Granite Point Mortgage Trust Inc. Announces Third Quarter 2024 Common and Preferred Stock Dividends and Business Update

September 20 2024 - 3:33PM

Business Wire

Granite Point Mortgage Trust Inc. (NYSE: GPMT) (“GPMT,” “Granite

Point” or the “Company”) today announced that the Company’s Board

of Directors declared a quarterly cash dividend of $0.05 per share

of common stock for the third quarter of 2024. This dividend is

payable on October 15, 2024, to holders of record of common stock

at the close of business on October 1, 2024.

The Company’s Board of Directors also declared a quarterly cash

dividend of $0.4375 per share of the 7.00% Series A

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock for

the third quarter of 2024. This dividend is payable on October 15,

2024, to the holders of record of the Series A Preferred Stock at

the close of business on October 1, 2024.

“We are pleased to report continued progress addressing our

nonearning assets having resolved three nonaccrual loans during the

third quarter totaling over $120 million in principal balance,”

said Jack Taylor, President and Chief Executive Officer of Granite

Point. “We anticipate resolving additional nonperforming loans

through the remainder of the year, as the real estate markets

continue their bottoming process, and the volume of transactions

improves. While we continue to actively asset manage our portfolio

and emphasize higher liquidity, we also have remained opportunistic

with respect to driving economic returns for our shareholders. As

such, we repurchased 0.7 million common shares during the quarter

generating book value accretion. To provide us with additional

flexibility to actively manage our capital over time, our Board has

increased our buyback authorization by an additional 3 million

common shares.”

Third Quarter Business Update

- In September, the Company resolved a $33 million loan secured

by a multifamily property located in Chicago, IL. The loan was

previously risk-rated “5” and was on nonaccrual status. As a result

of this transaction, the Company expects to realize a write-off of

approximately $(4) million, which had been reserved for through a

previously recorded allowance for credit losses.

- In July, the Company modified a $51 million loan secured by a

mixed-use multifamily, event space and office property located in

Pittsburgh, PA. The loan was previously risk-rated “5” and was on

nonaccrual status. As a result of the modification, the Company

expects to realize a write-off of approximately $(19) million,

which had been reserved for through a previously recorded allowance

for credit losses.

- In July, the Company resolved a $37 million loan secured by a

mixed-use office and retail asset located in Los Angeles, CA. The

loan was previously risk-rated “5” and was on nonaccrual status. As

a result of this transaction, the Company expects to realize a

write-off of approximately $(22) million, which had been reserved

for through a previously recorded allowance for credit losses.

- During the quarter, the Company funded approximately $10

million on existing loan commitments and realized about $190

million in principal repayments and paydowns, excluding the

nonaccrual loan resolutions referenced above.

- A mixed-use office and retail property located in New York, NY,

securing the Company’s $94 million senior loan, is currently under

contract to be sold. The loan was previously risk-rated “5” and was

on nonaccrual status. The potential transaction is expected to

close during the fourth quarter of 2024.

- During the quarter, the Company repurchased 0.7 million shares

of its common stock at an average price of $2.73 per share for a

total of approximately $2 million. Consistent with its flexible

capital return strategy and the goal of supporting long-term

shareholder value, since June of 2021, the Company has repurchased

approximately 6.1 million common shares representing approximately

11% of its common shares outstanding.

- Granite Point today announced that its Board of Directors has

authorized the Company to repurchase up to an additional 3 million

shares of its common stock, which increased the number of shares

available for repurchase to 5.9 million, including the shares

remaining under the prior authorization. The shares are expected to

be repurchased from time to time through privately negotiated

transactions or open market transactions, including pursuant to a

trading plan in accordance with Rules 10b5-1 and 10b-18 under the

Securities Exchange Act of 1934, as amended, or by any combination

of such methods. The manner, price, number and timing of share

repurchases will be subject to a variety of factors, including

market conditions and applicable U.S. Securities and Exchange

Commission rules.

- As of September 20th, the Company carried approximately $110

million in unrestricted cash and about $54 million in unlevered REO

assets.

About Granite Point Mortgage Trust Inc. Granite Point

Mortgage Trust Inc. is a Maryland corporation focused on directly

originating, investing in and managing senior floating-rate

commercial mortgage loans and other debt and debt-like commercial

real estate investments. Granite Point is headquartered in New

York, NY. Additional information is available at

www.gpmtreit.com.

Forward-Looking Statements This press release contains,

or incorporates by reference, not only historical information, but

also forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements are not historical in nature and can be identified by

words such as “anticipate,” “estimate,” “will,” “should,” “expect,”

“target,” “believe,” “outlook,” “potential,” “continue,” “intend,”

“seek,” “plan,” “goals,” “future,” “likely,” “may” and similar

expressions or their negative forms, or by references to strategy,

plans or intentions. The illustrative examples herein are

forward-looking statements. Our expectations, beliefs and estimates

are expressed in good faith, and we believe there is a reasonable

basis for them. However, there can be no assurance that

management's expectations, beliefs and estimates will prove to be

correct or be achieved, and actual results may vary materially from

what is expressed in or indicated by the forward-looking

statements.

These forward-looking statements are subject to risks and

uncertainties, including, among other things, those described in

our Annual Report on Form 10-K for the year ended December 31,

2023, under the caption “Risk Factors,” and our subsequent filings

made with the SEC. Forward-looking statements speak only as of the

date they are made, and we undertake no obligation to update or

revise any such forward-looking statements, whether as a result of

new information, future events or otherwise.

Additional Information Stockholders of Granite Point and

other interested persons may find additional information regarding

the Company at the Securities and Exchange Commission’s Internet

site at www.sec.gov or by directing requests to: Granite Point

Mortgage Trust Inc., 3 Bryant Park, 24th floor, New York, NY 10036,

telephone (212) 364-5500.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240920243412/en/

Investors: Chris Petta, Investor Relations, Granite Point

Mortgage Trust Inc., (212) 364-5500, investors@gpmtreit.com

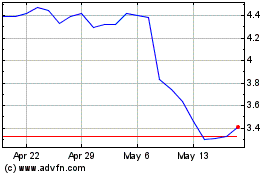

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

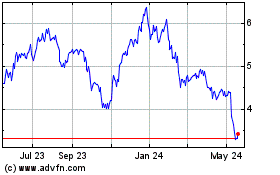

Granite Point Mortgage (NYSE:GPMT)

Historical Stock Chart

From Dec 2023 to Dec 2024