SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report of Foreign Issuer

pursuant to Rule 13-a-16 or 15d-16

of the Securities Exchange

Act of 1934

FOR THE MONTH

OF April 2016

FORM 6-K

COMMISSION FILE NUMBER

1-15150

The Dome Tower

Suite

3000, 333 - 7th Avenue S.W.

Calgary, Alberta

Canada T2P 2Z1

(403) 298-2200

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Indicate by check mark

whether, by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the securities Exchange Act of 1934.

EXHIBIT

INDEX

| EXHIBIT 99.1 - |

|

News Release

Dated April 11, 2016 - Enerplus Announces Sale of Certain Assets in Northwest Alberta |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

ENERPLUS CORPORATION

| BY: |

/s/ |

David A. McCoy |

|

| |

|

David A. McCoy |

|

| |

|

Vice President, General Counsel & Corporate Secretary |

|

| |

|

|

|

DATE: April 11,

2016

Exhibit 99.1

Enerplus Announces Sale of Certain Assets in Northwest Alberta

CALGARY, April 11, 2016 /CNW/ - Enerplus Corporation

("Enerplus" or the "Company") (TSX & NYSE: ERF) announces that it has entered into a definitive agreement

to sell certain non-core assets located in Northwest Alberta, including its Pouce Coupe asset (the "Assets"). The total

cash consideration for the Assets is approximately $95.5 million, subject to closing adjustments, and the transaction is expected

to close in the second quarter of 2016. Enerplus has used its 2016 divestment proceeds, which will total $288.5 million upon the

closing of this divestment, to reduce its outstanding debt, including repurchasing a portion of its senior unsecured notes.

At December 31, 2015 the Assets were estimated to have proved

plus probable reserves of 9.1 million BOE (50% natural gas) with production from the Assets expected to average approximately 2,300

BOE per day in 2016 (50% natural gas, 30% non-operated). Given the higher operating costs and lower project returns relative to

other areas in Enerplus' portfolio, the Assets were considered non-core to the Company's long-term strategy.

The divestment is expected to be accretive on both a production

per debt adjusted share and funds flow per debt adjusted share basis, and have a modest impact on 2016 funds flow.

Enerplus is maintaining its 2016 production guidance range

of 90,000 to 94,000 BOE per day, despite this divestment, as a result of continued strong operational performance.

TD Securities Inc. is acting as exclusive financial advisor

to Enerplus on this transaction.

About Enerplus

Enerplus Corporation is a responsible developer of high quality crude oil and natural gas assets in Canada and the United States,

focused on providing both growth and income to its shareholders.

CURRENCY AND ACCOUNTING PRINCIPLES

All amounts in this news release are stated in Canadian

dollars unless otherwise specified.

BARRELS OF OIL EQUIVALENT

This news release also contains references to "BOE"

(barrels of oil equivalent). Enerplus has adopted the standard of six thousand cubic feet of gas to one barrel of oil (6 Mcf: 1

bbl) when converting natural gas to BOEs. BOEs may be misleading, particularly if used in isolation. The foregoing conversion ratios

are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent a value equivalency

at the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is significantly different

from the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading.

PRESENTATION OF PRODUCTION INFORMATION

Under U.S. GAAP oil and gas sales are generally presented

net of royalties and U.S. industry protocol is to present production volumes net of royalties. Under Canadian industry protocol

oil and gas sales and production volumes are presented on a gross basis before deduction of royalties. In order to continue to

be comparable with our Canadian peer companies, the summary results contained within this news release presents our production

and BOE measures on a before royalty company interest basis. All production volumes and revenues presented herein are reported

on a "company interest" basis, before deduction of Crown and other royalties, plus Enerplus' royalty interest.

FORWARD-LOOKING INFORMATION AND STATEMENTS

Except for the historical and present factual information

contained herein, the matters set forth in this news release, including words such as "expects", "projects",

"plans" and similar expressions, are forward-looking information that represents management of Enerplus' internal projections,

expectations or beliefs concerning, among other things, the proposed sale of certain assets in Northwest Alberta, including anticipated

proceeds therefrom, production and anticipated 2016 funds flow associated therewith, and expected closing thereof. The projections,

estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks and uncertainties,

which may cause Enerplus' actual performance and financial results in future periods to differ materially from any projections

of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include,

among other things, Enerplus' failure to complete the proposed asset dispositions, on the terms and within the timeframe described

herein or at all, and those described in Enerplus' filings with the Canadian and U.S. securities authorities. Accordingly,

holders of Enerplus shares and potential investors are cautioned that events or circumstances could cause results to differ materially

from those predicted.

NON-GAAP MEASURES

In this news release, we use the terms "funds flow"

as a measure to analyze operating performance. "Funds flow" is calculated as net cash generated from operating activities

but before changes in non-cash operating working capital and asset retirement obligation expenditures. Enerplus believes

that, in addition to net earnings and other measures prescribed by U.S. GAAP, the term "funds flow" is a useful supplemental

measure as it provides an indication of the results generated by Enerplus' principal business activities. However, this measure

is not a measure recognized by U.S. GAAP and does not have a standardized meaning prescribed by U.S. GAAP. Therefore, this measure,

as defined by Enerplus, may not be comparable to similar measures presented by other issuers. For reconciliation of this measure

to the most directly comparable measure calculated in accordance with U.S. GAAP, and further information about this measure, see

disclosure under "Non-GAAP Measures" in Enerplus' 2015 annual management's discussion and analysis available at www.enerplus.com.

Follow @EnerplusCorp on Twitter at https://twitter.com/EnerplusCorp.

Ian C. Dundas

President & Chief Executive Officer

Enerplus Corporation

SOURCE Enerplus Corporation

%CIK: 0001126874

For further information: please contact Investor Relations

at 1-800-319-6462 or investorrelations@enerplus.com

CO: Enerplus Corporation

CNW 17:29e 11-APR-16

This regulatory filing also includes additional resources:

ex991.pdf

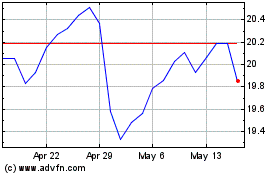

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

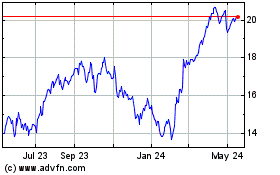

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024