0001337298

FUTUREFUEL CORP.

false

--12-31

Q1

2024

8,294

11,381

41

55

890

890

0.0001

0.0001

5,000,000

5,000,000

0

0

0

0

0.0001

0.0001

75,000,000

75,000,000

43,763,243

43,763,243

43,763,243

43,763,243

2,198

1

2.50

23,119

0

2

4

0

5

100,000

1.00

1.00

1.50

1.50

2.00

2.00

2.50

2.50

0

2

2

false

false

false

false

Exclusive of the BTC of $11,381 and $8,970, respectively, and net of allowances for bad debt of $55 and $48, respectively, as of the dates noted.

00013372982024-01-012024-03-31

xbrli:shares

00013372982024-05-09

iso4217:USD

00013372982024-03-31

00013372982023-12-31

iso4217:USDxbrli:shares

0001337298ff:NonrelatedPartiesMember2024-01-012024-03-31

0001337298ff:NonrelatedPartiesMember2023-01-012023-03-31

0001337298ff:RelatedPartiesMember2024-01-012024-03-31

0001337298ff:RelatedPartiesMember2023-01-012023-03-31

0001337298ff:NonrelatedPartiesMemberff:ExcludingShippingAndHandlingMember2024-01-012024-03-31

0001337298ff:NonrelatedPartiesMemberff:ExcludingShippingAndHandlingMember2023-01-012023-03-31

0001337298ff:RelatedPartiesMemberff:ExcludingShippingAndHandlingMember2024-01-012024-03-31

0001337298ff:RelatedPartiesMemberff:ExcludingShippingAndHandlingMember2023-01-012023-03-31

0001337298ff:NonrelatedPartiesMemberus-gaap:ShippingAndHandlingMember2024-01-012024-03-31

0001337298ff:NonrelatedPartiesMemberus-gaap:ShippingAndHandlingMember2023-01-012023-03-31

0001337298ff:RelatedPartiesMemberus-gaap:ShippingAndHandlingMember2024-01-012024-03-31

0001337298ff:RelatedPartiesMemberus-gaap:ShippingAndHandlingMember2023-01-012023-03-31

00013372982023-01-012023-03-31

0001337298us-gaap:CommonStockMember2023-12-31

0001337298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31

0001337298us-gaap:AdditionalPaidInCapitalMember2023-12-31

0001337298us-gaap:RetainedEarningsMember2023-12-31

0001337298us-gaap:CommonStockMember2024-01-012024-03-31

0001337298us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-31

0001337298us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-31

0001337298us-gaap:RetainedEarningsMember2024-01-012024-03-31

0001337298us-gaap:CommonStockMember2024-03-31

0001337298us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-31

0001337298us-gaap:AdditionalPaidInCapitalMember2024-03-31

0001337298us-gaap:RetainedEarningsMember2024-03-31

0001337298us-gaap:CommonStockMember2022-12-31

0001337298us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0001337298us-gaap:AdditionalPaidInCapitalMember2022-12-31

0001337298us-gaap:RetainedEarningsMember2022-12-31

00013372982022-12-31

0001337298us-gaap:CommonStockMember2023-01-012023-03-31

0001337298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0001337298us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0001337298us-gaap:RetainedEarningsMember2023-01-012023-03-31

0001337298us-gaap:CommonStockMember2023-03-31

0001337298us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0001337298us-gaap:AdditionalPaidInCapitalMember2023-03-31

0001337298us-gaap:RetainedEarningsMember2023-03-31

00013372982023-03-31

0001337298ff:ChemicalsMember2024-01-012024-03-31

0001337298ff:ChemicalsMember2023-01-012023-03-31

00013372982024-04-01 2024-03-31

utr:Y

0001337298srt:MinimumMember2024-04-01 2024-03-31

0001337298srt:MaximumMember2024-04-01 2024-03-31

xbrli:pure

utr:M

00013372982025-01-01 2024-03-31

0001337298us-gaap:ShortTermContractWithCustomerMember2024-01-012024-03-31

0001337298us-gaap:ShortTermContractWithCustomerMember2023-01-012023-03-31

0001337298us-gaap:LongTermContractWithCustomerMember2024-01-012024-03-31

0001337298us-gaap:LongTermContractWithCustomerMember2023-01-012023-03-31

0001337298ff:BillAndHoldRevenueMember2024-01-012024-03-31

0001337298ff:BillAndHoldRevenueMember2023-01-012023-03-31

0001337298ff:NonBillAndHoldRevenueMember2024-01-012024-03-31

0001337298ff:NonBillAndHoldRevenueMember2023-01-012023-03-31

0001337298ff:FourCustomersMemberff:BillAndHoldArrangementsMember2024-03-31

0001337298ff:FourCustomersMemberff:BillAndHoldArrangementsMember2023-12-31

0001337298us-gaap:FutureMember2024-03-31

0001337298us-gaap:FutureMember2023-12-31

0001337298us-gaap:RevolvingCreditFacilityMemberff:RegionsBankAndPNCBankNaMember2020-03-302020-03-30

0001337298us-gaap:RevolvingCreditFacilityMemberff:RegionsBankAndPNCBankNaMember2020-03-30

0001337298ff:LeverageRatio1Membersrt:MaximumMember2024-01-012024-03-31

0001337298ff:LeverageRatio1Memberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-03-31

0001337298ff:LeverageRatio1Memberus-gaap:BaseRateMember2024-01-012024-03-31

0001337298ff:LeverageRatio1Member2024-01-012024-03-31

0001337298ff:LeverageRatio2Membersrt:MinimumMember2024-01-012024-03-31

0001337298ff:LeverageRatio2Membersrt:MaximumMember2024-01-012024-03-31

0001337298ff:LeverageRatio2Memberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-03-31

0001337298ff:LeverageRatio2Memberus-gaap:BaseRateMember2024-01-012024-03-31

0001337298ff:LeverageRatio2Member2024-01-012024-03-31

0001337298ff:LeverageRatio3Membersrt:MinimumMember2024-01-012024-03-31

0001337298ff:LeverageRatio3Membersrt:MaximumMember2024-01-012024-03-31

0001337298ff:LeverageRatio3Memberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-03-31

0001337298ff:LeverageRatio3Memberus-gaap:BaseRateMember2024-01-012024-03-31

0001337298ff:LeverageRatio3Member2024-01-012024-03-31

0001337298ff:LeverageRatio4Membersrt:MinimumMember2024-01-012024-03-31

0001337298ff:LeverageRatio4Membersrt:MaximumMember2024-01-012024-03-31

0001337298ff:LeverageRatio4Memberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-03-31

0001337298ff:LeverageRatio4Memberus-gaap:BaseRateMember2024-01-012024-03-31

0001337298ff:LeverageRatio4Member2024-01-012024-03-31

0001337298ff:LeverageRatio5Membersrt:MinimumMember2024-01-012024-03-31

0001337298ff:LeverageRatio5Memberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-03-31

0001337298ff:LeverageRatio5Memberus-gaap:BaseRateMember2024-01-012024-03-31

0001337298ff:LeverageRatio5Member2024-01-012024-03-31

0001337298us-gaap:RevolvingCreditFacilityMemberff:RegionsBankAndPNCBankNaMember2024-03-31

0001337298us-gaap:RevolvingCreditFacilityMemberff:RegionsBankAndPNCBankNaMember2023-12-31

0001337298us-gaap:EmployeeStockOptionMember2024-01-012024-03-31

0001337298us-gaap:EmployeeStockOptionMember2023-01-012023-03-31

0001337298us-gaap:OperatingSegmentsMemberff:CustomChemicalsMemberff:ChemicalsMember2024-01-012024-03-31

0001337298us-gaap:OperatingSegmentsMemberff:CustomChemicalsMemberff:ChemicalsMember2023-01-012023-03-31

