false000010488900001048892024-10-302024-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 30, 2024

GRAHAM HOLDINGS COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Delaware | 001-06714 | 53-0182885 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | |

1300 North 17th Street, Arlington, Virginia | | 22209 |

| (Address of principal executive offices) | | (Zip Code) |

(703) 345-6300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Class B Common Stock, par value $1.00 per share | GHC | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 30, 2024, Graham Holdings Company issued a press release announcing the Company’s earnings for the third quarter ended September 30, 2024. A copy of this press release is furnished with this report as an exhibit to this Form 8-K.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Graham Holdings Company Earnings Release Dated October 30, 2024.

Exhibit Index

Exhibit 104 Cover Page Interactive Data File, formatted in Inline XBRL and included as Exhibit 101.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | | Graham Holdings Company |

| | | (Registrant) |

| | | |

| | | |

| Date: October 30, 2024 | | /s/ Wallace R. Cooney |

| | | Wallace R. Cooney,

Chief Financial Officer

(Principal Financial Officer) |

Exhibit 99.1

| | | | | | | | | | | | | | |

| Contact: | | Wallace R. Cooney | | For Immediate Release |

| | (703) 345-6470 | | October 30, 2024 |

| | | | |

| GRAHAM HOLDINGS COMPANY REPORTS |

| THIRD QUARTER EARNINGS |

ARLINGTON, VA - Graham Holdings Company (NYSE: GHC) today reported its financial results for the third quarter and first nine months of 2024. The Company also filed its Form 10-Q today for the quarter ended September 30, 2024 with the Securities and Exchange Commission.

Division Operating Results

Revenue for the third quarter of 2024 was $1,207.2 million, up 9% from $1,111.5 million in the third quarter of 2023. Revenues increased at education, television broadcasting, healthcare and automotive, partially offset by declines at manufacturing and other businesses. The Company reported operating income of $81.6 million for the third quarter of 2024, compared to an operating loss of $57.1 million for the third quarter of 2023. The improvement in operating results is due to goodwill and other long-lived asset impairment charges at World of Good Brands (WGB) and Dekko in the third quarter of 2023 and increases at education, television broadcasting, healthcare and automotive, partially offset by declines at manufacturing and other businesses, excluding the impairments. The Company reported adjusted operating cash flow (non-GAAP) of $126.1 million for the third quarter of 2024, compared to $83.7 million for the third quarter of 2023. Adjusted operating cash flow improved at education, television broadcasting, healthcare and automotive, partially offset by declines at manufacturing and other businesses. Capital expenditures totaled $23.8 million and $26.7 million for the third quarter of 2024 and 2023, respectively.

Revenue for the first nine months of 2024 was $3,545.1 million, up 9% from $3,248.1 million in the first nine months of 2023. Revenues increased at education, television broadcasting, healthcare and automotive, partially offset by declines at manufacturing and other businesses. The Company recorded operated income of $143.0 million for the first nine months of 2024, compared to $28.6 million for the first nine months of 2023. Excluding goodwill and other long-lived asset impairment charges, the improvement in operating results is due to increases at education, television broadcasting, healthcare and automotive, partially offset by declines at manufacturing and other businesses. The Company reported adjusted operating cash flow (non-GAAP) of $307.4 million for the first nine months of 2024, compared to $255.3 million for the first nine months of 2023. Adjusted operating cash flow improved at education, television broadcasting, healthcare, automotive and other businesses, partially offset by declines at manufacturing. Capital expenditures totaled $66.0 million and $71.6 million for the first nine months of 2024 and 2023, respectively.

Acquisitions and Dispositions of Businesses

There were no significant business acquisitions or dispositions during the first nine months of 2024.

Debt, Cash and Marketable Equity Securities

At September 30, 2024, the Company had $765.2 million in borrowings outstanding at an average interest rate of 6.2%, including $66.9 million outstanding on its $300 million revolving credit facility. Cash, marketable equity securities and other investments totaled $1,114.0 million at September 30, 2024.

Overall, the Company recognized $30.5 million and $154.3 million in net gains on marketable equity securities in the third quarter and first nine months of 2024, respectively, compared to $16.8 million and $113.4 million in net gains on marketable equity securities in the third quarter and first nine months of 2023, respectively.

Common Stock Repurchases

During the third quarter and first nine months of 2024, the Company purchased a total of 64,490 and 133,276 shares, respectively, of its Class B common stock at a cost of $48.7 million and $98.2 million, respectively. At September 30, 2024, there were 4,347,533 shares outstanding. On September 12, 2024, the Board of Directors authorized the Company to acquire up to 500,000 shares of its Class B common stock; the Company has remaining authorization for 486,132 shares as of September 30, 2024.

