false000159327500015932752024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 7, 2024

Date of Report (date of earliest event reported)

___________________________________

Hamilton Insurance Group, Ltd.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Bermuda (State or other jurisdiction of incorporation or organization) | 001-41862 (Commission File Number) | 98-1153847 (I.R.S. Employer Identification Number) |

Wellesley House North, 1st Floor 90 Pitts Bay Road Pembroke, Bermuda HM 08 |

(Address of principal executive offices and zip code) |

(441) 405-5200 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Class B common shares, par value $0.01 per share | | HG | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act. Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 – Results of Operations and Financial Condition

On August 7, 2024, Hamilton Insurance Group, Ltd. (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2024 and the availability of its corresponding supplementary financial information. Copies of this press release and the supplementary financial information are furnished as Exhibits 99.1 and 99.2, respectively, to this report. In addition, a copy of our investor presentation which may be referred to during our earnings call is furnished as Exhibit 99.3.

As provided in General Instruction B.2 of Form 8-K, the information and exhibits in this report are being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, nor shall they be deemed to be incorporated by reference into any filing or other document under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing or document.

Item 9.01 - Financial Statements and Exhibits

(d):The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 7, 2024.

| | | | | | | | |

| HAMILTON INSURANCE GROUP, LTD. |

| | |

| By: | /s/ Brian Deegan |

| Name: | Brian Deegan |

| Title: | Group Chief Accounting Officer |

Hamilton Reports 2024 Second Quarter Results

Net Income of $131 million; Seven Consecutive Quarters of Underwriting Income

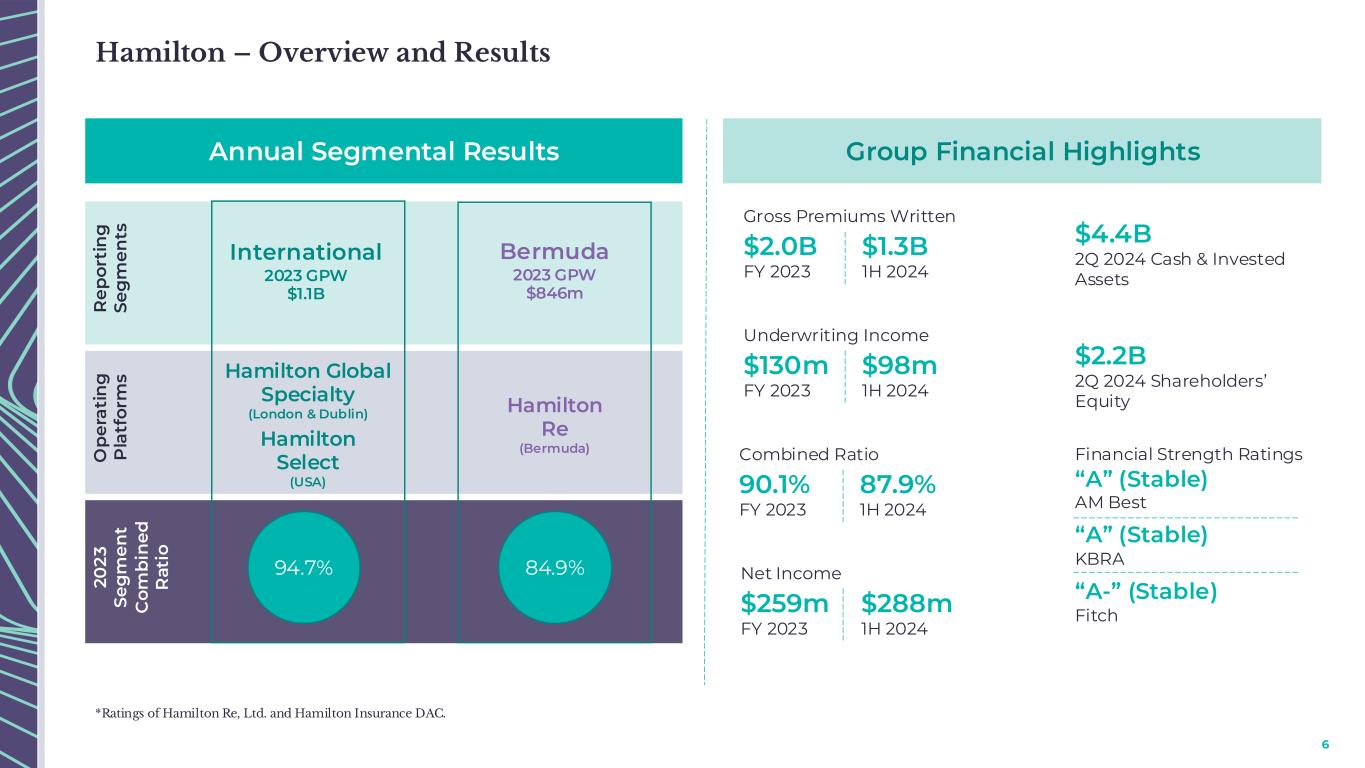

PEMBROKE, Bermuda, August 7, 2024 – Hamilton Insurance Group, Ltd. (NYSE: HG; “Hamilton” or “the Company”) today announced financial results for the second quarter ended June 30, 2024.

Commenting on the financial results, Pina Albo, CEO of Hamilton, said:

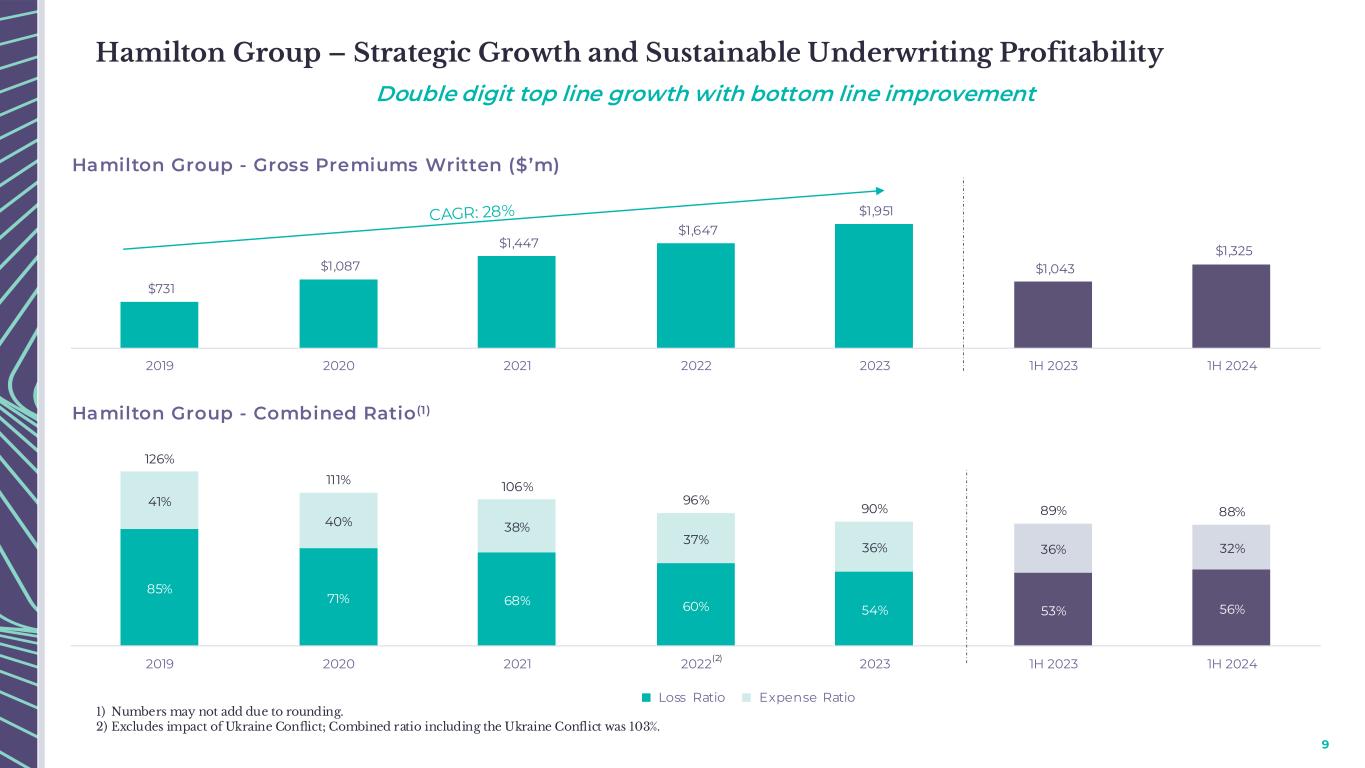

“This was an outstanding quarter for Hamilton by any metric. We reported $131.1 million of net income, equating to an annualized return on average equity of 23.6%. We recorded an all-time low combined ratio of 84.4%, had strong net investment income of $95.7 million, and continued our targeted growth in this favorable market environment.

I am exceptionally proud of the Hamilton team for remaining laser focused on underwriting profitability and strategic growth, as well as realizing the objectives we shared with investors in the context of our IPO in November of last year.”

Consolidated Highlights – Second Quarter

•Net income of $131.1 million, or $1.20 per diluted share;

•Annualized return on average equity of 23.6%;

•Gross premiums written of $603.3 million, an increase of 19.5% compared to the second quarter of 2023;

•Net premiums earned of $418.8 million, an increase of 26.3% compared to the second quarter of 2023;

•Combined ratio of 84.4%;

•Underwriting income of $65.3 million;

