Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) delivered a strong

performance in Q4, increasing gold production by 15% and copper

production by 33% over Q3 to meet its annual guidance for the year.

Additionally, gold cost of sales1 and total cash costs2 for the

quarter were reduced by 3% and 5%, respectively.

The results for the year, released today, report a 69% increase

in net earnings to $2.14 billion, a 51% increase in adjusted net

earnings3 to $2.21 billion and a 30% rise in attributable EBITDA4

to $5.19 billion for 2024 — the highest in over a decade.

Year-on-year operating cash flow increased 20% to $4.49 billion and

free cash flow5 more than doubled to $1.32 billion, driven by the

stronger earnings. A quarterly dividend of $0.10 per share was

maintained, bringing the total annual dividend paid to shareholders

to $696 million, and a further $498 million was returned in buying

back shares.

“Barrick remains focused on sustainable value creation for all

our stakeholders and as our results today clearly demonstrate, we

have the asset quality, balance sheet strength and organic growth

projects to deliver on our vision well into the future,” said

Barrick president and chief executive Mark Bristow.

Barrick’s North America and Africa and Middle East operations

met their production guidance for the year, while in the Latin

America and Asia Pacific region, a slower-than-expected ramp up at

Pueblo Viejo meant the region delivered slightly below guidance

despite a stellar performance from Veladero. Pueblo Viejo is

planning further upgrades in 2025 to continue the improvement in

throughput and recovery, starting with a planned 35-day shutdown in

the first quarter of the year.

“During the fourth quarter, we made steady progress in ramping

up operations at Pueblo Viejo, improving recovery, despite lower

production on the back of a slight decrease in grade. At Veladero

and Nevada Gold Mines, we boosted production and we closed the gaps

at Kibali while strengthening the management team there.

Additionally, we completed two major feasibility studies to advance

the transformational Lumwana and Reko Diq projects, and also

significantly increased our reserves and resources,” said

Bristow.

Barrick continued its strong track record of reserve additions,

growing attributable proven and probable gold mineral reserves by

17.4 million ounces18 (23%) before 2024 depletion. Attributable

proven and probable gold mineral reserves now stand at 89 million

ounces at 0.99g/t19, increasing from 77 million ounces at 1.65g/t20

in 2023. Copper mineral reserves grew by 224% year-on-year on an

attributable basis, at more than 13% higher grade, to 18 million

tonnes of copper at 0.45%19, from 5.6 million tonnes of copper at

0.39% in 2023.20 This resulted from the completion of the Lumwana

and Reko Diq feasibility studies — affirming both projects as

potential Tier One21 copper assets. Additionally, the wholly-owned

Fourmile project is advancing to prefeasibility following a

successful 2024 drilling program.

For 2025, attributable gold production is expected to be in the

range of 3.15–3.5 million ounces, excluding production from

Loulo-Gounkoto while it is temporarily suspended. Attributable

copper production for 2025 is projected to increase from 195,000

tonnes in 2024 to 200,000–230,000 tonnes, driven by increased

production at Lumwana.

Bristow said Barrick remains open to a constructive engagement

with the Malian government and he continues to believe that a

mutually beneficial solution can be found.

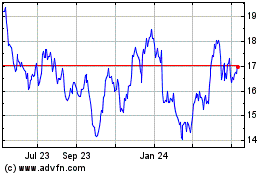

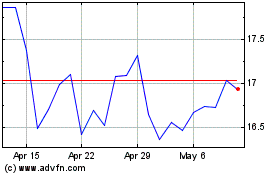

“While ongoing issues in Mali remain an investor concern, which

have overly weighed on the share price, Barrick’s fundamental value

proposition has never been stronger. As such, we have capitalized

on the undervaluation of our shares by increasing our repurchases,

and we have renewed our $1 billion share buyback program for the

upcoming year,” said Bristow.

“Our ability to self-fund our growth pipeline is a major

strength and, unlike many of our peers, we won't need costly

mergers and acquisitions or to issue additional equity to grow

production. Our focus on a quality Tier One21 asset portfolio,

continuous talent development, growth potential, robust balance

sheet and unparalleled track record in replacing the reserves we

mine, are the key reasons why we should be the go-to stock,” he

said.

Key Performance Indicators

Best Assets…

- Replaced depleted gold reserves at

existing mines and added 13 million ounces attributable proven and

probable reserves from Reko Diq6

- Significant increases in production

across all regions deliver higher Q4 gold production

- Full year attributable gold

production of 3.91 million ounces, in line with annual

guidance

- Quarter-on-quarter improvement at

Pueblo Viejo across flotation, CIL2 circuit stability and recovery

step up

- Veladero delivers best production in

last five years and successfully commissions Phase 7B leach

pad

- Increased Q4 copper production

ensures delivery at midpoint of annual guidance

- Engineering partners appointed for

Lumwana and Reko Diq and on track with early works design and long

lead item fabrication

- Pueblo Viejo Naranjo TSF feasibility

completed and drilling ongoing to validate design

- New decline development commences at

Bulyanhulu to access new reserves and increase mining

flexibility

- Significant drilling results at NGM,

Reko Diq, Loulo, Tanzania and Kibali confirm quality pipeline of

targets with progress on early-stage targets across Barrick’s

expanding greenfields portfolio

Key Growth Projects…

- Reko Diq and Lumwana Feasibility

Studies add 13Mt of new attributable copper reserves (73Moz of gold

equivalent ounces)6,7,8

- Barrick’s Fourmile proceeds to

prefeasibility study on back of successful drilling program

- Lumwana expansion permitted and Reko

Diq ESIA progresses

Leader in Sustainability…

- 48% reduction in LTIFR9 and 20%

reduction in TRIFR9 year-on-year

- Africa & Middle East region has

again achieved its best Malaria Incident Rate (MIR) on record,

lowering the MIR by a further 51% from 2023

- 824 hectares of concurrent

rehabilitation completed in 2024 – exceeding target by 13%

Delivering Value…

- 20% increase in operating cash flow

for 2024 to $4.5 billion

- Free cash flow5 for 2024 more than

double 2023 at $1.3 billion

- Net earnings per share of $0.57 and

adjusted net earnings per share3 of $0.46 for the quarter

- Q4 share buyback increased to $354

million – brings total to $498 million for the year

- $0.10 per share dividend declared

with $1.2 billion in total shareholder returns in 2024

Financial and Operating Highlights

|

Financial Results |

Q4 2024 |

Q3 2024 |

2024 |

2023 |

|

Realized gold

price10,11

($ per ounce) |

2,657 |

2,494 |

2,397 |

1,948 |

| Realized copper

price10,11

($ per pound) |

3.96 |

4.27 |

4.15 |

3.85 |

| Net

earnings12

($ millions) |

996 |

483 |

2,144 |

1,272 |

| Adjusted net

earnings3

($ millions) |

794 |

529 |

2,213 |

1,467 |

| Attributable

EBITDA4

($ millions) |

1,697 |

1,292 |

5,185 |

3,987 |

| Net cash provided by operating

activities ($ millions) |

1,392 |

1,180 |

4,491 |

3,732 |

| Free cash

flow5

($ millions) |

501 |

444 |

1,317 |

646 |

| Net earnings per share

($) |

0.57 |

0.28 |

1.22 |

0.72 |

| Adjusted net earnings per

share3 ($) |

0.46 |

0.30 |

1.26 |

0.84 |

| Total

attributable capital expenditures13,14 ($ millions) |

758 |

583 |

2,607 |

2,363 |

|

Financial Position |

As at 12/31/24 |

As at 9/30/24 |

As at 12/31/24 |

As at 12/31/23 |

|

Debt (current and long-term) ($ millions) |

4,729 |

4,725 |

4,729 |

4,726 |

| Cash and equivalents ($

millions) |

4,074 |

4,225 |

4,074 |

4,148 |

| Debt,

net of cash ($ millions) |

655 |

500 |

655 |

578 |

|

Operating Results |

Q4 2024 |

Q3 2024 |

2024 |

2023 |

|

Gold |

|

|

|

|

|

Production10

(thousands of ounces) |

1,080 |

943 |

3,911 |

4,054 |

| Cost of sales1,10

($ per ounce) |

1,428 |

1,472 |

1,442 |

1,334 |

| Total cash

costs2,10

($ per ounce) |

1,046 |

1,104 |

1,065 |

960 |

| All-in

sustaining

costs2,10

($ per ounce) |

1,451 |

1,507 |

1,484 |

1,335 |

|

Copper |

|

|

|

|

|

Production10,15

(thousands of tonnes) |

64 |

48 |

195 |

191 |

| Cost of sales10,16

($ per pound) |

2.62 |

3.23 |

2.99 |

2.90 |

| C1 cash

costs10,17

($ per pound) |

2.04 |

2.49 |

2.26 |

2.28 |

| All-in

sustaining

costs10,17

($ per pound) |

3.07 |

3.57 |

3.45 |

3.21 |

Q4 2024 Results Presentation

Mark Bristow will host a live presentation of the results today

at 11:00 EST, with an interactive webinar linked to a conference

call. Participants will be able to ask questions.