Overall Company Results

The Company reported net income attributable to common shares of $72.5 million ($16.42 per share) for the third quarter of 2024, compared to a net loss of $23.0 million ($5.02 per share) for the third quarter of 2023. For the first

nine months of 2024, the Company recorded net income attributable to common shares of $175.8 million ($39.49 per share), compared to $152.0 million ($32.14 per share) for the first nine months of 2023.

The results for the third quarter and first nine months of 2024 and 2023 were affected by a number of items as described in the Non-GAAP Financial Information schedule attached to this release. Excluding these items, net income attributable to common shares was $76.1 million ($17.25 per share) for the third quarter of 2024, compared to $48.9 million ($10.45 per share) for the third quarter of 2023. Excluding these items, net income attributable to common shares was $183.5 million ($41.20 per share) for the first nine months of 2024, compared to $150.8 million ($31.87 per share) for the first nine months of 2023.

Subsequent Event

In October 2024, the Company purchased an irrevocable group annuity contract from an insurance company for $461.3 million to settle $457.9 million of the outstanding defined benefit pension obligation related to certain retirees and beneficiaries. The purchase of the group annuity contract was funded from the assets of the Company’s pension plan. As a result of this transaction, the Company was relieved of all responsibility for these pension obligations and the insurance company is now required to pay and administer the retirement benefits owed to approximately 1,850 retirees and beneficiaries, with no change to the amount, timing or form of monthly retirement benefit payments. As a result, the Company estimates that it will record a one-time pre-tax settlement gain of approximately $700 million in the fourth quarter of 2024.

* * * * * * * * * * * *

Forward-Looking Statements

All public statements made by the Company and its representatives that are not statements of historical fact, including certain statements in this press release, in the Company’s Annual Report on Form 10-K and in the Company’s 2023 Annual Report to Stockholders, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by the Company’s management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ from those stated, including, without limitation, comments about expectations related to acquisitions or dispositions or related business activities, the Company’s business strategies and objectives, the prospects for growth in the Company’s various business operations, the Company’s future financial performance, and the risks and uncertainties described in Item 1A of the Company’s Annual Report on Form 10-K. Accordingly, undue reliance should not be placed on any forward-looking statement made by or on behalf of the Company. The Company assumes no obligation to update any forward-looking statement after the date on which such statement is made, even if new information subsequently becomes available.

| | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| | |

| | Three Months Ended | |

| | September 30 | % |

| (in thousands, except per share amounts) | 2024 | | 2023 | Change |

| Operating revenues | $ | 1,207,162 | | | $ | 1,111,519 | | 9 | |

| Operating expenses | 1,095,797 | | | 1,036,344 | | 6 | |

| Depreciation of property, plant and equipment | 21,332 | | | 22,207 | | (4) | |

| Amortization of intangible assets | 8,385 | | | 11,759 | | (29) | |

Impairment of goodwill and other long-lived assets | — | | | 98,321 | | — | |

Operating income (loss) | 81,648 | | | (57,112) | | — | |

Equity in losses of affiliates, net | (13,361) | | | (791) | | — | |

| Interest income | 2,277 | | | 1,986 | | 15 | |

| Interest expense | (25,896) | | | (11,810) | | — | |

| Non-operating pension and postretirement benefit income, net | 38,307 | | | 35,653 | | 7 | |

| Gain on marketable equity securities, net | 30,496 | | | 16,759 | | 82 | |

| Other (expenses) income, net | (465) | | | 3,581 | | — | |

Income (loss) before income taxes | 113,006 | | | (11,734) | | — | |

Provision for income taxes | 38,500 | | | 9,400 | | — | |

Net income (loss) | 74,506 | | | (21,134) | | — | |

Net income attributable to noncontrolling interests | (2,003) | | | (1,897) | | 6 | |

Net Income (Loss) Attributable to Graham Holdings Company Common Stockholders | $ | 72,503 | | | $ | (23,031) | | — | |

Per Share Information Attributable to Graham Holdings Company Common Stockholders | | | | |

| Basic net income (loss) per common share | $ | 16.54 | | | $ | (5.02) | | — | |

| Basic average number of common shares outstanding | 4,352 | | | 4,602 | | |

| Diluted net income (loss) per common share | $ | 16.42 | | | $ | (5.02) | | — | |

| Diluted average number of common shares outstanding | 4,384 | | | 4,602 | | |

| | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | |

| (Unaudited) | |

| | |

| | Nine Months Ended | |

| | September 30 | % |

| (in thousands, except per share amounts) | 2024 | | 2023 | Change |

| Operating revenues | $ | 3,545,104 | | | $ | 3,248,064 | | 9 | |

| Operating expenses | 3,280,590 | | | 3,018,057 | | 9 | |

| Depreciation of property, plant and equipment | 66,032 | | | 63,335 | | 4 | |

| Amortization of intangible assets | 29,194 | | | 39,007 | | (25) | |

| Impairment of goodwill and other long-lived assets | 26,287 | | | 99,066 | | (73) | |

