Exhibit D

EXECUTION VERSION

TENDER AND SUPPORT AGREEMENT

This

TENDER AND SUPPORT AGREEMENT (this “Agreement”), dated as of February 16, 2025, is made by and among Shift4

Payments, Inc., a Delaware corporation (“Parent”), and the undersigned shareholder (the “Shareholder”)

of Global Blue Group Holding AG, a stock corporation incorporated under the laws of Switzerland, with its registered office in Zurichstrasse

38, 8306, Bruttisellen, Switzerland (the “Company”). Parent and the Shareholder are each sometimes referred to herein

as a “Party” and, collectively, as the “Parties.”

RECITALS

WHEREAS, concurrently with

the execution and delivery of this Agreement, Parent and the Company are entering into a Transaction Agreement, dated as of the date

hereof, (as amended, restated, supplemented or otherwise modified from time to time in accordance with its terms, the “Transaction

Agreement”), pursuant to which, among other things, Merger Sub shall (and Parent shall cause Merger Sub to) commence a tender

offer (the “Offer”) to acquire all of the outstanding Company Shares, in which Offer each Company Share validly tendered

and not properly withdrawn would be purchased for the Common Share Offer Consideration, the Series A Offer Consideration or the

Series B Offer Consideration, as applicable, and following completion of the Offer, and provided that at such time Parent directly

or indirectly has acquired or controls at least 90% of the then outstanding Company Shares, the Company and Merger Sub will consummate

a statutory squeeze-out merger pursuant to which the Company shall be merged with and into Merger Sub, with Merger Sub continuing as

the surviving corporation and as a wholly-owned Subsidiary of Parent (the “Merger”), in each case, upon the terms

and subject to the conditions set forth in the Transaction Agreement;

WHEREAS,

as of the date hereof, the Shareholder Beneficially Owns the Company Common Shares set forth on Schedule A (together with

any Company Common Shares, Company Series A Preferred Shares and Company Series B Preferred Shares with respect to which the

Shareholder or any of its controlled Affiliates acquires Beneficial Ownership of, on or after the date hereof and prior to the Expiration

Time, collectively, the Shareholder’s “Shares”);

WHEREAS,

concurrently with the execution and delivery of this Agreement and the Transaction Agreement, the Specified Shareholders of the

Company are entering into tender and support agreements substantially in the form of this Agreement;

WHEREAS,

the Company Board has (a) determined that the Transaction Agreement is in the best interests of, and fair to, the Company and its

shareholders, and declared it advisable for the Company to enter into the Transaction Agreement and effect the Board Modification,

(b) adopted the Transaction Agreement and authorized and approved the Offer and the other transactions contemplated thereby, and

(c) resolved to recommend that the shareholders of the Company accept the Offer and tender their Company Shares in the Offer and

approve and adopt the Board Modification at the Company Shareholder Meeting subject to the terms of the Transaction Agreement, and directed

that such matters be submitted for consideration by the shareholders of the Company at the Company Shareholder Meeting; and

WHEREAS,

Parent desires that the Shareholder agrees, and the Shareholder is willing to agree, on the terms and subject to the conditions set forth

herein, not to Transfer (as defined below) any of its Shares, to accept the offer and tender its Shares in the Offer and to vote all

of its Shares in favor of the approval and adoption of the Board Modification and against any action or proposal that would reasonably

be expected to interfere with or delay the timely consummation of the Offer or the Merger.

NOW, THEREFORE, in consideration

of the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of

which are hereby acknowledged, the Parties hereto, intending to be legally bound, hereby agree as follows:

1. Definitions.

This Agreement is a “Specified Shareholders Support Agreement” as defined in the Transaction Agreement. Capitalized terms

used but not otherwise defined herein shall have the respective meanings ascribed to such terms in the Transaction Agreement. As used

in this Agreement, the following terms shall have the meanings indicated below:

“Agreement”

shall have the meaning set forth in the Preamble.

“Applicable

Period” means the period beginning upon the execution and delivery of this Agreement and ending at 11:59 p.m., New York City

time, on the day that is the later of (a) the Final Date and (b) the fifth Business Day immediately following Parent’s

receipt (if applicable) of either (i) the final Notice of Company Recommendation Change (including any new Notice of Recommendation

change as a result of any material amendments to the Company Superior Proposal) with respect to a Qualifying Proposal or (ii) the

final Notice of Superior Proposal (including any new Notice of Superior Proposal change as a result of any material amendments to the

Company Superior Proposal) with respect to a Qualifying Proposal. For purposes of this definition, the “final” Notice of

Company Recommendation Change and the “final” Notice of Company Superior Proposal shall mean the Notice of Company Recommendation

Change or the Notice of Company Superior Proposal, as applicable, after which either (x) Parent has not negotiated with the

Company to make adjustments to the terms and conditions of the Transaction Agreement during the applicable period under Section 7.4(e) of

the Transaction Agreement in response to a Qualifying Proposal or (y) the Person or group submitting the Qualifying Proposal has

not made a material amendments to the Company Superior Proposal within five Business Days after submitting to the Company such Qualifying

Proposal.

“Beneficially

Own,” “Beneficial Ownership” or “Beneficial Owner” shall mean, with respect to any securities,

having “beneficial ownership” of such securities for purposes of Rule 13d-3 or 13d-5 under the Exchange Act (or any

successor statute or regulation).

“Chosen

Courts” shall have the meaning set forth in Section 9.7.

“Company”

shall have the meaning set forth in the Preamble.

“control”

shall mean the possession, direct or indirect, of the power to direct, or cause the direction of, the management and policies of a Person,

whether through the ownership of voting securities, voting equity, limited liability company interests, general partner interests, or

other voting interests, by contract or otherwise.

“Expiration

Time” shall have the meaning set forth in Section 6.

“Final

Date” means March 4, 2025.

