false

0000316253

0000316253

2024-07-24

2024-07-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July

24, 2024

ENZO BIOCHEM, INC.

(Exact name of registrant as specified in its charter)

| New York |

001-09974 |

13-2866202 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(IRS Employer

Identification No.) |

21 Executive Blvd.

Farmingdale, New York 11735

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including area

code: (631) 755-5500

N/A

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock, par value $0.01 per share |

|

ENZ |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors;

Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 24, 2024, the Compensation

Committee (the “Committee”) of the board of directors (the “Board”) of Enzo Biochem, Inc. (the “Company”)

approved an employment agreement, effective as of June 3, 2024, with Patricia Eckert, Chief Financial Officer of the Company (the “CFO

Agreement”).

Under the CFO Agreement, Ms.

Eckert’s annual base salary increased from $275,000 to $300,000, effective as of June 3, 2024, and she is entitled to receive a

sign-on equity grant (the “Equity Grant”) of options to purchase 100,000 shares of the Company’s common stock at an

exercise price equal to $2.00 per share, subject to the terms and conditions of the Company’s 2011 Amended and Restated Incentive

Plan. The options will have a five-year term and vest in equal annual installments over three years, commencing on the first anniversary

of the grant date, provided Ms. Eckert remains employed in good standing on any such vesting date. In addition, Ms. Eckert remains eligible

to receive (i) an annual discretionary bonus and (ii) an annual equity grant, as determined by the Board in its sole discretion. Ms. Eckert

also remains eligible to receive reimbursement for reasonable business expenses and to participate in customary employment benefits.

The foregoing description of the CFO

Agreement is not complete and is qualified in its entirety by reference to full text of the CFO

Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and

Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ENZO BIOCHEM, INC. |

|

| |

|

|

| |

By: |

/s/ Patricia Eckert |

| |

Name: |

Patricia Eckert |

| |

Title: |

Chief Financial Officer |

| Date: July 25, 2024 |

|

|

| |

|

|

|

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

This Executive Employment Agreement (the “Agreement”),

dated as of June 03, 2024 (the “Effective Date”), is made between Enzo Biochem, Inc., a New York corporation, with

its principal office at 21 Executive Boulevard, Farmingdale, New York 11735 (the “Company”) and Patricia Eckert (the

“Executive”) (each individually a “Party”, and collectively the “Parties”).

Whereas,

Executive is currently a full-time employee of the Company; and

Whereas,

the Company desires for Executive to continue to provide services to the Company, and wishes to provide Executive with certain compensation

and benefits in return for such employment services; and

Whereas,

Executive wishes to continue to be employed by the Company and to provide personal services to the Company in return for certain compensation

and benefits;

Now,

Therefore, in consideration of the mutual promises and covenants contained herein and for other good and valuable consideration,

the receipt and sufficiency of which is hereby acknowledged, the Parties hereto agree as follows:

1.

Employment by the Company.

1.1

Term. The Executive’s employment pursuant to this Agreement commenced on the Effective Date, and shall continue until

terminated in accordance as provided in Section 4 (the “Term”). Subject to the terms contained herein, Executive’s

employment shall be “at-will” and may be terminated by either side, with or without notice.

1.2

Position. Executive shall serve as the Company’s Chief Financial Officer (“CFO”). During Executive’s

employment with the Company, Executive will devote Executive’s best efforts and substantially all of Executive’s business

time and attention to the business of the Company, except for approved vacation periods and reasonable periods of illness or other incapacities

permitted by the Company’s general employment policies.

1.3

Duties and Location. Executive shall report to the Company’s Chief Executive Officer (“CEO”), and shall perform

the services, duties and responsibilities that may be assigned to her by the CEO and/or that are consistent with Executive’s position

of CFO, including but not limited to: (i) asset management; (ii) financial planning and analysis, with a focus on driving the business

to unlock further value; (iii) financial reporting and financial controls; and (iv) such other services, duties or responsibilities as

may otherwise be required to effectively perform Executive’s position of CFO. Executive’s primary office location shall be

the Company’s office located in Farmingdale, New York. The Company reserves the right to reasonably require Executive to perform

Executive’s duties at places other than Executive’s primary office location from time to time, and to require business travel.

1.4

Policies and Procedures. The employment relationship between the Parties shall be governed by the general employment policies

and practices of the Company. Executive shall at all times comply with all applicable laws, rules, and regulations, including those promulgated

by regulatory and self-regulatory authorities, securities exchanges, and domestic and foreign agencies and authorities, as well as the

Employee Handbook, the Compliance Manual, and any other internal policies and procedures established by the Company and made available

to employees generally.

2.

Compensation.