Go to the webinarUS/Canada (toll-free), 1 844 763 8274UK (toll),

+44 20 3795 9972International (toll), +1 647 484 8814

The Q4 presentation materials will be available on Barrick’s

website at www.barrick.com and the webinar will remain on the

website for later viewing.

Barrick Reports Share Repurchases and Declares Q4

Dividend

Barrick today announced the declaration of a dividend of

$0.10 per share for the fourth quarter of 2024. The dividend is

consistent with the Company’s Performance Dividend Policy announced

at the start of 2022.

The Q4 2024 dividend will be paid on March 17, 2025 to

shareholders of record at the close of business on February 28,

2025.

In addition to the quarterly dividends, Barrick repurchased

28.675 million shares during the year under the share buyback

program that was announced in February 2024, including 21 million

shares during Q4 2024.

“The strong performance of our business has allowed us to

provide significant returns to shareholders in 2024 through the

combination of dividends and share buybacks, especially in the

fourth quarter, at a compelling valuation. At the same time,

Barrick continues to maintain one of the strongest balance sheets

in the industry ensuring adequate liquidity to invest in our

significant growth projects,” said senior executive vice-president

and chief financial officer Graham Shuttleworth.

Barrick Announces New Share Buyback Program

Barrick announced today that it plans to undertake a new

share repurchase program for the buyback of its common

shares.

Barrick’s Board of Directors has authorized a new program for

the repurchase of up to $1.0 billion of the Company’s outstanding

common shares over the next 12 months at prevailing market prices

in accordance with applicable law. In connection with the new share

repurchase program, Barrick has terminated the share repurchase

program announced by the Company on February 14, 2024. The Company

repurchased $498 million in common shares under its 2024 share

repurchase program.

Under the program, repurchases can be made from time to time

through published markets in the United States such as the New York

Stock Exchange using a variety of methods, including open market

purchases, as well as by any other means permitted under the rules

of the U.S. Securities and Exchange Commission and other applicable

legal requirements.

Barrick believes that, from time to time, the market price of

its common shares trade at prices that may not adequately reflect

their underlying value. The actual number of shares that may be

purchased, if any, and the timing of such purchases, will be

determined by Barrick based on a number of factors, including the

Company’s financial performance, the availability of cash flows,

and the consideration of other uses of cash, including capital

investment opportunities, returns to shareholders, and debt

reduction.

The repurchase program does not obligate the Company to acquire

any particular number of common shares, and the repurchase program

may be suspended or discontinued at any time at the Company’s

discretion.Barrick Grows Gold and Copper Reserves

Significantly,Setting It Apart From Its Peers as

It Positions for Growth

Barrick grew attributable proven and probable gold

mineral reserves by 17.4 million ounces18

(23%) before 2024 depletion. Attributable proven and

probable mineral reserves now stand at 89 million ounces at

0.99g/t19, increasing from 77

million ounces at 1.65g/t20 in

2023.

The year-on-year change was led by the conversion of Reko Diq

resources to mineral reserves, adding 13 million ounces of gold at

0.28g/t19 on an attributable basis, following the completion of the

feasibility study. Significantly, before the addition of Reko Diq,

Barrick delivered a fourth consecutive year of replacing annual

depletion at a 4% higher grade, continuing to demonstrate the

results of an unremitting focus on asset quality and further

extending the life of our existing operations.

Since the end of 2019, Barrick has replaced more than 180%18 of

the company’s depleted gold reserves, adding almost 46 million

ounces18 of attributable proven and probable reserves (77 million

ounces18 of proven and probable reserves on a 100% basis) across

Barrick-managed assets.

Attributable measured and indicated gold resources for 2024

remain consistent, at 180 million ounces at 1.06g/t19, with a

further 41 million ounces at 0.9g/t19 of inferred resources, up 5%

from 2023.

At the same time, copper mineral reserves grew by 224%

year-on-year on an attributable basis, at more than 13% higher

grade to 18 million tonnes of copper at 0.45%19, from 5.6 million

tonnes of copper at 0.39% in 2023.20 This resulted from the

completion of the Lumwana and Reko Diq feasibility studies

affirming both projects as Tier One21 Copper Assets. The Lumwana

Super Pit Expansion feasibility study added 5.5Mt of Cu reserves to

the project, resulting in proven and probable copper reserves of

8.3 million tonnes of copper at 0.52%.19 The Reko Diq feasibility

study added 7.3 million tonnes of copper at 0.48%6 to attributable

copper reserves. This represents an addition of more than 20

million tonnes19 of proven and probable copper reserves on a 100%

basis since 2023.

Attributable measured and indicated copper resources for 2024

stand at 24 million tonnes19 of copper at 0.39%, with a further

3.9Mt19 of copper at 0.3% of inferred resources, reflecting the

conversion and upgrade of copper mineral resources at Lumwana.

For 2024, mineral reserves are based on an updated gold price

assumption of $1,400/oz22 and a consistent copper price of

$3.00/lb.22 Mineral resources are reported inclusive of reserves

and for 2024 are based on an updated gold price of $1,900/oz22 and

a consistent copper price of $4.00/lb.22

President and chief executive Mark Bristow said Barrick’s

strategy of investing in organic growth through exploration and

mineral resource management has set the group apart from its peers

within the industry, positioning Barrick as a champion for value

creation as we continue to grow our production profile

organically.

“In order for our industry to help build a better world, we have

to invest in our own future, with transformational projects like

the Lumwana Super Pit and Pueblo Viejo expansions, Reko Diq and

Fourmile. Barrick’s vision for these projects extends beyond

mining, ensuring the benefits of these investments provide

multi-generational benefits to our host countries and local

communities through the development of local service provider

partnerships and investment in the sustainability of our operating

environments,” said Bristow.

Mineral Resource Management and Evaluation Executive Simon

Bottoms said that since the end of 2019, Barrick has successfully

added 111 million ounces18 of attributable gold equivalent reserves

at a cost of approximately $10 per ounce23, demonstrating the value

proposition of our strategy.

“The company's reserve prices of $1,400/oz for gold22 and

$3.00/lb for copper22 are designed to extract the optimum value

from our geologically defined orebodies whilst delivering the

highest value, demonstrating the quality differentiation of our

Tier One21 assets. This approach is complemented by our reserve

replacement strategy, where we aim to add value by delineating ore

body extensions and satellites at our long-term reserve prices

rather than diluting the quality of our reserves through lifting

reserve prices beyond the relative levels of cost inflation,” said

Bottoms.

Gold mineral reserves in the Africa & Middle East region,

after annual depletion, grew to 19 million ounces at 3.35g/t19 in

2024 from 18.8 million ounces at 3.24g/t20 in 2023. This was

predominantly driven by both Bulyanhulu and Loulo-Gounkoto, with

extensions of the high-grade Reef 2 and Yalea underground orebodies

respectively, combined with growth of the Faraba open pit. Overall,

this delivered a 2.3 million ounce19 increase in attributable

proven and probable reserves across the region, before depletion.

North Mara also contributed to the strong results through the

extension of the Gokona underground and Gena open pit. At Kibali,

the ongoing conversion drilling in the 9000 and 11000 lodes in KCD

underground replaced 98% of depletion, with ongoing development to

establish further underground drill platforms for 2025.

