SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report of Foreign Issuer

pursuant to Rule 13-a-16 or 15d-16

of the Securities Exchange

Act of 1934

FOR THE MONTH

OF FEBRUARY 2023

FORM 6-K

COMMISSION FILE NUMBER

1-15150

The Dome Tower

Suite

3000, 333 – 7th Avenue S.W.

Calgary, Alberta

Canada T2P 2Z1

(403) 298-2200

US

Bank Tower

Suite 2200, 950 – 17th Street

Denver, Colorado

United States of

America 80202-2805

(720) 279-5500

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

ENERPLUS CORPORATION

| BY: |

/s/ |

David A. McCoy |

|

| |

|

David A. McCoy |

|

| |

|

Vice President, General Counsel & Corporate Secretary |

|

| |

|

|

|

DATE: February 23, 2023

Exhibit 99.1

Enerplus Announces

2022 Year End Reserves Results

Readers are advised

to review the "Notice Regarding Information Contained in this News Release" at the conclusion of this news release for information

regarding the presentation of the reserves information contained in this news release, including the definitions of, and differences

between, "U.S. Standards" and "Canadian NI 51-101 Standards" used herein.

All amounts in

this news release are stated in United States dollars unless otherwise specified.

CALGARY, AB, Feb. 23,

2023 /CNW/ - Enerplus Corporation ("Enerplus" or the "Company") (TSX: ERF) (NYSE: ERF) today reported year-end

2022 reserves under U.S. Standards and Canadian NI 51-101 Standards.

YEAR END 2022 RESERVES

SUMMARY

U.S. Standards -

after deduction of royalties ("net"), constant prices, U.S. dollars:

- Net total proved reserves were

322.3 MMBOE, a decrease of 5% year-over-year, with the reduction driven by the sale of substantially all of the Company's Canadian assets

in 2022. Excluding reserves changes due to the Canadian asset sales, net total proved reserves increased 2% year-over-year

- Enerplus added 40.8 MMBOE of net

proved reserves in 2022 (including technical revisions and economic factors), replacing 112% of its 2022 net production

- Net proved developed producing

("PDP") finding and development ("F&D") costs were $8.27 per BOE

- Net proved F&D costs were $16.43

per BOE, including future development costs ("FDC")

Canadian NI 51-101

Standards - before deduction of royalties ("gross"), forecast prices, U.S. dollars:

- Gross proved plus probable ("2P")

reserves were 601.1 MMBOE, a decrease of 2% year-over-year, with the reduction driven by the sale of substantially all of the Company's

Canadian assets in 2022. Excluding reserves changes due to the Canadian asset sales, gross 2P reserves increased 3% year-over-year

- Enerplus added 63.3 MMBOE of gross

2P reserves in 2022 (including technical revisions and economic factors), replacing 139% of its 2022 gross production

- Gross PDP F&D costs were $7.15

per BOE

- Gross 2P F&D costs were $17.82

per BOE, including FDC

"Enerplus' reserves

additions and production replacement at competitive costs highlight the sustainability of our business. The Company's deep resource base

in North Dakota continues to support a resilient long-term outlook," said Ian C. Dundas, President and CEO.

YEAR-END RESERVES

EVALUATIONS

Reserves Summary

The following information

sets out Enerplus' net (prepared in accordance with U.S. Standards) and gross and net (prepared in accordance with Canadian NI 51-101

Standards) crude oil, natural gas liquids ("NGLs") and natural gas reserves volumes as at December 31, 2022. Under different

price scenarios, these reserves could vary as a change in price can affect the economic limit associated with a property. For additional

information regarding Enerplus' crude oil, NGLs and natural gas reserves as at December 31, 2022, see Enerplus' Annual Information Form

for the year ended December 31, 2022 (the "AIF") on Enerplus' SEDAR profile at www.sedar.com, and Enerplus' U.S. Form 40-F

for the year ended December 31, 2022 (the "Form 40-F") on EDGAR at www.sec.gov, each of which are anticipated to be filed on

February 23, 2023.

