12 Reliance

by Third Parties. Notwithstanding anything to the contrary in this Agreement, any Person dealing with the Company shall be entitled

to assume that any Officer authorized by the Board to act for and on behalf of and in the name of the Company has full power and authority

to encumber, sell or otherwise use in any manner any and all assets of the Company and to enter into any authorized contracts on behalf

of the Company, and such Person shall be entitled to deal with any such Officer as if it were the Company’s sole party in interest,

both legally and beneficially. The Sole Member hereby waives any and all defenses or other remedies that may be available against such

Person to contest, negate or disaffirm any action of any such Officer in connection with any such dealing. In no event shall any Person

dealing with any such Officer or its representatives be obligated to ascertain that the terms of the Agreement have been complied with

or to inquire into the necessity or expedience of any act or action of any such Officer or its representatives. Each and every certificate,

document or other instrument executed on behalf of the Company by any Officer authorized by the Board shall be conclusive evidence in

favor of any and every Person relying thereon or claiming thereunder that (a) at the time of the execution and delivery of such

certificate, document or instrument, this Agreement was in full force and effect, (b) the Person executing and delivering such certificate,

document or instrument was duly authorized and empowered to do so for and on behalf of and in the name of the Company and (c) such

certificate, document or instrument was duly executed and delivered in accordance with the terms and provisions of this Agreement and

is binding upon the Company.

Section 5.13 Other

Business of Members.

(a) Existing

Business Ventures. The Sole Member, each Director and their respective Affiliates may engage in or possess an interest in other business

ventures of any nature or description, independently or with others, similar or dissimilar to the business of the Company or EnLink Midstream,

and the Company, EnLink Midstream, the Directors and the Sole Member shall have no rights by virtue of this Agreement in and to such

independent ventures or the income or profits derived therefrom, and the pursuit of any such venture, even if competitive with the business

of the Company or EnLink Midstream, shall not be deemed wrongful or improper.

(b) Business

Opportunities. None of the Sole Member, any Director (except, to the extent required under applicable law or pursuant to any contractual

obligation, in his or her capacity as an officer or employee of the Company or any Affiliate of the Company) or any of their respective

Affiliates shall be obligated to present any particular investment opportunity to the Company or EnLink Midstream even if such opportunity

is of a character that the Company, EnLink Midstream or any of their respective subsidiaries might reasonably be deemed to have pursued

or had the ability or desire to pursue if granted the opportunity to do so, and the Sole Member, each Director or any of their respective

Affiliates shall have the right to take for such person’s own account (individually or as a partner or fiduciary) or to recommend

to others any such particular investment opportunity.

Article VI

OFFICERS

Section 6.1 Officers.

(a) Generally.

The Board shall appoint agents of the Company, referred to as “Officers” of the Company as described in this Section 6.1,

who shall be responsible for the day-to-day business affairs of the Company, subject to the overall direction and control of the Board.

Unless provided otherwise by the Board, the Officers shall have the titles, power, authority and duties described below in this Section 6.1.

(b) Titles

and Number. The Officers shall be one Chief Executive Officer, one or more Presidents, any and all Vice Presidents, the Secretary

and any and all Assistant Secretaries and any Treasurer and any and all Assistant Treasurers and any other Officers appointed pursuant

to this Section 6.1. There shall be appointed from time to time, in accordance with this Section 6.1, such Vice

Presidents, Secretaries, Assistant Secretaries, Treasurers and Assistant Treasurers as the Board may desire. Any Person may hold two

or more offices.

(i) President/Chief

Executive Officer. The Board shall elect one or more individuals to serve, subject to the direction and supervision of the Board,

as the President and/or Chief Executive Officer of the Company and shall have general and active management and control of the affairs

and business and general supervision of the Company, and EnLink Midstream and its subsidiaries, and its officers, agents and employees,

and shall perform all duties incident to the office of chief executive officer of the Company and such other duties as may be prescribed

from time to time by the Board. Each President and/or Chief Executive Officer shall have the nonexclusive authority to sign on behalf

of the Company any deeds, mortgages, leases, bonds, notes, certificates, contracts or other instruments, except in cases where the execution

thereof shall be expressly delegated by the Board or by this Agreement to some other Officer or agent of the Company or shall be required

by law to be otherwise executed. In the absence of the Chairman, or the Vice Chairman, if there is one, or in the event of the Chairman’s

inability or refusal to act, a President and/or Chief Executive Officer shall perform the duties of the Chairman, and each President

and/or Chief Executive Officer, when so acting, shall have all of the powers of the Chairman.

(ii) Vice

Presidents. The Board, in its discretion, may elect one or more Vice Presidents. In the absence of any President and Chief Executive

Officer or in the event of a President’s or Chief Executive Officer’s inability or refusal to act, the Vice President (or

in the event there be more than one Vice President, the Vice Presidents in the order designated, or in the absence of any designation,

then in the order of their election) shall perform the duties of a President and/or Chief Executive Officer, and the Vice President,

when so acting, shall have all of the powers and be subject to all the restrictions upon a President and/or Chief Executive Officer.