The Latin America & Asia Pacific region, led by Pueblo

Viejo, replaced 115% of the regional 2024 gold reserve depletion

before the addition of Reko Diq, which added 0.78 million ounces19

to attributable proven and probable reserves before depletion as a

result of additional pit design pushbacks unlocked by the

additional TSF capacity in the new Naranjo facility. Porgera grew

attributable gold reserves by 22% year-on-year with the successful

conversion of the open pit Link cutback adjacent to the West Wall

cutback.

In North America, the ongoing growth programs at Turquoise

Ridge, Leeville Underground in Carlin and the Reona cut-back in

Phoenix, added 1.54 million ounces19 of gold to proven and probable

reserves on an attributable basis before annual depletion, which

were partially offset by reductions in Cortez driven by

metallurgical model updates in Crossroads and Robertson. This

resulted in attributable proven and probable mineral reserves for

the region of 30 million ounces at 2.71g/t19, representing a more

than 10% increase in the grade year-over-year (2.45g/t in 2023) as

a result of the high-grade growth additions and reductions of

low-grade at Cortez. At the same time, attributable gold measured

and indicated mineral resources for the region now stands at 66

million ounces at 2.18g/t19, due to the removal of Long Canyon

mineral resources, as the site is planned to progress into full

closure during 2025. Meanwhile, attributable inferred gold mineral

resources for the region grew to 21 million ounces at 3.3 g/t19,

driven by Fourmile’s mineral resource24 growth in the southernmost

portion of the orebody immediately adjacent to the existing

Goldrush mine. Looking forward to 2025, Barrick plans to commence

prefeasibility-study drilling at the end of the first quarter of

2025 which will target continued extension of the mineral resource

along strike to the north, while also completing the foundational

studies for the planned Bullion Hill northern access portal.

Transforming Lumwana Into a Top 25 Copper

Producer

Barrick has completed a comprehensive feasibility study

for the Super Pit Expansion at Lumwana in

Zambia25, transforming the mine

into a long-life, high yielding, Top 25 copper producer and Tier

One21 copper mine, capable of

contending with the volatility of the copper demand

cycles.

The expansion will substantially increase the mine’s production

capacity, extending its operational life by 17 years to 2057, and

doubling the capacity of the processing plant from 27 million

tonnes per annum (Mtpa) to a peak design of 54Mtpa — achieving an

average copper output of 240,000 tonnes annually over the life of

the mine, from a planned 52Mtpa process feed. Based on the

feasibility study, the total project capital cost is estimated to

be $2 billion.

Construction is set to begin in 2025, with the project promising

substantial improvements in operational efficiency. The expansion

has significantly grown Lumwana’s mineral reserves, increasing

proven and probable copper reserves from 510 million tonnes at

0.58% for 3.0 million tonnes of contained copper as of year-end

2023 to 1,600 million tonnes at 0.52% for 8.3 million tonnes of

contained copper as of year-end 2024.7 Notably, this expansion will

replace the total copper produced by Lumwana since 2009 by over

400%.25

The project involves key infrastructure developments, including

the expansion of existing mining operations at Chimiwungo and

Malundwe, the opening of two new open pits at Kamisengo and

Kababisa, and a substantial increase in mining capacity to 200Mtpa

in 2026 and 300Mtpa in 2030. By 2039, the mine is projected to

reach a maximum peak mining capacity of 350Mtpa, positioning

Lumwana as the largest mine in Africa by total tonnes moved.

Technological advancements are central to the expansion, with

plans to introduce high-level automation and modern process control

systems. The parallel process circuit will enable substantial

productivity improvements and reduced operating costs. A new

pit-rim crusher and conveyor system will optimize hauling

efficiency, cutting current ultra-class trucking haul cycles by at

least 15%. The tailings storage facility will see a capacity

increase from 360 million tonnes to two billion tonnes.

The expansion capitalizes on copper fundamentals and delivers a

financially robust low capital intensity mine, with a projected

cumulative operating cash flow of $36 billion and free cash flow of

$15.2 billion5 over the mine's life, based on a three-year trailing

copper price of $4.03 per pound.25 The project will be

self-funded by Barrick and current Lumwana operations, paying back

the initial expansion capital in approximately two years after

completion of the expansion at $4.03 per pound.

Environmental and social responsibility are key considerations

of the project. Barrick has secured all necessary mining licenses

over the entire project area and completed an Environmental and

Social Impact Assessment, which was approved in November 2024.

Additional permits are on schedule to be approved prior to

construction. The Company is also investing up to $2 million

through a REDD+ Project to offset environmental impacts, partnering

with local chiefdoms and the Zambian government to conserve

approximately 215,000 hectares of forest.

Updated Feasibility Study

DemonstratesReko Diq’s Transformative

Potential

Barrick has completed the updated feasibility study for

the Reko Diq project26, marking a

significant milestone in the development of one of the world's

largest undeveloped copper-gold deposits. Reko Diq will be a major

contributor to Pakistan’s economy which is expected to have a

transformative impact on the Balochistan province.

Barrick’s share of the project represents 50%, with 25% held by

three Pakistani state-owned enterprises and 25% held by the

Government of Balochistan, of which 15% is on a fully funded basis

and 10% is on a free carried basis.

The updated feasibility study outlines a 37-year mine life with

a total estimated capital investment on a 100% basis of $8.83

billion, to be divided into two phases, with Phase 1 having an

estimated total capital cost of $5.6-$6.0 billion (100% basis,

exclusive of financing costs). On February 11, 2025, the Board of

Directors conditionally approved the development of Phase 1 subject

to the closing of up to $3 billion of limited recourse project

financing. Assuming $3 billion of project financing, Barrick’s

share of the total partner equity contribution required for the

development of Phase 1 is expected to be $1.8-$2.0 billion.

Early works construction commenced during the first quarter of

2025, with first production anticipated by the end of 2028. The

project will leverage five of the fifteen identified porphyry

surface expressions within the current mining lease, highlighting

substantial future growth potential.

Under the updated feasibility study, Phase 1 is planned to see

45 million tonnes of mill feed processed annually (Mtpa), ramping

up to 240,000 tonnes of copper and 297,000 ounces of gold (on a

100% basis).26 By 2034, Phase 2 will expand operations to 90Mtpa,

increasing annual production to an average of 460,000 tonnes of

copper and 520,000 ounces of gold for the first ten years

(2034-2043).26 2044 will see the peak mining rate of 250Mtpa and a

life-of-mine strip ratio of 1.07.26

Probable mineral reserves, on a 100% basis, are 3,000 million

tonnes at 0.48% representing 15 million tonnes of copper and 2,900

million tonnes at 0.28g/t representing 26 million ounces of gold.6

The mining operation will utilize electric rope shovels, diesel

hydraulic excavators and 360-tonne ultra class haul trucks. The

processing plant consists of a three-stage crushing circuit, ball

milling and conventional flotation.

Saline groundwater, located approximately 300-750 meters below

the surface, that is not suitable for drinking or irrigation is

planned as the primary water supply sourced from a nearby aquifer,

with power produced through a combination of heavy fuel oil

generators, solar systems and battery storage. Future integration

into Pakistan’s national grid is planned for Phase 2.

An Environmental and Social Impact Assessment (ESIA) was

completed in December 2024 and submitted to the relevant government

authorities, with approval expected during Q1 2025. Throughout the

ESIA process, continuous engagement with local communities and

other key stakeholders was undertaken to ensure that their concerns

were considered.

Based on a three-year trailing average copper price of $4.03 per

pound and gold price of $2,045 per ounce, Barrick estimates the

project will deliver an internal rate of return of 21.32%,

generating $90 billion in operating cash flow and $70 billion in

free cash flow5 (on a 100% basis) over the life of mine and

generating $54 billion of revenue within Pakistan.

Reko Diq is the largest foreign direct investment project in

Balochistan and one of the largest in Pakistan.

Barrick Advances Fourmile Project in Nevada

The results of Barrick’s 2024 drilling program at the

wholly owned Fourmile project in Nevada, have been incorporated

into a preliminary economic assessment, highlighting an impressive

resource base and promising economic indicators that position

Fourmile as a world-class gold deposit.

