CALGARY, Nov. 12 /CNW/ -- CALGARY, Nov. 12 /CNW/ - Enerplus

Resources Fund ("Enerplus") (TSX - ERF.un, NYSE - ERF) is pleased

to announce operating and financial results for the third quarter

of 2010. Full copies of our third quarter 2010 Financial Statements

and MD&A have been filed on our website at www.enerplus.com,

under our profile on SEDAR at www.sedar.com, and on the EDGAR

website at www.sec.gov. TRANSITIONING THE ASSET BASE -- To date

this year Enerplus has acquired over $900 million of new

growth-oriented assets in two of the best plays in North America -

the Bakken crude oil play in the Williston Basin and the Marcellus

shale gas play in northeast United States. The proceeds from our

disposition activities have ensured we maintain our strong

financial position while repositioning into higher growth assets

and improving the focus in our portfolio. -- We expanded our

interest in the Marcellus shale gas region with the purchase of

58,500 net acres of high working interest land in West Virginia and

Maryland. We now own and operate a total of 70,000 net acres of

concentrated land in addition to the nearly 130,000 net acres of

non-operated land in the Marcellus which will provide us with

significant future growth potential. -- We also acquired 46,500 net

acres of additional land in the Fort Berthold area of North Dakota

subsequent to the quarter that we believe is prospective for both

Bakken and Three Forks crude oil. This complements our existing

operated position in the region and gives Enerplus over 70,000 net

acres of undeveloped land in North Dakota together with 140,000 net

acres of undeveloped Bakken prospective land in the Freda

Lake/Neptune/Oungre area of southern Saskatchewan that we operate

as well. -- We added 39 sections of land prospective for natural

gas from the Stacked Mannville and Montney formations. We now hold

over 65,000 net acres of undeveloped land in the Deep Basin area.

-- 2,500 BOE/day of oil and gas production located in Alberta and

British Columbia was sold during the quarter for proceeds of $153

million. As well, we expect to close the sale of a further 4,500

BOE/day of non-core assets during the fourth quarter for proceeds

of approximately $140 million. The average operating cost of these

properties ranged from $17.00/BOE to $23.00/BOE. -- We were also

successful in selling our Kirby oil sands lease for $405 million

subsequent to the quarter. OPERATING AND FINANCIAL PERFORMANCE --

Operations continued to meet expectations with production volumes

in line with guidance. Operating costs have continued to decline

throughout the year and our capital program has delivered results

in key growth areas as well as in mature, cash flow generating

assets. -- Production averaged 82,869 BOE/day after adjusting for

the sale of 2,500 BOE/day of production during the third quarter.

To date in 2010, we've sold 6,000 BOE/day of non-core production.

-- We had an active quarter spending $128 million in development

capital, 80% of which was invested in our Bakken/tight oil,

Marcellus and crude oil waterflood resource plays. Year-to-date

capital investment has totaled $314 million, the majority of which

has been funded from cash flow. -- 25 net wells were drilled, 85%

of which were oil wells. All but one of these wells were drilled

horizontally. -- Cash flow from operations totaled $203.6 million

for the third quarter. For the first nine months of 2010, Enerplus

has generated approximately $556.3 million of cash flow from

operating activities, distributing 52% to unitholders through

monthly distributions. -- Development capital spending and

distributions totaled 110% of cash flow for the third quarter and

108% for the first nine months of the year. -- Operating costs

averaged $10.28/BOE for the quarter with year-to-date costs

averaging $10.02/BOE. -- Our balance sheet remains strong with a

debt to cash flow ratio of 0.9x at September 30, 2010 providing us

with ample financial flexibility to pursue our future growth plans.

