UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-33153

ENDEAVOUR SILVER CORP.

(Translation of registrant's name into English)

#1130-609 Granville Street

Vancouver, British Columbia, Canada V7Y 1G5

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ ] Form 20-F [ x ] Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Incorporated by Reference

Exhibits 99.1 and 99.2 to this Form 6-K of Endeavour Silver Corp. (the "Company") are hereby incorporated by reference as exhibits to the Registration Statement on Form F-10 (File No. 333-272755) of the Company, as amended or supplemented.

SUBMITTED HEREWITH

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Endeavour Silver Corp. |

| |

(Registrant) |

| |

|

|

| Date: November 7, 2023 |

By: |

/s/ Daniel Dickson |

| |

|

Daniel Dickson |

| |

Title: |

CEO |

ENDEAVOUR SILVER CORP.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(unaudited - prepared by management)

(expressed in thousands of US dollars)

| |

|

|

|

|

|

|

|

| |

|

|

September 30, |

|

|

December 31, |

|

| |

Notes |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

40,957 |

|

$ |

83,391 |

|

| Other investments |

4 |

|

6,192 |

|

|

8,647 |

|

| Accounts and other receivables |

5 |

|

16,664 |

|

|

13,136 |

|

| Income tax receivable |

|

|

1,264 |

|

|

4,024 |

|

| Inventories |

6 |

|

27,601 |

|

|

19,184 |

|

| Prepaids |

|

|

37,508 |

|

|

16,951 |

|

| Loans receivable |

8 (c) |

|

1,250 |

|

|

1,000 |

|

| Total current assets |

|

|

131,436 |

|

|

146,333 |

|

| |

|

|

|

|

|

|

|

| Non-current deposits |

|

|

717 |

|

|

565 |

|

| Non-current income tax receivable |

|

|

3,570 |

|

|

3,570 |

|

| Non-current other investments |

4 |

|

- |

|

|

1,388 |

|

| Non-current IVA receivable |

5 |

|

17,476 |

|

|

10,154 |

|

| Non-current loans receivable |

8 (c) |

|

2,273 |

|

|

2,729 |

|

| Right-of-use leased assets |

|

|

819 |

|

|

806 |

|

| Mineral properties, plant and equipment |

8, 9 |

|

276,864 |

|

|

233,892 |

|

| Total assets |

|

$ |

433,155 |

|

$ |

399,437 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

43,416 |

|

$ |

39,831 |

|

| Income taxes payable |

|

|

7,296 |

|

|

6,616 |

|

| Loans payable |

9 |

|

4,339 |

|

|

6,041 |

|

| Lease liabilities |

|

|

436 |

|

|

261 |

|

| Total current liabilities |

|

|

55,487 |

|

|

52,749 |

|

| |

|

|

|

|

|

|

|

| Loans payable |

9 |

|

5,500 |

|

|

8,469 |

|

| Lease liabilities |

|

|

678 |

|

|

812 |

|

| Provision for reclamation and rehabilitation |

|

|

9,582 |

|

|

7,601 |

|

| Deferred income tax liability |

|

|

16,273 |

|

|

12,944 |

|

| Other non-current liabilities |

|

|

1,016 |

|

|

968 |

|

| Total liabilities |

|

|

88,536 |

|

|

83,543 |

|

| |

|

|

|

|

|

|

|

| Shareholders' equity |

|

|

|

|

|

|

|

| Common shares, unlimited shares authorized, no par value, issued, issuable |

|

|

|

|

|

|

| and outstanding 199,700,826 shares (Dec 31, 2022 - 189,995,563 shares) |

Page 4 |

|

684,736 |

|

|

657,866 |

|

| Contributed surplus |

Page 4 |

|

4,597 |

|

|

6,115 |

|

| Retained earnings (deficit) |

Page 4 |

|

(344,714 |

) |

|

(348,087 |

) |

| Total shareholders' equity |

|

|

344,619 |

|

|

315,894 |

|

| Total liabilities and shareholders' equity |

|

$ |

433,155 |

|

$ |

399,437 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

Approved on behalf of the Board:

| /s/ Margaret Beck |

/s/ Daniel Dickson |

| ________________________________________ |

________________________________________ |

| Director |

Director |

ENDEAVOUR SILVER CORP.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF COMPREHENSIVE EARNINGS (LOSS)

(unaudited - prepared by management)

(expressed in thousands of US dollars, except for shares and per share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three months ended |

|

|

Nine months ended |

|

| |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

Notes |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

11 |

$ |

49,432 |

|

$ |

39,649 |

|

$ |

154,964 |

|

$ |

128,171 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Direct production costs |

|

|

34,020 |

|

|

24,510 |

|

|

86,014 |

|

|

71,059 |

|

| Royalties |

|

|

4,821 |

|

|

2,821 |

|

|

17,105 |

|

|

9,332 |

|

| Share-based payments |

10 (b)(c) |

|

44 |

|

|

113 |

|

|

(118 |

) |

|

353 |

|

| Depreciation, depletion and amortization |

|

|

7,855 |

|

|

5,753 |

|

|

20,704 |

|

|

16,234 |

|

| Write down of inventory to net realizable value |

6 |

|

- |

|

|

1,323 |

|

|

- |

|

|

1,323 |

|

| |

|

|

46,740 |

|

|

34,520 |

|

|

123,705 |

|

|

98,301 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mine operating earnings |

|

|

2,692 |

|

|

5,129 |

|

|

31,259 |

|

|

29,870 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exploration and evaluation |

12 |

|

4,155 |

|

|

4,023 |

|

|

12,678 |

|

|

11,023 |

|

| General and administrative |

13 |

|

2,358 |

|

|

2,201 |

|

|

9,633 |

|

|

7,846 |

|

| Care and maintenance costs |

|

|

- |

|

|

203 |

|

|

- |

|

|

582 |

|

| Write off of mineral properties |

8 (e) |

|

- |

|

|

- |

|

|

435 |

|

|

500 |

|

| |

|

|

6,513 |

|

|

6,427 |

|

|

22,746 |

|

|

19,951 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating earnings (loss) |

|

|

(3,821 |

) |

|

(1,298 |

) |

|

8,513 |

|

|

9,919 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Finance costs |

|

|

316 |

|

|

311 |

|

|

1,090 |

|

|

945 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange gain (loss) |

|

|

(418 |

) |

|

841 |

|

|

3,326 |

|

|

1,363 |

|

| Gain on asset disposal |

8(f) |

|

6,992 |

|

|

2,780 |

|

|

7,059 |

|

|

2,780 |

|

| Investment and other |

|

|

(1,627 |

) |

|

(272 |

) |

|

(267 |

) |

|

(1,324 |

) |

| |

|

|

4,947 |

|

|

3,349 |

|

|

10,118 |

|

|

2,819 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

810 |

|

|

1,740 |

|

|

17,541 |

|

|

11,793 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income tax expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current income tax expense |