2022 Net Proved

Reserves Summary - U.S. Standards (Constant prices) (1)(2)

| |

Tight Oil

(Mbbls) |

Total Oil

(Mbbls) |

Natural Gas

Liquids

(Mbbls) |

Shale Gas

(MMcf) |

Total

(MBOE) |

| Net |

|

|

|

|

|

| Proved developed producing |

78,342 |

78,342 |

15,993 |

621,563 |

197,928 |

| Proved developed non-producing |

2,468 |

2,468 |

348 |

3,425 |

3,387 |

| Proved undeveloped |

68,144 |

68,144 |

10,758 |

252,480 |

120,982 |

| Total Proved |

148,953 |

148,953 |

27,100 |

877,468 |

322,298 |

| |

| Notes: |

| (1) |

Volumes are calculated in accordance with U.S. Standards, using net reserves (being the Company's working interest share after deduction of royalty interests plus the Company's royalty interests) and constant prices (being the unweighted arithmetic average of the first-day-of the-month price for the applicable product for each of the twelve months in 2022) and costs. For additional information regarding U.S. Standards, see "Notice Regarding Information Contained in this News Release – Presentation of Reserves Information" in this news release. |

| (2) |

Tables may not add due to rounding. |

2022 Gross and Net

Proved plus Probable Reserves Summary - Canadian NI 51-101 Standards (Forecast prices) (1)(2)

| |

Tight Oil

(Mbbls) |

Total Oil

(Mbbls) |

Natural Gas

Liquids

(Mbbls) |

Shale Gas

(MMcf) |

Total

(MBOE) |

| Gross |

|

|

|

|

|

| Proved developed producing |

92,788 |

92,788 |

18,839 |

756,966 |

237,789 |

| Proved developed non-producing |

2,925 |

2,925 |

413 |

4,131 |

4,026 |

| Proved undeveloped |

84,560 |

84,560 |

13,340 |

313,106 |

150,085 |

| Total proved |

180,273 |

180,273 |

32,592 |

1,074,204 |

391,899 |

| Total probable |

136,863 |

136,863 |

23,743 |

291,705 |

209,224 |

| Gross Proved plus Probable |

317,136 |

317,136 |

56,335 |

1,365,908 |

601,123 |

| Net |

|

|

|

|

|

| Proved developed producing |

74,632 |

74,632 |

15,172 |

607,337 |

191,027 |

| Proved developed non-producing |

2,352 |

2,352 |

332 |

3,334 |

3,240 |

| Proved undeveloped |

67,699 |

67,699 |

10,676 |

252,747 |

120,500 |

| Total proved |

144,684 |

144,684 |

26,179 |

863,419 |

314,766 |

| Total probable |

109,661 |

109,661 |

19,036 |

237,802 |

168,331 |

| Net Proved plus Probable |

254,345 |

254,345 |

45,215 |

1,101,221 |

483,097 |

| |

| Notes: |

| (1) |

Volumes are calculated in accordance with Canadian NI 51-101 Standards, using gross reserves (being the Company's working interest share before deduction of royalty interests and without including any of the Company's royalty interests) and net reserves (being the Company's working interest share after deduction of royalty interests plus the Company's royalty interests), forecast prices and escalating costs. For additional information regarding the forecast prices used and Canadian NI 51-101 Standards, see "Price Assumptions Used Under U.S. Standards and Canadian NI 51-101 Standards" and "Notice Regarding Information Contained in this News Release – Presentation of Reserves Information" in this news release. |

| (2) |

Tables may not add due to rounding. |

Reserves Reconciliation

2022 Net Proved

Reserves Reconciliation - U.S. Standards (Constant prices) (1)(2)(3)