The 2024 mineral resource update expanded the project's mineral

resources, across the southernmost portion of the orebody,

immediately adjacent to the existing Goldrush mine, resulting in a

192% increase in indicated resources (to 1.4 million ounces grading

11.76 g/t), a 137% increase in inferred resources (to 6.4 million

ounces at 14.1 g/t) and a 35% increase in grade relative to

Barrick’s 2023 year-end mineral resource

estimate.24,27

President and chief executive Mark Bristow, stated that the

Fourmile project is a truly world-class asset which can only really

be compared to the original Goldstrike deposit that was the

foundational asset of Barrick and is now part of Carlin within the

Nevada Gold Mines joint venture.

“The current resource represents approximately one-third of the

total orebody defined by drilling to date, supporting substantial

growth potential, with increasing grades as drilling progresses

northward,” said Bristow.

Economic projections for Fourmile are equally compelling,

whereby the preliminary economic assessment demonstrates Fourmile’s

potential to become a Tier One mine21 at comparable annual mining

rates and costs to the current Goldrush mine plan.24 These results

have encouraged Barrick to advance the project through a three-year

pre-feasibility-study program.

Barrick’s Mineral Resource Management and Evaluation Executive

Simon Bottoms stated, “Geotechnical drilling and ongoing

hydrological measurements have confirmed more favourable ground

conditions with lower permeability than other typical Carlin-style

deposits. This has the potential to reduce the dewatering

requirements during mine development and allows for stope heights

to be increased up to 25m high compared to 15m within the

neighboring Goldrush mine.”

“Metallurgical test work has demonstrated compatibility with

existing facilities, offering processing flexibility through both

autoclave and roaster facilities. The initial mine design

incorporates three semi-independent production zones, providing

operational flexibility and potential for increased production

rates,” said Bottoms.

Looking ahead, Barrick plans to commence pre-feasibility-study

drilling at the end of the first quarter of 2025, which will

provide the foundational study data to underpin the planned Bullion

Hill northern access portal.

The upcoming studies will also explore materials handling

options and investigate the synergies Fourmile could bring to both

the existing Goldrush mine and associated processing

facilities.

Ma'aden Barrick Copper Company

AdvancesFemale Employment in Saudi

Mining

In August 2020, the Kingdom of Saudi Arabia’s Cabinet

approved landmark amendments to the Labor Law, repealing Articles

149 and 150, which previously restricted women from working in

hazardous occupations or during night shifts.

A new clause was introduced to guarantee women equal access to

job opportunities as men, provided the roles are not hazardous to

their health.

This progressive step aligns with Saudi Arabia’s Vision 2030, a

national initiative to empower women across all sectors, including

mining. The Ma'aden Barrick Copper Company (MBCC), a 50/50 joint

venture between Barrick and Ma'aden, exemplifies this vision by

opening doors for women in the traditionally male-dominated mining

industry.

Starting in 2022, MBCC began employing women in various roles,

including accounting, human resources, procurement, geology, supply

chain management, logistics and compliance. By the beginning of

2025, MBCC had more than doubled the number of female employees,

rising from eight in 2022 to 17 — a testament to Barrick’s

commitment to fostering a diverse and inclusive workforce.

MBCC became the first mine in Saudi Arabia to recruit women to

work in remote areas for operational roles. Women now actively

contribute to the company’s operations, taking on positions such as

project coordinators and chemists in the process lab. Additionally,

MBCC has trained 15 women across multiple disciplines, including as

instrument and planning engineers in the maintenance department,

and as chemists in the process plant.

Barrick’s efforts extend beyond hiring to developing future

talent. The Company collaborates with local universities and

colleges to provide tailored training opportunities, empowering

women to excel in roles critical to the mining sector.

This progress not only supports Saudi Arabia’s national goals

but also highlights Barrick’s dedication to creating a diverse,

equitable and forward-thinking workplace. By integrating talented

women into their operations, MBCC and Barrick are setting a new

standard for the mining industry in Saudi Arabia and beyond.

APPENDIX

2025 Operating and Capital Expenditure

Guidance

|

GOLD PRODUCTION AND COSTS |

|

|

2025 forecast attributable production (000s ozs) |

2025 forecast cost of sales1 ($/oz) |

2025 forecast total cash costs2 ($/oz) |

2025 forecast all-in sustaining costs2 ($/oz) |

|

Carlin (61.5%) |

705 - 785 |

1,470 - 1,570 |

1,140 - 1,220 |

1,630 - 1,730 |

|

Cortez (61.5%)28 |

420 - 470 |

1,420 - 1,520 |

1,050 - 1,130 |

1,370 - 1,470 |

|

Turquoise Ridge (61.5%) |

310 - 345 |

1,370 - 1,470 |

1,000 - 1,080 |

1,260 - 1,360 |

|

Phoenix (61.5%) |

85 - 105 |

2,070 - 2,170 |

890 - 970 |

1,240 - 1,340 |

|

Nevada Gold Mines (61.5%) |

1,540 - 1,700 |

1,470 - 1,570 |

1,070 - 1,150 |

1,460 - 1,560 |

|

Hemlo |

140 - 160 |

1,500 - 1,600 |

1,200 - 1,280 |

1,600 - 1,700 |

|

North America |

1,680 - 1,860 |

1,470 - 1,570 |

1,080 - 1,160 |

1,480 - 1,580 |

| |

|

Pueblo Viejo (60%) |

370 - 410 |

1,540 - 1,640 |

910 - 990 |

1,280 - 1,380 |

|

Veladero (50%) |

190 - 220 |

1,390 - 1,490 |

890 - 970 |

1,570 - 1,670 |

|

Porgera (24.5%) |

70 - 95 |

1,510 - 1,610 |

1,210 - 1,290 |

1,770 - 1,870 |

|

Latin America & Asia Pacific |

630 - 730 |

1,490 - 1,590 |

940 - 1,020 |

1,430 - 1,530 |

| |

|

Loulo-Gounkoto (80%)29 |

— |

— |

— |

— |

|

Kibali (45%) |

310 - 340 |

1,280 - 1,380 |

940 - 1,020 |

1,130 - 1,230 |

|

North Mara (84%) |

230 - 260 |

1,370 - 1,470 |

1,020 - 1,100 |

1,400 - 1,500 |

|

Bulyanhulu (84%) |

150 - 180 |

1,470 - 1,570 |

1,010 - 1,090 |

1,540 - 1,640 |

|

Tongon (89.7%) |

110 - 140 |

1,790 - 1,890 |

1,570 - 1,650 |

1,660 - 1,760 |

|

Africa and Middle East |

820 - 910 |

1,420 - 1,520 |

1,060 - 1,140 |

1,360 - 1,460 |

|

|

| Total

Attributable to Barrick30,31,32 |

3,150 - 3,500 |

1,460 - 1,560 |

1,050 - 1,130 |

1,460 - 1,560 |

| |

|

COPPER PRODUCTION AND COSTS |

|

|

2025 forecast attributable production (000s tonnes) |

2025 forecast cost of sales16 ($/lb) |

2025 forecast C1 cash costs17 ($/lb) |

2025 forecast all-in sustaining costs17 ($/lb) |

|

Lumwana |

125 - 155 |

2.30 - 2.60 |

1.60 - 1.90 |

2.80 - 3.10 |

| Zaldívar (50%) |

40 - 45 |

3.60 - 3.90 |

2.70 - 3.00 |

3.50 - 3.80 |

|

Jabal Sayid (50%) |

25 - 35 |

2.00 - 2.30 |

1.60 - 1.90 |

1.80 - 2.10 |

|

Total Copper30,31,32 |

200 - 230 |

2.50 - 2.80 |

1.80 - 2.10 |

2.80 - 3.10 |

| |

|

ATTRIBUTABLE CAPITAL

EXPENDITURES13 |

|

|

|

|

(millions) |

|

Attributable minesite sustaining13,14 |

1,400 - 1,650 |

|

Attributable project13,14 |

1,700 - 1,950 |

| Total

attributable capital expenditures13 |

3,100 - 3,600 |

|

OUTLOOK ASSUMPTIONS AND ECONOMIC SENSITIVITY

ANALYSIS |

|

|

2025 guidance assumption |

Hypothetical change |

Consolidated impact on EBITDA4 (millions) |

Attributable impact on EBITDA4 (millions) |

Attributable impact on TCC and AISC2,17 |

|

Gold price sensitivity |

$2,400/oz |

+/- $100/oz |

‘+/-$450 |

‘+/-$320 |

‘+/-$5/oz |

| Copper

price sensitivity |

$4.00/lb |

‘+/-$0.25/lb |

‘+/- $120 |

‘+/- $120 |

‘+/-$0.01/lb |

Production and Cost Summary - Gold

| |

For the three months ended |

For the years ended |

|

|

12/31/24 |

9/30/24 |

Change |

12/31/24 |

12/31/23 |

Change |

| Nevada Gold Mines LLC (61.5%)a |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