|

|

2,250 |

|

|

1,186 |

|

|

11,137 |

|

|

3,526 |

|

| Deferred income tax expense |

|

|

888 |

|

|

2,053 |

|

|

3,330 |

|

|

10,027 |

|

| |

|

|

3,138 |

|

|

3,239 |

|

|

14,467 |

|

|

13,553 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) and comprehensive earnings |

|

$ |

(2,328 |

) |

$ |

(1,499 |

) |

$ |

3,074 |

|

$ |

(1,760 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss) per share |

|

$ |

(0.01 |

) |

$ |

(0.01 |

) |

$ |

0.02 |

|

$ |

(0.01 |

) |

| Diluted earnings (loss) per share |

10(f) |

$ |

(0.01 |

) |

$ |

(0.01 |

) |

$ |

0.02 |

|

$ |

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic weighted average number of shares outstanding |

|

|

194,249,283 |

|

|

189,241,367 |

|

|

192,003,752 |

|

|

180,655,842 |

|

| Diluted weighted average number of shares outstanding |

10(f) |

|

194,249,283 |

|

|

189,241,367 |

|

|

193,875,315 |

|

|

180,655,842 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

ENDEAVOUR SILVER CORP.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(unaudited - prepared by management)

(expressed in thousands of US dollars, except share amounts)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Notes |

|

Number of shares |

|

|

Share

Capital |

|

|

Contributed

Surplus |

|

|

Retained

Earnings (Deficit) |

|

|

Total

Shareholders'

Equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

|

|

170,537,307 |

|

$ |

585,406 |

|

$ |

6,331 |

|

$ |

(354,330 |

) |

$ |

237,407 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public equity offerings, net of issuance costs |

10 (a) |

|

9,293,150 |

|

|

43,096 |

|

|

- |

|

|

- |

|

|

43,096 |

|

| Exercise of options |

10 (b) |

|

563,200 |

|

|

2,364 |

|

|

(766 |

) |

|

- |

|

|

1,598 |

|

| Settlement of performance and deferred share units |

10 (c) |

|

1,014,999 |

|

|

1,361 |

|

|

(3,264 |

) |

|

- |

|

|

(1,903 |

) |

| Issued on acquisition of mineral properties |

8 (c) |

|

8,577,380 |

|

|

25,589 |

|

|

- |

|

|

- |

|

|

25,589 |

|

| Issued for deferred share units |

10 (c) |

|

3,527 |

|

|

17 |

|

|

(17 |

) |

|

- |

|

|

- |

|

| Share-based compensation |

10 (b)(c) |

|

- |

|

|

- |

|

|

3,259 |

|

|

- |

|

|

3,259 |

|

| Loss for the period |

|

|

- |

|

|

- |

|

|

- |

|

|

(1,760 |

) |

|

(1,760 |

) |

| Balance at September 30, 2022 |

|

|

189,989,563 |

|

$ |

657,833 |

|

$ |

5,543 |

|

$ |

(356,090 |

) |

$ |

307,286 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public equity offerings, net of issuance costs |

10 (a) |

|

- |

|

|

20 |

|

|

- |

|

|

- |

|

|

20 |

|

| Exercise of options |

10 (b) |

|

6,000 |

|

|

13 |

|

|

(4 |

) |

|

- |

|

|

9 |

|

| Share-based compensation |

10 (b)(c) |

|

- |

|

|

- |

|

|

618 |

|

|

- |

|

|

618 |

|

| Canceled options |

10 (b) |

|

- |

|

|

- |

|

|

(42 |

) |

|

42 |

|

|

- |

|

| Earnings for the period |

|

|

- |

|

|

- |

|

|

- |

|

|

7,961 |

|

|

7,961 |

|

| Balance at December 31, 2022 |

|

|

189,995,563 |

|

$ |

657,866 |

|

$ |

6,115 |

|

$ |

(348,087 |

) |

$ |

315,894 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Public equity offerings, net of issuance costs |

10 (a) |

|

8,195,527 |

|

|

22,707 |

|

|

- |

|

|

- |

|

|

22,707 |

|

| Exercise of options |

10 (b) |

|

1,097,900 |

|

|

3,758 |

|

|

(1,305 |

) |

|

- |

|

|

2,453 |

|

| Settlement of performance and deferred share units |

10 (c) |

|

411,836 |

|

|

405 |

|

|

(2,817 |

) |

|

- |

|

|

(2,412 |

) |

| Share-based compensation |

10 (b)(c) |

|

- |

|

|

- |

|

|

2,903 |

|

|

- |

|

|

2,903 |

|

| Canceled options |

10 (b) |

|

- |

|

|

- |

|

|

(299 |

) |

|

299 |

|

|

- |

|

| Earnings for the period |

|

|

- |

|

|

- |

|

|

- |

|

|

3,074 |

|

|

3,074 |

|

| Balance at September 30, 2023 |

|

|

199,700,826 |

|

$ |

684,736 |

|

$ |

4,597 |

|

$ |

(344,714 |

) |

$ |

344,619 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

ENDEAVOUR SILVER CORP.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(unaudited - prepared by management)

(expressed in thousands of US dollars)

| |

|

|

|

|

|

|

|

| |

|

|

Three months ended |

|

|

Nine months ended |

|

| |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

Notes |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) for the period |

|

$ |

(2,328 |

) |

$ |

(1,499 |

) |

$ |

3,074 |

|

$ |

(1,760 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items not affecting cash: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share-based compensation |