2.1

Salary. For services to be rendered hereunder while Executive is employed by the Company, Executive shall receive a base salary

of no less than $300,000 per year (the “Base Salary”), subject to standard payroll deductions and withholdings and

payable in accordance with the Company’s regular payroll schedule. Executive’s Base Salary shall be reviewed on an annual

basis with increases approved by the Board on notice to the Executive.

2.2

Annual Bonus. Executive will be eligible for an annual discretionary bonus (the “Annual Bonus”), which will

be based on a fiscal year basis (the “Bonus Period”). Executive’s target for each Annual Bonus shall be up to

50% of Executive’s Base Salary (“Target”). Whether Executive receives an Annual Bonus for any Bonus Period will

be determined by the Board or the compensation committee thereof in its sole discretion. The Annual Bonus will be paid when bonuses are

paid to similarly situated executives, which shall be prior to seventy-five (75) days following the conclusion of the Bonus Period.

2.3

Sign-On Equity Grant. Subject to the approval of the Board and pursuant to the Company’s 2011 Amended and Restated Incentive

Plan, as amended or replaced (the “Plan”), Executive will receive 100,000 shares (“Options”) of the Company’s

common at stock at a strike price of $2.00 per share (the “Option Grant”). The Option Grant shall vest in equal one-third

annual increments, with the first vesting on the first anniversary of the grant date provided Executive remains employed in good standing

on any such vesting date, and in all cases subject to the terms of the Plan.

2.4

Annual Equity Grant. For each year of employment during the Term, pursuant to the Plan, as hereinafter amended, restated, or

replaced, Executive shall receive grants thereunder in an amount and pursuant to terms as determined by the Board in its sole discretion.

Each annual grant provided hereunder, if any, shall vest on terms as provided by the Company and shall be subject to the terms of the

Plan, the execution of which by Executive is required for any such grant. Notwithstanding the foregoing, nothing herein requires the Board

to make any grant under the Plan or otherwise.

3.

Company Benefits. During the Term, Executive shall be eligible to participate in all employee benefit programs for which Executive

is eligible under the terms and conditions of the benefit plans that may be in effect from time to time and provided by the Company to

its senior-level employees including medical and dental insurance, life and disability insurance, and participation in the Company’s

401(k) retirement plan. During the Term, Executive shall further receive paid vacation and a car allowance as determined by the Company

in its sole discretion. The Company reserves the right to cancel or change the benefit plans or programs it offers to the Executive at

any time; provided, however, that any such change shall be across the board changes similarly affecting the eligibility requirements of

all senior-level employees of the Company.

4.

Termination of Employment; Severance.

4.1

Employment. During the Term, either Executive or the Company may terminate Executive’s employment relationship at any

time, provided, however, that if Executive resigns during the Term, Executive shall provide no less than ninety (90) days’ advance

written notice of any such termination (the “Notice Period”). During the Notice Period, Executive shall remain an employee

of the Company, and shall continue to receive Base Salary, but no other compensation. The Company may elect to have Executive not report

to work for all or any portion of such Notice Period. The Company shall have the right, at its sole discretion, to accelerate Executive’s

termination date to any date subsequent to receiving written notice from Executive, and thus conclude the Notice Period. In the event

of termination for any reason, Executive shall resign from all positions and terminate any relationships as an employee, advisor, officer

or director with the Company and any of its affiliates, each effective on the date of termination.

4.2

Termination Without Cause or With Good Reason

a.

The Company may terminate Executive’s employment with the Company at any time with or without Cause (as defined below)

during the Term.

b.

If Executive’s employment is terminated by the Company without Cause, or if Executive terminates her employment with

Good Reason and complies with the Notice Period requirements set forth in Section 4.1 above, the Company shall pay Executive, as severance,

(x) the equivalent of six (6) months of Executive’s Base Salary and Executive’s portion of the premium to continue health

insurance pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985 (“COBRA”), (y) if the termination

date occurs subsequent to the conclusion of the fiscal year but prior to the payment of the Annual Bonus to which the fiscal year relates,

such Annual Bonus, as computed in accordance with Section 2.2 above, and (z) the Annual Bonus for the Bonus Period in which the termination

occurs at the Target level; all of which payments shall be subject to standard payroll deductions and withholdings (the “Severance”).

The Severance will be paid as a continuation on the Company’s regular payroll, beginning no later than the first regularly-scheduled

payroll date following the sixtieth (60th) day after Executive’s Separation from Service (as defined below), provided the Separation

Agreement (as discussed in Section 5) has become effective and further provided that the Bonus components under (y), if any, and (z) shall

be paid in a lump sum on the sixtieth day after Executive’s Separation from Service.

c.