| Operating income | 143,001 | | | 28,599 | | — | |

Equity in losses of affiliates, net | (8,470) | | | (2,245) | | — | |

| Interest income | 6,566 | | | 4,738 | | 39 | |

| Interest expense | (136,607) | | | (37,878) | | — | |

| Non-operating pension and postretirement benefit income, net | 105,379 | | | 97,313 | | 8 | |

| Gain on marketable equity securities, net | 154,276 | | | 113,429 | | 36 | |

| Other income, net | 2,973 | | | 22,458 | | (87) | |

| Income before income taxes | 267,118 | | | 226,414 | | 18 | |

| Provision for income taxes | 86,100 | | | 70,400 | | 22 | |

| Net income | 181,018 | | | 156,014 | | 16 | |

Net income attributable to noncontrolling interests | (5,175) | | | (3,985) | | 30 | |

Net Income Attributable to Graham Holdings Company Common Stockholders | $ | 175,843 | | | $ | 152,029 | | 16 | |

Per Share Information Attributable to Graham Holdings Company Common Stockholders | | | | |

| Basic net income per common share | $ | 39.74 | | | $ | 32.23 | | 23 | |

| Basic average number of common shares outstanding | 4,395 | | | 4,686 | | |

| Diluted net income per common share | $ | 39.49 | | | $ | 32.14 | | 23 | |

| Diluted average number of common shares outstanding | 4,423 | | | 4,700 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY |

| BUSINESS DIVISION INFORMATION |

| (Unaudited) |

| | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | % | | September 30 | | % |

| (in thousands) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Operating Revenues | | | | | | | | | | | |

| Education | | $ | 438,090 | | | $ | 411,837 | | | 6 | | | $ | 1,283,587 | | | $ | 1,192,105 | | | 8 | |

| Television broadcasting | | 145,422 | | | 116,112 | | | 25 | | | 373,958 | | | 347,818 | | | 8 | |

| Manufacturing | | 95,385 | | | 109,216 | | | (13) | | | 300,914 | | | 343,882 | | | (12) | |

| Healthcare | | 155,413 | | | 116,164 | | | 34 | | | 431,142 | | | 331,505 | | | 30 | |

| Automotive | | 289,392 | | | 272,018 | | | 6 | | | 902,046 | | | 765,251 | | | 18 | |

| Other businesses | | 83,464 | | | 86,653 | | | (4) | | | 253,753 | | | 269,110 | | | (6) | |

| Corporate office | | 576 | | | 365 | | | 58 | | | 1,727 | | | 1,215 | | | 42 | |

| Intersegment elimination | | (580) | | | (846) | | | — | | | (2,023) | | | (2,822) | | | — | |

| | $ | 1,207,162 | | | $ | 1,111,519 | | | 9 | | | $ | 3,545,104 | | | $ | 3,248,064 | | | 9 | |

| Operating Expenses | | | | | | | | | | | |

| Education | | $ | 403,200 | | | $ | 381,978 | | | 6 | | | $ | 1,182,833 | | | $ | 1,109,090 | | | 7 | |

| Television broadcasting | | 83,508 | | | 84,165 | | | (1) | | | 251,283 | | | 254,098 | | | (1) | |

| Manufacturing | | 90,890 | | | 150,190 | | | (39) | | | 289,085 | | | 365,546 | | | (21) | |

| Healthcare | | 141,153 | | | 110,193 | | | 28 | | | 398,054 | | | 314,221 | | | 27 | |

| Automotive | | 280,328 | | | 263,781 | | | 6 | | | 873,127 | | | 736,711 | | | 19 | |

| Other businesses | | 112,358 | | | 164,206 | | | (32) | | | 364,563 | | | 401,525 | | | (9) | |

| Corporate office | | 14,657 | | | 14,964 | | | (2) | | | 45,181 | | | 41,096 | | | 10 | |

| Intersegment elimination | | (580) | | | (846) | | | — | | | (2,023) | | | (2,822) | | | — | |

| | $ | 1,125,514 | | | $ | 1,168,631 | | | (4) | | | $ | 3,402,103 | | | $ | 3,219,465 | | | 6 | |

| Operating Income (Loss) | | | | | | | | | | | |

| Education | | $ | 34,890 | | | $ | 29,859 | | | 17 | | | $ | 100,754 | | | $ | 83,015 | | | 21 | |

| Television broadcasting | | 61,914 | | | 31,947 | | | 94 | | | 122,675 | | | 93,720 | | | 31 | |

| Manufacturing | | 4,495 | | | (40,974) | | | — | | | 11,829 | | | (21,664) | | | — | |