“Governing

Documents” shall mean, with respect to any Person, such Person’s articles or certificate of association, incorporation,

formation or organization, bylaws, limited liability company agreement, partnership agreement or other constituent document or documents,

each in its currently effective form as amended from time to time.

“Merger”

shall have the meaning set forth in the Recitals.

“Non-Recourse

Party” shall have the meaning set forth in Section 9.13.

“Offer”

shall have the meaning set forth in the Recitals.

“Other

Shareholder” means any other shareholder of the Company entering into a Tender and Support Agreement in connection with the

transactions contemplated by the Transaction Agreement.

“Other

Tender and Support Agreement” means any Tender and Support Agreement, dated as of the date hereof, between Parent and any Other

Shareholder.

“Parent”

shall have the meaning set forth in the Preamble.

“Party”

or “Parties” shall each have the meaning set forth in the Preamble.

“Qualifying

Proposal” means a Company Takeover Proposal with respect to which the Company has delivered to Parent either a Notice of Company

Recommendation Change or a Notice of Superior Proposal, in each case, prior to 11:59 p.m., New York City time, on the Final Date.

“Shareholder”

shall have the meaning set forth in the Recitals.

“Shares”

shall have the meaning set forth in the Recitals.

“Side

Arrangements” shall have the meaning set forth in Section 2.10.

“Transaction

Agreement” shall have the meaning set forth in the Recitals.

“Transfer”

shall mean, with respect to any Share, any direct or indirect sale, transfer, tender, exchange, conversion, assignment, pledge, hypothecation,

mortgage, license, gift, creation of a security interest in or lien on, placement in trust (voting or otherwise), encumbrance or other

disposition of any interest (including the right to vote) in such Share, as applicable, including those by way of any spin-off (such

as through a dividend), hedging or derivative transactions, sale, transfer or assignment of a majority of the equity interest in, or

sale, transfer or assignment of control of, any Person holding such Share, as applicable, merger, consolidation, division, statutory

conversion, domestication, transfer or continuance, share exchange, operation of Law, or otherwise.

2. Certain

Agreements.

2.1 Agreement

to Tender. Subject to the terms of this Agreement, the Shareholder shall, and shall cause its controlled Affiliates to validly tender,

or cause to be tendered, in the Offer, as promptly as practicable following the commencement of the Offer (but in any event within ten

Business Days following the commencement of the Offer (within the meaning of Rule 14d-2 of the Exchange Act)) all of its Shares

pursuant to the terms of the Offer and shall not withdraw, or cause to be withdrawn such Shares at any time, unless and until this Agreement

shall have been validly terminated in accordance with Section 6. Without limiting the generality of the foregoing, no later

than ten Business Days after the commencement (within the meaning of Rule 14d-2 of the Exchange Act) of the Offer, the Shareholder

shall, and shall cause its controlled Affiliates to deliver pursuant to the terms of the Offer (i) a letter of transmittal with

respect to all Shares complying with the terms of the Offer, (ii) a certificate (or effective affidavit of loss in lieu thereof)

representing the Shares or an “agent’s message” (or such other evidence, if any, of transfer as the Exchange Agent

may reasonably request) in the case of book-entry evidence and (iii) all other documents or instruments reasonably required to be

delivered by shareholders of the Company pursuant to the terms of the Offer or as Parent may reasonably require or request in order to

effect the valid tender of the Shares in accordance with the terms of the Offer or cause the Shareholder’s broker or such other

Person that is the holder of record of any Shares Beneficially Owned by the Shareholder to validly tender such Shares pursuant to and

in accordance with this Section 2.1 and the terms of the Offer. If the Offer is terminated or withdrawn by Merger Sub in

accordance with the Transaction Agreement or the Transaction Agreement is terminated in accordance with Article IX thereof prior

to the purchase of the Shares in the Offer, Parent and Merger Sub shall promptly return, and shall cause any depository or paying agent,

acting on behalf of Parent and Merger Sub, to promptly return all tendered Shares to the Shareholder.

2.2 Agreement

to Vote. Subject to the terms of this Agreement, the Shareholder hereby irrevocably and unconditionally agrees that from the date

hereof and until the Expiration Time, at any meeting of shareholders of the Company called to vote upon the Board Modification, including

the Company Shareholder Meeting, or at any adjournment or postponement thereof or in any other circumstances upon which a vote, consent

or approval is sought with respect to the Board Modification, the Shareholder shall, and shall cause its controlled Affiliates to, in

each case (whether by proxy or in person), to the fullest extent that the Shares are entitled to vote thereon be present and vote (or

cause to be voted), or deliver (or cause to be delivered) a written consent with respect to all of its Shares (w) in favor of the

adoption and approval of the Board Modification and any other proposal required for the consummation of the transactions contemplated

by the Transaction Agreement, (x) against any proposal, motion, action, agreement or transaction that would reasonably be expected

to (A) directly result in a breach of any covenant, representation or warranty or any other obligation or agreement of the Company

contained in the Transaction Agreement, or of the Shareholder contained in this Agreement or (B) result in any of the conditions

set forth in Annex D of the Transaction Agreement not being satisfied prior to the End Date; (y) against any change in the Company

Board (other than the Board Modification or in the event of a director’s death or resignation, to fill the vacancy created thereby);

and (z) against any Company Takeover Proposal and against any other action, agreement or transaction involving the Company that

would reasonably be expected to materially impede, materially delay or prevent the consummation of the Offer, including (1) any

proposal to authorize, declare, set aside, make or pay any dividends on, or make other distributions in respect of, any of its share

capital; (2) any proposal to adjust, split, combine or reclassify any of its share capital, or any other securities in respect of,

in lieu of or in substitution for, shares of its share capital; (3) any amendment or proposal to amend the articles of association

of the Company (except for amendments to the Company’s articles of association incidental to or in connection with the issue of

Company Common Shares permitted pursuant to Section 6.1(b) of the Transaction Agreement or cancellations of Company Shares

held in treasury); (4) any restriction on the transferability of shares; (5) any sale of all or substantially all of the assets

of the Company (faktische Liquidation); and (6) any merger, demerger or similar reorganization of the Company, in each case

of the foregoing clauses (1) through (6), if such actions would reasonably be expected to materially impede, materially delay or

prevent the consummation of the Offer. If and to the extent the Company convenes any general meeting, the Shareholder has the right to

vote in favor of the proposals by the Company Board with respect to the items to be included by law in the agenda of such general meeting

to the extent otherwise permitted by this Section 2.2.

