- Global Blue, a Europe and APAC-based business partner for

the shopping journey, and Shift4, a US-leader in integrated

payments and commerce technology, have entered into a definitive

agreement under which Shift4 will acquire 100% of Global Blue

shares

- Both companies power billions of transactions annually and

aim to provide mission-critical merchant solutions that simplify

complex shopping journeys. The combination will create a global

leader in commerce and shopping technologies, with a footprint in

over 50 countries, serving several hundred thousand of retail and

hospitality locations

- Under the terms of the agreement, Shift4 intends to acquire

Global Blue common shares for $7.50 per share

- Closing is expected to take place by the third quarter of

calendar year 2025

Shift4, a leader in integrated payments and

technology

Shift4 is a global leader in financial technology with a

track record in the industry for more than 25 years. It

provides a wide range of integrated payment technologies to

the retail and hospitality sectors, processing billions of

in-person and online transactions. Through its best-in-class

technology, Shift4 is simplifying complex payment journeys

and changing the way the world experiences commerce. Beyond

technology, Shift4 supports over 200,000 clients with advisory

services, like business intelligence, revenue optimization and

fraud prevention.

A common vision and complementary assets with Global

Blue

Both companies share the same vision of simplifying consumer

experiences through integrated technology and advisory

services, reinforced by long-lasting partnerships and a culture

of operational excellence, in the retail and hospitality

industries.

Similar to Shift4, Global Blue aims to simplify complex consumer

journeys across more than 400,000 retail and hospitality

locations(1) by offering its technology platform that enables

Tax Free Shopping, Dynamic Currency Conversion and e-Commerce

Post-Purchase businesses. Global Blue also supports partners

via consulting services in Business Intelligence, Digital Marketing

and Training.

Shift4 and Global Blue also have a highly complementary

geographic footprint. Shift4 has a large presence in the US and

an expanding international footprint, while Global Blue operates

across 52 countries in Europe, APAC and Latin America. The

combination of the two companies will create a global leader in

integrated technologies for the payment and shopping journey.

The acquisition of Global Blue by Shift4 will also bring

together two experienced teams, with a shared entrepreneurial

spirit. Both teams will work together to create new growth

opportunities through product expansion into new markets, cross

selling and product innovation.

“Joining forces with Shift4 marks a significant milestone in

Global Blue’s growth journey, further strengthening our integrated

value proposition for our marquee merchants worldwide. We are

particularly thrilled to partner with Shift4 to continue our track

record of innovation, delivering enhanced experiences for all

stakeholders in the shopping ecosystem,” said Global Blue CEO

Jacques Stern. “I would like to thank all Global Blue team

members, without whom the success of Global Blue would not have

been possible. Additionally, I extend my gratitude to Joe Osnoss,

representative of Silver Lake on the Board, for his continuous

support and guidance over the last 10 years.”

Shift4 CEO Taylor Lauber said “We are incredibly excited

for the opportunity to welcome Jacques and the Global Blue team

into the Shift4 family. This transaction is the most significant in

our 26 years of history and with good reason. The Global Blue

technology stack, marquee customers and industry leading position

will serve as a cornerstone for our global expansion strategy and

gives us meaningful scale in many new geographies. Boldly

Forward!”

Transaction details

Under the terms of the definitive agreement, Shift4 intends to

acquire Global Blue for $7.50 per common share in cash,

representing a 15% premium to Global Blue’s closing share price as

of February 14, 2025, through a tender offer and a subsequent

statutory merger. Shift4 intends to acquire Global Blue’s Series A

Preferred shares at $10.00 per preferred share and Series B

Preferred shares at $11.81 per preferred share.

Upon completion of the transaction, Global Blue’s common and

preferred stock will no longer be listed on any public stock

exchange. Global Blue warrant holders will be able to exercise

their warrants, ahead of their maturity in August 2025.

The acquisition has been unanimously approved by the boards of

directors of Shift4 and Global Blue, and the board of directors of

Global Blue has unanimously resolved that it will recommend to the

Global Blue shareholders to accept the tender offer. The

transaction is expected to close by the third quarter of calendar

year 2025, subject to regulatory approvals, other customary closing

conditions, and a minimum tender of 90% of Global Blue’s issued and

outstanding common shares and preferred shares on a combined basis.

Certain Global Blue shareholders have entered into tender and

support agreements, pursuant to which such shareholders agreed,

among other things, to tender their shares in the tender offer

subject to the terms and conditions of such agreements. Shift4

expects to finance the acquisition with cash on hand and a 364-day

$1,795 million bridge loan facility entered in connection with the

transaction.

Tom Farley, Chairman of Global Blue, on behalf of the

existing board of directors including representatives of Silver

Lake, Partners Group, Certares and Knighthead, said: “We are

pleased to unanimously recommend the transaction, which we believe

will deliver significant, immediate and certain value to Global

Blue’s shareholders. More broadly, we firmly believe that this

transaction is in the best interests of our employees, customers

and stakeholders, ensuring continued growth and innovation under

new ownership.”