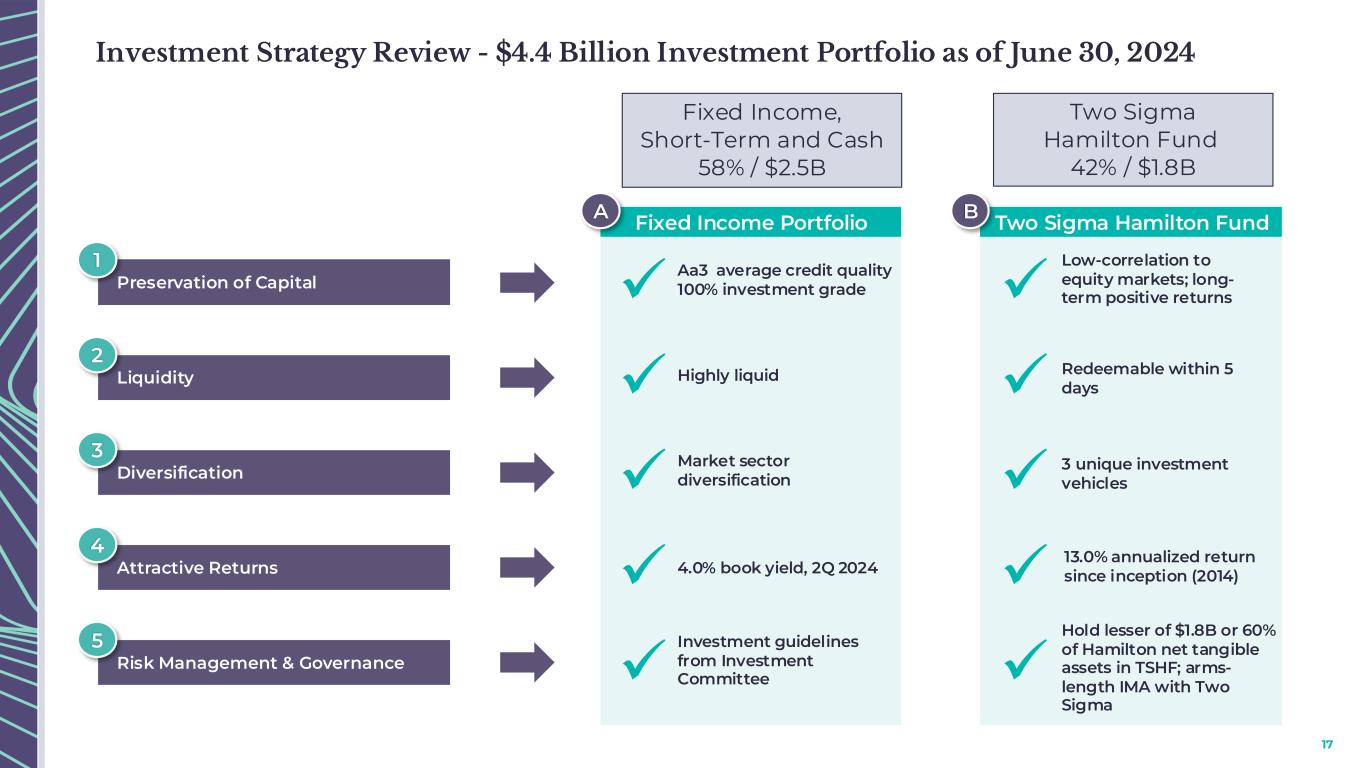

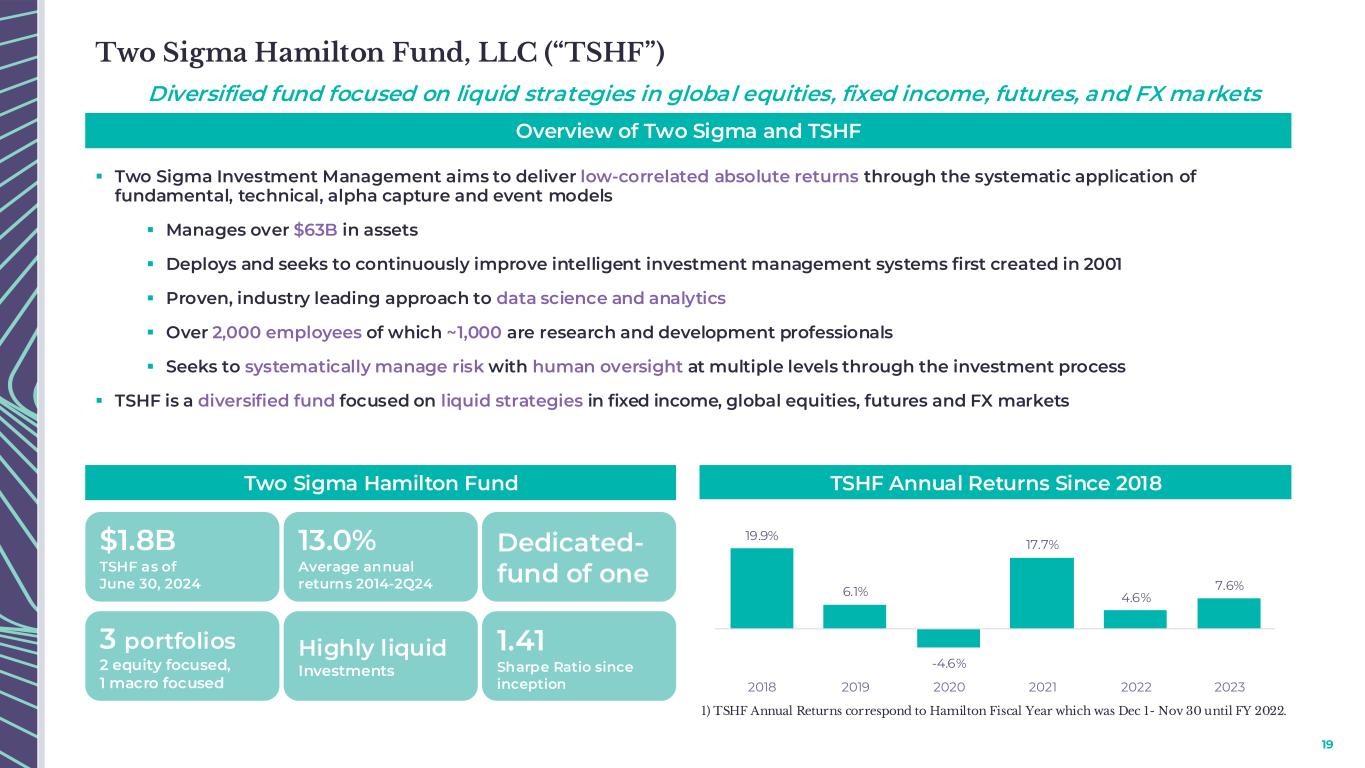

•Net investment income of $95.7 million, comprised of Two Sigma Hamilton Fund returns of $75.9 million, and fixed income, short term, cash and cash equivalent returns of $19.8 million;

•Corporate expenses of $16.3 million, which includes $2.5 million of compensation costs related to the Value Appreciation Pool; and

•On May 8, 2024, the Company entered into an agreement to repurchase 9,124,729 Class A common shares at $12.00 per share. The total purchase price was $109.5 million.

Consolidated Highlights – Year to Date

•Net income of $288.3 million;

•Annualized return on average equity of 26.9%;

•Gross premiums written of $1,325.2 million, an increase of 27.0% compared to the same period in 2023;

•Net premiums earned of $804.1 million, an increase of 30.7% compared to the same period in 2023;

•Combined ratio of 87.9%;

•Underwriting income of $97.8 million;

•Net investment income of $243.5 million comprised of Two Sigma Hamilton Fund returns of $218.5 million, and fixed income, short term and cash and cash equivalents returns of $25.0 million;

•Corporate expenses of $27.8 million, which includes $6.2 million of compensation costs related to the Value Appreciation Pool; and

•Book value per share of $21.96, an increase of 18.2% compared to December 31, 2023.

Consolidated Underwriting Results – Second Quarter

| | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | | | | |

| ($ in thousands, except for per share amounts and percentages) | June 30, 2024 | | June 30, 2023 | | Change | | | | | |

| Gross premiums written | $ | 603,304 | | $ | 504,960 | | $ | 98,344 | | | | | |

| Net premiums written | 475,068 | | 384,708 | | 90,360 | | | | | |

| Net premiums earned | 418,764 | | 331,460 | | 87,304 | | | | | |

| Underwriting income (loss) | $ | 65,299 | | $ | 34,894 | | $ | 30,405 | | | | | |

| Combined ratio | 84.4% | | 89.5% | | (5.1 pts) | | | | | |

| | | | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | 131,085 | | $ | 36,787 | | $ | 94,298 | | | | | |

| Income (loss) per share attributable to common shareholders - diluted | $ | 1.20 | | $ | 0.35 | | | | | | | |

| Book value per common share | $ | 21.96 | | $ | 16.90 | | | | | | | |

| Change in book value per common share | 10.4% | | 2.1% | | | | | | | |

| | | | | | | | | | |

| Return on average common equity - annualized | 23.6% | | 8.5% | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | |

| Key Ratios | June 30, 2024 | | June 30, 2023 | | Change | | |

| Attritional loss ratio - current year | 51.6 | % | | 51.0 | % | | 0.6 | pts | | |

| Attritional loss ratio - prior year | (0.4 | %) | | (1.6 | %) | | 1.2 | pts | | |

| Catastrophe loss ratio - current year | 0.0 | % | | 5.0 | % | | (5.0 | pts) | | |

| Catastrophe loss ratio - prior year | 0.0 | % | | (0.3 | %) | | 0.3 | pts | | |

| Loss and loss adjustment expense ratio | 51.2 | % | | 54.1 | % | | (2.9 | pts) | | |

| Acquisition cost ratio | 23.0 | % | | 23.2 | % | | (0.2 | pts) | | |

| Other underwriting expense ratio | 10.2 | % | | 12.2 | % | | (2.0 | pts) | | |

| Combined ratio | 84.4 | % | | 89.5 | % | | (5.1 | pts) | | |

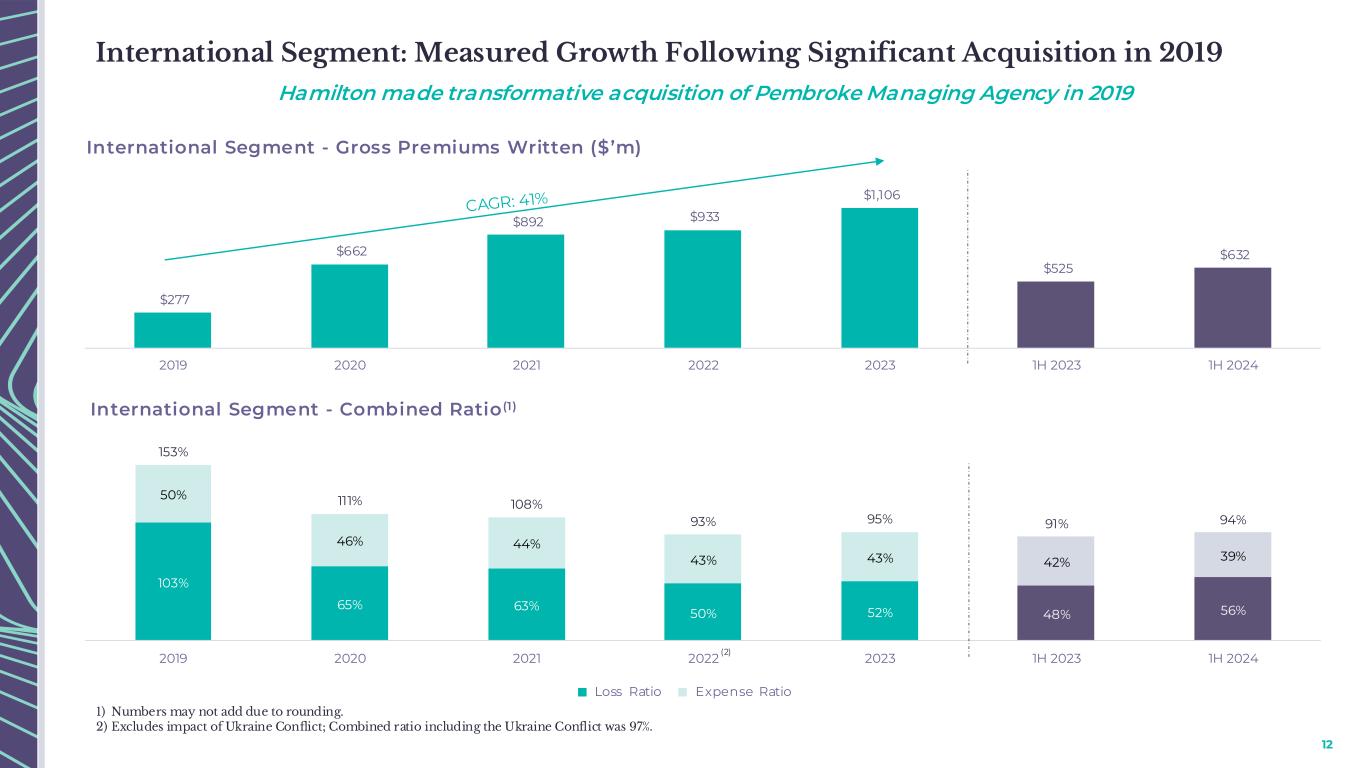

•Gross premiums written increased by $98.3 million, or 19.5%, to $603.3 million with an increase of $33.8 million, or 12.2%, in the International Segment, and $64.5 million, or 28.4%, in the Bermuda Segment.

•Net premiums written increased by $90.4 million, or 23.5%, to $475.1 million with an increase of $37.3 million, or 18.9%, in the International Segment, and $53.1 million, or 28.3%, in the Bermuda Segment.

•Net premiums earned increased by $87.3 million, or 26.3%, to $418.8 million with an increase of $39.0 million, or 22.1%, in the International Segment, and $48.3 million, or 31.2%, in the Bermuda Segment.

•Net favorable attritional prior year reserve development, net of reinsurance, was $1.6 million, primarily driven by favorable development in property classes in both our International and Bermuda segments.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio decreased by 0.2 points compared to the same period in 2023.

•The other underwriting expense ratio decreased 2.0 points compared to the same period in 2023, primarily driven by an increase in net premiums earned and increased third party fee income, which offsets the other underwriting expense ratio.

