Equinor (OSE: EQNR, NYSE: EQNR) delivered adjusted

operating income* of USD 7.48 billion and USD 2.15 billion after

tax in the second quarter of 2024. Equinor reported net operating

income of USD 7.66 billion and net income at USD 1.87 billion.

Adjusted net income* was USD 2.42 billion, leading to adjusted

earnings per share* of USD 0.84.

Financial and operational performance

- Continued strong operational performance

- Solid financial results

- Cash flow impacted by tax payments in Norway and capital

distribution

Strategic progress

- New fields on stream on the NCS

- Continued high grading of oil and gas portfolio

- Three new CO2 license awards in Norway and Denmark

Capital distribution

- Second quarter ordinary cash dividend of USD 0.35 per share,

extraordinary cash dividend of USD 0.35 per share and third tranche

of share buy-back of up to USD 1.6 billion

- Maintain expected total capital distribution for 2024 of around

USD 14 billion

Anders Opedal, President and CEO of Equinor ASA:

“Our operational performance continued to be strong through the

quarter and we delivered 3% production growth. This secured solid

financial results. We maintain a competitive capital distribution,

expecting to deliver a total of 14 billion dollars to our

shareholders in 2024.”

“Field developments and high production contributes to energy

security for Europe. To unlock further long-term value creation, we

continue to optimise our portfolio. We also progressed our

renewables projects and accessed three new licences for CO2

storage, to build a profitable business for a future low carbon

energy system.”

Strong operational performance

Equinor delivered a total equity production of 2,048 mboe per

day in the second quarter, up from 1,994 mboe per day in the same

quarter last year.

On the NCS, strong operational performance and lower impact from

turnarounds, together with new production from the Breidablikk

field contributed to a production growth of 5% compared to the

second quarter last year. High production particularly from the

Troll and Oseberg fields contributed to a 13% increase in gas

production, compared to the same period last year.

Internationally, the Buzzard field in the UK and new wells

contributed with new production but was more than offset by lower

production from the US due to turnarounds offshore and planned

curtailments onshore to capture higher value when demand is

higher.

In the quarter, Equinor completed seven exploration wells

offshore, including the Argerich well in Argentina, with no

commercial discoveries. Seven wells were ongoing at the quarter

end.

In the second quarter, Equinor produced 655 GWh from renewables,

up 90% from the same quarter last year. Production from onshore

power plants contributed with more than half of the production in

the quarter, mainly from the Rio Energy assets and Mendubim solar

plants in Brazil, as well as new production in Poland. The offshore

windfarms contributed to the growth with strong production.

Strategic progress

Equinor’s NCS portfolio progressed in the quarter. Equinor and

its partners made an investment decision for further development of

gas infrastructure in the Troll West gas province, contributing to

energy security to Europe long-term. The Johan Castberg FPSO left

the dock for inshore testing and is on track for sail away to the

Barents Sea later this summer. The production started from the

partner-operated Hanz field in April and from the Kristin South

area in July.

Equinor continued to optimise the portfolio through strategic

business development. This quarter an agreement with Petoro was

announced to harmonise equity interest in the Haltenbanken area to

increase long-term value creation, and a divestment of interests in

the Gina Krog area. The swap transaction to increase profitability

in the US onshore business, exiting the operated position in Ohio

and increasing its position in partner-operated assets in Northern

Marcellus in Pennsylvania was closed.

Equinor accessed CO2 storage capacity opportunities of 17

million tonnes per year with the awarded three new licences Kinna

and Albondigas on the NCS, and the Kalundborg licence onshore

Denmark.

In the UK, construction is progressing on Dogger Bank A offshore

wind farm with 27 turbines either fully or partly installed. The

project targets full commercial operations during the first half of

2025. Based on this the expected growth in power production from

renewables assets in 2024 is now adjusted to be around 70% from the

2023-level.

Solid financial results

Equinor delivered adjusted operating income* of USD 7.48

billion, of which USD 6.13 billion from the E&P Norway, USD 699

million from E&P international and USD 264 million from E&P

USA.

The Marketing, Midstream & Processing (MMP) segment

delivered adjusted operating income* of USD 521 million, mainly

from the Gas and Power business, including strong results from LNG

trading.

Adjusted operating income* from Renewables was negative USD 90

million, as the costs of project development exceeds the earnings

from assets in operations which was USD 41 million in the

quarter.

Cash flow from operating activities before taxes paid and

working capital items amounted to USD 9.75 billion for the second

quarter. Cash flow from operations after taxes paid* was USD 1.90

billion for the quarter, and USD 7.74 billion year to date. Equinor

paid two NCS tax instalments, totalling USD 6.98 billion in the

quarter. Organic capital expenditure* was USD 2.89 billion for the

quarter, and total capital expenditures were USD 4.78 billion.

After taxes, capital distribution to shareholders and investments,

net cash flow* ended at negative USD 4.22 billion in the second

quarter.

Adjusted net debt to capital employed ratio* was negative 3.4%

at the end of the second quarter, compared to negative 19.8% at the

end of the first quarter of 2024. The calculation of net debt ratio

includes the effect of the Norwegian state’s share of the share

buy-back, at USD 4.02 billion paid in July.

Capital distribution

The board of directors has decided an ordinary cash dividend of

USD 0.35 per share, and to continue the extraordinary cash dividend

of USD 0.35 per share for the second quarter of 2024, in line with

communication at the Capital Markets Update in February.

Expected total capital distribution for 2024 is around USD 14

billion, including a share buy-back programme of up to USD 6

billion. The board has decided to initiate a third tranche of the

share buy-back programme of up to USD 1.6 billion. The third

tranche will commence on 25 July and end no later than 22 October

2024.

The second tranche of the share buy-back programme for 2024 was

completed on 19 July 2024 with a total value of USD 1.6

billion.

All share buy-back amounts include shares to be redeemed from

the Norwegian State.

---

*For items marked with an asterisk throughout this report, see

Use and reconciliation of non-GAAP financial measures in the

Supplementary disclosures.

---

Further information from:

Investor relationsBård Glad Pedersen, Senior vice president

Investor relations,+47 918 01 791 (mobile)

PressSissel Rinde, vice president Media relations,+47 412 60 584

(mobile)

This information is subject to the disclosure requirements

pursuant to Section 5-12 of the Norwegian Securities Trading

Act

- Equinor Second quarter 2024 Financial statements and

review

- CFO presentation - 2nd quarter 2024 results

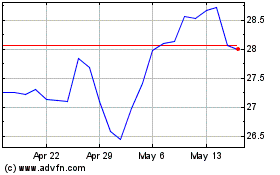

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Dec 2023 to Dec 2024