Judging Panel of International Industry Experts Announced For 2025 FICO Decisions Awards

August 26 2024 - 8:01PM

Business Wire

Awards honor FICO customers achieving

outstanding results with AI, decision management and digital

transformation

FICO (NYSE: FICO):

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240826515188/en/

2025 Judges (Left to Right): Joe

McKendrick, Regan Goble, Megha Kumar, Luiz Pacete (2nd Row): Ali

Paterson, Erin Stillwell, Mike Roberts, Allan Tan (Photo: FICO)

Highlights:

- FICO announces panel of independent industry judges for

2025 awards.

- Entries for the FICO® Decisions Awards are due

August 28, 2024

- The ten award categories are AI, Machine Learning and

Optimization, Cloud Deployment, Customer Onboarding and Management,

Debt Management, Decision Management Innovation, ESG Champion,

Financial Inclusion, Fraud Management, FICO Industry Vanguard and

Pioneer Award.

- Entry form and information are at

www.fico.com/decisionawards

Global analytics software leader FICO has announced its panel of

independent judges for the 2025 FICO® Decisions

Awards, which honor businesses achieving outstanding results

using analytics and decision management technology to grow their

business, manage risk and reduce costs.

“The panel of judges for the 2025 awards combines a rich

diversity of expertise and experience, ensuring a comprehensive

evaluation process,” said Nikhil Behl, EVP of software at

FICO. “Our eight judges are esteemed business leaders,

analysts, and industry journalists from across the globe. I extend

my gratitude to them for their dedication in selecting the most

outstanding projects this year.”

Entries are due August 28, 2024. For more information and

to enter a nomination, visit www.fico.com/decisionawards.

This year our judges, in alphabetical order, are:

- Regan Goble, risk analytics senior manager at Westpac NZ

(Previous Winner) Regan Goble leads the credit decision

analytics function at Westpac NZ, overseeing credit lifecycle

management strategies for consumer lending. He has played a key

role in modernizing Westpac NZ’s credit decisioning capabilities,

earning recognition in the 2024 FICO Decision Awards. With more

than 20 years in financial services, Regan has led market and

credit risk analytics teams across the US, UK, Singapore, and New

Zealand. He is passionate about using data and advanced analytics

to automate processes and optimize outcomes.

- Megha Kumar, research vice president at IDC Megha

Kumar is the research vice president at IDC, leading global

research on business analytics, enterprise intelligence, and

decisioning solutions within the AI, automation, data, and

analytics organization. Her research offers insights into

technology trends, adoption, and vendor strategies, with a focus on

business analytics and decision intelligence. Megha also explores

best practices for building data-driven organizations, including

data culture and the evolving roles of key personas.

- Joe McKendrick, analyst and senior contributor at Forbes

Joe McKendrick is an author, independent researcher and speaker

exploring innovation, information technology trends and markets. He

is a senior contributor to Forbes, exploring topics such as digital

transformation, artificial intelligence, and the forces moving

markets and careers. Joe is regularly published in Harvard Business

Review and has a column on CNET's ZDNet site, exploring the

technology implications of business transformation. He also served

as co-chair of the past three AI Summits in New York.

- Luiz Pacete, technology and marketing industry

influencer Luiz Pacete is a recognized influencer and industry

expert, serving as the technology and innovation editor at Forbes

Brazil as well as curator at Rio2C. A LinkedIn Top Voices -

Creator, TEDx Speaker, and Forbes+ Expert, Pacete is also an

admired figure in tech. He frequently covers major events like SXSW

and is a recipient of the Prêmio Comunique-se 2021. His expertise

spans marketing, innovation, startups, AI and VR.

- Ali Paterson, founder and editor-in-chief at Fintech

Finance At Fintech Finance (FF News), Ali Paterson and his team

create engaging and insightful content covering the full spectrum

of financial services, from branches to blockchain. Founded in 2015

in his kitchen with his brother-in-law, FF News has grown rapidly,

producing top-notch episodes, interviews, and event coverage. Ali

focuses on production and editorial for its video channels and

magazines, hosting episodes where he interviews the brightest minds

in fintech and attends the coolest events around the globe.

