Reports Q4 Diluted EPS of $0.81, Adjusted

Diluted EPS* of $0.85

FB Financial Corporation (the “Company”) (NYSE: FBK), parent

company of FirstBank, reported net income of $37.9 million, or

$0.81 per diluted common share, for the fourth quarter of 2024,

compared to $0.22 in the previous quarter and $0.63 in the fourth

quarter of last year. Adjusted net income* was $39.8 million, or

$0.85 per diluted common share, compared to $0.86 in the previous

quarter and $0.77 in the fourth quarter of last year.

The Company ended the fourth quarter with loans held for

investment (“HFI”) of $9.60 billion compared to $9.48 billion at

the end of the previous quarter, a 5.22% annualized increase, and

$9.41 billion at the end of the fourth quarter of last year, a

2.06% increase. Deposits were $11.21 billion as of December 31,

2024, compared to $10.98 billion as of September 30, 2024, an 8.49%

annualized increase, and $10.55 billion as of December 31, 2023, a

6.28% increase. Net interest margin (“NIM”) was 3.50% for the

fourth quarter of 2024, compared to 3.55% in the prior quarter and

3.46% in the fourth quarter of 2023. The Company ended the quarter

with book value per common share of $33.59 and tangible book value

per common share* of $28.27.

President and Chief Executive Officer, Christopher T. Holmes

stated, “The Company continued producing both deposit and loan

growth during the quarter, resulting in increased net interest

income. The growth came with an improved GAAP return on average

assets of 1.14% and an adjusted pre-tax, pre-provision return on

average assets* of 1.80%. Our strong financial position and

operating momentum position us well moving into 2025.”

Annualized

(dollars in thousands, except share

data)

Dec 2024

Sep 2024

Dec 2023

Dec 24 / Sep 24 %

Change

Dec 24 / Dec 23 %

Change

Balance Sheet

Highlights

Investment securities, at fair value

$

1,538,008

$

1,567,922

$

1,471,973

(7.59

)%

4.49

%

Loans held for sale

126,760

103,145

67,847

91.1

%

86.8

%

Loans HFI

9,602,384

9,478,129

9,408,783

5.22

%

2.06

%

Allowance for credit losses on loans

HFI

(151,942

)

(156,260

)

(150,326

)

(11.0

)%

1.07

%

Total assets

13,157,482

12,920,222

12,604,403

7.31

%

4.39

%

Interest-bearing deposits

(non-brokered)

8,625,113

8,230,867

8,179,430

19.1

%

5.45

%

Brokered deposits

469,089

519,200

150,475

(38.4

)%

211.7

%

Noninterest-bearing deposits

2,116,232

2,226,144

2,218,382

(19.6

)%

(4.60

)%

Total deposits

11,210,434

10,976,211

10,548,287

8.49

%

6.28

%

Borrowings

176,789

182,107

390,964

(11.6

)%

(54.8

)%

Allowance for credit losses on unfunded

commitments

6,107

6,042

8,770

4.28

%

(30.4

)%

Total common shareholders’ equity

1,567,538

1,562,329

1,454,794

1.33

%

7.75

%

Book value per common share

$

33.59

$

33.48

$

31.05

1.31

%

8.18

%

Tangible book value per common share*

$

28.27

$

28.15

$

25.69

1.70

%

10.0

%

Total common shareholders’ equity to total

assets

11.9

%

12.1

%

11.5

%

Tangible common equity to tangible

assets*

10.2

%

10.4

%

9.74

%

*Non-GAAP financial measure; A

reconciliation of non-GAAP measures to the most directly comparable

GAAP measure is included in the Company’s Fourth Quarter 2024

Financial Supplement.