| |

Light &

Medium

Oil

(Mbbls)(2) |

Heavy

Oil

(Mbbls)(2) |

Tight

Oil

(Mbbls) |

Total

Crude

Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf) |

Shale

Gas

(MMcf) |

Total

Natural

Gas

(MMcf) |

Total

(MBOE) |

Proved Reserves at

Dec. 31, 2021 |

5,213 |

13,464 |

144,697 |

163,374 |

27,561 |

15,117 |

873,268 |

888,385 |

339,000 |

Purchases of reserves in

place |

- |

- |

231 |

231 |

24 |

- |

143 |

143 |

278 |

| Sales of reserves in place |

(4,502) |

(12,531) |

(1,148) |

(18,181) |

(628) |

(12,955) |

(1,395) |

(14,349) |

(21,200) |

| Discoveries and extensions |

- |

- |

15,554 |

15,554 |

2,430 |

- |

122,762 |

122,762 |

38,444 |

Revisions of previous

estimates |

- |

- |

6,961 |

6,961 |

1,246 |

- |

(34,876) |

(34,876) |

2,394 |

| Improved recovery |

- |

- |

- |

- |

- |

- |

- |

- |

- |

| Production |

(712) |

(933) |

(17,342) |

(18,986) |

(3,534) |

(2,162) |

(82,433) |

(84,596) |

(36,619) |

Proved Reserves at

Dec. 31, 2022 |

- |

- |

148,953 |

148,953 |

27,100 |

- |

877,468 |

877,468 |

322,298 |

| |

| Notes: |

| (1) |

Volumes are calculated in accordance with U.S. Standards, using net reserves (being the Company's working interest share after deduction of royalty interests plus the Company's royalty interests) and constant prices (being the unweighted arithmetic average of the first-day-of the-month price for the applicable product for each of the twelve months in 2022) and costs. For additional information regarding U.S. Standards, see "Notice Regarding Information Contained in this News Release – Presentation of Reserves Information" at the conclusion of this news release. |

| (2) |

Substantially all Canadian assets were sold during 2022. |

| (3) |

Tables may not add due to rounding. |

2022 Net Proved

Reserves Reconciliation - Canadian NI 51-101 Standards (Forecast prices) (1)(2)(3)

| |

Light &

Medium

Oil

(Mbbls)(2) |

Heavy

Oil

(Mbbls)(2) |

Tight

Oil

(Mbbls) |

Total

Crude

Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf) (2) |

Shale

Gas

(MMcf) |

Total

Natural

Gas

(MMcf) |

Total

(MBOE) |

Proved Reserves at

Dec. 31, 2021 |

5,173 |

13,255 |

143,365 |

161,793 |

27,236 |

14,648 |

861,939 |

876,586 |

335,127 |

| Acquisitions |

- |

- |

231 |

231 |

24 |

- |

143 |

143 |

278 |

| Dispositions |

(4,461) |

(12,322) |

(1,145) |

(17,929) |

(605) |

(12,485) |

(1,368) |

(13,853) |

(20,843) |

| Discoveries |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Extensions & improved

recovery |

- |

- |

15,463 |

15,463 |

2,414 |

- |

54,910 |

54,910 |

27,029 |

| Economic factors |

- |

- |

3,998 |

3,998 |

809 |

- |

(356) |

(356) |

4,748 |

| Technical revisions |

- |

- |

114 |

114 |

(165) |

- |

30,584 |

30,584 |

5,046 |

| Production |

(712) |

(933) |

(17,342) |

(18,986) |

(3,534) |

(2,162) |

(82,433) |

(84,596) |

(36,619) |

Proved Reserves at

Dec. 31, 2022 |

- |

- |

144,684 |

144,684 |

26,179 |

- |

863,419 |

863,419 |

314,766 |

| |

| Notes: |

| (1) |

Volumes are calculated in accordance with Canadian NI 51-101 Standards, using net reserves (being the Company's working interest share after deduction of royalty interests), forecast prices and escalating costs. For additional information regarding the forecast prices used and Canadian NI 51-101 Standards, see "Notice Regarding Information Contained in this News Release – Presentation of Reserves Information" at the conclusion of this news release. |

| (2) |

Substantially all Canadian assets were sold during 2022. |

| (3) |

Tables may not add due to rounding. |

2022 Gross Proved

and Proved plus Probable Reserves Reconciliations - Canadian NI 51-101 Standards (Forecast prices) (1)(2)(3)

| |

Light &

Medium

Oil

(Mbbls)(2) |

Heavy Oil

(Mbbls)(2) |

Tight Oil

(Mbbls) |

Total

Crude Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf)(2) |

Shale

Gas

(MMcf) |

Total

Natural

Gas

(MMcf) |

Total

(MBOE) |

Proved Reserves at

Dec. 31, 2021 |

6,245 |

15,612 |

178,600 |

200,457 |

33,897 |

15,196 |

1,070,500 |

1,085,696 |

415,304 |

| Acquisitions |

- |

- |

290 |

290 |

31 |

- |

148 |

148 |

346 |

| Dispositions |

(5,267) |

(14,401) |

(1,432) |

(21,100) |

(728) |

(13,090) |

(1,655) |

(14,745) |

(24,286) |

| Discoveries |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Extensions & improved