10 (b)(c) |

|

864 |

|

|

760 |

|

|

2,904 |

|

|

3,259 |

|

| Depreciation, depletion and amortization |

8 |

|

9,067 |

|

|

6,023 |

|

|

22,659 |

|

|

16,809 |

|

| Write off of exploration properties |

8 |

|

- |

|

|

- |

|

|

435 |

|

|

500 |

|

| Deferred income tax expense |

|

|

888 |

|

|

2,053 |

|

|

3,330 |

|

|

10,027 |

|

| Unrealized foreign exchange loss (gain) |

|

|

(409 |

) |

|

89 |

|

|

1,205 |

|

|

(131 |

) |

| Finance costs |

|

|

316 |

|

|

312 |

|

|

1,090 |

|

|

946 |

|

| Accretion of loans receivable |

|

|

(87 |

) |

|

- |

|

|

(294 |

) |

|

- |

|

| Write down of inventory to net realizable value |

|

|

- |

|

|

1,323 |

|

|

- |

|

|

1,323 |

|

| Gain on asset disposal |

|

|

(6,992 |

) |

|

(2,826 |

) |

|

(7,059 |

) |

|

(2,780 |

) |

| Loss on other investments |

4 |

|

1,944 |

|

|

1,097 |

|

|

1,997 |

|

|

3,366 |

|

| Performance and deferred share units settled in cash |

|

|

- |

|

|

- |

|

|

(2,118 |

) |

|

- |

|

| Net changes in non-cash working capital |

14 |

|

(2,650 |

) |

|

85 |

|

|

(22,158 |

) |

|

(20,957 |

) |

| Cash from operating activities |

|

|

613 |

|

|

7,417 |

|

|

5,065 |

|

|

10,602 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds on disposal of property, plant and equipment |

8(f) |

|

7,567 |

|

|

250 |

|

|

7,567 |

|

|

332 |

|

| Mineral properties, plant and equipment |

8 |

|

(31,736 |

) |

|

(53,046 |

) |

|

(76,317 |

) |

|

(81,494 |

) |

| Purchase of other investments |

|

|

- |

|

|

- |

|

|

- |

|

|

(2,119 |

) |

| Proceeds from disposal of other investments |

4 |

|

- |

|

|

- |

|

|

1,846 |

|

|

- |

|

| Redemption of (investment in) non-current deposits |

|

|

(57 |

) |

|

30 |

|

|

(152 |

) |

|

34 |

|

| Cash used in investing activities |

|

|

(24,226 |

) |

|

(52,766 |

) |

|

(67,056 |

) |

|

(83,247 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repayment of loans payable |

9 |

|

(1,522 |

) |

|

(1,268 |

) |

|

(4,671 |

) |

|

(3,565 |

) |

| Repayment of lease liabilities |

|

|

(126 |

) |

|

(55 |

) |

|

(275 |

) |

|

(161 |

) |

| Interest paid |

9 |

|

(206 |

) |

|

(204 |

) |

|

(659 |

) |

|

(585 |

) |

| Public equity offerings |

10 (a) |

|

23,390 |

|

|

- |

|

|

23,390 |

|

|

46,001 |

|

| Exercise of options |

10 (b) |

|

- |

|

|

20 |

|

|

2,453 |

|

|

1,598 |

|

| Proceeds from loans receivable |

8(c) |

|

- |

|

|

- |

|

|

500 |

|

|

- |

|

| Share issuance costs |

10 (a) |

|

(683 |

) |

|

(93 |

) |

|

(683 |

) |

|

(2,905 |

) |

| Performance and deferred share units withholding tax settlement |

|

|

- |

|

|

- |

|

|

(294 |

) |

|

(1,903 |

) |

| Cash from (used in) financing activities |

|

|

20,853 |

|

|

(1,600 |

) |

|

19,761 |

|

|

38,480 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Effect of exchange rate change on cash and cash equivalents |

|

|

213 |

|

|

(84 |

) |

|

(204 |

) |

|

55 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Increase (decrease) in cash and cash equivalents |

|

|

(2,760 |

) |

|

(46,949 |

) |

|

(42,230 |

) |

|

(34,165 |

) |

| Cash and cash equivalents, beginning of the period |

|

|

43,504 |

|

|

116,226 |

|

|

83,391 |

|

|

103,303 |

|

| Cash and cash equivalents, end of the period |

|

$ |

40,957 |

|

$ |

69,193 |

|

$ |

40,957 |

|

$ |

69,193 |

|

Supplemental cash flow information (Note 14)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

1. CORPORATE INFORMATION

Endeavour Silver Corp. (the "Company" or "Endeavour Silver") is a corporation governed by the Business Corporations Act (British Columbia, Canada). The Company is engaged in silver mining in Mexico and related activities including acquisition, exploration, development, extraction, processing, refining and reclamation. The Company is also engaged in exploration activities in Chile and United States. The address of the registered office is #1130 - 609 Granville Street, Vancouver, B.C., V7Y 1G5.

2. BASIS OF PRESENTATION

These condensed consolidated interim financial statements have been prepared in accordance with IAS 34 Interim Financial Reporting and do not include all of the information required for full annual financial statements and should be read in conjunction with the Company's consolidated financial statements as at and for the year ended December 31, 2022.

The Board of Directors approved the consolidated financial statements for issue on November 3, 2023.

The preparation of consolidated financial statements requires management to make judgments, estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates.

These consolidated financial statements are presented in the Company's functional currency of US dollars and include the accounts of the Company and its wholly owned subsidiaries. All intercompany transactions and balances have been eliminated upon consolidation of these subsidiaries.

3. SIGNIFICANT ACCOUNTING POLICIES

The accounting policies applied in these condensed consolidated interim financial statements are the same as those applied in the Company's annual audited consolidated financial statements as at and for the year ended December 31, 2022.

In preparing these condensed consolidated interim financial statements, the significant judgements made by management in applying the Company's accounting policies and the key sources of estimation uncertainty were the same as those that were applied to the annual audited consolidated financial statements for the year ended December 31, 2022 and should be read in conjunction with the Company's annual audited consolidated financial statements for the year ended December 31, 2022.

4. OTHER INVESTMENTS

| |

|

|

September 30, |

|

|

December 31, |

|

| |

Note |

|

2023 |

|

|

2022 |

|

| Balance at beginning of the period |

|

$ |

10,035 |

|

$ |

11,200 |

|

| Investment in marketable securities, at cost |

|

|

- |

|

|

2,305 |

|

| Proceeds from disposals |

|

|

(1,846 |

) |

|

- |

|

| Loss on marketable securities |

|

|

(1,997 |

) |

|

(3,470 |

) |

| Balance at end of the period |

|

|

6,192 |

|

|

10,035 |

|

| Less: Non-Current portion |

|

|

- |

|

|

1,388 |

|

| Current other investments |

|

$ |

6,192 |

|

$ |

8,647 |

|

As at September 30, 2023 the Company held $6,143 in marketable securities that are classified as Level 1 and $49 in marketable securities that are classified as Level 3 in the fair value hierarchy (Note 17). Marketable securities classified as Level 3 in the fair value hierarchy are share purchase warrants and the fair value of the warrants at each period end has been estimated using the Black-Scholes Option Pricing Model.