Three Months Ended

(dollars in thousands, except share

data)

Dec 2024

Sep 2024

Dec 2023

Statement of

Income Highlights

Net interest income

$

108,381

$

106,017

$

101,088

NIM

3.50

%

3.55

%

3.46

%

Noninterest income (loss)

$

21,997

$

(16,497

)

$

15,339

(Loss) gain from securities, net

$

—

$

(40,165

)

$

183

Total revenue

$

130,378

$

89,520

$

116,427

Noninterest expense

$

73,174

$

76,212

$

80,200

Early retirement and severance costs

$

463

$

—

$

2,214

Efficiency ratio

56.1

%

85.1

%

68.9

%

Core efficiency ratio*

54.6

%

58.4

%

61.7

%

Pre-tax, pre-provision net revenue

$

57,204

$

13,308

$

36,227

Adjusted pre-tax, pre-provision net

revenue*

$

59,829

$

53,762

$

45,390

Provisions for credit losses

$

7,084

$

1,914

$

305

Net charge-offs (recoveries) ratio

0.47

%

0.03

%

(0.04

)%

Net income applicable to FB Financial

Corporation

$

37,886

$

10,220

$

29,369

Diluted earnings per common share

$

0.81

$

0.22

$

0.63

Effective tax rate

24.4

%

10.3

%

18.2

%

Adjusted net income*

$

39,835

$

40,132

$

36,152

Adjusted diluted earnings per common

share*

$

0.85

$

0.86

$

0.77

Weighted average number of shares

outstanding - fully diluted

46,862,935

46,803,330

46,916,939

Returns on

average:

Return on average total assets

(“ROAA”)

1.14

%

0.32

%

0.94

%

Adjusted*

1.20

%

1.25

%

1.15

%

Return on average shareholders’ equity

9.63

%

2.67

%

8.41

%

Return on average tangible common equity

(“ROATCE”)*

11.5

%

3.19

%

10.3

%

Adjusted*

12.2

%

12.7

%

12.9

%

*Non-GAAP financial measure; A

reconciliation of non-GAAP measures to the most directly comparable

GAAP measure is included in the Company’s Fourth Quarter 2024

Financial Supplement.

Balance Sheet and Net Interest

Margin

The Company reported loans HFI of $9.60 billion at the end of

the fourth quarter of 2024, compared to $9.48 billion at the end of

the prior quarter. Net growth in loans HFI was driven by net

increases of $51.1 million in owner occupied commercial real estate

loans, $33.4 million in non-owner occupied commercial real estate

loans, $16.1 million in residential real estate loans and $13.7

million in consumer and other loans.

The Company reported total deposits of $11.21 billion at the end

of the fourth quarter compared to $10.98 billion at the end of the

third quarter. Total cost of deposits decreased to 2.70% during the

fourth quarter compared to 2.83% in the third quarter of 2024. The

decrease in cost was driven by the federal funds rate cuts as the

cost of the Company’s indexed deposits moved lower and pricing of

other interest-bearing deposits also adjusted lower to align with

the rate cuts. Noninterest-bearing deposits were $2.12 billion at

the end of the quarter compared to $2.23 billion at the end of the

third quarter of 2024, decreasing largely due to a seasonal decline

of $57.9 million in mortgage escrow deposits compared to the prior

period.

The Company’s net interest income on a tax-equivalent basis

increased in the fourth quarter of 2024 to $109.0 million from

$106.6 million in the prior quarter. NIM was 3.50% for the fourth

quarter of 2024 compared to 3.55% for the previous quarter. NIM was

impacted by an increase in the Company’s cash and cash equivalents

during the quarter relative to the previous quarter as the Company

grew deposits in anticipation of additional loan growth in 2025.

The cost of interest-bearing deposits decreased to 3.37% from 3.58%

in the previous quarter and the contractual yield on loans HFI

decreased to 6.40% from 6.62% in the third quarter of 2024.

Holmes continued, “The Company achieved core deposit growth of

10.8% annualized and loan growth of 5.22% annualized for the

quarter. NIM was within our expected range as we built deposits to

prepare for expected loan growth. Our focus is customer

relationships and we will continue to build the Company by adding

and expanding on core banking relationships.”

Noninterest Income

Core noninterest income* was $24.2 million for the fourth

quarter of 2024, compared to $24.0 million and $18.7 million for

the prior quarter and fourth quarter of 2023, respectively.

Mortgage banking income declined to $10.6 million in the fourth

quarter of 2024, compared to $11.6 million in the prior quarter and

$8.4 million in the fourth quarter of 2023.