recovery |

- |

- |

19,235 |

19,235 |

3,002 |

- |

67,503 |

67,503 |

33,488 |

| Economic factors |

- |

- |

4,963 |

4,963 |

1,005 |

- |

5,924 |

5,924 |

6,956 |

| Technical revisions |

- |

- |

165 |

165 |

(220) |

- |

34,560 |

34,560 |

5,705 |

| Production |

(978) |

(1,211) |

(21,549) |

(23,737) |

(4,395) |

(2,106) |

(102,776) |

(104,882) |

(45,613) |

Proved Reserves at

Dec. 31, 2022 |

- |

- |

180,273 |

180,273 |

32,592 |

- |

1,074,204 |

1,074,204 |

391,899 |

| |

Light &

Medium

Oil

(Mbbls)(2) |

Heavy

Oil

(Mbbls)(2) |

Tight Oil

(Mbbls) |

Total

Crude

Oil (Mbbls) |

Natural

Gas Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf)(2) |

Shale

Gas

(MMcf) |

Total

Natural

Gas

(MMcf) |

Total

(MBOE) |

Proved plus Probable

Reserves at Dec. 31, 2021 |

8,162 |

20,691 |

299,346 |

328,199 |

56,221 |

19,677 |

1,367,927 |

1,387,604 |

615,688 |

| Acquisitions |

- |

- |

363 |

363 |

38 |

- |

183 |

183 |

431 |

| Dispositions |

(7,184) |

(19,480) |

(1,782) |

(28,447) |

(996) |

(17,571) |

(2,156) |

(19,727) |

(32,731) |

| Discoveries |

- |

- |

- |

- |

- |

- |

- |

- |

- |

Extensions & improved

recovery |

- |

- |

43,451 |

43,451 |

7,018 |

- |

137,336 |

137,336 |

73,358 |

| Economic factors |

- |

- |

7,094 |

7,094 |

1,414 |

- |

8,203 |

8,203 |

9,875 |

| Technical revisions |

- |

- |

(9,786) |

(9,786) |

(2,965) |

- |

(42,808) |

(42,808) |

(19,886) |

| Production |

(978) |

(1,211) |

(21,549) |

(23,737) |

(4,395) |

(2,106) |

(102,776) |

(104,882) |

(45,613) |

Proved plus Probable

Reserves at Dec. 31, 2022 |

- |

- |

317,136 |

317,136 |

56,335 |

- |

1,365,908 |

1,365,908 |

601,123 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Notes: |

| (1) |

Volumes are calculated in accordance with Canadian NI 51-101 Standards, using gross reserves (being the Company's working interest share before deduction of royalty interests), forecast prices and escalating costs. For additional information regarding the forecast prices used and Canadian NI 51-101 Standards, see "Notice Regarding Information Contained in this News Release – Presentation of Reserves Information" at the conclusion of this news release. |