SELECTED FINANCIAL RESULTS Three months ended Nine months ended

September 30, September 30, (in Canadian dollars) 2010 2009 2010

2009 Financial (000's) Cash Flow from Operating $203,622 $207,211

$556,362 $587,207 Activities Cash Distributions to 96,111 93,504

287,732 272,651 Unitholders((1)) Excess of Cash Flow Over Cash

107,511 113,707 268,630 314,556 Distributions Net Income 16,808

38,182 128,107 86,399 Debt Outstanding - net of cash 680,264

561,218 680,264 561,218 Development Capital Spending( 127,837

42,863 313,650 174,316 (2)) Property and Land Acquisitions( 140,530

195,038 493,731 228,783 (2)) Divestments 150,747 519 333,523 2,255

Actual Cash Distributions paid $0.54 $0.54 $1.62 $1.69 to

Unitholders Financial per Weighted Average Trust Units((3)) Cash

Flow from Operating $1.14 $1.23 $3.13 $3.52 Activities Cash

Distributions per Unit( 0.54 0.55 1.62 1.63 (1)) Excess of Cash

Flow Over Cash 0.60 0.68 1.51 1.89 Distributions Net Income 0.09

0.23 0.72 0.52 Payout Ratio((4)) 47% 45% 52% 46% Adjusted Payout

Ratio((2)(4)) 110% 68% 108% 78% Selected Financial Results per BOE

((5)) Oil & Gas Sales((6)) $40.08 $35.23 $42.96 $35.36

Royalties (7.29) (5.56) (7.74) (6.10) Commodity Derivative 2.76

4.89 1.84 5.08 Instruments Operating Costs (10.09) (10.00) (10.03)

(9.84) General and Administrative (2.55) (2.21) (2.22) (2.18)

Interest and Other Expenses (1.88) (0.79) (1.51) (0.22) Taxes

Recovery/(Expense) 4.43 (0.35) 1.45 (0.22) Asset Retirement

Obligations (0.30) (0.31) (0.44) (0.34) Settled Cash Flow from

Operating Activities before changes in non-cash working capital

$25.16 $20.90 $24.31 $21.54 Weighted Average Number of Trust

177,871 168,521 177,526 166,724 Units Outstanding((3)) Debt to

Trailing Twelve Month 0.9x 0.7x 0.9x 0.7x Cash Flow Ratio SELECTED

OPERATING RESULTS Three months ended Nine months ended September

30, September 30, 2010 2009 2010 2009 Average Daily Production

Natural gas (Mcf/day) 285,292 323,884 293,543 333,606 Crude oil

(bbls/day) 31,639 32,218 31,393 33,454 Natural gas liquids

(bbls/day) 3,681 3,912 3,842 4,129 Total daily sales (BOE/day)