Noninterest Expense

Core noninterest expense* during the fourth quarter of 2024 was

$72.7 million compared to $76.2 million for the prior quarter and

$74.4 million for the fourth quarter of 2023. During the fourth

quarter of 2024, the Company’s core efficiency ratio* was 54.6%,

compared to 58.4% in the previous quarter and 61.7% in the fourth

quarter of 2023. Core banking noninterest expense* was $60.7

million for the quarter, compared to $63.3 million in the prior

quarter and $62.6 million in the fourth quarter of 2023.

Chief Financial Officer Michael Mettee commented, “Improvement

in operating efficiency was a highlight this quarter driven by

strong revenue growth and expenses that met expectations.”

Credit Quality

In the fourth quarter, the Company recorded provision expenses

of $7.0 million related to loans HFI and $65 thousand related to

unfunded loan commitments. The Company had an allowance for credit

losses on loans HFI as of the end of the fourth quarter of 2024 of

$151.9 million, representing 1.58% of loans HFI compared to $156.3

million, or 1.65% of loans HFI as of September 30, 2024.

The Company had net charge-offs of $11.3 million in the fourth

quarter of 2024, representing annualized net charge-offs of 0.47%

of average loans HFI, which compares to annualized net charge-offs

of 0.03% in the prior quarter and annualized net recoveries of

0.04% in the fourth quarter of 2023. For the year ended December

31, 2024, the Company experienced annualized net charge-offs of

$13.1 million, or 0.14% of average loans HFI, compared to

annualized net charge-offs of 0.01% for the year ended December 31,

2023. The increase was driven by the charge-off of a single

previously reserved commercial and industrial relationship during

the fourth quarter of 2024.

The Company’s nonperforming loans HFI as a percentage of total

loans HFI decreased to 0.87% as of the end of the fourth quarter of

2024, compared to 0.96% at the previous quarter-end and 0.65% at

the end of the fourth quarter of 2023. Nonperforming assets as a

percentage of total assets decreased to 0.93% as of the end of the

fourth quarter of 2024, compared to 0.99% at the end of the prior

quarter and 0.69% as of the end of the fourth quarter of 2023.

Holmes commented, “Annualized net charge-offs for the quarter

were 47 basis points due to the charge-off of a relationship that

was previously disclosed and had a related specific reserve.

Excluding the impact of this charge-off, our allowance for credit

losses increased as a percent of loans HFI as we continue to

maintain a healthy reserve that keeps us prepared for a full range

of economic conditions.”

Capital

The Company continued its capital build in the fourth quarter,

resulting in a preliminary total risk-based capital ratio of 15.2%,

preliminary common equity tier 1 ratio of 12.8% and tangible common

equity to tangible assets ratio* of 10.2%.

Holmes continued, “The Company continues to build capital for

organic and strategic opportunities. We are well situated for

opportunities or challenges, but are optimistic about a strong

economic environment in our markets in 2025.”

Summary

Holmes finalized, “The team finished 2024 with strong revenue

growth, managed expenses and a solid balance sheet. We head into

2025 with optimism and momentum.”

_________________________________________

*Non-GAAP financial measure; A

reconciliation of non-GAAP measures to the most directly comparable

GAAP measure is included in the Company’s Fourth Quarter 2024

Financial Supplement.

WEBCAST AND CONFERENCE CALL INFORMATION

FB Financial Corporation will host a conference call to discuss

the Company’s financial results on January 21, 2025, at 8:00 a.m.

(Central Time). To listen to the call, participants should dial

1-877-883-0383 (confirmation code 6995872) approximately 10 minutes

prior to the call. A telephonic replay will be available

approximately two hours after the call through January 28, 2025, by

dialing 1-877-344-7529 and entering confirmation code 7270666.

A live online broadcast of the Company’s quarterly conference

call will be available online at

https://event.choruscall.com/mediaframe/webcast.html?webcastid=CYYSGkob.

An online replay will be available on the Company’s website

approximately two hours after the conclusion of the call and will

remain available for 12 months.

ABOUT FB FINANCIAL CORPORATION

FB Financial Corporation (NYSE: FBK) is a financial holding

company headquartered in Nashville, Tennessee. FB Financial

Corporation operates through its wholly owned banking subsidiary,

FirstBank with 77 full-service bank branches across Tennessee,

Kentucky, Alabama and North Georgia, and mortgage offices across

the Southeast. FB Financial Corporation has approximately $13.16

billion in total assets.

