Delivered third quarter financial results

within guidance Moody’s Ratings Upgrades Holley’s CFR to

B2 Targeted efforts and marketing calendar event support

normalizing distribution partner inventory levels

Holley Performance Brands (NYSE: HLLY), a leader in automotive

aftermarket performance solutions, today announced financial

results for its third quarter ended September 29, 2024.

Third Quarter Highlights vs. Prior Year

Period

- Net Sales decreased (14.4%) to $134.0 million compared to

$156.5 million last year

- Net Loss was $(6.3) million, or $(0.05) per diluted share,

compared to a Net Income of $0.8 million, or $0.01 per diluted

share, last year

- Net Cash Used in Operating Activities was $(1.7) million

compared to Net Cash Provided by Operating Activities of $22.5

million last year

- Adjusted Net Loss1 was $(0.5) million compared to Adjusted Net

Income of $3.5 million last year

- Adjusted EBITDA1 was $22.1 million compared to $29.7 million

last year

- Free Cash Flow1 was $(2.1) million compared to $21.7 million

last year

1See “Use and Reconciliation of Non-GAAP Financial Measures”

below.

“We continued our progress in our organizational transformation

through the third quarter and are encouraged by the immediate

impact that our new team members have made in their short time

here. Our organization now operates with unprecedented capabilities

and professionalism, as demonstrated by the significant

advancements we've made across our business operations, even in a

challenging macroeconomic environment. Of note, digital

modernization and customer service optimization, B2B sales

capabilities, new and targeted product launches and revamped

pricing strategy have all been upgraded within the last year and

well positioned to drive our organic growth engine,” said Matthew

Stevenson, President and CEO of Holley.

Stevenson commented, "We are pleased to report that our

well-executed marketing calendar helped drive a 16% year-over-year

increase in our direct-to-consumer channel and a 10% median lift in

B2B out-the-door sales during the event windows. Our marketing

events helped our B2B customers align their inventory positions

with overall market demand. Also, through focused effort, strategy,

and execution, we are seeing significant growth in some of our

power brands year to date, such as ADS, Stilo, Dinan, APR, and

Simpson, some up as much as over 30%.

However, overall quarterly sales were impacted by distributor

inventory normalization driven by two significant factors:

alignment to overall macro demand and our greatly improved order

fulfillment capability. Our lead times are significantly better

than a year ago, so our major customers are reducing their required

safety stock.

Our operational efforts also contributed to the quarter's

success, with year-over-year improvements in Gross Margin, a 133%

increase in revenue per SKU year-to-date, and a 25% rise in new

product revenue year-to-date. Additionally, we concluded the event

season with strong attendance at our flagship LS Fest East event in

Bowling Green, which attracted record attendance of 45,000

enthusiasts."

Key Operating Metrics and Strategic

Highlights

- Growth in significant areas of the business, including DTC and

multiple key power brands

- Total net inventory reduced to $179.3 million compared to

$207.2 million Q3 of last year; inventory turns improved to 2.2x

compared to 1.9x last year

- Moody’s Ratings (Moody’s) upgraded Holley's corporate family

rating (CFR) to B2 from B3, probability of default rating to B2-PD

from B3-PD and senior secured ratings to B2 from B3, noting that

the outlook remains stable and the speculative grade liquidity

(SGL) rating is unchanged at SGL-2 on August 8, 2024

- Holley’s bank-adjusted EBITDA leverage ratio1 at quarter end of

4.25x was well below covenant ceiling of 5.00x

1See “Use and Reconciliation of Non-GAAP Financial Measures”

below.

Jesse Weaver, Holley's CFO, added, "We continued to make

progress with our financial priorities in the third quarter. We

were, once again, recognized by the ratings agencies for the work

we have done to strengthen our balance sheet shown by the Moody’s

ratings upgrades in August.”

Weaver added, "While our sales were at the low end of the

guidance range, this was largely due to continued softness in the

industry and our distribution partners taking advantage of the

successful out-the-door sales events to clean up their inventories

going into the back half of the year. Overall, we're encouraged by

our out-the-door sales numbers relative to the overall market and

believe that, despite being down, our efforts to partner more

closely with distribution partners and investments in DTC are

allowing us to maintain our share gains in this challenging

environment. Given the performance in Q3 and the continued softness

impacting our consumer base, we have lowered our expectations for

the full year. While we’re excited about continuing our expanded

channel partnership going into Holley Days, we believe this revised

outlook is warranted given current industry trends and the current

level of uncertainty around distribution partner inventory

adjustments going into 2025."