82,869 90,111 84,159 93,184 % Natural gas 57% 60% 58% 60% Average

Selling Price ((6)) Natural gas (per Mcf) $3.67 $2.95 $4.19 $3.86

Crude oil (per bbl) 66.97 64.94 69.80 55.57 NGLs (per bbl) 46.69

32.59 50.61 36.21 CDN$/US$ exchange rate 0.96 0.91 0.97 0.85 Net

Wells drilled 25.0 27.6 183.8 156.6 ((1)) Calculated based on

distributions paid or payable. ((2) ) Land acquisitions in prior

periods have been reclassified from development capital

expenditures to property acquisitions to conform with the current

year presentation. ((3) ) Weighted average trust units outstanding

for the period, includes the equivalent exchangeable limited

partnership units. ((4)) Payout ratio is calculated as cash

distributions to unitholders divided by cash flow from operating

activities. Adjusted payout ratio is calculated as the sum of cash

distributions to unitholders plus development capital and office

expenditures divided by cash flow from operating activities. See

"Non-GAAP Measures" below. ((5)) Non-cash amounts have been

excluded. ((6)) Net of oil and gas transportation costs, but before

the effects of commodity derivative instruments. TRUST UNIT TRADING

SUMMARY TSX - ERF.un U.S.* - ERF For the three months ended

September 30, 2010 (CDN$) (US$) High $26.57 $25.84 Low $22.53

$20.90 Close $26.50 $25.75 * U.S. Composite Exchange Data including

NYSE. 2010 CASH DISTRIBUTIONS PER TRUST UNIT Payment Month CDN$ US$

First Quarter Total $0.54 $0.52 Second Quarter Total $0.54 $0.53

July $0.18 $0.17 August 0.18 0.18 September 0.18 0.17 Third Quarter

Total $0.54 $0.52 Total Year-to-Date $1.62 $1.57 PRODUCTION AND

DEVELOPMENT CAPITAL SPENDING

____________________________________________________________________

| |Three months ended Sept.|Nine months ended Sept. 30,| | | 30,

2010 | 2010 |

|_______________|________________________|___________________________|

| | Average | Capital | Average | Capital | | |Production |

Spending |Production | Spending | |Play Type | Volumes|($

millions)| Volumes| ($ millions)|

|_______________|___________|____________|___________|_______________|

|Bakken/Tight | 13,039| 51| 10,722| 115| |Oil (BOE/day) | 13,979|

28| 15,209| 64| |Crude Oil | 8,029| 3| 9,068| 9| |Waterfloods | | |

| | |(BOE/day) | | | | | |Conventional | | | | | |Oil (BOE/day) | |

| | |

|_______________|___________|____________|___________|_______________|

|Total Oil | 35,047| 82| 34,999| 188| |(BOE/day) | | | | | | |

11,230| 26| 6,783| 61| |Marcellus Shale| 116,313| 6| 121,805| 14|

|Gas (Mcfe/day) | 82,647| 12| 86,437| 41| |Shallow Gas | 76,741| 2|

79,935| 10| |(Mcfe/day) | | | | | |Tight Gas | | | | | |(Mcfe/day)

| | | | | |Conventional | | | | | |Gas (Mcfe/day) | | | | |

|_______________|___________|____________|___________|_______________|

|Total Gas | 286,931| 46| 294,960| 126| |(Mcfe/day) | | | | |

|_______________|___________|____________|___________|_______________|

|Company Total | 82,869| 128| 84,159| 314|

|_______________|___________|____________|___________|_______________|

DRILLING ACTIVITY Net wells drilled for the three months ended

Sept. 30, 2010

____________________________________________________________________

| | | | | Wells | | | | | | | | Pending | | Dry & | | | | |

|Completion/| Wells|Abandoned| | |Horizontal|Vertical|Total | | On-

| | |Play Type | Wells| Wells| Wells| Tie-in*|stream| Wells|

|____________|__________|________|______|___________|______|_________|

|Bakken/Tight| 11.7| -| 11.7| 10.7| 1.0| -| |oil | 6.2| -| 6.2|

3.1| 3.1| -| |Crude Oil | 2.6| -| 2.6| 2.6| -| -| |Waterfloods | |

| | | | | |Conventional| | | | | | | |Oil | | | | | | |

|____________|__________|________|______|___________|______|_________|

|Total Oil | 20.5 | -| 20.5| 16.4| 4.1| -| | | | | | | | |

|Marcellus | 2.4| 1.0| 3.4| 3.4| -| -| |Shale Gas | -| -| -| -| -|

-| |Shallow Gas | 0.9| -| 0.9| 0.9| -| -| |Tight Gas | 0.2| -| 0.2|

0.2| -| -| |Conventional| | | | | | | |Gas | | | | | | |

|____________|__________|________|______|___________|______|_________|

|Total Gas | 3.5| 1.0| 4.5| 4.5| -| -|

|____________|__________|________|______|___________|______|_________|

|Company | 24.0| 1.0| 25.0| 20.9| 4.1| -| |Total | | | | | | |

|____________|__________|________|______|___________|______|_________|

* includes wells that are pending evaluation BAKKEN/TIGHT OIL The

Bakken/tight oil resource play continues to be a key growth driver

within Enerplus. Production from this play has increased by

approximately 50% this year as a result of our successful

development program and our acquisition activities. We expect

significant growth in production and reserves from this resource

play in the future. Overall we are very encouraged by the results

of our drilling program in North Dakota. At Fort Berthold, five

horizontal wells were drilled during the quarter - three operated

long horizontal wells and two short horizontal wells associated

with our recent acquisition. In addition, two wells drilled in the

second quarter were brought on stream. We now have nine wells

drilled into this play, six of which have been completed to

date. The lateral length of these wells has ranged from 4,300

feet with 12 frac stages for the short lateral wells to 9,000 feet

with 24 frac stages for the long lateral wells. Actual

production results shown in the table below continue to either meet

or materially exceed our type curve estimates. Production

from the long lateral wells was limited due to fluid handling

capacity.