444 |

385 |

15 |

% |

1,650 |

1,865 |

(12 |

%) |

|

Gold produced (000s oz 100% basis) |

721 |

625 |

15 |

% |

2,684 |

3,032 |

(12 |

%) |

|

Cost of sales ($/oz) |

1,468 |

1,553 |

(5 |

%) |

1,478 |

1,351 |

9 |

% |

|

Total cash costs ($/oz)b |

1,121 |

1,205 |

(7 |

%) |

1,126 |

989 |

14 |

% |

|

All-in sustaining costs ($/oz)b |

1,453 |

1,633 |

(11 |

%) |

1,561 |

1,366 |

14 |

% |

|

Carlin (61.5%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

186 |

182 |

2 |

% |

775 |

868 |

(11 |

%) |

|

Gold produced (000s oz 100% basis) |

301 |

296 |

2 |

% |

1,261 |

1,411 |

(11 |

%) |

|

Cost of sales ($/oz) |

1,489 |

1,478 |

1 |

% |

1,429 |

1,254 |

14 |

% |

|

Total cash costs ($/oz)b |

1,240 |

1,249 |

(1 |

%) |

1,187 |

1,033 |

15 |

% |

|

All-in sustaining costs ($/oz)b |

1,657 |

1,771 |

(6 |

%) |

1,730 |

1,486 |

16 |

% |

|

Cortez (61.5%)c |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

125 |

98 |

28 |

% |

444 |

549 |

(19 |

%) |

|

Gold produced (000s oz 100% basis) |

203 |

160 |

28 |

% |

722 |

892 |

(19 |

%) |

|

Cost of sales ($/oz) |

1,405 |

1,526 |

(8 |

%) |

1,402 |

1,318 |

6 |

% |

|

Total cash costs ($/oz)b |

1,064 |

1,180 |

(10 |

%) |

1,046 |

906 |

15 |

% |

|

All-in sustaining costs ($/oz)b |

1,431 |

1,570 |

(9 |

%) |

1,441 |

1,282 |

12 |

% |

|

Turquoise Ridge (61.5%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

94 |

76 |

24 |

% |

304 |

316 |

(4 |

%) |

|

Gold produced (000s oz 100% basis) |

153 |

123 |

24 |

% |

494 |

514 |

(4 |

%) |

|

Cost of sales ($/oz) |

1,491 |

1,674 |

(11 |

%) |

1,615 |

1,399 |

15 |

% |

|

Total cash costs ($/oz)b |

1,107 |

1,295 |

(15 |

%) |

1,238 |

1,026 |

21 |

% |

|

All-in sustaining costs ($/oz)b |

1,260 |

1,516 |

(17 |

%) |

1,466 |

1,234 |

19 |

% |

|

Phoenix (61.5%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

39 |

29 |

34 |

% |

127 |

123 |

3 |

% |

|

Gold produced (000s oz 100% basis) |

64 |

46 |

34 |

% |

207 |

200 |

3 |

% |

|

Cost of sales ($/oz) |

1,474 |

1,789 |

(18 |

%) |

1,687 |

2,011 |

(16 |

%) |

|

Total cash costs ($/oz)b |

752 |

764 |

(2 |

%) |

765 |

961 |

(20 |

%) |

|

All-in sustaining costs ($/oz)b |

956 |

1,113 |

(14 |

%) |

1,031 |

1,162 |

(11 |

%) |

|

Long Canyon (61.5%)d |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

— |

— |

— |

% |

— |

9 |

(100 |

%) |

|

Gold produced (000s oz 100% basis) |

— |

— |

— |

% |

— |

15 |

(100 |

%) |

|

Cost of sales ($/oz) |

— |

— |

— |

% |

— |

1,789 |

(100 |

%) |

|

Total cash costs ($/oz)b |

— |

— |

— |

% |

— |

724 |

(100 |

%) |

|

All-in sustaining costs ($/oz)b |

— |

— |

— |

% |

— |

779 |

(100 |

%) |

| Pueblo Viejo (60%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

93 |

98 |

(5 |

%) |

352 |

335 |

5 |

% |

|

Gold produced (000s oz 100% basis) |

155 |

164 |

(5 |

%) |

586 |

559 |

5 |

% |

|

Cost of sales ($/oz) |

1,679 |

1,470 |

14 |

% |

1,576 |

1,418 |

11 |

% |

|

Total cash costs ($/oz)b |

1,030 |

957 |

8 |

% |

1,005 |

889 |

13 |

% |

|

All-in sustaining costs ($/oz)b |

1,325 |

1,221 |

9 |

% |

1,323 |

1,249 |

6 |

% |

| Loulo-Gounkoto (80%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

156 |

144 |

8 |

% |

578 |

547 |

6 |

% |

|

Gold produced (000s oz 100% basis) |

196 |

180 |

8 |

% |

723 |

683 |

6 |

% |

|

Cost of sales ($/oz) |

1,397 |

1,257 |

11 |

% |

1,218 |

1,198 |

2 |

% |

|

Total cash costs ($/oz)b |

923 |

865 |

7 |

% |

828 |

835 |

(1 |

%) |

|

All-in sustaining costs ($/oz)b |

2,136 |

1,288 |

66 |

% |

1,304 |

1,166 |

12 |

% |

| Kibali (45%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

80 |

71 |

13 |

% |

309 |

343 |

(10 |

%) |

|

Gold produced (000s oz 100% basis) |

177 |

159 |

13 |

% |

686 |

763 |

(10 |

%) |

|

Cost of sales ($/oz) |

1,413 |

1,441 |

(2 |

%) |

1,344 |

1,221 |

10 |

% |

|

Total cash costs ($/oz)b |

966 |

978 |

(1 |

%) |

905 |

789 |

15 |

% |

|

All-in sustaining costs ($/oz)b |

1,182 |

1,172 |

1 |

% |

1,123 |

918 |

22 |

% |

| Veladero (50%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

82 |

57 |

44 |

% |

252 |

207 |

22 |

% |

|

Gold produced (000s oz 100% basis) |

165 |

113 |

44 |

% |

505 |

414 |

22 |

% |

|

Cost of sales ($/oz) |

1,151 |

1,311 |

(12 |

%) |

1,254 |

1,440 |

(13 |

%) |

|

Total cash costs ($/oz)b |

828 |

951 |

(13 |

%) |

905 |

1,011 |

(10 |

%) |

|

All-in sustaining costs ($/oz)b |

1,191 |

1,385 |

(14 |

%) |

1,334 |

1,516 |

(12 |

%) |

| Porgera (24.5%)e |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

13 |

18 |

(28 |

%) |

46 |

— |

100 |

% |

|

Gold produced (000s oz 100% basis) |

53 |

72 |

(28 |

%) |

188 |

— |

100 |

% |

|

Cost of sales ($/oz) |

2,127 |

1,163 |

83 |

% |

1,423 |

— |

100 |

% |

|

Total cash costs ($/oz)b |

1,322 |

999 |

32 |

% |

1,073 |

— |

100 |

% |

|

All-in sustaining costs ($/oz)b |

2,967 |

1,214 |

144 |

% |

1,666 |

— |

100 |

% |

| Tongon (89.7%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

39 |

28 |

39 |

% |

148 |

183 |

(19 |

%) |

|

Gold produced (000s oz 100% basis) |

43 |

32 |

39 |

% |

165 |

204 |

(19 |

%) |

|

Cost of sales ($/oz) |

1,405 |

2,403 |

(42 |

%) |

1,903 |

1,469 |

30 |

% |

|

Total cash costs ($/oz)b |

1,198 |

2,184 |

(45 |

%) |

1,670 |

1,240 |

35 |

% |

|

All-in sustaining costs ($/oz)b |

1,460 |

2,388 |

(39 |

%) |

1,867 |

1,408 |

33 |

% |

| Hemlo (100%) |

|

|

|

|

|

|

|

Gold produced (000s oz) |

39 |

30 |

30 |

% |

143 |

141 |

1 |

% |

|

Cost of sales ($/oz) |

1,754 |

1,929 |

(9 |

%) |

1,754 |

1,589 |

10 |

% |

|

Total cash costs ($/oz)b |

1,475 |

1,623 |

(9 |

%) |

1,483 |

1,382 |

7 |

% |

|

All-in sustaining costs ($/oz)b |

1,689 |

2,044 |

(17 |