Any stock options held by Executive as of the Effective Date of the Agreement or hereinafter granted shall immediately vest

upon a termination of Executive’s employment without Cause or with Good Reason, or as a result of a Change in Control, subject to

any other terms as provided in the Plan. Furthermore, all RSUs shall become unrestricted immediately upon termination without Cause or

with Good Reason or Change in Control.

d.

For purposes of this Agreement, “Cause” for termination will mean: (a) commission of any (i) felony or (ii)

crime involving fraud, dishonesty or moral turpitude (whether or not a felony); (b) any action by Executive involving fraud, breach of

the duty of loyalty, malfeasance, willful misconduct, or negligence, (c) the failure or refusal by Executive to perform any material duties

hereunder or to follow any lawful and reasonable direction of the Company; (d) intentional damage to any property of the Company; (e)

willful misconduct, gross negligence, or other material violation of a material Company policy or code of conduct that causes an adverse

effect upon the Company; or (f) breach of any written agreement with the Company (including this Agreement). Prior to any termination

for Cause under section (c), (e), or (f), the Board shall provide Executive by written notice with ten (10) calendar days to cure same,

provided any such actions underlying Cause are determined by the Board to be curable. Any determination of Cause hereunder shall be made

by the Board in its good faith discretion, which shall only be made by the Board and, to the extent deemed practicable by the Board, after

providing the Executive an opportunity to respond to any determination or allegation of Cause.

4.3

For purposes of this Agreement, “Good Reason” for termination will mean: (i) material diminution of the

Executive’s title or duties below that of the level of a Chief Financial Officer; (ii) a significant reduction in Executive’s

Base Salary; (iii) the Company requiring Executive to work on a full-time basis outside of the state of New York; or (iv) a material and

uncured breach by the Company of any provision of this Agreement; provided that Executive shall give written notice to the Company within

ninety (90) days following the occasion of any allegation of Good Reason, and the Company shall have thirty (30) days to cure same. In

the event such occurrence is not cured, then Executive may terminate Executive’s employment for Good Reason hereunder within ninety

(90) days from the end of the cure period. The Executive’s continued employment prior to the conclusion of the ninety (90) day period

stated in the preceding sentence shall not constitute consent to, or waiver of rights with respect to, any act or failure to act by the

Company constituting “Good Reason” hereunder, if not cured in the preceding thirty-day period.

4.4

For the purposes of this Agreement, “Change

in Control” shall mean, in respect of the Company or Operating Subsidiary of the Company, any of (i) the beneficial ownership

(as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of securities representing

more than 50% of the combined voting power of the Company is acquired by any “person” as defined in sections 13(d) and 14(d)

of the Exchange Act (other than the Company, any subsidiary of the Company, or any trustee or other fiduciary holding securities under

an employee benefit plan of the Company), (ii) the merger or consolidation of the Company with or into another corporation where the shareholders

of the Company, immediately prior to the consolidation or merger, would not, immediately after the consolidation or merger, beneficially

own (as such term is defined in Rule 13d-3 under the Exchange Act), directly or indirectly, shares representing in the aggregate 50% or

more of the combined voting power of the securities of the corporation issuing cash or securities in the consolidation or merger

(or of its ultimate parent corporation, if any) in substantially the same proportion as their ownership of the Company immediately prior

to such merger or consolidation, or (iii) the sale or other disposition of all or substantially all of the Company’s assets to an

entity, other than a sale or disposition by the Company of all or substantially all of the Company’s assets to an entity, at least

50% of the combined voting power of the voting securities of which are owned directly or indirectly by shareholders of the Company, immediately

prior to the sale or disposition, in substantially the same proportion as their ownership of the Company. “Operating Subsidiary”

shall mean, a major division of the Company through which the parent Company directly or indirectly conducts a portion of its business,

or company assets.

4.5

Termination for Any Other Reason. Upon a termination for any reason other than without Cause or with Good Reason, then upon

Executive’s termination date all payments of compensation by the Company to Executive hereunder will terminate immediately (except

as to amounts already earned), and Executive will not be entitled to any Severance.

5.

Conditions to Receipt of Severance Benefits. In order to receive any Severance Benefits, the termination of Executive’s

employment must constitute a “separation from service” (as defined under Treasury Regulation Section 1.409A-1(h), without

regard to any alternative definition thereunder, a “Separation from Service”), and Executive must be in compliance

with the terms of this Agreement. Further, the receipt of the Severance Benefits will be conditioned on Executive signing, not revoking,

and complying with a separation agreement and release of claims in a form provided by the Company (the “Separation Agreement”).

No Severance Benefits will be paid or provided until the Separation Agreement becomes effective.

6.