During the year ended December 31, 2022, the Company acquired 6,600,000 units of Max Resource Corp ("Max") through a private placement with each unit consisting of one common share and ½ share purchase warrant. At the same time, the Company entered into a collaboration agreement with Max under which acquired shares and warrants of Max have certain transfer restrictions and cannot be liquidated before March 28, 2024. Accordingly, at inception these shares and warrants were classified as non-current and are classified as such in the comparative figures.

5. ACCOUNTS AND OTHER RECEIVABLES

| |

|

|

September 30, |

|

|

December 31, |

|

| |

Note |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Trade receivables (1) |

|

$ |

6,918 |

|

$ |

4,385 |

|

| IVA receivable (2) |

16 |

|

8,741 |

|

|

8,062 |

|

| Other receivables |

|

|

1,005 |

|

|

689 |

|

| |

|

$ |

16,664 |

|

$ |

13,136 |

|

(1) The trade receivables consist of receivables from provisional silver and gold sales from the Bolañitos mine. The fair value of receivables arising from concentrate sales contracts that contain provisional pricing mechanisms is determined using the appropriate period end closing prices on the measurement date from the exchange that is the principal active market for the particular metal. As such, these receivables, which meet the definition of an embedded derivative, are classified within Level 2 of the fair value hierarchy (Note 17).

(2) The Company's Mexican subsidiaries pay value added tax, Impuesto al Valor Agregado ("IVA"), on the purchase and sale of goods and services. The net amount paid is recoverable but is subject to review and assessment by the tax authorities. The Company regularly files the required IVA returns and all supporting documentation with the tax authorities, however, the Company has been advised that certain IVA amounts receivable from the tax authorities are being withheld pending completion of the authorities' audit of certain of the Company's third-party suppliers. Under Mexican law the Company has legal rights to those IVA refunds and the results of the third-party audits should have no impact on refunds. A smaller portion of IVA refund requests are from time to time improperly denied based on the alleged lack of compliance of certain formal requirements and information returns by the Company's third-party suppliers. The Company takes necessary legal action on the delayed refunds as well as any improperly denied refunds.

These delays and denials have occurred in Refinadora Plata Guanaceví S.A. de C.V. ("Guanaceví,"). At September 30, 2023, Guanaceví holds $8,398 in IVA receivables which the Company and its advisors have determined to be recoverable from tax authorities (December 31, 2022 $6,402 respectively).

As at September 30, 2023, the total IVA receivable of $26,217 (December 31, 2022 - $18,216) has been allocated between the current portion of $8,741, which is included in accounts and other receivables, and a non-current portion of $17,476 (December 31, 2022 - $8,062 and $10,154 respectively). The non-current portion is composed of Guanacevi of $2,293, which is currently under appeal and is unlikely to be received in the next 12 months. The remaining $15,183 is IVA receivable for Terronera, which may not become recoverable until Terronera recognizes revenue for tax purposes.

The Company is in regular contact with the tax authorities in respect of its IVA filings and believes the full amount of its IVA receivables will ultimately be received; however, the timing of recovery of these amounts and the nature and extent of any adjustments to the Company's IVA receivables remains uncertain.

6. INVENTORIES

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Warehouse inventory(1) |

$ |

12,825 |

|

$ |

9,682 |

|

| Stockpile inventory |

|

3,085 |

|

|

2,389 |

|

| Finished goods inventory |

|

11,014 |

|

|

6,138 |

|

| Work in process inventory |

|

677 |

|

|

975 |

|

| |

$ |

27,601 |

|

$ |

19,184 |

|

(1) The warehouse inventory balances at September 30, 2023 and December 31, 2022 are net of a write down to net realizable value of $1,179 at the Guanacevi mine and $1,038 at the Bolañitos mine.

7. RELATED PARTY TRANSACTIONS

The Company previously shared common administrative services and office space with a company related by virtue of a former common director and from time to time incurred third party costs on behalf of related parties on a full cost recovery basis. The agreement for sharing office space and administrative services ended in May 2022. The charges for these costs totaled $nil for the three and nine months ended September 30, 2023 (September 30, 2022 - $nil and $9 respectively). The Company has a $nil net receivable related to these costs as of September 30, 2023 (December 31, 2022 - $nil).

The Company was charged $204 and $490 for legal services for the three and nine months ended September 30, 2023 by a legal firm in which the Company's corporate secretary is a partner (September 2022 - $57 and $402 respectively). The Company has $72 payable to the legal firm as at September 30, 2023 (December 31, 2022 - $10).

8. MINERAL PROPERTIES, PLANT AND EQUIPMENT

(a) Mineral properties, plant and equipment comprise:

| |

|

Mineral |

|

|

|

|

|

Machinery & |

|

|

|

|

|

Transport & |

|

|

|

|

| |

|

properties |

|

|

Plant |

|

|

equipment |

|

|

Building |

|

|

office equipment |

|

|

Total |

|

| Cost |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

$ |

511,399 |

|

$ |

98,185 |

|

$ |

87,140 |

|

$ |

13,445 |

|

$ |

12,045 |

|

$ |

722,214 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additions |

|

103,635 |

|

|

5,217 |

|

|

19,877 |

|

|

7,573 |

|

|

1,978 |

|

|

138,280 |

|

| Disposals |

|

(14,966 |

) |

|

(6,542 |

) |

|

(757 |

) |

|

(662 |

) |

|

(746 |

) |

|

(23,673 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2022 |

$ |

600,068 |

|

$ |

96,860 |

|

$ |

106,260 |

|

$ |

20,356 |

|

$ |

13,277 |

|

$ |

836,821 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additions |

|

50,251 |

|

|

5,660 |

|

|

7,748 |

|

|

1,715 |

|

|

1,834 |

|

|

67,208 |

|

| Disposals |

|

(670 |

) |

|

- |

|

|

(417 |

) |

|

- |

|

|

(176 |

) |

|

(1,263 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2023 |

$ |

649,649 |

|

$ |

102,520 |

|

$ |

113,591 |

|

$ |

22,071 |

|

$ |

14,935 |

|

$ |

902,766 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accumulated amortization and impairment |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2021 |

$ |

444,769 |

|

$ |

88,208 |

|

$ |

49,445 |

|

$ |

9,194 |

|

$ |

8,401 |

|

$ |

600,017 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

14,786 |

|

|

2,268 |

|

|

5,301 |

|

|

346 |

|

|

1,205 |

|

|

23,906 |

|

| Disposals |

|

(13,574 |

) |

|

(6,442 |

) |

|

(326 |

) |

|

(159 |

) |

|

(493 |

) |

|

(20,994 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at December 31, 2022 |