International Segment Underwriting Results – Second Quarter

| | | | | | | | | | | | | | | | | | | | | | | |

| International Segment | For the Three Months Ended | | | | | | |

| ($ in thousands, except for percentages) | June 30, 2024 | | June 30, 2023 | | Change | | | | | | |

| Gross premiums written | $ | 311,616 | | $ | 277,796 | | $ | 33,820 | | | | | | |

| Net premiums written | 234,305 | | 197,047 | | 37,258 | | | | | | |

| Net premiums earned | 215,643 | | 176,636 | | 39,007 | | | | | | |

| Underwriting income (loss) | $ | 19,428 | | $ | 14,662 | | $ | 4,766 | | | | | | |

| | | | | | | | | | | |

| Key Ratios | | | | | | | | | | | |

| Attritional loss ratio - current year | 52.5 | % | | 52.9 | % | | (0.4 | pts) | | | | | | |

| Attritional loss ratio - prior year | (0.2 | %) | | (3.3 | %) | | 3.1 | pts | | | | | | |

| Catastrophe loss ratio - current year | 0.0 | % | | 0.9 | % | | (0.9 | pts) | | | | | | |

| Catastrophe loss ratio - prior year | 0.0 | % | | (0.9 | %) | | 0.9 | pts | | | | | | |

| Loss and loss adjustment expense ratio | 52.3 | % | | 49.6 | % | | 2.7 | pts | | | | | | |

| Acquisition cost ratio | 24.7 | % | | 26.8 | % | | (2.1 | pts) | | | | | | |

| Other underwriting expense ratio | 14.0 | % | | 15.4 | % | | (1.4 | pts) | | | | | | |

| Combined ratio | 91.0 | % | | 91.8 | % | | (0.8 | pts) | | | | | | |

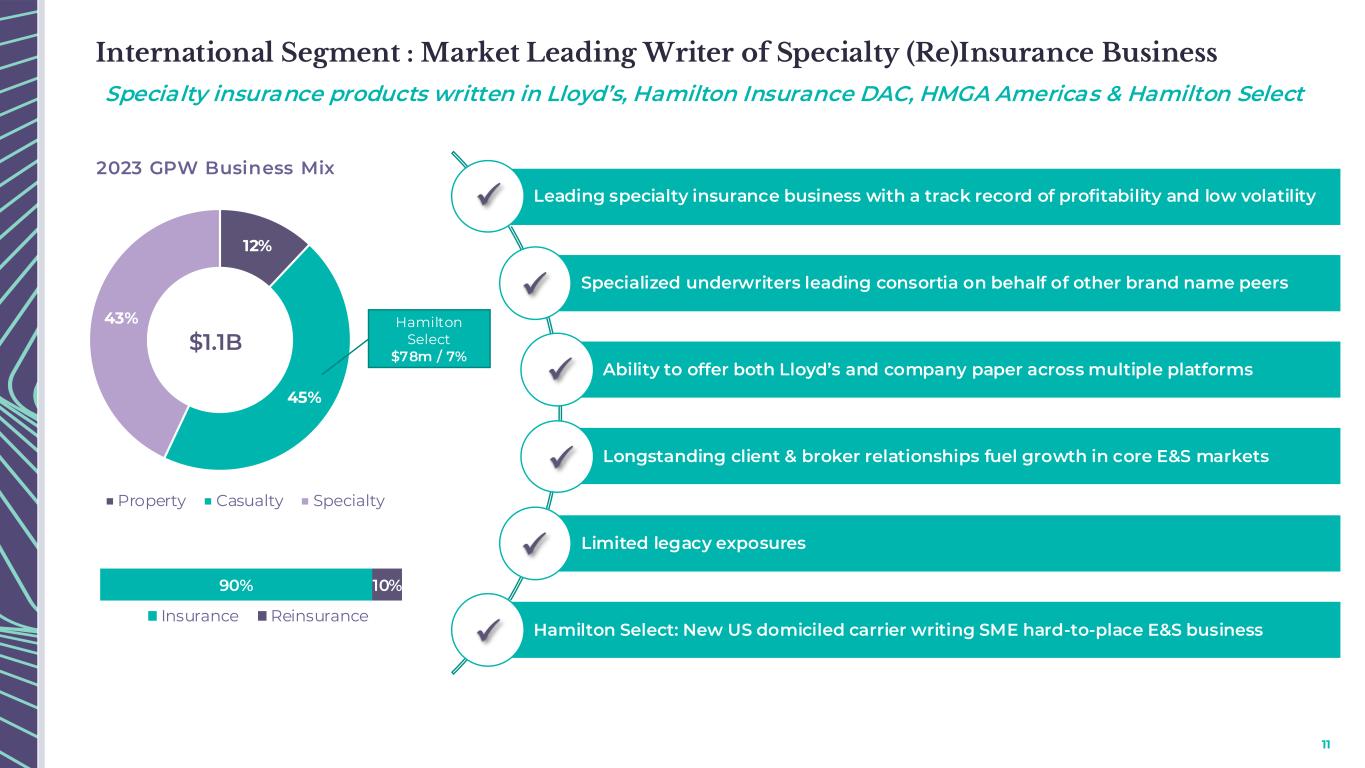

•Gross premiums written increased by $33.8 million, or 12.2%, to $311.6 million, primarily driven by growth, improved pricing and new business in specialty, casualty and property insurance classes.

•Net favorable attritional prior year reserve development, net of reinsurance, was $0.5 million.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio decreased by 2.1 points compared to the same period in 2023, primarily driven by a change in the business mix.

•The other underwriting expense ratio decreased by 1.4 points compared to the same period in 2023, primarily driven by an increase in net premiums earned.

Bermuda Segment Underwriting Results – Second Quarter

| | | | | | | | | | | | | | | | | | | | | |

| Bermuda Segment | For the Three Months Ended | | | | |

| ($ in thousands, except for percentages) | June 30, 2024 | | June 30, 2023 | | Change | | | | |

| Gross premiums written | $ | 291,688 | | $ | 227,164 | | $ | 64,524 | | | | |

| Net premiums written | 240,763 | | 187,661 | | 53,102 | | | | |

| Net premiums earned | 203,121 | | 154,824 | | 48,297 | | | | |

| Underwriting income (loss) | $ | 45,871 | | $ | 20,232 | | $ | 25,639 | | | | |

| | | | | | | | | |

| Key Ratios | | | | | | | | | |

| Attritional loss ratio - current year | 50.5 | % | | 48.9 | % | | 1.6 | pts | | | | |

| Attritional loss ratio - prior year | (0.5 | %) | | 0.3 | % | | (0.8 | pts) | | | | |

| Catastrophe loss ratio - current year | 0.0 | % | | 9.8 | % | | (9.8 | pts) | | | | |

| Catastrophe loss ratio - prior year | 0.0 | % | | 0.3 | % | | (0.3 | pts) | | | | |

| Loss and loss adjustment expense ratio | 50.0 | % | | 59.3 | % | | (9.3 | pts) | | | | |

| Acquisition cost ratio | 21.2 | % | | 19.1 | % | | 2.1 | pts | | | | |

| Other underwriting expense ratio | 6.2 | % | | 8.5 | % | | (2.3 | pts) | | | | |