Section 409A. It is intended that all of the Severance and other payments payable under this Agreement satisfy, to the greatest

extent possible, the exemptions from the application of Code Section 409A provided under Treasury Regulations 1.409A-1(b)(4), 1.409A-1(b)(5)

and 1.409A-1(b)(9), and this Agreement will be construed to the greatest extent possible as consistent with those provisions, and to the

extent not so exempt, this Agreement (and any definitions hereunder) will be construed in a manner that complies with Section 409A. For

purposes of Code Section 409A (including, without limitation, for purposes of Treasury Regulation Section 1.409A-2(b)(2)(iii)), Executive’s

right to receive any installment payments under this Agreement (whether severance payments, reimbursements or otherwise) shall be treated

as a right to receive a series of separate payments and, accordingly, each installment payment hereunder shall at all times be considered

a separate and distinct payment.

7.

Restrictive Covenants

7.1

Definitions. The following capitalized terms used in this Agreement shall have the meanings assigned to them below,

which definitions shall apply to both the singular and the plural forms of such terms:

i.

“Confidential Information” “Confidential Information” shall be given its broadest possible

interpretation and shall mean any and all non-public, proprietary information of the Company, its affiliates, subsidiaries, and parents

(each, a “Company Entity”, and collectively, “Company Entities”), including without limitation:

(i) financial and business information relating to any Company Entity, such as information with respect to costs, fees, profits, revenues,

markets, mailing/client lists, strategies and plans for future business, new business, product or other development, potential acquisitions

or divestitures and new marketing ideas; (ii) product and technical information relating to any Company Entity, such as software, software

codes, computer models and research and development projects; (iii) customer or investor information, such as the identity of any Company

Entity’s clients or investors, the names of representatives of Company Entity customer or investors responsible for entering into

contracts with a Company Entity, the amounts paid by such investors or customers to any Company Entity, specific customer or investor

needs and requirements, specific customer or investor risk characteristics, and specific customer or investor preferences; (iv) personnel

information, such as the identity and number of any Company Entity’s other employees and officers, their salaries, bonuses, benefits,

skills, qualifications, and abilities; (v) any and all information in whatever form relating to any customer or prospective customer of

a Company Entity, including but not limited to its business, employees, operations, systems, assets, liabilities, finances, products,

and marketing, selling and operating practices; (vi) any information related to any security system of any Company Entity or any of employees,

(vii) any and all information pertaining to the business and or personal affairs of the Company’s partners, members and employees,

including but not limited to their personal lives, characteristics, opinions, ideas, conduct, habits or background or their business or

financial condition, affairs, dealings or operations or their personal database, personal photographs or videotapes, purchases, travel

itineraries, social interactions, tax information, emails, private conversations, phone calls and correspondence; (viii) any information

not included in (i) through (vii), above, which the Executive knows or should know is subject to a restriction on disclosure or which

the Executive knows or should know is considered by any Company Entity’s clients or prospective clients to be confidential, sensitive,

proprietary, or a trade secret or is not readily available to the public; or (ix) intellectual property, including inventions and copyrightable

works. Confidential Information is not generally known or available to the general public, but has been developed, compiled, or acquired

by the Company at its effort and expense. Confidential Information can be in any form, including but not limited to verbal, written, or

machine readable, including electronic files. By way of example but not limitation of the foregoing, Confidential Information may be acquired

by observing documents, things, people or events, by direct communication with clients or others or by overhearing conversations in person

or over the telephone or otherwise. “Confidential Information” shall not include information that has become generally available

to the public by the act of one who has the right to disclose such information without violating any right or privilege of the Company.

ii.

“Restricted Period” from the Start Date through the twelvemonth anniversary of Executive’s Termination

Date.

iii.

“Person” means any individual or any corporation, partnership, joint venture, limited liability company,

association or other entity or enterprise.

iv.

“Restricted Business” means any person, business, entity, organization or group within a larger firm that

engages in, or plans to engage in, (i) those parts of the business of the Company and any Company Entity with which you were involved

during the employment or about which you received Confidential Information, or (ii) any business activity which the Company or any Company

Entity was actively planning to engage in as of the Termination Date;

v.

“Restrictive Covenants” means the covenants contained in this Section 7.

vi.

“Termination” means the termination of Executive’s employment with the Company, for any reason, whether

with or without Cause, upon the initiative of either party.

vii.

“Termination Date” means the date of Executive’s Termination.

viii.

“Work Product” means all memoranda, summaries, written work product, business plans, formulas, recipes,

inventions, innovations, improvements, developments, methods, designs, analyses, drawings, reports and all similar or related information

(whether patentable or not) that are based upon Confidential Information and that are conceived, developed or made by Executive during

her employment.