__________________________________________________________________

| |Expected 30 Day |Actual 30 Day | Actual 60 Day | | | Average |

Average |Average Production| | | Production | Production | | | |

Rate/Well | Rate/Well | Rate/Well |

|_______________|________________|______________|__________________|

|Short Lateral | 650 bbls/day| 800 bbls/day| 650 bbls/day| |Wells

(4 wells)| | | |

|_______________|________________|______________|__________________|

|Long Lateral | 1,200 bbls/day|1,190 bbls/day| 1,100 bbls/day|

|Wells (2 wells)| | | |

|_______________|________________|______________|__________________|

First 100 day cumulative production from our two long Bakken

lateral wells totaled 101,000 and 91,000 barrels of oil

respectively. We continue working on our frac design and

procedures, but have been very encouraged to date with rates and

flowing pressures. Gathering infrastructure work is underway both

on and off the Fort Berthold Indian Reservation with midstream

companies to build the necessary infrastructure to allow us to

capture produced gas and additional crude oil volumes. We

anticipate the first well tie-ins will occur late in the fourth

quarter and continue into 2011. Current production from

Enerplus' Fort Berthold area is approximately 4,000 bbls/day. We

currently have two rigs active in Fort Berthold, both drilling

multi-well pads. We plan to add an additional rig at our

Sleeping Giant property in Montana in December which will move

to Fort Berthold after drilling one to two development wells.

Access to service crews continues to be a challenge due to the high

activity levels in the Williston Basin. Given our sizeable

land position as a result of our recent acquisitions, we believe we

can mitigate this issue given our anticipated increase in spending

over the next three to five years. We expect to have long term

service agreements in place by year end that will help us execute

our plans going forward. Production from this area is expected to

grow to over 20,000 BOE/day over the next five years. In Canada,

our activities have been focused on conducting an appraisal of the

lands acquired earlier this year through the drilling of a number

of delineation wells and shooting 3-D seismic. We haven't been able

to drill and complete as many wells as originally planned on our

Saskatchewan Bakken lands and the results to date have been

mixed. Weather has proved to be a significant challenge over

the summer as extremely wet conditions made well sites difficult to

access. Three horizontal wells were drilled during the quarter,

however completion activities were delayed. We are currently

in the process of completing these wells. The completion results

and the seismic information will help us evaluate the potential of

the Saskatchewan land and define future plans for the play.

MARCELLUS SHALE GAS Activity in our Marcellus shale gas play during

the third quarter increased from the second quarter with 14 gross

wells drilled (3.4 net wells) and development spending of $26

million. Production volumes have also increased

significantly, averaging over 11 MMcf/day during the quarter,

almost double the levels we realized in the second quarter.

The majority of our joint venture activities were concentrated in

Lycoming and Susquehanna counties this quarter. In addition to the

14 gross wells that were drilled and awaiting tie in, six gross

wells drilled earlier in the year were also tied in. Early results

indicate these six wells are meeting our performance expectations

with peak 24 hour test rates averaging over 6.2 MMcf/day. Another

seven gross wells were completed and are currently awaiting tie-in.

To date, 93 wells have been drilled across nine counties in

Pennsylvania (Lycoming, Bradford, Susquehanna, Wyoming, Clearfield,

Blair, Somerset, Greene and Fayette) as well as Marshall County in

West Virginia. Expected ultimate recoveries range from 3.75 Bcf to

7 Bcf per well, varying by county, Marcellus thickness and lateral

length. As discussed earlier this year, lateral lengths and the

number of frac stages are increasing with the most recent wells

ranging from 4,300 to 5,800 foot lateral lengths with 10 to 15 frac

stages. As a result of the longer lateral length and increased frac

stages, well costs are trending higher, however initial production

rates and expected ultimate recoveries are increasing as

well. There are currently 42 wells on production, 15 wells

waiting on pipeline and 36 wells waiting on completion.

