Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

November 27 2024 - 1:58PM

Edgar (US Regulatory)

COHEN & STEERS CLOSED-END OPPORTUNITY FUND,

INC.

SCHEDULE OF INVESTMENTS

September 30, 2024 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| CLOSED-END FUNDS |

|

|

85.1 |

% |

|

|

|

|

|

|

|

|

| COMMODITY FUNDS |

|

|

14.4 |

% |

|

|

|

|

|

|

|

|

| DIVERSIFIED COMMODITY FUNDS |

|

|

6.8 |

% |

|

|

|

|

|

|

|

|

| Adams Natural Resources Fund, Inc. |

|

|

|

175,985 |

|

|

$ |

4,086,372 |

|

| PIMCO Dynamic Income Strategy Fund |

|

|

|

804,173 |

|

|

|

18,970,441 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23,056,813 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SINGLE COMMODITY FUNDS |

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

| Sprott Physical Gold & Silver Trust (Canada)(a) |

|

|

|

510,497 |

|

|

|

12,502,072 |

|

| Sprott Physical Gold Trust (Canada)(a) |

|

|

|

492,155 |

|

|

|

10,030,119 |

|

| Sprott Physical Silver Trust (Canada)(a) |

|

|

|

308,145 |

|

|

|

3,220,115 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25,752,306 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMODITY FUNDS |

|

|

|

|

|

|

|

48,809,119 |

|

|

|

|

|

|

|

|

|

|

|

| EQUITY FUNDS |

|

|

43.1 |

% |

|

|

|

|

|

|

|

|

| GLOBAL EQUITY FUNDS |

|

|

0.3 |

% |

|

|

|

|

|

|

|

|

| abrdn Total Dynamic Dividend Fund |

|

|

|

45,976 |

|

|

|

418,382 |

|

| Gabelli Multimedia Trust, Inc. |

|

|

|

157,549 |

|

|

|

776,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,195,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GLOBAL HYBRID FUNDS |

|

|

9.9 |

% |

|

|

|

|

|

|

|

|

| BlackRock Capital Allocation Term Trust |

|

|

|

444,148 |

|

|

|

7,306,235 |

|

| BlackRock ESG Capital Allocation Term Trust |

|

|

|

632,092 |

|

|

|

11,213,312 |

|

| Calamos Long/Short Equity & Dynamic Income Trust |

|

|

|

150,854 |

|

|

|

2,366,899 |

|

| Guggenheim Active Allocation Fund |

|

|

|

597,300 |

|

|

|

9,885,315 |

|

| Thornburg Income Builder Opportunities Trust |

|

|

|

150,323 |

|

|

|

2,672,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33,444,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| MLP FUNDS |

|

|

0.9 |

% |

|

|

|

|

|

|

|

|

| Kayne Anderson Energy Infrastructure Fund |

|

|

|

16,000 |

|

|

|

176,000 |

|

| Neuberger Berman Energy Infrastructure & Income Fund, Inc. |

|

|

|

262,000 |

|

|

|

2,148,400 |

|

| Tortoise Energy Infrastructure Corp. |

|

|

|

16,000 |

|

|

|

628,000 |

|

| Tortoise Midstream Energy Fund, Inc. |

|

|

|

3,000 |

|

|

|

142,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,094,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPTION INCOME FUNDS |

|

|

8.6 |

% |

|

|

|

|

|

|

|

|

| BlackRock Enhanced Capital & Income Fund, Inc. |

|

|

|

102,853 |

|

|

|

2,025,175 |

|

| BlackRock Enhanced Equity Dividend Trust |

|

|

|

20,000 |

|

|

|

173,000 |

|

| Eaton Vance Enhanced Equity Income Fund II |

|

|

|

226,914 |

|

|

|

4,924,034 |

|

| Eaton Vance Risk-Managed Diversified Equity Income Fund |

|

|

|

442,446 |

|

|

|

4,074,928 |

|

| Eaton Vance Tax-Managed Diversified Equity

Income Fund |

|

|

|

315,617 |

|

|

|

4,623,789 |

|

| Eaton Vance Tax-Managed Buy-Write Income Fund |

|

|

|

154,963 |

|

|

|

2,236,116 |

|

| Eaton Vance Tax-Managed Buy-Write Opportunities Fund |

|

|

|

209,931 |

|

|

|

2,897,048 |

|

| Eaton Vance Tax-Managed Global Diversified

Equity Income Fund |

|

|

|

939,977 |

|

|

|

8,196,599 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29,150,689 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| REAL ESTATE, INCLUDING REITS FUNDS |