2.3 Waiver

of Appraisal Rights. The Shareholder hereby irrevocably and unconditionally waives and agrees to cause to be waived and to prevent

the exercise of or any demand related to, any rights of appraisal or any dissenters’ rights in respect of the Shares that exist

in relation to the Offer, the Merger and/or the transactions contemplated by the Transaction Agreement.

2.4 [Intentionally

Omitted.]

2.5 No

Solicitation by the Shareholder. From and after the execution of this Agreement and until the Expiration Time, the Shareholder shall

not, and shall cause its Subsidiaries not to, and shall cause its and its Subsidiaries’ respective directors, officers, employees

and Representatives not to, directly or indirectly, (i) solicit, initiate, propose, knowingly encourage or knowingly facilitate

any inquiry, discussion, offer or request that constitutes, or would reasonably be expected to lead to a Company Takeover Proposal, (ii) enter

into, continue, initiate or otherwise participate in any discussions (except to notify a Person of the existence of the provisions of

this Section 2.5 and Section 7.4 of the Transaction Agreement) or negotiations regarding, or furnish to any Person (other

than to Parent and its Representatives) any non-public information regarding the Company or any of its Subsidiaries or afford to any

Person (other than to Parent and its Representatives) access to the properties, books, records, officers or personnel of the Company

or any of its Subsidiaries in connection with any Company Takeover Proposal or any inquiry, discussion or request that would reasonably

be expected to lead to a Company Takeover Proposal, (iii) approve, endorse, adopt or recommend, or publicly propose to approve,

endorse, adopt or recommend, any Company Takeover Proposal or submit to the vote of its shareholders any Company Takeover Proposal before

the termination of this Agreement in accordance with its terms or (iv) enter into or execute, or approve or recommend or publicly

propose to approve or recommend the entering into of any letter of intent, memorandum of understanding, amalgamation or merger agreement

or other agreement, arrangement or understanding relating to any Company Takeover Proposal before the termination of this Agreement in

accordance its terms (other than a Company Acceptable Confidentiality Agreement) or (v) formally authorize any of, or commit, resolve

or agree to do any of, the foregoing. Upon the execution of this Agreement until the Expiration Time, the Shareholder shall and shall

cause its Subsidiaries and each of its and their respective directors, officers and employees to, and shall direct, and use its reasonable

best efforts to cause its other Representatives to immediately cease any existing solicitation, encouragement, discussions or negotiations

with any Person or group relating to any Company Takeover Proposal or any discussion that would reasonably be expected to lead to a Company

Takeover Proposal. Any violation of the restrictions set forth in this Section 2.5 by any Representative of the Shareholder

shall be deemed to be a breach of this Section 2.5 by the Shareholder. Notwithstanding anything to the contrary herein, (i) this

Section 2.5 shall not restrict the Shareholder from (A) taking any action or doing anything that the Company or any

of its Subsidiaries is permitted to do in accordance with the terms of Section 7.4 of the Transaction Agreement, (B) sharing

with the Company Board any Company Takeover Proposal received by the Shareholder; provided that such Company Takeover Proposal

referenced in this clause (B) was not received in violation of this Section 2.5 or (C) communicating with Other

Shareholders of the Company that are party to an Other Tender and Support Agreement so long as such communications would not reasonably

be expected to require the Shareholder, any Other Shareholder or the Company to make any public disclosure, and (ii) the Shareholder

shall under no circumstances be liable for any actions taken or any failure to act by the Company under or in respect of the Transaction

Agreement or the transactions contemplated thereby. For purposes of this Agreement, none of the Company or any of its Subsidiaries shall

be deemed to be a Subsidiary or a Representative of the Shareholder for any purpose hereunder.

2.6 Company

Takeover Proposal. From and after the execution of this Agreement and until the Expiration Time, the Shareholder shall not submit

to the Company or the Company Board, or publicly propose, any Company Takeover Proposal. For the avoidance of doubt, the foregoing shall

not restrict the Shareholder from sharing with the Company Board any Company Takeover Proposal received by the Shareholder in compliance

with Section 2.5.

2.7 Regulatory

Cooperation. From and after the execution of this Agreement and until the Expiration Time, the Shareholder shall provide any information

of the type customarily provided to a Governmental Entity by a Person similarly situated to the Shareholder to the extent necessary to

obtain each Required Approval pursuant to the Transaction Agreement, in each case as promptly as reasonably practicable after any request

by Parent or the Company; provided that the Shareholder shall not be required to provide any information that is subject to attorney-client

privilege, confidentiality obligations or legal restrictions to which the Shareholder or its Affiliates are bound.

2.8 [Intentionally

Omitted.]

2.9 [Intentionally

Omitted.]

2.10 Other

Tender and Support Agreements. Parent will not, and will cause each of its controlled Affiliates not to, amend, modify, waive or

terminate any provision of any Other Tender and Support Agreement, or enter into any other agreement (including side letters) that is

inconsistent in a material respect with this Agreement or the other Tender and Support Agreements, as applicable, with any Other Shareholders

(collectively “Side Arrangements”), in each case, without the prior written consent of the Shareholder. Each Other

Shareholder shall be an express third-party beneficiary of this Section 2.10 and shall be entitled to enforce this Section 2.10.