Another 20 wells are being drilled or remain to be drilled in 2010,

with activity planned for northeast Pennsylvania, south central

Pennsylvania, and Marshall County, West Virginia. Similar to our

experience in the Bakken play, high activity levels have strained

service company availability and impacted our completions

activity. A number of wells were only partially completed

during the quarter due to crew availability and will now be

completed in the fourth quarter of 2010 or the early part of 2011.

As a result, some volumes anticipated at year end may now come on

production in early 2011. We currently have eight rigs running in

the play and expect an additional rig may be added before the end

of the year. Production volumes in early November were

approximately 16 MMcf/day. Enerplus operated activity commenced

with construction on the pad site of our first operated horizontal

well in Clinton County, Pennsylvania during the quarter.

Drilling is currently underway with a planned horizontal length of

4,500 feet. WATERFLOODS Our waterflood projects continue to

be a core focus area within Enerplus' portfolio, representing

approximately 18% of our daily production volumes. Approximately

$64 million has been spent year to date drilling 26 net wells and

improving/expanding facilities to support our future plans. As a

result of our 2010 capital investment activities, we expect

production volumes will be maintained year-over-year excluding

production volumes sold through our disposition program. During the

third quarter, the majority of our activities occurred at our Freda

Lake Ratcliffe property in Saskatchewan. Six horizontal wells

have been drilled in the last year (three in the third quarter)

resulting in a 140% increase in production from approximately 500

bbls/day at the start of 2010 to 1,200 bbls/day currently. Three

dual lateral wells and three single lateral wells have been drilled

with 30 day initial production rates of 200 to 300 bbls/day from

the dual lateral wells. We are in the process of completing the

single lateral wells and expect initial production rates of over

100 bbls/day. To date, the decline rates have also been better than

expected. Our activities have also included facility upgrades and

increased production and water handling capacity in order to

accommodate the current and future increases in production volumes.