0001337298us-gaap:OperatingSegmentsMemberff:PerformanceChemicalsMemberff:ChemicalsMember2024-01-012024-03-31

0001337298us-gaap:OperatingSegmentsMemberff:PerformanceChemicalsMemberff:ChemicalsMember2023-01-012023-03-31

0001337298us-gaap:OperatingSegmentsMemberff:ChemicalsMember2024-01-012024-03-31

0001337298us-gaap:OperatingSegmentsMemberff:ChemicalsMember2023-01-012023-03-31

0001337298us-gaap:OperatingSegmentsMemberff:BiofuelsMember2024-01-012024-03-31

0001337298us-gaap:OperatingSegmentsMemberff:BiofuelsMember2023-01-012023-03-31

thunderdome:item

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the quarterly period ended March 31, 2024 |

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from __________ to ___________ |

| | Commission file number: 0-52577 |

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 20-3340900 |

| (State or Other Jurisdiction of | | (IRS Employer Identification No.) |

| Incorporation or Organization) | | |

| | | |

| 8235 Forsyth Blvd., Suite 400, St Louis, Missouri | | 63105 |

| (Address of Principal Executive Offices) | | (Zip Code) |

| | | |

| | (314) 854-8352 | |

| | (Registrant’s Telephone Number, Including Area Code) | |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

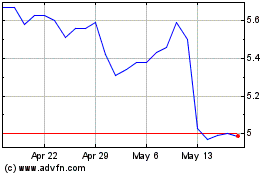

| Common Stock | FF | NYSE |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | | Accelerated filer | ☑ | |

| Non-accelerated filer ☐ | | Smaller reporting company | ☑ | |

| | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of May 10, 2024: 43,763,243

PART I FINANCIAL INFORMATION

Item 1. Financial Statements.

FutureFuel Corp.

Consolidated Balance Sheets

(Dollars in thousands)

| | | (Unaudited) | | | | | |

| | | March 31, 2024 | | | December 31, 2023 | |

| Assets | | | | | | | | |

| Cash and cash equivalents | | $ | 201,122 | | | $ | 219,444 | |

| Accounts receivable, inclusive of the blenders’ tax credit of $8,294 and $11,381, and net of allowances for expected credit losses of $41 and $55, respectively | | | 24,359 | | | | 28,406 | |

| Accounts receivable – related parties | | | 8 | | | | 1 | |

| Inventory | | | 56,097 | | | | 32,978 | |

| Income tax receivable | | | 1,935 | | | | 1,940 | |

| Prepaid expenses | | | 3,197 | | | | 4,346 | |

| Prepaid expenses – related parties | | | 12 | | | | 12 | |

| Other current assets | | | 2,570 | | | | 3,419 | |

| Total current assets | | | 289,300 | | | | 290,546 | |

| Property, plant and equipment, net | | | 72,572 | | | | 72,711 | |

| Other assets | | | 3,513 | | | | 3,824 | |

| Total noncurrent assets | | | 76,085 | | | | 76,535 | |

| Total Assets | | $ | 365,385 | | | $ | 367,081 | |

| Liabilities and Stockholders’ Equity | | | | | | | | |

| Accounts payable, inclusive of the blenders’ tax credit rebates due customers of $890 and $890 | | $ | 16,628 | | | $ | 22,178 | |

| Accounts payable – related parties | | | 42 | | | | 42 | |

| Deferred revenue – current | | | 3,458 | | | | 3,863 | |

| Dividends payable | | | 117,285 | | | | 10,503 | |

| Accrued expenses and other current liabilities | | | 7,112 | | | | 4,758 | |

| Total current liabilities | | | 144,525 | | | | 41,344 | |

| Deferred revenue – non-current | | | 12,114 | | | | 12,570 | |

| Noncurrent deferred income taxes | | | 626 | | | | - | |

| Other noncurrent liabilities | | | 3,296 | | | | 3,287 | |

| Total noncurrent liabilities | | | 16,036 | | | | 15,857 | |

| Total liabilities | | | 160,561 | | | | 57,201 | |

| Preferred stock, $0.0001 par value, 5,000,000 shares authorized, none issued and outstanding | | | - | | | | - | |

| Common stock, $0.0001 par value, 75,000,000 shares authorized, 43,763,243 shares issued and outstanding as of March 31, 2024 and December 31, 2023 | | | 4 | | | | 4 | |

| Additional paid in capital | | | 204,820 | | | | 282,489 | |

| Retained earnings | | | - | | | | 27,387 | |

| Total stockholders’ equity | | | 204,824 | | | | 309,880 | |

| Total Liabilities and Stockholders’ Equity | | $ | 365,385 | | | $ | 367,081 | |

The accompanying notes are an integral part of these consolidated financial statements.

FutureFuel Corp.

Consolidated Statements of Operations and Comprehensive Income

(Dollars in thousands, except per share amounts)

(Unaudited)

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Revenue | | $ | 58,281 | | | $ | 74,161 | |

| Revenue – related parties | | | - | | | | 20 | |

| Cost of goods sold | | | 52,704 | | | | 51,936 | |

| Cost of goods sold – related parties | | | 15 | | | | 10 | |

| Distribution | | | 497 | | | | 558 | |

| Distribution – related parties | | | 58 | | | | 54 | |

| Gross profit | | | 5,007 | | | | 21,623 | |

| Selling, general, and administrative expenses | | | | | | | | |

| Compensation expense | | | 987 | | | | 1,138 | |

| Other expense | | | 763 | | | | 1,009 | |

| Related party expense | | | 153 | | | | 153 | |

| Research and development expenses | | | 906 | | | | 1,072 | |

| Total operating expenses | | | 2,809 | | | | 3,372 | |

| Income from operations | | | 2,198 | | | | 18,251 | |

| Interest and dividend income | | | 2,800 | | | | 2,336 | |

| Interest expense | | | (35 | ) | | | (33 | ) |

| Gain on marketable securities | | | - | | | | 533 | |

| Other (expense) income | | | (1 | ) | | | 1 | |

| Other income (expense), net | | | 2,764 | | | | 2,837 | |

| Income before taxes | | | 4,962 | | | | 21,088 | |

| Income tax provision | | | 632 | | | | 7 | |

| Net income | | $ | 4,330 | | | $ | 21,081 | |

| | | | | | | | | |

| Earnings per common share | | | | | | | | |

| Basic | | $ | 0.10 | | | $ | 0.48 | |

| Diluted | | $ | 0.10 | | | $ | 0.48 | |

| Weighted average shares outstanding | | | | | | | | |

| Basic | | | 43,763,243 | | | | 43,763,243 | |

| Diluted | | | 43,763,243 | | | | 43,766,536 | |

| | | | | | | | | |

| Comprehensive income | | | | | | | | |

| Net income | | $ | 4,330 | | | $ | 21,081 | |

| Other comprehensive income from unrealized net gains on available-for-sale debt securities | | | - | | | | 22 | |

| Income tax effect | | | - | | | | (5 | ) |

| Total other comprehensive income, net of tax | | | - | | | | 17 | |

| Comprehensive income | | $ | 4,330 | | | $ | 21,098 | |

The accompanying notes are an integral part of these consolidated financial statements.

FutureFuel Corp.