$ |

445,981 |

|

$ |

84,034 |

|

$ |

54,420 |

|

$ |

9,381 |

|

$ |

9,113 |

|

$ |

602,929 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization |

|

15,468 |

|

|

1,293 |

|

|

5,064 |

|

|

285 |

|

|

1,185 |

|

|

23,295 |

|

| Disposals |

|

- |

|

|

- |

|

|

(177 |

) |

|

- |

|

|

(145 |

) |

|

(322 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at September 30, 2023 |

$ |

461,449 |

|

$ |

85,327 |

|

$ |

59,307 |

|

$ |

9,666 |

|

$ |

10,153 |

|

$ |

625,902 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net book value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| At December 31, 2022 |

$ |

154,087 |

|

$ |

12,826 |

|

$ |

51,840 |

|

$ |

10,975 |

|

$ |

4,164 |

|

$ |

233,892 |

|

| At September 30, 2023 |

$ |

188,200 |

|

$ |

17,193 |

|

$ |

54,284 |

|

$ |

12,405 |

|

$ |

4,782 |

|

$ |

276,864 |

|

Included in mineral properties is $80,085 in acquisition costs for exploration properties and $57,792 for acquisition and development costs for development properties (December 31, 2022 - $80,155 and $26,669 respectively), which are not subject to amortization.

As of September 30, 2023, the Company has $35,704 committed for capital equipment purchases, predominantly related to the ongoing construction and development in the Terronera project.

(b) Acquisition of the Pitarrilla Project

On January 17, 2022, the Company entered into a definitive agreement to purchase the Pitarrilla project in Durango State, Mexico, by acquiring all of the issued and outstanding shares of Minera Pitarrilla S.A. de C. V. (formerly SSR Durango, S.A. de C.V.) from SSR Mining Inc. ("SSR") for total consideration of $70 million (consisting of $35 million in Company's shares and a further $35 million in cash or in the Company's shares at the election of SSR and as agreed to by the Company) and a 1.25% net smelter returns royalty. SSR retains a 1.25% NSR Royalty in Pitarrilla. Endeavour will have matching rights to purchase the NSR Royalty in the event SSR proposes to sell it.

The acquisition was completed on July 6, 2022. Total consideration included 8,577,380 shares of the Company issued on July 6, 2022 and a $35.1 million cash payment. Fair value of the 8,577,380 common shares issued on July 6, 2022 was $25,589 at CAN$3.89 per share. The deemed value of the common shares issued, at the time of agreement, was $34.9 million. The shares are subject to a hold period of four months and one day following the date of closing.

The 4,950-hectares Pitarrilla exploration project is located in northern Mexico, consists of five concessions, has significant infrastructure in place and has access to utilities.

The acquisition is outside the scope of IFRS 3 Business Combinations, as the Pitarrilla project did not meet the definition of a business, and as such, the transaction was accounted for as an asset acquisition. The purchase price is allocated to the underlying assets acquired and liabilities assumed, based upon their estimated fair values at the date of acquisition.

| Pitarilla Project purchase consideration: |

|

|

|

| |

|

|

|

| Common shares issued(1) |

$ |

25,589 |

|

| Consideration paid in cash |

|

35,067 |

|

| Acquisition costs |

|

881 |

|

| Total consideration |

$ |

61,537 |

|

| Fair value summary of assets acquired and liabilities assumed: |

|

|

|

| |

|

|

|

| Assets: |

|

|

|

| Current assets |

$ |

288 |

|

| Buildings and equipment |

|

652 |

|

| Mineral properties |

|

60,811 |

|

| Total assets |

$ |

61,751 |

|

| Liabilities: |

|

|

|

| Accounts payable and accrued liabilities |

|

170 |

|

| Reclamation liability |

|

44 |

|

| Total liabilities |

$ |

214 |

|

| |

|

|

|

| Net identifiable assets acquired |

$ |

61,537 |

|

(c) El Compas, Mexico

On September 9, 2022, the Company entered into an agreement to sell its 100% interest in Minera Oro Silver de Mexico, S.A. de C.V. ("MOS") to Grupo ROSGO, S.A. de C.V., ("Grupo ROSGO"). Minera Oro Silver holds the El Compas property and the lease on the La Plata processing plant in Zacatecas, Mexico.

Pursuant to the agreement, Grupo ROSGO assumed the Minera Oro Silver loan payable to the Company, in the amount of $5,000 payable in cash payments over a five year period with an initial payment of $250 and subsequent Instalment payments of $500 every six months other than the third payment, which will be $750. The payments are secured by a pledge of the shares of MOS. As of September 30, 2023, the carrying value of the loan receivable is $3,523, consisting of the current portion of $1,250 and non-current portion of $2,273 (December 31, 2022 - $1,000 and $2,729 respectively).

The carrying value of the net Minera Oro Silver's net assets at the date of the sale was $1,149 resulting in the Company recording a $2,733 gain on sale.

(d) Baxter Gold

On July 18, 2023, the Company entered into a definitive agreement with Bravada Gold Corporation which grants the Company an option to earn an 85% interest in the Baxter gold and silver property ("Baxter"), by incurring $4,000 in exploration and development expenditures and paying $500 in option payments over a five-year period from the date of the agreement. Baxter is located directly north of the Company's Bruner project in Nevada's Walker Lane Gold trend. Baxter consists of 114 unpatented lode claims (approximately 920 hectares). Upon completion of the exploration and development expenditures and payment of the option payments, the Company can exercise the option and would have the right to form a joint venture with 85% of the interest belonging to the Company.

(e) Write-off of Paloma exploration property

In December 2018, the Company signed an option agreement to acquire up to a 70% interest in the Paloma project in Antofagasta Province, Chile. Agreement granted the Company the right to acquire its initial 51% interest by paying $750 and spending $5,000 over five years with the final payment due in 2023, followed by a second option to acquire 70% by completing a Preliminary Economic Assessment and a Preliminary Feasibility Study. In June 2023, the Company elected to not proceed with the final payment and the carrying value of $435 has been written off during the nine month period ended September 30, 2023.