We plan to drill another five single lateral wells in the fourth

quarter in addition to 11 injector well conversions. Our

Saskatchewan land acquisitions earlier this year also added acreage

with rights to the Ratcliffe formation which will enhance our

future development plans in this area. Based upon our current

acreage, we see two to three years of drilling potential similar to

this year's activity that will maintain production volumes. We also

commenced a horizontal drilling program at our Gleneath waterflood

property. This waterflood has been producing exclusively from

vertical wells drilled into the Viking light crude oil

formation. We drilled and completed two horizontal wells

during the third quarter. Initial flowing test rates indicate these

wells could produce approximately 100 bbls/day per well once they

are placed on pump, in line with our 30 day type curve. We plan to

drill another four wells during the fourth quarter. Depending upon

the success of this activity, we believe there are 20 to 30 future

drilling locations at Gleneath. OUTLOOK FOR THE REMAINDER OF 2010

As we announced in September, we expect annual production to

average 83,000 to 84,000 BOE/day, with an exit rate of 80,000 to

82,000 BOE/day taking into account the impact of the assets we sold

or expect to sell this year. Service crew availability

remains a challenge and could pose a potential for delays in

completing a number of high impact wells in the Bakken and

Marcellus regions. Should we experience delays in obtaining

services and also given the level of capital spending planned for

the fourth quarter of this year we may be challenged to spend our

entire capital budget in 2010. If this occurs, exit

production rates would be impacted but with the expectation that

the planned activities would be completed early in 2011. We

continue to expect to invest $515 million in development capital in

2010 with operating cost and G&A cost guidance of $10.20/BOE

and $2.45/BOE respectively. CORPORATE CONVERSION On September 30,

2010, we formally announced our plans to convert to a dividend

paying corporation January 1, 2011. We plan to hold a Special

Meeting of Unitholders on December 9, 2010 in Calgary, Alberta to

vote on the conversion and, subject to Unitholder approval and

obtaining all of the necessary Court and regulatory approvals, we

would convert to a corporation effective January 1, 2011. We have

proposed a straight forward conversion to our Unitholders. We will

exchange one trust unit of Enerplus Resources Fund for one share in

Enerplus Corporation. This exchange will be tax-deferred and will

not result in a capital gain or loss to our Unitholders. Our ticker

symbols will remain the same as will our corporate brand. Further,

the conversion will not result in the acceleration or vesting of

any compensation or incentive based awards to any employees or

Directors of Enerplus. We intend to continue to pay monthly

dividends to investors after the conversion and expect to maintain

the current rate of $0.18/share through the conversion. This

dividend level is based upon commodity prices, debt levels, capital

spending and other factors and may fluctuate in the future.

We will also utilize our available tax pools to mitigate our

Canadian cash tax obligations and do not expect to incur cash taxes

in Canada for three to five years after conversion. For more

information on the conversion and how to cast your vote, details

can be found at www.enerplus.com. We look forward to your

support on December 9(th). CONSOLIDATED FINANCIAL STATEMENTS AND

MD&A Third quarter 2010 Consolidated Financial Statements and

Notes to the Consolidated Financial Statements, along with the

Management's Discussion and Analysis for Enerplus, have been filed

on our website at www.enerplus.com, under our profile on SEDAR

www.sedar.com and on the EDGAR website at www.sec.gov. INFORMATION

REGARDING DISCLOSURE IN THIS NEWS RELEASE All amounts in this news

release are stated in Canadian dollars unless otherwise specified.

Where applicable, natural gas has been converted to barrels of oil

equivalent ("BOE") based on 6 Mcf:1 BOE. The BOE rate is based on

an energy equivalent conversion method primarily applicable at the

burner tip and does not represent a value equivalent at the

wellhead. Use of BOE in isolation may be misleading. "Mcfe" means

thousand cubic feet of gas equivalent. Enerplus has adopted

the standard of one barrel of oil to six thousand cubic feet of gas

(1 barrel: 6 Mcf) when converting oil to Mcfes. Mcfes may be

misleading, particularly if used in isolation. An Mcfe conversion

ratio of 1 barrel: 6 Mcf is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Under Canadian

disclosure requirements and industry practice, production is

reported using gross volumes, which are volumes prior to deduction

of royalty and similar payments. The practice in the United States

is to report production using net volumes, after deduction of

applicable royalties and similar payments. Readers are

also urged to review the Management's Discussion & Analysis and

financial statements for the three and nine months ended September

30, 2010 filed on SEDAR and EDGAR concurrently with this news

release for more complete disclosure on our operations.

FORWARD-LOOKING INFORMATION AND STATEMENTS This news release

contains certain forward-looking information and statements within

the meaning of applicable securities laws. The use of any of the

words "expect", "anticipate", "continue", "estimate", "guidance",

"objective", "ongoing", "may", "will", "project", "should",

"believe", "plans", "intends" and similar expressions are intended

to identify forward-looking information or statements. In

particular, but without limiting the foregoing, this news release

contains forward-looking information and statements pertaining to

the following: Enerplus' strategy and future growth potential in

production and reserves; the expected disposition of certain

non-core assets in the fourth quarter of 2010; future drilling

plans and prospects and well tie-ins; our ability to mitigate

shortages in service crews; future production levels and increases,

including average 2010 and year-end 2010 exit production levels;