Consolidated Statements of Stockholders’ Equity

(Dollars in thousands)

(Unaudited)

| | | For the Three Months Ended March 31, 2024 | |

| | | | | | | | | | | Accumulated | | | | | | | | | | | | | |

| | | | | | | | | | | Other | | | Additional | | | | | | | Total | |

| | | Common Stock | | | Comprehensive | | | paid-in | | | Retained | | | Stockholders’ | |

| | | Shares | | | Amount | | | Income (Loss) | | | Capital | | | Earnings | | | Equity | |

| Balance - December 31, 2023 | | | 43,763,243 | | | $ | 4 | | | $ | - | | | $ | 282,489 | | | $ | 27,387 | | | $ | 309,880 | |

| Cash dividends declared, $2.50 per common share | | | - | | | | - | | | | - | | | | (77,691 | ) | | | (31,717 | ) | | | (109,408 | ) |

| Stock based compensation | | | - | | | | - | | | | - | | | | 22 | | | | - | | | | 22 | |

| Net income | | | - | | | | - | | | | - | | | | - | | | | 4,330 | | | | 4,330 | |

| Balance - March 31, 2024 | | | 43,763,243 | | | $ | 4 | | | $ | - | | | $ | 204,820 | | | $ | - | | | $ | 204,824 | |

| |

|

For the Three Months Ended March 31, 2023 |

|

| |

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Other |

|

|

Additional |

|

|

|

|

|

|

Total |

|

| |

|

Common Stock |

|

|

Comprehensive |

|

|

paid-in |

|

|

Retained |

|

|

Stockholders’ |

|

| |

|

Shares |

|

|

Amount |

|

|

(Loss) Income |

|

|

Capital |

|

|

Earnings |

|

|

Equity |

|

| Balance - December 31, 2022 |

|

|

43,763,243 |

|

|

$ |

4 |

|

|

$ |

(1 |

) |

|

$ |

282,489 |

|

|

$ |

508 |

|

|

$ |

283,000 |

|

| Other comprehensive income |

|

|

- |

|

|

|

- |

|

|

|

17 |

|

|

|

- |

|

|

|

- |

|

|

|

17 |

|

| Net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

21,081 |

|

|

|

21,081 |

|

| Balance - March 31, 2023 |

|

|

43,763,243 |

|

|

$ |

4 |

|

|

$ |

16 |

|

|

$ |

282,489 |

|

|

$ |

21,589 |

|

|

$ |

304,098 |

|

The accompanying notes are an integral part of these consolidated financial statements.

FutureFuel Corp.

Consolidated Statements of Cash Flows

(Dollars in thousands)

(Unaudited)

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Cash flows from operating activities | | | | | | | | |

| Net income | | $ | 4,330 | | | $ | 21,081 | |

| Adjustments to reconcile net income to net cash used in operating activities: | | | | | | | | |

| Depreciation | | | 2,615 | | | | 2,551 | |

| Amortization of deferred financing costs | | | 26 | | | | 24 | |

| Provision (benefit) for deferred income taxes | | | 626 | | | | (5 | ) |

| Change in fair value of equity securities | | | - | | | | (533 | ) |

| Change in fair value of derivative instruments | | | 2,274 | | | | (4,902 | ) |

| Stock based compensation | | | 22 | | | | - | |

| Noncash interest expense | | | 9 | | | | 8 | |

| Changes in operating assets and liabilities: | | | | | | | | |

| Accounts receivable | | | 4,047 | | | | 277 | |

| Accounts receivable – related parties | | | (7 | ) | | | - | |

| Inventory | | | (23,119 | ) | | | (42,473 | ) |

| Income tax receivable | | | 5 | | | | 23 | |

| Prepaid expenses | | | 1,149 | | | | 525 | |

| Other assets | | | 72 | | | | (5,165 | ) |

| Accounts payable | | | (5,753 | ) | | | 413 | |

| Accounts payable – related parties | | | - | | | | 25 | |

| Accrued expenses and other current liabilities | | | 2,354 | | | | (270 | ) |

| Accrued expenses and other current liabilities – related parties | | | - | | | | (1 | ) |

| Deferred revenue | | | (861 | ) | | | (1,274 | ) |

| Other noncurrent liabilities | | | - | | | | (114 | ) |

| Net cash used in operating activities | | | (12,211 | ) | | | (29,810 | ) |

| Cash flows from investing activities | | | | | | | | |

| Collateralization of derivative instruments | | | (1,212 | ) | | | 4,327 | |

| Capital expenditures | | | (2,273 | ) | | | (2,459 | ) |

| Net cash (used in) provided by investing activities | | | (3,485 | ) | | | 1,868 | |

| Cash flows from financing activities | | | | | | | | |

| Payment of dividends | | | (2,626 | ) | | | (2,626 | ) |

| Deferred financing costs | | | - | | | | (14 | ) |

| Net cash used in financing activities | | | (2,626 | ) | | | (2,640 | ) |

| Net change in cash and cash equivalents | | | (18,322 | ) | | | (30,582 | ) |

| Cash and cash equivalents at beginning of period | | | 219,444 | | | | 175,640 | |

| Cash and cash equivalents at end of period | | $ | 201,122 | | | $ | 145,058 | |

| | | | | | | | | |

| Cash dividends declared in the current period, not paid | | $ | 109,408 | | | $ | 7,877 | |

| Noncash investing and financing activities: | | | | | | | | |

| Noncash capital expenditures | | $ | 536 | | | $ | 258 | |

The accompanying notes are an integral part of these consolidated financial statements.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

(Unaudited)

| 1) |

SIGNIFICANT ACCOUNTING POLICIES |

Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared by FutureFuel Corp. (“FutureFuel” or “the Company”) in accordance and consistent with the accounting policies stated in the Company's 2023 Annual Report on Form 10-K, inclusive of the audited consolidated financial statements and should be read in conjunction with these consolidated financial statements.

In the opinion of FutureFuel, all normal recurring adjustments necessary for a fair presentation have been included in the unaudited consolidated financial statements. The unaudited consolidated financial statements have been prepared in compliance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with instructions to Form 10-Q adopted by the Securities and Exchange Commission (“SEC”). Accordingly, the unaudited consolidated financial statements do not include all the information and footnotes required by GAAP for complete financial statements, and do include amounts that are based upon management estimates and judgments. Future actual results could differ from such current estimates. The unaudited consolidated financial statements include assets, liabilities, revenues, and expenses of FutureFuel and its direct and indirect wholly owned subsidiaries; namely, FutureFuel Chemical Company; FFC Grain, L.L.C.; FutureFuel Warehouse Company, L.L.C.; and Legacy Regional Transport, L.L.C. Intercompany transactions and balances have been eliminated in consolidation.

Recently Adopted Accounting Standards

No new accounting standards have been adopted recently.

Issued Accounting Standards Not Yet Adopted

In December 2023, the FASB issued Accounting Standards Update (ASU) No. 2023-09 Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which aims to address requests for improved income tax disclosures from investors that use the financial statements to make capital allocation decisions. The amendments in this ASU address the investor requests for more transparency of income tax information and apply to all entities that are subject to income taxes. The ASU is effective for years beginning after December 15, 2024, but early adoption is permitted. This ASU should be applied on a prospective basis, although retrospective application is permitted. Management is currently evaluating the impact of the changes required by the new standard on the Company's financial statements and related disclosures.

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which aims to improve disclosures about a public entity’s reportable segments. This update addresses requests from investors for more detailed information about a reportable segment’s expenses in order to improve understanding of a public entity’s business activities, overall performance, and potential future cash flows. The amendments in this ASU require public business entities to disclose, on an annual and interim basis, significant segment expenses that are regularly provided to the chief operating decision maker and are included within each reported measure of segment profit or loss. This update does not change how an entity identifies or aggregates its reportable segments or how it applies the quantitative thresholds to determine them. This update is effective for fiscal years beginning after December 15, 2023, and interim periods within those fiscal years starting after December 15, 2024. This ASU must be applied retrospectively to all prior periods presented. Management is currently evaluating the impact of the changes required by this new standard on the Company's financial statements and related disclosures for the year ending December 31, 2024.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

| 2) | GOVERNMENT TAX CREDITS |

BIODIESEL BLENDERS’ TAX CREDIT AND SMALL AGRI-BIODIESEL PRODUCER TAX CREDIT

The biodiesel Blenders’ Tax Credit (“BTC”) provides a one dollar per gallon tax credit to the blender of biomass-based diesel with at least 0.1% petroleum-based diesel fuel. The BTC will expire December 31, 2024 based on current law. The Company records this credit as a reduction to cost of goods sold.