| Healthcare | | 14,260 | | | 5,971 | | | — | | | 33,088 | | | 17,284 | | | 91 | |

| Automotive | | 9,064 | | | 8,237 | | | 10 | | | 28,919 | | | 28,540 | | | 1 | |

| Other businesses | | (28,894) | | | (77,553) | | | 63 | | | (110,810) | | | (132,415) | | | 16 | |

| Corporate office | | (14,081) | | | (14,599) | | | 4 | | | (43,454) | | | (39,881) | | | (9) | |

| | $ | 81,648 | | | $ | (57,112) | | | — | | | $ | 143,001 | | | $ | 28,599 | | | — | |

| Amortization of Intangible Assets and Impairment of Goodwill and Other Long-Lived Assets | | | | | | | | | | | | |

| Education | | $ | 2,421 | | | $ | 3,210 | | | (25) | | | $ | 8,267 | | | $ | 11,610 | | | (29) | |

| Television broadcasting | | 1,360 | | | 1,363 | | | 0 | | | 4,070 | | | 4,088 | | | 0 | |

| Manufacturing | | 2,619 | | | 51,489 | | | (95) | | | 8,387 | | | 60,683 | | | (86) | |

| Healthcare | | 159 | | | 866 | | | (82) | | | 1,393 | | | 2,702 | | | (48) | |

| Automotive | | 5 | | | 3 | | | 67 | | | 10 | | | 3 | | | — | |

| Other businesses | | 1,821 | | | 53,149 | | | (97) | | | 33,354 | | | 58,987 | | | (43) | |

| Corporate office | | — | | | — | | | — | | | — | | | — | | | — | |

| | $ | 8,385 | | | $ | 110,080 | | | (92) | | | $ | 55,481 | | | $ | 138,073 | | | (60) | |

| Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Goodwill and Other Long-Lived Assets | | | | | | | | | | | |

| Education | | $ | 37,311 | | | $ | 33,069 | | | 13 | | | $ | 109,021 | | | $ | 94,625 | | | 15 | |

| Television broadcasting | | 63,274 | | | 33,310 | | | 90 | | | 126,745 | | | 97,808 | | | 30 | |

| Manufacturing | | 7,114 | | | 10,515 | | | (32) | | | 20,216 | | | 39,019 | | | (48) | |

| Healthcare | | 14,419 | | | 6,837 | | | — | | | 34,481 | | | 19,986 | | | 73 | |

| Automotive | | 9,069 | | | 8,240 | | | 10 | | | 28,929 | | | 28,543 | | | 1 | |

| Other businesses | | (27,073) | | | (24,404) | | | (11) | | | (77,456) | | | (73,428) | | | (5) | |

| Corporate office | | (14,081) | | | (14,599) | | | 4 | | | (43,454) | | | (39,881) | | | (9) | |

| | $ | 90,033 | | | $ | 52,968 | | | 70 | | | $ | 198,482 | | | $ | 166,672 | | | 19 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | % | | September 30 | | % |

| (in thousands) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Depreciation | | | | | | | | | | | |

| Education | | $ | 8,576 | | | $ | 10,000 | | | (14) | | | $ | 26,736 | | | $ | 28,428 | | | (6) | |

| Television broadcasting | | 2,756 | | | 3,120 | | | (12) | | | 8,494 | | | 9,243 | | | (8) | |

| Manufacturing | | 2,818 | | | 2,388 | | | 18 | | | 8,227 | | | 6,957 | | | 18 | |

| Healthcare | | 1,754 | | | 1,411 | | | 24 | | | 5,031 | | | 3,802 | | | 32 | |

| Automotive | | 1,774 | | | 1,304 | | | 36 | | | 5,203 | | | 3,565 | | | 46 | |

| Other businesses | | 3,522 | | | 3,832 | | | (8) | | | 11,909 | | | 10,882 | | | 9 | |

| Corporate office | | 132 | | | 152 | | | (13) | | | 432 | | | 458 | | | (6) | |

| | $ | 21,332 | | | $ | 22,207 | | | (4) | | | $ | 66,032 | | | $ | 63,335 | | | 4 | |

| Pension Expense | | | | | | | | | | | |

| Education | | $ | 4,445 | | | $ | 2,226 | | | 100 | | | $ | 13,267 | | | $ | 6,680 | | | 99 | |

| Television broadcasting | | 1,528 | | | 833 | | | 83 | | | 4,583 | | | 2,498 | | | 83 | |

| Manufacturing | | 978 | | | 280 | | | — | | | 1,897 | | | 836 | | | — | |

| Healthcare | | 4,804 | | | 3,521 | | | 36 | | | 14,413 | | | 10,563 | | | 36 | |

| Automotive | | 29 | | | 16 | | | 81 | | | 86 | | | 26 | | | — | |

| Other businesses | | 1,963 | | | 662 | | | — | | | 5,577 | | | 1,847 | | | — | |

| Corporate office | | 1,014 | | | 952 | | | 7 | | | 3,043 | | | 2,856 | | | 7 | |

| | $ | 14,761 | | | $ | 8,490 | | | 74 | | | $ | 42,866 | | | $ | 25,306 | | | 69 | |