7.2

Restriction on Disclosure and Use of Confidential Information. Executive agrees that Executive shall not, directly or

indirectly, use any Confidential Information on Executive’s own behalf or on behalf of any Person other than the Company, or reveal,

divulge, or disclose any Confidential Information to any Person not expressly authorized by the Company to receive such Confidential Information.

This obligation shall remain in effect for as long as the information or materials in question retain their status as Confidential Information.

Executive further agrees that he shall fully cooperate with the Company in maintaining the Confidential Information to the extent permitted

by law. The parties acknowledge and agree that this Agreement is not intended to, and does not, alter either the Company’s rights

or Executive’s obligations under any state or federal statutory or common law regarding trade secrets and unfair trade practices.

Anything herein to the contrary notwithstanding, Executive shall not be restricted from: (i) disclosing information that is required to

be disclosed by law, court order or other valid and appropriate legal process: provided, however, that in

the event such disclosure is required by law, Executive shall provide the Company with prompt notice of such requirement so that the Company

may seek an appropriate protective order prior to any such required disclosure by Executive; or (ii) reporting possible violations of

federal, state, or local law or regulation to any governmental agency or entity, or from making other disclosures that are protected under

the whistleblower provisions of federal, state, or local law or regulation, and Executive shall not need the prior authorization of the

Company to make any such reports or disclosures and shall not be required to notify the Company that Executive has made such reports or

disclosures. Notwithstanding anything in the foregoing to the contrary, in accordance with the Defend Trade Secrets Act of 2016, Executive

will not be criminally or civilly liable for disclosing a trade secret if it was disclosed: (1) to any government official or attorney

in confidence directly or indirectly for the sole purpose of reporting or investigating a suspected violation of law; (2) in a complaint

or other document filed in a lawsuit or other proceeding if filed under seal; or (3) to an attorney or used in a court proceeding in a

retaliation lawsuit if any document containing a trade secret is filed under seal and is not disclosed except pursuant to court order.

7.3

Non-Competition. The Executive acknowledges and agrees that solely by reason of employment by the Company, the Executive

has and will come into contact with a significant number of the Company’s customers and prospective customers and have access to

Confidential Information (as defined herein) and trade secrets relating thereto, including those regarding the Company’s clients,

prospective clients, proprietary business models and strategies, and related information. Consequently, the Executive covenants and agrees

that during the Restricted Period, Executive shall not directly or indirectly, an individual proprietor, partner, stock-holder, officer,

employee, director, joint venturer, investor, lender, or in any other capacity whatsoever (other than as the holder of not more than three

percent (3%) of the total outstanding stock of a publicly held company), engage in the Restricted Business.

7.4

Non-Solicitation. Executive agrees that, during the Restricted Period, he shall not, directly or indirectly, in her

own capacity or through any other entity or person: (i) solicit, persuade or induce any investor of the Company to terminate, reduce,

disrupt or refrain from renewing or extending its contractual or other relationship with the Company in regard to the purchase of products

or services, procured, performed, manufactured, marketed, or sold, by the Company; (ii) in any way interfere with the relationship between

any such investor, client, supplier, licensee, licensor, franchisee or business relation of the Company and/or any of its affiliates;

(iii) induce or attempt to induce any employee of the Company or any of its affiliates to leave the employ of the Company and/or any of

its affiliates, or in any way interfere with the relationship between the Company and/or any of its affiliates on the one hand and any

employee thereof on the other hand; or (iv) solicit to hire (other than through general advertisements for employment not directed at

employees of the Company or any of its affiliates) or hire any person who was an employee of any of the Company or any of its affiliates

at any time during the one (1) year preceding such solicitation.

7.5

Non-Disparagement. Executive agrees that, at any time hereinafter, Executive will not do or say anything, including

but not limited to communicating on the internet (including but not limited to any posting or reference on any social networking site),

or via e-mail, telephone, face-to-face communication, or otherwise, that (i) criticizes or disparages the Company or its products or services;

(ii) disrupts or impairs the normal, ongoing business operations of Company, or any member of the Company Group; or (iii) harms the business

reputation of Company or the Company Group with its employees, customers, suppliers, contractors or the public. Executive will not discuss

any information (whether confidential or not) about the Company with any reporter, author, producer, or similar person or entity, or take

any other action seeking to publicize or disclose any such information in any way likely to result in such information being made available

to the general public in any form, including books, articles or writings of any kind, as well as film, videotape, audiotape or any other

medium or as commonly provided on a resume. Executive acknowledges and agree that these prohibitions extend to statements, written or

verbal, made to anyone and includes statements made via social media including on blogs or social networking sites, including but not

limited to Facebook, LinkedIn, or Twitter. Neither the Board nor the Company or any of its affiliates shall authorize any disparaging

comments about Executive. Notwithstanding the foregoing, nothing in this Section shall prevent either Executive, the Board or the Company

or any of its affiliates from making any truthful statement to the extent necessary with respect to any legal claim, litigation, arbitration,

or mediation involving this Agreement, including, but not limited to, enforcement of this Agreement or as required by law or by any court,

arbitrator, mediator, or administrative or legislative body with actual or apparent jurisdiction to order such person to disclose or make

accessible such information.