Additionally, small agri-biodiesel producers with production capacity not in excess of 60 million gallons are eligible for an additional tax credit of $0.10 per gallon on the first 15 million gallons of agri-biodiesel sold (the “Small Agri-biodiesel Producer Tax Credit”). The Company is eligible for this credit as part of the tax provision.

CARES ACT – EMPLOYEE RETENTION TAX CREDIT

The Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), was enacted on March 27, 2020, to encourage eligible employers to retain employees on their payroll through, among other things, an available employee retention tax credit. The Consolidated Appropriations Act, effective January 1, 2021 broadened the eligibility of the credit. FutureFuel has applied for this credit and will recognize the benefit of the credit once reasonable assurance can be made as to the retention of the credit.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

The majority of revenue is from short term contracts with revenue recognized when a single performance obligation to transfer product under the terms of a contract with a customer are satisfied.

Certain of the Company's custom chemical contracts within the chemical segment contain a material right as defined by ASC Topic 606, from the provision of a customer option to purchase future goods or services at a discounted price as a result of upfront payments provided by customers. Each contract also has a performance obligation to transfer products with 30-day payment terms. The Company recognizes revenue when the customer takes control of the inventory, either upon shipment or when the material is made available for pick up. If the customer is deemed to take control of the inventory prior to pick up, the Company recognizes the revenue as a bill-and-hold transaction in accordance with ASC Topic 606. The Company applies the renewal option approach in allocating the transaction price to these material rights and transfer of product. As a basis for allocating the transaction price to the material right and transfer of product, the Company estimates the expected life of the contract, the expected contractual volumes to be sold over that life, and the most likely expected sales price. Each estimate is updated quarterly on a prospective basis.

Contract Assets and Liabilities:

Contract assets consist of unbilled amounts typically resulting from revenue recognized through bill-and-hold arrangements. The contract assets at March 31, 2024 and December 31, 2023 consist of unbilled revenue from one customer and cash due from another customer and are recorded as accounts receivable in the consolidated balance sheets. Contract liabilities consist of advance payment arrangements related to material rights recorded as deferred revenue in the consolidated balance sheets. Increases to contract liabilities from cash received or due for a performance obligation of chemical segment plant expansions were $0 for the three months ended March 31, 2024 and 2023. Contract liabilities are reduced as the Company transfers product to the customer under the renewal option approach. Revenue recognized in the chemical segment from the contract liability reductions was $806 and $1,219 for the three months ended March 31, 2024 and 2023, respectively. These contract asset and liability balances are reported on the consolidated balance sheets on a contract-by-contract basis at the end of each reporting period.

The following table provides the balances of receivables, contract assets, and contract liabilities from contracts with customers.

| Contract Assets and Liability Balances | | March 31, 2024 | | | December 31, 2023 | |

| Trade receivables, included in accounts receivable* | | $ | 14,521 | | | $ | 15,897 | |

| Contract assets, included in accounts receivable | | | 1,544 | | | | 1,128 | |

| Contract liabilities, included in deferred revenue - short-term | | | 3,251 | | | | 3,656 | |

| Contract liabilities, included in deferred revenue - long-term | | | 8,917 | | | | 9,318 | |

*Exclusive of the BTC of $8,294 and $11,381, respectively, and net of allowances for expected credit losses of $41 and $55, respectively, as of the dates noted.

Transaction price allocated to the remaining performance obligations:

At March 31, 2024, approximately $12,168 of revenue is expected to be recognized from remaining performance obligations. FutureFuel expects to recognize this revenue ratably over expected sales over the expected term of its long-term contracts ranging from two to four years. Approximately 27% of this revenue is expected to be recognized over the next 12 months, and 73% is expected to be recognized over the subsequent 33 months. These amounts are subject to change based upon changes in the estimated contract life and estimated quantities to be sold over the contract life.

The Company applies the practical expedient in ASC 606-10-50-14 and excludes the value of unsatisfied performance obligations for (i) contracts with an original expected length of one year or less; and (ii) contracts for which the Company recognizes revenue at the amount to which it has the right to invoice for services performed.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

The following tables provide revenue from customers disaggregated by the type of arrangement and by the timing of the recognized revenue.

Disaggregation of revenue - contractual and non-contractual:

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Contract revenue from customers with > one-year arrangements | | $ | 9,240 | | | $ | 10,465 | |

| Contract revenue from customers with < one-year arrangements | | | 48,986 | | | | 63,661 | |

| Revenue from non-contractual arrangements | | | 55 | | | | 55 | |

| Total revenue | | $ | 58,281 | | | $ | 74,181 | |

Timing of revenue:

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Bill-and-hold revenue | | $ | 11,644 | | | $ | 10,590 | |

| Non-bill-and-hold revenue | | | 46,637 | | | | 63,591 | |

| Total revenue | | $ | 58,281 | | | $ | 74,181 | |

As of March 31, 2024 and December 31, 2023, $3,291 and $4,317 of bill-and-hold revenue had not shipped, respectively.

The carrying values of inventory were as follows as of:

| | | March 31, 2024 | | | December 31, 2023 | |

| At average cost (approximates current cost) | | | | | | | | |

| Finished goods | | $ | 18,057 | | | $ | 16,235 | |

| Work in process | | | 733 | | | | 611 | |

| Raw materials and supplies | | | 43,680 | | | | 25,532 | |

| | | | 62,470 | | | | 42,378 | |

| LIFO reserve | | | (6,373 | ) | | | (9,400 | ) |

| Total inventory | | $ | 56,097 | | | $ | 32,978 | |

No liquidation occurred in the three months ended March 31, 2024 and 2023.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

| 5) | DERIVATIVE INSTRUMENTS |

The Company records all derivative instruments at fair value. Fair value is determined by using the closing prices of the derivative instruments on the New York Mercantile Exchange at the end of an accounting period. Changes in the fair value of derivative instruments are recognized at the end of each accounting period and recorded in the statements of operations and comprehensive income as a component of cost of goods sold. These instruments use inputs considered Level 1 holdings.

Fair value accounting pronouncements include a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the asset or liability developed based on market data obtained from sources independent of FutureFuel. Unobservable inputs are inputs that reflect FutureFuel’s assumptions about the factors market participants would use in valuing the asset or liability developed based upon the best information available in the circumstances. The hierarchy is broken down into three levels. Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities. Level 2 inputs include quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the asset or liability. Categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

In order to manage commodity price risk caused by market fluctuations in biofuel prices, future purchases of feedstock used in biodiesel production, physical feedstock, finished product inventories attributed to the process, and other petroleum products purchased or sold, the Company may enter into exchange-traded commodity futures and options contracts. The Company accounts for these derivative instruments in accordance with ASC 815-20-25, Derivatives and Hedging. Under this standard, the accounting for changes in the fair value of a derivative instrument depends upon whether it has been designated as an accounting hedging relationship and, further, on the type of hedging relationship. To qualify for designation as an accounting hedging relationship, specific criteria must be met and appropriate documentation maintained. The Company had no derivative instruments that qualified under these rules as designated accounting hedges in 2024 or 2023. The Company has elected the normal purchase and normal sales exception for certain feedstock purchase contracts and supply agreements.

Realized gains and losses on derivative instruments and changes in fair value of the derivative instruments are recorded in the consolidated statements of operations as a component of cost of goods sold and amounted to a loss of $3,464 (realized loss of $1,190) for the three months ended March 31, 2024, and a gain of $8,307 (realized gain of $3,405) for the three months ended March 31, 2023.