Adjusted Operating Cash Flow (non-GAAP)(1) | | | | | | | | | | | |

| Education | | $ | 50,332 | | | $ | 45,295 | | | 11 | | | $ | 149,024 | | | $ | 129,733 | | | 15 | |

| Television broadcasting | | 67,558 | | | 37,263 | | | 81 | | | 139,822 | | | 109,549 | | | 28 | |

| Manufacturing | | 10,910 | | | 13,183 | | | (17) | | | 30,340 | | | 46,812 | | | (35) | |

| Healthcare | | 20,977 | | | 11,769 | | | 78 | | | 53,925 | | | 34,351 | | | 57 | |

| Automotive | | 10,872 | | | 9,560 | | | 14 | | | 34,218 | | | 32,134 | | | 6 | |

| Other businesses | | (21,588) | | | (19,910) | | | (8) | | | (59,970) | | | (60,699) | | | 1 | |

| Corporate office | | (12,935) | | | (13,495) | | | 4 | | | (39,979) | | | (36,567) | | | (9) | |

| | $ | 126,126 | | | $ | 83,665 | | | 51 | | | $ | 307,380 | | | $ | 255,313 | | | 20 | |

____________ | | | | | |

(1) | Adjusted Operating Cash Flow (non-GAAP) is calculated as Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Goodwill and Other Long-Lived Assets plus Depreciation Expense and Pension Expense. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GRAHAM HOLDINGS COMPANY |

| EDUCATION DIVISION INFORMATION |

| (Unaudited) |

| | | | | | | | |

| | | Three Months Ended | | | | Nine Months Ended | | |

| | | September 30 | | % | | September 30 | | % |

| (in thousands) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Operating Revenues | | | | | | | | | | | | |

| Kaplan international | | $ | 277,009 | | | $ | 249,976 | | | 11 | | | $ | 813,833 | | | $ | 714,715 | | | 14 | |

| Higher education | | 85,655 | | | 81,925 | | | 5 | | | 246,818 | | | 250,557 | | | (1) | |

| Supplemental education | | 76,134 | | | 78,332 | | | (3) | | | 221,389 | | | 226,535 | | | (2) | |

| Kaplan corporate and other | | 158 | | | 3,101 | | | (95) | | | 5,739 | | | 8,360 | | | (31) | |

| Intersegment elimination | | (866) | | | (1,497) | | | — | | | (4,192) | | | (8,062) | | | — | |

| | $ | 438,090 | | | $ | 411,837 | | | 6 | | | $ | 1,283,587 | | | $ | 1,192,105 | | | 8 | |

| Operating Expenses | | | | | | | | | | | | |

| Kaplan international | | $ | 251,471 | | | $ | 227,756 | | | 10 | | | $ | 731,159 | | | $ | 650,443 | | | 12 | |

| Higher education | | 74,270 | | | 73,460 | | | 1 | | | 215,560 | | | 217,214 | | | (1) | |

| Supplemental education | | 64,948 | | | 68,603 | | | (5) | | | 199,951 | | | 209,543 | | | (5) | |

| Kaplan corporate and other | | 10,875 | | | 10,513 | | | 3 | | | 32,096 | | | 28,434 | | | 13 | |

| Amortization of intangible assets | | 2,421 | | | 3,210 | | | (25) | | | 8,267 | | | 11,133 | | | (26) | |

Impairment of long-lived assets | | — | | | — | | | — | | | — | | | 477 | | | — | |

| Intersegment elimination | | (785) | | | (1,564) | | | — | | | (4,200) | | | (8,154) | | | — | |

| | $ | 403,200 | | | $ | 381,978 | | | 6 | | | $ | 1,182,833 | | | $ | 1,109,090 | | | 7 | |

| Operating Income (Loss) | | | | | | | | | | | | |

| Kaplan international | | $ | 25,538 | | | $ | 22,220 | | | 15 | | | $ | 82,674 | | | $ | 64,272 | | | 29 | |

| Higher education | | 11,385 | | | 8,465 | | | 34 | | | 31,258 | | | 33,343 | | | (6) | |

| Supplemental education | | 11,186 | | | 9,729 | | | 15 | | | 21,438 | | | 16,992 | | | 26 | |

| Kaplan corporate and other | | (10,717) | | | (7,412) | | | (45) | | | (26,357) | | | (20,074) | | | (31) | |

| Amortization of intangible assets | | (2,421) | | | (3,210) | | | 25 | | | (8,267) | | | (11,133) | | | 26 | |