7.6

Return of Materials. Executive agrees that she will not retain or destroy (except as set forth below), and will immediately

return to the Company on or, if specifically requested, prior to the Termination Date, or at any other time the Company requests such

return, any and all Company property, including Confidential Information and all other documents, materials, information, and property,

including but not limited to memoranda, letters, notes, plans, reports, analyses, recaps, jump drives, disks, tapes, journals, notebooks,

and any Company-provided computer, cell phone, Blackberry, beeper, keys, key fob, security card, phone card, credit cards, computer user

name and password, and/or voicemail code, all other files and documents relating to the Company and its business (regardless of form,

but specifically including all electronic files and data of the Company). Executive will not make, distribute, or retain copies of any

such information or property. Executive agrees that the ownership and right of control of all programs, databases, electronic files, reports,

records and supporting documents prepared by, for or on behalf of Executive in connection with the performance of Executive’s duties

during her employment are vested exclusively in the Company and remain the exclusive property of the Company.

7.7

Inventions. Executive acknowledges and agrees that any and all Work Product, products, improvements, and inventions

or creations conceived or made by Executive during the period of Executive’s employment with the Company relating to the activities

or business of the Company or the Company Group are the sole and exclusive property of the Company or its nominee. Executive shall promptly

disclose any Work Product to the Company and perform all acts and things and sign whatever documents and agreements are necessary to confirm

and vest the entire right, title and interest in such Work Product in the Company, including copyright assignments, patent applications

and other documents and papers. Any assignment of Work Product includes all rights of attribution, paternity, integrity, modification,

disclosure and withdrawal, and any other rights throughout the world that may be known as or referred to as “moral rights,”

“artist’s rights,” “droit moral” or the like (collectively, “Moral Rights”). To the extent

that Moral Rights cannot be assigned under applicable law, Executive hereby waives and agrees not to enforce any and all Moral Rights,

including, without limitation, any limitation on subsequent modification, to the extent permitted under applicable law. Executive agrees

to assist the Company, or its designee, at its expense, in every proper way to secure the Company’s, or its designee’s, rights

in the Company Inventions and any copyrights, patents, trademarks, mask work rights, Moral Rights, or other intellectual property rights

relating thereto in any and all countries, including the disclosure to the Company or its designee of all pertinent information and data

with respect thereto, the execution of all applications, specifications, oaths, assignments, recordations, and all other instruments which

the Company or its designee shall deem necessary in order to apply for, obtain, maintain and transfer such rights, or if not transferable,

waive and agree never to assert such rights, and in order to assign and convey to the Company or its designee, and any successors, assigns

and nominees the sole and exclusive right, title and interest in and to such Company Inventions, and any copyrights, patents, mask work

rights or other intellectual property rights relating thereto. Executive hereby irrevocably designates and appoints the Company and its

duly authorized officers and agents as Executive’s agent and attorney-in-fact, to act for and in Executive’s behalf and stead

to execute and file any such instruments and papers and to do all other lawfully permitted acts to further the application for, prosecution,

issuance, maintenance or transfer of patent, copyright, mask work and other registrations related to such Work Product. These obligations

shall be binding upon Executive and Executive’s heirs, assigns, executors, administrators, agents or other legal representatives.

Executive may not use, disclose to third parties or otherwise retain any such works or inventions, without the prior written permission

of the Company.

7.8

Cooperation. The Executive shall cooperate with the Company and its counsel in connection with any litigation or regulatory

or self-regulatory inquiry, investigation or proceeding relating to activities of Executive, or by activities of others of which the Executive

may have knowledge, and this obligation shall survive the termination of this Agreement. The Company shall reimburse the Executive for

reasonable out-of-pocket travel and other reasonable incidental expenses (other than legal expenses unless such legal expenses are requested

by the Executive as a result of divergent interests between Executive and the Company, and approved by the Board in writing) incurred

as a result of the Executive’s cooperation pursuant to the immediately preceding sentence.