The volumes and carrying values of FutureFuel’s derivative instruments were as follows at:

| | | (Liability) Asset | |

| | | March 31, 2024 | | | December 31, 2023 | |

| | | Contract Quantity | | | Fair Value | | | Contract Quantity | | | Fair Value | |

| Regulated fixed price future commitments, included in other current assets (in thousand barrels) | | | 232 | | | $ | (538 | ) | | | 354 | | | $ | 1,736 | |

The margin account maintained with a broker to collateralize these derivative instruments carried an account balance of $1,957 and $745 at March 31, 2024 and December 31, 2023, respectively, and was classified as other current assets in the consolidated balance sheets. The carrying values of the margin account and of the derivative instruments are included net, in other current assets.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

At March 31, 2024 and December 31, 2023, FutureFuel held no marketable equity and trust preferred (debt) securities.

The change in the fair value of marketable equity securities (preferred and other equity instruments) for the three months ended March 31, 2023 was a gain of $533, in accordance with ASC 321. There was no change for the three months ended March 31, 2024.

| 7) | ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES |

Accrued expenses and other current liabilities consisted of the following at:

| | | March 31, 2024 | | | December 31, 2023 | |

| Refundable deposit | | $ | 4,000 | | | $ | - | |

| Accrued employee liabilities | | | 1,521 | | | | 2,179 | |

| Accrued property, franchise, motor fuel and other taxes | | | 1,027 | | | | 1,346 | |

| Lease liability, current | | | 281 | | | | 389 | |

| Other | | | 283 | | | | 844 | |

| Total | | $ | 7,112 | | | $ | 4,758 | |

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

On March 30, 2020, the Company, with FutureFuel Chemical Company as the borrower and certain of the Company’s other subsidiaries as guarantors, amended and restated its credit agreement (the “Credit Agreement”) originally entered into on April 16, 2015 (as amended, the “Prior Credit Agreement”) with the lenders party thereto, Regions Bank as administrative agent and collateral agent, and PNC Bank, N.A., as syndication agent. The Credit Agreement consists of a five-year revolving credit facility in a dollar amount of up to $100,000, which includes a sublimit of $30,000 for letters of credit and $15,000 for swingline loans (collectively, the “Credit Facility”). The Credit Facility expires on March 30, 2025.

On March 1, 2023, the Company entered into a First Amendment to the Credit Agreement (the “First Amendment”). The First Amendment primarily amends the Credit Agreement to transition the Credit Facility from LIBOR to the Secured Overnight Financing Rate (“SOFR”) and other conforming changes, in each case as more specifically set forth in the First Amendment. The First Amendment does not modify the aggregate amount, or expiration date, of the Credit Facility. We do not expect the transition from LIBOR to have a material impact on the Credit Facility. Pursuant to the First Amendment, the interest rate floats at the following margins over SOFR or base rate based upon our leverage ratio.

| | | Adjusted SOFR Rate Loans and | | | | | | | | | |

| Consolidated Leverage Ratio | | Letter of Credit Fee | | | Base Rate Loans | | | Commitment Fee | |

| < 1.00:1.0 | | | 1.00 | % | | | 0.00 | % | | | 0.15 | % |

| ≥ 1.00:1.0 And < 1.50:1.0 | | | 1.25 | % | | | 0.25 | % | | | 0.15 | % |

| ≥ 1.50:1.0 And < 2.00:1.0 | | | 1.50 | % | | | 0.50 | % | | | 0.20 | % |

| ≥ 2.00:1.0 And < 2.50:1.0 | | | 1.75 | % | | | 0.75 | % | | | 0.20 | % |

| ≥ 2.50:1.0 | | | 2.00 | % | | | 1.00 | % | | | 0.25 | % |

The terms of the Credit Facility contain certain negative covenants and conditions including a maximum consolidated leverage ratio and a consolidated minimum interest coverage ratio.

There were no borrowings under the Credit Agreement at March 31, 2024 or December 31, 2023.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

The following table summarizes the income tax provision.

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Income tax provision | | $ | 632 | | | $ | 7 | |

| Effective tax rate | | | 12.7 | % | | | 0.0 | % |

The Company’s income tax provision for the three months ended March 31, 2024 comprises primarily an increase in the valuation allowance against net deferred assets, plus immaterial state taxes and miscellaneous items. No deferred tax benefits on ongoing tax losses have been recognized, reflecting management’s determination that none of the net deferred tax assets generated on the Company's 2023 tax losses are more likely than not to be realized. The three-month period in 2023 similarly reflected immaterial state taxes and miscellaneous items.

In the three months ended March 31, 2024 and 2023, FutureFuel used the treasury method in computing earnings per share.

Basic and diluted earnings per common share were computed as follows:

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Numerator: | | | | | | | | |

| Net income | | $ | 4,330 | | | $ | 21,081 | |

| Denominator: | | | | | | | | |

| Weighted average shares outstanding – basic | | | 43,763,243 | | | | 43,763,243 | |

| Effect of dilutive securities: | | | | | | | | |

| Stock options and other awards | | | - | | | | 3,293 | |

| Weighted average shares outstanding – diluted | | | 43,763,243 | | | | 43,766,536 | |

| | | | | | | | | |

| Basic earnings per share | | $ | 0.10 | | | $ | 0.48 | |

| Diluted earnings per share | | $ | 0.10 | | | $ | 0.48 | |

For the three months ended March 31, 2024 and 2023, 44,000 and 40,707 options to purchase FutureFuel’s common stock were excluded, respectively, in the computation of diluted earnings per share as all were anti-dilutive.

| 11) | RELATED PARTY TRANSACTIONS |

FutureFuel enters into transactions with companies affiliated with or controlled by a director and significant shareholder. Revenues, expenses, prepaid amounts, and unpaid amounts related to these transactions are captured in the accompanying consolidated financial statements as related party line items.

Related party revenues are the result of sales of biodiesel, petrodiesel, blends, other petroleum products, and other similar or related products to these related parties.

Related party cost of goods sold and distribution are the result of sales and purchases of biodiesel, petrodiesel, blends, and other petroleum products with these related parties along with the associated expense from storage and terminalling services provided by these related parties.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

FutureFuel has two reportable segments organized along similar product groups – chemicals and biofuels.

Chemicals

FutureFuel’s chemical segment manufactures diversified chemical products that are sold externally to third party customers. This segment is composed of two components: “custom manufacturing” (manufacturing chemicals for specific customers) and “performance chemicals” (multi-customer specialty chemicals).

Biofuels

FutureFuel’s biofuel segment primarily manufactures and markets biodiesel. Biodiesel revenues are generated through the sale of biodiesel to customers through FutureFuel’s distribution network at its Batesville Plant, through distribution facilities available at leased oil storage facilities, and through a network of remotely located tanks. Biofuel revenues also include the sale of biodiesel blends with petrodiesel; petrodiesel with no biodiesel added; internally generated, separated Renewable Identification Numbers (“RINs”); and biodiesel production byproducts. Biodiesel selling prices and profitability can at times fluctuate based on the timing of unsold, internally generated RINs. FutureFuel does not allocate production costs to internally generated RINs, and, from time to time, can enter into sales of biodiesel on a “RINs-free” basis, resulting in FutureFuel maintaining possession of the applicable RINs from the sale. The benefit derived from the eventual sale of the RINs is not reflected in results of operations until such time as the RINs sale has been completed, which may lead to variability in reported operating results.

As of March 31, 2024, FutureFuel held 2.0 million of RINs with a fair market value of $1,624 and no cost. Comparatively, at March 31, 2023, FutureFuel held no RINs. These fair values are considered Level 1 inputs.