%) |

1,769 |

1,672 |

6 |

% |

| North Mara (84%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

90 |

75 |

20 |

% |

265 |

253 |

5 |

% |

|

Gold produced (000s oz 100% basis) |

107 |

89 |

20 |

% |

315 |

302 |

5 |

% |

|

Cost of sales ($/oz) |

1,018 |

1,108 |

(8 |

%) |

1,266 |

1,206 |

5 |

% |

|

Total cash costs ($/oz)b |

771 |

850 |

(9 |

%) |

989 |

944 |

5 |

% |

|

All-in sustaining costs ($/oz)b |

1,098 |

1,052 |

4 |

% |

1,274 |

1,335 |

(5 |

%) |

| Bulyanhulu (84%) |

|

|

|

|

|

|

|

Gold produced (000s oz attributable basis) |

44 |

37 |

19 |

% |

168 |

180 |

(7 |

%) |

|

Gold produced (000s oz 100% basis) |

53 |

44 |

19 |

% |

200 |

214 |

(7 |

%) |

|

Cost of sales ($/oz) |

1,505 |

1,628 |

(8 |

%) |

1,509 |

1,312 |

15 |

% |

|

Total cash costs ($/oz)b |

1,072 |

1,191 |

(10 |

%) |

1,070 |

920 |

16 |

% |

|

All-in sustaining costs ($/oz)b |

1,489 |

1,470 |

1 |

% |

1,420 |

1,231 |

15 |

% |

| Total

Attributable to Barrickf |

|

|

|

|

|

|

|

Gold produced (000s oz) |

1,080 |

943 |

15 |

% |

3,911 |

4,054 |

(4 |

%) |

|

Cost of sales ($/oz)g |

1,428 |

1,472 |

(3 |

%) |

1,442 |

1,334 |

8 |

% |

|

Total cash costs ($/oz)b |

1,046 |

1,104 |

(5 |

%) |

1,065 |

960 |

11 |

% |

|

All-in sustaining costs ($/oz)b |

1,451 |

1,507 |

(4 |

%) |

1,484 |

1,335 |

11 |

% |

| |

|

|

|

|

|

|

|

|

- These results represent our 61.5% interest in Carlin, Cortez,

Turquoise Ridge, Phoenix and Long Canyon until it transitioned to

care and maintenance at the end of 2023, as previously

reported.

- Further information on these non-GAAP financial measures,

including detailed reconciliations, is included on pages 59 to 75

of Barrick’s Q4 2024 MD&A.

- Includes Goldrush.

- Starting in Q1 2024, we have ceased to include production or

non-GAAP cost metrics for Long Canyon as it was placed on care and

maintenance at the end of 2023, as previously reported.

- As Porgera was placed on care and maintenance from April 25,

2020 until December 22, 2023, no operating data or per ounce data

has been provided from Q3 2020 to Q4 2023. On December 22,

2023, we completed the Commencement Agreement, pursuant to which

the PNG government and BNL, the 95% owner and operator of the

Porgera joint venture, agreed on a partnership for the future

ownership and operation of the mine. Ownership of Porgera is

held in a joint venture owned 51% by PNG stakeholders and 49% by a

Barrick affiliate, PJL. PJL is jointly owned on a 50/50 basis by

Barrick and Zijin Mining Group and therefore Barrick now holds a

24.5% ownership interest in the Porgera joint venture. Barrick

holds a 23.5% interest in the economic benefits of the mine under

the economic benefit sharing arrangement agreed with the PNG

government whereby Barrick and Zijin Mining Group together share

47% of the overall economic benefits derived from the mine

accumulated over time, and the PNG stakeholders share the remaining

53%.

- Excludes Pierina, which is producing incidental ounces while in

closure.

- Gold cost of sales per ounce is calculated as cost of sales

across our gold operations (excluding sites in closure or care and

maintenance) divided by ounces sold (both on an attributable basis

using Barrick’s ownership share).

Production and Cost Summary - Copper

| |

For the three months ended |

For the years ended |

| |

12/31/24 |

09/30/24 |

% Change |

12/31/24 |

12/31/23 |

% Change |

| Lumwana

(100%) |

|

|

|

|

|

|

|

Copper production (thousands of tonnes)a |

46 |

30 |

53 |

% |

123 |

118 |

4 |

% |

|

Cost of sales ($/lb)c |

2.27 |

3.27 |

(31 |

%) |

2.94 |

2.91 |

1 |

% |

|

C1 cash costs ($/lb)b |

1.89 |

2.53 |

(25 |

%) |

2.23 |

2.29 |

(3 |

%) |

|

All-in sustaining costs ($/lb)b |

3.14 |

3.94 |

(20 |

%) |

3.85 |

3.48 |

11 |

% |

| Zaldívar

(50%) |

|

|

|

|

|

|

|

Copper production (thousands of tonnes attributable basis)a |

11 |

10 |

10 |

% |

40 |

40 |

0 |

% |

|

Copper production (thousands of tonnes 100% basis)a |

22 |

20 |

10 |

% |

80 |

81 |

0 |

% |

|

Cost of sales ($/lb)c |

4.22 |

4.04 |

4 |

% |

4.09 |

3.83 |

7 |

% |

|

C1 cash costs ($/lb)b |

3.11 |

2.99 |

4 |

% |

3.04 |

2.95 |

3 |

% |

|

All-in sustaining costs ($/lb)b |

3.98 |

3.45 |

15 |

% |

3.58 |

3.46 |

3 |

% |

| Jabal Sayid (50%) |

|

|

|

|

|

|

|

Copper production (thousands of tonnes attributable basis)a |

7 |

8 |

(13 |

%) |

32 |

32 |

0 |

% |

|

Copper production (thousands of tonnes 100% basis)a |

15 |

16 |

(13 |

%) |

65 |

64 |

0 |

% |

|

Cost of sales ($/lb)c |

2.02 |

1.76 |

15 |

% |

1.77 |

1.60 |

11 |

% |

|

C1 cash costs ($/lb)b |

1.29 |

1.54 |

(16 |

%) |

1.37 |

1.35 |

1 |

% |

|

All-in sustaining costs ($/lb)b |

1.44 |

1.76 |

(18 |

%) |

1.56 |

1.53 |

2 |

% |

| Total Attributable to Barrick |

|

|

|

|

|

|

|

Copper production (thousands of tonnes)a |

64 |

48 |

33 |

% |

195 |

191 |

2 |

% |

|

Cost of sales ($/lb)c |

2.62 |

3.23 |

(19 |

%) |

2.99 |

2.90 |

3 |

% |

|

C1 cash costs ($/lb)b |

2.04 |

2.49 |

(18 |

%) |

2.26 |

2.28 |

(1 |

%) |

|

All-in sustaining costs ($/lb)b |

3.07 |

3.57 |

(14 |

%) |

3.45 |

3.21 |

7 |

% |

| |

|

|

|

|

|

|

|

|

- Starting in 2024, we have presented our copper production and

sales quantities in tonnes rather than pounds (1 tonne is

equivalent to 2,204.6 pounds). Production and sales amounts

for prior periods have been restated for comparative

purposes. Our copper cost metrics are still reported on a per

pound basis.

- Further information on these non-GAAP financial measures,

including detailed reconciliations, is included on pages 59 to 75

of Barrick’s Q4 2024 MD&A.

- Copper cost of sales per pound is calculated as cost of sales

across our copper operations divided by pounds sold (both on an

attributable basis using Barrick's ownership share).

