Moody’s Ratings Upgrades Holley’s CFR to B2; Outlook Stable

August 09 2024 - 1:02PM

Business Wire

Holley Performance Brands (NYSE: HLLY) (Holley), a leader in

automotive aftermarket performance solutions, today announced that

Moody’s Ratings (Moody’s) upgraded Holley's corporate family rating

(CFR) to B2 from B3, probability of default rating to B2-PD from

B3-PD and senior secured ratings to B2 from B3, noting that the

outlook remains stable and the speculative grade liquidity (SGL)

rating is unchanged at SGL-2.

Moody’s highlighted that the rating upgrade and stable outlook

reflect their expectation that Holley will maintain healthy

profitability and moderate financial leverage while generating

solid free cash flow over the next 12 – 18 months. Moody’s report

states, “Despite revenue headwinds persisting in 2024, Holley has

executed on operational initiatives to improve its earnings and

free cash flow, which the company used to repay debt.”

"We continue to make progress on our financial priorities. Our

balance sheet is continuing to get stronger and our free cash flow

remains robust," stated Jesse Weaver, CFO of Holley Performance

Brands. "The recent upgrades from both Moody’s and S&P affirm

that the strides we’ve made financially are acknowledged by leading

rating agencies. We're committed to staying the course on our

strategy of decreasing debt, enhancing profitability, and

generating strong free cash flow."

For more Holley company news, click here.

Certain statements in this press release may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are

subject to risks, uncertainties, and other important factors which

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements, including

but not limited to Holley’s ability to (1) successfully design,

develop, and market new products, (2) maintain and strengthen

demand for our products, (3) attract new customers in a

cost-effective manner, (4) expand into additional consumer markets,

and (5) and the other risks and uncertainties set forth in the

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the U.S. Securities and Exchange Commission (“SEC”) on

March 14, 2024, and in any subsequent filings with the SEC.

About Holley Performance

Brands Holley Performance Brands (NYSE: HLLY) leads in

the design, manufacturing and marketing of high-performance

products for automotive enthusiasts. The company owns and manages a

portfolio of iconic brands, catering to a diverse community of

enthusiasts passionate about the customization and performance of

their vehicles. Holley Performance Brands distinguishes itself

through a strategic focus on four consumer vertical groupings,

including Domestic Muscle, Modern Truck & Off-Road, Euro &

Import, and Safety & Racing, ensuring a wide-ranging impact

across the automotive aftermarket industry. Renowned for its

innovative approach and strategic acquisitions, Holley Performance

Brands is committed to enhancing the enthusiast experience and

driving growth through innovation. For more information on Holley

Performance Brands and its dedication to automotive excellence,

visit https://www.holley.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240809843921/en/

Media Relations Contact(s): Paul Oakley,

poakley@tinymightyco.com / Rachel Withers,

rwithers@tinymightyco.com

Investor Relations Contacts: Anthony Rozmus / Neel Sikka

Solebury Strategic Communications 203-428-3224

Holley@soleburystrat.com

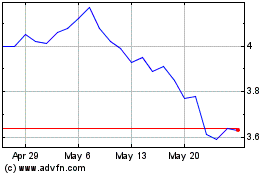

Holley (NYSE:HLLY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Holley (NYSE:HLLY)

Historical Stock Chart

From Jan 2024 to Jan 2025