3. Agreement

Not to Transfer or Encumber. The Shareholder hereby agrees with Parent that, from the date hereof until the Expiration Time, it shall

not, directly or indirectly, (i) Transfer (or enter into any contract related to the Transfer of) any of its Shares or any right,

title or interest therein, (ii) deposit any of its Shares into a voting trust or enter into a voting agreement, voting trust or

arrangement with respect to any Shares, as applicable, (iii) grant a proxy or power of attorney or other authorization or consent

with respect to the Shares, (iv) enter into any agreement or take any action that would make any covenant, agreement, representation

or warranty of the Shareholder contained herein untrue, incorrect, ineffective or unenforceable in any material respect or have the effect

of preventing the Shareholder from performing any of its obligations under this Agreement, or (v) approve or consent to any of the

foregoing; provided that, notwithstanding the foregoing, the Shareholder may Transfer Shares (A) to an Affiliate of the Shareholder

that, concurrently with such Transfer, executes a joinder substantially in the form attached hereto as Annex I, (B) to any

custodian or nominee in connection with the tender of Shares in the Offer, or (C) in order to tender Shares in the Offer as provided

hereunder and under the Transaction Agreement. Any Transfer or attempted Transfer of any Shares in violation of this Section 3

shall be null and void ab initio. If any involuntary Transfer of any of the Shares shall occur (including a sale by the Shareholder’s

trustee in any bankruptcy, or a sale to a purchaser at any creditor’s or court sale), the transferee (which term, as used herein,

shall include any and all transferees and subsequent transferees of the initial transferee) shall take and hold such Shares subject to

all of the restrictions, liabilities and rights under this Agreement, which shall continue in full force and effect until valid termination

of this Agreement in accordance with Section 6. Notwithstanding anything herein to the contrary, the Shareholder shall be

permitted to grant a proxy or power of attorney or other authorization or consent to the Company’s independent proxy (as elected

on the annual general meeting of the shareholders of the Company) on the Company’s official proxy card to vote the Shares in a

manner consistent with the terms of this Agreement.

4. Representations,

Warranties and Covenants of the Shareholder. The Shareholder hereby represents and warrants to Parent as follows:

4.1 The

Shareholder has all requisite power and authority to execute and deliver this Agreement and to perform its obligations hereunder. The

Shareholder is duly organized, validly existing and in good standing in accordance with the laws of its jurisdiction of formation, as

applicable. The execution and delivery by the Shareholder of this Agreement and the performance of its obligations hereunder have been

duly authorized by all necessary corporate or other organizational action in accordance with the Shareholder’s Governing Documents,

as applicable. This Agreement has been duly executed and delivered by the Shareholder and, assuming the due authorization, execution

and delivery of this Agreement by Parent and in case of the Company Series B Preferred Shares and the Company Series A Preferred

Shares approval by the Company Board on the transfer, constitutes the legal, valid and binding obligation of the Shareholder, except

to the extent that enforceability may be limited by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’

rights generally and subject to general principles of equity (regardless of whether such enforcement is considered in a proceeding at

law or at equity).

4.2 The

execution and delivery of this Agreement by the Shareholder and the performance of its obligations hereunder will not constitute or result

in (i) a breach or violation of, or a default under, the Governing Documents of the Shareholder, (ii) a breach or violation

of, a termination (or right of termination) or default under, the creation or acceleration of any obligations under, or the creation

of a Lien on any of the assets of by the Shareholder (with or without notice, lapse of time or both) pursuant to, any agreement, lease,

license, contract, note, mortgage, indenture, arrangement or other obligation binding upon by the Shareholder, or (iii) a conflict

with, breach or violation of any Law applicable to by the Shareholder or by which its properties are bound or affected, except, in the

case of clauses (ii) or (iii), for any breach, violation, termination, default, creation or acceleration that would not, individually

or in the aggregate, reasonably be expected to impair the ability of by the Shareholder to perform its obligations under this Agreement

on a timely basis.

4.3 As

of the date hereof, the Shareholder (i) Beneficially Owns the Shares and has good and marketable title to all such Shares, free

and clear of any and all Liens, other than those that may be created by this Agreement and (ii) has sole voting power over and sole

power to issue instructions with respect to the matters set forth herein and the right to consent (or cause to consent) to all of the

matters set forth in this Agreement, in each case, with respect to all of such Shares.

4.4 Except

as contemplated by this Agreement, the Voting Agreement, dated as of September 7, 2020, by and among SL Globetrotter, L.P., Global

Blue Holding LP and Antfin (Hong Kong) Holding Limited, as amended by the Amendment and Joinder Agreement to the Voting Agreement, dated

as of December 28, 2024, by and among SL Globetrotter, L.P., Global Blue Holding LP, Antfin (Hong Kong) Holding Limited and Ant

International Technologies (Hong Kong) Holding Limited, and the Second Amended and Restated Relationship Agreement, dated as of September 7,

2020, by and among Global Blue Group Holding AG, SL Globetrotter, L.P. and Antfin (Hong Kong) Holding Limited, as amended by the Amendment

and Joinder Agreement to the Second Amended and Restated Relationship Agreement, dated December 28, 2024, by and among Global Blue

Group Holdings AG, SL Globetrotter, L.P., Antfin (Hong Kong) Holding Limited, and Ant International Technologies (Hong Kong) Holding

Limited, as applicable, the Shareholder has not entered into any tender, voting or other agreement or arrangement, or proxy or power

of attorney, with respect to any of its Shares or entered into any other contract relating to the voting of any of its Shares. Any and

all proxies in respect of the Shares in effect prior to the date hereof are revocable, and such proxies either have been revoked prior

to the date hereof or are hereby revoked. For the avoidance of doubt, nothing in this Section 4.4 shall limit the ability

of the Shareholder to grant a proxy or power of attorney, or issue voting instructions, to the Company’s independent proxy in accordance

with Section 3 and the applicable Swiss Law.