SUPPLEMENTAL FINANCIAL INFORMATION AND EARNINGS

PRESENTATION

Investors are encouraged to review this Earnings Release in

conjunction with the Fourth Quarter 2024 Financial Supplement and

Earnings Presentation posted on the Company’s website, which can be

found at https://investors.firstbankonline.com. This Earnings

Release, the Fourth Quarter 2024 Financial Supplement and the

Earnings Presentation are also included with a Current Report on

Form 8-K that the Company furnished to the U.S. Securities and

Exchange Commission (“SEC”) on January 21, 2025.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Earnings Release that are

not historical in nature may be considered forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements include,

without limitation, statements regarding the Company’s future

plans, results, strategies, and expectations, including

expectations around changing economic markets. These statements can

generally be identified by the use of the words and phrases “may,”

“will,” “should,” “could,” “would,” “goal,” “plan,” “potential,”

“estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,”

“target,” “aim,” “predict,” “continue,” “seek,” and other

variations of such words and phrases and similar expressions. These

forward-looking statements are not historical facts, and are based

upon management’s current expectations, estimates, and projections,

many of which, by their nature, are inherently uncertain and beyond

the Company’s control. The inclusion of these forward-looking

statements should not be regarded as a representation by the

Company or any other person that such expectations, estimates, and

projections will be achieved. Accordingly, the Company cautions

shareholders and investors that any such forward-looking statements

are not guarantees of future performance and are subject to risks,

assumptions, and uncertainties that are difficult to predict.

Actual results may prove to be materially different from the

results expressed or implied by the forward-looking statements. A

number of factors could cause actual results to differ materially

from those contemplated by the forward-looking statements

including, without limitation, (1) current and future economic

conditions, including the effects of inflation, interest rate

fluctuations, changes in the economy or global supply chain,

supply-demand imbalances affecting local real estate prices, and

high unemployment rates in the local or regional economies in which

the Company operates and/or the US economy generally, (2) changes

or the lack of changes in government interest rate policies and the

associated impact on the Company’s business, net interest margin,

and mortgage operations, (3) increased competition for deposits,

(4) changes in the quality or composition of the Company’s loan or

investment portfolios, including adverse developments in borrower

industries or in the repayment ability of individual borrowers or

issuers of investment securities, or the impact of interest rates

on the value of our investment securities portfolio, (5) any

deterioration in commercial real estate market fundamentals, (6)

the Company’s ability to identify potential candidates for,

consummate, and achieve synergies from, potential future

acquisitions, (7) the Company’s ability to manage any unexpected

outflows of uninsured deposits and avoid selling investment

securities or other assets at an unfavorable time or at a loss, (8)

the Company’s ability to successfully execute its various business

strategies, (9) changes in state and federal legislation,

regulations or policies applicable to banks and other financial

service providers, including legislative developments, (10) the

effectiveness of the Company’s controls and procedures to detect,

prevent, mitigate and otherwise manage the risk of fraud or

misconduct by internal or external parties, including attempted

physical-security and cybersecurity attacks, denial-of-service

attacks, hacking, phishing, social-engineering attacks, malware

intrusion, data-corruption attempts, system breaches, identity

theft, ransomware attacks, environmental conditions, and

intentional acts of destruction, (11) the Company’s dependence on

information technology systems of third party service providers and

the risk of systems failures, interruptions, or breaches of

security, and (12) the impact, extent and timing of technological

changes, (13) concentrations of credit or deposit exposure, (14)

the impact of natural disasters, pandemics, acts of war or

terrorism, or other catastrophic events, (15) events giving rise to

international or regional political instability, including the

broader impacts of such events on financial markets and/or global

macroeconomic environments, and/or (16) general competitive,

economic, political, and market conditions. Further information

regarding the Company and factors which could affect the

forward-looking statements contained herein can be found in the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and in any of the Company’s subsequent filings

with the SEC. Many of these factors are beyond the Company’s

ability to control or predict. If one or more events related to

these or other risks or uncertainties materialize, or if the

underlying assumptions prove to be incorrect, actual results may

differ materially from the forward-looking statements. Accordingly,

shareholders and investors should not place undue reliance on any

such forward-looking statements. Any forward-looking statement

speaks only as of the date of this Earnings Release, and the

Company undertakes no obligation to publicly update or review any

forward-looking statement, whether as a result of new information,

future developments or otherwise, except as required by law. New

risks and uncertainties may emerge from time to time, and it is not

possible for the Company to predict their occurrence or how they

will affect the Company.