7.9

Exceptions. Nothing in this Agreement shall limit the rights of any government agency or any party’s right of

access to, participation or cooperation with any government agency. Notwithstanding anything to the foregoing, nothing herein, or in any

other agreement or policy, shall limit Executive’s right under applicable law to file a charge or complaint with the U.S. Equal

Employment Opportunity Commission, the National Labor Relations Board, the Occupational Safety and Health Administration, the Securities

and Exchange Commission, or any other federal, state or local governmental agency or commission (“Government Agencies”).

Executive further understands that this Agreement does not limit her ability to communicate with any Government Agencies or otherwise

participate in any investigation or proceeding that may be conducted by any Government Agency, including providing documents or other

information, without notice to the Company. This Agreement does not limit Executive’s right to receive an award for information

provided to any Government Agencies.

7.10

Enforcement of Restrictive Covenants.

i.

Rights and Remedies Upon Breach. The parties specifically acknowledge and agree that the remedy at law for any breach

of the Restrictive Covenants will be inadequate, and that in the event Executive breaches, or threatens to breach, any of the Restrictive

Covenants, the Company shall have the right and remedy, without the necessity of proving actual damage or posting any bond, to enjoin,

preliminarily and permanently, Executive from violating or threatening to violate the Restrictive Covenants and to have the Restrictive

Covenants specifically enforced by any court of competent jurisdiction, it being agreed that any breach or threatened breach of the Restrictive

Covenants would cause irreparable injury to the Company and that money damages would not provide an adequate remedy to the Company.

ii.

Severability and Modification of Covenants. Executive acknowledges and agrees that each of the Restrictive Covenants

is reasonable and valid in time and scope and in all other respects. The parties agree that it is their intention that the Restrictive

Covenants be enforced in accordance with their terms to the maximum extent permitted by law. Each of the Restrictive Covenants shall be

considered and construed as a separate and independent covenant. Should any part or provision of any of the Restrictive Covenants be held

invalid, void, or unenforceable, such invalidity, voidness, or unenforceability shall not render invalid, void, or unenforceable any other

part or provision of this Agreement or such Restrictive Covenant. If any of the provisions of the Restrictive Covenants should ever be

held by a court of competent jurisdiction to exceed the scope permitted by the applicable law, such provision or provisions shall be automatically

modified to such lesser scope as such court may deem just and proper for the reasonable protection of the Company’s legitimate business

interests and may be enforced by the Company to that extent in the manner described above and all other provisions of this Agreement shall

be valid and enforceable. The Restrictive Covenants shall survive the termination of the Term and this Agreement.

8.

Governing Law; Dispute Resolution. The interpretation and application of this Employment shall be governed by the laws of the

State of New York without regard to principles of conflict of laws, other than laws which violate a fundamental public policy of the state

of employ, in which case such state’s laws shall govern with regard to such policies. Except for claims requesting injunctive relief,

any dispute or claim arising out of, in connection with, or relating to this Agreement (including without limitation its subject matter,

interpretation, or formation) or to Executive’s employment or relationship with the Company shall be resolved by binding arbitration

to be held in or around Farmingdale, New York, before three (3) arbitrators selected by the American Arbitration Association, conducted

in accordance with the then-prevailing Employment Arbitration Rules and Mediation Procedures of the American Arbitration Association.

A copy of these rules can be accessed through the American Arbitration Association’s website (www.adr.org). The arbitrators’

decision will be final and binding in accordance with the Federal Arbitration Act and may be enforced in any court of competent jurisdiction.

The arbitrators will not have the right to modify or change any of the terms of this Employment Agreement. The arbitrators, and not any

court, shall have exclusive authority to resolve any dispute relating to the interpretation, applicability, enforceability or formation

of this Employment Agreement including any claim that all or any part of this Agreement is void or voidable. The parties agree that the

arbitrators may provide all appropriate remedies at law and equity and will have the power to summarily adjudicate claims and/or enter

summary judgment in appropriate cases. In any arbitration proceeding conducted pursuant to this Section, the parties shall have the right

to discovery, to call witnesses, and to cross-examine the other party’s witnesses. The arbitrator shall render a final decision

in writing, setting forth the reasons for the arbitration award. Both parties are bound by this agreement to arbitrate, but it does not

include disputes, controversies or differences which may not by law be arbitrated. The parties agree that the arbitration proceedings

described in this Section are to be treated as confidential, and that the parties will act to protect the confidentiality of the documents,

facts, and proceedings related to the arbitration. THE PARTIES WAIVE THEIR RIGHT TO HAVE ANY SUCH DISPUTE, CLAIM OR CONTROVERSY DECIDED

BY A JUDGE OR JURY IN A COURT. THE PARTIES ALSO AGREE THAT EACH MAY BRING CLAIMS AGAINST THE OTHER ONLY IN THEIR INDIVIDUAL CAPACITIES,

AND NOT AS A PLAINTIFF OR CLASS MEMBER IN ANY PURPORTED CLASS OR COLLECTIVE PROCEEDING. THE PARTIES ALSO AGREE THAT EACH MAY NOT BRING

CLAIMS AGAINST THE OTHER IN ANY PURPORTED REPRESENTATIVE ACTION, EXCEPT TO THE EXTENT THIS STATEMENT IS UNENFORCEABLE UNDER THE LAW. All

American Arbitration Association filing fees, administrative costs, and arbitrator fees (as well as other related fees) shall be paid

by the Company, with the exception of fees that would be paid by the Executive should the dispute be settled in a Court of Law.