| (2) |

Substantially all Canadian assets were sold during 2022. |

| (3) |

Tables may not add due to rounding. |

Price Assumptions

Used Under U.S. Standards and Canadian NI 51-101 Standards

Constant prices used under

U.S. Standards(2) |

|

|

Forecast prices and cost escalation used under

Canadian NI 51-101 Standards(3) |

| Year |

WTI

Crude Oil

US$/bbl |

U.S. Henry Hub Gas Price

US$/MMBtu |

Inflation Rate

%/year |

|

|

|

WTI

Crude Oil

US$/bbl |

U.S. Henry Hub Gas Price

US$/MMBtu |

Inflation Rate

%/year |

| 2023+ |

94.14 |

6.25 |

n/a |

|

|

2023 |

80.33 |

4.74 |

0.0 |

| |

|

|

|

|

|

2024 |

78.50 |

4.50 |

2.3 |

| |

|

|

|

|

|

2025 |

76.95 |

4.31 |

2.0 |

| |

|

|

|

|

|

2026 |

77.61 |

4.40 |

2.0 |

| |

|

|

|

|

|

2027 |

79.16 |

4.49 |

2.0 |

| |

|

|

|

|

|

2028 |

80.74 |

4.58 |

2.0 |

| |

|

|

|

|

|

2029 |

82.36 |

4.67 |

2.0 |

| |

|

|

|

|

|

2030 |

84.00 |

4.76 |

2.0 |

| |

|

|

|

|

|

2031 |

85.69 |

4.86 |

2.0 |

| |

|

|

|

|

|

2032 |

87.40 |

4.95 |

2.0 |

| |

|

|

|

|

|

2033 |

89.15 |

5.05 |

2.0 |

| |

|

|

|

|

|

2034 |

90.93 |

5.15 |

2.0 |

| |

|

|

|

|

|

2035 |

92.75 |

5.26 |

2.0 |

| |

|

|

|

|

|

2036 |

94.61 |

5.36 |

2.0 |

| |

|

|

|

|

|

2037 |

96.50 |

5.47 |

2.0 |

| |

|

|

|

|

|

Thereafter |

(1) |

(1) |

2.0 |

| |

| Notes: |

| (1) |

Escalation is approximately 2% per year thereafter. |

| (2) |

Represents the unweighted arithmetic average of the first-day-of the-month price for that product for each of the twelve months in 2022. Under the U.S. Standards costs are not inflated. |

| (3) |

Represents the average commodity price forecasts and inflation rates of McDaniel & Associates Consultants Ltd, GLJ Ltd. and Sproule Associates Limited as of January 1, 2023, and assume no legislative or regulatory amendments. |

Future Development

Costs

Changes in forecast

FDC occur annually as a result of development activities, acquisition and divestment activities and capital cost estimates that reflect

the evaluators' best estimate of the capital required to bring the proved and proved plus probable reserves on production. The aggregate

of the exploration and development costs incurred in the most recent year and the change during the year in estimated FDC generally reflect

the total finding and development costs related to reserves additions for that year.

The following is a

summary of the estimated FDC required to bring the total proved and proved plus probable reserves on production:

| |

U.S. Standards(1)(2) |

Canadian NI 51-101 Standards(1)(2) |

| Future Development Costs |

Proved

Reserves |

Proved

Reserves |

Proved Plus

Probable Reserves |

| (US$ millions) |

|

|

|

| 2023 |

484 |

484 |

485 |

| 2024 |

344 |

347 |

347 |

| 2025 |

457 |

472 |

472 |

| 2026 |

236 |

248 |

316 |

| 2027 |

1 |

1 |

463 |

| 2028 |

0 |

0 |

379 |

| Remainder |

- |

0 |

574 |

| Total FDC Undiscounted |

1,523 |

1,553 |

3,038 |

| Total FDC Discounted at 10% |

1,297 |

1,320 |

2,207 |

| |

| Note: |

| (1) |

FDC under U.S. Standards are not inflated. FDC under Canadian NI 51-101 Standards are inflated as per the price assumption table in the section above. |

| (2) |

Tables may not add due to rounding. |

Electronic copies of

the AIF and Form 40-F, along with Enerplus' 2022 MD&A and Financial Statements and other public information including investor presentations,

are available on the Company's website at www.enerplus.com. For further information, please contact Investor Relations at 1-800-319-6462

or email investorrelations@enerplus.com.

Follow @EnerplusCorp

on Twitter at https://twitter.com/EnerplusCorp.

About Enerplus

Enerplus is an independent

North American oil and gas exploration and production company focused on creating long-term value for its shareholders through a disciplined,

returns-based capital allocation strategy and a commitment to safe, responsible operations. For more information, visit the Company's

website at www.enerplus.com.

NOTICE REGARDING

INFORMATION CONTAINED IN THIS NEWS RELEASE

Barrels of Oil

Equivalent

This news release

also contains references to "BOE" (barrels of oil equivalent), "MBOE" (one thousand barrels of oil equivalent), and

"MMBOE" (one million barrels of oil equivalent). Enerplus has adopted the standard of six thousand cubic feet of gas to one

barrel of oil (6 Mcf: 1 bbl) when converting natural gas to BOEs. BOE, MBOE and MMBOE may be misleading, particularly if used in

isolation. The foregoing conversion ratios are based on an energy equivalency conversion method primarily applicable at the burner

tip and do not represent a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared

to natural gas is significantly different from the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading.