|

|

0.6 |

% |

|

|

|

|

|

|

|

|

| Nuveen Real Asset Income & Growth Fund |

|

|

|

137,846 |

|

|

|

1,884,355 |

|

|

|

|

|

|

|

|

|

|

|

| US GENERAL EQUITY FUNDS |

|

|

19.3 |

% |

|

|

|

|

|

|

|

|

| Adams Diversified Equity Fund, Inc. |

|

|

|

971,864 |

|

|

|

20,953,388 |

|

| Cornerstone Strategic Value Fund, Inc. |

|

|

|

539,000 |

|

|

|

4,139,520 |

|

| Eaton Vance Tax-Advantaged Dividend Income

Fund |

|

|

|

334,333 |

|

|

|

8,254,682 |

|

| Eaton Vance Tax-Advantaged Global Dividend

Income Fund |

|

|

|

210,868 |

|

|

|

4,099,274 |

|

| Gabelli Dividend & Income Trust |

|

|

|

178,886 |

|

|

|

4,373,763 |

|

| Gabelli Equity Trust, Inc. |

|

|

|

743,640 |

|

|

|

4,082,584 |

|

| General American Investors Co., Inc. |

|

|

|

185,323 |

|

|

|

9,935,166 |

|

| Neuberger Berman Next Generation Connectivity Fund, Inc. |

|

|

|

80,000 |

|

|

|

1,026,400 |

|

| Nuveen Core Equity Alpha Fund |

|

|

|

16,585 |

|

|

|

254,911 |

|

| Royce Micro-Cap Trust, Inc. |

|

|

|

30,884 |

|

|

|

296,795 |

|

| Royce Small-Cap Trust, Inc. |

|

|

|

143,821 |

|

|

|

2,257,990 |

|

| SRH Total Return Fund, Inc. |

|

|

|

355,158 |

|

|

|

5,611,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65,285,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| US SECTOR EQUITY FUNDS |

|

|

1.1 |

% |

|

|

|

|

|

|

|

|

| abrdn Healthcare Opportunities Fund |

|

|

|

71,845 |

|

|

$ |

1,586,338 |

|

| abrdn Healthcare Investors |

|

|

|

107,573 |

|

|

|

2,003,009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,589,347 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UTILITIES FUNDS |

|

|

2.4 |

% |

|

|

|

|

|

|

|

|

| abrdn Global Infrastructure Income Fund |

|

|

|

66,000 |

|

|

|

1,333,860 |

|

| DNP Select Income Fund, Inc. |

|

|

|

176,323 |

|

|

|

1,770,283 |

|

| Duff & Phelps Utility & Infrastructure Fund, Inc. |

|

|

|

216,271 |

|

|

|

2,539,021 |

|

| NYLI CBRE Global Infrastructure Megatrends Term Fund |

|

|

|

169,391 |

|

|

|

2,525,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,168,784 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EQUITY FUNDS |

|

|

|

|

|

|

|

145,813,736 |

|

|

|

|

|

|

|

|

|

|

|

| FIXED INCOME FUNDS |

|

|

21.0 |

% |

|

|

|

|

|

|

|

|

| BANK LOAN FUNDS |

|

|

2.5 |

% |

|

|

|

|

|

|

|

|

| Ares Dynamic Credit Allocation Fund, Inc. |

|

|

|

72,481 |

|

|

|

1,107,510 |

|

| BlackRock Floating Rate Income Trust |

|

|

|

103,470 |

|

|

|

1,338,902 |

|

| Blackstone Long-Short Credit Income Fund |

|

|

|

164,996 |

|

|

|

2,110,299 |

|

| Eaton Vance Floating-Rate Income Trust |

|

|

|

101,240 |

|

|

|

1,303,971 |

|

| Eaton Vance Senior Floating-Rate Trust |

|

|

|

193,258 |

|

|

|

2,464,039 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,324,721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GLOBAL INCOME FUNDS |