Summary of business by segment

| | | Three Months Ended March 31, | |

| | | 2024 | | | 2023 | |

| Revenue | | | | | | | | |

| Custom chemicals | | $ | 15,427 | | | $ | 16,620 | |

| Performance chemicals | | | 2,632 | | | | 5,261 | |

| Chemical revenue | | | 18,059 | | | | 21,881 | |

| Biofuel revenue | | | 40,222 | | | | 52,300 | |

| Total Revenue | | $ | 58,281 | | | $ | 74,181 | |

| | | | | | | | | |

| Segment gross profit | | | | | | | | |

| Chemical | | $ | 4,021 | | | $ | 8,623 | |

| Biofuel | | | 986 | | | | 13,000 | |

| Total gross profit | | $ | 5,007 | | | $ | 21,623 | |

Depreciation is allocated to segment cost of goods sold based on plant usage. The total assets and capital expenditures of FutureFuel have not been allocated to individual segments as large portions of these assets are shared to varying degrees by each segment, causing such an allocation to be of little value.

Notes to Consolidated Financial Statements of FutureFuel Corp.

(Dollars in thousands, except per share and per gallon amounts)

From time to time, FutureFuel and its subsidiaries are parties to, or targets of, lawsuits, claims, investigations, regulatory matters, and proceedings, which are being handled and defended in the ordinary course of business. While FutureFuel is unable to predict the outcomes of these matters, it does not believe, based upon currently available facts, that the ultimate resolution of any such pending matters will have a material adverse effect on its overall financial condition, results of operations, or cash flows.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations of FutureFuel Corp. (“FutureFuel”, “the Company”, “we”, or “our”) should be read together with our consolidated financial statements, including the notes thereto, set forth herein. This discussion contains forward-looking statements that reflect our current views with respect to future events and financial performance. Actual results may differ materially from those anticipated in these forward-looking statements. See “Forward-Looking Information” below for additional discussion regarding risks associated with forward-looking statements.

Unless otherwise stated, all dollar amounts are in thousands.

Overview

Our Company is managed and reported in two reporting segments: chemicals and biofuels. Within the chemical segment are two product groupings: custom chemicals and performance chemicals. The custom product group is composed of specialty chemicals manufactured for a single customer whereas the performance product group is composed of chemicals manufactured for multiple customers. The biofuel segment is composed of one product group. Management believes that the diversity of each segment strengthens the company in the ability to utilize resources and is committed to growing each segment.

Within the United States Environmental Protection Agency (“EPA”) Renewable Fuel Standard (“RFS”), we generate 1.5 Renewable Identification Numbers (“RINs”) for each gallon of biodiesel sold in the United States with a classification of a D4 or D6 RIN. RINs are used to monitor the level of renewable fuel traded in a given year in accordance with RFS 2 within the EPA moderated transaction system. We do not assign cost of goods sold to the generation of RINs as the physical fuel generates the full cost. As of March 31, 2024, we held 2.0 million D4 and D6 RINs with a fair market value of $1,624. Comparatively, as of March 31, 2023, FutureFuel held no inventory.

Summary of Financial Results

Set forth below is a summary of certain consolidated financial information for the periods indicated.

| |

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

|

|

|

Dollar |

|

|

% |

|

| |

|

2024 |

|

|

2023* |

|

|

Change |

|

|

Change |

|

| Revenue |

|

$ |

58,281 |

|

|

$ |

74,181 |

|

|

$ |

(15,900 |

) |

|

|

(21 |

)% |

| Income from operations |

|

$ |

2,198 |

|

|

$ |

18,251 |

|

|

$ |

(16,053 |

) |

|

|

(88 |

)% |

| Net income |

|

$ |

4,330 |

|

|

$ |

21,081 |

|

|

$ |

(16,751 |

) |

|

|

(79 |

)% |

| Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.10 |

|

|

$ |

0.48 |

|

|

$ |

(0.38 |

) |

|

|

(79 |

)% |

| Diluted |

|

$ |

0.10 |

|

|

$ |

0.48 |

|

|

$ |

(0.38 |

) |

|

|

(79 |

)% |

| Adjusted EBITDA* |

|

$ |

7,108 |

|

|

$ |

15,900 |

|

|

$ |

(8,792 |

) |

|

|

(55 |

)% |

| * Adjusted EBITDA for the three months of 2023 has been restated to be consistent with 2024 reporting. Adjusted EBITDA in both years excludes the impact from unrealized gains or losses on derivatives. Realized gains and losses are included in Adjusted EBITDA in both 2023 and 2024. |

We use adjusted EBITDA as a key operating metric to measure both performance and liquidity. Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is not a substitute for operating income, net income, or cash flow from operating activities (each as determined in accordance with GAAP) as a measure of performance or liquidity. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of results as reported under GAAP. We define adjusted EBITDA as net income before interest, income taxes, depreciation, and amortization expenses, excluding, when applicable, non-cash stock-based compensation expenses, public offering expenses, acquisition-related transaction costs, purchase accounting adjustments, losses on disposal of property and equipment, non-cash gains or losses on derivative instruments, and other non-operating income or expenses. Information relating to adjusted EBITDA is provided so that investors have the same data that we employ in assessing the overall operation and liquidity of our business. Our calculation of adjusted EBITDA may be different from similarly titled measures used by other companies; therefore, the results of our calculation are not necessarily comparable to the results of other companies.

Adjusted EBITDA allows our chief operating decision makers to assess the performance and liquidity of our business on a consolidated basis to assess the ability of our operating segments to produce operating cash flow to fund working capital needs, to fund capital expenditures, and to pay dividends. In particular, our management believes that adjusted EBITDA permits a comparative assessment of our operating performance and liquidity, relative to a performance and liquidity based on GAAP results. This measure isolates the effects of certain items, including depreciation and amortization (which may vary among our operating segments without any correlation to their underlying operating performance), non-cash stock-based compensation expense (which is a non-cash expense that varies widely among similar companies), and non-cash gains and losses on derivative instruments (which can cause net income to appear volatile from period to period relative to the sale of the underlying physical product).

We utilize commodity derivative instruments primarily to protect our operations from downward movements in commodity prices, and to provide greater certainty of cash flows associated with sales of our commodities. We enter into hedges, and we utilize mark-to-market accounting to account for these instruments. Thus, our results in any given period can be impacted, and sometimes significantly, by changes in market prices relative to our contract price along with the timing of the valuation change in the derivative instruments relative to the sale of biofuel. We include the mark-to-market or non-cash portion of this item as an adjustment as we believe it provides a relevant indicator of the underlying performance of our business in a given period.

Additionally, we held marketable securities of certain debt securities (trust preferred stock) and in preferred stock and other equity instruments during the three months ended March 31, 2023, but sold all marketable security investments during the three months ended June 30, 2023. The realized and unrealized gains and losses on these marketable securities fluctuated from period to period. We included this item as an adjustment in the prior year period as we believed it provided a relevant indicator of the underlying performance of our business.

The following table reconciles net income, the most directly comparable GAAP performance financial measure, with adjusted EBITDA.

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023* |

|

| Net income |

|

$ |

4,330 |

|

|

$ |

21,081 |

|

| Depreciation |

|

|

2,615 |

|

|

|

2,551 |

|

| Non-cash stock-based compensation |

|

|

22 |

|

|

|

- |

|

| Interest and dividend income |

|

|

(2,800 |

) |

|

|

(2,336 |

) |

| Non-cash interest expense and amortization of deferred financing costs |

|

|

35 |

|

|

|

32 |

|

| Unrealized loss (gain) on derivative instruments |

|

|

2,274 |

|

|

|

(4,902 |

) |

| Gain on marketable securities |

|

|

- |

|

|

|

(533 |

) |

| Income tax provision |

|

|

632 |

|

|

|

7 |

|

| Adjusted EBITDA* |

|

$ |

7,108 |

|

|

$ |

15,900 |

|

The following table reconciles cash flows from operations, the most directly comparable GAAP liquidity financial measure, with adjusted EBITDA.