| Combined ratio | 77.4 | % | | 86.9 | % | | (9.5 | pts) | | | | |

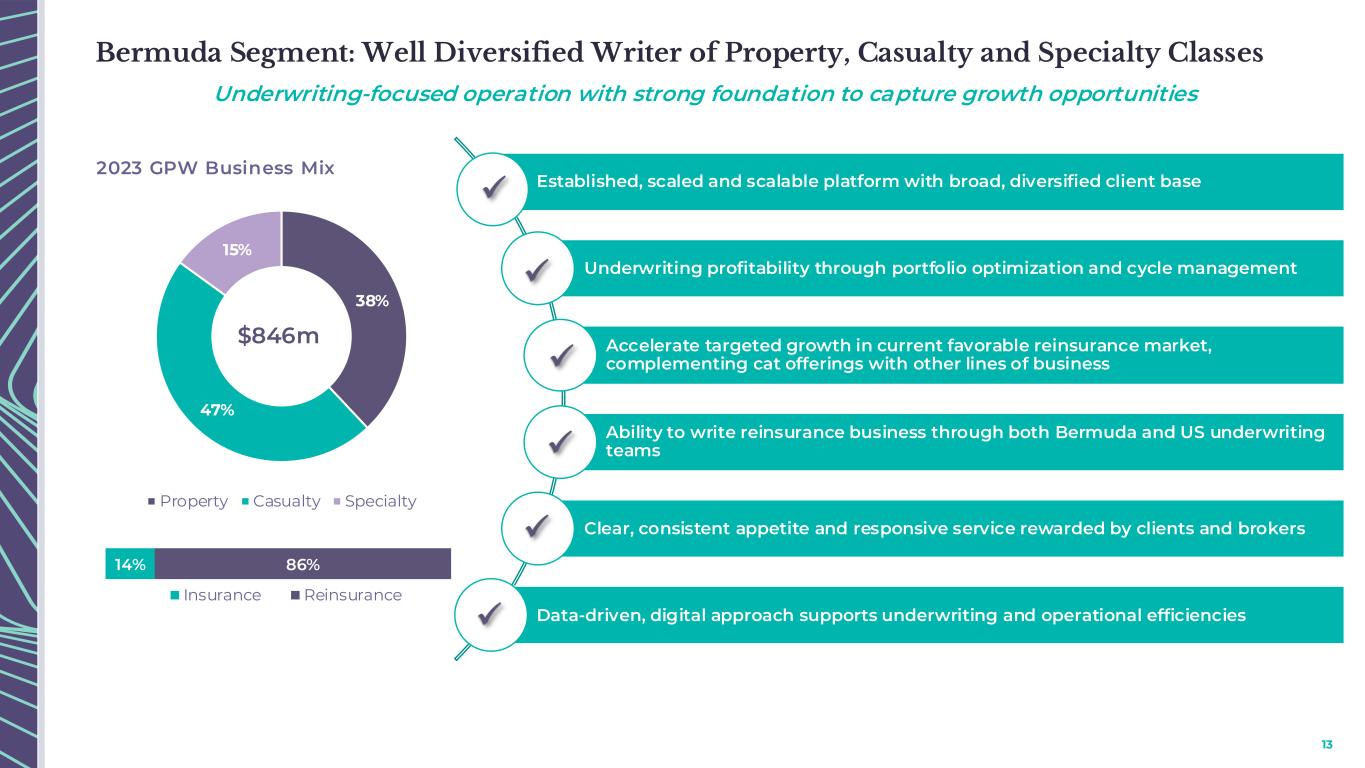

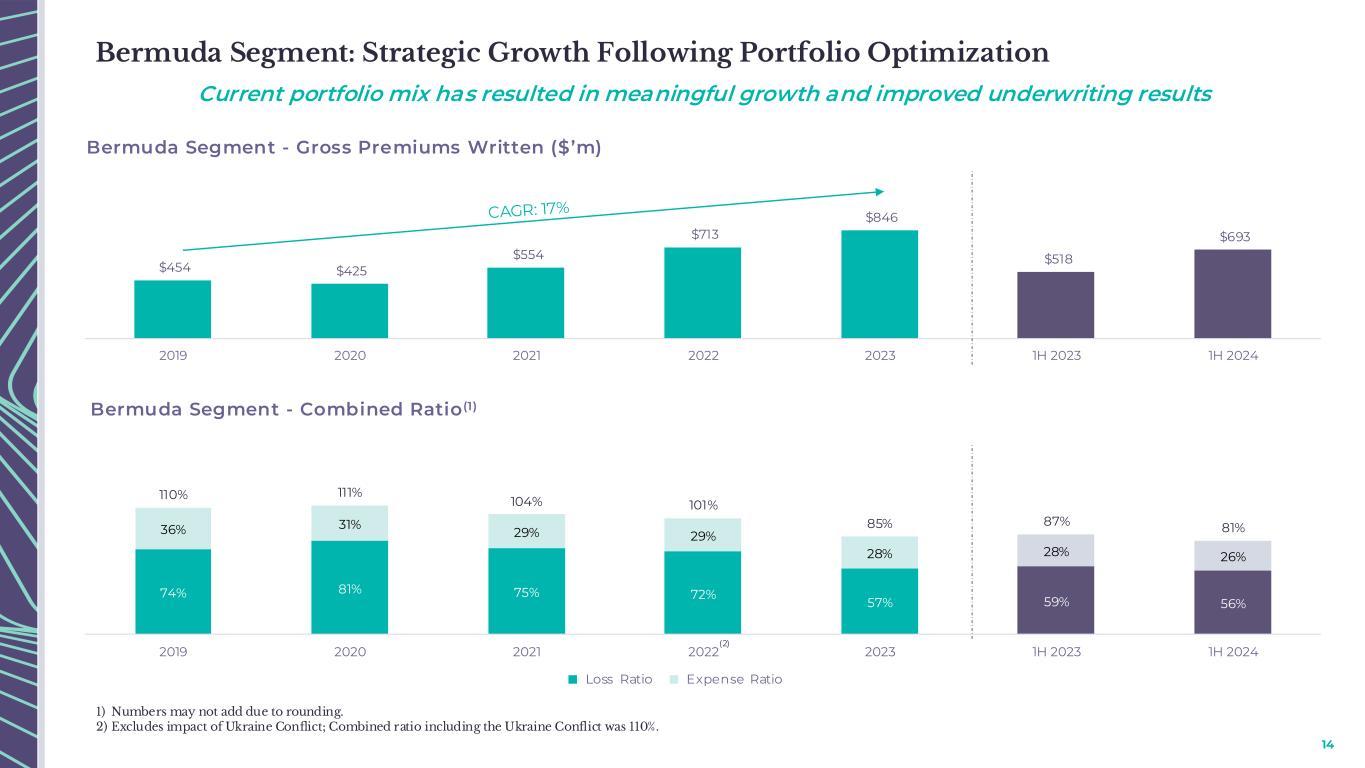

•Gross premiums written increased by $64.5 million, or 28.4%, to $291.7 million, primarily driven by new business, increased participations and a strong rate environment in both our casualty reinsurance and property reinsurance classes.

•Net favorable attritional prior year reserve development, net of reinsurance, was $1.1 million, primarily driven by modest favorable development across property and specialty classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio increased by 2.1 points compared to the same period in 2023, primarily driven by a change in the mix of business.

•The other underwriting expense ratio decreased by 2.3 points compared to the same period in 2023. The decrease was primarily driven by an increase in net premiums earned and by performance based management fees generated by our third party capital manager, which offsets the other underwriting expense ratio.

Consolidated Underwriting Results – Year to Date

| | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended | | | | | |

| ($ in thousands, except for per share amounts and percentages) | June 30, 2024 | | June 30, 2023 | | Change | | | | | |

| Gross premiums written | $ | 1,325,245 | | $ | 1,043,124 | | $ | 282,121 | | | | | |

| Net premiums written | 989,948 | | 733,206 | | 256,742 | | | | | |

| Net premiums earned | 804,067 | | 615,362 | | 188,705 | | | | | |

| Underwriting income (loss) | $ | 97,825 | | $ | 68,956 | | $ | 28,869 | | | | | |

| Combined ratio | 87.9% | | 88.8% | | (0.9%) | | | | | |

| | | | | | | | | | |

| Net income (loss) attributable to common shareholders | $ | 288,259 | | $ | 88,279 | | $ | 199,980 | | | | | |

| Income (loss) per share attributable to common shareholders - diluted | $ | 2.57 | | $ | 0.84 | | | | | | | |

| Book value per common share | $ | 21.96 | | $ | 16.90 | | | | | | | |

| Change in book value per share | 18.2% | | 4.7% | | | | | | | |

| | | | | | | | | | |

| Return on average common equity - annualized | 26.9% | | 10.3% | | | | | | | |

| | | | | | | | | | | | | | | | | |

| For the Six Months Ended |

| Key Ratios | June 30, 2024 | | June 30, 2023 | | Change |

| Attritional loss ratio - current year | 54.3 | % | | 50.1 | % | | 4.2 | % |

| Attritional loss ratio - prior year | 1.3 | % | | (0.6 | %) | | 1.9 | % |

| Catastrophe loss ratio - current year | 0.0 | % | | 3.6 | % | | (3.6 | %) |

| Catastrophe loss ratio - prior year | 0.0 | % | | 0.2 | % | | (0.2 | %) |

| Loss and loss adjustment expense ratio | 55.6 | % | | 53.3 | % | | 2.3 | % |

| Acquisition cost ratio | 22.5 | % | | 23.1 | % | | (0.6 | %) |

| Other underwriting expense ratio | 9.8 | % | | 12.4 | % | | (2.6 | %) |

| Combined ratio | 87.9 | % | | 88.8 | % | | (0.9 | %) |

•Gross premiums written increased by $282.1 million, or 27.0%, to $1,325.2 million, with an increase of $107.5 million, or 20.5%, in the International Segment, and $174.6 million, or 33.7%, in the Bermuda Segment.

•Net premiums written increased by $256.7 million, or 35.0%, to $989.9 million, with an increase of $100.3 million, or 31.4%, in the International Segment, and $156.5 million, or 37.8%, in the Bermuda Segment.

•Net premiums earned increased by $188.7 million, or 30.7%, to $804.1 million, with an increase of $86.3 million, or 26.5%, in the International Segment, and $102.4 million, or 35.4%, in the Bermuda Segment.

•The attritional loss ratio (current year), net of reinsurance, was 54.3%. The increase of 4.2 points compared to the same period in 2023 was primarily driven by losses of $37.9 million, or 4.7 points, arising from the Francis Scott Key Baltimore Bridge collapse.

•Net unfavorable attritional prior year reserve development, net of reinsurance, was $10.3 million, primarily driven by two specific large losses on our specialty insurance and reinsurance classes, partially offset by favorable development in our International property insurance and reinsurance classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $0.2 million.

•The acquisition cost ratio decreased by 0.6 points compared to the same period in 2023.

•The other underwriting expense ratio decreased 2.6 points compared to the same period in 2023, primarily driven by an increase in net premiums earned and increased third party fee income, which offsets the other underwriting expense ratio.

International Segment Underwriting Results – Year to Date

| | | | | | | | | | | | | | | | | | | | | | | |

| International Segment | For the Six Months Ended | | | | | | |

| ($ in thousands, except for percentages) | June 30, 2024 | | June 30, 2023 | | Change | | | | | | |

| Gross premiums written | $ | 632,457 | | $ | 524,909 | | $ | 107,548 | | | | | | |

| Net premiums written | 419,338 | | 319,067 | | 100,271 | | | | | | |

| Net premiums earned | 412,456 | | 326,151 | | 86,305 | | | | | | |

| Underwriting income (loss) | $ | 24,747 | | $ | 31,032 | | $ | (6,285) | | | | | | |

| | | | | | | | | | | |

| Key Ratios | | | | | | | | | | | |

| Attritional loss ratio - current year | 54.2 | % | | 51.6 | % | | 2.6 | % | | | | | | |

| Attritional loss ratio - prior year | 1.3 | % | | (3.8 | %) | | 5.1 | % | | | | | | |

| Catastrophe loss ratio - current year | 0.0 | % | | 0.4 | % | | (0.4 | %) | | | | | | |

| Catastrophe loss ratio - prior year | 0.0 | % | | 0.2 | % | | (0.2 | %) | | | | | | |

| Loss and loss adjustment expense ratio | 55.5 | % | | 48.4 | % | | 7.1 | % | | | | | | |

| Acquisition cost ratio | 24.5 | % | | 25.9 | % | | (1.4 | %) | | | | | | |

| Other underwriting expense ratio | 14.0 | % | | 16.2 | % | | (2.2 | %) | | | | | | |

| Combined ratio | 94.0 | % | | 90.5 | % | | 3.5 | % | | | | | | |

•Gross premiums written increased by $107.5 million, or 20.5%, to $632.5 million, primarily driven by growth, improved pricing and new business in casualty insurance, specialty insurance and reinsurance and property insurance classes.

•The attritional loss ratio (current year), net of reinsurance, was 54.2%. The increase of 2.6 points compared to the same period in 2023 was primarily driven by losses of $11.8 million, or 2.9 points, arising from the Baltimore Bridge collapse.

•Net unfavorable attritional prior year reserve development was $5.3 million, primarily driven by two specific large losses on our specialty insurance class, partially offset by favorable development in our property classes.

•Catastrophe losses (current and prior year), net of reinsurance, were $0.2 million.

•The acquisition cost ratio decreased by 1.4 points compared to the same period in 2023.

•The other underwriting expense ratio decreased by 2.2 points compared to the same period in 2023, primarily driven by an increase in net premiums earned.

Bermuda Segment Underwriting Results – Year to Date

| | | | | | | | | | | | | | | | | | | | | |

| Bermuda Segment | For the Six Months Ended | | | | |

| ($ in thousands, except for percentages) | June 30, 2024 | | June 30, 2023 | | Change | | | | |

| Gross premiums written | $ | 692,788 | | $ | 518,215 | | $ | 174,573 | | | | |

| Net premiums written | 570,610 | | 414,139 | | 156,471 | | | | |

| Net premiums earned | 391,611 | | 289,211 | | 102,400 | | | | |

| Underwriting income (loss) | $ | 73,078 | | $ | 37,924 | | $ | 35,154 | | | | |

| | | | | | | | | |

| Key Ratios | | | | | | | | | |

| Attritional loss ratio - current year | 54.3 | % | | 48.5 | % | | 5.8 | % | | | | |

| Attritional loss ratio - prior year | 1.3 | % | | 3.0 | % | | (1.7 | %) | | | | |

| Catastrophe loss ratio - current year | 0.0 | % | | 7.1 | % | | (7.1 | %) | | | | |

| Catastrophe loss ratio - prior year | 0.0 | % | | 0.2 | % | | (0.2 | %) | | | | |

| Loss and loss adjustment expense ratio | 55.6 | % | | 58.8 | % | | (3.2 | %) | | | | |

| Acquisition cost ratio | 20.4 | % | | 19.9 | % | | 0.5 | % | | | | |

| Other underwriting expense ratio | 5.3 | % | | 8.2 | % | | (2.9 | %) | | | | |

| Combined ratio | 81.3 | % | | 86.9 | % | | (5.6 | %) | | | | |

•Gross premiums written increased by $174.6 million, or 33.7%, to $692.8 million, primarily driven by new business, expanded participations and rate increases in property and casualty reinsurance classes.

•The attritional loss ratio (current year), net of reinsurance, was 54.3%. The increase of 5.8 points compared to the same period in 2023 was primarily driven by losses of $26.1 million, or 6.7 points, arising from the Baltimore Bridge collapse.

•Net unfavorable attritional prior year reserve development, net of reinsurance, was $5.1 million, primarily driven by modest unfavorable development across a variety of casualty reinsurance classes and unfavorable development in specialty reinsurance classes relating to one specific large loss.

•Catastrophe losses (current and prior year), net of reinsurance, were $Nil.

•The acquisition cost ratio increased by 0.5 points compared to the same period in 2023.

•The other underwriting expense ratio decreased by 2.9 points compared to the same period in 2023. The decrease was primarily driven by an increase in net premiums earned and by performance based management fees generated by our third party capital manager, which offsets the other underwriting expense ratio.