|

|

9.2 |

% |

|

|

|

|

|

|

|

|

| MFS Multimarket Income Trust |

|

|

|

144,209 |

|

|

|

702,298 |

|

| PIMCO Access Income Fund |

|

|

|

512,498 |

|

|

|

8,522,842 |

|

| PIMCO Dynamic Income Fund |

|

|

|

496,195 |

|

|

|

10,057,873 |

|

| PIMCO Dynamic Income Opportunities Fund |

|

|

|

745,280 |

|

|

|

10,523,353 |

|

| Western Asset Diversified Income Fund |

|

|

|

94,090 |

|

|

|

1,475,331 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,281,697 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HIGH YIELD BOND FUNDS |

|

|

0.9 |

% |

|

|

|

|

|

|

|

|

| PGIM Global High Yield Fund, Inc. |

|

|

|

133,752 |

|

|

|

1,709,351 |

|

| Western Asset High Income Fund II, Inc. |

|

|

|

315,000 |

|

|

|

1,420,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,130,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED STOCK FUNDS |

|

|

3.7 |

% |

|

|

|

|

|

|

|

|

| First Trust Intermediate Duration Preferred & Income Fund |

|

|

|

55,821 |

|

|

|

1,090,184 |

|

| Flaherty & Crumrine Dynamic Preferred & Income Fund, Inc. |

|

|

|

105,100 |

|

|

|

2,259,650 |

|

| Flaherty & Crumrine Preferred & Income Securities Fund |

|

|

|

166,755 |

|

|

|

2,736,450 |

|

| John Hancock Premium Dividend Fund |

|

|

|

301,061 |

|

|

|

3,980,026 |

|

| Nuveen Preferred & Income Opportunities Fund |

|

|

|

320,490 |

|

|

|

2,586,354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12,652,664 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US HIGH YIELD BOND FUNDS |

|

|

2.3 |

% |

|

|

|

|

|

|

|

|

| Allspring Income Opportunities Fund |

|

|

|

103,646 |

|

|

|

738,996 |

|

| Barings Global Short Duration High Yield Fund |

|

|

|

91,674 |

|

|

|

1,391,611 |

|

| BlackRock Debt Strategies Fund, Inc. |

|

|

|

10,664 |

|

|

|

117,624 |

|

| High Income Securities Fund |

|

|

|

250,000 |

|

|

|

1,707,500 |

|

| PGIM High Yield Bond Fund, Inc. |

|

|

|

115,895 |

|

|

|

1,615,576 |

|

| PGIM Short Duration High Yield Opportunities Fund |

|

|

|

134,450 |

|

|

|

2,248,004 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,819,311 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US MULTI SECTOR BOND FUNDS |

|

|

2.4 |

% |

|

|

|

|

|

|

|

|

| Guggenheim Strategic Opportunities Fund |

|

|

|

409,789 |

|

|

|

6,458,275 |

|

| PIMCO High Income Fund |

|

|

|

318,038 |

|

|

|

1,590,190 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,048,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL FIXED INCOME FUNDS |

|

|

|

|

|

|

|

71,256,859 |

|

|

|

|

|

|

|

|

|

|

|

| MUNICIPAL FUNDS |

|

|

6.6 |

% |

|

|

|

|

|

|

|

|

| DIVERSIFIED MUNICIPAL BOND FUNDS |

|

|

4.8 |

% |

|

|

|

|

|

|

|

|

| BlackRock MuniHoldings Fund, Inc. |

|

|

|

60,447 |

|

|

|

764,655 |

|

| BlackRock MuniVest Fund, Inc. |

|

|

|

207,225 |

|

|

|

1,574,910 |

|

| BlackRock MuniYield Fund, Inc. |

|

|

|

48,315 |

|

|

|

552,240 |

|

| BlackRock MuniYield Quality Fund III, Inc. |

|

|

|

166,757 |

|

|

|

2,001,084 |

|

| BlackRock MuniYield Quality Fund, Inc. |

|

|

|

25,385 |

|

|

|

332,797 |

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| DWS Municipal Income Trust |