Each Vice President shall perform such other duties as from time to time may be assigned by a President and/or Chief Executive Officer

or the Board.

(iii) Secretary

and Assistant Secretaries. The Board, in its discretion, may elect a Secretary and one or more Assistant Secretaries. The Secretary

shall record or cause to be recorded in books provided for that purpose the minutes of the meetings or actions of the Board, of the Sole

Member and of the non-managing members of EnLink Midstream, shall see that all notices are duly given in accordance with the provisions

of this Agreement and as required by law, shall be custodian of all records (other than financial), shall see that the books, reports,

statements, certificates and all other documents and records required by law are properly kept and filed, and, in general, shall perform

all duties incident to the office of Secretary and such other duties as may, from time to time, be assigned to him by this Agreement,

the Board or a President. The Assistant Secretaries shall exercise the powers of the Secretary during that Officer’s absence or

inability or refusal to act.

(iv) Treasurer

and Assistant Treasurers. The Board, in its discretion, may elect a Treasurer and one or more Assistant Treasurers. The Treasurer

shall keep or cause to be kept the books of account of the Company and shall render statements of the financial affairs of the Company

in such form and as often as required by this Agreement, the Board or a President. The Treasurer, subject to the order of the Board,

shall have the custody of all funds and securities of the Company. The Treasurer shall perform all other duties commonly incident to

his office and shall perform such other duties and have such other powers as this Agreement, the Board or a President, shall designate

from time to time. The Assistant Treasurers shall exercise the power of the Treasurer during that Officer’s absence or inability

or refusal to act. Each of the Assistant Treasurers shall possess the same power as the Treasurer to sign all certificates, contracts,

obligations and other instruments of the Company. If no Treasurer or Assistant Treasurer is appointed and serving or in the absence of

the appointed Treasurer and Assistant Treasurer, a President or such other Officer as the Board shall select, shall have the powers and

duties conferred upon the Treasurer.

(c) Other

Officers and Agents. The Board may appoint such other Officers and agents as may from time to time appear to be necessary or advisable

in the conduct of the affairs of the Company, who shall hold their offices for such terms and shall exercise such powers and perform

such duties as shall be determined from time to time by the Board.

(d) Appointment

and Term of Office. The Officers shall be appointed by the Board at such time and for such terms as the Board shall determine. Any

Officer may be removed, with or without cause, only by the Board. Vacancies in any office may be filled only by the Board.

(e) Powers

of Attorney. The Board may grant powers of attorney or other authority as appropriate to establish and evidence the authority of

the Officers and other Persons.

(f) Officers’

Delegation of Authority. Unless otherwise provided by resolution of the Board, no Officer shall have the power or authority to delegate

to any Person such Officer’s rights and powers as an Officer to manage the business and affairs of the Company.

Section 6.2 Compensation.

The Officers shall receive such compensation for their services as may be designated by the Board or any committee thereof established

for the purpose of setting compensation.

Article VII

BOOKS, RECORDS, ACCOUNTING AND REPORTS

Section 7.1 Records

and Accounting. The Board shall keep or cause to be kept at the principal office of the Company appropriate books and records

with respect to the Company’s business. The books of account of the Company shall be (i) maintained on the basis of a fiscal

year that is the calendar year and (ii) maintained on an accrual basis in accordance with U.S. generally accepted accounting principles,

consistently applied.

Section 7.2 Reports.

With respect to each calendar year, the Company shall prepare, or cause to be prepared, and deliver, or cause to be delivered, to the

Sole Member such reports as the Sole Member reasonably requests, including to satisfy its contractual obligations, including but not

limited to:

(a) Within

120 days after the end of such calendar year, a profit and loss statement and a statement of cash flows for such year and a balance sheet

as of the end of such year; and

(b) Such

federal, state and local income tax returns and such other accounting, tax information and schedules as shall be necessary for the preparation

by the Sole Member on or before June 15 following the end of each calendar year of its income tax return with respect to such year;

provided, however, that (i) the Sole

Member shall bear all costs and expenses incurred by the Company or EnLink Midstream in connection with the preparation and delivery

of any reports requested by the Sole Member that are not otherwise provided to public unitholders or lenders for any indebtedness of

any of EnLink Midstream, EnLink Midstream Partners, LP or any of their respective Subsidiaries and (ii) the preparation of any such

requested reports shall not unreasonably disrupt or interfere with the normal operation of the business of the Company or EnLink Midstream.

Section 7.3 Bank

Accounts. Funds of the Company shall be deposited in such banks or other depositories as shall be designated from time to time

by the Officers. All withdrawals from any such depository shall be made only as authorized by the Officers and shall be made only by

check, wire transfer, debit memorandum or other written instruction.

Article VIII

DISSOLUTION AND LIQUIDATION

Section 8.1 Dissolution.

(a) The

Company shall be of perpetual duration; however, the Company shall dissolve, and its affairs shall be wound up, upon:

(i) an

election to dissolve the Company by the Sole Member;

(ii) the

entry of a decree of judicial dissolution of the Company pursuant to the provisions of the Act; or

(iii) a

merger or consolidation under the Act where the Company is not the surviving entity in such merger or consolidation.