Presentation

of Reserves and Other Oil and Gas Information

All of the Company's

reserves have been evaluated in accordance with Canadian reserve evaluation standards under National Instrument 51-101 – Standards

of Disclosure for Oil and Gas Activities ("Canadian NI 51-101 Standards"). Independent reserves evaluations have been conducted

on properties comprising 100% of the net present value (discounted at 10%, before tax, using January 1, 2023 forecast prices and costs)

of the Company's total proved plus probable reserves. McDaniel & Associates Consultants Ltd. ("McDaniel"), an independent

petroleum consulting firm based in Calgary, Alberta, has evaluated all of the proved plus probable reserves associated with the Company's

properties located in North Dakota and Colorado. Netherland, Sewell & Associates, Inc. ("NSAI"), independent petroleum

consultants based in Dallas, Texas, has evaluated all of the Company's reserves associated with the Company's properties in Pennsylvania

in accordance with Canadian NI 51-101 Standards. For consistency in the Company's reserves reporting, NSAI also used the average commodity

price forecasts and inflation rates of McDaniel, GLJ Ltd. and Sproule Associates Limited, independent petroleum consultants, as of January

1, 2023 to prepare its report.

The Company has

also presented certain reserves information effective December 31, 2022 in accordance with the provisions of the Financial Accounting

Standards Board's ASC Topic 932 Extractive Activities – Oil and Gas ("ASC 932"), which generally utilize definitions

and estimations of proved reserves that are consistent with Rule 4-10 of Regulation S-X promulgated by the U.S. Securities and Exchange

Commission ("SEC Rules"), but does not necessarily include all of the disclosure required by the SEC disclosure standards set

forth in Subpart 1200 of Regulation S-K (collectively, the "U.S. Standards"). Concurrent to the evaluation of the Company's

Canadian NI 51-101 Standards reserves, McDaniel and NSAI prepared and reviewed estimates of the Company's reserves under the U.S. Standards.

The practice of preparing production and reserves data under Canadian NI 51-101 Standards differs from the U.S. Standards. The

primary differences between the two reporting requirements include:

- the Canadian NI 51-101 Standards

require disclosure of proved and probable reserves, while the U.S. Standards require disclosure of only proved reserves;

- the Canadian NI 51-101 Standards

require the use of forecast prices in the estimation of reserves, while the U.S. Standards require the use of 12-month average trailing

historical prices, which are held constant;

- the Canadian NI 51-101 Standards

require disclosure of reserves on a gross (before royalties) and net (after royalties) basis, while the U.S. Standards require disclosure

on a net (after royalties) basis;

- the Canadian NI 51-101 Standards

require disclosure of production on a gross (before royalties) basis, while the U.S. Standards require disclosure on a net (after royalties)

basis;

- the Canadian NI 51-101 Standards

require that reserves and other data be reported on a more granular product type basis than required by the U.S. Standards;

- the Canadian NI 51-101 Standards

require that proved undeveloped reserves be reviewed annually for retention or reclassification if development has not proceeded as previously

planned, while the U.S. Standards specify a five-year limit after initial booking for the development of proved undeveloped reserves;

and

- The SEC prohibits disclosure

of oil and gas resources in SEC filings, including contingent resources, whereas Canadian securities regulatory authorities allow disclosure

of oil and gas resources. Resources are different than, and should not be construed as, reserves.

F&D costs

presented in this news release are calculated (i) in the case of F&D costs for proved developed producing reserves, by dividing the

sum of the exploration and development costs incurred in the year, by the additions to proved developed producing reserves in the year,

(ii) in the case of F&D costs for proved reserves, by dividing the sum of exploration and development costs incurred in the year

plus the change in estimated future development costs in the year, by the additions to proved reserves in the year, and (iii) in the

case of F&D costs for proved plus probable reserves, by dividing the sum of exploration and development costs incurred in the year

plus the change in estimated future development costs in the year, by the additions to proved plus probable reserves in the year. The

aggregate of the exploration and development costs incurred in the most recent financial year and the change during that year in estimated

future development costs generally reflect total finding and development costs related to its reserves additions for that year. F&D

costs are presented in U.S. dollars per net of gross BOE, as specified.