- Mike Roberts, head of unsecured retail risk at HSBC UK bank

(Previous Winner) Mike Roberts is a credit risk leader with

more than 25 years of experience across the full credit lifecycle,

including non-financial risk management at four major financial

services providers. Currently, he serves as head of unsecured

credit risk for HSBC UK, overseeing credit risk management for

credit cards, personal loans and overdrafts across HSBC, M&S

Bank, and First Direct. Mike is highly analytical and skilled in

optimizing credit risk strategies through detailed scorecard

development and portfolio performance analysis.

- Erin Stillwell, head of strategic partnerships and

engagements at TSYS (Previous Winner) Erin Stillwell is the

head of Strategic Partnerships and Engagements at TSYS, with over

20 years in the payments industry. She leads the Global Strategic

Partnerships practice, focusing on fintechs, product solutions, and

payment networks. Erin is skilled in SaaS, payments modernization,

corporate strategy, M&A and digital transformation. Her

previous roles at TSYS include managing corporate strategy and

planning, driving growth in issuer, acquiring, and prepaid lines of

business.

- Allan Tan, group editor-in-chief at Cxociety Allan Tan

is the group editor-in-chief for Cxociety, leading the editorial

teams for FutureCFO, FutureCIO, FutureCISO, and FutureIoT. He

supports content marketing for Cxociety clients, including

roundtables, executive forums and targeted surveys. Allan

frequently moderates and chairs industry events like the C-Engage

Convention and the FutureCFO series. With more than 41 years of

experience across business, technology, and operational

disciplines, his expertise spans sales, marketing, PR and software

design.

Awards will be presented in ten categories: AI, Machine

Learning and Optimization, Cloud Deployment, Customer Onboarding

and Management, Debt Management, Decision Management Innovation,

ESG Champion, Financial Inclusion, Fraud Management, FICO Industry

Vanguard and Pioneer Award.

Winners will receive recognition at FICO® World, which will be

held May 6-9, 2025, at the Diplomat Hotel in Hollywood, Florida.

Winning implementations will be featured in conference activities,

and two representatives of each winning company will receive

complimentary conference passes.

Last year’s winning firms represented multiple industries and

countries worldwide, all with outstanding results: Nedbank &

HSBC (AI, Machine Learning and Optimization); Network International

& Scotiabank (Cloud Deployment); GXS Bank & Volvo Cars

(Customer Onboarding & Management); CIBC & Itaú (Debt

Management); Bradesco (Decision Management Innovation); PSR (ESG

Champion); AU Small Finance Bank & FNBO (Financial Inclusion);

Bank Mandiri & TD Bank (Fraud Management); Westpac NZ (Pioneer

Award) and TSYS & BAC Credomatic & Natura (FICO Industry

Vanguard Award).

About FICO

FICO (NYSE: FICO) powers decisions that help people and

businesses around the world prosper. Founded in 1956, the company

is a pioneer in the use of predictive analytics and data science to

improve operational decisions. FICO holds more than 200 US and

foreign patents on technologies that increase profitability,

customer satisfaction and growth for businesses in financial

services, insurance, telecommunications, health care, retail and

many other industries. Using FICO solutions, businesses in more

than 100 countries do everything from protecting 4 billion payment

cards from fraud, to improving financial inclusion, to increasing

supply chain resiliency. The FICO® Score, used by 90% of top US

lenders, is the standard measure of consumer credit risk in the US

and has been made available in over 40 other countries, improving

risk management, credit access and transparency.

Learn more at http://www.fico.com.

Join the conversation at https://x.com/FICO_corp &

https://www.fico.com/blogs/.

For FICO news and media resources, visit www.fico.com/news.

FICO is a registered trademark of Fair Isaac Corporation in the

U.S. and other countries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240826515188/en/

Media: Saxon Shirley saxonshirley@fico.com +65 9171

0965

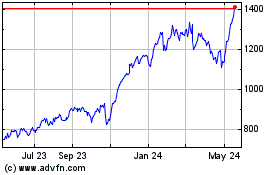

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Oct 2024 to Nov 2024

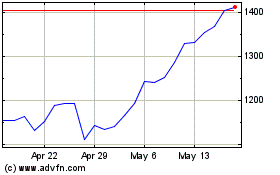

Fair Isaac (NYSE:FICO)

Historical Stock Chart

From Nov 2023 to Nov 2024