(f) Sale of Cozamin Royalty

On August 31, 2023, Minera Plata Adelante SA de CV ("MPA") executed an agreement with Gold Royalty Corpand sold all of the MPA's interest in the 1% Cozamin royalty ("Royalty") for total consideration of $7,500 payable in cash. The Royalty applies to two concessions (Calicanto and Vicochea) on Capstone's Cozamin copper-silver mine, located 3.6 kilometres north-northwest of Zacatecas City in state of Zacatecas, Mexico. The Company obtained the Royalty through a concession division agreement signed in 2017 on seven wholly owned concessions which were acquired for $445. The Cozamin Mine, a copper-silver mine owned and operated by Capstone Copper in Zacatecas, Mexico, is located on two of the seven concessions. The sale agreement includes an option granted to Gold Royalty Corp to purchase any additional royalties which may be granted on the five remaining concessions under the 2017 concession division agreement.

9. LOANS PAYABLE

| |

|

September 30, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

| Balance at the beginning of the period |

$ |

14,510 |

|

$ |

10,494 |

|

| Net proceeds from software and equipment financing |

|

- |

|

|

9,070 |

|

| Finance cost |

|

599 |

|

|

726 |

|

| Repayments of principal |

|

(4,671 |

) |

|

(5,054 |

) |

| Repayments of finance costs |

|

(599 |

) |

|

(726 |

) |

| Balance at the end of the period |

$ |

9,839 |

|

$ |

14,510 |

|

| |

|

|

|

|

|

|

| Statements of Financial Position presentation |

|

|

|

|

|

|

| Current loans payable |

$ |

4,339 |

|

$ |

6,041 |

|

| Non-current loans payable |

|

5,500 |

|

|

8,469 |

|

| Total |

$ |

9,839 |

|

$ |

14,510 |

|

The Company currently has $23,313 in financing arrangements for equipment, with terms ranging from one to four years. The agreements require either monthly or quarterly payments of principal and interest with a weighted-average interest rate of 5.7%.

The equipment financing is secured by the underlying equipment purchased and is subject to various non-financial covenants. As at September 30, 2023 the Company was in compliance with these covenants. As at September 30, 2023, the net book value of equipment includes $21,799 (December 31, 2022 - $24,379) of equipment pledged as security for the equipment financing.

10. SHARE CAPITAL

(a) Public Offerings

On March 22, 2022, the Company completed a prospectus equity financing with the offering co-led by BMO Capital Markets and PI Financial Corp., together with a syndicate of underwriters consisting of CIBC World Markets Inc., B. Riley Securities Inc., and H.C. Wainwright & Co., LLC. The Company issued a total of 9,293,150 common shares at a price of $4.95 per share for aggregate gross proceeds of $46,001, less commission of $2,524 and recognized $361 of other transaction costs related to the financing as share issuance costs, which have been presented net within share capital.

In June 2023, the Company filed a short form base shelf prospectus that qualified for the distribution of up to $200 million of common shares, debt securities, warrants or units of the Company comprising any combination of common shares and warrants (the "Securities") over a 25 month period. The Company filed a corresponding registration statement in the United States registering the Securities under United States federal securities laws. The distribution of Securities could be effected from time to time in one or more transactions at a fixed price or prices, which could be changed, at market prices prevailing at the time of sale, or at prices related to such prevailing market prices to be negotiated with purchasers and as set forth in an accompanying prospectus supplement, including transactions that are "At-The-Market" ("ATM") distributions.

On June 27, 2023, the Company entered into an ATM equity facility with BMO Capital Markets (the lead agent), CIBC World Markets Inc, TD Securities (USA) LLC, National Bank of Canada Financial Inc., Raymond James (USA) Inc., B. Riley Securities Inc. and H.C. Wainwright & Co. LLC. (collectively, the "Agents"). Under the terms of this ATM facility, the Company could, from time to time, sell common stock having an aggregate offering value of up to $60 million on the New York Stock Exchange. The Company determined, at its sole discretion, the timing and number of shares to be sold under the ATM facility.

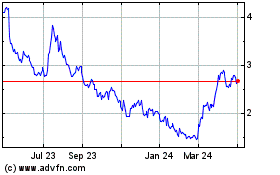

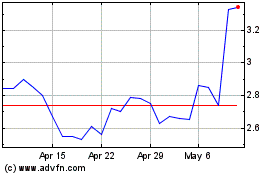

During the nine-month period ended September 30, 2023, the Company issued 8,195,527 common shares under the ATM facility at an average price of $2.85 per share for gross proceeds of $23,390, less commission of $468 and recognized $215 of other transaction costs related to the ATM financing as share issuance costs, which have been presented net within share capital.

Subsequent to September 30, 2023 an additional 6,828,796 common shares were issued under the ATM facility at an average price of $2.44 per share for gross proceeds of $16,638 less commission of $332.

(b) Stock Options

Options to purchase common shares have been granted to directors, officers, employees and consultants pursuant to the Company's current stock option plan, approved by the Company's shareholders in fiscal 2009 and amended and re-ratified in 2021, at exercise prices determined by reference to the market value on the date of grant. The stock option plan allows for, with approval by the Board, granting of options to its directors, officers, employees and consultants to acquire up to 5.0% of the issued and outstanding shares at any time. Prior to the 2021 amendment, the plan allowed for the granting of up to 7.0% of the issued and outstanding shares at any time.

The following table summarizes the status of the Company's stock option plan and changes during the period:

| Expressed in Canadian dollars |

|

Nine months ended |

|

|

Year ended |

|

| |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

| |

|

Number of

options |

|

|

Weighted

average

exercise price |

|

|

Number of

options |

|

|

Weighted

average

exercise price |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding, beginning of the period |

|

3,899,630 |

|

$ |

4.09 |

|

|

3,848,200 |

|

$ |

3.68 |

|

| Granted |

|

1,079,000 |

|

$ |

4.12 |

|

|

736,986 |

|

$ |

6.24 |

|

| Exercised |

|

(1,097,900 |

) |

$ |

3.05 |

|

|

(569,200 |

) |

$ |

3.57 |

|

| Expired and forfeited |

|

(251,839 |

) |

$ |

5.65 |

|

|

(116,356 |

) |

$ |

6.63 |

|

| Outstanding, end of the period |

|

3,628,891 |

|

$ |

4.31 |

|

|

3,899,630 |

|

$ |

4.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Options exercisable at the end of the period |

|

2,921,934 |

|

$ |

4.27 |

|

|

3,374,459 |

|

$ |

3.74 |

|

During the nine months ended September 30, 2023, the weighted-average share price at the date of exercise was CAN$4.49 (December 31, 2022 - CAN$6.77).

