Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

October 05 2023 - 11:26AM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated October 5, 2023

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive

offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 5, 2023

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President |

| |

|

Investor Relations Director |

Exhibit 99.1

GERDAU

S.A.

Corporate Tax ID (CNPJ/MF): 33.611.500/0001-19

Company Registry (NIRE): 35300520696 |

METALÚRGICA

GERDAU S.A.

Corporate Tax ID (CNPJ/MF): 92.690.783/0001-09

Company Registry (NIRE): 35300520751 |

MATERIAL FACT

Gerdau S.A.

(B3: GGBR / NYSE: GGB) and Metalúrgica Gerdau S.A. (B3: GOAU) (jointly, “Companies”), in

accordance with the CVM Resolution n.º 44, from August 23, 2021, hereby inform their shareholders and the market in general

that, on this date, Section 3 of the Reference Form has been updated to report information regarding future management perspectives

on CAPEX Strategic Investments and its consequent Potential Growth in Annual EBITDA (as per definitions below) and foreseen on “Gerdau

Stakeholder Day 2023” Presentation, disclosed to the market on September 28th, 2023.

The Companies’ management expects that

the Investments in Strategic CAPEX amounts to R$ 11.9 billion, considering the period of 2021 to 2026 (“Investments in Strategic

CAPEX”). Of this amount, 27.7% (or R$ 3.3 billion) has already been invested, while the remaining 73.3% (or R$8.6 billion)

are projected for the coming years (period of 2024 to 2026).

The Companies’ management expects that

the Investments in Strategic CAPEX have the potential to, throughout the years of 2021 to 2031, generate a potential annual EBITDA growth

of R$ 4.0 billion, at the end of the period (“Potential Annual EBITDA Growth”). It is worth mentioning that around

15% of this amount (or R$ 600 million) has already been captured in the EBITDA, while the remaining 85% (R$ 3.4 billion) is expected

to be added to the Companies’ profitability in its future earnings.

The updated Reference Form on this date

is available on the CVM and B3 websites, as well as on our IR portal (https://ri.gerdau.com/).

Lastly, the Companies clarify that the information

presented above was based on forecasts, which are subject to market risks and uncertainties, having been estimated upon beliefs and assumptions

of the Companies’ management, according to available data. In that regard, the Companies emphasize that such information does not

constitute an assurance of performance, since the Companies’ actual performance for such measures may be materially different from

the results expressly or implicitly contemplated by this data.

São Paulo, October 4, 2023

Rafael Dorneles Japur

Executive Vice President

Investor Relations Director

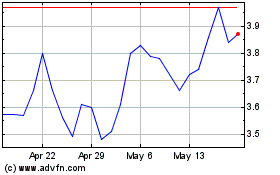

Gerdau (NYSE:GGB)

Historical Stock Chart

From Nov 2024 to Dec 2024

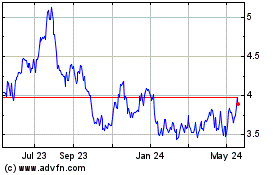

Gerdau (NYSE:GGB)

Historical Stock Chart

From Dec 2023 to Dec 2024