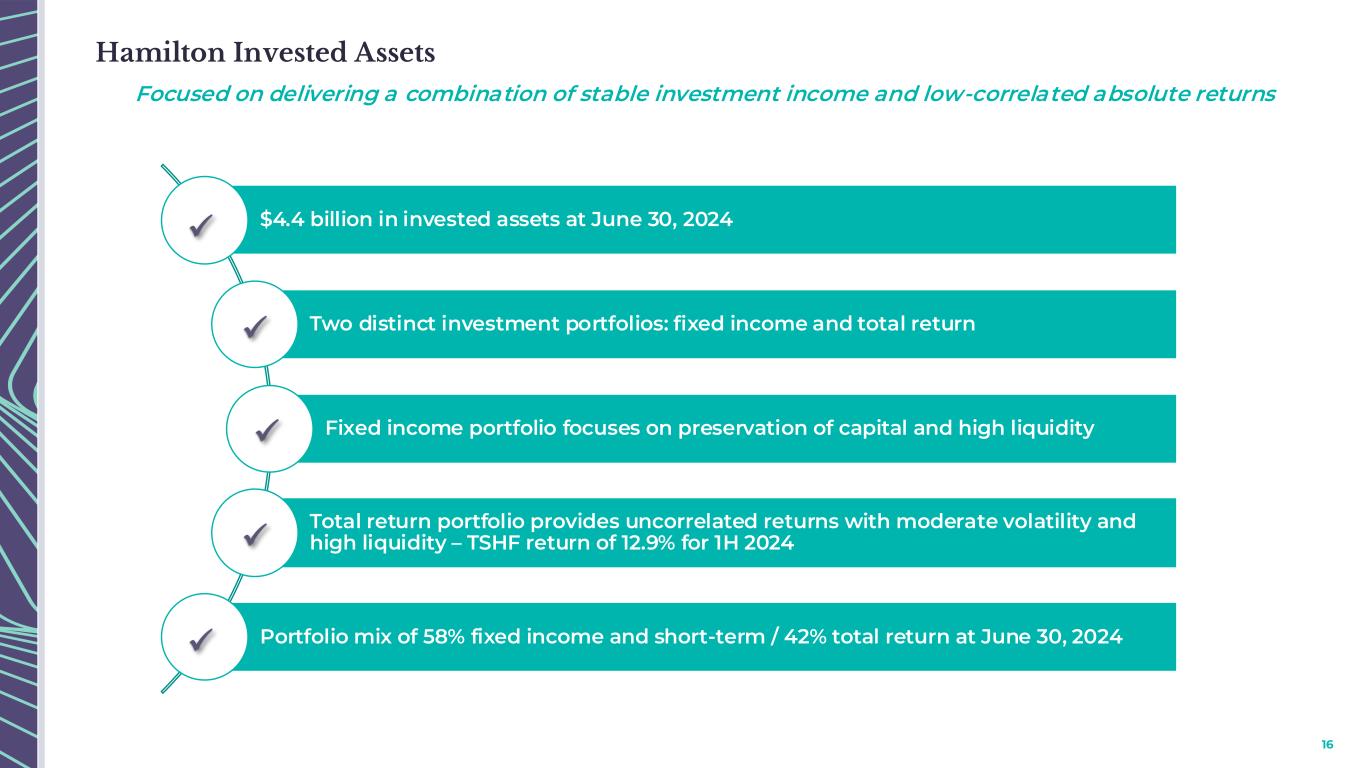

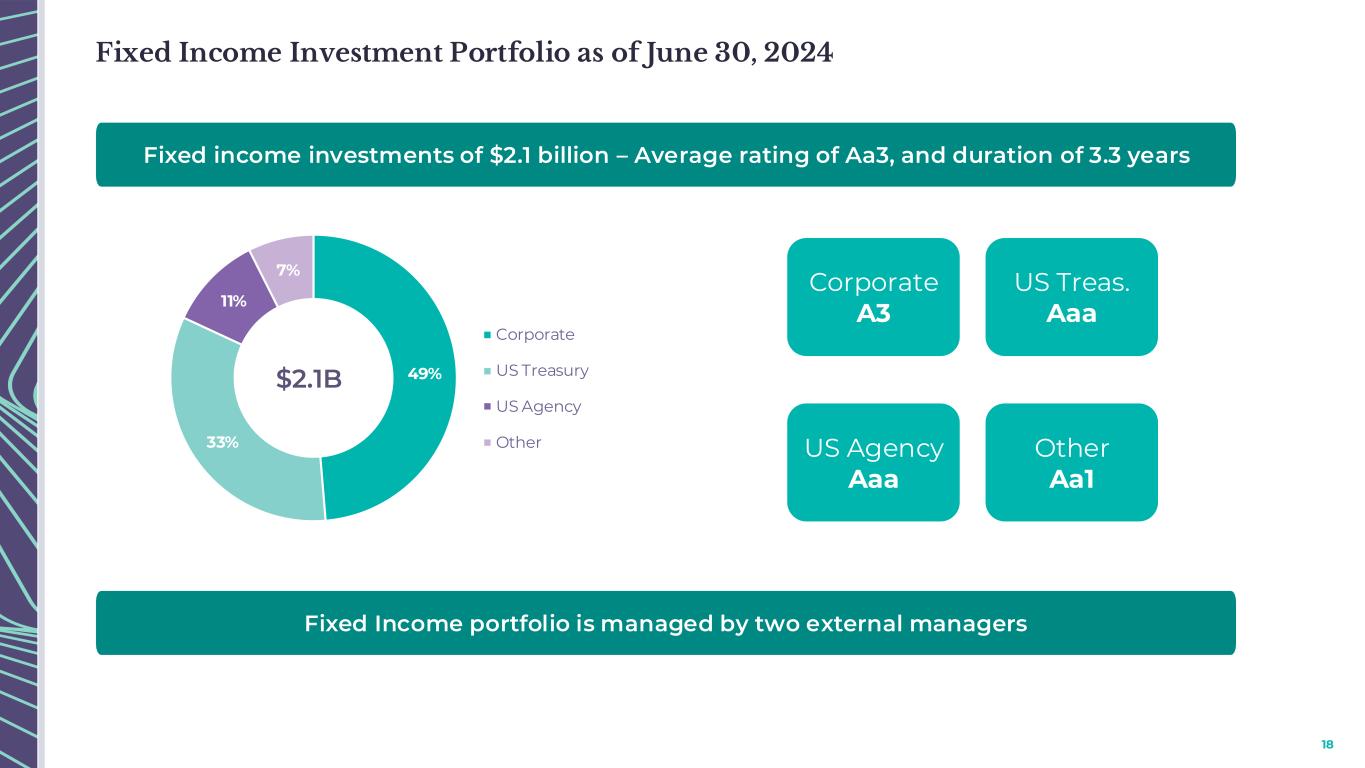

Investments and Shareholders’ Equity as of June 30, 2024

•Total invested assets and cash of $4.4 billion compared to $4.0 billion at December 31, 2023.

•Total shareholders’ equity of $2.2 billion compared to $2.0 billion at December 31, 2023.

•Book value per share of $21.96 compared to $18.58 at December 31, 2023, an increase of 18.2%.

Conference Call Details and Additional Information

Conference Call Information

Hamilton will host a conference call to discuss its financial results on Thursday, August 8, 2024, at 10:00 am ET. The conference call can be accessed by dialing 1-646-960-0308 (US toll free), or 1-888-350-3870, and entering the conference ID 6439207.

A live, audio webcast of the conference call will also be available through the Investors portal of the Company’s website at investors.hamiltongroup.com.

For access to either the conference call or webcast, please dial in/login a few minutes in advance to complete any necessary registration.

A replay of the audio conference call will be available at investors.hamiltongroup.com or by dialing 1-609-800-9909 (US toll free) and entering the conference ID 6439207.

Additional Information

In addition to the information provided in the Company's earnings release, we have also made available supplementary financial information and an investor presentation which may be referred to during the conference call and will be available on the Company’s website at investors.hamiltongroup.com.

About Hamilton Insurance Group, Ltd.

