Lower Production From Linn Energy & Enerplus May Keep Hefty Dividends Safe

August 10 2011 - 7:16AM

Marketwired

With the markets in the midst of a correction, investors are

looking at high yielding dividend plays as safe havens. Companies

in the Oil & Gas sector have posted surging top lines in recent

quarters, leading several explorers to begin boosting dividend

payments. The Bedford Report examines the outlook for companies in

the Shipping Industry and provides investment research on Linn

Energy, LLC (NASDAQ: LINE) and Enerplus Corporation (NYSE: ERF)

(TSX: ERF). Access to the full company reports can be found at:

www.bedfordreport.com/LINE

www.bedfordreport.com/ERF

Oil stocks have taken a tumble over the last week, as crude

prices have plummeted and a report on the services industry raised

new concern that the economy is faltering. The US government's

Department of Energy had revealed that American crude reserves

climbed by 1.0 million barrels in the week ending July 29 --

suggesting weaker demand in the world's biggest crude-consuming

nation.

Greg Priddy, director of global oil at consultancy Eurasia

Group, told The Wall Street Journal that "the evidence accumulating

of very slow growth in the US economy and substantial demand

destruction... the main risk in the crude oil market over the next

quarter will be to the downside."

The Bedford Report releases stock research on the Oil and Gas

Sector so investors can stay ahead of the crowd and make the best

investment decisions to maximize their returns. Take a few minutes

to register with us free at www.bedfordreport.com and get exclusive

access to our numerous analyst reports and industry

newsletters.

The drop in oil prices has been particularly hard on oil

producers, many of which boosted production in recent quarters in

hopes of capitalizing on higher oil prices.

Canada's Enerplus "fortunately" was forced to cut its production

guidance for the remainder of 2011 due to unusually wet weather at

some of its properties. The company forecasted 2011 production of

76,000-78,000 barrels of oil equivalent per day (boe/d), down 2000

boe/d from its prior outlook. Last Friday the company announced

that it earned C$268 million, or C$1.50 a share, in the second

quarter, up from C$76.5 million, or 44 Canadian cents a share, a

year ago. Presently Enerplus pays an annual dividend of $2.20 a

share for a hefty yield of 8.2 percent.

Linn Energy pays an annual dividend of $2.76 a share for a yield

of around 8 percent. Last month Linn Energy posted a quarterly

profit that fell short of market expectations, hurt by lower prices

and a shortfall in June production due to bad weather.

The Bedford Report provides Market Research focused on equities

that offer growth opportunities, value, and strong potential

return. We strive to provide the most up-to-date market activities.

We constantly create research reports and newsletters for our

members. The Bedford Report has not been compensated by any of the

above-mentioned publicly traded companies. The Bedford Report is

compensated by other third party organizations for advertising

services. We act as an independent research portal and are aware

that all investment entails inherent risks. Please view the full

disclaimer at http://www.bedfordreport.com/disclaimer

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: The Bedford Report Email Contact

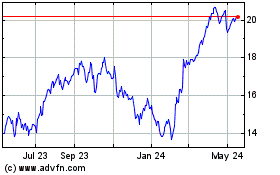

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

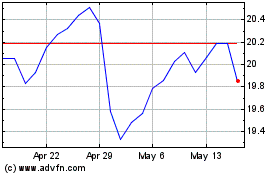

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024