Impairment of long-lived assets | | — | | | — | | | — | | | — | | | (477) | | | — | |

| Intersegment elimination | | (81) | | | 67 | | | — | | | 8 | | | 92 | | | — | |

| | $ | 34,890 | | | $ | 29,859 | | | 17 | | | $ | 100,754 | | | $ | 83,015 | | | 21 | |

| Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Long-Lived Assets | | | | | | | | | | | |

| Kaplan international | | $ | 25,538 | | | $ | 22,220 | | | 15 | | | $ | 82,674 | | | $ | 64,272 | | | 29 | |

| Higher education | | 11,385 | | | 8,465 | | | 34 | | | 31,258 | | | 33,343 | | | (6) | |

| Supplemental education | | 11,186 | | | 9,729 | | | 15 | | | 21,438 | | | 16,992 | | | 26 | |

| Kaplan corporate and other | | (10,717) | | | (7,412) | | | (45) | | | (26,357) | | | (20,074) | | | (31) | |

| Intersegment elimination | | (81) | | | 67 | | | — | | | 8 | | | 92 | | | — | |

| | $ | 37,311 | | | $ | 33,069 | | | 13 | | | $ | 109,021 | | | $ | 94,625 | | | 15 | |

| Depreciation | | | | | | | | | | | | |

| Kaplan international | | $ | 7,202 | | | $ | 7,599 | | | (5) | | | $ | 21,735 | | | $ | 20,832 | | | 4 | |

| Higher education | | 589 | | | 1,258 | | | (53) | | | 2,291 | | | 3,431 | | | (33) | |

| Supplemental education | | 777 | | | 1,117 | | | (30) | | | 2,653 | | | 4,087 | | | (35) | |

| Kaplan corporate and other | | 8 | | | 26 | | | (69) | | | 57 | | | 78 | | | (27) | |

| | $ | 8,576 | | | $ | 10,000 | | | (14) | | | $ | 26,736 | | | $ | 28,428 | | | (6) | |

| Pension Expense | | | | | | | | | | | | |

| Kaplan international | | $ | 198 | | | $ | 83 | | | — | | | $ | 527 | | | $ | 244 | | | — | |

| Higher education | | 1,903 | | | 958 | | | 99 | | | 5,729 | | | 2,803 | | | — | |

| Supplemental education | | 1,962 | | | 1,063 | | | 85 | | | 5,874 | | | 3,110 | | | 89 | |

| Kaplan corporate and other | | 382 | | | 122 | | | — | | | 1,137 | | | 523 | | | — | |

| | $ | 4,445 | | | $ | 2,226 | | | 100 | | | $ | 13,267 | | | $ | 6,680 | | | 99 | |

Adjusted Operating Cash Flow (non-GAAP)(1) | | | | | | | | | | | |

| Kaplan international | | $ | 32,938 | | | $ | 29,902 | | | 10 | | | $ | 104,936 | | | $ | 85,348 | | | 23 | |

| Higher education | | 13,877 | | | 10,681 | | | 30 | | | 39,278 | | | 39,577 | | | (1) | |

| Supplemental education | | 13,925 | | | 11,909 | | | 17 | | | 29,965 | | | 24,189 | | | 24 | |

| Kaplan corporate and other | | (10,327) | | | (7,264) | | | (42) | | | (25,163) | | | (19,473) | | | (29) | |

| Intersegment elimination | | (81) | | | 67 | | | — | | | 8 | | | 92 | | | — | |

| | $ | 50,332 | | | $ | 45,295 | | | 11 | | | $ | 149,024 | | | $ | 129,733 | | | 15 | |

____________ | | | | | |

(1) | Adjusted Operating Cash Flow (non-GAAP) is calculated as Operating Income (Loss) before Amortization of Intangible Assets and Impairment of Long-Lived Assets plus Depreciation Expense and Pension Expense. |

NON-GAAP FINANCIAL INFORMATION

GRAHAM HOLDINGS COMPANY

(Unaudited)

In addition to the results reported in accordance with accounting principles generally accepted in the United States (GAAP) included in this press release, the Company has provided information regarding Adjusted Operating Cash Flow and Net income excluding certain items described below, reconciled to the most directly comparable GAAP measures. Management believes that these non-GAAP measures, when read in conjunction with the Company’s GAAP financials, provide useful information to investors by offering:

•the ability to make meaningful period-to-period comparisons of the Company’s ongoing results;

•the ability to identify trends in the Company’s underlying business; and

•a better understanding of how management plans and measures the Company’s underlying business.

Adjusted Operating Cash Flow and Net income, excluding certain items, should not be considered substitutes or alternatives to computations calculated in accordance with and required by GAAP. These non-GAAP financial measures should be read only in conjunction with financial information presented on a GAAP basis.