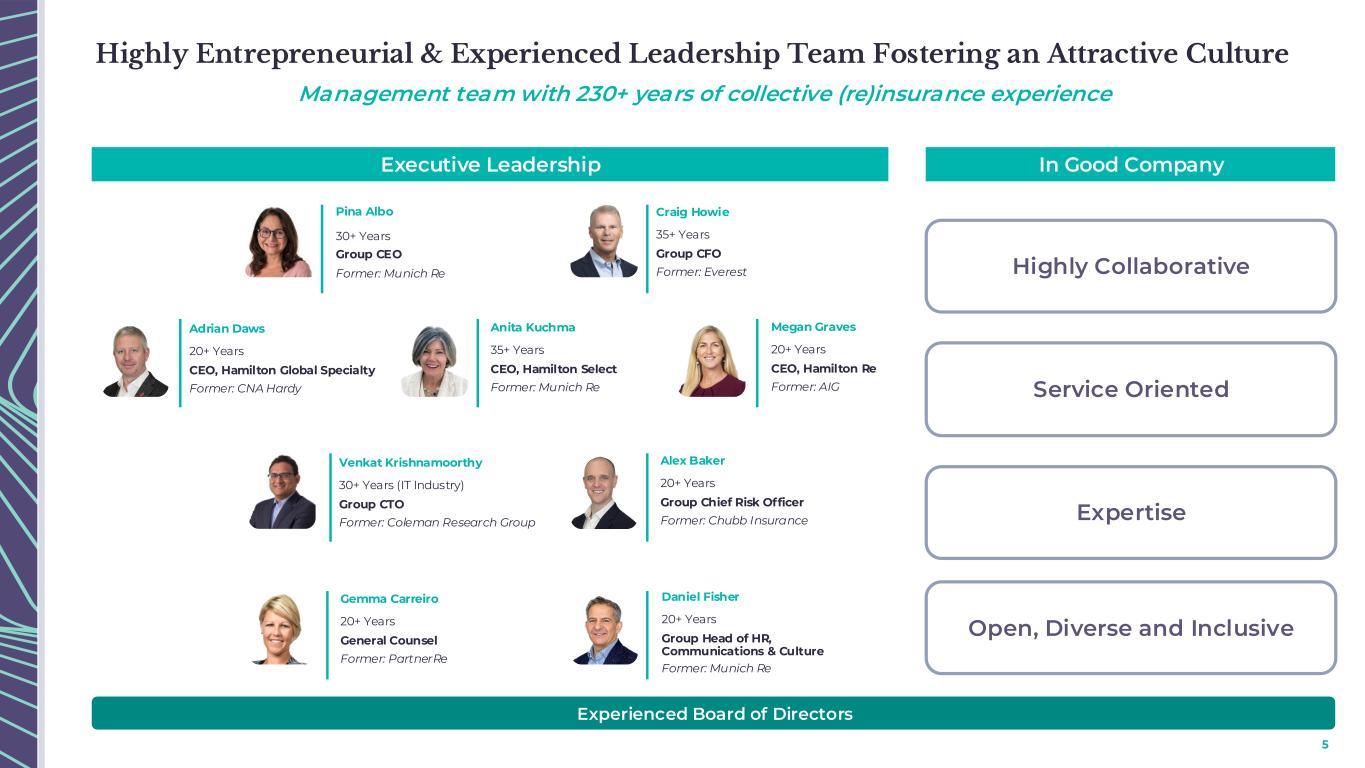

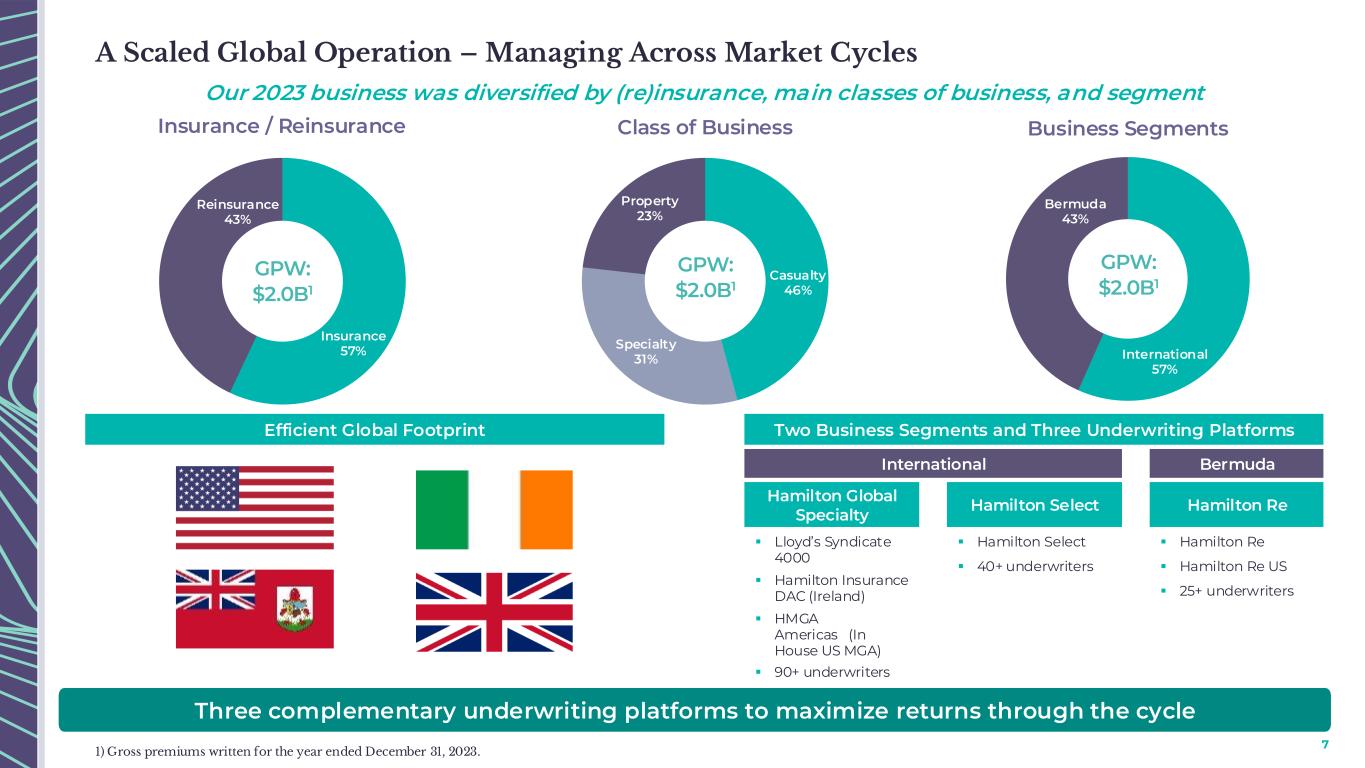

Hamilton is a Bermuda-headquartered company that underwrites specialty insurance and reinsurance risks on a global basis through its wholly owned subsidiaries. Its three underwriting platforms: Hamilton Global Specialty, Hamilton Re and Hamilton Select, each with dedicated and experienced leadership, provide us with access to diversified and profitable markets around the world.

For more information about Hamilton Insurance Group, visit our website at www.hamiltongroup.com or on LinkedIn at Hamilton.

Consolidated Balance Sheet

| | | | | | | | | | | |

($ in thousands) | June 30,

2024 | | December 31,

2023 |

| Assets | | | |

Fixed maturity investments, at fair value

(amortized cost 2024: $2,119,739; 2023: $1,867,499) | $ | 2,068,930 | | | $ | 1,831,268 | |

| Short-term investments, at fair value (amortized cost 2024: $461,525; 2023: $427,437) | 463,542 | | 428,878 |

| Investments in Two Sigma Funds, at fair value (cost 2024: $711,236; 2023: $770,191) | 923,682 | | 851,470 |

Total investments | 3,456,154 | | | 3,111,616 | |

Cash and cash equivalents | 1,016,573 | | | 794,509 | |

| Restricted cash and cash equivalents | 98,279 | | | 106,351 | |

Premiums receivable | 933,211 | | | 658,363 | |

| Paid losses recoverable | 147,690 | | | 145,202 | |

Deferred acquisition costs | 203,279 | | | 156,895 | |

Unpaid losses and loss adjustment expenses recoverable | 1,160,309 | | | 1,161,077 | |

Receivables for investments sold | 12,307 | | | 42,419 | |

Prepaid reinsurance | 299,574 | | | 194,306 | |

Intangible assets | 94,410 | | | 90,996 | |

Other assets | 201,317 | | | 209,621 | |

| Total assets | $ | 7,623,103 | | | $ | 6,671,355 | |

| | | |

| Liabilities, non-controlling interest, and shareholders' equity | | | |

| Liabilities | | | |

Reserve for losses and loss adjustment expenses | $ | 3,242,893 | | | $ | 3,030,037 | |

Unearned premiums | 1,202,371 | | | 911,222 | |

Reinsurance balances payable | 399,633 | | | 272,310 | |

Payables for investments purchased | 111,280 | | | 66,606 | |

| Term loan, net of issuance costs | 149,887 | | | 149,830 | |

Accounts payable and accrued expenses | 158,187 | | | 186,887 | |

Payables to related parties | 43,030 | | | 6,480 | |

| Total liabilities | 5,307,281 | | | 4,623,372 | |

| | | |

Non-controlling interest – TS Hamilton Fund | 77,275 | | | 133 | |

| | | |

Shareholders’ equity | | | |

Common shares: | | | |

Class A, authorized (2024 and 2023: 28,644,807), par value $0.01;

issued and outstanding (2024: 19,520,078 and 2023: 28,644,807) | 195 | | | 286 | |

Class B, authorized (2024: 72,837,352 and 2023: 72,337,352), par value $0.01;

issued and outstanding (2024: 57,358,464 and 2023: 56,036,067) | 574 | | | 560 | |

Class C, authorized (2024: 25,044,229 and 2023: 25,544,229), par value $0.01;

issued and outstanding (2024: 25,044,229 and 2023: 25,544,229) | 250 | | | 255 | |

Additional paid-in capital | 1,171,585 | | | 1,249,817 | |

Accumulated other comprehensive loss | (4,441) | | | (4,441) | |

Retained earnings | 1,070,384 | | | 801,373 | |

| Total shareholders' equity | 2,238,547 | | | 2,047,850 | |

| | | |

| Total liabilities, non-controlling interest, and shareholders' equity | $ | 7,623,103 | | | $ | 6,671,355 | |

Consolidated Statement of Operations

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

($ in thousands, except per share information) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues | | | | | | | |

| Gross premiums written | $ | 603,304 | | | $ | 504,960 | | | $ | 1,325,245 | | | $ | 1,043,124 | |

| Reinsurance premiums ceded | (128,236) | | | (120,252) | | | (335,297) | | | (309,918) | |

| Net premiums written | 475,068 | | | 384,708 | | | 989,948 | | | 733,206 | |

| | | | | | | |

| Net change in unearned premiums | (56,304) | | | (53,248) | | | (185,881) | | | (117,844) | |

| Net premiums earned | 418,764 | | | 331,460 | | | 804,067 | | | 615,362 | |

| | | | | | | |

| Net realized and unrealized gains (losses) on investments | 151,251 | | | 19,406 | | | 406,622 | | | 54,539 | |

| Net investment income (loss) | 13,720 | | | 7,291 | | | 26,338 | | | 9,650 | |

| Total net realized and unrealized gains (losses) on investments and net investment income (loss) | 164,971 | | | 26,697 | | | 432,960 | | | 64,189 | |

| | | | | | | |

| | | | | | | |

| Other income (loss) | 5,989 | | | 2,420 | | | 13,470 | | | 5,452 | |

| Net foreign exchange gains (losses) | (1,782) | | | (3,341) | | | (3,911) | | | (5,387) | |

| Total revenues | 587,942 | | | 357,236 | | | 1,246,586 | | | 679,616 | |

| | | | | | | |

| Expenses | | | | | | | |

| Losses and loss adjustment expenses | 214,494 | | | 179,416 | | | 446,846 | | | 327,977 | |

| Acquisition costs | 96,305 | | | 76,856 | | | 180,858 | | | 141,995 | |

| General and administrative expenses | 64,917 | | | 49,234 | | | 119,772 | | | 95,040 | |

| | | | | | | |

| Amortization of intangible assets | 3,317 | | | 2,305 | | | 6,569 | | | 5,075 | |

| Interest expense | 6,031 | | | 5,189 | | | 11,738 | | | 10,718 | |

| Total expenses | 385,064 | | | 313,000 | | | 765,783 | | | 580,805 | |

| | | | | | | |

| Income (loss) before income tax | 202,878 | | | 44,236 | | | 480,803 | | | 98,811 | |

| Income tax expense (benefit) | 2,496 | | | 2,948 | | | 3,089 | | | 4,521 | |

| Net income (loss) | 200,382 | | | 41,288 | | | 477,714 | | | 94,290 | |

| | | | | | | |

| Net income (loss) attributable to non-controlling interest | 69,297 | | | 4,501 | | | 189,455 | | | 6,011 | |

| | | | | | | |

| Net income (loss) and other comprehensive income (loss) attributable to common shareholders | $ | 131,085 | | | $ | 36,787 | | | $ | 288,259 | | | $ | 88,279 | |

| | | | | | | |

| Per share data | | | | | | | |

| Basic income (loss) per share attributable to common shareholders | $ | 1.24 | | | $ | 0.35 | | | $ | 2.66 | | | $ | 0.85 | |

| Diluted income (loss) per share attributable to common shareholders | $ | 1.20 | | | $ | 0.35 | | | $ | 2.57 | | | $ | 0.84 | |

Non-GAAP Financial Measures Reconciliation

We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate our performance. Some of the measurements are considered non-GAAP financial measures under SEC rules and regulations. In this press release, we present underwriting income (loss), a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. We believe that non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Where appropriate, reconciliations of our non-GAAP measures to the most comparable GAAP figures are included below.

Underwriting Income (Loss)

We calculate underwriting income (loss) on a pre-tax basis as net premiums earned less losses and loss adjustment expenses, acquisition costs and other underwriting expenses (net of third party fee income). We believe that this measure of our performance focuses on the core fundamental performance of the Company’s reportable segments in any given period and is not distorted by investment market conditions, corporate expense allocations or income tax effects.

The following table reconciles underwriting income (loss) to net income (loss), the most comparable GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Underwriting income (loss) | $ | 65,299 | | | $ | 34,894 | | | $ | 97,825 | | | $ | 68,956 | |

| Total net realized and unrealized gains (losses) on investments and net investment income (loss) | 164,971 | | | 26,697 | | | 432,960 | | | 64,189 | |

| | | | | | | |

| Other income (loss), excluding third party fee income | — | | | (29) | | | — | | | — | |

| Net foreign exchange gains (losses) | (1,782) | | | (3,341) | | | (3,911) | | | (5,387) | |

| Corporate expenses | (16,262) | | | (6,491) | | | (27,764) | | | (13,154) | |

| | | | | | | |

| Amortization of intangible assets | (3,317) | | | (2,305) | | | (6,569) | | | (5,075) | |

| Interest expense | (6,031) | | | (5,189) | | | (11,738) | | | (10,718) | |

| Income tax (expense) benefit | (2,496) | | | (2,948) | | | (3,089) | | | (4,521) | |

| Net income (loss), prior to non-controlling interest | $ | 200,382 | | | $ | 41,288 | | | $ | 477,714 | | | $ | 94,290 | |

Third Party Fee Income

Third party fee income includes income that is incremental and/or directly attributable to our underwriting operations. It is primarily comprised of fees earned by the International Segment for management services provided to third party syndicates and consortia and by the Bermuda Segment for performance based management fees generated by our third party capital manager, Ada Capital Management Limited. We believe that this measure is a relevant component of our underwriting income (loss).