Outlook

Holley is providing the following outlook for the fourth quarter

and full-year 2024:

Metric

Fourth Quarter 2024

Outlook

Full Year 2024 Outlook

Net Sales

$133 – $143 million

$595 - $605 million

Adjusted EBITDA *

$24 - $29 million

$115 - $120 million

Capital Expenditures

$6 - $8 million

Depreciation and Amortization

Expense

$23 - $25 million

Interest Expense

$50 - $55 million

Bank-adjusted EBITDA Leverage

Ratio *

4. 35x - 4.15x

* Holley is not providing reconciliations of forward-looking

fourth quarter 2024 and full year 2024 Adjusted EBITDA outlook and

full year 2024 Bank-adjusted EBITDA Leverage Ratio outlook because

certain information necessary to calculate the most comparable GAAP

measure, net income, is unavailable due to the uncertainty and

inherent difficulty of predicting the occurrence and the future

financial statement impact of certain items. Therefore, as a result

of the uncertainty and variability of the nature and amount of

future adjustments, which could be significant, Holley is unable to

provide these forward-looking reconciliations without unreasonable

effort. Accordingly, Holley is relying on the exception provided by

Item 10(e)(1)(i)(B) of Regulation S-K to exclude these

reconciliations.

Holley notes that its outlook for the fourth quarter and

full-year 2024 may vary due to changes in assumptions or market

conditions and other factors described below under “Forward-Looking

Statements.”

Conference Call

A conference call and audio webcast has been scheduled for 8:30

a.m. Eastern Time today to discuss these results. Investors,

analysts, and members of the media interested in listening to the

live presentation are encouraged to join a webcast of the call

available on the investor relations portion of the Company’s

website at investor.holley.com. For those that cannot join the

webcast, you can participate by dialing 877-407-4019 (Toll Free) or

201-689-8337 (Toll) using the access code of 13748642.

For those unable to participate, a telephone replay recording

will be available until Friday, November 15, 2024. To access the

replay, please call 877-660-6853 (Toll Free) or 201-612-7415 (Toll)

and enter confirmation code 13748642. A web-based archive of the

conference call will also be available on the Company’s

website.

Additional Financial

Information

The Investor Relations page of Holley’s website,

investor.holley.com contains a significant amount of financial

information about Holley, including our earnings presentation,

which can be found under Events & Presentations. Holley

encourages investors to visit this website regularly, as

information is updated, and new information is posted.

About Holley Inc.

Holley Performance Brands (NYSE: HLLY) is a leading designer,

marketer, and manufacturer of high-performance products for car and

truck enthusiasts. Holley offers a leading portfolio of iconic

brands that deliver innovation and inspiration to a large and

diverse community of millions of avid automotive enthusiasts who

are passionate about the performance and personalization of their

classic and modern cars. Holley has disrupted the performance

category by putting the enthusiast consumer first, developing

innovative new products, and building a robust M&A process that

has added meaningful scale and diversity to its platform. For more

information on Holley, visit https://www.holley.com.

Forward-Looking

Statements

Certain statements in this press release may be considered

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements generally

relate to future events or Holley’s future financial or operating

performance. For example, projections of future revenue and

adjusted EBITDA and other metrics, along with statements regarding

the impact of organizational changes, are forward-looking

statements. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “expect,”

“intend,” “will,” “estimate,” “anticipate,” “believe,” “predict,”

“or” or the negatives of these terms or variations of them or

similar terminology. Such forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements. These forward-looking statements

are based upon estimates and assumptions that, while considered

reasonable by Holley and its management, are inherently uncertain.