Financial and Operating Highlights

| |

For the three months ended |

|

For the years ended |

| |

12/31/24 |

9/30/24 |

% Change |

|

12/31/24 |

12/31/23 |

% Change |

| Financial Results($ millions) |

|

|

|

|

|

|

|

| Revenues |

3,645 |

|

3,368 |

|

8 |

% |

|

12,922 |

|

11,397 |

|

13 |

% |

| Cost of sales |

1,995 |

|

2,051 |

|

(3 |

)% |

|

7,961 |

|

7,932 |

|

0 |

% |

| Net earningsa |

996 |

|

483 |

|

106 |

% |

|

2,144 |

|

1,272 |

|

69 |

% |

| Adjusted net earningsb |

794 |

|

529 |

|

50 |

% |

|

2,213 |

|

1,467 |

|

51 |

% |

| Attributable EBITDAb |

1,697 |

|

1,292 |

|

31 |

% |

|

5,185 |

|

3,987 |

|

30 |

% |

| Attributable EBITDA marginb |

56 |

% |

46 |

% |

22 |

% |

|

48 |

% |

42 |

% |

14 |

% |

| Minesite sustaining capital expendituresb,c |

525 |

|

511 |

|

3 |

% |

|

2,217 |

|

2,076 |

|

7 |

% |

| Project capital expendituresb,c |

362 |

|

221 |

|

64 |

% |

|

924 |

|

969 |

|

(5 |

)% |

| Total consolidated capital expendituresc,d |

891 |

|

736 |

|

21 |

% |

|

3,174 |

|

3,086 |

|

3 |

% |

| Total attributable capital

expenditurese |

758 |

|

583 |

|

30 |

% |

|

2,607 |

|

2,363 |

|

10 |

% |

| Net cash provided by operating activities |

1,392 |

|

1,180 |

|

18 |

% |

|

4,491 |

|

3,732 |

|

20 |

% |

| Net cash provided by operating activities marginf |

38 |

% |

35 |

% |

9 |

% |

|

35 |

% |

33 |

% |

6 |

% |

| Free cash flowb |

501 |

|

444 |

|

13 |

% |

|

1,317 |

|

646 |

|

104 |

% |

| Net earnings per share (basic and diluted) |

0.57 |

|

0.28 |

|

104 |

% |

|

1.22 |

|

0.72 |

|

69 |

% |

| Adjusted net earnings (basic)bper share |

0.46 |

|

0.30 |

|

53 |

% |

|

1.26 |

|

0.84 |

|

50 |

% |

| Weighted average

diluted common shares (millions of shares) |

1,742 |

|

1,752 |

|

(1 |

)% |

|

1,751 |

|

1,755 |

|

0 |

% |

| Operating Results |

|

|

|

|

|

|

|

| Gold production (thousands of ounces)g |

1,080 |

|

943 |

|

15 |

% |

|

3,911 |

|

4,054 |

|

(4 |

)% |

| Gold sold (thousands of ounces)g |

965 |

|

967 |

|

0 |

% |

|

3,798 |

|

4,024 |

|

(6 |

)% |

| Market gold price ($/oz) |

2,663 |

|

2,474 |

|

8 |

% |

|

2,386 |

|

1,941 |

|

23 |

% |

| Realized gold priceb,g($/oz) |

2,657 |

|

2,494 |

|

7 |

% |

|

2,397 |

|

1,948 |

|

23 |

% |

| Gold cost of sales (Barrick’s share)g,h($/oz) |

1,428 |

|

1,472 |

|

(3 |

)% |

|

1,442 |

|

1,334 |

|

8 |

% |

| Gold total cash costsb,g($/oz) |

1,046 |

|

1,104 |

|

(5 |

)% |

|

1,065 |

|

960 |

|

11 |

% |

| Gold all-in sustaining costsb,g($/oz) |

1,451 |

|

1,507 |

|

(4 |

)% |

|

1,484 |

|

1,335 |

|

11 |

% |

| Copper production (thousands of tonnes)g,j |

64 |

|

48 |

|

33 |

% |

|

195 |

|

191 |

|

2 |

% |

| Copper sold (thousands of tonnes)g,j |

54 |

|

42 |

|

29 |

% |

|

177 |

|

185 |

|

(4 |

)% |

| Market copper price ($/lb) |

4.17 |

|

4.18 |

|

0 |

% |

|

4.15 |

|

3.85 |

|

8 |

% |

| Realized copper priceb,g($/lb) |

3.96 |

|

4.27 |

|

(7 |

)% |

|

4.15 |

|

3.85 |

|

8 |

% |

| Copper cost of sales (Barrick’s share)g,i($/lb) |

2.62 |

|

3.23 |

|

(19 |

)% |

|

2.99 |

|

2.90 |

|

3 |

% |

| Copper C1 cash costsb,g($/lb) |

2.04 |

|

2.49 |

|

(18 |

)% |

|

2.26 |

|

2.28 |

|

(1 |

)% |

| Copper all-in

sustaining costsb,g($/lb) |

3.07 |

|

3.57 |

|

(14 |

)% |

|

3.45 |

|

3.21 |

|

7 |

% |

| |

As at 12/31/24 |

As at 9/30/24 |

% Change |

|

As at 12/31/24 |

As at 12/31/23 |

% Change |

| Financial Position($ millions) |

|

|

|

|

|

|

|

| Debt (current and long-term) |

4,729 |

|

4,725 |

|

0 |

% |

|

4,729 |

|

4,726 |

|

0 |

% |

| Cash and equivalents |

4,074 |

|

4,225 |

|

(4 |

)% |

|

4,074 |

|

4,148 |

|

(2 |

)% |

| Debt, net of cash |

655 |

|

500 |

|

31 |

% |

|

655 |

|

578 |

|

13 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

- Net earnings represents net earnings attributable to the equity

holders of the Company.

- Further information on these non-GAAP financial measures,

including detailed reconciliations, is included on pages 59 to 75

of Barrick’s Q4 2024 MD&A.

- Amounts presented on a consolidated cash basis. Project capital

expenditures are not included in our calculation of all-in

sustaining costs.

- Total consolidated capital expenditures also includes

capitalized interest of $4 million and $33 million, respectively,

for the Q4 2024 and 2024 (Q3 2024: $4 million; 2023: $41

million).

- These amounts are presented on the same basis as our

guidance.

- Represents net cash provided by operating activities divided by

revenue.

- On an attributable basis.

- Gold cost of sales per ounce is calculated as cost of sales

across our gold operations (excluding sites in closure or care and

maintenance) divided by ounces sold (both on an attributable basis

using Barrick’s ownership share).

- Copper cost of sales per pound is calculated as cost of sales

across our copper operations divided by pounds sold (both on an

attributable basis using Barrick’s ownership share).

- Starting in 2024, we have presented our copper production and

sales quantities in tonnes rather than pounds (1 tonne is

equivalent to 2,204.6 pounds). Production and sales amounts for

prior periods have been restated for comparative purposes. Our

copper cost metrics are still reported on a per pound basis.

Consolidated Statements of Income

| Barrick Gold Corporation |

|

|

|

For the years ended December 31 (in millions of United States

dollars, except per share data) |

|

2024 |

|

|

2023 |

|

| Revenue (notes 5 and

6) |

$12,922 |

|

$11,397 |

|

| Costs and expenses (income) |

|

|

|

|

| Cost of sales (notes 5 and 7) |

|

7,961 |

|

|

7,932 |

|

| General and administrative expenses (note 11) |

|

115 |

|

|

126 |

|

| Exploration, evaluation and project expenses (notes 5 and

8) |

|

392 |

|

|

361 |

|

| Impairment (reversals) charges (notes 10 and 21) |

|

(457 |

) |

|

312 |

|

| Loss on currency translation |

|

39 |

|

|

93 |

|

| Closed mine rehabilitation (note 27b) |

|

59 |

|

|

16 |

|

| Income from equity investees (note 16) |

|

(241 |

) |

|

(232 |

) |

| Other (income) expense

(note 9) |

|

214 |

|

|

(195 |

) |

| Income before finance items and income

taxes |

|

4,840 |

|

|

2,984 |

|

| Finance costs, net

(note 14) |

|

(232 |

) |

|

(170 |

) |

| Income before income taxes |

|

4,608 |

|

|

2,814 |

|

| Income tax expense

(note 12) |

|

(1,520 |

) |

|

(861 |

) |

| Net

income |

$3,088 |

|

$1,953 |

|

| Attributable to: |

|

|

|

|

| Equity holders of Barrick Gold Corporation |

$2,144 |

|

$1,272 |

|

| Non-controlling

interests (note 32) |

$944 |

|

$681 |

|

| Earnings per share data attributable to the equity holders of

Barrick Gold Corporation (note 13) |

|

|

|

|

| Net income |

|

|

|

|

|

Basic |

$1.22 |

|

$0.72 |

|

|

Diluted |

$1.22 |

|

$0.72 |

|

|

|

The notes to these consolidated financial statements, which are

contained in the Fourth Quarter and Year End Report, available on

our website are an integral part of these consolidated financial

statements.