The following table reconciles third party fee income to other income, the most comparable GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Third party fee income | $ | 5,989 | | | $ | 2,449 | | | $ | 13,470 | | | $ | 5,452 | |

| Other income (loss), excluding third party fee income | — | | | (29) | | | — | | | — | |

| Other income (loss) | $ | 5,989 | | | $ | 2,420 | | | $ | 13,470 | | | $ | 5,452 | |

Other Underwriting Expenses

Other underwriting expenses include those general and administrative expenses that are incremental and/or directly attributable to our underwriting operations. While this measure is presented in Note 8, Segment Reporting, in the unaudited condensed consolidated financial statements, it is considered a non-GAAP financial measure when presented elsewhere.

Corporate expenses include holding company costs necessary to support our reportable segments. As these costs are not incremental and/or directly attributable to our underwriting operations, these costs are excluded from other underwriting expenses, and therefore, underwriting income (loss). General and administrative expenses, the most comparable GAAP financial measure to other underwriting expenses, also includes corporate expenses.

The following table reconciles other underwriting expenses to general and administrative expenses, the most comparable GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| ($ in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Other underwriting expenses | $ | 48,655 | | | $ | 42,743 | | | $ | 92,008 | | | $ | 81,886 | |

| Corporate expenses | 16,262 | | | 6,491 | | | 27,764 | | | 13,154 | |

| General and administrative expenses | $ | 64,917 | | | $ | 49,234 | | | $ | 119,772 | | | $ | 95,040 | |

Special Note Regarding Forward-Looking Statements

This information includes “forward looking statements” pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of terms such as “believes,” “expects,” “may,” “will,” “target,” “should,” “could,” “would,” “seeks,” “intends,” “plans,” “contemplates,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions. These forward-looking statements appear in a number of places throughout and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements.

There are a number of risks, uncertainties, and other important factors that could cause our actual results to differ materially from the forward-looking statements contained herein. Such risks, uncertainties, and other important factors include, among others, the risks, uncertainties and factors set forth in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) and other subsequent periodic reports filed with the Securities and Exchange Commission and the following:

•our results of operations and financial condition could be adversely affected by unpredictable catastrophic events, global climate change or emerging claim and coverage issues;

•our business could be materially adversely affected if we do not accurately assess our underwriting risk, our reserves are inadequate to cover our actual losses, our models or assessments and pricing of risks are incorrect or we lose important broker relationships;

•the insurance and reinsurance business is historically cyclical and the pricing and terms for our products may decline, which would affect our profitability and ability to maintain or grow premiums;

•we have significant foreign operations that expose us to certain additional risks, including foreign currency risks and political risk;

•we do not control the allocations to and/or the performance of the Two Sigma Hamilton Fund, LLC ("TS Hamilton Fund")’s investment portfolio, and its performance depends on the ability of its investment manager, Two Sigma Investments, LP ("Two Sigma"), to select and manage appropriate investments and we have a limited ability to withdraw our capital accounts;

•Two Sigma Principals, LLC, Two Sigma and their respective affiliates have potential conflicts of interest that could adversely affect us;

•the historical performance of Two Sigma is not necessarily indicative of the future results of the TS Hamilton Fund’s investment portfolio or of our future results;

•our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including public health crises, current or anticipated military conflicts, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events;

•our ability to compete successfully with more established competitors and risks relating to consolidation in the reinsurance and insurance industries;

•downgrades, potential downgrades or other negative actions by rating agencies;

•our dependence on key executives, including the potential loss of Bermudian personnel as a result of Bermuda employment restrictions, and the inability to attract qualified personnel, particularly in very competitive hiring conditions;

•our dependence on letter of credit facilities that may not be available on commercially acceptable terms;

•our potential need for additional capital in the future and the potential unavailability of such capital to us on favorable terms or at all;

•the suspension or revocation of our subsidiaries’ insurance licenses;

•risks associated with our investment strategy, including such risks being greater than those faced by competitors;

•changes in the regulatory environment and the potential for greater regulatory scrutiny of the Company going forward;

•a cyclical downturn of the reinsurance industry;

•operational failures, failure of information systems or failure to protect the confidentiality of customer information, including by service providers, or losses due to defaults, errors or omissions by third parties or our affiliates;

•we are a holding company with no direct operations, and our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us is restricted by law;

•risks relating to our ability to identify and execute opportunities for growth or our ability to complete transactions as planned or realize the anticipated benefits of our acquisitions or other investments;

•our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise;

•the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC;

•our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions;

•our costs will increase as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations;

•if we were to identify a material weakness and were unable to remediate such material weakness, or fail to achieve and maintain effective internal controls, our operating results and financial condition could be impacted and the market price of our Class B common shares may be negatively affected;

•the lack of a prior public market for our Class B common shares means our share price may be volatile and anti-takeover provisions contained in our organizational documents could delay management changes;

•the potential that the market price of our Class B common shares could decline due to future sales of shares by our existing shareholders;

•applicable insurance laws, which could make it difficult to effect a change of control of our company; and

•investors may have difficulties in serving process or enforcing judgments against us in the United States.

There may be other factors that could cause our actual results to differ materially from the forward-looking statements, including factors disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Form 10-K. You should evaluate all forward-looking statements made herein in the context of these risks and uncertainties.

You should read this information completely and with the understanding that actual future results may be materially different from expectations. We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements contained herein apply only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

Investor contacts:

Jon Levenson & Darian Niforatos

Investor.Relations@hamiltongroup.com

Media contact:

Kelly Corday Ferris

kelly.ferris@hamiltongroup.com

Hamilton Insurance Group, Ltd. Supplementary Financial Information June 30, 2024 Investor Contact Investor.Relations@hamiltongroup.com

Hamilton Insurance Group, Ltd. Table of Contents Page I. Basis of Presentation ............................................................................................................................................................................................................ 1 II. Financial Highlights Financial Highlights .................................................................................................................................................................................................................. 4 Key Operating and Financial Metrics .................................................................................................................................................................................... 5 III. Summary Consolidated Results Statements of Operations ...................................................................................................................................................................................................... 6 Consolidated Balance Sheets ................................................................................................................................................................................................ 7 Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet .......................................................................................... 8 Net Investment Return ............................................................................................................................................................................................................ 9 Fixed Maturity and Short-Term Investments ........................................................................................................................................................................ 10 IV. Segment Results Consolidated Underwriting Results ....................................................................................................................................................................................... 11 5Q Consolidated Underwriting Results - Group .................................................................................................................................................................. 13 5Q Underwriting Results - International ............................................................................................................................................................................... 14 5Q Underwriting Results - Bermuda ..................................................................................................................................................................................... 15 V. Other Information Modeled Exposure to Catastrophe Losses (PML) ............................................................................................................................................................. 16 Non-GAAP Measures .............................................................................................................................................................................................................. 17

1 Basis of Presentation All financial information contained herein is unaudited, however, certain information relating to the consolidated balance sheet at the most recent year end is derived from or agrees to audited financial information. Unless otherwise noted, all data is in thousands, except for share and per share amounts and ratio information. This information is being provided for informational purposes only. It should be read in conjunction with the documents filed by Hamilton Insurance Group, Inc. ("Hamilton") with the U.S Securities and Exchange Commission, including its Form 10-Q. Special Note Regarding Forward-Looking Statements This information includes “forward looking statements” pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of terms such as “believes,” “expects,” “may,” “will,” “target,” “should,” “could,” “would,” “seeks,” “intends,” “plans,” “contemplates,” “estimates,” or “anticipates,” or similar expressions which concern our strategy, plans, projections or intentions. These forward-looking statements appear in a number of places throughout and relate to matters such as our industry, growth strategy, goals and expectations concerning our market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information. By their nature, forward-looking statements: speak only as of the date they are made; are not statements of historical fact or guarantees of future performance; and are subject to risks, uncertainties, assumptions, or changes in circumstances that are difficult to predict or quantify. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs and projections will be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. There are a number of risks, uncertainties, and other important factors that could cause our actual results to differ materially from the forward-looking statements contained herein. Such risks, uncertainties, and other important factors include, among others, the risks, uncertainties and factors set forth in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “Form 10-K”) and other subsequent periodic reports filed with the Securities and Exchange Commission and the following: • our results of operations and financial condition could be adversely affected by unpredictable catastrophic events, global climate change or emerging claim and coverage issues; • our business could be materially adversely affected if we do not accurately assess our underwriting risk, our reserves are inadequate to cover our actual losses, our models or assessments and pricing of risks are incorrect or we lose important broker relationships; • the insurance and reinsurance business is historically cyclical and the pricing and terms for our products may decline, which would affect our profitability and ability to maintain or grow premiums; • we have significant foreign operations that expose us to certain additional risks, including foreign currency risks and political risk; • we do not control the allocations to and/or the performance of the Two Sigma Hamilton Fund, LLC ("TS Hamilton Fund")’s investment portfolio, and its performance depends on the ability of its investment manager, Two Sigma Investments, LP (“Two Sigma”), to select and manage appropriate investments and we have a limited ability to withdraw our capital accounts; • Two Sigma Principals, LLC, Two Sigma and their respective affiliates have potential conflicts of interest that could adversely affect us; • the historical performance of Two Sigma is not necessarily indicative of the future results of the TS Hamilton Fund’s investment portfolio or of our future results;

2 Basis of Presentation (continued) Special Note Regarding Forward-Looking Statements (continued) • our ability to manage risks associated with macroeconomic conditions resulting from geopolitical and global economic events, including public health crises, current or anticipated military conflicts, terrorism, sanctions, rising energy prices, inflation and interest rates and other global events; • our ability to compete successfully with more established competitors and risks relating to consolidation in the reinsurance and insurance industries; • downgrades, potential downgrades or other negative actions by rating agencies; • our dependence on key executives, including the potential loss of Bermudian personnel as a result of Bermuda employment restrictions, and the inability to attract qualified personnel, particularly in very competitive hiring conditions; • our dependence on letter of credit facilities that may not be available on commercially acceptable terms; • our potential need for additional capital in the future and the potential unavailability of such capital to us on favorable terms or at all; • the suspension or revocation of our subsidiaries’ insurance licenses; • risks associated with our investment strategy, including such risks being greater than those faced by competitors; • changes in the regulatory environment and the potential for greater regulatory scrutiny of the Company going forward; • a cyclical downturn of the reinsurance industry; • operational failures, failure of information systems or failure to protect the confidentiality of customer information, including by service providers, or losses due to defaults, errors or omissions by third parties or our affiliates; • we are a holding company with no direct operations, and our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us is restricted by law; • risks relating to our ability to identify and execute opportunities for growth or our ability to complete transactions as planned or realize the anticipated benefits of our acquisitions or other investments; • our potentially becoming subject to U.S. federal income taxation, Bermuda taxation or other taxes as a result of a change of tax laws or otherwise; • the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC; • our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions; • our costs will increase as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations; • if we were to identify a material weakness and were unable to remediate such material weakness, or fail to achieve and maintain effective internal controls, our operating results and financial condition could be impacted and the market price of our Class B common shares may be negatively affected; • the lack of a prior public market for our Class B common shares means our share price may be volatile and anti-takeover provisions contained in our organizational documents could delay management changes; • the potential that the market price of our Class B common shares could decline due to future sales of shares by our existing shareholders; • applicable insurance laws, which could make it difficult to effect a change of control of our company; and • investors may have difficulties in serving process or enforcing judgments against us in the United States. There may be other factors that could cause our actual results to differ materially from the forward-looking statements, including factors disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Form 10-K and other subsequent periodic reports filed with the Securities and Exchange Commission. You should evaluate all forward-looking statements made herein in the context of these risks and uncertainties.

