Form 6-K/A - Report of foreign issuer [Rules 13a-16 and 15d-16]: [Amend]

September 23 2024 - 4:05PM

Edgar (US Regulatory)

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K/A

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

Dated September 23, 2024

Commission File Number 1-14878

GERDAU S.A.

(Translation of Registrant’s Name into English)

Av. Dra. Ruth Cardoso, 8,501 – 8° andar

São Paulo, São Paulo - Brazil CEP

05425-070

(Address of principal executive

offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

EXPLANATORY NOTE

Gerdau is amending its

report on Form 6-K furnished to the Securities and Exchange Commission on September 18, 2024 (the “Original 6-K”)

solely for the purpose of replacing Exhibit 99.1 therein with the attached corrected Exhibit 99.1. Except as described above,

this amendment does not amend any information set forth in the Original 6-K.

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: September 23, 2024 |

|

| |

GERDAU S.A. |

| |

|

| |

By: |

/s/ Rafael Dorneles Japur |

| |

Name: |

Rafael Dorneles Japur |

| |

Title: |

Executive Vice President |

| |

|

Investor Relations Director |

Exhibit 99.1

GERDAU S.A.

Corporate Tax ID (CNPJ/MF): 33.611.500/0001-19

Registry (NIRE): 35300520696

NOTICE TO THE MARKET

Gerdau S.A. (B3:

GGBR / NYSE: GGB) announces to its shareholders and the general market that, on September 17, 2024, Gerdau Ameristeel US Inc., subsidiary

of Gerdau in North America, signed an agreement to acquire the assets of Dales Recycling Partnership, a company engaged in the operation,

processing, and recycling of ferrous and non- ferrous scrap. The acquisition price of approximately US$ 60 million to be paid in cash,

using available own resources, at the closing of the transaction, subject to customary price adjustments. The closing of the transaction

is expected to occur by the end of 2024, following the satisfaction of customary conditions precedent for operations of this nature.

The assets include

land, inventory, and fixed assets associated with Dales Recycling's operations in Tennessee, Kentucky, and Missouri, in the United

States. Dales Recycling has an annual capacity to process approximately 160,000 tons of ferrous and non-ferrous scrap and reported

an average annual EBITDA of approximately US$ 10 million over the past three years.

The acquisition aims to increase Gerdau's

captive ferrous scrap supply through proprietary channels, supplying raw material to its operations at a competitive cost. Gerdau

also clarifies that this acquisition is aligned with its strategy of growth and competitiveness of operations through assets with

greater potential for long-term value generation and expansion of its presence in more profitable markets for its business.

São Paulo, September 20, 2024.

Rafael Dorneles

Japur

Executive Vice-President and

Investor Relations Officer

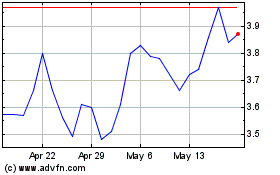

Gerdau (NYSE:GGB)

Historical Stock Chart

From Oct 2024 to Nov 2024

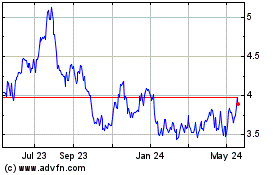

Gerdau (NYSE:GGB)

Historical Stock Chart

From Nov 2023 to Nov 2024