Factors that may cause actual results to differ materially from

current expectations include, but are not limited to: 1) the

ability of Holley to grow and manage growth profitably which may be

affected by, among other things, competition; to maintain

relationships with customers and suppliers; and to retain its

management and key employees; 2) Holley’s ability to compete

effectively in our market; 3) Holley’s ability to successfully

design, develop, and market new products; 4) Holley’s ability to

respond to changes in vehicle ownership and type; 5) Holley’s

ability to maintain and strengthen demand for our products; 6)

Holley’s ability to effectively manage our growth; 7) Holley’s

ability to attract new customers in a cost-effective manner; 8)

Holley’s ability to expand into additional consumer markets; 9)

costs related to Holley being a public company; 10) disruptions to

Holley’s operations, including as a result of cybersecurity

incidents; 11) changes in applicable laws or regulations; 12) the

outcome of any legal proceedings that have been or may be

instituted against Holley; 13) general economic and political

conditions, including the current macroeconomic environment,

political tensions, and war (including the conflict in Ukraine, the

conflict in the Middle East, and the possible expansion of such

conflicts and potential geopolitical consequences); 14) the

possibility that Holley may be adversely affected by other

economic, business, and/or competitive factors, including recent

events affecting the financial services industry (such as the

closures of certain regional banks); 15) Holley’s estimates and

expectations of its financial performance and future growth

prospects; 16) Holley’s ability to anticipate and manage through

disruptions and higher costs in manufacturing, supply chain,

logistical operations, and shortages of certain company products in

distribution channels; and 17) other risks and uncertainties set

forth in the section entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in the Annual Report on Form

10-K for the year ended December 31, 2023 filed with the U.S.

Securities and Exchange Commission (“SEC”) on March 14, 2024,

and/or disclosed in any subsequent filings with the SEC. Although

Holley believes the expectations reflected in the forward-looking

statements are reasonable, nothing in this press release should be

regarded as a representation by any person that the forward-looking

statements or projections set forth herein will be achieved or that

any of the contemplated results of such forward looking statements

or projections will be achieved. There may be additional risks that

Holley presently does not know or that Holley currently believes

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made. Holley undertakes no duty to

update these forward-looking statements, except as otherwise

required by law.

[Financial Tables to Follow]

HOLLEY INC. and SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

Variance

Variance

September 29,

October 1,

Variance

Variance

2024

2023

($)

(%)

2024

2023

($)

(%)

Net Sales

$

134,038

$

156,530

$

(22,492

)

-14.4

%

$

462,170

$

503,997

$

(41,827

)

-8.3

%

Cost of Goods Sold

81,732

98,156

(16,424

)

-16.7

%

287,512

308,162

(20,650

)

-6.7

%

Gross Profit

52,306

58,374

(6,068

)

-10.4

%

174,658

195,835

(21,177

)

-10.8

%

Selling, General, and Administrative

30,109

28,880

1,229

4.3

%

97,675

87,998

9,677

11.0

%

Research and Development Costs

4,620

6,100

(1,480

)

-24.3

%

13,743

18,935

(5,192

)

-27.4

%

Amortization of Intangible Assets

3,436

3,687

(251

)

-6.8

%

10,307

11,040

(733

)

-6.6

%

Restructuring Costs

954

415

539

129.9

%

1,566

2,106

(540

)

-25.6

%

Write-down of assets held-for-sale

7,505

-

7,505

100.0

%

7,505

-

7,505

100.0

%

Other Operating Expense (Income)

119

(28

)

147

nm

213

508

(295

)

-58.1

%

Operating Expense

46,743

39,054

7,689

19.7

%

131,009

120,587

10,422

8.6

%

Operating Income

5,563

19,320

(13,757

)

-71.2

%

43,649

75,248

(31,599

)

-42.0

%

Change in Fair Value of Warrant

Liability

(1,041

)

2,064

(3,105

)

nm

(7,570

)

5,516

(13,086

)

-237.2

%

Change in Fair Value of Earn-Out

Liability

(634

)

700

(1,334

)

nm

(2,341

)

2,089

(4,430

)

-212.1

%

Loss on Early Extinguishment of Debt

—

—

-

nm

141

—

141

100.0

%

Interest Expense, Net

15,010

13,712

1,298

9.5

%

39,192

41,909

(2,717

)

-6.5

%

Non-Operating Expense

13,335

16,476

(3,141

)

-19.1

%

29,422

49,514

(20,092

)

-40.6

%

Income Before Income Taxes

(7,772

)

2,844

(10,616

)

-373.3

%

14,227

25,734

(11,507

)

-44.7

%

Income Tax Expense (Benefit)

(1,484

)

2,092

(3,576

)

nm

(320

)

7,756

(8,076

)

-104.1

%

Net Income

$

(6,288

)

$

752

$

(7,040

)

-936.2

%

$

14,547

$

17,978

$

(3,431

)

-19.1

%

Comprehensive Income:

Foreign Currency Translation

Adjustment

386

(176

)

562

-319.3

%

244

(103

)