4.5 As

of the date hereof, there is no Action pending or, to the knowledge of the Shareholder, threatened against or affecting the Shareholder

that, individually or in the aggregate, would reasonably be expected to materially impair the ability of the Shareholder to perform its

obligations under this Agreement or to consummate the transactions contemplated by this Agreement on a timely basis.

4.6 The

Shareholder hereby authorizes Parent to publish and disclose in any announcement or disclosure in connection with the transactions contemplated

by the Transaction Agreement, including the Other Parent Filings and the Other Company Filings, its identity and ownership of its Shares

consistent with public filings made by the Shareholder and the nature of its obligations under this Agreement, and agrees that it shall

promptly furnish to Parent any information reasonably available to the Shareholder that Parent may reasonably request for the preparation

of any such announcement or disclosure in order to comply with applicable Law and notify Parent of any required corrections with respect

to any written information supplied by it specifically for use in any such announcement or disclosure, if and to the extent that any

such information contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein

or necessary in order to make the statements therein, in light of the circumstances under which they were made, not misleading.

4.7 The

Shareholder (i) has been represented by or has had the opportunity to be represented by, independent counsel of its own choice,

and has had the full right and opportunity to consult with its attorney and avail itself of this opportunity, (ii) has received,

and reviewed and fully understands this Agreement and the Transaction Agreement, and has had the opportunity to have the Agreement and

the Transaction Agreement fully explained by counsel of its choosing, and is fully aware of the contents thereof and its meaning, intent

and legal effect, and (iii) is competent to execute this Agreement and has executed this Agreement free from coercion, duress or

undue influence. The Shareholder understands and acknowledges that Parent is entering into the Transaction Agreement in reliance upon

the Shareholder’s execution, delivery and performance of this Agreement.

4.8 The

Shareholder irrevocably confirms that no special meetings of the holders of the Company Series A Preferred Shares are required under

the Company Articles in connection with the Offer.

4.9 The

Offer Consideration to be paid in respect of each of the Company Common Shares and the Company Series A Shares in the Offer to the

Shareholder, as applicable, is not in breach with any liquidation preference, preferential treatment or payment in respect thereof and

is in compliance in all material respects with the Series A Conversion Agreement.

5. Representations,

Warranties and Covenants of Parent. Parent hereby represents and warrants to the Shareholder as follows:

5.1 Parent

has all requisite power and authority to execute and deliver this Agreement and to perform its obligations hereunder. Parent is duly

organized, validly existing and in good standing in accordance with the laws of its jurisdiction of formation, as applicable. The execution

and delivery by Parent of this Agreement and the performance of its obligations hereunder have been duly authorized by all necessary

corporate or other organizational action in accordance with Parent’s Governing Documents, as applicable. This Agreement has been

duly executed and delivered by Parent and, assuming the due authorization, execution and delivery of this Agreement by the Shareholder

and in case of the Company Series B Preferred Shares and the Company Series A Preferred Shares approval by the Company Board

on the transfer, constitutes the legal, valid and binding obligation of Parent, except to the extent that enforceability may be limited

by applicable bankruptcy, insolvency or similar laws affecting the enforcement of creditors’ rights generally and subject to general

principles of equity (regardless of whether such enforcement is considered in a proceeding at law or at equity).

5.2 The

execution and delivery of this Agreement by Parent and the performance of its obligations hereunder will not constitute or result in

(i) a breach or violation of, or a default under, the Governing Documents of Parent, (ii) a breach or violation of, a termination

(or right of termination) or default under, the creation or acceleration of any obligations under, or the creation of a Lien on any of

the assets of by Parent (with or without notice, lapse of time or both) pursuant to, any agreement, lease, license, contract, note, mortgage,

indenture, arrangement or other obligation binding upon by Parent, or (iii) a conflict with, breach or violation of any Law applicable

to by Parent or by which its properties are bound or affected, except, in the case of clauses (ii) or (iii), for any breach, violation,

termination, default, creation or acceleration that would not, individually or in the aggregate, reasonably be expected to impair the

ability of Parent to perform its obligations under this Agreement on a timely basis.

5.3 Parent

has or has caused to be provided to the Shareholder true, correct and complete copies of (i) the Other Tender and Support Agreements,

and (ii) neither Parent nor its Affiliates have entered into any Side Arrangement without the prior written consent of the Shareholder.

6. Termination.

This Agreement shall terminate and shall have no further force or effect (i) (A) during the Applicable Period, (x) immediately,

upon written notice by the Shareholder to Parent, if there has been a Company Change of Recommendation or (y) immediately upon termination

of the Transaction Agreement in accordance with Section 9.1(e) or Section 9.1(g) and (B) from and after the

expiration of the Applicable Period, on the date that is (1) three months following the termination of the Transaction Agreement,

if the Transaction Agreement is terminated in accordance with Section 9.1(e) or (2) five months following the termination

of the Transaction Agreement, if the Transaction Agreement is terminated in accordance with Section 9.1(f) (solely to the extent

resulting from Willful Breach by the Company) or Section 9.1(g) thereof, in each case of clauses (1) and (2), except with

respect to Section 2.1, Section 2.2 (other than the Shareholder’s obligation to vote (or cause to be voted),

or deliver (or cause to be delivered) a written consent, against any Company Takeover Proposal as set forth in clause (z) thereof),

Section 2.3 and Section 2.7, each of which shall terminate immediately upon termination of the Transaction Agreement,

(ii) immediately upon termination of the Transaction Agreement, if the Transaction Agreement is terminated in accordance with Section 9.1(a),

Section 9.1(b), Section 9.1(c), Section 9.1(d), Section 9.1(f) (other than as described in the foregoing clause

(i) of this Section 6) or Section 9.1(h) thereof, (iii) immediately as of and following the Acceptance

Time, or (iv) immediately, upon written notice by the Shareholder to Parent, if there has been any modification, waiver or amendment

to any provision of the Transaction Agreement that reduces or changes the form of Offer Consideration to be paid in respect of the Shares

(in each case, without the Shareholder’s prior written consent) (the date that any such termination is effective pursuant to clauses

(i), (ii), (iii) or (iv) of this Section 6, the “Expiration Time”). Notwithstanding the foregoing,

nothing herein shall relieve any Party hereto from liability for any breach of this Agreement that occurred prior to such termination.