Complete disclosure

of our oil and gas reserves and other oil and gas information presented in accordance with Canadian NI 51-101 Standards , as well as

supplemental information presented in accordance with U.S. Standards, is contained within our AIF, which is available on our website

at www.enerplus.com and under our SEDAR profile at www.sedar.com. Additionally, our AIF forms part of our Form 40-F that

is filed with the U.S. Securities and Exchange Commission and is available on EDGAR at www.sec.gov. Readers are also urged to review

the Management's Discussion & Analysis and audited financial statements for the year ended December 31, 2022 filed on SEDAR and as

part of our Form 40-F filed on EDGAR concurrently with this news release for more complete disclosure on our operations.

All references to

"crude oil" in this news release include light and medium crude oil, heavy oil and tight oil on a combined basis. All references

to "natural gas" in this news release include conventional natural gas and shale gas on a combined basis.

FORWARD-LOOKING

INFORMATION AND STATEMENTS

This news release

contains certain forward-looking information and forward-looking statements within the meaning of applicable securities laws ("forward-looking

information"). The use of any of the words "anticipate", "estimate", "believes" and similar expressions

are intended to identify forward-looking information. In particular, but without limiting the foregoing, this news release contains forward-looking

information pertaining to the following: the quantity of the Company's oil and gas reserves; forecast oil and natural gas prices in 2023

and in the future; and estimated future FDC. Additionally, statements relating to "reserves" are also deemed to be forward-looking

information, as they involve the implied assessment, based on certain estimates and assumptions, that the reserves described exist in

the quantities predicted or estimated and that the reserves can be profitably produced in the future.

The forward-looking

information contained in this news release reflects several material factors, expectations and assumptions including, without limitation:

that we will conduct our operations and achieve results of operations as anticipated; that our development plans will achieve the expected

results; that lack of adequate infrastructure will not result in curtailment of production and/or reduced realized prices beyond our

current expectations; current commodity prices, differentials and cost assumptions; the general continuance of current or, where applicable,

assumed industry conditions; the continuation of assumed tax, royalty and regulatory regimes; the accuracy of the estimates of our reserve

and contingent resource volumes; and the availability of third party services. We believe the material factors, expectations and assumptions

reflected in the forward-looking information are reasonable but no assurance can be given that these factors, expectations and assumptions

will prove to be correct.

The forward-looking

information included in this news release is not a guarantee of future performance and should not be unduly relied upon. Such information

involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those

anticipated in such forward-looking information including, without limitation: decreases in commodity prices or volatility in commodity

prices; changes in realized prices of Enerplus' products from those currently anticipated; changes in the demand for or supply of our

products, including global energy demand and including as a result of ongoing disruptions to global supply chains; unanticipated operating

results, results from our capital spending activities or production declines; curtailment of our production due to low realized prices

or lack of adequate infrastructure; changes in tax or environmental laws, royalty rates or other regulatory matters; inaccurate estimation

of our oil and gas reserve and contingent resource volumes; increased costs; reliance on industry partners and third party service providers;

and certain other risks detailed from time to time in our public disclosure documents (including, without limitation, those risks and

contingencies described under "Risk Factors and Risk Management" in Enerplus' 2022 MD&A, AIF and in our other public filings).

The forward-looking

information contained in this press release speaks only as of the date of this press release, and we do not assume any obligation to

publicly update or revise such forward-looking information to reflect new events or circumstances, except as may be required pursuant

to applicable laws.

SOURCE Enerplus Corporation

View original content:

http://www.newswire.ca/en/releases/archive/February2023/23/c3236.html

%CIK: 0001126874

For further information: Investor

Contacts: Drew Mair, 403-298-1707, Krista Norlin, 403-298-4304

CO: Enerplus Corporation

CNW 17:00e 23-FEB-23

This regulatory filing also includes additional resources:

ex991.pdf

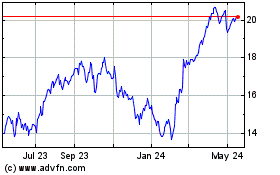

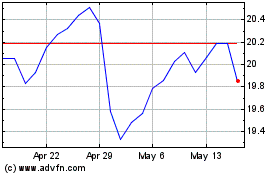

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024