|

|

|

60,000 |

|

|

$ |

598,200 |

|

| Eaton Vance Municipal Bond Fund |

|

|

|

44,732 |

|

|

|

481,316 |

|

| Neuberger Berman Municipal Fund, Inc. |

|

|

|

181,982 |

|

|

|

2,021,820 |

|

| Nuveen AMT-Free Quality Municipal Income

Fund |

|

|

|

275,711 |

|

|

|

3,300,261 |

|

| Nuveen Municipal Value Fund, Inc. |

|

|

|

150,880 |

|

|

|

1,360,938 |

|

| Nuveen Quality Municipal Income Fund |

|

|

|

249,123 |

|

|

|

3,084,143 |

|

| Putnam Municipal Opportunities Trust |

|

|

|

14,200 |

|

|

|

154,780 |

|

| Western Asset Managed Municipals Fund, Inc. |

|

|

|

8,000 |

|

|

|

86,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16,313,864 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HIGH YIELD MUNICIPAL BOND FUNDS |

|

|

1.8 |

% |

|

|

|

|

|

|

|

|

| BNY Mellon Strategic Municipals, Inc. |

|

|

|

30,000 |

|

|

|

195,300 |

|

| Nuveen AMT-Free Municipal Credit Income

Fund |

|

|

|

227,778 |

|

|

|

3,049,947 |

|

| Nuveen Municipal Credit Income Fund |

|

|

|

222,060 |

|

|

|

2,908,986 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,154,233 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL MUNICIPAL FUNDS |

|

|

|

|

|

|

|

22,468,097 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL CLOSED-END FUNDS

(Identified

cost—$256,062,140) |

|

|

|

|

|

|

|

288,347,811 |

|

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK |

|

|

3.7 |

% |

|

|

|

|

|

|

|

|

| COMMUNICATION SERVICES |

|

|

0.0 |

% |

|

|

|

|

|

|

|

|

| Reddit, Inc., Class A(a) |

|

|

|

1,000 |

|

|

|

65,920 |

|

|

|

|

|

|

|

|

|

|

|

| FINANCIALS |

|

|

1.5 |

% |

|

|

|

|

|

|

|

|

| Berkshire Hathaway, Inc., Class B(a) |

|

|

|

10,507 |

|

|

|

4,835,952 |

|

| Bowhead Specialty Holdings, Inc.(a) |

|

|

|

12,000 |

|

|

|

336,120 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,172,072 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| HEALTH CARE |

|

|

1.4 |

% |

|

|

|

|

|

|

|

|

| Concentra Group Holdings Parent, Inc.(a) |

|

|

|

130,000 |

|

|

|

2,906,800 |

|

| Tempus AI, Inc.(a) |

|

|

|

13,000 |

|

|

|

735,800 |

|

| Waystar Holding Corp.(a) |

|

|

|

45,000 |

|

|

|

1,255,050 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,897,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INDUSTRIALS |

|

|

0.7 |

% |

|

|

|

|

|

|

|

|

| UL Solutions, Inc., Class A |

|

|

|

45,000 |

|

|

|

2,218,500 |

|

|

|

|

|

|

|

|

|

|

|

| INFORMATION TECHNOLOGY |

|

|

0.1 |

% |

|

|

|

|

|

|

|

|

| Astera Labs, Inc.(a) |

|

|

|

1,500 |

|

|

|

78,585 |

|

| Rubrik, Inc., Class A(a) |

|

|

|

4,000 |

|

|

|

128,600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

207,185 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMON STOCK

(Identified cost—$9,105,194) |

|

|

|

|

|

|

|

12,561,327 |

|

|

|

|

|

|

|

|

|

|

|

| EXCHANGE-TRADED FUNDS |

|

|

9.1 |

% |

|

|

|

|

|

|

|

|

| COMMODITY FUNDS |

|

|

1.9 |

% |

|

|

|

|

|

|

|

|

| DIVERSIFIED COMMODITY FUNDS |

|

|

0.2 |

% |

|

|

|

|

|

|

|

|

| Global X Copper Miners ETF |

|

|

|

11,000 |

|

|

|

519,970 |

|

|

|

|

|

|

|

|

|

|

|

| SINGLE COMMODITY FUNDS |

|

|

1.7 |

% |

|

|

|

|

|

|

|

|

| SPDR Gold Shares(a) |

|

|

|

23,675 |

|

|

|

5,754,446 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL COMMODITY FUNDS |