7. Duties.

The Shareholder is entering into this Agreement solely in its capacity as Beneficial Owner of the Shares, and nothing in this Agreement

shall apply to any Person serving in his or her capacity as a director or officer of the Company. Parent acknowledges that investment

professionals affiliated with the Shareholder may serve on the Company Board and agrees that any actions taken by a director or officer

of the Company in his or her capacity as such shall not constitute actions taken by or on behalf of the Shareholder. For the avoidance

of doubt, nothing in this Agreement shall be construed to prohibit a Person (or be construed to create any obligation on such Person)

who is an officer or member of the Company Board from taking any action (or failure to act) in his or her capacity as an officer

or member of the Company Board or from taking any action with respect to any Company Takeover Proposal in his or her capacity as an officer or director of the Company or in the exercise of his or her duties in his or her capacity as director or officer of the Company

or any of its Subsidiaries and no action taken in any such capacity as an officer or director of the Company or any of its Subsidiaries

shall be deemed to constitute a breach of this Agreement.

8. No

Ownership Interest. Nothing contained in this Agreement shall be deemed to vest in Parent or any of its direct or indirect owners

any direct or indirect ownership or incidence of ownership of or with respect to the Shares. All rights, ownership and economic benefits

of and relating to the Shares shall remain vested in and belong to the Shareholder, and neither Parent nor any of its direct or indirect

owners shall have the authority to direct the Shareholder in the voting or disposition of any Shares, except as otherwise expressly provided

herein.

9. Miscellaneous.

9.1 Enforcement.

The Parties agree that money damages would be both incalculable and an insufficient remedy and that irreparable damage would occur if

any of the provisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached. It is

accordingly agreed that each of the Parties shall be entitled to specific performance, an injunction or other equitable relief to prevent

breaches or violations of this Agreement and to enforce specifically the terms and provisions of this Agreement in any Chosen Court.

Moreover, and in recognition of the foregoing, each of the Parties hereby waives (a) any defense in any action for specific performance

of this Agreement that a remedy at Law would be adequate or that a remedy of specific performance is unenforceable, invalid, contrary

to Law or inequitable for any reason and (b) any requirement under any Law for any Party to post security as a prerequisite to obtaining

equitable relief. Each Party acknowledges and agrees that the agreements contained in this Section 9.1 are an integral part

of the transactions contemplated by this Agreement and that, without these agreements, the other Party would not enter into this Agreement.

Notwithstanding anything to the contrary in this Agreement, the Parties hereby agree that specific performance or injunctive relief pursuant

to this Section 9.1 shall be the sole and exclusive remedy with respect to breaches or threatened breaches by the Shareholder

under this Agreement, and neither Parent nor any of its Affiliates may pursue or accept any other form of relief (including monetary

damages or reimbursement) that may be available at law or in equity for any breach or violation of this Agreement.

9.2 Assignment.

Neither this Agreement nor any of the rights, interests or obligations of the Parties hereunder shall be assigned by any of the Parties

(whether by operation of Law or otherwise) without the prior written consent of the other Party, which may be granted or withheld in

the sole discretion of the other Party. Any attempt to make any such assignment without such consent shall be null and void. Subject

to the preceding sentence, this Agreement shall be binding upon, inure to the benefit of and be enforceable by the Parties and their

respective successors and permitted assigns.

9.3 No

Rights or Obligations of the Company: The undertakings and representations and warranties by the Shareholder contained herein are

for the sole benefit of and can only be enforced by Parent and do not create any rights for or obligations by the Company to the Shareholder

or the Parent, as the case may be. The Company may rely on the confirmation set forth in Section 4.8.

9.4 Amendment.

This Agreement may not be amended, modified or supplemented in any manner, whether by course of conduct or otherwise, except by an instrument

in writing specifically designated as an amendment hereto, signed on behalf of each of the Parties in interest at the time of the amendment.

9.5 Notices.

All notices and other communications hereunder shall be in writing and shall be deemed duly given and properly received on the date of

delivery if delivered personally, when received when sent by email by the Party to be notified; provided that no “bounceback”

or notice of non-delivery is received or when delivered by a courier (with confirmation of delivery). All notices hereunder shall be

delivered as set forth below or under such other instructions as may be designated in writing by the Party to receive such notice.

Shift4 Payments, Inc.

3501 Corporate Parkway

Center Valley, PA 18034

| |

Email: |

tlauber@shift4.com |

| |

|

jfrankel@shift4.com |

| |

Attention: |

Taylor Lauber |

| |

|

Jordan Frankel |

with a copy (which shall not constitute notice) to:

Latham & Watkins LLP

1271 Avenue of the Americas

New York, NY 10020

| Email: | andrew.elken@lw.com |

| | | leah.sauter@lw.com |

| | Attention: | Andrew Elken |

| | | Leah Sauter |

| (ii) | if

to the Shareholder, to: |

Ant International Technologies (Hong Kong) Holding Limited

Level 27, Tower One, Times Square

1 Matheson Street

Causeway Bay

Hong Kong

| Email: | sally.wang@antgroup.com; |

| | | lisa.wang@antgroup.com |

| | Attention: | Sally Wang |

| | | Lisa Wang |

with a copy (which shall not constitute notice) to:

Investment Legal Department

Level 27, Tower One, Times Square

1 Matheson Street

Causeway Bay

Hong Kong

| |

Email: |

antnotice.investmentlegal@list.antgroup.com |

| |

Attention: |

Richard Lin |

9.6 Governing

Law. This Agreement shall be governed by, interpreted and construed with regard to, in all respects, including as to validity, interpretation

and effect, the Laws of the State of Delaware, without giving effect to its principles or rules of conflict of laws. The Merger

Agreement shall be governed by, interpreted and construed with regard to, in all respects, including as to validity, interpretation and

effect, the Laws of Switzerland, without giving effect to its principles or rules of conflict of laws.