9.

General Provisions.

9.1

Notices. Any notices provided must be in writing and will be deemed effective upon the earlier of personal delivery, email,

or the next day after sending by overnight carrier, to the Company at its primary office location and to Executive at the address as listed

on the Company payroll.

9.2

Severability. Whenever possible, each provision of this Agreement will be interpreted in such manner as to be effective and

valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in any respect under

any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability will not affect any other provision or

any other jurisdiction, but this Agreement will be reformed, construed and enforced in such jurisdiction to the extent possible in keeping

with the intent of the parties.

9.3

Waiver. Any waiver of any breach of any provisions of this Agreement must be in writing to be effective, and it shall not thereby

be deemed to have waived any preceding or succeeding breach of the same or any other provision of this Agreement.

9.4

Complete Agreement. This Agreement constitutes the entire agreement between Executive and the Company with regard to this subject

matter and is the complete, final, and exclusive embodiment of the Parties’ agreement with regard to this subject matter, inclusive

of any earlier offer letter. This Agreement is entered into without reliance on any promise or representation, written or oral, other

than those expressly contained herein, and it supersedes any other such promises, warranties or representations. It is entered into without

reliance on any promise or representation other than those expressly contained herein, and it cannot be modified or amended except in

a writing signed by a duly authorized officer of the Company.

9.5

Counterparts. This Agreement may be executed in separate counterparts, any one of which need not contain signatures of more

than one party, but all of which taken together will constitute one and the same Agreement.

9.6

Headings. The headings of the Sections hereof are inserted for convenience only and shall not be deemed to constitute a part

hereof nor to affect the meaning thereof.

9.7

Successors and Assigns. This Agreement is intended to bind and inure to the benefit of and be enforceable by Executive and

the Company, and their respective successors, assigns, heirs, executors and administrators. The Company may freely assign this Agreement,

without Executive’s prior written consent. Executive may not assign any of her duties hereunder and she may not assign any of her

rights hereunder without the written consent of the Company. The Company will require any successor (whether direct or indirect, by purchase,

merger, consolidation, assign or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly

and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such

succession had taken place. As used in this Agreement, “Company” shall mean the Company as hereinbefore defined and any successor

to its business and/or assets as aforesaid.

9.8

Background Check and Ability to Work. This offer of employment is contingent upon verification of Executive’s identity

and authorization to legally work in the United States, a background and reference check, and all other Company practices and procedures

as reasonably requested by the Company.

9.9 Tax

Withholding. All payments and awards contemplated or made pursuant to this Agreement will be subject to withholdings of applicable

taxes in compliance with all relevant laws and regulations of all appropriate government authorities. Executive acknowledges and agrees

that the Company has neither made any assurances nor any guarantees concerning the tax treatment of any payments or awards contemplated

by or made pursuant to this Agreement. Executive has had the opportunity to retain a tax and financial advisor and fully understands the

tax and economic consequences of all payments and awards made pursuant to the Agreement.

You

acknowledge and agree that you have read and understand this Employment agreement and you voluntarily agree to the terms and conditions

contained herein.

If

you accept this amended offer of employment, please sign and return to me this Employment Agreement by no later than July 31, 2024 or

this offer shall expire.

In

Witness Whereof, the Parties have executed this Agreement on the day and year first written above.

| |

ENZO BIOCHEM INC. |

| |

|

| |

By: |

/s/ Kara Cannon |

| |

|

Kara Cannon |

| |

|

Chief Executive Officer |

| |

Executive |

| |

|

| |

/s/ Patricia Eckert |

| |

Patricia Eckert |

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

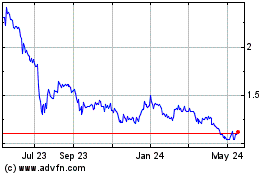

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

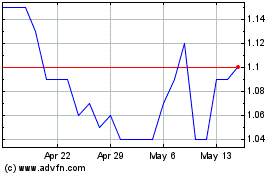

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Jan 2024 to Jan 2025