The gains and losses on marketable equity securities relate to the change in the fair value (quoted prices) of its portfolio of equity securities. The mandatorily redeemable noncontrolling interest represents the ownership portion of a group of minority shareholders at a subsidiary of the Company's Healthcare business. The Company measures the redemption value of this minority ownership on a quarterly basis with changes in the fair value recorded as interest expense or income, which is included in net income for the period. The effect of gains and losses on marketable equity securities and net interest expense related to fair value adjustments of the mandatorily redeemable noncontrolling interest are not directly related to the core performance of the Company’s business operations since these items do not directly relate to the sale of the Company’s services or products. The accounting principles generally accepted in the United States (“GAAP”) require that the Company include the gains and losses on marketable equity securities and net interest expense related to fair value adjustments of the mandatorily redeemable noncontrolling interest in net income on the Condensed Consolidated Statements of Operations. The Company excludes the gains and losses on marketable equity securities and net interest expense related to fair value adjustments of the mandatorily redeemable noncontrolling interest from the non-GAAP adjusted net income because these items are independent of the Company’s core operations and not indicative of the performance of the Company’s business operations.

The following tables reconcile the non-GAAP financial measures for Net income, excluding certain items, to the most directly comparable GAAP measures:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30 | | | | | |

| 2024 | | 2023 | | | | | |

| (in thousands, except per share amounts) | Income before income taxes | | Income Taxes | | Net (Loss) Income | | (Loss) Income before income taxes | | Income Taxes | | Net Income | | | | | |

| Amounts attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | | | | | | |

| As reported | $ | 113,006 | | | $ | 38,500 | | | $ | 74,506 | | | $ | (11,734) | | | $ | 9,400 | | | $ | (21,134) | | | | | | |

| Attributable to noncontrolling interests | | | | | (2,003) | | | | | | | (1,897) | | | | | | |

| Attributable to Graham Holdings Company Stockholders | | | | | 72,503 | | | | | | | (23,031) | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Goodwill and other long-lived asset impairment charges | — | | | (626) | | | 626 | | | 98,321 | | | 13,876 | | | 84,445 | | | | | | |

| Charges related to non-operating Separation Incentive Programs | 3,665 | | | 938 | | | 2,727 | | | — | | | — | | | — | | | | | | |

| Interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | 9,730 | | | (3,501) | | | 13,231 | | | 1,132 | | | 105 | | | 1,027 | | | | | | |

| Net gains on marketable equity securities | (30,496) | | | (7,808) | | | (22,688) | | | (16,758) | | | (4,411) | | | (12,347) | | | | | | |

Net losses of affiliates whose operations are not managed by the Company | 2,307 | | | 590 | | | 1,717 | | | 2,836 | | | 746 | | | 2,090 | | | | | | |

| Gain on sale of certain businesses and websites | (3,763) | | | (1,197) | | | (2,566) | | | — | | | — | | | — | | | | | | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | — | | | — | | | — | | | (4,581) | | | (1,252) | | | (3,329) | | | | | | |

Net non-operating loss from impairment and write-up equity and cost method investments | 14,236 | | | 3,642 | | | 10,594 | | | — | | | — | | | — | | | | | | |

| | | | | | | | | | | | | | | | |

Net Income, adjusted (non-GAAP) | | | | | $ | 76,144 | | | |

| | | $ | 48,855 | | | | | | |

| | | | | | | | | | | | | | | | |

| Per share information attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | | | | | | |

Diluted (loss) income per common share, as reported | | | | | $ | 16.42 | | | | | | | $ | (5.02) | | | | | | |

| Adjustments: | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Goodwill and other long-lived asset impairment charges | | | | | 0.14 | | | | | | | 18.18 | | | | | | |

| Charges related to non-operating Separation Incentive Programs | | | | | 0.62 | | | | | | | — | | | | | | |

| Interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | | | | | 3.00 | | | | | | | 0.22 | | | | | | |

| Net gains on marketable equity securities | | | | | (5.14) | | | | | | | (2.66) | | | | | | |

Net losses of affiliates whose operations are not managed by the Company | | | | | 0.39 | | | | | | | 0.45 | | | | | | |

| Gain on sale of certain businesses and websites | | | | | (0.58) | | | | | | | — | | | | | | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | | | | | — | | | | | | | (0.72) | | | | | | |