9.7 Submission

to Jurisdiction. Each Party irrevocably and unconditionally consents, agrees and submits to the exclusive jurisdiction of the Court

of Chancery of the State of Delaware (and appropriate appellate courts therefrom) (the “Chosen Courts”), for the purposes

of any Action with respect to the subject matter hereof (other than the Merger Agreement, which shall be interpreted, construed, governed

and enforced as set forth therein). Each Party agrees to commence any Action relating hereto only in the State of Delaware, or if such

Action may not be brought in such court for reasons of subject matter jurisdiction, in the other appellate courts therefrom or other

courts of the State of Delaware. Each Party irrevocably and unconditionally waives any objection to the laying of venue of any Action

with respect to the subject matter hereof (other than the Merger Agreement, which shall be interpreted, construed, governed and enforced

as set forth therein) in the Chosen Courts, and hereby further irrevocably and unconditionally waives and agrees not to plead or claim

in any such court that any such Action brought in any such court has been brought in an inconvenient forum. Each Party further irrevocably

and unconditionally consents to and grants any such court jurisdiction over the Person of such Parties and, to the extent legally effective,

over the subject matter of any such dispute and agrees that mailing of process or other documents in connection with any such Action

in the manner provided in Section 9.5 hereof or in such other manner as may be permitted by applicable Law, shall be valid

and sufficient service thereof. The Parties agree that a final judgment in any such Action shall be conclusive and may be enforced in

other jurisdictions by suit on the judgment or in any other manner provided by applicable Law; provided, however, that

nothing in the foregoing shall restrict any party’s rights to seek any post-judgment relief regarding, or any appeal from such

final trial court judgment.

9.8 WAIVER

OF JURY TRIAL. EACH OF THE PARTIES HEREBY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO

A TRIAL BY JURY WITH RESPECT TO ANY LITIGATION DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER OR IN CONNECTION WITH THIS AGREEMENT OR THE

MERGER. EACH OF THE PARTIES HEREBY CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY

OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND ACKNOWLEDGES

THAT IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT AND THE TRANSACTIONS CONTEMPLATED BY THIS AGREEMENT, AS APPLICABLE, BY, AMONG OTHER

THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 9.8.

9.9 Interpretation.

The Parties have participated jointly in negotiating and drafting this Agreement. If an ambiguity or a question of intent or interpretation

arises, this Agreement shall be construed as if drafted jointly by the Parties, and no presumption or burden of proof shall arise favoring

or disfavoring any Party by virtue of the authorship of any provision of this Agreement. When a reference is made in this Agreement to

sections or subsections, such reference shall be to a section or subsection of this Agreement unless otherwise indicated. The headings

contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement.

Whenever the words “include,” “includes” or “including” are used in this Agreement, they shall be

deemed to be followed by the words “without limitation” unless otherwise indicated. The words “herein,” “hereof,”

“hereunder” and words of similar import shall be deemed to refer to this Agreement as a whole, including the schedules and

annexes hereto, and not to any particular provision of this Agreement. Any pronoun shall include the corresponding masculine, feminine

and neuter forms. References to “CHF” in this Agreement are to the lawful currency of Switzerland. References to any agreement

shall be deemed to include the exhibits, schedules and annexes to such agreement, together with all amendments thereto. References to

any Law shall include all statutory and regulatory provisions consolidating, amending, replacing, supplementing or interpreting such

Law. Time periods within or following which any act is to be done shall be calculated by excluding the day on which the period commences

and including the day on which the period ends and by extending the period to the next Business Day following if the last day of the

period is not a Business Day.

9.10 Entire

Agreement; Third-Party Beneficiaries.

(a) This

Agreement (including the documents and the instruments referred to herein) constitutes the entire agreement among the Parties and supersedes

all prior agreements and understandings, both written and oral, among the Parties with respect to the subject matter hereof.

(b) This

Agreement is not intended to, and shall not, confer upon any other Person any rights or remedies hereunder, except as set forth in or

contemplated by the terms and provisions of Section 9.3 and Section 9.13.

9.11 Severability.

Any term or provision of this Agreement that is invalid or unenforceable in any jurisdiction shall, as to that jurisdiction, be ineffective

to the extent of such invalidity or unenforceability and shall not render invalid or unenforceable the remaining terms and provisions

of this Agreement or affect the validity or enforceability of any of the terms or provisions of this Agreement in any other jurisdiction.

If any provision of this Agreement is so broad as to be unenforceable, the provision shall be interpreted to be only so broad as is enforceable.

Notwithstanding anything to the contrary in this Agreement, this Agreement shall not be interpreted without giving effect to Section 9.1

and Section 9.13.

9.12 Counterparts.

This Agreement may be executed in separate counterparts, each of which shall be considered one and the same agreement and shall become

effective when each of the Parties has delivered a signed counterpart to the other Party, it being understood that all Parties need not

sign the same counterpart. Delivery of an executed signature page of this Agreement by electronic transmission or electronic “.pdf”,

including using generally recognized e-signature technology (e.g., DocuSign or Adobe Sign), shall be effective as delivery of a manually

executed counterpart hereof.