(b) No

other event shall cause a dissolution of the Company.

Section 8.2 Effect

of Dissolution. Except as otherwise provided in this Agreement, upon the dissolution of the Company, the Sole Member shall take

such actions as may be required pursuant to the Act and shall proceed to wind up, liquidate and terminate the business and affairs of

the Company. In connection with such winding up, the Sole Member shall have the authority to liquidate and reduce to cash (to the extent

necessary or appropriate) the assets of the Company as promptly as is consistent with obtaining fair value therefor, to apply and distribute

the proceeds of such liquidation and any remaining assets in accordance with the provisions of Section 8.3, and to do any

and all acts and things authorized by, and in accordance with, the Act and other applicable laws for the purpose of winding up and liquidation.

Section 8.3 Application

of Proceeds. Upon dissolution and liquidation of the Company, the assets of the Company shall be applied and distributed in the

following order of priority:

(a) First,

to the payment of debts and liabilities of the Company (including to the Sole Member to the extent permitted by applicable law) and the

expenses of liquidation;

(b) Second,

to the setting up of such reserves as the Person required or authorized by law to wind up the Company’s affairs may reasonably

deem necessary or appropriate for any disputed, contingent or unforeseen liabilities or obligations of the Company, provided that any

such reserves shall be paid over by such Person to an escrow agent appointed by the Sole Member, to be held by such agent or its successor

for such period as such Person shall deem advisable for the purpose of applying such reserves to the payment of such liabilities or obligations

and, at the expiration of such period, the balance of such reserves, if any, shall be distributed as hereinafter provided; and

(c) Thereafter,

the remainder to the Sole Member.

Article IX

GENERAL PROVISIONS

Section 9.1 Addresses

and Notices. Any notice, demand, request, report or proxy materials required or permitted to be given or made to the Sole Member

under this Agreement shall be in writing and shall be deemed given or made when delivered in person, when received by electronic message

or facsimile or when sent by first class United States mail or by other means of written communication to the Sole Member at the address

described below. Any notice to the Company shall be deemed given if received by a President at the principal office of the Company designated

pursuant to Section 2.3. The Company may rely and shall be protected in relying on any notice or other document from the

Sole Member or other Person if believed by it to be genuine.

If to the Sole Member:

ONEOK, Inc.

100 West Fifth Street

Tulsa, Oklahoma 74103

Attention: Chief Legal Officer

Section 9.2 Creditors.

None of the provisions of this Agreement shall be for the benefit of, or shall be enforceable by, any creditor of the Company.

Section 9.3 Applicable

Law. This Agreement shall be construed in accordance with and governed by the laws of the State of Delaware, without regard to

the principles of conflicts of law.

Section 9.4 Invalidity

of Provisions. If any provision of this Agreement is or becomes invalid, illegal or unenforceable in any respect, the validity,

legality and enforceability of the remaining provisions contained herein shall not be affected thereby.

Section 9.5 Third

Party Beneficiaries. The Sole Member agrees that any Indemnitee shall be entitled to assert rights and remedies hereunder as

a third-party beneficiary hereto with respect to those provisions of this Agreement affording a right, benefit or privilege to such Indemnitee.

Section 9.6 Amendments.

This Agreement may be modified, altered, supplemented or amended at any time only by a written agreement executed and delivered by the

Sole Member.

[The remainder of this page is intentionally

blank]

IN WITNESS WHEREOF, the Sole

Member has executed this Agreement as of the date first written above.

| |

ONEOK, INC. |

| |

|

| |

By: |

/s/ Walter S. Hulse III |

| |

Name: |

Walter S. Hulse III |

| |

Title: |

Chief Financial Officer, Treasurer and Executive

Vice President, Investor Relations and Corporate Development |

[Signature Page to Third Amended and Restated

Limited Liability Company Agreement of Enlink Midstream Manager, LLC]

APPENDIX A

The following are provisions

of the EnLink Midstream Agreement where the Company is permitted to act in its sole discretion or would be acting in its individual capacity.

Capitalized terms used but not defined in this Appendix A have the meanings assigned to them in the EnLink Midstream Agreement.

(a) Section 2.4

(“Purpose and Business”), with respect to decisions to propose or approve the conduct by EnLink Midstream of any

business;

(b) Section 4.6

(“Transfer of the Managing Member’s Managing Member Interest”), solely with respect to the decision by the

Company to transfer its managing member interest in EnLink Midstream;

(c) Section 5.8

(“Limited Preemptive Right”), with respect to the right to purchase EnLink Midstream Interests from EnLink Midstream;

(d) Section 7.6(d) (relating

to the right of the Company and its Affiliates to purchase Units or other Membership Interests and exercise rights related thereto);

(e) Section 7.7

(“Indemnification”), solely with respect to any decision by the Company to exercise its rights as an “Indemnitee”;

(f) Section 11.1

(“Withdrawal of the Managing Member”), solely with respect to the decision by the Company to withdraw as Managing