capital expenditure levels and the timing thereof; operating and

G&A costs; the conversion of Enerplus from an income trust to a

corporation, the timing thereof and the tax treatment to

unitholders; the amount and timing of cash dividends to

Enerplus shareholders; and the Fund's income taxes, tax liabilities

and tax pools. This press release also contains estimates of

contingent resources, which are by their nature estimates that the

quantities described exist in the amounts estimated. The

forward-looking information and statements contained in this news

release reflect several material factors and expectations and

assumptions of Enerplus including, without limitation: that

Enerplus will continue to conduct its operations in a manner

consistent with past operations; the general continuance of current

or, where applicable, assumed industry conditions and tax and

regulatory regimes; availability of cash flow, debt and/or equity

sources to fund Enerplus' capital and operating requirements as

needed; the continuance of existing and, in certain circumstances,

proposed tax and royalty regimes; that there will be willing buyers

of certain of Enerplus' oil and gas assets on terms acceptable to

Enerplus; that all required conditions to complete the conversion

of Enerplus from a trust to a corporation will be obtained or

satisfied; the accuracy of the estimates of Enerplus' reserve and

resource volumes; acquisition and disposition activity and certain

commodity price and other cost assumptions. Enerplus believes the

material factors, expectations and assumptions reflected in the

forward-looking information and statements are reasonable at this

time but no assurance can be given that these factors, expectations

and assumptions will prove to be correct. The forward-looking

information and statements included in this news release are not

guarantees of future performance and should not be unduly relied

upon. Such information and statements involve known and unknown

risks, uncertainties and other factors that may cause actual

results or events to differ materially from those anticipated in

such forward-looking information or statements including, without

limitation: changes in commodity prices; unanticipated operating

results or production declines; changes in tax or environmental

laws or royalty rates; increased debt levels or debt service

requirements; failure to complete anticipated asset sales; failure

to obtain all necessary approvals and satisfy all conditions for

the conversion of Enerplus from an income trust to a corporation;

inaccurate estimates of tax pools and future income tax

liabilities; inaccurate estimation of Enerplus' oil and gas

reserves and resources volumes; limited, unfavourable or no access

to debt or equity capital markets; increased costs and expenses;

the impact of competitors; reliance on industry partners including

a continued shortage of service crews; and certain other risks

detailed from time to time in the Fund's public disclosure

documents including, without limitation, those risks identified in

our MD&A for the three and nine months ended September 30,

2010, our MD&A for the year ended December 31, 2009 and in the

Fund's Annual Information Form for the year ended December 31,

2009, copies of which are available on the Fund's SEDAR profile at

www.sedar.com and which also form part of the Fund's Form 40-F for

the year ended December 31, 2009 filed with the SEC, a copy of

which is available at www.sec.gov. The forward-looking information

and statements contained in this news release speak only as of the

date of this release and none of the Fund or its subsidiaries

assumes any obligation to publicly update or revise them to reflect

new events or circumstances, except as may be required pursuant to

applicable laws. NON-GAAP MEASURES Throughout this news release we

use the term "payout ratio" and "adjusted payout ratio" to analyze

operating performance, leverage and liquidity We calculate payout

ratio by dividing cash distributions to Unitholders ("cash

distributions") by cash flow from operating activities ("cash

flow"), both of which appear on our consolidated statements of cash

flows prepared in accordance with Canadian generally accepted

accounting principles ("GAAP"). "Adjusted payout ratio" is

calculated as cash distributions plus development capital and

office expenditures divided by cash flow. The terms "payout

ratio" and "adjusted payout ratio" do not have a standardized

meaning or definition as prescribed by GAAP and therefore may not

be comparable with the calculation of similar measures by other

entities. Refer to the Liquidity and Capital Resources section of

our Management's Discussion and Analysis for the three and nine

months ended September 30, 2010 for further information.

Gordon J. Kerr President & Chief Executive Officer Enerplus

Resources Fund %CIK: 0001126874 pregarding this news release or a

copy of our 2010 third quarter interim report, please contact our

investor relations department at 1-800-319-6462 or email a

href="mailto:investorrelations@enerplus.com"investorrelations@enerplus.com/a./p

Copyright

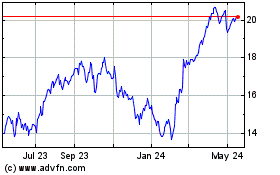

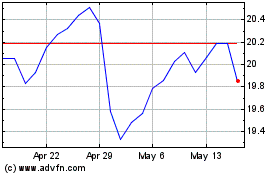

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024