|

|

|

|

|

|

|

6,274,416 |

|

|

|

|

|

|

|

|

|

|

|

| EQUITY FUNDS |

|

|

7.2 |

% |

|

|

|

|

|

|

|

|

| MLP FUNDS |

|

|

1.0 |

% |

|

|

|

|

|

|

|

|

| FT Energy Income Partners Enhanced Income ETF |

|

|

|

186,937 |

|

|

|

3,617,231 |

|

|

|

|

|

|

|

|

|

|

|

| US GENERAL EQUITY FUNDS |

|

|

6.2 |

% |

|

|

|

|

|

|

|

|

| Invesco S&P 500 Equal Weight Consumer Discretionary ETF |

|

|

|

54,926 |

|

|

|

2,862,194 |

|

| Invesco S&P 500 Equal Weight ETF |

|

|

|

24,223 |

|

|

|

4,339,793 |

|

| iShares Russell 1000 Value ETF |

|

|

|

7,719 |

|

|

|

1,465,066 |

|

| Pacer U.S. Cash Cows 100 ETF |

|

|

|

56,609 |

|

|

|

3,273,698 |

|

| SPDR S&P 500 ETF Trust |

|

|

|

8,047 |

|

|

|

4,617,047 |

|

3

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Shares |

|

|

Value |

|

| Vanguard S&P 500 ETF |

|

|

|

8,132 |

|

|

$ |

4,291,012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20,848,810 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EQUITY FUNDS |

|

|

|

|

|

|

|

24,466,041 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL EXCHANGE-TRADED FUNDS

(Identified cost—$21,245,627) |

|

|

|

|

|

|

|

30,740,457 |

|

|

|

|

|

|

|

|

|

|

|

| INTERVAL FUNDS—FIXED INCOME FUNDS—BANK LOAN FUNDS |

|

|

0.1 |

% |

|

|

|

|

|

|

|

|

| Invesco Dynamic Credit Opportunity Fund, Class AX(b) |

|

|

|

|

|

|

16,476 |

|

|

|

180,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INTERVAL FUNDS

(Identified cost—$184,863) |

|

|

|

|

|

|

|

180,742 |

|

|

|

|

|

|

|

|

|

|

|

| SHORT-TERM INVESTMENTS |

|

|

1.8 |

% |

|

|

|

|

|

|

|

|

| MONEY MARKET FUNDS |

|

|

|

|

|

|

|

|

|

|

|

|

| State Street Institutional U.S. Government Money Market Fund,

Premier Class,

4.94%(c) |

|

|

|

1,384,900 |

|

|

|

1,384,900 |

|

| State Street Institutional Treasury Plus Money Market Fund,

Premier Class,

4.95%(c) |

|

|

|

4,891,668 |

|

|

|

4,891,668 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL SHORT-TERM INVESTMENTS

(Identified cost—$6,276,568) |

|

|

|

|

|

|

|

6,276,568 |

|

|

|

|

|

|

|

|

|

|

|

| TOTAL INVESTMENTS IN SECURITIES

(Identified cost—$292,874,392) |

|

|

99.8 |

% |

|

|

|

|

|

|

338,106,905 |

|

| OTHER ASSETS IN EXCESS OF LIABILITIES |

|

|

0.2 |

|

|

|

|

|

|

|

517,972 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET ASSETS (Equivalent to $12.26 per share based on 27,627,007 shares of common stock

outstanding) |

|

|

100.0 |

% |

|

|

|

|

|

$ |

338,624,877 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Glossary of Portfolio Abbreviations

|

|

|

| ETF |

|

Exchange-Traded Fund |

| MLP |

|

Master Limited Partnership |

| SPDR |

|

Standard & Poor’s Depositary Receipt |

Note: Percentages indicated are based on the net assets of the Fund.

| (a) |

Non–income producing security. |

| (b) |

Investment valued using NAV as the practical expedient and has been excluded from the fair value

hierarchy. The investment fund provides liquidity through quarterly repurchase offers. |

| (c) |

Rate quoted represents the annualized seven–day yield.

|

4

COHEN & STEERS CLOSED-END OPPORTUNITY FUND, INC.