Consolidated Statements of Comprehensive

Income

| Barrick Gold Corporation |

|

|

For the years ended December 31 (in millions of United States

dollars) |

|

2024 |

|

|

2023 |

|

| Net income |

|

$3,088 |

|

$1,953 |

|

| Other comprehensive income (loss), net of

taxes |

|

|

|

|

| Items that may be reclassified subsequently to profit

or loss: |

|

|

|

|

|

Unrealized gains on derivatives designated as cash flow hedges, net

of tax $nil and $nil |

|

1 |

|

|

— |

|

|

Currency translation adjustments, net of tax $nil and $nil |

|

— |

|

|

(3 |

) |

| Items that will not be reclassified to profit or

loss: |

|

|

|

|

|

Actuarial loss on post-employment benefit obligations, net of tax

$nil and $nil |

|

(4 |

) |

|

— |

|

|

Net change in value of equity investments, net of tax $nil and

($2) |

|

12 |

|

|

1 |

|

|

Total other comprehensive income (loss) |

|

9 |

|

|

(2 |

) |

| Total

comprehensive income |

$3,097 |

|

$1,951 |

|

| Attributable to: |

|

|

|

|

| Equity holders of Barrick Gold Corporation |

$2,153 |

|

$1,270 |

|

| Non-controlling

interests |

$944 |

|

$681 |

|

| |

|

|

|

|

The notes to these consolidated financial statements, which are

contained in the Fourth Quarter and Year End Report, available on

our website are an integral part of these consolidated financial

statements.

Consolidated Statements of Cash Flow

| Barrick Gold Corporation |

|

|

For the years ended December 31 (in millions of United States

dollars) |

|

2024 |

|

|

2023 |

|

| OPERATING ACTIVITIES |

|

|

| Net income |

|

$3,088 |

|

|

$1,953 |

|

| Adjustments for the following items: |

|

|

|

Depreciation |

|

1,915 |

|

|

2,043 |

|

|

Finance costs, net (note 14) |

|

232 |

|

|

170 |

|

|

Impairment (reversals) charges (notes 10 and 21) |

|

(457 |

) |

|

312 |

|

|

Income tax expense (note 12) |

|

1,520 |

|

|

861 |

|

|

Income from equity investees (note 16) |

|

(241 |

) |

|

(232 |

) |

|

Loss on currency translation |

|

39 |

|

|

93 |

|

|

Gain on acquisition/sale of non-current assets (note 9) |

|

(24 |

) |

|

(364 |

) |

| Change in working capital (note 15) |

|

(382 |

) |

|

(404 |

) |

| Other operating

activities (note 15) |

|

(280 |

) |

|

(113 |

) |

| Operating cash flows

before interest and income taxes |

|

5,410 |

|

|

4,319 |

|

| Interest paid |

|

(380 |

) |

|

(300 |

) |

| Interest received |

|

237 |

|

|

237 |

|

| Income taxes

paid1 |

|

(776 |

) |

|

(524 |

) |

| Net cash

provided by operating activities |

|

4,491 |

|

|

3,732 |

|

| INVESTING ACTIVITIES |

|

|

| Property, plant and equipment |

|

|

|

Capital expenditures (note 5) |

|

(3,174 |

) |

|

(3,086 |

) |

|

Sales proceeds |

|

19 |

|

|

13 |

|

| Investment (purchases) sales |

|

97 |

|

|

(23 |

) |

| Funding of equity method investments (note 16) |

|

(59 |

) |

|

— |

|

| Dividends received from equity method investments (note

16) |

|

198 |

|

|

273 |

|

| Shareholder loan

repayments from equity method investments (note 16) |

|

155 |

|

|

7 |

|

| Net cash used

in investing activities |

|

(2,764 |

) |

|

(2,816 |

) |

| FINANCING ACTIVITIES |

|

|

| Lease repayments |

|

(14 |

) |

|

(13 |

) |

| Debt repayments |

|

— |

|

|

(43 |

) |

| Dividends (note 31) |

|

(696 |

) |

|

(700 |

) |

| Share buyback program (note 31) |

|

(498 |

) |

|

— |

|

| Funding from non-controlling interests (note 32) |

|

146 |

|

|

40 |

|

| Disbursements to non-controlling interests (note 32) |

|

(785 |

) |

|

(554 |

) |

| Pueblo Viejo JV

partner shareholder loan (note 29) |

|

52 |

|

|

65 |

|

| Net cash used

in financing activities |

|

(1,795 |

) |

|

(1,205 |

) |

| Effect of

exchange rate changes on cash and equivalents |

|

(6 |

) |

|

(3 |

) |

| Net increase (decrease) in cash and equivalents |

|

(74 |

) |

|

(292 |

) |

| Cash and equivalents

at beginning of year (note 25a) |

|

4,148 |

|

|

4,440 |

|

| Cash and

equivalents at the end of year |

|

$4,074 |

|

|

$4,148 |

|

| |

|

|

|

|

|

|

1 Income taxes paid excludes $107 million

(2023: $137 million) of income taxes payable that were settled

against offsetting value added tax (“VAT”) receivables.

The notes to these consolidated financial

statements, which are contained in the Fourth Quarter and Year End

Report, available on our website are an integral part of these

consolidated financial statements.

Consolidated Balance Sheets

| Barrick Gold Corporation |

As at December 31, 2024 |

As at December 31, 2023 |

| (in millions of United

States dollars) |

| ASSETS |

|

|

| Current assets |

|

|

|

Cash and equivalents (note 25a) |

|

$4,074 |

|

|

$4,148 |

|

|

Accounts receivable (note 18) |

|

763 |

|

|

693 |

|

|

Inventories (note 17) |

|

1,942 |

|

|

1,782 |

|

|

Other current assets (note 18) |

|

853 |

|

|

815 |

|

| Total current assets |

|

7,632 |

|

|

7,438 |

|

| Non-current assets |

|

|

|

Non-current portion of inventory (note 17) |

|

2,783 |

|

|

2,738 |

|

|

Equity in investees (note 16) |

|

4,112 |

|

|

4,133 |

|

|

Property, plant and equipment (note 19) |

|

28,559 |

|

|

26,416 |

|

|

Intangible assets (note 20a) |

|

148 |

|

|

149 |

|

|

Goodwill (note 20b) |

|

3,097 |

|

|

3,581 |

|

|

Other assets (note 22) |

|

1,295 |

|

|

1,356 |

|

| Total

assets |

|

$47,626 |

|

|

$45,811 |

|

| LIABILITIES AND EQUITY |

|

|

| Current liabilities |

|

|

|

Accounts payable (note 23) |

|

$1,613 |

|

|

$1,503 |

|

|

Debt (note 25b) |

|

24 |

|

|

11 |

|

|

Current income tax liabilities |

|

545 |

|

|

303 |

|

|

Other current liabilities (note 24) |

|

460 |

|

|

539 |

|

| Total current

liabilities |

|

2,642 |

|

|

2,356 |

|

| Non-current liabilities |

|

|

|

Debt (note 25b) |

|

4,705 |

|

|

4,715 |

|

|

Provisions (note 27) |

|

1,962 |

|

|

2,058 |

|

|

Deferred income tax liabilities (note 30) |

|

3,887 |

|

|

3,439 |

|

|

Other liabilities (note 29) |

|

1,174 |

|

|