347

-336.9

%

Total Comprehensive Income

$

(5,902

)

$

576

$

(6,478

)

-1124.7

%

$

14,791

$

17,875

$

(3,084

)

-17.3

%

Common Share Data:

Basic Net Income per Share

$

(0.05

)

$

0.01

$

(0.06

)

-600.0

%

$

0.12

$

0.15

$

(0.03

)

-20.0

%

Diluted Net Income per Share

$

(0.05

)

$

0.01

$

(0.06

)

-600.0

%

$

0.12

$

0.15

$

(0.03

)

-20.0

%

Weighted Average Common Shares Outstanding

- Basic

118,694

117,397

1,297

1.1

%

118,345

117,257

1,088

0.9

%

Weighted Average Common Shares Outstanding

- Diluted

118,694

119,246

(552

)

-0.5

%

119,154

118,120

1,034

0.9

%

nm - not meaningful

HOLLEY INC. and

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEET

(In thousands)

(Unaudited)

As of

September 29,

December 31,

2024

2023

Assets

Cash and cash equivalents

$

50,751

$

41,081

Accounts receivable

44,492

48,360

Inventory

179,285

192,260

Prepaids and other current assets

16,332

15,665

Assets held for sale

7,696

-

Total Current Assets

298,556

297,366

Property, Plant and Equipment, Net

42,718

47,206

Goodwill

413,245

419,056

Other Intangibles, Net

398,804

410,465

Other Noncurrent Assets

30,911

29,250

Total Assets

$

1,184,234

$

1,203,343

Liabilities and Stockholders’ Equity

Accounts payable

$

52,738

$

43,692

Accrued interest

487

455

Accrued liabilities

41,164

42,129

Current portion of long-term debt

7,479

7,461

Total Current Liabilities

101,868

93,737

Long-Term Debt, Net of Current Portion

548,905

576,710

Deferred Taxes

45,008

53,542

Other Noncurrent Liabilities

29,710

38,203

Total Liabilities

725,491

762,192

Common Stock

12

12

Additional Paid-In Capital

376,670

373,869

Accumulated Other Comprehensive Loss

(466

)

(710

)

Retained Earnings

82,527

67,980

Total Stockholders’ Equity

458,743

441,151

Total Liabilities and Stockholders’

Equity

$

1,184,234

$

1,203,343

HOLLEY INC. and

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

September 29,

October 1,

2024

2023

2024

2023

Operating

Activities

Net Income

$

(6,288

)

$

752

$

14,547

$

17,978

Adjustments to Reconcile to Net Cash

12,879

15,463

26,832

29,446

Changes in Operating Assets and

Liabilities

(8,339

)

6,265

1,394

9,439

Net Cash Provided by (Used in) Operating

Activities

(1,748

)

22,480

42,773

56,863

Investing

Activities

Capital Expenditures, Net of

Dispositions

(311

)

(743

)

(2,727

)

(3,125

)

Net Cash Used in Investing Activities

(311

)

(743

)

(2,727

)

(3,125

)

Financing

Activities

Net Change in Debt

(227

)

(26,365

)

(28,832

)

(40,437

)

Deferred financing fees

—

—

—

(1,427

)

Payments from Stock-Based Award

Activities

(45

)

(1,061

)

(1,482

)

(1,134

)

Net Cash Used in Financing Activities

(272

)

(27,426

)

(30,314

)

(42,998

)

Effect of Foreign Currency Rate

Fluctuations on Cash

2

(218

)

(62

)

(57

)

Net Change in Cash and Cash

Equivalents

(2,329

)

(5,907

)

9,670

10,683

Cash and Cash

Equivalents

Beginning of Period

53,080

42,740

41,081

26,150

End of Period

$

50,751

$

36,833

$

50,751

$

36,833

We present certain information with respect to EBITDA, Adjusted

EBITDA, Adjusted EBITDA Margin, Bank-adjusted EBITDA Leverage

Ratio, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted Net

Income, Adjusted Diluted EPS and Free Cash Flow as supplemental

measures of our operating performance and believe that such

non-GAAP financial measures are useful to investors in evaluating

our financial performance and in comparing our financial results

between periods because they exclude the impact of certain items

that we do not consider indicative of our ongoing operating

performance. We believe that the presentation of these non-GAAP

financial measures enhances the usefulness of our financial

information by presenting measures that management uses internally

to establish forecasts, budgets, and operational goals to manage

and monitor our business. We believe that these non-GAAP financial

measures help to depict a more realistic representation of the

performance of our underlying business, enabling us to evaluate and

plan more effectively for the future.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Bank-adjusted