NOTES TO SCHEDULE OF INVESTMENTS (Unaudited)

Note 1. Portfolio Valuation

Investments in securities that are listed on the New York Stock Exchange (NYSE) are valued, except as indicated below, at the

last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no

ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign

securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the

business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity holdings may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the

over-the-counter (OTC) market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the investment manager)

to be OTC, are valued on the basis of prices provided by a third-party pricing service or third-party broker-dealers when such prices are believed by the investment manager, pursuant to delegation by the Board of Directors, to reflect the fair value

of such securities.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost,

which approximates fair value. Investments in open-end mutual funds and closed-end interval funds are valued at net asset value (NAV).

The Board of Directors has designated the investment manager as the Fund’s “Valuation Designee” under Rule 2a-5 under the 1940 Act. As Valuation Designee, the investment manager is authorized to make fair valuation determinations, subject to the oversight of the Board of Directors. The investment manager has established

a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to

utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment manager determines that the bid

and/or ask price or a counterparty valuation does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund’s Board of Directors. Circumstances in

which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close

of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or

factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

Foreign equity fair value pricing procedures utilized by the Fund may cause certain

non-U.S. equity holdings to be fair valued on the basis of fair value factors provided by a pricing service to reflect any significant market movements between the time the Fund values such securities and the

earlier closing of foreign markets.

The Fund’s use of fair value pricing may cause the NAV of Fund shares to differ

from the NAV that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon

the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an

investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of

inputs that are used in determining the fair value of the Fund’s investments is summarized below.

| |

• |

|

Level 1 — quoted prices in active markets for identical investments |

| |

• |

|

Level 2 — other significant observable inputs (including quoted prices for similar investments, interest

rates, credit risk, etc.) |

| |

• |

|

Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the

fair value of investments) |

The inputs or methodology used for valuing investments may or may not be an

indication of the risk associated with those investments. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

COHEN & STEERS CLOSED-END OPPORTUNITY FUND, INC.

NOTES TO SCHEDULE OF INVESTMENTS (Unaudited) (Continued)

The following is a summary of the inputs used as of September 30, 2024 in

valuing the Fund’s investments carried at value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quoted Prices in

Active Markets

for Identical

Investments

(Level 1) |

|

|

Other

Significant

Observable

Inputs

(Level 2) |

|

|

Significant

Unobservable

Inputs

(Level 3) |

|

|

Total |

|

| Closed-End Funds |

|

$ |

288,347,811 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

288,347,811 |

|

| Common Stock |

|

|

12,561,327 |

|

|

|

— |

|

|

|

— |

|

|

|

12,561,327 |

|

| Exchange-Traded Funds |

|

|

30,740,457 |

|

|

|

— |

|

|

|

— |

|

|

|

30,740,457 |

|

| Short-Term Investments |

|

|

— |

|

|

|

6,276,568 |

|

|

|

— |

|

|

|

6,276,568 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Subtotal(a) |

|

|

331,649,595 |

|

|

|

6,276,568 |

|

|

|

— |

|

|

|

337,926,163 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments Valued at NAV(b) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

180,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments in Securities(a) |

|

$ |

331,649,595 |

|

|

$ |

6,276,568 |

|

|

$ |

— |

|

|

$ |

338,106,905 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Portfolio holdings are disclosed individually on the Schedule of Investments. |

| (b) |

As of September 30, 2024, one of the Fund’s investments was valued using NAV per unit as a

practical expedient and has been excluded from the fair value hierarchy. The fair value amount presented in this table is intended to permit reconciliation of the fair value hierarchy to the amounts presented within the Schedule of Investments.

|

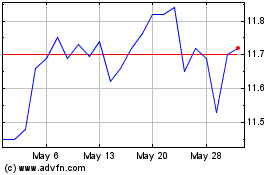

Cohen and Steers Closed ... (NYSE:FOF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Cohen and Steers Closed ... (NYSE:FOF)

Historical Stock Chart

From Jan 2024 to Jan 2025