Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

October 24 2024 - 3:21PM

Edgar (US Regulatory)

First Trust Specialty Finance and Financial Opportunities Fund (FGB)

Portfolio of Investments

August 31, 2024 (Unaudited)

|

|

|

|

COMMON STOCKS – BUSINESS DEVELOPMENT

COMPANIES – 99.7%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bain Capital Specialty Finance,

Inc. (a)

|

|

|

|

|

|

|

|

BlackRock TCP Capital

Corp. (a)

|

|

|

|

Blackstone Secured Lending

Fund (a)

|

|

|

|

Blue Owl Capital Corp. III

|

|

|

|

Capital Southwest Corp. (a)

|

|

|

|

Crescent Capital BDC, Inc. (a)

|

|

|

|

|

|

|

|

Goldman Sachs BDC, Inc. (a)

|

|

|

|

Golub Capital BDC, Inc. (a)

|

|

|

|

Hercules Capital, Inc. (a)

|

|

|

|

|

|

|

|

Main Street Capital Corp. (a)

|

|

|

|

New Mountain Finance Corp. (a)

|

|

|

|

Nuveen Churchill Direct Lending

Corp. (a)

|

|

|

|

Oaktree Specialty Lending Corp.

|

|

|

|

|

|

|

|

Palmer Square Capital BDC, Inc.

|

|

|

|

PennantPark Investment

Corp. (a)

|

|

|

|

Portman Ridge Finance Corp.

|

|

|

|

Sixth Street Specialty Lending,

Inc. (a)

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks -

Business Development

Companies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Services – 3.5%

|

|

|

|

Berkshire Hathaway, Inc.,

Class B (a) (b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annaly Capital Management,

Inc. (a)

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments – 111.1%

|

|

|

|

|

|

|

|

Outstanding Loan – (14.0)%

|

|

|

|

Net Other Assets and

Liabilities – 2.9%

|

|

|

|

|

|

|

|

All or a portion of this security serves as collateral on the

outstanding loan. At August 31, 2024, the segregated value

of these securities amounts to $38,008,890.

|

|

|

Non-income producing security.

|

Abbreviations throughout the Portfolio of Investments:

|

|

|

– Real Estate Investment Trusts

|

Valuation Inputs

The Fund is subject to fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the measurement date. The three levels of the fair value hierarchy are as follows:

•

Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

•

Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived from observable market data.)

•

Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in pricing the investment.

The inputs or methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

First Trust Specialty Finance and Financial Opportunities Fund (FGB)

Portfolio of Investments (Continued)

August 31, 2024 (Unaudited)

A summary of the inputs used to value the Fund’s investments as of August 31, 2024 is as follows:

|

|

|

|

Level 2

Significant

Observable

Inputs

|

Level 3

Significant

Unobservable

Inputs

|

Common Stocks -

Business

Development

Companies*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Portfolio of Investments for industry breakout.

|

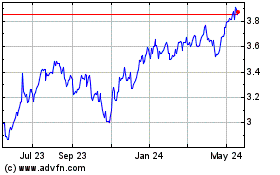

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Nov 2024 to Dec 2024

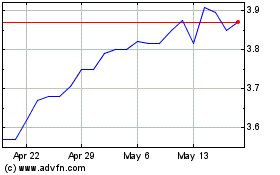

First Trust Specialty Fi... (NYSE:FGB)

Historical Stock Chart

From Dec 2023 to Dec 2024