Joe Osnoss, Global Blue Board member and a Managing Partner

at Silver Lake, added, “We are grateful to Global Blue’s

management team and employees for their unwavering commitment to

developing Global Blue into what it is today. We especially

appreciate Jacques Stern’s decade of stewardship as CEO, during

which the company accelerated its technology leadership, posted

significant merchant wins, increased its digital value proposition

for consumers and doubled profits. We look forward to seeing the

company continue to thrive in its next chapter."

Preliminary figures for Q3 FY24/25

On the occasion of the announced transaction, Global Blue is

releasing its preliminary Q3 FY24/25 financial results and the Last

Twelve Months figures, which show significant improvements across

all key metrics.

Q3 FY24/25 financial performance

The Group is expecting to deliver a 20% YoY increase in Revenue

to €131m and a 31% YoY increase in Adjusted EBITDA to €52m(2). The

increase in Adjusted EBITDA implied an improvement in margin of

3.4pts to 39.7% with a 56% drop-through.

Last Twelve Months as of December 31st 2024 financial

performance

The Tax Free Shopping and Payments Completed Sales-in-Store

highlight a continued positive trend, reaching €29.9b and

representing a 23% YoY increase. The Group is therefore expecting

to deliver a 20% YoY increase in Revenue to €486m and a 38% YoY

increase in Adjusted EBITDA to €188m(2). The increase in Adjusted

EBITDA implied an improvement in margin of 5pts to 38.6% with a 63%

drop-through.

Global Blue’s preliminary financial results for Q3 FY24/25 and

the Last Twelve Months ended December 31, 2024 are not yet

finalized and are subject to change. The information above

represents Global Blue’s estimates for Q3 FY24/25 and the Last

Twelve Months ended December 31, 2024, which are based only on

currently available information and do not present all necessary

information for an understanding of Global Blue’s results of

operations and financial condition for such periods.

€M

For the three months

ended December 31 2024

For the twelve months

ended December 31 2024

Profit for the period

33.9

73.5

Profit margin (%)

25.8%

15.1%

Income Tax Expense

12.3

40.3

Net Finance Costs

13.9

57.3

Exceptional Items(3)

(21.9)

(35.9)

Depreciation & Amortization

14.0

52.6

Adjusted EBITDA

52.2

187.8

Adjusted EBITDA Margin (%)

39.7%

38.6%

Advisors

Goldman Sachs & Co. LLC is acting as financial advisor to

Shift4, Latham & Watkins LLP is acting as legal counsel, and

Loyens & Loeff is acting as Swiss counsel.

J.P. Morgan Securities LLC is acting as lead financial advisor

for Global Blue, Deutsche Bank Securities, IFBC, Oppenheimer &

Co. Inc., PJT Partners, and UBS are acting as financial advisors

(in alphabetical order), and Simpson Thacher & Bartlett LLP and

Niederer Kraft Frey Ltd are acting as legal counsel.

For further information regarding all terms and conditions

contained in the definitive agreement, please see Global Blue's

Current Report on Form 6-K, which will be filed in connection with

the transaction.

About Global Blue

Global Blue is the business partner for the shopping journey,

providing technology and services to enhance the experience and

drive performance.

With over 40 years of expertise, today we connect thousands of

retailers, acquirers, and hotels with nearly 80 million consumers

across 52 countries, in three industries: Tax Free Shopping,

Payments and Post-Purchase solutions.

With over 2,000 employees, Global Blue generated €28bn Sales in

Store and €422M revenue in FY 2023/24. Global Blue is listed on the

New York Stock Exchange.

For more information, please visit www.globalblue.com

(1) Active merchants definition per 20-F (2) Please see the

table on page 4, which provides a reconciliation between Profit and

Adjusted EBITDA (3) Exceptional Items consist of items which Global

Blue does not consider indicative of its ongoing operating and

financial performance, not directly related to ordinary business

operations and which are not included in the assessment of

management performance

About Shift4

Shift4 (NYSE: FOUR) is boldly redefining commerce by simplifying

complex payments ecosystems across the world. As the leader in

commerce-enabling technology, Shift4 powers billions of

transactions annually for hundreds of thousands of businesses in

virtually every industry. For more information, visit

shift4.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218525108/en/

Media Contacts

Virginie Alem – SVP Marketing & Communications Mail:

valem@globalblue.com

Investor Relations Contacts

Frances Gibbons – Head of Investor Relations Mob: +44 (0)7815

034 212 Mail: fgibbons@globalblue.com

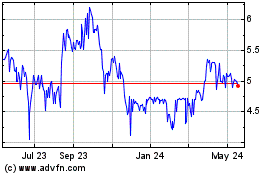

Global Blue (NYSE:GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

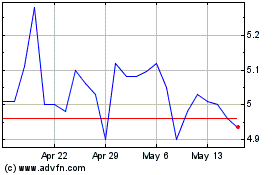

Global Blue (NYSE:GB)

Historical Stock Chart

From Feb 2024 to Feb 2025