9.13 Non-Recourse.

Notwithstanding anything that may be expressed or implied in this Agreement or any document or instrument delivered in connection herewith,

by its acceptance of the benefits of this Agreement, the Shareholder and Parent each covenant, agree and acknowledge that no Persons

other than the Parties hereto have any liabilities, obligations, commitments (whether known or unknown or whether contingent or otherwise)

hereunder, and that each Party has no right of recovery under this Agreement, or any claim based on such liabilities, obligations, commitments

against, and no personal liability shall attach to, the former, current or future equity holders, controlling persons, directors, officers,

employees, agents, Affiliates, members, managers or general or limited partners of any of either Party or any former, current or future

equity holder, controlling person, director, officer, employee, general or limited partner, member, manager, Affiliate or agent of any

of the foregoing (collectively, but not including the Parties hereto, each a “Non-Recourse Party”), through the other

Party or otherwise, whether by or through attempted piercing of the corporate veil, by or through a claim by or on behalf of the other

Party against any Non-Recourse Party, by the enforcement of any assessment or by any legal or equitable proceeding, by virtue of any

statute, regulation or Law, or otherwise. Without limiting the foregoing, no claim will be brought or maintained by the Shareholder,

Parent or any of its Affiliates or any of their respective successors or permitted assigns against any Non-Recourse Party that is not

otherwise expressly identified as a Party to this Agreement, and no recourse will be brought or granted against any of them, by virtue

of or based upon any alleged misrepresentation or inaccuracy in or breach or nonperformance of any of the representations, warranties,

covenants or agreements of any Party set forth or contained in this Agreement, any exhibit or schedule hereto, any other document contemplated

hereby or any certificate, instrument, opinion, agreement or other document of the other Party or any other Person delivered hereunder.

The Non-Recourse Parties shall be express third-party beneficiaries of this Section 9.13.

9.14 Fees

and Expenses. All Expenses incurred in connection with this Agreement, the Transaction Agreement and the transactions contemplated

hereby and thereby shall be paid by the party incurring such Expense, except as otherwise expressly provided in the Transaction Agreement

and this Section 9.14. If the Offer is completed, Parent shall pay, or cause the Company to pay, legal Expenses incurred

by the Shareholder in connection with the negotiation and execution of this Agreement, up to an aggregate amount not to exceed $500,000.00.

9.15 Affiliated

Entities. If any controlled Affiliate of the Shareholder becomes a Beneficial Owner of Shares on or after the date hereof, the Shareholder

shall give Parent a written notice thereof as promptly as practicable in advance of such controlled Affiliate becoming a Beneficial Owner

and such controlled Affiliate shall, and the Shareholder shall cause such controlled Affiliate to, promptly (and in advance of such

controlled Affiliate becoming a Beneficial Owner) execute a joinder to this Agreement substantially in the form attached hereto as Annex

I, to ensure that such controlled Affiliate is subject to the obligations under this Agreement applicable to the Shareholder and

that such Shares are subject to this Agreement.

[Remainder of Page Intentionally Left

Blank]

IN WITNESS WHEREOF, the Parties

have caused this Agreement to be duly executed as of the date first above written.

| |

|

SHIFT4 PAYMENTS, INC. |

| |

|

|

| |

|

By: |

/s/

Taylor Lauber |

| |

|

Name: |

Taylor Lauber |

| |

|

Title: |

President |

[SIGNATURE PAGE TO TENDER

AND SUPPORT AGREEMENT]

| |

|

ANT INTERNATIONAL TECHNOLOGIES (HONG KONG) HOLDING LIMITED |

| |

|

|

| |

|

By: |

/s/ Richard Lin |

| |

|

Name: |

Richard Lin |

| |

|

Title: |

Director |

[SIGNATURE PAGE TO TENDER

AND SUPPORT AGREEMENT]

1

Annex I

Form of Joinder

The

undersigned is executing and delivering this joinder agreement (this “Joinder”) pursuant to that certain Tender and

Support Agreement, dated as of February 16, 2025 (as amended, restated, supplemented or otherwise modified from time to time

in accordance with its terms, the “Support Agreement”) by and between Shift4 Payments, Inc., a Delaware corporation

(“Parent”), and [●] (the “Shareholder”), a shareholder of Global Blue Group Holding AG, a

stock corporation incorporated under the laws of Switzerland, with its registered office in Zurichstrasse 38, 8306, Bruttisellen, Switzerland

(the “Company”). Capitalized terms used but not defined in this Joinder shall have the respective meanings ascribed

to such terms in the Support Agreement.

By

executing and delivering this Joinder to the Support Agreement, the undersigned hereby adopts and approves the Support Agreement

and agrees, effective commencing on the date hereof and as a condition to the undersigned becoming a Beneficial Owner of Shares, to become

a Party to, and to be bound by and comply with the provisions of, the Support Agreement applicable to the Shareholder in the same manner

as if the undersigned were an original signatory to the Support Agreement.

The

undersigned hereby represents and warrants that it is a controlled Affiliate of [●]1.

Section 9

of the Support Agreement is hereby incorporated herein by reference, mutatis mutandis.

[Remainder of Page Intentionally Left

Blank]

1

The Shareholder transferring Shares.

1

Accordingly, the undersigned

has executed and delivered this Joinder as of the day of , .

| |

|

[TRANSFEREE] |

| |

|

|

|

|

| |

|

By: |

|

| |

|

|

Name: |

|

| |

|

|

Title: |

|

| |

|

Notice Information |

| |

|

Address: |

|

| |

|

Email: |

|

2

Schedule A

Shares

| Name

and Address of Shareholder |

Number

of Company Common Shares |

Ant International Technologies (Hong Kong)

Holding Limited

Level 27, Tower One, Times Square

1 Matheson Street

Causeway Bay

Hong Kong |

12,500,000 |

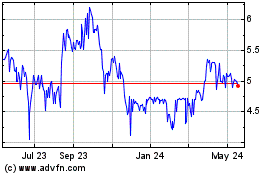

Global Blue (NYSE:GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

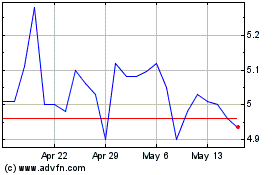

Global Blue (NYSE:GB)

Historical Stock Chart

From Feb 2024 to Feb 2025