Net non-operating loss from impairment and write-up equity and cost method investments | | | | | 2.40 | | | | | | | — | | | | | | |

| | | | | | | | | | | | | | | | |

Diluted income per common share, adjusted (non-GAAP) | | | | | $ | 17.25 | | | | | | | $ | 10.45 | | | | | | |

| | | | | | | | | | | | | | | | |

| The adjusted diluted per share amounts may not compute due to rounding. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30 |

| 2024 | | 2023 |

| (in thousands, except per share amounts) | Income before income taxes | | Income Taxes | | Net Income | | Income before income taxes | | Income Taxes | | Net Income |

| Amounts attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | |

| As reported | $ | 267,118 | | | $ | 86,100 | | | $ | 181,018 | | | $ | 226,414 | | | $ | 70,400 | | | $ | 156,014 | |

| Attributable to noncontrolling interests | | | | | (5,175) | | | | | | | (3,985) | |

| Attributable to Graham Holdings Company Stockholders | | | | | $ | 175,843 | | | | | | | $ | 152,029 | |

| Adjustments: | | | | | | | | | | | |

| Net credit related to fair value changes in contingent consideration from prior acquisitions | — | | | — | | | — | | | (4,688) | | | (143) | | | (4,545) | |

| Goodwill and other long-lived asset impairment charges | 26,287 | | | 5,067 | | | 21,220 | | | 99,066 | | | 14,078 | | | 84,988 | |

| Charges related to non-operating Voluntary Retirement Incentive Program and Separation Incentive Programs | 20,493 | | | 5,246 | | | 15,247 | | | 9,646 | | | 2,481 | | | 7,165 | |

| Interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | 85,145 | | | 8,740 | | | 76,405 | | | 1,421 | | | 152 | | | 1,269 | |

| Net gains on marketable equity securities | (154,276) | | | (39,502) | | | (114,774) | | | (113,429) | | | (29,861) | | | (83,568) | |

Net losses of affiliates whose operations are not managed by the Company | 4,922 | | | 1,260 | | | 3,662 | | | 9,657 | | | 2,542 | | | 7,115 | |

| Gain on sale of certain businesses and websites | (7,246) | | | (1,956) | | | (5,290) | | | — | | | — | | | — | |

| Gain on sale of Pinna | — | | | — | | | — | | | (10,033) | | | (2,641) | | | (7,392) | |

| | | | | | | | | | | |

Non-operating loss (gain) from impairment, write-up and sales of equity and cost method investments | 14,980 | | | 3,833 | | | 11,147 | | | (3,935) | | | (1,008) | | | (2,927) | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | — | | | — | | | — | | | (4,581) | | | (1,252) | | | (3,329) | |

| | | | | | | | | | | |

| Net Income, adjusted (non-GAAP) | | | | | $ | 183,460 | | | | | | | $ | 150,805 | |

| | | | | | | | | | | |

| Per share information attributable to Graham Holdings Company Common Stockholders | | | | | | | | | | | |

| Diluted income per common share, as reported | | | | | $ | 39.49 | | | | | | | $ | 32.14 | |

| Adjustments: | | | | | | | | | | | |

| Net credit related to fair value changes in contingent consideration from prior acquisitions | | | | | — | | | | | | | (0.98) | |

| Goodwill and other long-lived asset impairment charges | | | | | 4.77 | | | | | | | 18.30 | |

| Charges related to non-operating Voluntary Retirement Incentive Program and Separation Incentive Programs | | | | | 3.42 | | | | | | | 1.54 | |

| Interest expense related to the fair value adjustment of the mandatorily redeemable noncontrolling interest | | | | | 17.16 | | | | | | | 0.27 | |

| Net gains on marketable equity securities | | | | | (25.77) | | | | | | | (17.99) | |

Net losses of affiliates whose operations are not managed by the Company | | | | | 0.82 | | | | | | | 1.53 | |

| Gain on sale of certain businesses and websites | | | | | (1.19) | | | | | | | — | |

| Gain on sale of Pinna | | | | | — | | | | | | | (1.59) | |

| | | | | | | | | | | |

Non-operating loss (gain) from impairment, write-up and sales of equity and cost method investments | | | | | 2.50 | | | | | | | (0.63) | |

| Credit to interest expense resulting from gains realized related to the termination of interest rate swaps | | | | | — | | | | | | | (0.72) | |

| | | | | | | | | | | |

| Diluted income per common share, adjusted (non-GAAP) | | | | | $ | 41.20 | | | | | | | $ | 31.87 | |

| | | | | | | | | | | |

| The adjusted diluted per share amounts may not compute due to rounding. |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

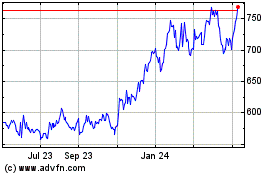

Graham (NYSE:GHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

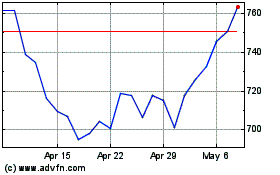

Graham (NYSE:GHC)

Historical Stock Chart

From Dec 2023 to Dec 2024