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023* |

|

| Net cash used in operating activities |

|

$ |

(12,211 |

) |

|

$ |

(29,810 |

) |

| Deferred income taxes, net |

|

|

(626 |

) |

|

|

5 |

|

| Interest and dividend income |

|

|

(2,800 |

) |

|

|

(2,336 |

) |

| Income tax provision |

|

|

632 |

|

|

|

7 |

|

| Change in operating assets and liabilities, net |

|

|

22,113 |

|

|

|

48,034 |

|

| Adjusted EBITDA* |

|

$ |

7,108 |

|

|

$ |

15,900 |

|

| * Adjusted EBITDA restated for the three months of 2023 has been restated to be consistent with 2024 reporting. Adjusted EBITDA in both years excludes the impact from unrealized gains or losses on derivatives. Realized gains and losses are included in Adjusted EBITDA in both 2023 and 2024. |

Results of Operations

Consolidated

| |

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

|

|

|

Change |

|

| |

|

2024 |

|

|

2023 |

|

|

Amount |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

58,281 |

|

|

$ |

74,181 |

|

|

$ |

(15,900 |

) |

|

|

(21.4 |

)% |

| Volume/product mix effect |

|

|

|

|

|

|

|

|

|

|

(1,452 |

) |

|

|

(2.0 |

) |

| Price effect |

|

|

|

|

|

|

|

|

|

|

(14,448 |

) |

|

|

(19.5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

5,007 |

|

|

|

21,623 |

|

|

|

(16,616 |

) |

|

|

(76.8 |

) |

| Operating expenses |

|

|

(2,809 |

) |

|

|

(3,372 |

) |

|

|

563 |

|

|

|

(16.7 |

) |

| Other income (expense), net |

|

|

2,764 |

|

|

|

2,837 |

|

|

|

(73 |

) |

|

|

(2.6 |

) |

| Income tax provision |

|

|

632 |

|

|

|

7 |

|

|

|

625 |

|

|

|

8928.6 |

|

| Net income |

|

$ |

4,330 |

|

|

$ |

21,081 |

|

|

$ |

(16,751 |

) |

|

|

(79.5 |

)% |

Consolidated revenue in the three months ended March 31, 2024 decreased $15,900 compared to the three months ended March 31, 2023. Relative to the three-month comparative period, net sales decreased $11,942 in the biofuel segment on lower average prices. Largely contributing to this reduced price was a significant drop in RIN prices following the EPA’s renewable fuel volume requirements release in the second quarter of 2023. Sales revenue was also lower in the chemical segment on both sales volumes and price from chemicals used in the industrial intermediate and additives for energy markets. Production and sales volumes were negatively impacted by extreme winter weather experienced during the three-month period ended March 31, 2024. Partially improving chemical sales was favorable product mix and revenue from new custom chemical contracts.

Gross profit in the three months ended March 31, 2024 decreased $16,616 as compared to the same period of 2023, from: (i) the narrowing of the spread in biofuel price and feedstock price (inclusive of the effect of the RIN price decline); (ii) the change in the activity in derivative instruments with a realized loss of $1,190 in the current three-month period as compared to a realized gain of $3,405 in the same three months of the prior year; (iii) the change in the mark-to-market derivative position which was an unrealized loss of $2,274 as compared to an unrealized gain of $4,902 in the three months ended March 31, 2024 and 2023, respectively; and (iv) the change in the adjustment in the carrying value of our inventory as determined utilizing the LIFO method of inventory accounting. The adjustment in item (iv) increased gross profit $3,027 in the three months ended March 31, 2024 as compared to $3,783 in 2023. The contrasting results in items (i) and (ii) reflect the impact of price movements in the biodiesel market during the course of each year compared to when we committed to our feedstock acquisition. In addition, gross profit was negatively impacted in the three-month period ended March 31, 2024 by higher costs resulting from the impact of extreme winter weather.

Operating expenses

Operating expenses decreased $563 in the three months ended March 31, 2024, as compared to the three months ended March 31, 2023. This decrease was from reduced compensation, legal, and research and development expenses.

Other income (expense), net

Other income (expense) decreased income a net $73 in the three months ended March 31, 2024, as compared to the same period of 2023. In the current three-month period, interest income was $2,800 as compared to dividend and interest income of $2,336 and a gain of $533 on marketable securities in the same period of 2023.

Income tax provision

The Company’s income tax provision for the three months ended March 31, 2024 comprises primarily an increase in the valuation allowance against net deferred assets, plus immaterial state taxes and miscellaneous items. No deferred tax benefits on ongoing tax losses have been recognized, reflecting management’s determination that none of the net deferred tax assets generated on the Company's 2023 tax losses are more likely than not to be realized. The three-month period in 2023 similarly reflected immaterial state taxes and miscellaneous items.

The Company evaluates its deferred tax assets quarterly and records a valuation allowance to reduce these assets to the amount that is more likely than not to be realized.

Chemical Segment

| |

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

|

|

|

Change |

|

| |

|

2024 |

|

|

2023 |

|

|

Amount |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

18,059 |

|

|

$ |

21,881 |

|

|

$ |

(3,822 |

) |

|

|

(17.5 |

)% |

| Volume/product mix effect |

|

|

|

|

|

|

|

|

|

|

(1,316 |

) |

|

|

(6.0 |

) |

| Price effect |

|

|

|

|

|

|

|

|

|

|

(2,506 |

) |

|

|

(11.5 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

$ |

4,021 |

|

|

$ |

8,623 |

|

|

$ |

(4,602 |

) |

|

|

(53.4 |

)% |

Chemical revenue in the three months ended March 31, 2024 decreased 17.5% or $3,822 compared to the same period of 2023. Revenue for our custom chemicals for the three months ended March 31, 2024 totaled $15,427, a decrease of $1,193 from the same period in 2023 from reduced sales volumes of chemicals sold into the energy market. Partially offsetting these reductions were sales from increased volumes of chemicals sold into the automotive coatings market as well as sales of two new contracts in the agricultural market. Performance chemicals revenue was $2,632, a decrease of $2,629 from the three months ended March 31, 2023. This decrease was mostly from lower sales of glycerin as markets softened on increased imports. Production and sales volumes for the segment were negatively impacted by extreme winter weather experienced during the three-month period ended March 31, 2024.

Gross profit for the chemical segment for the three months ended March 31, 2024, decreased $4,602 when compared to the same period of 2023. This decrease was primarily from: (i) reduced sales volumes as noted above, and (ii) impact of higher costs from extreme winter weather experienced in the current period.

Biofuel Segment

| |

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

|

|

|

Change |

|

| |

|

2024 |

|

|

2023 |

|

|

Amount |

|

|

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

40,222 |

|

|

$ |

52,300 |

|

|

$ |

(12,078 |

) |

|

|

(23.1 |

)% |

| Volume/product mix effect |

|

|

|

|

|

|

|

|

|

|

(136 |

) |

|

|

(0.3 |

) |

| Price effect |

|

|

|

|

|

|

|

|

|

|

(11,942 |

) |

|

|

(22.8 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

$ |

986 |

|

|

$ |

13,000 |

|

|

$ |

(12,014 |

) |

|

|

(92.4 |

)% |

Biofuels revenue in the three months ended March 31, 2024 decreased $12,078 as compared to the same period of 2023. This decrease primarily resulted from a 23% reduction in the average price of fuel sold. The lower prices were driven in part by the reduction in D4 RIN prices which fell following the EPA’s proposed rule issued June 21, 2023. In addition, production and sales volumes were negatively impacted by extreme winter weather experienced during the three-month period ended March 31, 2024.