EBITDA Leverage Ratio, Adjusted Gross Profit, Adjusted Gross

Margin, Adjusted Net Income, Adjusted Diluted EPS and Free Cash

Flow are not prepared in accordance with generally accepted

accounting principles (“GAAP”) and may be different from non-GAAP

and other financial measures used by other companies. These

measures should not be considered as measures of financial

performance under GAAP, and the items excluded from or included in

these metrics are significant components in understanding and

assessing our financial performance. These metrics should not be

considered as alternatives to net income, gross profit, net cash

provided by operating activities, or any other performance

measures, as applicable, derived in accordance with GAAP.

We define EBITDA as earnings before depreciation, amortization

of intangible assets, interest expense, and income tax expense. We

define Adjusted EBITDA as EBITDA adjusted to exclude, to the extent

applicable, restructuring costs, which includes operational

restructuring and integration activities, termination related

benefits, facilities relocation, and executive transition costs;

changes in the fair value of the warrant liability; changes in the

fair value of the earn-out liability; equity-based compensation

expense; inventory charges primarily due to product rationalization

initiatives that are part of a portfolio transformation aimed at

eliminating unprofitable or slow-moving SKUs; gain or loss on the

early extinguishment of debt; notable items that we do not believe

are reflective of our underlying operating performance, including

litigation settlements and certain costs incurred for advisory

services related to identifying performance initiatives; and other

expenses or gains, which includes gains or losses from disposal of

fixed assets, franchise taxes, and gains or losses from foreign

currency transactions. We define Adjusted EBITDA Margin as Adjusted

EBITDA divided by net sales.

HOLLEY INC. and

SUBSIDIARIES

USE AND RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES

(In thousands)

(Unaudited)

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

September 29,

October 1,

2024

2023

2024

2023

Net Income

$

(6,288

)

$

752

$

14,547

$

17,978

Adjustments:

Interest Expense, Net

15,010

13,712

39,192

41,909

Income Tax Expense (Benefit)

(1,484

)

2,092

(320

)

7,756

Depreciation

2,231

2,785

7,364

7,738

Amortization

3,436

3,687

10,307

11,040

EBITDA

12,905

23,028

71,090

86,421

Restructuring Costs

954

415

1,566

2,106

Change in Fair Value of Warrant

Liability

(1,041

)

2,064

(7,570

)

5,516

Change in Fair Value of Earn-Out

Liability

(634

)

700

(2,341

)

2,089

Equity-Based Compensation Expense

1,521

2,970

4,283

5,170

Write-down of Assets Held-for-Sale

7,505

-

7,505

-

Strategic Product Rationalization

Charge

—

—

8,835

(800

)

Loss on Early Extinguishment of Debt

—

—

141

—

Notable Items

785

556

6,479

564

Other Expense (Income)

119

(28

)

213

508

Adjusted EBITDA

$

22,114

$

29,705

$

90,201

$

101,574

Net Sales

$

134,038

$

156,530

$

462,170

$

503,997

Net Income Margin

-4.7

%

0.5

%

3.1

%

3.6

%

Adjusted EBITDA Margin

16.5

%

19.0

%

19.5

%

20.2

%

We define the Bank-adjusted EBITDA Leverage Ratio as Net Debt

divided by our Bank-adjusted EBITDA for the trailing twelve-month

(“TTM”) period, as defined under our Credit Agreement entered into

in November 2021, as amended, which is used in calculating covenant

compliance.

TTM September 29, 2024

Net Income

$

15,749

Adjustments:

Interest Expense, Net

58,029

Income Tax Expense (Benefit)

323

Depreciation

9,934

Amortization

13,824

EBITDA

97,859

Restructuring Costs

2,101

Change in Fair Value of Warrant

Liability

(8,975

)

Change in Fair Value of Earn-Out

Liability

(2,127

)

Equity-Based Compensation Expense

6,404

Write-down of Assets Held-for-Sale

7,505

Strategic Product Rationalization

Charge

8,835

Gain on Early Extinguishment of Debt

(560

)

Notable Items

7,200

Other Expense

470

Adjusted EBITDA

118,712

Additional Permitted Charges

2,441

Adjusted EBITDA per Credit

Agreement

$

121,153

Total Debt

$

565,126

Less: Permitted Cash and Cash

Equivalents

50,000

Net Indebtedness per Credit Agreement

$

515,126

Bank-adjusted EBITDA Leverage Ratio

4.25 x

We define adjusted gross profit as gross profit excluding

inventory charges primarily due to product rationalization

initiatives that are part of a portfolio transformation aimed at

eliminating unprofitable or slow-moving SKUs. We define Adjusted

Gross Margin as Adjusted Gross Profit divided by net sales.