The Company qualifies all forward-looking statements by these

cautionary statements.

GAAP RECONCILIATION AND USE OF NON-GAAP FINANCIAL

MEASURES

This Earnings Release contains certain financial measures that

are not measures recognized under U.S. generally accepted

accounting principles (“GAAP”) and therefore are considered

non-GAAP financial measures. These non-GAAP financial measures may

include, without limitation, adjusted net income, adjusted diluted

earnings per common share, adjusted pre-tax pre-provision net

revenue, consolidated core revenue, consolidated core and segment

noninterest expense and consolidated core noninterest income,

consolidated core efficiency ratio (tax-equivalent basis), and

adjusted return on average assets and equity. Each of these

non-GAAP metrics excludes certain income and expense items that the

Company’s management considers to be non-core/adjusted in nature.

The Company refers to these non-GAAP measures as adjusted (or core)

measures. Also, the Company presents tangible assets, tangible

common equity, tangible book value per common share, tangible

common equity to tangible assets, return on average tangible common

equity, and adjusted return on average tangible common equity. Each

of these non-GAAP metrics excludes the impact of goodwill and other

intangibles.

The Company’s management uses these non-GAAP financial measures

in their analysis of the Company’s performance, financial condition

and the efficiency of its operations as management believes such

measures facilitate period-to-period comparisons and provide

meaningful indications of its operating performance as they

eliminate both gains and charges that management views as

non-recurring or not indicative of operating performance.

Management believes that these non-GAAP financial measures provide

a greater understanding of ongoing operations and enhance

comparability of results with prior periods as well as demonstrate

the effects of significant non-core gains and charges in the

current and prior periods. The Company’s management also believes

that investors find these non-GAAP financial measures useful as

they assist investors in understanding the Company’s underlying

operating performance and in the analysis of ongoing operating

trends. In addition, because intangible assets such as goodwill and

the other items excluded each vary extensively from company to

company, the Company believes that the presentation of this

information allows investors to more easily compare the Company’s

results to the results of other companies. However, the non-GAAP

financial measures discussed herein should not be considered in

isolation or as a substitute for the most directly comparable or

other financial measures calculated in accordance with GAAP.

Moreover, the manner in which the Company calculates the non-GAAP

financial measures discussed herein may differ from that of other

companies reporting measures with similar names. Investors should

understand how such other banking organizations calculate their

financial measures with names similar to the non-GAAP financial

measures the Company has discussed herein when comparing such

non-GAAP financial measures.

A reconciliation of these measures to the most directly

comparable GAAP financial measures is included in the Company’s

Fourth Quarter 2024 Financial Supplement, which is available at

https://investors.firstbankonline.com.

Financial Summary and Key

Metrics

(Unaudited)

(dollars in thousands, except

share data)

As of or for the Three Months

Ended

Dec 2024

Sep 2024

Dec 2023

Selected Balance Sheet Data

Cash and cash equivalents

$

1,042,488

$

951,750

$

810,932

Investment securities, at fair value

1,538,008

1,567,922

1,471,973

Loans held for sale

126,760

103,145

67,847

Loans HFI

9,602,384

9,478,129

9,408,783

Allowance for credit losses on loans

HFI

(151,942

)

(156,260

)

(150,326

)

Total assets

13,157,482

12,920,222

12,604,403

Interest-bearing deposits

(non-brokered)

8,625,113

8,230,867

8,179,430

Brokered deposits

469,089

519,200

150,475

Noninterest-bearing deposits

2,116,232

2,226,144

2,218,382

Total deposits

11,210,434

10,976,211

10,548,287

Borrowings

176,789

182,107

390,964

Allowance for credit losses on unfunded

commitments

6,107

6,042

8,770

Total common shareholders’ equity

1,567,538

1,562,329

1,454,794

Selected Statement of Income

Data

Total interest income

$

186,369

$

185,628

$

174,835

Total interest expense

77,988

79,611

73,747

Net interest income

108,381

106,017

101,088

Total noninterest income (loss)