The following table summarizes the information about stock options outstanding at September 30, 2023:

| Expressed in Canadian dollars |

|

|

|

| |

Options Outstanding |

Options Exercisable |

| |

Number |

Weighted Average |

Weighted |

Number |

Weighted |

| |

Outstanding |

Remaining |

Average |

Exercisable |

Average |

| Price |

as at |

Contractual Life |

Exercise |

as at |

Exercise |

| Intervals |

September 30, 2023 |

(Number of Years) |

Price |

September 30, 2023 |

Price |

| |

|

|

|

|

|

| $2.00 - $2.99 |

960,600 |

1.4 |

$2.14 |

960,600 |

$1.42 |

| $3.00 - $3.99 |

442,400 |

0.5 |

$3.23 |

442,400 |

$0.46 |

| $4.00 - $4.99 |

976,600 |

4.5 |

$4.12 |

386,600 |

$4.45 |

| $5.00 - $5.99 |

60,000 |

2.0 |

$5.60 |

60,000 |

$1.96 |

| $6.00 - $6.99 |

1,189,291 |

3.0 |

$6.55 |

1,072,334 |

$2.93 |

| |

3,628,891 |

2.6 |

$4.31 |

2,921,934 |

$2.24 |

During the three and nine months ended September 30, 2023, the Company recognized share-based compensation expense of $370 and $1,316 respectively (September 30, 2022 - $320 and $1,425 respectively) based on the fair value of the vested portion of options granted in the current and prior years.

The weighted-average fair values of stock options granted and the assumptions used to calculate the related compensation expense have been estimated using the Black-Scholes Option Pricing Model with the following assumptions:

| |

Nine months ended |

| |

September 30,

2023 |

September 30,

2022 |

| Weighted-average fair value of options in CAN$ |

$2.21 |

$3.17 |

| Risk-free interest rate |

3.84% |

2.19% |

| Expected dividend yield |

0% |

0% |

| Expected stock price volatility |

70% |

67% |

| Expected options life in years |

3.79 |

3.80 |

(c) Share Units Plan

On March 23, 2021 the Company adopted an equity-based Share Unit Plan ("SUP"), which was approved by the Company's shareholders on May 12, 2021. The SUP allows for, with approval by the Board, granting of Performance Share Units ("PSU"s) and Deferred Share Units ("DSU"s), to its directors, officers, employees to acquire up to 1.5% of the issued and outstanding shares. The SUP incorporates any new PSUs and DSUs granted and are to be subject to cash, share settlement or a combination of cash and share procedures at the discretion of the Board of Directors.

Performance Share Units

The PSUs granted are subject to a performance payout multiplier between 0% and 200% based on the Company's total shareholder return at the end of a three-year period, relative to the total shareholder return of the Company's peer group.

| |

|

Nine months ended |

|

|

Year ended |

|

| |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

| |

|

Number of units |

|

|

Number of units |

|

| |

|

|

|

|

|

|

| Outstanding, beginning of period |

|

1,158,000 |

|

|

1,639,000 |

|

| Granted |

|

471,000 |

|

|

316,000 |

|

| Cancelled |

|

(140,000 |

) |

|

- |

|

| Settled |

|

(611,000 |

) |

|

(797,000 |

) |

| Outstanding, end of period |

|

878,000 |

|

|

1,158,000 |

|

There were 471,000 PSUs granted during the nine months ended September 30, 2023 (September 30, 2022 - 316,000) under the SUP. The PSUs vest at the end of a three-year period if certain pre-determined performance and vesting criteria are achieved. Performance criteria are based on the Company's share price performance relative to a representative group of other mining companies. 194,000 PSUs vest on March 4, 2024, 215,000 PSUs vest on March 24, 2025, 60,000 PSUs vest on or before June 30, 2024, and 409,000 PSUs vest on March 7, 2026.

On March 2, 2023, PSUs granted in 2020 vested with a payout multiplier of 200% based on the Company's shareholder return, relative to the total shareholder return of the Company's peer group over the three-year period and 205,918 PSUs were settled, through the issuance of 411,836 common shares and 405,082 PSUs were settled for $2,413 cash.

On August 16, 2022, vesting was accelerated on a pro-rata basis for 195,000 PSUs granted in 2020 and 67,000 PSUs granted in 2021. During the nine months ended September 30, 2023, 350,829 shares were issued for the settlement of these PSUs.

During the three and nine months ended September 30, 2023, the Company recognized share-based compensation expense of $476 and $938 respectively related to the PSUs (September 30, 2022 - $428 and $1,321 respectively).

Deferred Share Units

The DSUs granted are vested immediately and are redeemable for shares at the time of a director's retirement.

| |

|

Nine months ended |

|

|

Year ended |

|

| |

|

September 30, 2023 |

|

|

December 31, 2022 |

|

| |

|

Number of units |

|

|

Number of units |

|

| |

|

|

|

|

|

|

| Outstanding, beginning of period |

|

104,596 |

|

|

- |

|

| Granted |

|

216,520 |

|

|

109,634 |

|

| Settled for shares |

|

- |

|

|

(5,038 |

) |

| Outstanding, end of period |

|

321,116 |

|

|

104,596 |

|

There were 216,520 DSUs granted during the nine months ended September 30, 2023 (September 30, 2022 - 106,153) under the SUP. During the three and nine months ended September 30, 2023, the Company recognized share-based compensation expense of $18 and $650 respectively related to the DSUs (September 30, 2022 - $12 and $513 respectively).

(d) Deferred Share Units - Cash Settled

The Company previously had a Deferred Share Unit ("DSU") plan whereby deferred share units were granted to independent directors of the Company in lieu of compensation in cash or share purchase options. These DSUs vested immediately and are redeemable for cash, based on the market value of the units at the time of a director's retirement. Upon adoption of the SUP plan in March 2021, no new DSUs will be granted under this cash settled plan.

| Expressed in Canadian dollars |

|

Nine months ended |

|

|

Year ended |

|

| |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

| |

|

Number

of Units |

|

|

Weighted Average

Grant Price |

|

|

Number

of Units |

|

|

Weighted Average

Grant Price |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding, beginning of period |

|

1,044,204 |

|

$ |

3.19 |

|

|

1,348,765 |

|

$ |

3.24 |

|

| Redeemed |

|

- |

|

$ |

0.00 |

|

|

(304,561 |

) |

$ |

3.41 |

|

| Outstanding, end of period |

|

1,044,204 |

|

$ |

3.19 |

|

|

1,044,204 |

|

$ |

3.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Fair value at period end |

|

1,044,204 |

|

$ |

3.32 |

|

|

1,044,204 |

|

$ |

4.38 |

|

During the three and nine months ended September 30, 2023, the Company recognized a mark to market recovery on director's compensation related to these DSUs, which is included in general and administrative salaries, wages and benefits, of $482 and $823 respectively (September 30, 2022 - a mark to market recovery of $110 and $1,099 respectively) based on the fair value of new grants and the change in the fair value of the DSUs granted in the current and prior years. As of September 30, 2023, there are 1,044,204 deferred share units outstanding (December 31, 2022 - 1,044,204) with a fair market value of $2,552 (December 31, 2022 - $3,375) recognized in accounts payable and accrued liabilities.