3 Basis of Presentation (continued) Special Note Regarding Forward-Looking Statements (continued) You should read this information completely and with the understanding that actual future results may be materially different from expectations. We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. All forward-looking statements contained herein apply only as of the date hereof and are expressly qualified in their entirety by these cautionary statements. We undertake no obligation to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

4 Financial Highlights Three Months Ended June 30, Six Months Ended June 30, Year Ended ($ in thousands) 2024 2023 2024 2023 2023 Net income (loss) attributable to common shareholders ......................................................................................... $ 131,085 $ 36,787 $ 288,259 $ 88,279 $ 258,727 Underwriting income (loss) Gross premiums written ................................................................................................................................................ $ 603,304 $ 504,960 $ 1,325,245 $ 1,043,124 $ 1,951,038 Net premiums written .................................................................................................................................................... 475,068 384,708 989,948 733,206 1,480,438 Net premiums earned ................................................................................................................................................... 418,764 331,460 804,067 615,362 1,318,533 Underwriting income (loss) ........................................................................................................................................... $ 65,299 $ 34,894 $ 97,825 $ 68,956 $ 129,851 Key Ratios: Attritional loss ratio - current year ............................................................................................................................... 51.6% 51.0% 54.3% 50.1% 52.2% Attritional loss ratio - prior year development ............................................................................................................ (0.4%) (1.6%) 1.3% (0.6%) (0.8%) Catastrophe loss ratio - current year .......................................................................................................................... 0.0% 5.0% 0.0% 3.6% 3.2% Catastrophe loss ratio - prior year development ....................................................................................................... 0.0% (0.3%) 0.0% 0.2% (0.4%) Loss and loss adjustment expense ratio .................................................................................................................... 51.2% 54.1% 55.6% 53.3% 54.2% Acquisition cost ratio ..................................................................................................................................................... 23.0% 23.2% 22.5% 23.1% 23.4% Other underwriting expense ratio ................................................................................................................................ 10.2% 12.2% 9.8% 12.4% 12.5% Combined ratio ............................................................................................................................................................... 84.4% 89.5% 87.9% 88.8% 90.1% Investments Total assets ..................................................................................................................................................................... $ 7,623,103 $ 6,280,551 $ 7,623,103 $ 6,280,551 $ 6,671,355 Total cash and invested assets(1) ................................................................................................................................ 4,351,728 3,558,285 4,351,728 3,558,285 3,981,676 Total investment return(2) .............................................................................................................................................. 95,674 22,196 243,505 58,178 218,506 Two Sigma Hamilton Fund Total net realized and unrealized gains (losses) on investments and net investment income (loss) - TSHF . 145,183 29,981 408,002 40,045 143,655 Net income (loss) attributable to non-controlling interest - TSHF .......................................................................... 69,297 4,501 189,455 6,011 21,560 $ 75,886 $ 25,480 $ 218,547 $ 34,034 $ 122,095 Two Sigma Hamilton Fund return, net of investment management fees and performance incentive allocations ....................................................................................................................................................................... 4.3% 1.6% 12.9% 2.1% 7.6% Fixed income, short term investments and cash and cash equivalents Total net realized and unrealized gains (losses) on investments and net investment income (loss) - other .. $ 19,788 $ (3,284) $ 24,958 $ 24,144 $ 96,411 (1) Total cash and total investments, plus receivables for investments sold, less payables for investments purchased, payables to related parties (TSHF) and non-controlling interest (TSHF). (2) Net realized and unrealized gains (losses) on investments, plus net investment income (loss), less non-controlling interest.

5 Three Months Ended June 30, Six Months Ended June 30, Year Ended ($ in thousands, except per share amounts) 2024 2023 2024 2023 2023 Income (loss) per share attributable to common shareholders - basic ................................................................. $ 1.24 $ 0.35 $ 2.66 $ 0.85 $ 2.47 Income (loss) per share attributable to common shareholders - diluted ............................................................... $ 1.20 $ 0.35 $ 2.57 $ 0.84 $ 2.44 Weighted average common shares outstanding - basic .......................................................................................... 105,909 103,732 108,416 103,714 104,563 Weighted average common shares outstanding - diluted ....................................................................................... 109,603 104,895 112,072 104,741 106,203 Return on average common shareholders' equity - annualized ............................................................................. 23.6% 8.5% 26.9% 10.3% 13.9% June 30, 2024 December 31, 2023 Closing common shareholders' equity less intangible assets ................................................................................. $ 2,144,137 $ 1,956,854 Closing common shareholders' equity ........................................................................................................................ $ 2,238,547 $ 2,047,850 Tangible book value per common share .................................................................................................................... $ 21.04 $ 17.75 Book value per common share .................................................................................................................................... $ 21.96 $ 18.58 Year-to-date change in tangible book value per common share ............................................................................ 18.5% 16.0% Year-to-date change in book value per common share ........................................................................................... 18.2% 15.1% Financial Highlights Key Operating and Financial Metrics

6 Three Months Ended June 30, Six Months Ended June 30, Year Ended ($ in thousands, except per share amounts) 2024 2023 2024 2023 2023 Revenues Gross premiums written ................................................................................................................................................ $ 603,304 $ 504,960 $ 1,325,245 $ 1,043,124 $ 1,951,038 Reinsurance premiums ceded ..................................................................................................................................... (128,236) (120,252) (335,297) (309,918) (470,600) Net premiums written .................................................................................................................................................... 475,068 384,708 989,948 733,206 1,480,438 Net change in unearned premiums ............................................................................................................................. (56,304) (53,248) (185,881) (117,844) (161,905) Net premiums earned .................................................................................................................................................... 418,764 331,460 804,067 615,362 1,318,533 Net realized and unrealized gains (losses) on investments .................................................................................... 151,251 19,406 406,622 54,539 209,610 Net investment income (loss) ....................................................................................................................................... 13,720 7,291 26,338 9,650 30,456 Total net realized and unrealized gains (losses) on investments and net investment income (loss) ............... 164,971 26,697 432,960 64,189 240,066 Third party fee income .................................................................................................................................................. 5,989 2,449 13,470 5,452 18,234 Other income (loss), excluding third-party fee income ............................................................................................ — (29) — — 397 Net foreign exchange gains (losses) .......................................................................................................................... (1,782) (3,341) (3,911) (5,387) (6,185) Total revenues .............................................................................................................................................................. 587,942 357,236 1,246,586 679,616 1,571,045 Expenses Losses and loss adjustment expenses ....................................................................................................................... 214,494 179,416 446,846 327,977 714,603 Acquisition costs ............................................................................................................................................................ 96,305 76,856 180,858 141,995 309,148 Other underwriting expenses ....................................................................................................................................... 48,655 42,743 92,008 81,886 183,165 Corporate expenses ...................................................................................................................................................... 16,262 6,491 27,764 13,154 76,691 Amortization of intangible assets ................................................................................................................................. 3,317 2,305 6,569 5,075 10,783 Interest expense ............................................................................................................................................................. 6,031 5,189 11,738 10,718 21,434 Total expenses ............................................................................................................................................................. 385,064 313,000 765,783 580,805 1,315,824 Income (loss) before income tax ................................................................................................................................. 202,878 44,236 480,803 98,811 255,221 Income tax expense (benefit) ....................................................................................................................................... 2,496 2,948 3,089 4,521 (25,066) Net income (loss) ......................................................................................................................................................... 200,382 41,288 477,714 94,290 280,287 Net income (loss) attributable to non-controlling interest ........................................................................................ 69,297 4,501 189,455 6,011 21,560 Net income (loss) and other comprehensive income (loss) attributable to common shareholders ..... $ 131,085 $ 36,787 $ 288,259 $ 88,279 $ 258,727 Per share data Income (loss) per share attributable to common shareholders - basic ................................................................. $ 1.24 $ 0.35 $ 2.66 $ 0.85 $ 2.47 Income (loss) per share attributable to common shareholders - diluted ............................................................... $ 1.20 $ 0.35 $ 2.57 $ 0.84 $ 2.44 Return on average common shareholders' equity - annualized ............................................................................. 23.6% 8.5% 26.9% 10.3% 13.9% Summary Consolidated Results Statements of Operations

7 June 30, March 31, December 31, September 30, June 30, ($ in thousands, except share information) 2024 2024 2023 2023 2023 Assets Fixed maturity investments, at fair value (amortized cost June 30, 2024: $2,119,739) .................................................. $ 2,068,930 $ 1,877,130 $ 1,831,268 $ 1,631,471 $ 1,451,249 Short-term investments, at fair value (amortized cost June 30, 2024: $461,525) ........................................................... 463,542 352,068 428,878 348,968 336,587 Investments in Two Sigma Funds, at fair value (cost June 30, 2024: $711,236) ............................................................. 923,682 953,659 851,470 979,986 868,486 Total investments ....................................................................................................................................................................... 3,456,154 3,182,857 3,111,616 2,960,425 2,656,322 Cash and cash equivalents ...................................................................................................................................................... 1,016,573 1,085,038 794,509 804,548 818,522 Restricted cash and cash equivalents .................................................................................................................................... 98,279 95,565 106,351 98,979 106,696 Premiums receivable ................................................................................................................................................................. 933,211 856,111 658,363 689,042 756,275 Paid losses recoverable ............................................................................................................................................................ 147,690 169,469 145,202 138,314 132,528 Deferred acquisition costs ........................................................................................................................................................ 203,279 190,883 156,895 151,314 145,280 Unpaid losses and loss adjustment expenses recoverable ................................................................................................ 1,160,309 1,167,504 1,161,077 1,157,123 1,162,940 Receivables for investments sold ............................................................................................................................................ 12,307 17,777 42,419 19,044 36 Prepaid reinsurance ................................................................................................................................................................... 299,574 285,984 194,306 232,211 251,818 Intangible assets ........................................................................................................................................................................ 94,410 92,651 90,996 89,589 88,770 Other assets ................................................................................................................................................................................ 201,317 205,186 209,621 164,015 161,364 Total assets ............................................................................................................................................................................... $ 7,623,103 $ 7,349,025 $ 6,671,355 $ 6,504,604 $ 6,280,551 Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses .............................................................................................................. $ 3,242,893 $ 3,148,782 $ 3,030,037 $ 2,948,822 $ 2,899,100 Unearned premiums .................................................................................................................................................................. 1,202,371 1,132,477 911,222 951,596 924,723 Reinsurance balances payable ................................................................................................................................................ 399,633 367,123 272,310 367,954 381,678 Payables for investments purchased ...................................................................................................................................... 111,280 55,071 66,606 117,836 18,670 Term loan, net of issuance costs ............................................................................................................................................. 149,887 149,859 149,830 149,801 149,772 Accounts payable and accrued expenses ............................................................................................................................. 158,187 155,684 186,887 159,681 149,833 Payables to related parties ....................................................................................................................................................... 43,030 75,797 6,480 9,060 4,497 Total liabilities ........................................................................................................................................................................... 5,307,281 5,084,793 4,623,372 4,704,750 4,528,273 Non-controlling interest - TS Hamilton Fund ................................................................................................................... 77,275 54,727 133 129 124 Shareholders' equity Common shares: Class A, authorized (June 30, 2024: 28,644,807), par value $0.01; issued and outstanding (June 30, 2024: 19,520,078) ................................................................................................................................................................................. 195 286 286 305 305 Class B, authorized (June 30, 2024: 72,837,352), par value $0.01; issued and outstanding (June 30, 2024: 57,358,464) ................................................................................................................................................................................. 574 568 560 427 426 Class C, authorized (June 30, 2024: 25,044,229), par value $0.01; issued and outstanding (June 30, 2024: 25,044,229) ................................................................................................................................................................................. 250 255 255 305 305 Additional paid-in-capital ........................................................................................................................................................... 1,171,585 1,255,055 1,249,817 1,128,553 1,124,566 Accumulated other comprehensive loss ................................................................................................................................. (4,441) (4,441) (4,441) (4,441) (4,441) Retained earnings ...................................................................................................................................................................... 1,070,384 957,782 801,373 674,576 630,993 Total shareholders' equity ..................................................................................................................................................... 2,238,547 2,209,505 2,047,850 1,799,725 1,752,154 Total liabilities, non-controlling interest, and shareholders' equity .......................................................................... $ 7,623,103 $ 7,349,025 $ 6,671,355 $ 6,504,604 $ 6,280,551 Summary Consolidated Results Consolidated Balance Sheets