21,997

(16,497

)

15,339

Total noninterest expense

73,174

76,212

80,200

Earnings before income taxes and

provisions for credit losses

57,204

13,308

36,227

Provisions for credit losses

7,084

1,914

305

Income tax expense

12,226

1,174

6,545

Net income applicable to noncontrolling

interest

8

—

8

Net income applicable to FB Financial

Corporation

$

37,886

$

10,220

$

29,369

Net interest income (tax-equivalent

basis)

$

109,004

$

106,634

$

101,924

Adjusted net income*

$

39,835

$

40,132

$

36,152

Adjusted pre-tax, pre-provision net

revenue*

$

59,829

$

53,762

$

45,390

Per Common Share

Diluted net income

$

0.81

$

0.22

$

0.63

Adjusted diluted net income*

0.85

0.86

0.77

Book value

33.59

33.48

31.05

Tangible book value*

28.27

28.15

25.69

Weighted average number of shares

outstanding - fully diluted

46,862,935

46,803,330

46,916,939

Period-end number of shares

46,663,120

46,658,019

46,848,934

Selected Ratios

Return on average:

Assets

1.14

%

0.32

%

0.94

%

Shareholders’ equity

9.63

%

2.67

%

8.41

%

Tangible common equity*

11.5

%

3.19

%

10.3

%

Efficiency ratio

56.1

%

85.1

%

68.9

%

Core efficiency ratio (tax-equivalent

basis)*

54.6

%

58.4

%

61.7

%

Loans HFI to deposit ratio

85.7

%

86.4

%

89.2

%

Noninterest-bearing deposits to total

deposits

18.9

%

20.3

%

21.0

%

Net interest margin (tax-equivalent

basis)

3.50

%

3.55

%

3.46

%

Yield on interest-earning assets

6.01

%

6.20

%

5.96

%

Cost of interest-bearing liabilities

3.40

%

3.63

%

3.47

%

Cost of total deposits

2.70

%

2.83

%

2.65

%

Credit Quality Ratios

Allowance for credit losses on loans HFI

as a percentage of loans HFI

1.58

%

1.65

%

1.60

%

Annualized net charge-offs (recoveries) as

a percentage of average loans HFI

0.47

%

0.03

%

(0.04

)%

Nonperforming loans HFI as a percentage of

loans HFI

0.87

%

0.96

%

0.65

%

Nonperforming assets as a percentage of

total assets

0.93

%

0.99

%

0.69

%

Preliminary Capital Ratios

(consolidated)

Total common shareholders’ equity to

assets

11.9

%

12.1

%

11.5

%

Tangible common equity to tangible

assets*

10.2

%

10.4

%

9.74

%

Tier 1 leverage

11.3

%

11.5

%

11.3

%

Tier 1 risk-based capital

13.1

%

13.0

%

12.5

%

Total risk-based capital

15.2

%

15.1

%

14.5

%

Common equity Tier 1

12.8

%

12.7

%

12.2

%

*Non-GAAP financial measure; A

reconciliation of non-GAAP measures to the most directly comparable

GAAP measure is included in the Company’s Fourth Quarter 2024

Financial Supplement.

(FBK - ER)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250121338521/en/

MEDIA CONTACT: Dustin Haupt 615-370-6737

dustin.haupt@firstbankonline.com www.firstbankonline.com

FINANCIAL CONTACT: Michael Mettee 615-564-1212

mmettee@firstbankonline.com

investorrelations@firstbankonline.com

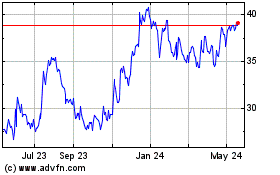

FB Financial (NYSE:FBK)

Historical Stock Chart

From Jan 2025 to Feb 2025

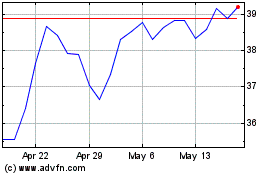

FB Financial (NYSE:FBK)

Historical Stock Chart

From Feb 2024 to Feb 2025