(e) Share Appreciation Rights

As part of the Company's bonus program, the Company may grant share appreciation rights ("SARs") to its employees in Mexico and Chile. The SARs are subject to vesting conditions and, when exercised, constitute a cash bonus based on the value of the appreciation of the Company's common shares between the SARs grant date and the exercise date.

| |

|

Nine months ended |

|

|

Year ended |

|

| |

|

September 30,

2023 |

|

|

December 31,

2022 |

|

| |

|

Number

of Units |

|

|

Weighted Average

Grant Price |

|

|

Number

of Units |

|

|

Weighted Average

Grant Price |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding, beginning of period |

|

181,739 |

|

$ |

5.12 |

|

|

113,670 |

|

$ |

5.40 |

|

| Granted |

|

- |

|

$ |

0.00 |

|

|

148,030 |

|

$ |

4.62 |

|

| Exercised |

|

- |

|

$ |

0.00 |

|

|

(5,726 |

) |

$ |

3.17 |

|

| Cancelled |

|

(86,256 |

) |

$ |

5.13 |

|

|

(74,235 |

) |

$ |

4.72 |

|

| Outstanding, end of period |

|

95,483 |

|

$ |

5.10 |

|

|

181,739 |

|

$ |

5.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Exercisable at the end of the period |

|

71,200 |

|

$ |

5.15 |

|

|

101,066 |

|

$ |

5.18 |

|

During the three and nine months ended September 30, 2023, the Company recognized a recovery related to SARs, which is included in operation and exploration salaries, wages and benefits, of $22 and $32 respectively (September 30, 2022 -recovery of $nill and $4 respectively) based on the change in the fair value of the SARs granted in prior years. As of September 30, 2023, there are 95,483 SARs outstanding (December 31, 2022 - 181,739) with a fair market value of $76 (December 31, 2022 - $111) recognized in accounts payable and accrued liabilities.

(f) Diluted Earnings per Share

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30,

2023 |

|

|

September 30,

2022 |

|

|

September 30,

2023 |

|

|

September 30,

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss) |

$ |

(2,328 |

) |

$ |

(1,499 |

) |

$ |

3,074 |

|

$ |

(1,760 |

) |

| Basic weighted average number of shares outstanding |

|

194,249,283 |

|

|

189,241,367 |

|

|

192,003,752 |

|

|

180,655,842 |

|

| Effect of dilutive securities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Stock options |

|

- |

|

|

- |

|

|

672,447 |

|

|

- |

|

| Equity settled deferred share units |

|

- |

|

|

- |

|

|

878,000 |

|

|

- |

|

| Performance share units |

|

- |

|

|

- |

|

|

321,116 |

|

|

- |

|

| Diluted weighted average number of share outstanding |

|

194,249,283 |

|

|

189,241,367 |

|

|

193,875,315 |

|

|

180,655,842 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings (loss) per share |

$ |

(0.01 |

) |

$ |

(0.01 |

) |

$ |

0.02 |

|

$ |

(0.01 |

) |

As of September 30, 2023, there 2,876,185 anti-dilutive stock options (September 30, 2022 - 2,833,740).

11. REVENUE

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Silver sales (1) |

$ |

32,863 |

|

$ |

25,541 |

|

$ |

103,027 |

|

$ |

81,123 |

|

| Gold sales (1) |

|

17,063 |

|

|

14,852 |

|

|

53,882 |

|

|

49,383 |

|

| Less: smelting and refining costs |

|

(494 |

) |

|

(744 |

) |

|

(1,945 |

) |

|

(2,335 |

) |

| Revenue |

$ |

49,432 |

|

$ |

39,649 |

|

$ |

154,964 |

|

$ |

128,171 |

|

(1) Changes in fair value from provisional pricing in the period are included in silver and gold sales.

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Revenue by product |

|

|

|

|

|

|

|

|

|

|

|

|

| Concentrate sales |

$ |

13,528 |

|

$ |

11,614 |

|

$ |

39,273 |

|

$ |

42,192 |

|

| Provisional pricing adjustments |

|

523 |

|

|

(443 |

) |

|

(66 |

) |

|

(400 |

) |

| Total revenue from concentrate sales |

|

14,051 |

|

|

11,171 |

|

|

39,207 |

|

|

41,792 |

|

| Refined metal sales |

|

35,381 |

|

|

28,478 |

|

|

115,757 |

|

|

86,379 |

|

| Total revenue |

$ |

49,432 |

|

$ |

39,649 |

|

$ |

154,964 |

|

$ |

128,171 |

|

Provisional pricing adjustments on sales of concentrate consist of provisional and final pricing adjustments made prior to the finalization of the sales contract. The Company's sales contracts are provisionally priced with provisional pricing periods lasting typically one to three months with provisional pricing adjustments recorded to revenue as market prices vary.

12. EXPLORATION AND EVALUATION

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30,

2023 |

|

|

September 30,

2022 |

|

|

September 30,

2023 |

|

|

September 30,

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and depletion |

$ |

(147 |

) |

$ |

143 |

|

$ |

448 |

|

$ |

348 |

|

| Share-based compensation |

|

125 |

|

|

117 |

|

|

368 |

|

|

328 |

|

| Exploration salaries, wages and benefits |

|

791 |

|

|

330 |

|

|

2,211 |

|

|

1,423 |

|

| Direct exploration expenditures |

|

1,599 |

|

|

1,541 |

|

|

4,653 |

|

|

3,353 |

|

| Evaluation salaries, wages and benefits |

|

616 |

|

|

487 |

|

|

1,622 |

|

|

1,632 |

|

| Direct evaluation expenditures |

|

1,171 |

|

|

1,405 |

|

|

3,376 |

|

|

3,939 |

|

| |

$ |

4,155 |

|

$ |

4,023 |

|

$ |

12,678 |

|

$ |

11,023 |

|

13. GENERAL AND ADMINISTRATIVE

| |

|

Three months ended |

|

|

Nine months ended |

|

| |

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| Depreciation and depletion |

$ |

63 |

|

$ |

57 |

|

$ |

179 |

|

$ |

156 |

|