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

September 29,

October 1,

2024

2023

2024

2023

Gross Profit

$

52,306

$

58,374

$

174,658

$

195,835

Adjust for: Strategic Product

Rationalization Charge

—

—

8,835

(800

)

Adjusted Gross Profit

$

52,306

$

58,374

$

183,493

$

195,035

Net Sales

$

134,038

$

156,530

$

462,170

$

503,997

Gross Margin

39.0

%

37.3

%

37.8

%

38.9

%

Adjusted Gross Margin

39.0

%

37.3

%

39.7

%

38.7

%

We define Adjusted Net Income as earnings excluding the

after-tax effect of changes in the fair value of the warrant

liability, write-downs of assets held-for-sale, changes in the fair

value of the earn-out liability, and gain or loss on the early

extinguishment of debt. We define Adjusted Diluted EPS as Adjusted

Net Income on a per share basis. Management uses these measures to

focus on on-going operations and believes that it is useful to

investors because it enables them to perform meaningful comparisons

of past and present consolidated operating results. We believe that

using this information, along with net income and net income per

diluted share, provides for a more complete analysis of the results

of operations.

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

September 29,

October 1,

2024

2023

2024

2023

Net Income

$

(6,288

)

$

752

$

14,547

$

17,978

Special items:

Adjust for: Change in Fair Value of

Warrant Liability

(1,041

)

2,064

(7,570

)

5,516

Adjust for: Change in Fair Value of

Earn-Out Liability

(634

)

700

(2,341

)

2,089

Adjust for: Write-down of Assets

Held-for-Sale

7,505

—

7,505

—

Adjust for: Loss on Early Extinguishment

of Debt

—

—

111

—

Adjusted Net Income

$

(458

)

$

3,516

$

12,252

$

25,583

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

September 29,

October 1,

2024

2023

2024

2023

Net Income per Diluted Share

$

(0.05

)

$

0.01

$

0.12

$

0.15

Special items:

Adjust for: Change in Fair Value of

Warrant Liability

(0.01

)

0.02

(0.06

)

0.05

Adjust for: Change in Fair Value of

Earn-Out Liability

(0.01

)

0.01

(0.02

)

0.02

Adjust for: Write-down of Assets

Held-for-Sale

0.06

—

0.06

—

Adjust for: Loss on Early Extinguishment

of Debt

—

—

—

—

Adjusted Diluted EPS

$

(0.01

)

$

0.04

$

0.10

$

0.22

We define Free Cash Flow as net cash provided by operating

activities minus cash payments for capital expenditures, net of

dispositions. Management believes providing Free Cash Flow is

useful for investors to understand our performance and results of

cash generation after making capital investments required to

support ongoing business operations.

For the thirteen weeks

ended

For the thirty-nine weeks

ended

September 29,

October 1,

September 29,

October 1,

2024

2023

2024

2023

Net Cash Provided by (Used in)

Operating Activities

$

(1,748

)

$

22,480

$

42,773

$

56,863

Capital Expenditures, Net of

Dispositions

(311

)

(743

)

(2,727

)

(3,125

)

Free Cash Flow

$

(2,059

)

$

21,737

$

40,046

$

53,738

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107801809/en/

Investor Relations: Anthony Rozmus / Neel Sikka Solebury

Strategic Communications 203-428-3324 holley@soleburystrat.com

Media Relations Contacts: Jordan Moore,

jmoore@tinymightyco.com / Rachel Withers, rwithers@tinymightyco.com

Tiny Mighty Communications 615-454-2913

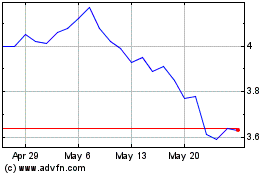

Holley (NYSE:HLLY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Holley (NYSE:HLLY)

Historical Stock Chart

From Dec 2023 to Dec 2024