A significant portion of our biodiesel sold was to four major refiners/blenders in the three months ended March 31, 2024 and 2023. No assurances can be given that we will continue to sell to such major refiners, or, if we do sell, the volume we will sell or the profit margin we will realize. We do not believe that the loss of these customers would have a material adverse effect on our biofuels segment or on us as a whole because: (i) we believe that we could readily sell our biodiesel to other customers on equivalent terms as potential demand from other customers for biodiesel exceeds our production capacity; (ii) our sales to these customers are not under fixed terms and the customers have no fixed obligation to purchase any minimum quantities except as stipulated by short-term purchase orders; and (iii) the prices we receive from these customers are based upon then-market rates, as would be the case with sales of this commodity to other customers.

Biofuels gross profit was $986 in the three months ended March 31, 2024, a decrease in gross profit of $12,014 from the comparative period. This decrease primarily resulted from the change in the activity of derivative instruments with a realized loss of $1,190 as compared to a realized gain of $3,405 in the same three months of the prior year. Also decreasing gross losses was the change in the mark-to-market derivative position which was an unrealized loss of $2,274 as compared to an unrealized gain of $4,902 in the same three months of the prior year. In addition, gross profit was negatively impacted in the three-month period ended March 31, 2024 by lower RIN prices and higher costs resulting from extreme winter weather.

For our derivative activity, we recognize all derivative instruments as either assets or liabilities at fair value in our consolidated balance sheets. The realized and unrealized derivative gains and losses are recorded as cost of goods sold. Our derivative instruments do not qualify for hedge accounting under the specific guidelines of ASC Topic 815, Derivatives and Hedging. None of the derivative instruments are designated and accounted for as hedges primarily due to the extensive record keeping requirements.

The volumes and carrying values of our derivative instruments included in other current assets were as follows:

| |

|

(Liability) Asset |

|

| |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

| |

|

Contract Quantity |

|

|

Fair Value |

|

|

Contract Quantity |

|

|

Fair Value |

|

| Regulated fixed price future commitments (in thousand barrels) |

|

|

232 |

|

|

$ |

(538 |

) |

|

|

354 |

|

|

$ |

1,736 |

|

| *All derivative instruments are entered into with the standard contract terms and conditions in accordance with major trading authorities of the New York Mercantile Exchange. |

Critical Accounting Estimates

Revenue Recognition

The Company recognizes revenue under ASC Topic 606, Revenue from Contracts with Customers. Certain long-term contracts had upfront non-cancellable payments considered material rights. The Company applied the renewal option approach in allocating the transaction price to the material rights. For each of these contracts, the Company estimated the expected contractual volumes to be sold at the most likely expected sales price as a basis for allocating the transaction price to the material right. Estimated amortization is updated quarterly on a prospective basis. These custom chemical contracts have payment terms of 30 days. See Note 3 to our consolidated financial statements.

For most product sales, revenue is recognized when product is shipped from our facilities and risk of loss and title have passed to the customer, which is in accordance with our customer contracts and the stated shipping terms. Nearly all custom manufactured products are manufactured under written master service agreements. Performance chemicals and biodiesel are generally sold pursuant to the terms of written purchase orders. In general, customers do not have any rights of return, except for quality disputes. All of our products are tested for quality before shipment, and historically returns have been inconsequential. We do not offer rebates, except those related to the BTC.

Biodiesel selling prices can at times fluctuate based on the timing of unsold, internally generated RINs. From time to time, sales of biodiesel are on a “RINs-free” basis. Such method of selling results in applicable RINs being held. The value of the RINs is not reflected in revenue until such time as the RIN sale has been completed.

Revenue from bill-and-hold transactions in which a performance obligation exists is recognized when the total performance obligation has been met and control of the product has transferred. Bill-and-hold transactions for the three months ended March 31, 2024 and 2023 were related to custom chemicals customers whereby revenue was recognized in accordance with contractual agreements based upon product being produced and ready for use by the customer. These sales were subject to written monthly purchase orders. The product was custom manufactured and stored at the customer’s request and could not be sold to another buyer. Credit and payment terms for bill-and-hold customers are similar to other custom chemicals customers. Revenues under bill-and-hold arrangements were $11,644 and $10,590 for the three months ended March 31, 2024 and 2023, respectively. As of March 31, 2024 and December 31, 2023, $3,291 and $4,317 of bill-and-hold revenue had not shipped, respectively.

Liquidity and Capital Resources

Our net cash from operating activities, investing activities, and financing activities for the three months ended March 31, 2024 and 2023 are set forth in the following table.

| |

|

Three Months Ended March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| Net cash used in operating activities |

|

$ |

(12,211 |

) |

|

$ |

(29,810 |

) |

| Net cash (used in) provided by investing activities |

|

|

(3,485 |

) |

|

|

1,868 |

|

| Net cash used in financing activities |

|

|

(2,626 |

) |

|

|

(2,640 |

) |

We believe that existing cash balances and cash flow to be generated from operating activities and borrowing capacity under the amended and restated credit agreement will be sufficient to fund operations, product development, cash dividends, and capital requirements for the foreseeable future.

Operating Activities

Cash used in operating activities was $12,211 in the three months ended March 31, 2024 as compared to $29,810 in the same period of 2023. This decrease in cash used was primarily attributable to the change in inventory resulting in less cash used of $19,354, the change in the fair value of derivative instruments of $7,176, and the change in other assets of $5,237. Partially offsetting these cash inflows was the reduction in net income of $16,751, and the change in accounts payable, including accounts payable - related parties, demonstrating a cash outflow of $6,191, primarily from the timing of vendor payments.

Investing Activities

Cash used in investing activities was $3,485 in the three months ended March 31, 2024 as compared to cash provided by investing activities of $1,868 in the three months ended March 31, 2023. This $5,353 decrease in cash was primarily due to an increase in the collateralization of derivative instruments of $5,539.

Financing Activities

Cash used in financing activities was $2,626 and $2,640 in the three months ended March 31, 2024 and 2023, respectively, primarily for payments of dividends on our common stock.

Credit Facility

We have a credit agreement, as amended on March 30, 2020, with a syndicated group of commercial banks for $100,000. The loan is a revolving facility, the proceeds of which may be used for our working capital, capital expenditures, and general corporate purposes. The facility terminates on March 30, 2025. See Note 8 to our consolidated financial statements for additional information regarding our credit agreement.

We intend to fund future capital requirements for our businesses from cash flow as well as from existing cash, cash investments, and, if the need should arise, borrowings under our credit facility. We do not believe there will be a need to issue any securities to fund such capital requirements.

Dividends

In the first quarter of 2024 we declared a special dividend of $2.50 per share on our common stock which amounted to $109,408. The special dividend had a record date of March 26, 2024 and a payment date of April 9, 2024. In the first quarter of 2024 and 2023, we paid a regular quarterly cash dividend of $0.06 per share on our common stock. The regular cash dividend amounted to $2,626 in each of the quarters of 2024 and 2023. The declaration of these regular quarterly cash dividends was made in the three months ended December 31, 2023 and December 31, 2022, respectively.

Capital Management

As a result of our initial equity offering, our subsequent positive operating results, the exercise of warrants, and the issuance of shares in our at-the-market offering, we accumulated excess working capital. Some of this excess working capital has been paid out as special and regular cash dividends. Additionally, regular dividends will be paid in 2024, as previously reported. Third parties have not placed significant restrictions on our working capital management decisions.

A significant portion of these funds was held in cash or cash equivalents at multiple financial institutions such as depositary accounts, money market accounts, and other similar accounts at selected financial institutions.

Off- Balance Sheet Arrangements